USA

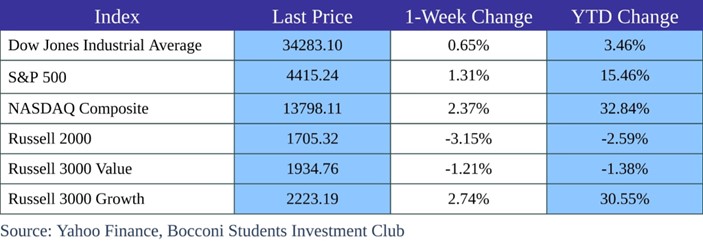

All three US equity indexes ended the week on a high note, mainly driven by semiconductor and other tech stocks. Namely, Nasdaq recorded its best day since May 26th rising 2.37% driven by the big tech stocks: Apple, Microsoft and Meta Platforms rose 2.3%, 2.5% and 2.6%. The Dow Jones added nearly 400 points, or 1.2%. As the ‘Santa Rally’ continued, the S&P 500 gained 1.31% with all 11 of the S&P 500’s sectors up for the week. S&P growth was driven by the chip stock rally on the back of a press report that South Korean memory chip-maker SK Hynix is planning a big increase in capex as well as a jump in October sales for TSMC. The best performing semiconductor stocks were KLA, Lam Research and Applied Materials which ended the day up 5.5%, 5.4% and 5.3%, respectively.

In today’s market where growth in the S&P500 index is driven by the big 7 and tech growth companies, it is interesting to look at the S&P600, i.e. the small cap American companies index. In the last five days, the S&P600 was down by 2.81% hence the driver of growth remains large tech, while small cap companies are not performing particularly well.

Investor sentiment looks bullish as there was no reaction to the survey released on Friday by University of Michigan reporting signs of weak consumer sentiment and higher inflation. This bullish stance might have been fueled by Powell’s comment on the survey on Thursday at the FED’s meeting, expressing that “The UM thing got blown out of proportion a little bit, you can always find one reading that is a little bit out of whack”. Volatility seems to have receded as the Vix index closed at its lowest level since September, at 14.17.

However, quarterly earnings reports have hurt some US stocks, namely Illumina, Trade Desk and Plug Power. Illumina shares dropped by 8% after the gene-sequencing product maker lowered its guidance metrics and expects to ship around just 330 million of its NovaSeq X instruments, down from its previous outlook for 390 due to lengthened sales cycles among customers. As of Saturday 11th, Illumina shares were down 10.5% to $97 and were on pace for their largest percentage decrease since May 2022 due to a failed acquisition attempt and weak core business. Trade Desk dropped 17% after the ad-tech company as guidance fell 10% short of estimates (EBITDA of $270 million vs. estimates of $291 million). Management blamed the ‘weaker-than-expected guide on a slowdown seen in the second week of October’. Finally, Plug Power finished at their lowest since April 2020 this week, falling more than 40% on Friday, after the hydrogen producer and fuel-cell maker warned they are running out of cash.

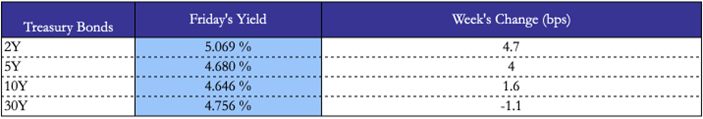

On Thursday, Federal Reserve Chair Jerome Powell kept the possibility of further rate hikes open, expressing that it is too early to declare price pressures over which ‘tapped the brakes on the stock market’s run’. Meanwhile, a weak government sale of longer-term debt pushed up bond yields and weighed on stocks. The bond market stabilized on Friday, with the benchmark 10-year Treasury yield settling at 4.627%, from 4.629% the day prior.

Moody’s lowered its outlook on the United States to “negative” from “stable” while re-affirming its AAA rating, on November 10th. They mentioned a significant increase in debt servicing expenses and the presence of “entrenched political polarization” as the reasons for this revision. Standard & Poor’s credit rating for the United States stands at AA+ with a stable outlook. Fitch’s credit rating for the United States was last reported at AA+ with a stable outlook.

The labor market showed resilience, with US weekly jobless claims down by 3K to 217K last week, compared with expectations of 218K and following an upwardly revised 220K in the previous period.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

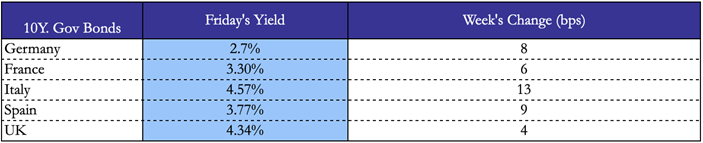

Consumer stocks did not perform well this week in Europe due to the statement from Lagarde, who alerted investors to the outlook for interest rates, indicating that interest rate cuts were unlikely to come within “the next couple of quarters”. European equities closed lower on Friday (STOXX Europe down by 1% as for France’s CAC 40), dragged down by the underperformance of the consumer stocks. However, both the STOXX Europe 600 and CAC 40 were already in the negatives before Lagarde’s warnings.

