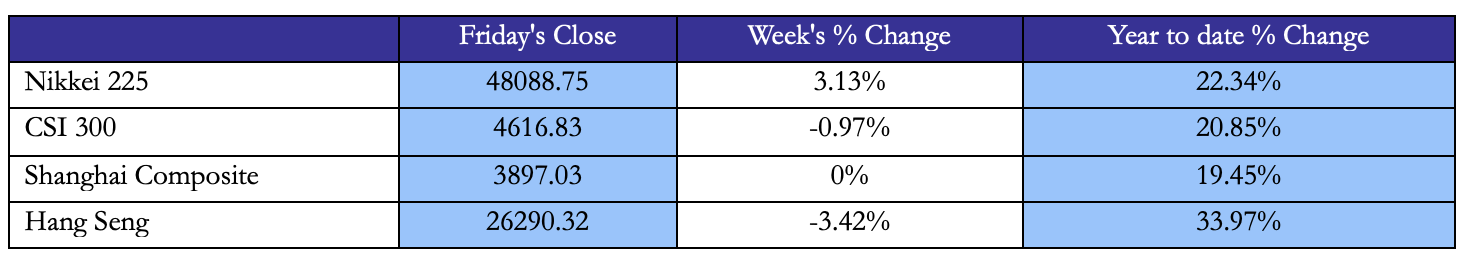

US

U.S. equities ended the week notably lower, marking a pause in the recent upward momentum. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average fell by approximately -2.43%, -3.01%, and -2.73%, respectively, logging only the third weekly decline in the past ten weeks. The market had been on track for modest gains until Friday, when a sharp sell-off triggered by renewed U.S. – China trade tensions reversed the week’s trajectory. President Trump announced that he was considering additional tariffs on Chinese imports and canceled a planned meeting with China’s leader, citing Beijing’s newly imposed restrictions on rare earth mineral exports. This escalation reignited investor concerns about the global supply chain and trade stability, prompting a broad-based decline across sectors. Despite the setback, the pullback follows a period of sustained gains, suggesting investors are recalibrating risk amid persistent geopolitical uncertainty.

Source: TradingEconomics, Bocconi Students Investment Club

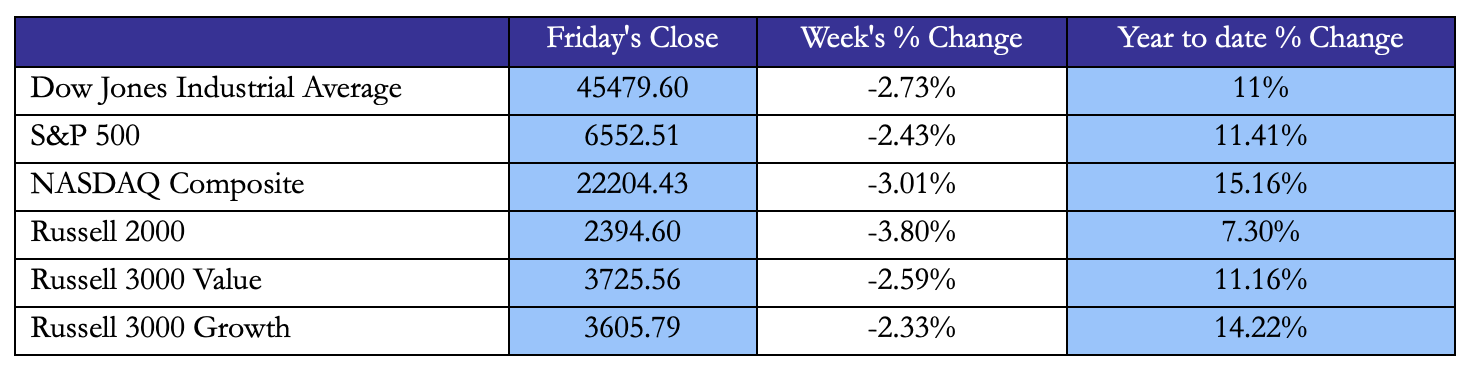

U.S. Treasury yields fluctuated throughout the week before ending broadly lower, as investors digested the Federal Reserve’s latest meeting minutes and the ongoing government shutdown. The 2-year Treasury yield declined to around 3.53%, its lowest level in nearly three weeks, reflecting stronger expectations for continued monetary easing into the year-end. Meanwhile, the 10-year yield edged down to 4.06%, and the 30-year held steady near 4.64%, producing a slight steepening of the yield curve. The combination of softer risk sentiment and reduced data flow has reinforced demand for longer-term Treasuries, while short-term rates continued to reflect dovish Fed bets.

