USA

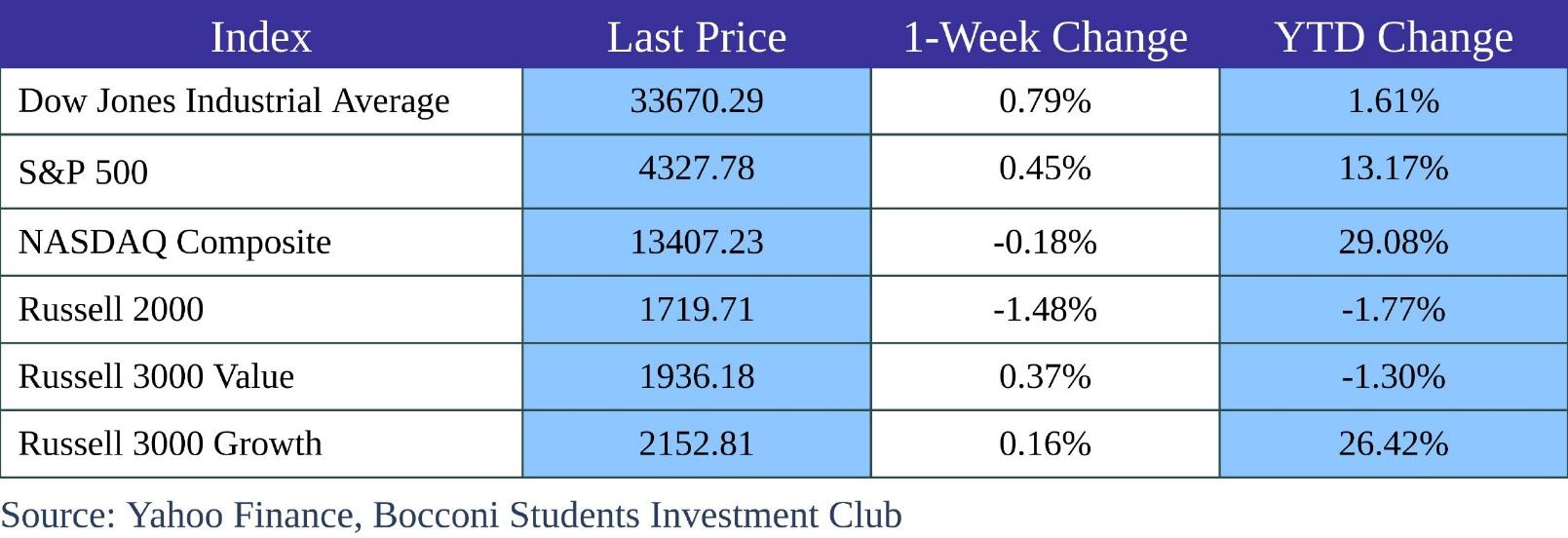

This week in the US, we observed a market recovery following the previous week’s declines, driven largely by the robust Non-Farm Payrolls data. However, by the week’s conclusion, this optimism had waned somewhat, with the S&P managing only a modest 0.4% increase. Leading the way was the Dow Jones, which closed the week on a positive note, posting a 0.79% gain. In contrast, NASDAQ experienced a slight decrease of 0.18%. The Russell 2000 index had a challenging week, falling by 1.5%, while the Russell 3000 Value and Russell 3000 Growth indices demonstrated a more resilient performance, with gains of 0.37% and 0.16%, respectively.