London’s benchmark FTSE 100 dropped 1.3%, pulled down by a 12% decline for Diageo, the company’s steepest drop since 1997. The slowdown in the Johnie Walker whisky and Guinness beer owner was driven by a profit warning on a drastic slowdown in sales (down 20% in first half of current financial year) mainly due to weakness of sales in Latin America – which makes up 11% of Diageo’s sales value. This slowdown is seen as a consequence of the slowing global economy, which has caused a shift in consumer spending on spirits as they buy cheaper drinks or cut back.

Additionally, the luxury sector in Europe is underperforming – Swiss luxury group Richemont sales were weaker than expected in the six months to September, as Cartier was the latest luxury jewelry maker to see a slowdown in demand for high-priced goods. Richemont reported first-half profits that missed forecasts and sales growing to 10.2bn euros instead of the expected 10.34bn, sending its shares down by 6%. The French rival LVMH also reported a slowdown in demand in both the United States and Europe where rising prices have prompted shoppers to spend less, especially younger generations.

On Friday, Lagarde warned that Eurozone inflation could rebound from its recent two-year low, potentially driven by another supply shock from the energy sector. Lagarde mentioned that the recent slowdown in inflation to 2.9% throughout October from its peak of 10.6% a year prior should not be taken for granted. Core inflation, which excludes volatility of energy and food prices remained at 4.2%, which is 2.2% higher than the ECB’s target.

Additionally, Lagarde further clarified that it could take more than the next couple of quarters for the ECB to start cutting rates and, in an attempt to tame this persistent inflation, the ECB has left its benchmark deposit unchanged for the last month at an all-time high of 4%.

In the UK, The Bank of England implemented a system-wide exploratory scenario in which it has asked the 53 major financial institutions to model the impact of a sharp rise in sovereign and corporate bond yields around the world, to observe overall financial stability and how the market would react to a severe shock – stress levels equivalent to those of the start of the pandemic. More specifically, a 1.15 percentage point increase in gilt yields, a 1.3 point increase in investment-grade borrowing costs, and a 0.75 point rise in US Treasury yields will be modeled. The BoE will release a report with its findings by the end of 2024.

Furthermore, the UK economy showed signs of stagnation in the three months to September. UK GDP is down from a 0.2% expansion in the previous quarter, suggesting that high borrowing costs and the increasing cost of living are halting activity. Prospects are bleak as the Bank of England expects the economy to register no growth in 2024. Compared to other European companies, the figures suggest that the UK is the lowest of the major economies relative to pre-pandemic levels. Compared with the final quarter of 2019, the UK economy has grown 1.8%, below the 7.4% growth of the US and the eurozone’s 2.9% expansion. However, the UK has outperformed Germany and has reported similar growth with respect to France.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

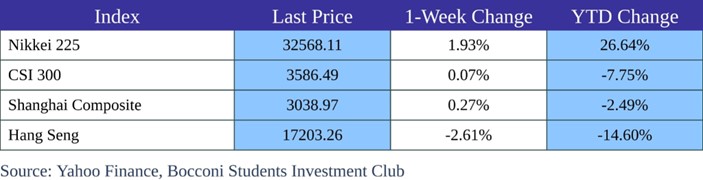

Stocks declined in Asian trading on Friday following hawkish comments from US Federal Reserve chair Jay Powell. Hong Kong’s Hang Seng index dropped 1.74% in the final hour of trading and is poised for a weekly decline of 2.59%, which would make it the worst performer this week among Asia’s major benchmarks. China’s CSI 300 index closed 0.7% lower and Japan’s Topix was almost flat.

China’s largest chip manufacturer, Semiconductor Manufacturing International Corp (SMIC), has increased its capex forecast for 2023 by 18% with new factory infrastructure and production expansion. SMIC innovation is especially important as it represents China’s ambition to have a self-reliant chip industry amidst tension between trade bans heighten (Biden banning Nvidia from exporting to China) and competition in Taiwan (TSMC) and South Korea (Samsung) increases. However, SMIC experienced a 15% dip in revenue to $1.62bn in the third quarter, with net income dropping by 80% to $94mn as global demand weakness hit foundries hard.

It will be interesting to watch out for US-China tensions at the expected summit between Joe Biden and Xi Jinping at the Asia-Pacific Economic Cooperation forum, which begins on Saturday and lasts until November 17.

