Sentiment in global financial markets was once again largely affected by rising inflation fears.

USA

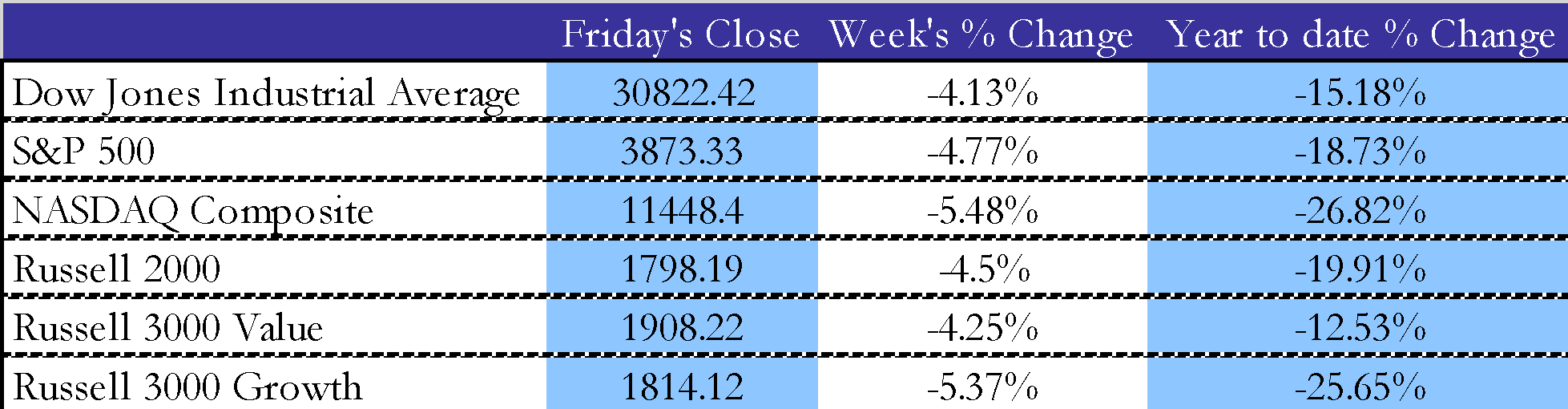

The week started with a continuation of the relief rally in risky assets, as sellers momentarily reduced their pressure. The scenario was quickly reversed as soon as traders’ expectations for Tuesday’s inflation reading were proven wrong. With the CPI rising to 8.3% YoY in August versus the 8.1% expectations, hopes of having reached “peak inflation” collapsed, leading to the worst drop for the S&P 500 in the last two years. On a more concerning note, even core inflation of 6.3% beat estimates of 6.1%.

Once again, growth stocks suffered the largest losses, with the Nasdaq Composite down 5.48% WoW. Important to note that, despite the selloff, volatility was contained, with slightly below average trading volumes for the day. In the meantime, giant corporations revealed their concern for what’s ahead: FedEx has withdrawn its earnings guidance for FY 2023, while General Electric warned of supply-chain issues weighing on its performance.

Source: BSIC, Yahoo Finance

Policymakers reiterated their commitment to taming inflation. Treasury Secretary Janet Yellen declared that Americans would understand the need for the Federal Reserve to fight inflation, which remains at a 40-year high. Without prices under control, a strong labor market was not feasible over the long run. The Secretary also pointed at the possibility of the United States avoiding a recession with “some good luck”: the economy was slowing, but the labor market remained strong, with almost two vacancies per jobseeker. Weekly jobless claims have fallen to their lowest level since early summer to a level of 213,000.

President of the United States, Joe Biden, reacted to the stock market performance by highlighting that it “doesn’t necessarily reflect the state of the economy”. The US economy, in fact, continues to show an unexpected resilience to higher prices and rate hikes. Despite consumers showing some signs of retreat, spending continues backed by historical wage increases. This could lead the Fed to be more aggressive at the next meeting. Traders are now fully pricing in a 75bps hike, which would be the third consecutive. The Fed Funds Futures indicate around a one-in-four chance of a 100bp hike. This historic hike could be enabled by the fact that there will be no policy meeting in October for the Fed to hike rates even further.