Source: Yahoo Finance, Bocconi Students Investment Club

Although the U.S. government shutdown continued to delay the release of key economic reports, it didn’t prevent the Federal Reserve from publishing minutes from its latest meeting. Wednesday’s release reaffirmed market expectations for further cuts before year-end, as a majority of policymakers warned that labor market conditions could deteriorate without additional support. Investors interpreted the minutes as evidence that the Fed’s focus is increasingly shifting toward sustaining employment, viewing inflation pressures as largely temporary. As a result, markets are now pricing in a high likelihood of another 25bps cut at the upcoming October meeting.

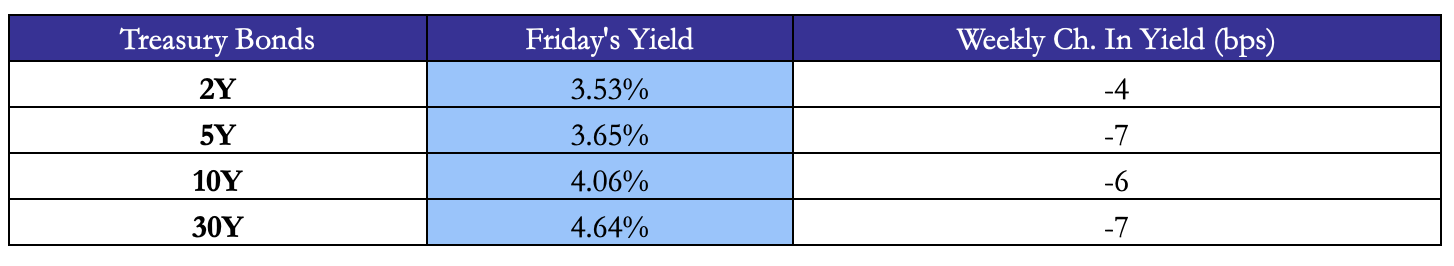

Europe and UK

European equities pulled back this week, ending their strong run as renewed global trade tensions and weaker risk appetite weighed on sentiment. The EuroStoxx 600 slipped 1.18%, marking its first weekly decline in three weeks. Most major national indices followed suit: Germany’s DAX 40 fell 0.48%, France’s CAC 40 lost 1.46%, and Italy’s FTSE MIB dropped 2.95%, its sharpest weekly decline since August. The Netherlands’ AEX also weakened (–2.2%), while Spain’s IBEX 35 posted a more moderate -0.7% loss. The selling was broad-based, with healthcare and technology lagging after recent outperformance, and energy stocks retreating amid softer oil prices and lower global demand expectations. In France, political uncertainty added to the cautious tone after Prime Minister Sébastien Lecornu tendered his resignation earlier in the week, only to be reappointed by President Macron amid efforts to preserve government stability and push forward the upcoming budget.

In the UK, the FTSE 100 declined 0.67%, pressured by weakness in financials and resource names as investors turned more defensive. Despite this setback, the index remains up around 15% year-to-date, supported by solid earnings and a resilient labor market. Business activity data, however, showed signs of fatigue—the latest PMI readings suggested the slowest expansion in nearly six months, reinforcing concerns that tighter fiscal conditions and the upcoming November 26 budget may weigh on domestic demand.

