USA

All major US equity indexes declined during the week as concerns about the labor market, stretched valuations in the tech sector, and prolonged uncertainty surrounding the longest government shutdown in US history weighed on investor sentiment. The S&P 500 fell 1.60%, while the Dow Jones Industrial Average and the NASDAQ Composite lost 1.21% and 3.04%, respectively. The correction was led by the best-performing stocks of recent years, as valuation and growth sustainability concerns hit large-cap AI-related names. Nvidia and Palantir each dropped around 11% just after the legendary investor Michael Burry disclosed his put positions on them, while Meta and Microsoft declined roughly 4%.

Market sentiment was also pressured by fresh labor data showing the highest number of October job cuts in more than 20 years (153,000), led by the technology and warehousing industries. These developments added to signs of a cooling labor market, reinforcing expectations that the Federal Reserve will proceed with an additional 25 bps rate cut in December, but also raising concerns about a potential economic slowdown.

Growth-oriented indices underperformed value benchmarks, with the Russell 3000 Growth down 2.88% compared to a 1.62% decline in the Russell 3000 Value, reflecting investors’ rotation toward companies with more stable earnings profiles.

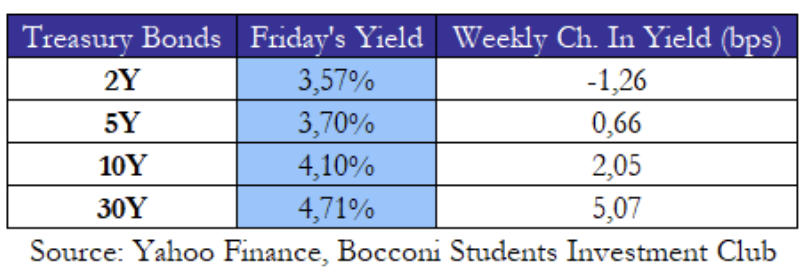

US Treasury yields ended the week mixed, as investors try to build their expectations without crucial sources of information due to the government shutdown. The 2-year yield edged lower by 1.26 bp to 3.57%, while longer maturities rose, with the 10-year up 2.05 bps to 4.10% and the 30-year climbing 5.07 bps to 4.71%, leading to a modest steepening of the yield curve. A recent survey by 22V Research found that investors view a labor-market outlook as the biggest risk to trading, helping explain why both risk assets and bond yields have been highly sensitive to employment-related news. In fact, the latest moves in yields followed weak private-sector employment data and record October layoff announcements, which reinforced expectations that the Federal Reserve could cut interest rates again in December. According to Fed funds futures, the probability of a rate cut has risen to 67%, reflecting growing conviction that the labor-market slowdown will prompt further policy easing.

Interestingly, the US government shutdown and the absence of key economic indicators such as CPI have forced traders in the $7 trillion inflation-linked market to rely on fallback mechanisms embedded in TIPS and inflation swap contracts, which operate under different methodologies. Under Treasury rules, TIPS use a synthetic CPI estimate based on the most recent twelve-month change in inflation, effectively substituting the missing data with the latest available annual rate. In contrast, inflation swaps follow the ISDA framework, which extrapolates the previous year’s CPI growth to generate a proxy figure. These differing calculations have already begun to drive a divergence in implied inflation rates, as markets attempt to price securities without fresh data. The discrepancy means that TIPS-linked payouts could rise relative to swap-linked instruments, leading to relative value opportunities for traders. As the shutdown drags on and more data releases are delayed, this misalignment between TIPS and swaps could widen even further.