On a more positive note, it seems that between Wednesday and Thursday, a tentative pact was reached between US railroad unions and companies. This is relevant news as the continued strike of more than 100,000 workers would have worsened the US supply chains constraints.

Source: BSIC, Yahoo Finance

Short-end yields increased in reaction to the inflation print with 2yr yields are now offering 42bps over the 10yr yield, and 36bps over the 30yr rate, sending the steepness of the inverted yield curve to levels last seen in the 2000s.

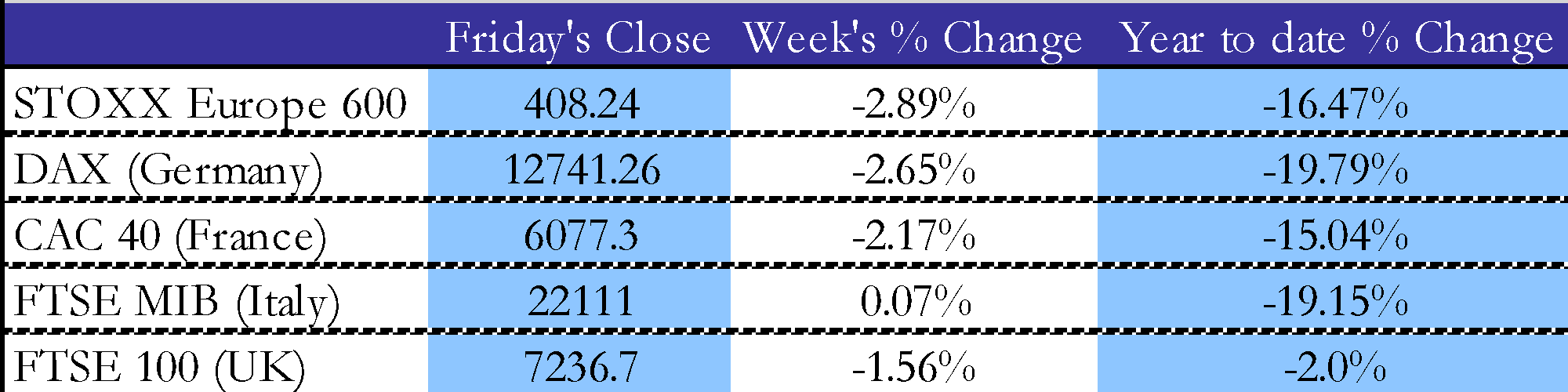

The European Union is facing the threat of a recession, as the central bank is planning to start fighting inflation aggressively. The STOXX 600 declined -2.89% WoW, and, with the indices of the largest economies, the German DAX and French CAC 40 suffered the largest losses, with a respective performance of -2.65% and -2.17%. Investors continue to flee funds from Europe, surpassing $80bn in the last six months, with analysts from Bank of America and JPMorgan that have slashed the year-end forecasts for the European major indexes.

Source: BSIC, Yahoo Finance

Ursula von der Leyen proposed to the European Parliament more radical steps to alleviate the energy crisis. The European Union could raise €140bn to ease the impact of energy prices on the cost of living, through windfall taxes on fossil fuel companies and revenue caps on non-gas power producers. It remains to be seen whether the proposed 5% cut in gas consumption will survive negotiations. Finally, regulatory changes will be introduced to improve liquidity in the energy market. Such declarations led to a weekly drop in gas prices, but they are still eight times higher than during normal times in this period of the year.

The German government is in advanced talks to finalize the historic takeover of their biggest gas importer, Uniper, to avoid a collapse of the energy market. Ukrainian troops have continued to lead a successful counteroffensive in the north, slightly increasing the probabilities of an unexpected defeat of the Russian military. However, Putin’s plans to react remain unclear.

As for the UK, price increases slowed down in August to 9.9% YoY, with respect to the previous 10.1% for July. However, core inflation still increased from 6.2% to 6.3%. GDP grew 0.2% in July, after the 0.6% drop in June.