Source: Yahoo Finance, Bocconi Students Investment Club

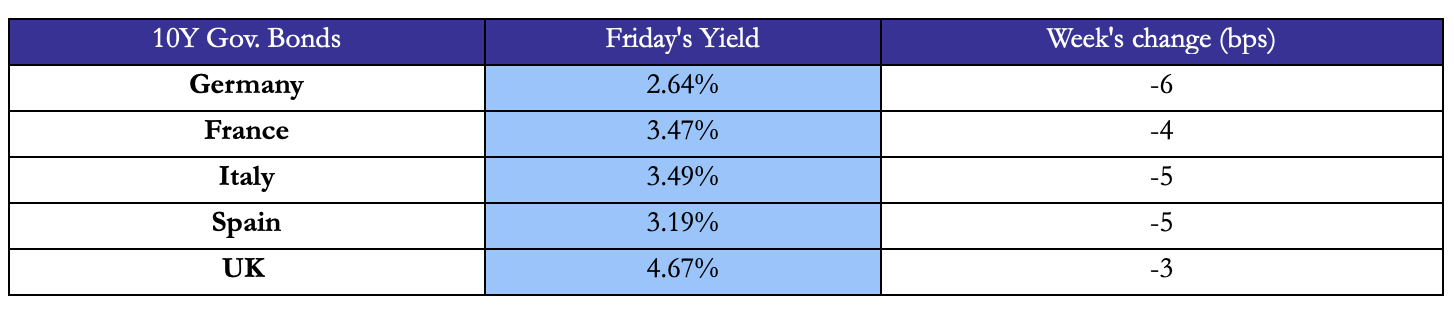

European government bond yields were little changed this week, reflecting a generally cautious tone across fixed-income markets. The German 10-year Bund yield slipped by 6 bps to 2.64%, while France’s OAT edged down to 3.47% and Italy’s BTP eased slightly to 3.49%, narrowing the Italy–Germany spread to roughly 85 bps. The moves came amid a lack of major economic surprises and modest safe-haven demand following the mid-week equity sell-off. In the UK, the 10-year gilt yield ended virtually flat at 4.67%, with investors weighing persistent inflation against softening growth indicators. Elsewhere, Switzerland’s 10-year yield held at 0.25%, underscoring subdued inflation expectations, while Turkey’s government bond yield rose sharply to 31.2%, reflecting local monetary tightening and ongoing inflation concerns. Overall, the stability in core European yields suggests that markets continue to anticipate a prolonged pause from the ECB as inflation moderates and growth momentum cools.

Source: Yahoo Finance, Bocconi Students Investment Club

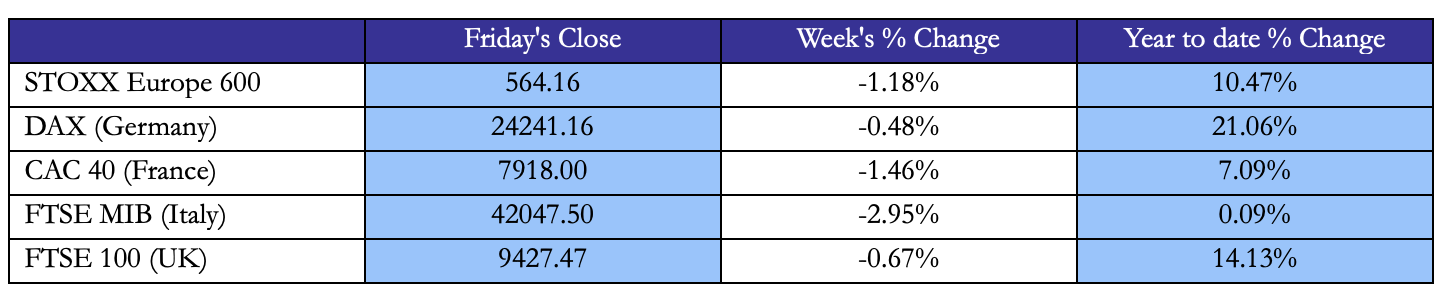

Rest of the World

Asian markets traded with a mixed tone this week, though Japan once again dominated headlines. The Nikkei 225 surged nearly 5% on Monday to a new record high before paring gains later in the week, finishing up 3.13% overall. The rally was initially fueled by optimism following a leadership change within Japan’s ruling Liberal Democratic Party, which investors viewed as supportive of pro-growth and reformist policies. However, sentiment cooled after one of the LDP’s key coalition partners withdrew its alliance, casting uncertainty over whether Sanae Takaichi would secure the premiership. Despite the political turbulence, Japan’s equity performance remains underpinned by robust corporate earnings and continued foreign inflows, aided by a still-weak yen and improving business confidence.

