Sentiment in global financial markets was once again largely affected by the developments of Russia’s invasion of Ukraine, and by the Federal Reserve policy.

USA

The declarations of Fed Governor Lael Brainard on Tuesday and the release of minutes of the Federal Open Market Committee of mid-March on Wednesday, where followed by a sharp pullback in the stock market. Governor Brainard, considered amongst the most dovish policymakers, announced that the Federal Reserve will start its quantitative tightening as soon as in May. Fed minutes revealed the intention of reducing the Central Bank’s balance sheet by $60bn in treasuries and $35bn in MBS per month, for a total of $95bn, which is higher than the $70-$90bn consensus expectations. This plan would lead to a shrink of the Federal Reserve balance sheet by more than $1tn per year.

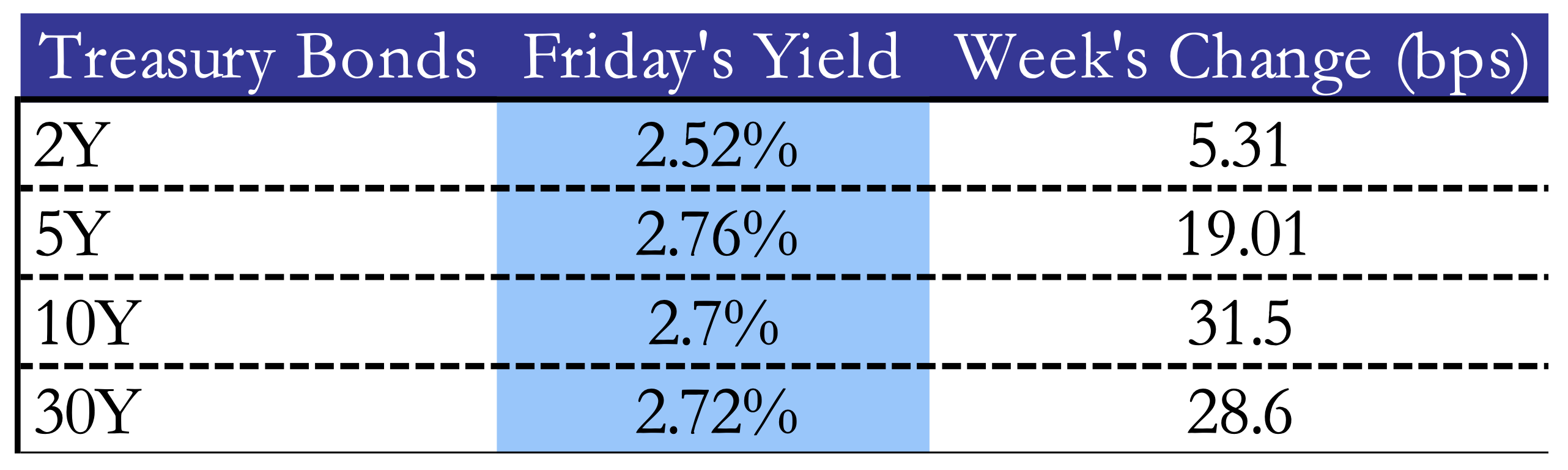

In addition, policymakers are determined to raise rates by 50bps in May, with futures that are pricing in a Fed range between 2.50% and 2.75%. This led to the 10yr yield rising to its highest levels since the start of 2019, with the 2-10yr yield curve steepening after inverting briefly on the 1st of April. Despite the fears of a possible future recession, we must highlight that the “near-term forward spread”, which has proven to be the timeliest indicator of an economic decline, has remained far from negative.

Source: Bocconi Students Investment Club, Yahoo Finance

On Wednesday, the U.S. has also imposed more sanctions on Russia, blocking two of its largest banks: Sberbank and Alfa Bank; respectively Russia’s largest financial institution and largest private bank. The additional sanctions have intensified worries about inflation, keeping buyers on the side-lines. This severe reaction comes after alleged reports of Russia committing war crimes on Ukraine’s civilians.