The unemployment rate decreased to 3.6%, its lowest level since 1974, but there are signs of the labor market possibly losing its momentum. At the same time, wages rose more than expected: 5.5% YoY. Overall, consumers’ confidence keeps declining.

The British Pound has further depreciated against the U.S. Dollar, clearing the pandemic’s lows and touching levels last seen in 1985. This is the result of recession expectations, combined with an anticipated 0.5 rate hike of the Bank of England at its next meeting, thus underperforming the U.S. Federal Reserve.

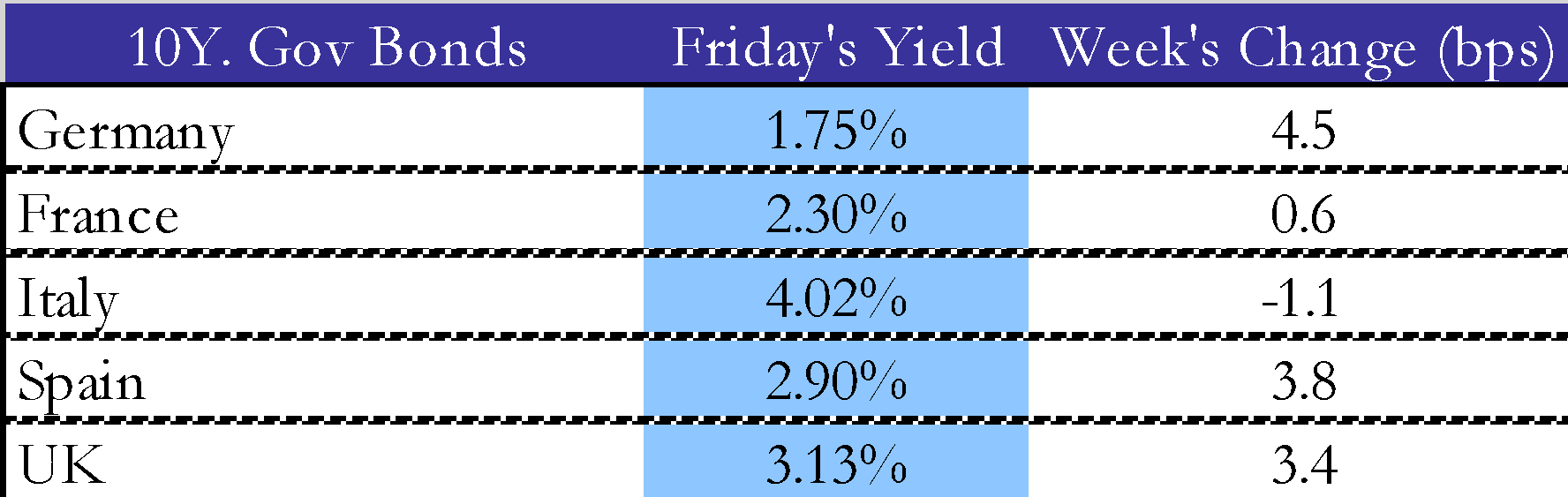

Source: BSIC, Yahoo Finance

10yr Government Bonds rose, especially in Germany as the European Central Bank policymakers continue to hint at more aggressive rate increases.