Elsewhere in Asia, performance was more muted. China’s major indices declined as trade tensions with the U.S. weighed on sentiment: the CSI 300 fell 0.97% , while the Shanghai Composite market was closed for holidays. Hong Kong’s Hang Seng Index also retreated 3.42%, reversing prior gains as technology and property shares slipped. India’s Sensex gained 1.6%, supported by banking and industrial stocks, while Taiwan and South Korea were little changed. Regional bond yields remained largely stable, with Japan’s 10-year government bond yield holding near 1.70% and China’s 10-year yield at 1.86%, as markets await signals from central banks on the pace of further normalization.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

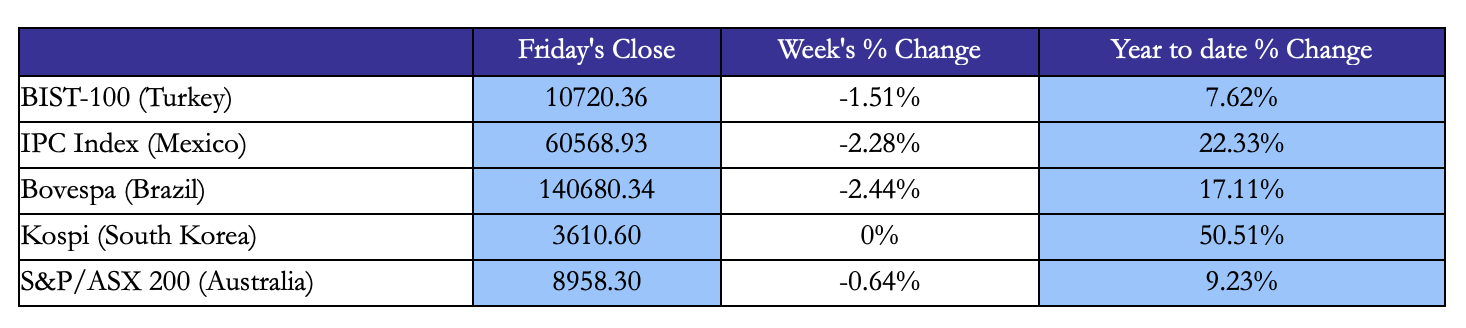

In other regions, Latin American markets were mixed. Brazil’s Bovespa edged higher after Congress approved a revised fiscal framework aimed at narrowing the budget deficit, which briefly strengthened the real and lifted local bank shares. In contrast, Mexico’s IPC index slipped as weaker industrial production data tempered optimism about U.S. demand.

Source: Yahoo Finance, Bocconi Students Investment Club

FX and Commodities

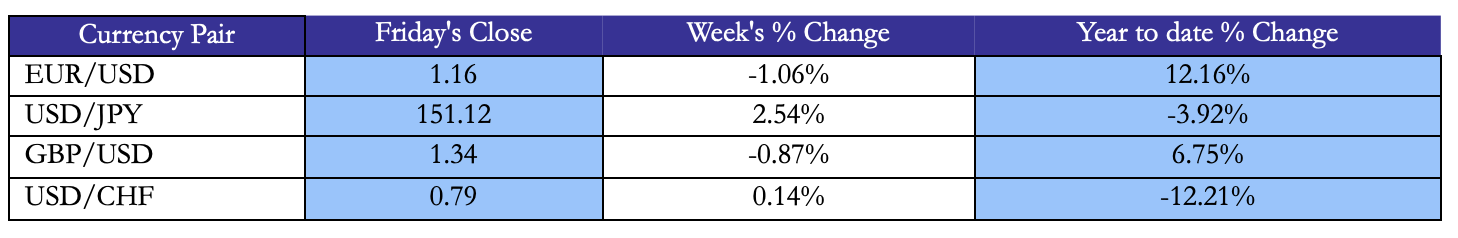

The U.S. dollar regained strength this week, with the Dollar Index (DXY) climbing +1.3% to around 98.9, supported by safe-haven demand following renewed geopolitical and trade tensions. The euro slipped 1.06% to $1.16, while the British pound eased 0.87% to $1.34, weighed by lingering fiscal uncertainty and weaker UK growth indicators. The Japanese yen depreciated 2.54% to roughly ¥151.12 per dollar, as investors unwound early-week bets on a Bank of Japan rate hike amid political turbulence in Tokyo. Meanwhile, commodity-linked currencies underperformed, with the Australian dollar (-2.0%) and New Zealand dollar (-1.8%) hit by softer Chinese demand data. In emerging markets, the picture was mixed: Brazil’s real strengthened 3.5% on optimism around fiscal reforms, while Turkey’s lira gained nearly 1%, extending its strong year-to-date appreciation above +18%.