Europe and UK

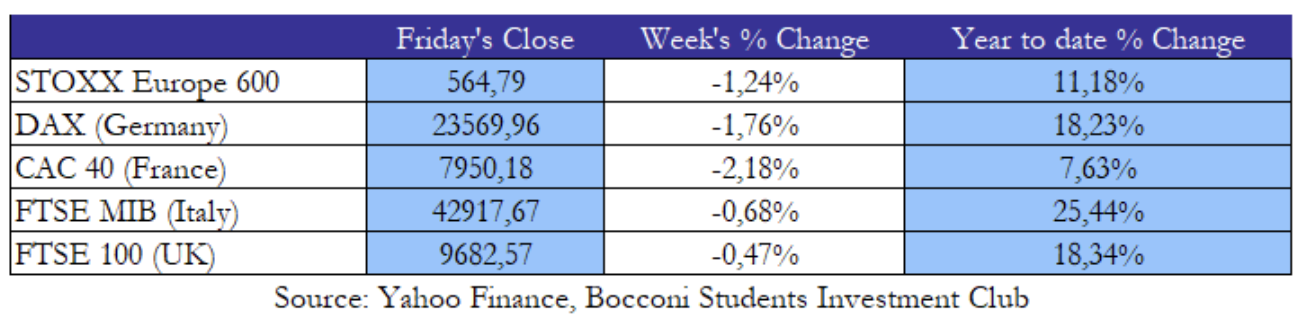

European equities followed the negative global trend, ending the week lower as concerns over elevated tech valuations and the prolonged US government shutdown weighed on overseas stocks sentiment as well. The STOXX Europe 600 declined 1.24%, with the DAX (–1.76%) and CAC 40 (–2.18%) underperforming compared to the FTSE MIB (–0.68%) and FTSE 100 (–0.47%), which posted smaller losses. Sector-wise, technology stocks led declines, with tech equipment makers such as Schneider Electric and Siemens Energy falling respectively 6.20% 5.36%. In contrast, automakers have rallied on expectations that Nexperia will resume chip shipments from China. In the UK, ITV (+16.6%) surged on reports of talks to sell its broadcasting division to Sky, partially offsetting losses from Rightmove (–12.5%) and British Airways (–11.6%) following weaker guidance on profit growth.

European sovereign bond yields edged slightly higher during the week, mirroring movements in US Treasuries and supported by growing confidence after last week’s ECB meeting that rates will remain on hold in the coming months. The German 10-year Bund yield rose 3.10 bps to 2.67%, while France and Italy saw increases to 3.46% and 3.43%, respectively. Notably, Italian 10-year yields remained near their lowest spreads versus German Bunds in years, reflecting improved investor confidence in the country renewed fiscal stability. The UK 10-year gilt climbed 6.07 bps to 4.47%, while waiting for future Bank of England policy moves to be announced next week.

Rest of the World

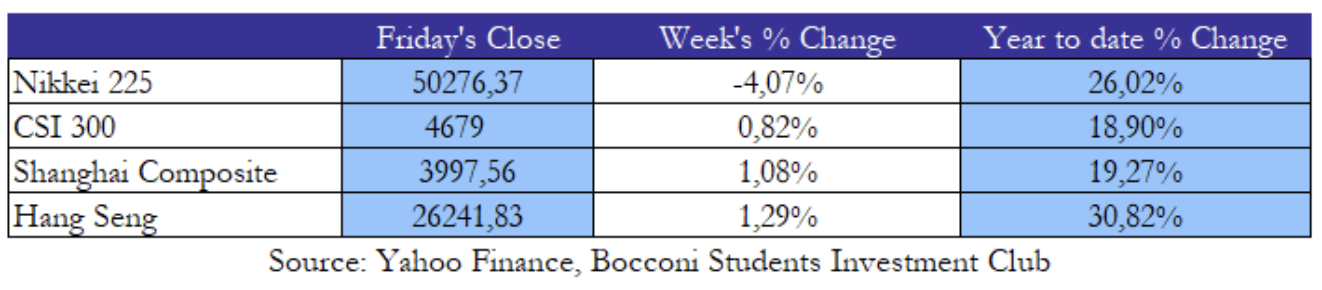

Asian equity markets were mixed this week. The Nikkei 225 fell 4.07%, which is its steepest weekly drop in months, weighed down by declines in major chipmakers such as SoftBank Group (-19%), Advantest (-13%) and Samsung Electronics (-8%). The retreat reflected renewed concerns that valuations in semiconductor and AI sectors may be unsustainable, following Wall Street sentiment.

In contrast, Chinese and Hong Kong markets posted moderate gains, with the CSI 300 and Shanghai Composite rising 0.82% and 1.08%, respectively, while the Hang Seng Index advanced 1.29%. Sentiment was supported by reports that China allowed Dutch chipmaker Nexperia to resume exports, a development viewed as a positive signal in the global semiconductor supply chain. However, optimism was softened by weaker Chinese trade data and by renewed US–China trade tensions over technology exports, amid rumors that the White House may block Nvidia’s chip sales to Beijing.