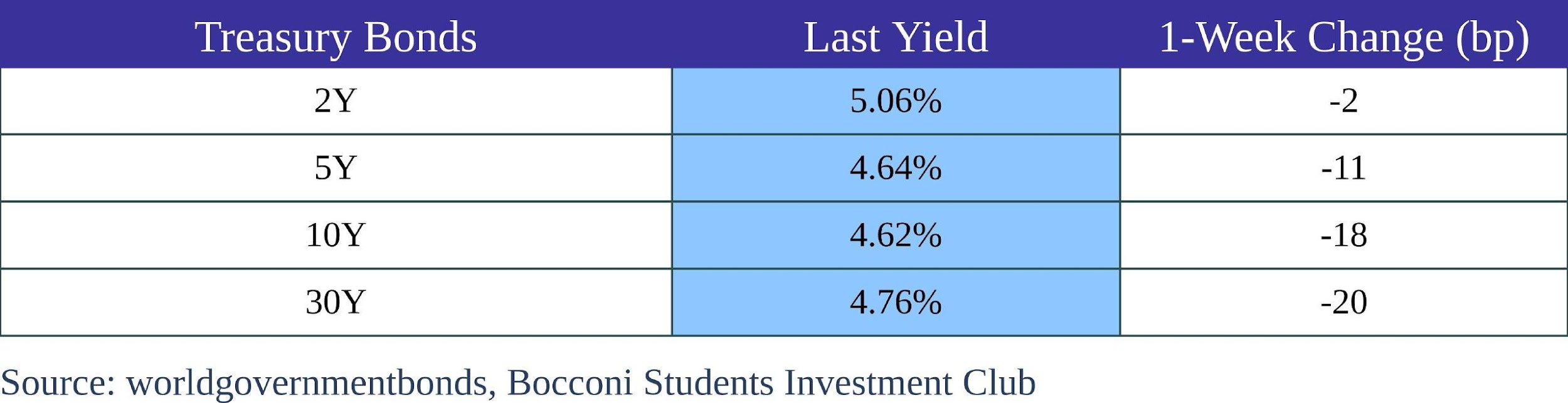

The S&P began the week with a minor decline, reflecting the uncertainty surrounding the Israel-Hamas conflict. However, it later rebounded and concluded the day with a slight uptick. Notably, energy and weapon companies led the charge with strong gains, buoyed by the temporary pause in Middle East production, emerging as the primary drivers of the index. The bond market had a delayed start, opening on Tuesday due to the Columbus Day holiday in the US. It immediately witnessed a notable drop in yields, with the 10-year Treasury yield declining from 4.8% at Friday’s close to 4.6%. This drop was primarily driven by efforts to reduce exposure to the Middle Eastern conflict and was influenced by a more cautious tone from the Fed regarding potential future rate hikes, recognizing the challenges that rising yields pose to the economy.

On Wednesday, the US PPI data for September was released, revealing a month-on-month increase of +0.5%, compared to the previous +0.7%. Year-on-year, it registered at +2.2%, exceeding the previous 2%, and surpassing expectations of 0.3% and 1.6%, respectively. Despite this hotter-than-expected PPI data, the yields on 10-year bonds continued to decline, dropping by another 10 bp.

Thursday and Friday witnessed a reversal in market trends, with US stocks trimming their weekly gains, despite strong earnings reports from banks. US 10-year Treasury Bonds experienced an increase of almost 20 basis points on Thursday but ultimately closed the week slightly lower at 4.63%. This shift was primarily driven by Thursday’s release of CPI inflation data, which exceeded expectations, showing a month-on-month increase of +0.4% (compared to the expected +0.3%) and a year-on-year figure of +3.7% (surpassing the expected 3.6%). Core CPI, however, aligned with expectations at 4.1%.

On Friday, the Preliminary Michigan Consumer Sentiment for October dropped to its lowest level in five months, plummeting from 68.1 in September to 63, significantly missing market estimates of 67.2. This decline was coupled with an unexpected increase in October’s 1-year inflation expectations, which rose to 3.8% (compared to the previous 3.2%). Even slightly better-than-expected unemployment data on Thursday, with 209,000 actual versus an expected 210,000, failed to offset concerns about inflation.