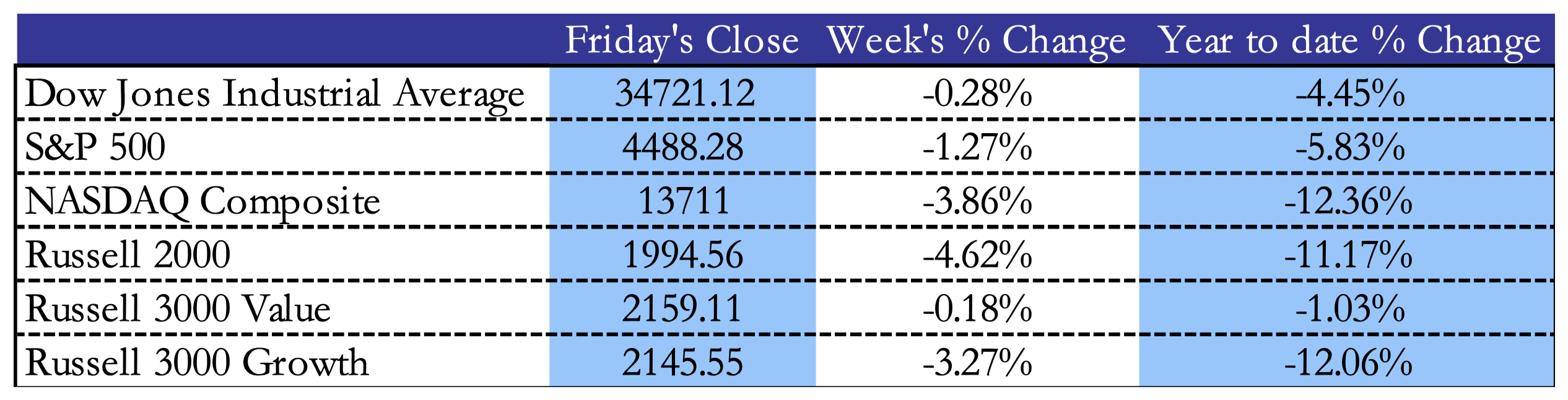

Focusing on equity, all the major indexes closed the week in negative territory, giving back some of the gains from the move that started around mid-March, which has managed to bring the Nasdaq out of the bear market territory and the S&P500 at less than 7% from its all-time highs. Growth stocks and small caps have shown relative weakness with respect to defensive stocks, as reflected in their year-to-date performance. In particular, money has rotated into Consumer Staples, Utilities and Health Care.

At the end of the week, trading volumes were moderate, with market participants that are cautiously waiting the start of the Q1 earnings season. Earnings expectations heading into next week, as surveyed by FactSet, are averaging 4.5% (YoY) for companies in the S&P500, which would mark the first time in the last two years that earnings growth has fallen short of 10%.

Source: Bocconi Students Investment Club, Yahoo Finance

It’s important to mention that weekly jobless claims considerably beat expectations, falling to their lower levels since 1968 and signalling a resilient economy in the face of the threats of the current global scenario.

Finally, it’s interesting to observe how Twitter shares rose 27% on Monday, following the announcement of Elon Musk’s 9.2% stake in the company. The business magnate was appointed to Twitter board of directors the following day, accompanied by some controversy around the disclosure of his stake.

