USA

Volatility is at lowest levels since pre-pandemic, indeed, the stock market ended a pretty stable week. Major indexes rose slightly mainly due to upbeat economic data and the beginning of the US earnings season, the financial sector kicked off with positive results from Wells Fargo, Goldman Sachs, JP Morgan Chase. The week ended with profit above expectations from Citi, Bank of America, BlackRock and Morgan Stanley. PepsiCo also reported confident results with an EPS higher than expected. Goldman Sachs saw its share trading at 4.5% higher after earnings release reported a 498% growth from a year earlier. JPMorgan earnings were 48% above consensus. Alongside profit slightly higher than estimated, BlackRock’s assets under management reached $9 trillion in the quarter, an impressive amount if compared to $6.47 trillion a year earlier.

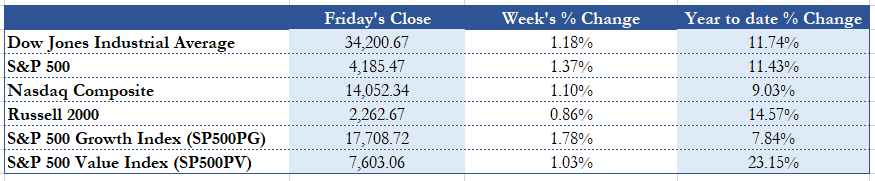

The S&P 500 kept rallying 1.37% to 4,185.47, the Nasdaq Composite gained 1.1% breaking the 14,000.00 barrier, but still slightly behind its all time-high. Coinbase, the largest U.S. cryptocurrency exchange, made its debut on Nasdaq through direct listing. Shares started trading Wednesday, after opening at $381.00 and reaching as high as $429.54, they ended the session at $328.28. The week ended with a price of $342.00 leading to a market cap of almost $65 billion. Dow Jones surpassed the 34,000.00 milestone. The blue-chip index outperforms the S&P 500 year-to-date, with a performance of 11.74% against 11.43% of the latter. The S&P Pure Growth Index and the S&P Pure Value Index rallied respectively 1.78% and 1.03%. The materials, health care and utilities sector performed the best, while the energy one was the worst.

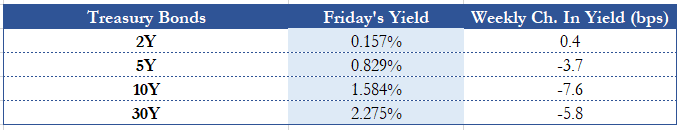

The 10Y Treasury yield closed 7.6 basis points lower, the week started with upward movements which led to as high as 1.7 level and then the trend reversed starting from Tuesday and finally closed slightly higher at 1.584%. On Monday, yields rose after Fed Chairman Jerome Powell on Sunday, reiterated the commitment to maintain a loose monetary policy. He said that it is highly unlikely that the Fed would raise interest rates this year. “I’m in a position to guarantee that the Fed will do everything we can to support the economy for as long as it takes to complete the recovery”, he added. On Tuesday, Treasury yield fell after the FDA asked for a halt on Johnson & Johnson vaccine distribution after 6 rare clotting cases emerged. Inflation report didn’t particularly affect the market as it came in only 0.1% above expectations. The downward trend was accentuated on Thursday after March retail sales surged 9.8%, analysts’ forecasts were around 5.9%. Weekly Jobless Claims fell to 576 000, much lower than the 700 000 expected, the data was at the lowest level since the initial period of the pandemic. Thursday’s move was the opposite of what investors expected. Normally, good news on the economy drives a shift from bond to equity market, leading the price of bonds to decrease and their yield to grow. The decline was the most important since November 4, the day after the U.S. election. The reasons behind the irregularity seem to be two: Japanese investors’ heavy buying in Treasurys ($15 billion in overseas bonds) and the possibility that the bond market has started to price in a peak for economic growth, with investors already looking at positive data as a closer moment to a possible inflection point for the economy.

Since last June, the Fed has been buying around $120 billion a month of Treasury debt to keep borrowing costs low. Concerning this, Jerome Powell made some important during the Economic Club of Washington on Wednesday, “We will reach the time at which we will taper asset purchases when we have made substantial further progress towards our goals from last December” he said, “That would in all likelihood be before, well before, the time we would consider raising interest rates. We have not voted on that order but that is the sense of the guidance.” Thus, even if the Fed pledged its support through a loose monetary policy, investors could see the bond market to spice up before their expectations.

Europe and UK

Europe’s major indexes climbed. The pan-European Stoxx Europe 600 increased 1.20%, going for the first time above the 440,00 threshold. The German DAX advanced 1.48%. Daimler, the German automaker, saw its share gaining 3.31% this week after it reported an adjusted EBIT of nearly €5 billion, a remarkable result if compared to €719 million of last year’s first quarter. The French CAC 40 rose 1.91% to 6,287.07, led by a surge of 7.09% in LVMH’s shares. The French luxury goods group posted a revenue 8% higher than the first quarter of 2019, Chinese and American customers sustained the demand. The FTSE 100 surpassed the 7000 level, with a 1.5% rise during the week. Tesco reported a 20% plunge in profits as costs relating the pandemic outweighed sales boost. Pre-tax profits were down to £825 million, last year’s result was £1.03 billion. Market didn’t react particularly, shares ended the week with a 1.03% decrease. Italian FTSE MIB reached pre-pandemic level with a slight increase.