Europe and UK

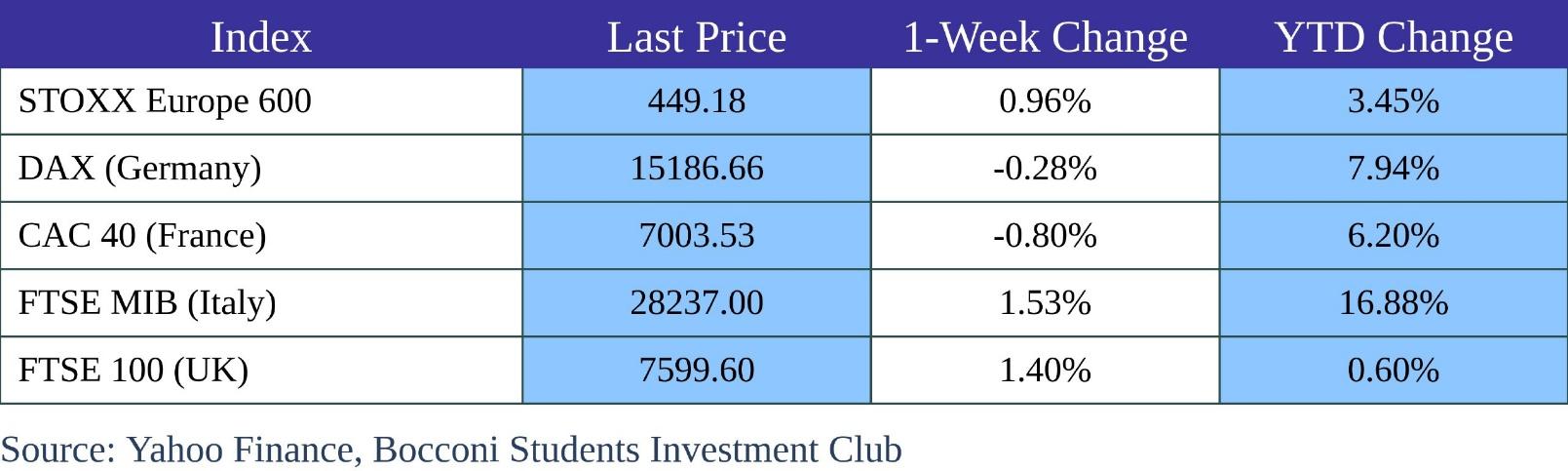

European markets exhibited a range of outcomes, with the FTSE MIB in Italy leading the way with the most substantial increase, surging by 1.53% following a challenging prior week. The FTSE 100 in the UK also posted notable gains, rising by 1.4%, while the STOXX Europe 600 index advanced by 0.96% over the same period. In contrast, the DAX in Germany and the CAC 40 in France extended their losing streaks, declining by 0.28% and 0.8%, respectively.

The start of the week for European markets brought unfavorable news, as all the indexes declined by approximately 0.5%. Only the FTSE 100 remained relatively flat at the beginning of the week following developments related to the Middle East conflict. Additionally, industrial production in Germany dipped by 0.2% month-on-month in August, slightly worse than the 0.1% forecasts.

However, a turnaround occurred on Tuesday when all the indexes surged by around 2%, with the FTSE MIB leading the way with a notable rise of 2.3%. This positive shift was attributed to encouraging news from the US, where stocks rose, and yields dropped. Furthermore, the Federal Reserve’s announcement of a more cautious approach towards monitoring yields contributed to the positive sentiment.

Wednesday and Thursday brought relative stability to the indexes, with minimal fluctuations. On Wednesday, Germany announced its year-on-year inflation rate, which was in line with expectations and significantly lower than the previous month’s figure (4.5% compared to 6.1%). On Thursday, the UK’s August GDP data matched the overall consensus of +0.2% month-on-month, marking a significant improvement over July’s revised data, which showed a contraction of -0.6%. Additionally, there was a decline in industrial production by 0.7% month-on-month.