Europe and UK

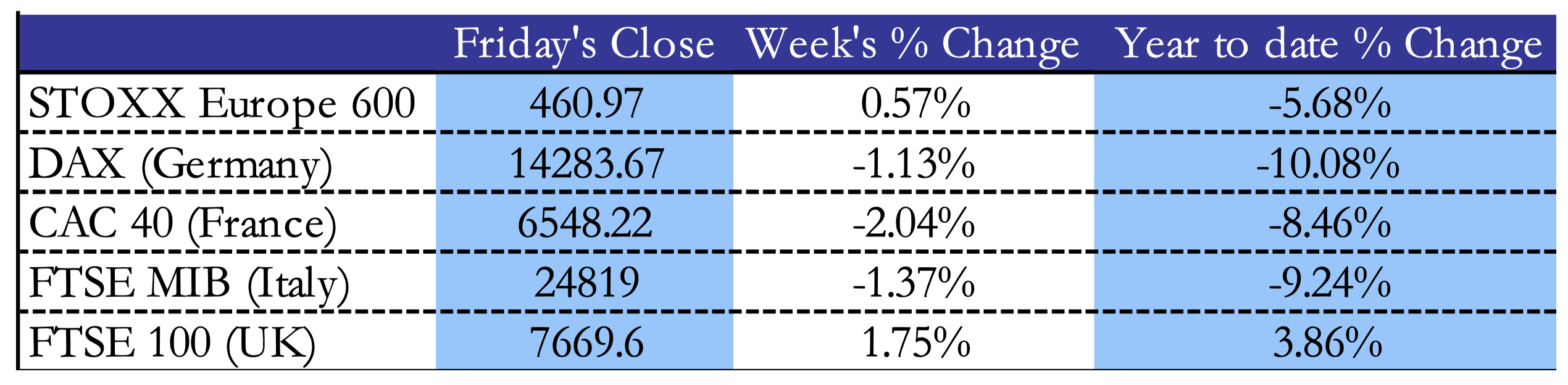

Europe’s stocks saw small gains, affected by concerns around inflation, Russia, and quantitative tightening of the European Central Bank. Among the major economies, only U.K. shares showed a positive performance, while Germany, France and Italy’s major indexes lagged behind.

Source: Bocconi Students Investment Club, Yahoo Finance

The STOXX Europe 600 climbed 1.3% on Friday, but analysts are warning that traders may have not yet priced the risks of the incoming election in France. Emmanuel Macron’s lead on his rival Marie Le Pen has been significantly narrowing in recent years and the possibility of Macron losing the elections are their highest levels.

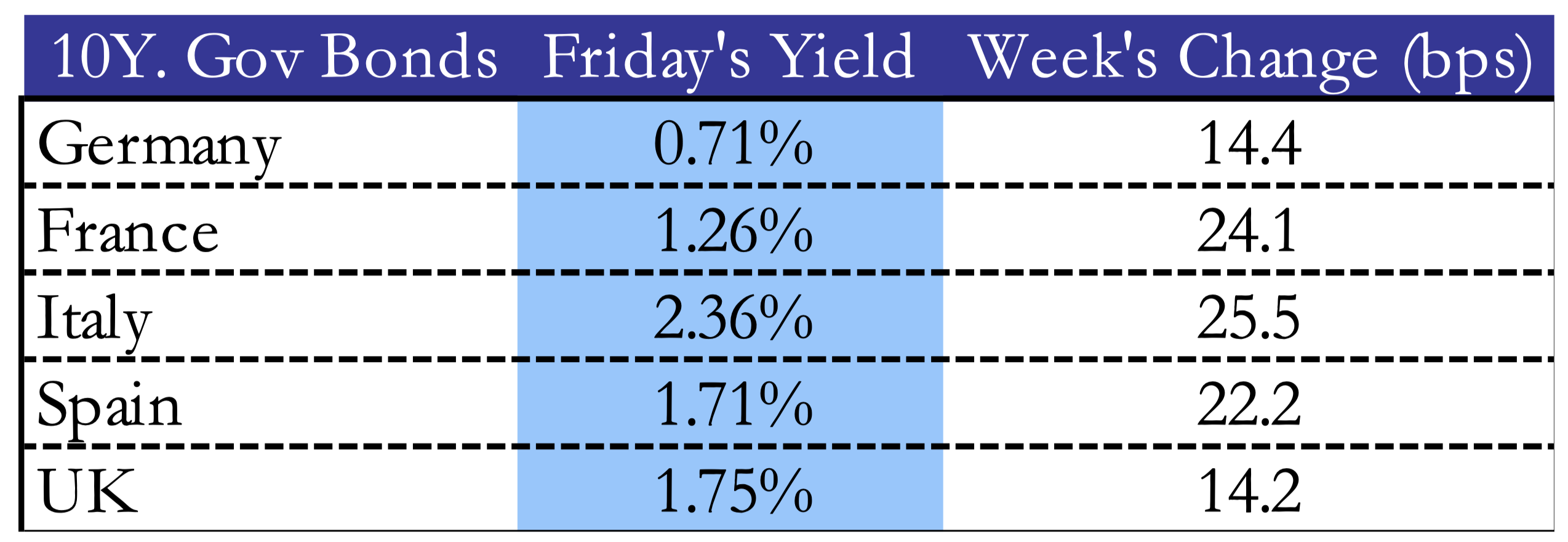

The week started with the re-election of two European leaders, both closely allied to Vladimir Putin: the Hungarian Prime Minister Viktor Orban, at its fourth mandate, and the Serbian President Aleksandar Vucic, that won a second term. On Thursday, minutes of the ECB March meeting were more hawkish than expected, with many policymakers that expressed the need for a normalization of the monetary policy. While the European Central Bank is still remaining very cautious, especially due to the uncertainty of the war, the 10yr bond yields climbed.

