USA

U.S. equities faced a volatile week as investors tried to figure out how to react to President Trump’s renewed threats of tariffs, inflation numbers that were higher than expected, and the Federal Reserve’s cautious stance on future rate cuts. At the beginning of the week, financial markets faced downward pressure following Trump’s announcement of an immediate 25% tariff on steel and aluminum imports, with the possibility of further tariffs on the horizon. Concerns regarding potential retaliatory actions, particularly from the EU and China, have heightened concerns about increasing costs and inflationary pressures, thereby reducing risk appetite.

Midweek, Fed Chairman Jerome Powell’s testimony to Congress added to the uncertainty. Powell emphasized that the Federal Reserve is not in a hurry to reduce interest rates, pointing to ongoing inflation that remains above the 2% target and a labor market that remains strong. This stance was tested by Wednesday’s CPI report, which showed headline inflation unexpectedly rising to 3% and core inflation moving up to 3.3%, both higher than estimates. This negatively impacted equity markets and led to an increase in Treasury yields, as market participants adjusted their expectations regarding potential rate cuts by year-end.

On Thursday, markets saw an above-forecast PPI reading and stronger jobless claims data, indicating a strong labor market but reinforcing concerns about persistent price pressure. Equities experienced an uptrend following President Trump’s decision to sign a memorandum aimed at reviewing additional tariffs instead of imposing them immediately, reducing some of the heightened concerns surrounding a potential trade war. By Friday, retail sales figures fell short of expectations, showing a -0.9% month-over-month decline for January. This development reignited concerns regarding the stability of consumer spending, leading major stock indices to fluctuate.

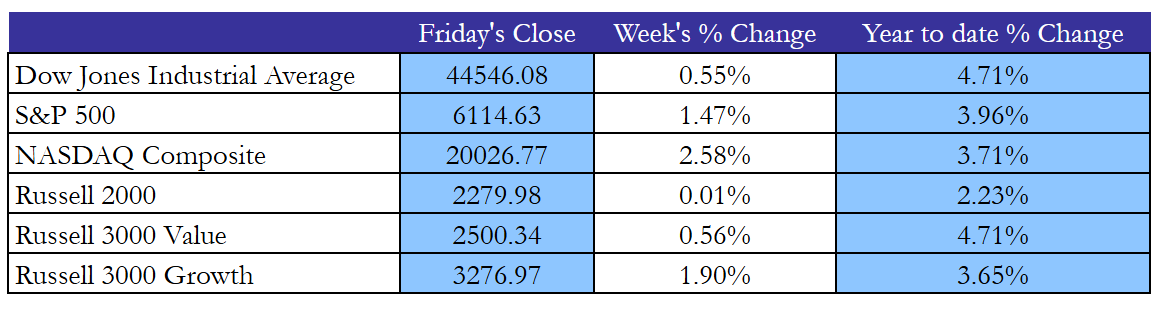

In summary, U.S. equities advanced significantly this week, with all major indices closing in positive territory. The Dow Jones Industrial Average rose 0.55% to 44,546.08 points, bringing its year-to-date gain to 4.71%. The S&P 500 rose 1.47% to 6,114.63, indicating investor enthusiasm amid persistent trade tensions and inflation fears. The Nasdaq Composite exceeded, rising 2.58% to 20,026.77. Meanwhile, small-cap stocks struggled to gain traction, with the Russell 2000 rising only 0.01% to 2,279.98, bringing the year-to-date gain to 2.23%. On a broader scale, growth companies outpaced value equities, with the Russell 3000 Growth index up 1.90% and the Russell 3000 Value index up 0.56%.

Source: Marketwatch, Bocconi Students Investment Club

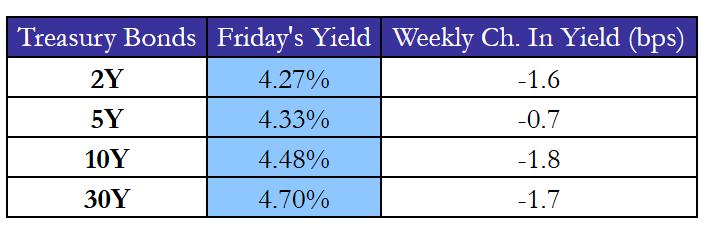

Treasury rates fell slightly this week, despite ongoing fears that the Federal Reserve may need to maintain a restrictive interest rate environment for longer than expected. The 10-year Treasury yield fell 1.8 basis points to 4.48%, remaining in the 4.5%-4.6% range, as investors absorbed a higher-than-expected CPI report and Fed Chair Powell’s cautious tone on future rate decreases.