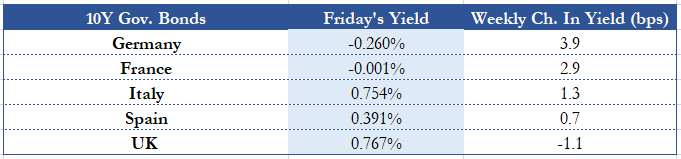

The Euro-zone bond market was pretty calm this week. Overall, yields increased by a few basis points across Europe. German 10Y Bund rose 3.9 bps, French yield moved higher towards the Zero-Bound level. Italian grew 1.3bps to 0.754%. Differently from the U.S bond market, which has suffered a huge sell-off, in Europe investors have just started to react to improving economic data and an accelerating vaccination programme. Due to delays in the vaccine distribution from pharmaceutical companies, the European situation is much worse than in the U.S. Analysts expect that the recovery in Europe will drive bond yields higher. The main difference between the U.S. and the European bond is that in Europe there is much less fear for high inflation, for this reason analysts do not expect a sell-off similar to the Treasury one but a much mild and calm prospect.

From the macroeconomic side, European countries didn’t report any data that affected the market. On Tuesday, the UK reported a 0.4% GDP growth in February, slightly lower than the 0.6% expected. April’s ZEW economic sentiment index for Germany came in worse than forecasted, 70.7 against 79.

Rest of The World China record growth

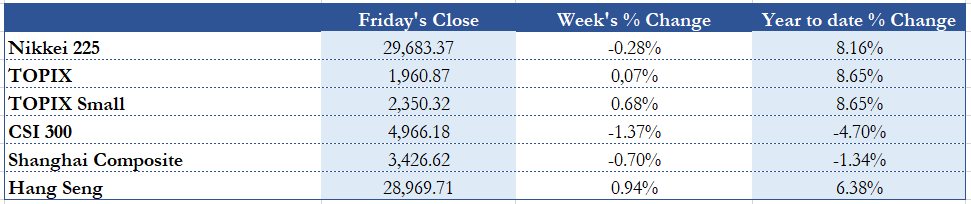

Asian markets were quiet during the week. Japanese indexes closed almost flat, the Nikkei 225 lost 0.28% ending the Friday session at 29683.37, the TOPIX and the TOPIX small rose respectively 0.07% and 0.68%. Hong Kong based Hang Seng gained 0.94%. The Chinese indexes closed lower, the CSI 300 decreased 1.37% and the Shanghai Composite shrank 0.70%. Alibaba shares surged more than 9% on Monday after the $2.8 billion fine by Chinese regulators was released last weekend. The week ended with a 6.89% gain in stock price. The large amount of the fine, which was equivalent to 4% of domestic revenues, was less than the maximum 10% penalty possible in the country. Investors feared for a much worse scenario and this fine was seen as a relief from recent monopoly investigation. “Despite the record fine amount, we think this should lift a major overhang on BABA and shift the market’s focus back to fundamentals,” Morgan Stanley wrote in a note after the fine was issued. Joe Tsai, the executive vice chairman of Alibaba said that they are pleased that they have finally closed this chapter. China GDP growth rate in the first quarter came in on Friday. China’s economy surged 18.3% in the first three months, still below 19.2% expectations. The year-on year data for the first quarter was the highest since 1992. On the other side, negative news was released regarding the Chinese vaccines. The director of China Centers for Disease Control, Gao Fu, said that Chinese vaccines don’t have very high protection rates. “It’s now under formal consideration whether we should use different vaccines from different technical lines for the immunization process”, Gao added. Chinese government has not approved any foreign vaccines in the country. Experts say Chinese vaccines are unlikely to be sold to the U.S. and to western Europe due to the complexity of the approval process. For this reason, analysts do not expect that the statement will have any particular relevance for the markets.

Turkish BIST-100 Index grew 1.07%. On Thursday, Turkey’s central bank decided to hold interest rates steady, this was the first major decision since President Erdogan fired Naci Agbal, the governor of the institution. In the weeks following the removal of Mr. Agbal, investors removed nearly $2 billion from the country. Mr. Agbal’s major goal was to control inflation by raising interest rates. President Erdogan, instead, has always preferred low rates to sustain economic growth. “Given the upwards risks on the inflationary prospects, I don’t think a steady policy rate will be able to address these pressures,” said Selva Demiralp, a former economist at the Federal Reserve Board. Turkey’s inflation surged to 16.19% in March in its sixth consecutive monthly rise. Economists do not expect any improvement concerning the current situation. Brazilian Bovespa increased nearly 3% surpassing 120,000.00. Australian S&P/ASX 200 closed the week 1% up exceeding 7,000.00.