In Brazil, investors welcomed evidence of slowing inflation in the Brazilian economy and stocks close at a three month high. Brazil’s inflation slowdown gave investors optimism and increased risk aversion. For commodities in Brazil, iron ore mining giant Vale rose 1.7% benefiting from higher demand and supply risks. Conversely, Petrobras shares lost 0.3% after lower oil prices resulted in a sharp profit decline from the previous year, although lower outstanding debt balanced the pessimism.

In South Korea, the market outperformed this week as Asian markets fell after Powell rate announcements and after country reimposed a ban on short selling.

FX and Commodities

Brent crude, which increased by around 1.8% higher to $81.43 a barrel on Friday, is the energy commodity with highest gains this week. However, in late October, Brent was trading at above $90 a barrel; this week, it fell below $80 for the first time this week since late July. West Texas Intermediate, the US market, settled 1.9% on Friday, trimming its weekly decline to 4.1%.

Despite this bounce in the price of oil on Friday, it settled lower over the week (lowest it has been in more than three months) due to the receding concerns about spillover effects from war in the Middle East and worries about the global outlook.

Platinum took the biggest hit this week within metal commodities, falling by 2.3% whereas gains were led by iron ore which increased by 1.56%.

The top energy commodity loser this week is Natural Gas in the UK with -3.45% but more importantly, there was a drop by 1.4% in the price of copper, its biggest daily drop since the start of October, which is viewed as an indicator for the health of the world economy. This reflects the signs of lingering concerns about global growth.

With regards to agricultural commodities, orange juice took the biggest hit (-10.64%) along with butter (-4.55%) and coffee (-2.4%). Instead, oat, palm oil and rice had the highest gains, with respectively 4.29%, 1.58% and 1.41% increases in price.

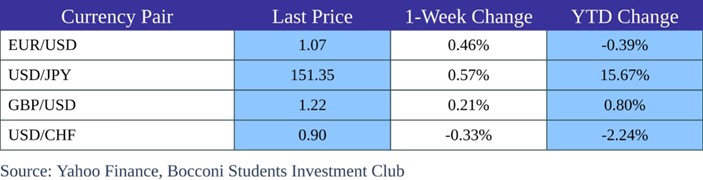

The top currency gainers this week are the Norwegian Krone (0.98%), Mexican Peso (0.93%) and Brazilian Real (0.67%). The Mexican peso strengthened towards 17.6 per USD, benefiting from a growing risk appetite as US bond yields were down. The Bank of Mexico maintained its benchmark interest rates at the existing record level of 11.25% this week, emphasizing its commitment to a tight monetary policy: this contributed to the MXP strength.

The biggest FX losers for the week are the Turkish Lira (-0.56%) and the Canadian Dollar which is hovering near 1-Year Low, 1.38 per USD level driven by the hawkish outlook from the Fed. It was an almost unchanged week for the Euro (0.17%), British Pound (0.04%), Japanese Yen (-0.12%) and Dollar Index (-0.11%).

The dollar index (DXY) was close to 106 on Friday (0.8% up on the week), as Federal Reserve officials pushed back against speculations that US interest rates have peaked. This week, the dollar was strong against the Aussie dollar, following dovish signals from the Reserve Bank of Australia.

Next Week Main Events

Source: TradingEconomics, Bocconi Students Investment Club

Brain Teaser #06

After the revolution, each of the 66 citizens of a certain city, including the king, has a salary of 1. The king cannot vote, but has the power to suggest changes – namely, redistribution of salaries. Each person’s salary must be a whole number of dollars, and the salaries must sum to 66. He suggests a new salary plan for every person including himself in front of the city. Citizens are greedy, and vote yes if their salary is raised, no if decreased, and don’t vote otherwise. The suggested plan will be implemented if the number of “yes” votes is more than “no” votes. The king is both selfish and clever. He proposes a series of such plans. What is the maximum salary he can obtain for himself?

SOLUTION: The king begins by proposing that 33 citizens have their salaries doubled to $2, at the expense of the remaining 33 (himself included). Next, he increases the salaries of 17 of the 33 salaried voters (to $3 or $4) while reducing the remaining 16 to $0. In successive turns, the number of salaried voters falls to 9, 5, 3, and 2. Finally, the king bribes three paupers with $1 each to help him turn over the two big salaries to himself, thus finishing with a royal salary of $63. It is not difficult to see that the king can do no better at any stage than to reduce the number of salaried voters to just over half the previous number; in particular, he can never achieve a unique salaried voter. Thus, he can do no better than $63 for himself, and the six rounds above are optimal. Hence the answer is $63.

Brain Teaser #07

Suppose you’re on a game show, and you’re given the choice of three doors: Behind one door is a car; behind the others, goats. You pick a door, say No. 1, and the host, who knows what’s behind the doors, opens another door, say No. 3, which has a goat. Now, do you want to pick door No. 2? What is the probability of winning the car if you switch?

0 Comments