Shorter-term rates also fell little, with the 2-year yield decreasing 1.6 basis points to 4.27%, indicating a slight repricing of rate cut expectations. The 5-year yield fell 0.7 basis points to 4.33%, while the 30-year yield decreased by 1.7 basis points to 4.70%.

The bond market’s reaction implies that investors are still unsure about the timing of rate cuts, with expectations sliding from multiple cuts this year to possibly one or none, following solid economic statistics and sustained inflation. Meanwhile, persistent concerns about Trump’s recently announced tariffs added another layer of uncertainty, with market participants weighing the possible inflationary impacts of trade policy. Next week’s FOMC minutes and major economic indicators will be eagerly examined for further clues about the Fed’s attitude.

Source: Marketwatch, Bocconi Students Investment Club

Europe and UK

For the majority of the week, European equity markets rose sharply, fueled by a combination of corporate earnings beats, an unexpected improvement in macro data, and renewed optimism for a resolution to geopolitical tensions. Initially, investors appeared to dismiss US President Trump’s freshly implemented 25% tariffs on steel and aluminum imports, instead focusing on business updates and the Eurozone economy’s relative strength.

Midweek, the STOXX 50 touched levels last seen in 2000, while the STOXX 600 set new highs. A flurry of impressive corporate earnings helped to underpin these gains, with outstanding performances from Heineken (+11% on higher-than-expected profit), Kering (boosted by favorable luxury demand), and Siemens (up nearly 5% on a record order book). Meanwhile, Nestlé rose more than 6% on sales growth and higher margins, propelling the overall food and beverage industry.

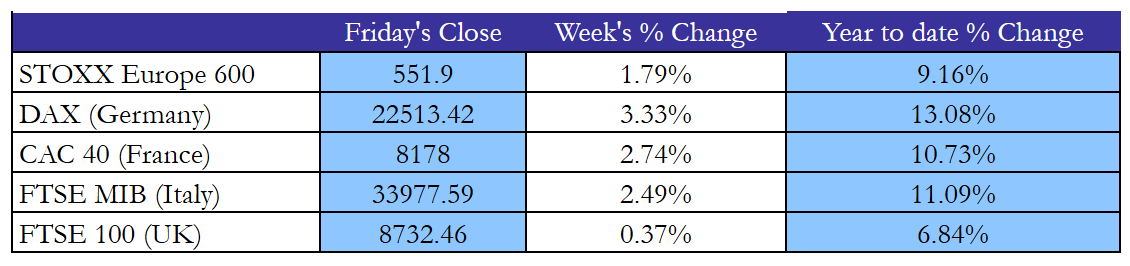

As of Friday’s close, the STOXX Europe 600 settled at 551.9, up 1.79% for the week and 9.16% year to date. Germany’s DAX ended at 22513.42 (+3.33% weekly, +13.08% YTD), France’s CAC 40 at 8178 (+2.74% weekly, +10.73% YTD), Italy’s FTSE MIB at 33977.59 (+2.49% weekly, +11.09% YTD), and the UK’s FTSE 100 at 8732.46 (+0.37% weekly, +6.84% YTD).

President Trump’s announcement that he had spoken with Russian President Putin about beginning quick negotiations to resolve the crisis in Ukraine boosted sentiment, increasing optimism that geopolitical concerns in Eastern Europe would be reduced. This news briefly overshadowed the release of disappointing Eurozone industrial production statistics for December (-1.1% MoM versus -0.6% predicted). The unexpected fall was driven by strong contractions in capital and intermediate goods, while non-durable consumer goods production increased.

By Thursday, most European indices had risen to new highs, but the rally slowed at the end of the week, with the Euro Stoxx 50 and STOXX 600 both falling slightly on Friday. Investors considered Trump’s follow-up statements on “reciprocal tariffs,” which, if fully implemented, might have an impact on the European Union. Despite the trade uncertainties, the Euro Area GDP for Q4 2024 was revised slightly higher to +0.1% QoQ, indicating that the bloc avoided stagnation despite Germany and France’s small contraction (-0.2% and -0.1%, respectively).