On the same day, Europe democrats signed off an agreement to ban coal imports from Russia, including its ships and truck entering the European Union, aiming at one of Russia’s key sources of revenue. The action was coordinated with representatives of the U.S. and U.K., and the plan will come into effect around mid-August. Europe is also blocking new machinery exports, while continuing to target the assets of Russian oligarchs and Putin’s two daughters. Meanwhile, there hasn’t been any significant breakthrough in the ceasefire talks between Ukraine and Russia.

On Friday Russia’s Central Bank unexpectedly cut interest rates from 20% to 17% to alleviate the effects of the western sanctions on the national economy, justifying the cut also thanks to the recent rebound of the rouble, which has apparently eased inflationary pressures.

Source: Bocconi Students Investment Club, Yahoo Finance

Finally, Labour shortages are worsening in the U.K., and workers’ increasing bargaining power has led the growth of the average salary awarded to new joiners at its highest level since when the polling began in October 1997. Reflecting not only demand from employers, but also rising prices.

Rest of the world

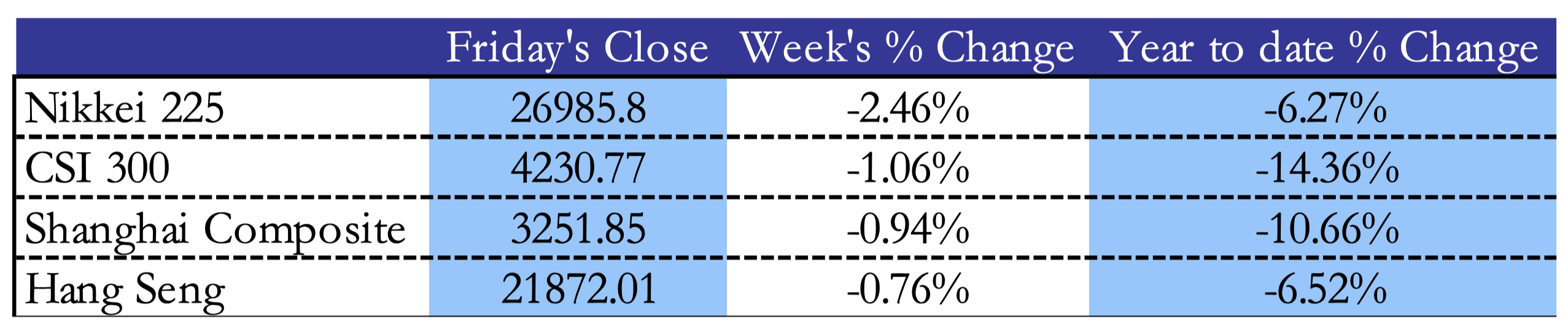

Notwithstanding easing borders restriction, Japan’s major indexes fell over the week on the expected impact of a hawkish Fed and inflation. The Japan yen further depreciated against the U.S. dollar, closing on Friday at its worst levels since 2015.

Bank of Japan Governor Haruhiko Kuroda commentated on the matter, reflecting on the importance of the stability of exchange rates due to their impact on the economy that is still recovering, and remained committed to the BoJ quantitative easing, targeting a 2% inflation rate. In addition, the IMF has revised downwards the projected economic growth for Japan in 2022 from 3.4% to 2.4% YoY. On a more positive note, the Tokyo Stock Exchange reform could potentially increase companies’ governance and value creation, elevating the capital attraction of the TSE.

China’s President Xi Jinping is currently facing one of his biggest challenges since he took power in 2012, as anxiety is growing due to Shanghai’s Covid lockdown. The Communist party sees the Covid Zero Policy as essential to keep saving lives and guarantee the future growth of the economy. However, Nomura estimated that the 23 cities that are currently affected by lockdowns account for 13.5% of the Chinese economy. In addition, China’s latest PMI readings indicate that the country’s manufacturing and services sectors are deteriorating, with the lockdowns that are halting production and causing labor issues.