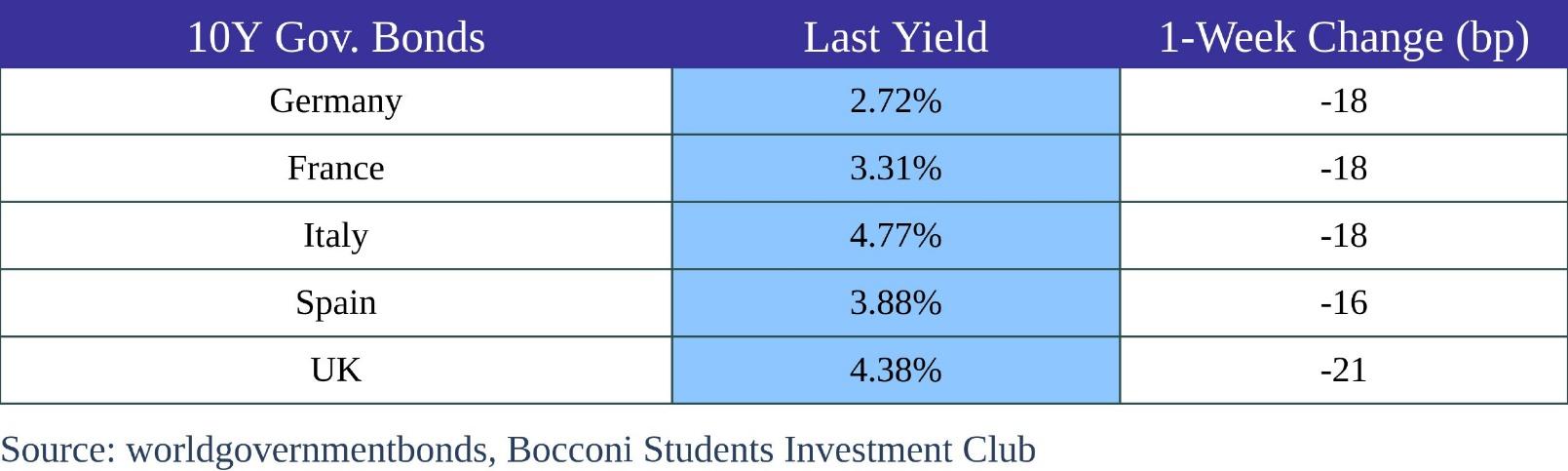

These developments had a modest impact on the FTSE 100, which edged slightly higher compared to the previous day. Furthermore, they influenced the yields on the 10-year Gilt, pushing them to a near two-week low of 4.28%, down from the previous week’s high of 4.67%.

On Friday, the indexes struggled to maintain their weekly gains, experiencing a sell-off. The DAX bore the brunt of the decline, plummeting by 1.55%. This drop was attributed to increasing uncertainty surrounding the Israel-Hamas conflict and the impact of the US CPI data. In France, inflation data matched expectations, with a year-on-year figure of 4.9%, remaining unchanged from the previous month. Meanwhile, the bond market saw a rebound in yields after four days of decline, but still closed the week with yields approximately 20 basis points lower than the previous week.

Rest of the World

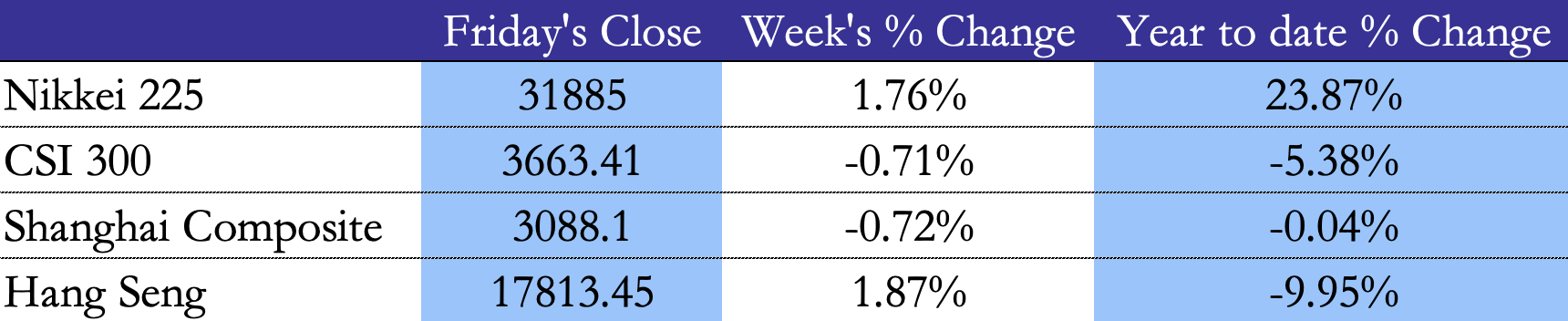

This week’s results have been mixed in the Asian economic area with Nikkei 225 and Hang Seng closing the week strong with 1.76% and 1.87% gains respectively. CSI 300 and Shanghai Composite each fell by 0.7% after a previous week’s trading pause.