In the United Kingdom, data showed that the economy surprisingly expanded by 0.1% in Q4, driven by an increase in services and government spending, although industrial output remained under pressure. The reading resolved concerns of an immediate recession and delivered a boost to UK-focused markets, despite the broader FTSE 100 struggled to find direction due to global trade uncertainties.

Source: Marketwatch, Bocconi Students Investment Club

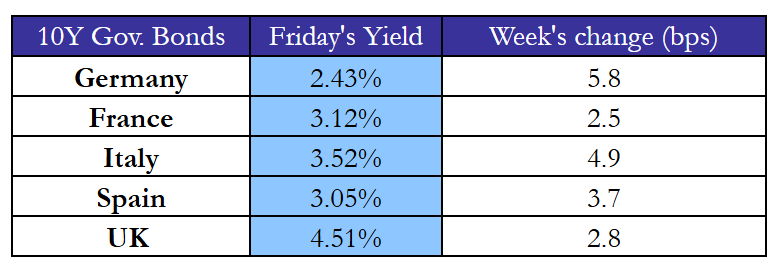

The German 10-year Bund yield stayed around 2.4% as investors evaluated the latest round of central bank guidance, corporate earnings, and geopolitical concerns in Europe. On Friday, the yield wrapped up at 2.43%, up 5.8 basis points from the previous week, showing shifting sentiment in response to the latest Eurozone inflation estimates. Meanwhile, Italy’s 10-year BTP yield stood at 3.52%, down from a brief midweek high of about 3.6%. France’s 10-year OAT yield closed Friday at 3.12%, having reached a one-month high before falling as traders looked for indications of slowing inflation.

Spain’s 10-year government bond advanced moderately, settling at 3.05% after rising beyond 3.1% earlier in the week. In the United Kingdom, the 10-year gilt yield briefly hit 4.6% before closing at 4.51% (up 2.8 basis points) as markets reviewed the Bank of England’s stance following its most recent policy meeting. The BoE underlined ongoing inflationary pressures, which are consistent with updated predictions from the Office for Budget Responsibility, encouraging investors to be wary about the possibility of further tightening if price rise fails to moderate.

Source: Marketwatch, Bocconi Students Investment Club

Rest of the World

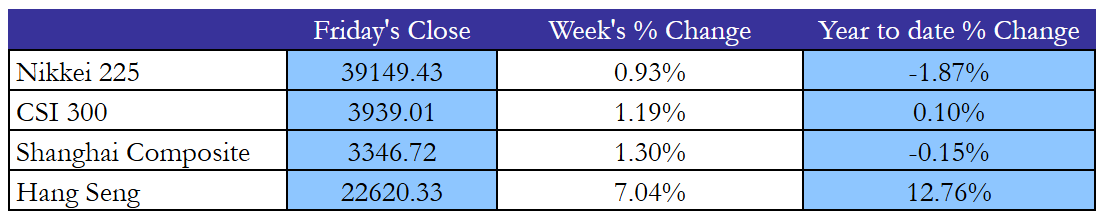

Chinese stock markets were generally upbeat this week, boosted by strong liquidity conditions and additional signals of policy support. The Shanghai Composite jumped 1.30% to 3346.72, while the CSI 300 increased 1.19% to 3939.01. In Hong Kong, the Hang Seng Index surged 7.04% to 22620.33, bringing its year-to-date gain to an incredible 12.76%.

On the economic front, China’s annual CPI rose to 0.5% in January (up from 0.1% earlier), its highest level in five months, due to Lunar New Year spending and favorable government policies. PPI remained in negative for the 28th consecutive month (-2.3%), indicating inconsistent price pressures across sectors. Despite low producer prices, new yuan loans reached a monthly high of CNY 5130 billion, indicating sustained stimulus efforts.

In Japan, the Nikkei 225 moved up 0.93% to 39149.43, but is still down 1.87% year to date. Investor mood was impacted by a slowing in machine tool orders (+4.7% y/y vs. +11.2% the previous month) and a rise in producer prices to +4.2% y/y, the quickest rate since mid-2023. Also, South Korea’s Kospi rose 2.74% to 2591.05 (+7.98% YTD) on positive labor data: the country’s unemployment rate fell to 2.9% in January from a three-year high of 3.7%.