What’s more, China’s 10yr yield declined by 19bps for the week, with its premium over Treasury bills that has almost entirely disappeared for the first time since 2012. Global funds continue to reduce their holdings of Chinese sovereign debt.

Frictions between China and the U.S. persist, with China refusing to condemn Russia’s invasion of Ukraine. Sanctions could arrive from the United States in the case of China materially supporting Putin.

Source: Bocconi Students Investment Club, Yahoo Finance

Mexico’s IPC Index and Brazil’s Bovespa experienced large losses, as the Central Banks of Latin America prepare to hike rate at a faster pace than planned. Brazil, Chile, Mexico and Peru are all experiencing rising prices, and even tough Brazil and Mexico’s Central Bank rates are as high as 11.75% and 6.5% respectively, they have failed to bring down prices.

Chile’s President Gabriel Boric announced on Tuesday the national Inclusive Recovery Plan, aimed at supporting the recovery of the economy from the pandemic and the effect of inflation on citizens. Considering the country’s fiscal deficit and inflation, a fiscal expansion could worsen the situation. However, the amount of the package could be covered by the revenues of an imminent tax reform.

Turkey’s BIST 100 experienced a weekly gain of 6.29%, while the country’s Central Bank allows for a loose expansionary monetary policy that seems completely disconnected from the rest of the world. The country is experiencing skyrocketing inflation, while the Lira remains under heavy pressure.

Regarding Australia, the Reserve Bank of Australia has decided to maintain the cash rate target at 10bps, and the interest rate on Exchange settlement balances at zero percent, supporting the country’s growth. The decision reflects the resilience of the Australian economy: national income is being boosted by rising commodity prices, unemployment is falling, and inflation has increased but remains under control.

Source: Bocconi Students Investment Club, Yahoo Finance

FX and commodities

The US dollar started the week with a mixed performance, but buyers jumped in after the hawkish announcements of the FOMC minutes, with Canadian and Australian dollars following as second and third strongest currencies. The worst performer was the Euro, followed by the Japanese Yen, which is at its weakest levels since 2015. The Pound Sterling and the Swiss Franc were more stable as they didn’t lose much territory with respect to the US dollar.

The performance of the Euro doesn’t reflect the unexpectedly hawkish position taken by some policymakers at the ECB’s March meeting. However, it’s important to keep in mind that the ECB is still lagging behind other major central banks in their quantitative tightening, and that the ongoing conflict still leaves a highly uncertain situation.

WTI Crude Oil closed the week under $100 per barrel, retracing for the second consecutive week, and closing around $98. The pullback has been led by the US announcement of the release of 1 million barrels per day from the Strategic Petroleum Reserve at the end of March, combined with demand worries from China. Nonetheless, it has remained slightly above pre-war levels. On the other hand, Brent Crude Oil price per barrel is still above $100.

Next week main events

Next week U.S. investors will be paying attention to the start of the Q1 earnings season. In addition, data that could significantly impact the markets is being released: the Consumer Price Index (CPI), the Producer Price Index (PPI), and the Import and Export Price Indexes. Those will define the inflation situation ahead of the May 4 Fed’s meeting. In Europe, the attention will be concentrated on the ECB Monetary Policy meeting in Frankfurt on the 14th of April. There are many CPI index reports, between China, Japan, Germany, UK, France, Italy and India. Overall, we have intense week with many data reports to keep a close eye on.

Brain Teaser #22

1972 USAMO P3. A random number selector can only select one of the nine integers 1, 2, …, 9, and it makes these selections with equal probability. Determine the probability that after n selections (n>1), the product of the n numbers selected will be divisible by 10.

Solution:

For a number to be divisible by 10, it needs to be divisible by 2 and 5. We can start by computing the probabilities for the following events:

1) there is no factor of 2 or 5, i.e., we select one of the numbers 1, 3, 7, 9 each time – with a probability of ![]()

2) there is no factor of 5, with a probability of ![]()

3) there is a factor of 2, with a probability ![]()

Therefore, the answer is ![]() .

.

Brain Teaser #23

1964 IMO P4. Seventeen people correspond by mail with one another – each one with all the rest. In their letters only three different topics are discussed. Each pair of correspondents deals with only one of these topics. Prove that there are at least three people who write to each other about the same topic.

0 Comments