FX and Commodities

Oil prices rallied this week, London-based Brent futures settled 5.82% higher at $66.71 per barrel. West Texas Intermediate (WTI) gained 6.29%, ending at $63.07, more than 30% up year-to-date. Upward pressure came from strong Chinese import data, but the pauses on Johnson & Johnson vaccine restricted the rally.

Gold futures settled 1.90% higher at $1,777.30 hitting a seven-week high. The recent surge in price was sustained by the sharp pull-back in the U.S. Treasury yields. Gold prices and bond yields are generally negatively correlated. Since they are both safe-haven assets, investors shift from gold to bonds when yields are high, and vice versa when bond yields are low and gold starts to look more attractive. Spot prices closed the week at $1,776.31. If analysts’ expectations of even lower bond yield in the following weeks come true, gold traded at more than $1,800.00 will not be a surprise for investors. “The macro argument for gold has also improved. We are poised for a run towards $1,800” said Edward Moya, senior market analyst at OANDA.

The U.S Dollar Currency Index fell to a four-week low against a basket of six major currencies, losing almost 1% during the week. The reason for the recent depreciation of the currency can be found in the sharp drop in the U.S. Treasury yields. Bond yield and the local currency are usually positively correlated since capital flows are attracted by the higher yielding currency. Analysts expect the dollar weakness to continue at least in the short term. EUR/USD closed 0.71% higher at 1.1986. GBP/USD rose 0.94% at 1.3834. Chinese Yuan closed almost flat against the dollar at 6.5209. Bitcoin/USD reached 64,400.00 on Wednesday after Coinbase made its debut on Nasdaq. After a sharp drop on Saturday, it is now traded at nearly 55,000.00

3 Biggest Movers

Nuance Communications, Inc. (NUAN), a technology company specialised in providing conversational and cognitive artificial intelligence based in Massachusetts, surged 23% on Monday after Microsoft agreed to buy the company for $19.6 billion The deal placed itself as the largest acquisition since LinkedIn Corp. The acquisition aims to strengthen Microsoft business in the healthcare sector. Indeed, the artificial-intelligence technology improves the doctor-patient interaction and upgrades hospital digital record-keeping. Shares ended the week almost 17% higher.

Alcoa Corporation (AA), an American industrial corporation, the eighth largest producer of aluminium on the earth. Shares gained 12% during the week after the metal giant reported first quarter earnings above expectations, $0.79 EPS well above $0.46 consensus. Stock price increased six-fold from the pandemic low of last year. They went from 5 to 35 in a twelve months range.

Plug Power Inc. (PLUG), an American company specialised in the development of solid oxide fuel cells. Shares gained more than 50% during the first month of the year but they pulled back to initial level after losing more than 40% from its high. Stock closed the week almost flat. The downward trend was reversed on Friday after JPMorgan upgraded shares to “overweight”, they surged 7% after the note from the investment bank.

Next week main events

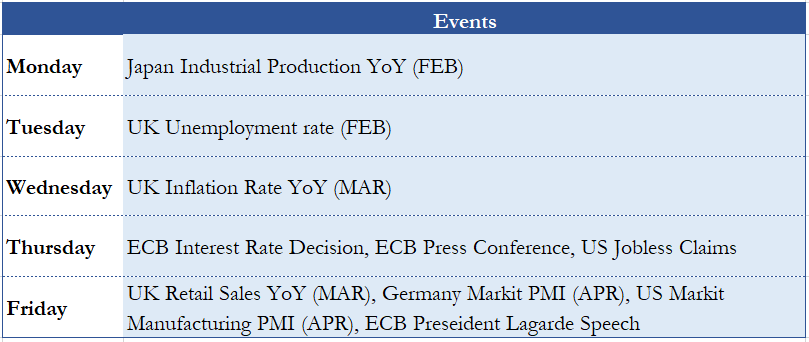

The calendar of the following week is pretty empty. The week starts with Japan February Industrial production, then on Tuesday and Wednesday we have the UK February Unemployment rate and March Inflation rate. On Thursday ECB Interest rate decision and US Jobless claims are expected. The week ends with UK March Retail sales, Markit PMI data for Germany and US and Lagarde’s speech.

Brain Teaser #4

Can we arrange the numbers 1, 2, 3,…, 21 on a circle such that the sum of any two is a prime number?

Solution:

We notice that we have ten even numbers and eleven odd numbers. So, no matter how we arrange the numbers on the circle, we will always have two consecutive odd numbers, and thus their sum will be an even number greater than 2 (not prime). Therefore, there is a contradiction.

Brain Teaser #5

You have 100 red balls, 100 white balls, and 100 green balls. How to split them into three buckets such that you maximize the probability of selecting a white ball if the bucket and the ball are randomly selected?

In the next Market Recap, we will provide the solution to the Brain Teaser #5

0 Comments