Source: TradingEconomics, Bocconi Students Investment Club

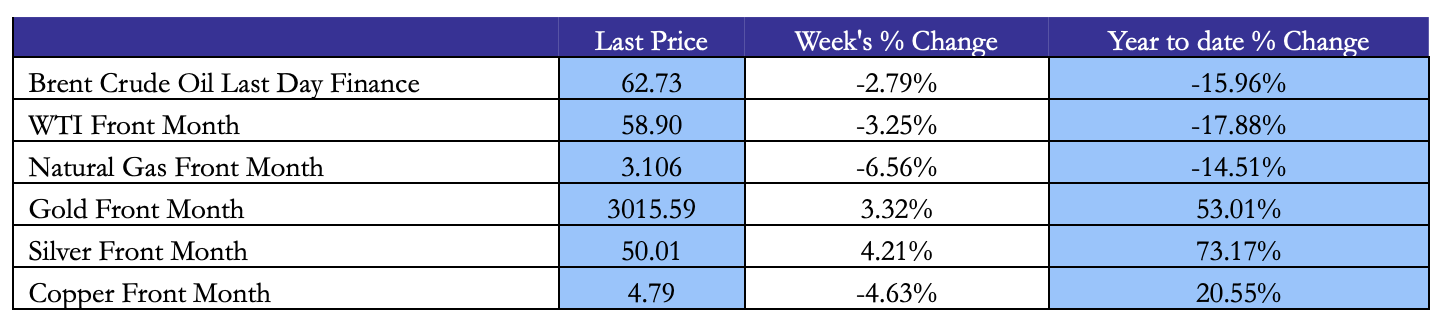

Commodities saw wide divergences this week, with precious metals sharply outperforming energy and industrial materials. Gold surged +3.32% to a new record above $4,000/oz, extending its year-to-date gain to over 50%, as rising geopolitical uncertainty and lower real yields fueled safe-haven demand. Silver also advanced +4.21%, supported by similar dynamics and strong industrial demand expectations. In contrast, crude oil and Brent extended their recent slide, down -3.25% and -2.79%, respectively, amid expectations of higher global supply ahead of the next OPEC+ meeting and resumption of Kurdish exports from Iraq. Natural gas prices tumbled -6.56%, reflecting milder weather forecasts and rising U.S. inventories.

In base metals, sentiment turned cautious as copper fell -4.63%, reversing the prior week’s gains, while steel and iron ore were broadly steady. The weakness across the energy complex contrasted sharply with renewed investor flows into precious metals, underscoring a broader shift toward defensive assets.

Source: Yahoo Finance, Bocconi Students Investment Club

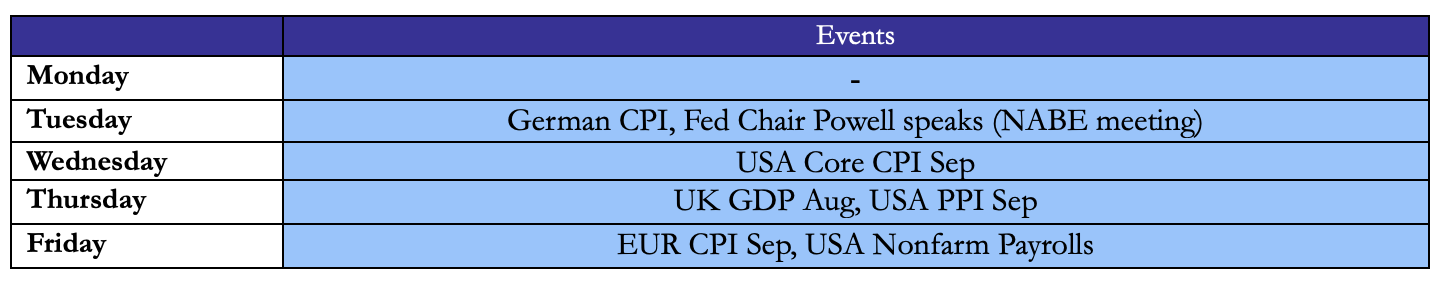

Next Week Main Events

Brain Teaser #35

You toss a fair coin till you get five consecutive heads. Since the outcomes of the tosses are random, the number of tosses required to get five consecutive heads will vary. So, what is the expected number of tosses to get five consecutive heads?

Solution: On average it takes 62 tosses because each extra required head roughly doubles the waiting time; getting five in a row means repeatedly building a streak that’s constantly reset by a single tail.

Brain Teaser #36

A clock (numbered 1 – 12 clockwise) fell off the wall and broke into three pieces. You

find that the sums of the numbers on each piece are equal. What are the numbers on each

piece? (No strange-shaped piece is allowed.)

0 Comments