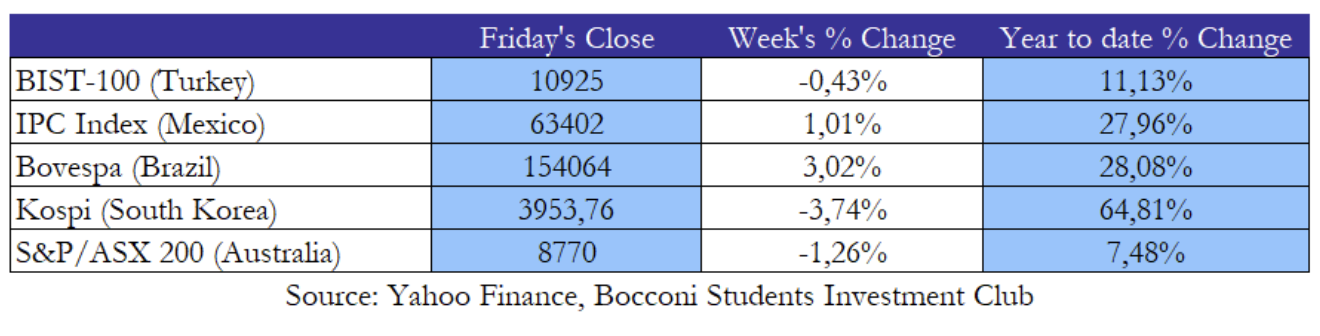

Outside major developed markets, performance was mixed. Latin American equities advanced, supported by generally resilient investor sentiment. The Bovespa gained 3.02%, marking one of the strongest weekly performances among global indices, while Mexico’s IPC Index rose 1.01%, extending its year-to-date gain to nearly 28%.

In Asia-Pacific, the picture was weaker. The Kospi (South Korea) fell sharply (–3.74%) amid the global correction in technology shares, reflecting the same pressure seen in US and Japanese markets, while keeping an impressive 64% performance YTD. Australia’s S&P/ASX 200 also closed lower (–1.26%), following global sentiment in equity markets.

FX and Commodities

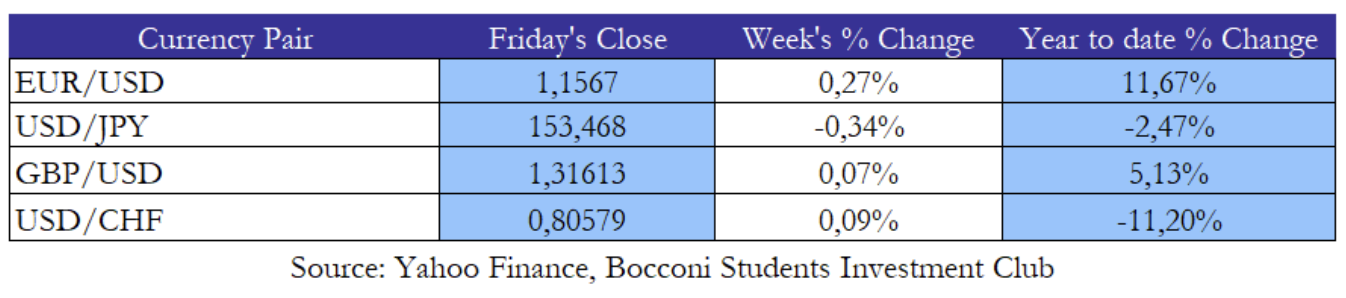

Currency markets remained pretty calm this week, reflecting the impact of the ongoing US government shutdown on liquidity and data availability. With key economic indicators, including labor and inflation releases, suspended, traders relied on private datasets and positioned cautiously, leading to low volatility across major pairs.

The US dollar was broadly stable. The EUR/USD edged up 0.27% to 1.1567 the GBP/USD gained 0.07% to 1.316, and the USD/JPY weakened slightly (–0.34%) to 153.47, all supported by the increased likelihood of a 25bps rates cut by the FED in December. Meanwhile, the USD/CHF was virtually unchanged (+0.09%) at 0.806.