Source: Marketwatch, Bocconi Students Investment Club

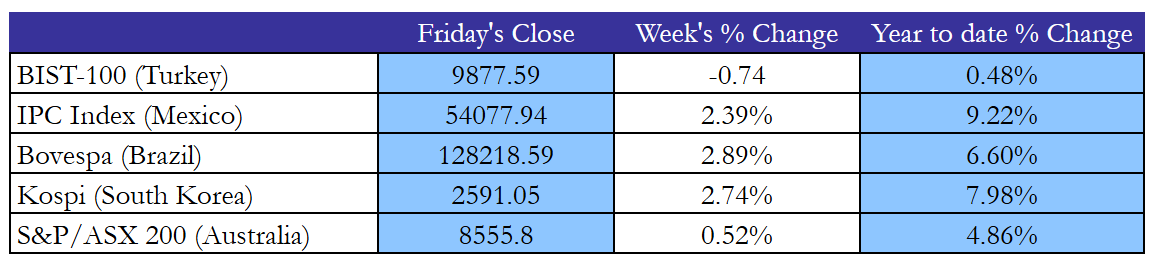

The S&P/ASX 200 in Australia increased 0.52% to 8555.8, boosted by stronger business optimism (the NAB index turned positive to +4), while consumer sentiment remained cautious at 92.2. In Southeast Asia, the Philippine central bank surprised investors by maintaining its benchmark rate at 5.75%, citing a continued robust domestic growth outlook despite inflation being near 3%.

In Latin America, Mexico’s IPC Index rose 2.39% to 54077.94 (+9.22% year to date). However, manufacturing data revealed weakness: car exports fell 13.7% year on year in January, while industrial production fell 2.7% year on year in December. In Brazil, the Bovespa rose 2.89% to 128218.59 (+6.60% YTD), boosted by a slowing of inflation to 4.56%—still above the central bank’s upper target range. In December, retail sales fell by 0.1% month-on-month but increased by 2% year-on-year, indicating that customers are facing higher borrowing expenses.

Turning to Turkey, the BIST-100 down 0.74% to 9877.59, pulled down by ongoing political and economic concerns. In Russia, the central bank maintained its benchmark rate at 21% for the second consecutive meeting, citing persistent inflation (about 10%) and a tight labor market. Finally, South Africa’s business confidence index fell marginally (to 120 from 121), as reduced export volumes offset an increase in vehicle sales and tourism.