The start of the week witnessed a strong performance from Hang Seng, which gained 1.58% on Monday and continued to show modest growth on Tuesday. However, the same cannot be said for the other indexes, which displayed mixed results in the initial couple of days, ultimately losing around 0.4% by the time the markets closed on Tuesday.

As the week progressed, Chinese indexes continued to decline on Wednesday, shedding another 0.7%. In contrast, Nikkei 225 experienced a substantial rise of 2.43% on the same day, buoyed by positive news. This upward momentum carried forward to Thursday, with Nikkei 225 posting a 0.6% gain in reaction to the release of the Fed’s minutes.

Hang Seng indeed demonstrated moderate growth, advancing by 0.84% on Wednesday and adding another 1.3% on Thursday. These gains were attributed to rumors circulating about the Chinese sovereign wealth fund increasing its stake in four of the largest banks in the country. However, Friday saw a similar sell-off as observed in global markets, with all the indexes experiencing a decline in gains. Hang Seng led this downward trend, falling by 2.33%. This decline was primarily driven by increased uncertainty in the Middle East, coupled with the release of hot US CPI data and China’s flat CPI data, which came in below the consensus of 0.2%. These figures indicated ongoing deflationary pressures.

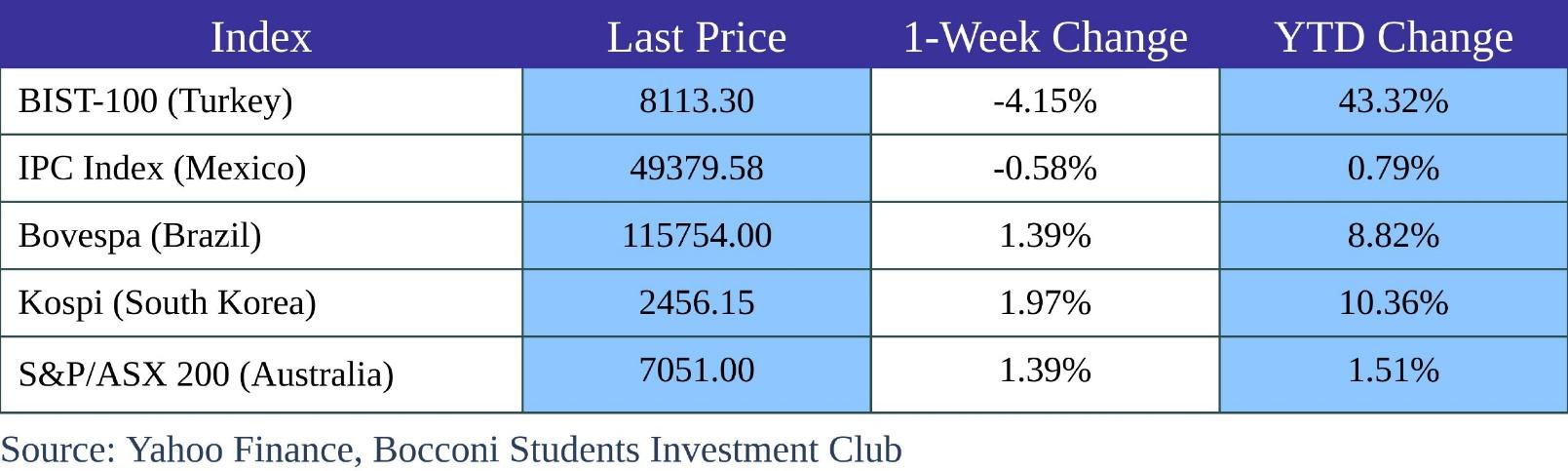

In contrast to Hang Seng’s decline, the rest of the world’s markets displayed different trends. Turkey’s BIST-100 lost all of the gains from the previous week, decreasing by 4.15%, particularly in the last couple of days of the week. This drop followed weak industrial production data for August, which came in at 3.1% year-on-year, a significant decrease from the 7.1% recorded the previous month. The IPC Index also continued its downward trajectory, decreasing by an additional 0.58%.