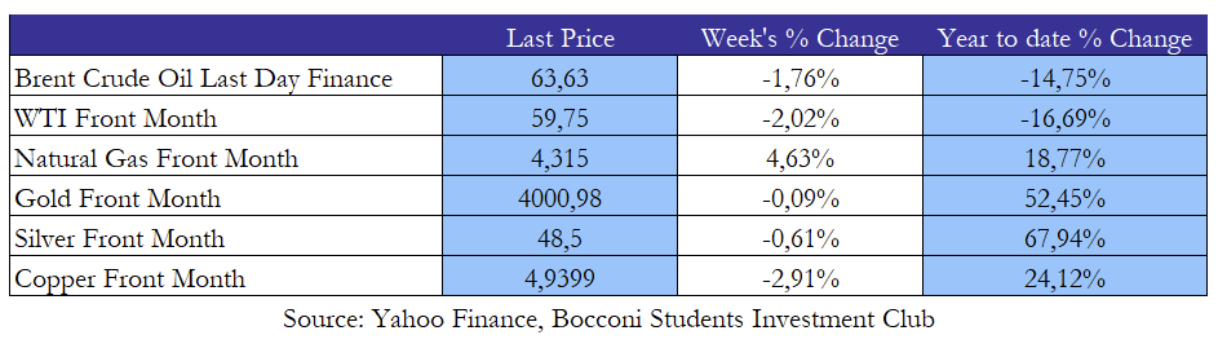

Commodity markets were mixed this week. Oil prices continued to weaken as investors focused on persistent oversupply and rising US inventories. Brent crude fell 1.76% to $63.63, while WTI dropped 2.02% to $59.75, extending their year-to-date losses to roughly 15%–17%. According to Bloomberg, US crude inventories rose by 5.2 million barrels, which is the biggest increase since July, amplifying concerns that global production remains well above demand expectations.

Gold was stable during the week, closing slightly lower (–0.09%) at $4,000.98. The precious metal is still down 8% because of last week drawdown, but in recent days it started rebounding, as traders priced-in the new outlook for the FED rate cuts following softer labor data. Silver slipped 0.61% to $48.50 but remained under close watch after the US Department of the Interior added it to its list of critical minerals, a move that increases the likelihood of the metal to be included in future tariff policies.

As regards energy, natural gas prices surged 4.63% amid seasonal demand and colder weather forecasts. Meanwhile, copper fell 2.91% to $4.94, weighed by concerns about slowing industrial activity and weaker demand expectations.

Next Week Main Events

A busy macro week lies ahead, with key policy and data releases likely to guide global markets. Early in the week, the US Manufacturing PMI and Reserve Bank of Australia rate decision will set the tone, followed by remarks from ECB President Lagarde and FOMC member Bowman on Tuesday. Midweek, markets will focus Trump’s speech and oil inventory data, as NFP will be probably delayed because of shutdown. On Thursday, attention shifts to the BoE and Banxico rate decisions and German industrial output. The week concludes with German trade data, Mexico CPI, and US inflation expectations.

Brain Teaser #37

You are holding two glass balls in a 100-story building. If a ball is thrown out of the window, it will not break if the floor number is less than X, and it will always break if the floor number is equal to or greater than X. You would like to determine X. What is the strategy that will minimize the number of drops for the worst case scenario?

Solution: To find the exact floor X where the glass ball starts to break, we use two balls and want to minimize the worst-case number of drops. Suppose the maximum number of drops needed is N. If the first ball is dropped from floor N and breaks, we can test the lower N–1 floors one by one with the second ball. If it doesn’t break, we can move up by N–1 floors for the next drop, since one attempt has already been used.

This pattern continues: the first ball is dropped from floors N, N+(N–1), N+(N–1)+(N–2), and so on. The total number of floors covered with N drops is N(N+1)/2. To ensure all 100 floors are covered, we need N(N+1)/2 ≥ 100, which gives N = 14 as the smallest possible value.

Therefore, the strategy is to drop the first ball from floors 14, 27, 39, 50, 60, 69, 77, 84, 90, 95, 99, and so on, increasing by one floor less each time. When the first ball breaks, use the second ball to test the floors just below it in order. The maximum number of drops needed is 14.

Brain Teaser #38

Your drawer contains 2 red socks, 20 yellow socks and 31 blue socks. Being a busy and absent-minded MIT student, you just randomly grab a number of socks out of the draw and try to find a matching pair. Assume each sock has equal probability of being selected, what is the minimum number of socks you need to grab in order to guarantee a pair of socks of the same color?

0 Comments