Source: Marketwatch, Bocconi Students Investment Club

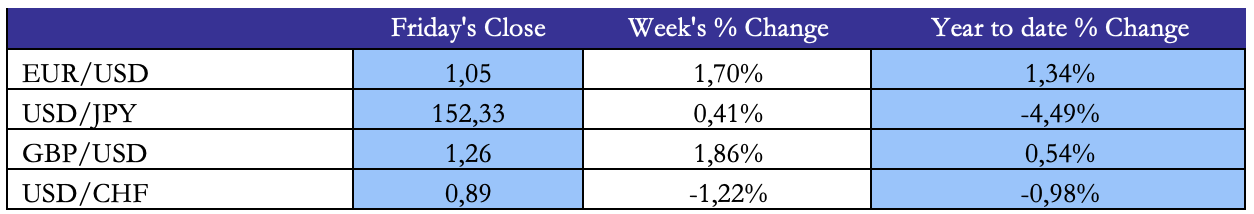

FX and Commodities

Source: Marketwatch, Bocconi Students Investment Club

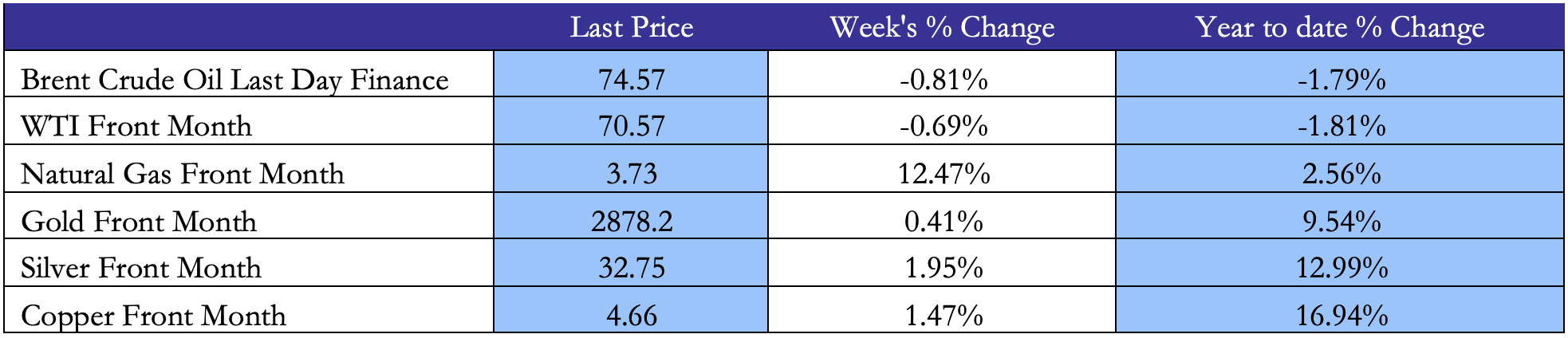

Gold prices jumped beyond $2,900 per ounce this week, setting a new all-time high, driven by demand following President Trump’s announcement of new global steel and aluminum tariffs. Fears of an expanding trade war have fueled inflows into the precious metal, which benefits from increased geopolitical and economic uncertainty. Further support came from dovish signals from major central banks: despite strong jobs data, markets predict two Fed rate cuts in 2024, while the Bank of England announced a larger-than-expected rate drop and the RBI reduced borrowing costs for the first time in five years. Meanwhile, official statistics showing increased central bank gold purchases, particularly by the People’s Bank of China, provided another boost.

Oil markets were turbulent, with Brent oil circling around $75 early in the week before falling below $75 on signals of plentiful supply. Supply fears were initially driven by new US sanctions targeting Iranian and Russian exports, but attitude turned later on prospects of mediation in Ukraine when President Trump claimed that he had spoken with Russia’s President Putin about peace talks. In the United States, API data revealed a larger-than-expected inventory build, supporting the assumption of sufficient short-term supply. Meanwhile, concerns remain that recently announced metals tariffs may disrupt specialty steel imports crucial to U.S. drilling operations.

Natural gas markets in Europe (TTF) rose to roughly €59 per megawatt-hour as a result of colder weather and limited storage levels, which fell below 50% capacity—far below historical averages. However, TTF prices fell below €50 per megawatt-hour as news of potential peace talks between Russia and Ukraine addressed supply-risk concerns, while milder temperature projections for late winter reduced demand expectations.

Aluminum prices maintained above $2,640 per tonne, boosted by President Trump’s decision to impose a 25% tariff on aluminum imports, while implementation specifics are uncertain. China’s record aluminum production in 2024 has reached the government-imposed threshold, potentially limiting further output increases and supporting pricing.

Source: Marketwatch, Bocconi Students Investment Club

Next Week Main Events

Source: Trading Economics, Bocconi Students Investment Club

Brain Teaser #28

You and your colleagues know that your boss A’s birthday is one of the following 10dates:

Mar 4, Mar 5, Mar 8

Jun 4, Jun 7

Sep 1, Sep 5

Dec 1, Dec 2, Dec 8

A told you only the month of his birthday and told your colleague Conly the day. After that, you first said: “I don’t know A’s birthday; C doesn’t know it either.” After hearing what you said, C replied: “I didn’t know A’s birthday, but now I know it.” You smiled and said: “Now I know it, too.” After looking at the 10 dates and hearing your comments, your administrative assistant wrote down A’s birthday without asking any questions. So, what did the assistant write?

Solution

Let D be the day of A’s birthday, with D in {1,2,4,5,7,8}. If A’s birthday were on a unique day, C would immediately know it. Among the possible values, only 2 and 7 are unique. Since C initially does not know the birthday, we can infer that D different 2 or D different 7 meaning the month cannot be June or December. This leaves March and September as possibilities.

Now that C knows the month, he must have identified a unique day in that list. This eliminates March 5 and September 5, leaving only March 4, March 8, and September 1. Since March 4 and March 8 share the same month, C wouldn’t be able to determine the exact date if the month were March. However, C does identify the birthday, which means it must be September 1. Therefore, A’s birthday is September 1.

Brain Teaser #29

A casino offers a card game using a normal deck of 52 cards. The rule is that you tum over two cards each time. For each pair, if both are black, they go to the dealer’s pile; if both are red, they go to your pile; if one black and one red, they are discarded. The process is repeated until you two go through all 52 cards. If you have more cards in your pile, you win $100; otherwise (including ties) you get nothing. The casino allows you to negotiate the price you want to pay for the game. How much would you be willing to pay to play this game?

0 Comments