On the brighter side, other global indexes showed positive returns, aligning with Wall Street’s performance. Brazil’s Bovespa and Australia’s S&P/ASX 200 both posted gains of 1.39%, while the Kospi recorded a notable increase of 2%, which helped mitigate some of the losses from the previous week.

FX and Commodities

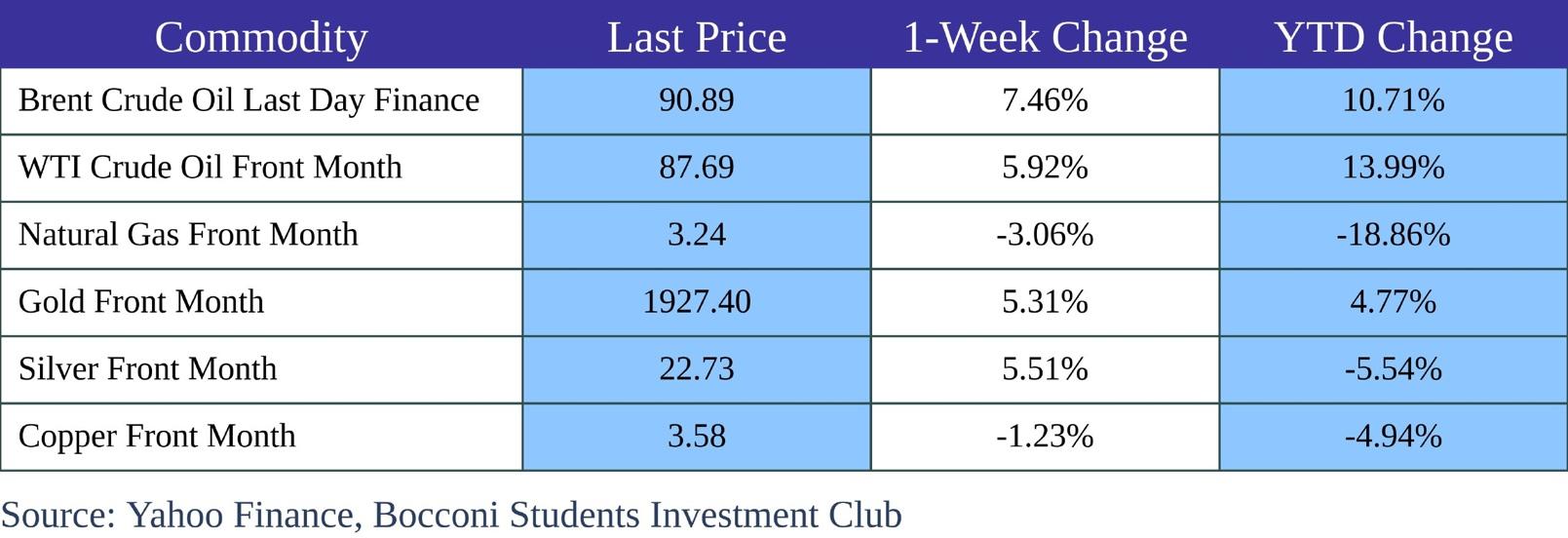

The beginning of the week witnessed a substantial 5% increase in oil prices, primarily driven by concerns related to the Israel-Hamas conflict and fears that the turmoil might spread throughout the Middle East, with particular attention on its potential impact on Iran. Although oil prices briefly returned to the previous week’s levels, they gained momentum once more following the US announcement of sanctions, capping Russian oil prices at $60 per barrel.

Gold also experienced a resurgence, surpassing the $1900 mark, triggered by concerns that emerged on Friday regarding the Middle East, especially the escalating conflict in the Gaza region and the possibility of Iran’s involvement. Interestingly, these movements in the gold market were somewhat synchronized with fluctuations in the DXY, which, after an initial decrease earlier in the week, returned close to 107. In contrast, natural gas lost 3% after reaching a 9-month high the previous week.

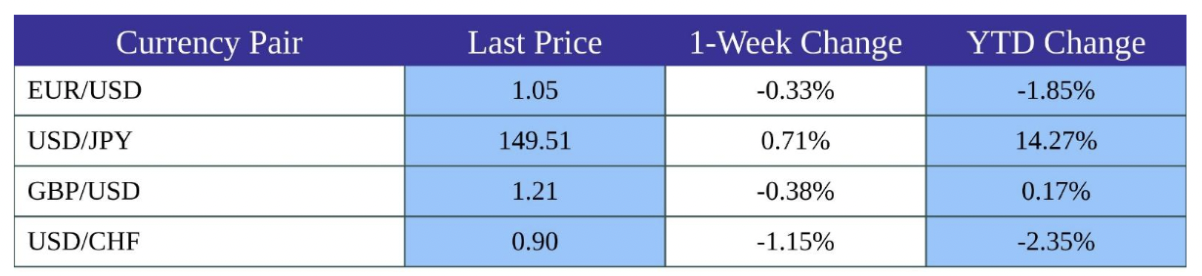

Currency markets remained relatively stable throughout the week, primarily influenced by the strengthening of the US dollar. Only the Swiss franc strengthened against the dollar, mirroring the demand for safe-haven currencies like the USD.

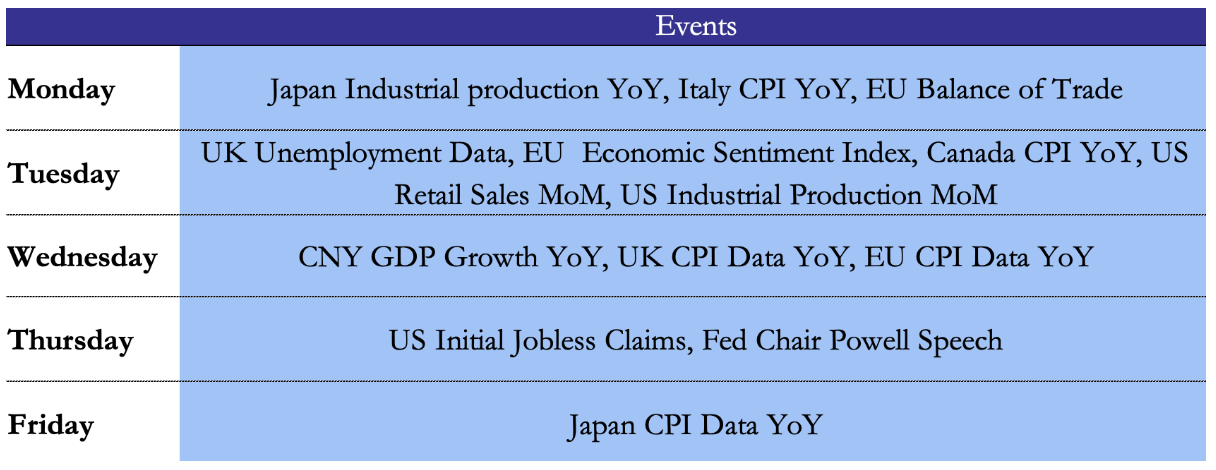

Next Week Main Events

Source: TradingEconomics, Bocconi Students Investment Club

Brain Teaser #04

We have a weighted coin that shows a Head with probability “p” and tails with “1−p”, (0.5<p<1). How would we define two equally likely events using this coin?

SOLUTION: For an arbitrary pp, this cannot be accomplished in a single toss. If we toss twice, we observe that the probability of HT and TH is the same, i.e. the probability of heads in the first toss and tails in the second is the same as its reverse. Hence, we can declare these two as the two events. If we observe HH or TT, we retry.

Brain Teaser #05

100 prisoners are lined up and assigned a random hat These hats are available in 10 different unique and distinguishable colors. Each prisoner can see the hats in front of him but not behind. Starting with the prisoner in the back of the line and moving forward, they must each, in turn, say only one word which must be the color like “red” or “blue” or “green” etc. If the word matches their hat color they are released, if not, they are killed on the spot. They can hear each other’s answers, no matter how far they are on the line. What strategy should be used to help release maximum number of prisoners?

0 Comments