Rest of the world

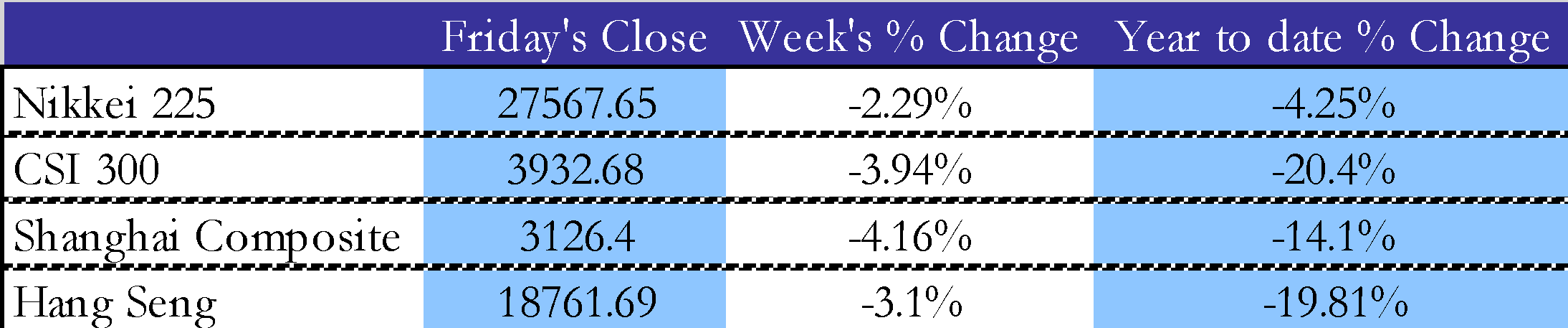

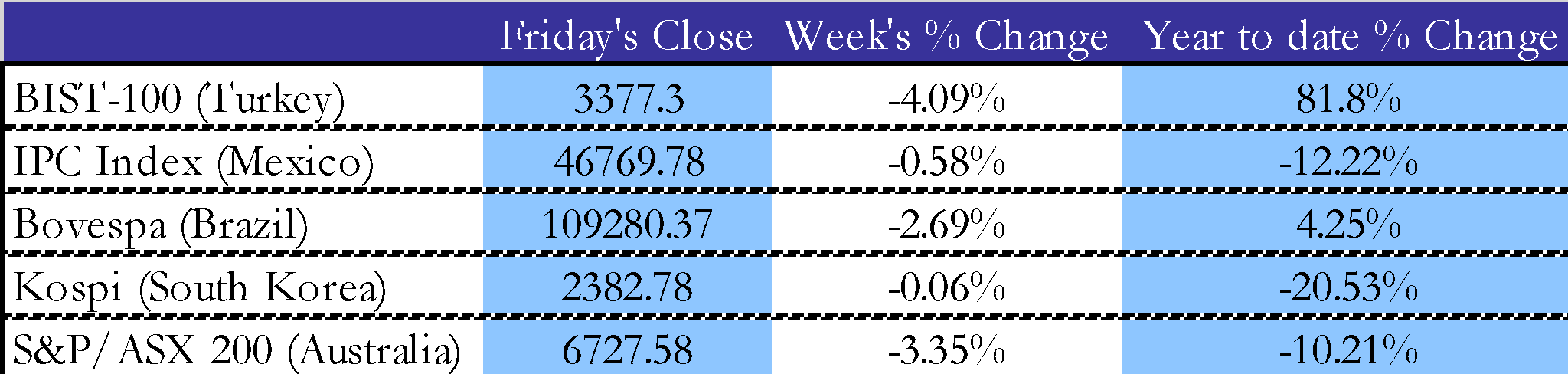

Japan’s Nikkei 225 slid 2.29% this week, while the 10yr government bonds yield increased from 0.23% to 0.25%. The yield remains far lower than US rates, significantly impacting trading volumes. The Yen closed the week around 143 against USD, as the Bank of Japan continues to take no action with respect to the weakness of its currency. Asset managers net-short positions on the Yen remain at record levels. All this was also reflected in export data, with a growth of 19% YoY for July, and the top importer being the United States.

China’s major indexes fell, with the CSI 300 closing at -3.94% for the week, and the Shanghai Composite at -4.16%. The major drivers were the widening divergence with the U.S. monetary policy, weakening the yuan, and the continued fall in home prices and property development.

Source: BSIC, Yahoo Finance

The People’s Bank of China has continued to drain liquidity from its banking system, but has maintained rates steady, to avoid attracting excessive pressure on the national currency. Positive news came from economic data, with factory output and retail sales growth both beating expectations. Unemployment rate declined.

Beijing’s top diplomat said that China is willing to work with Russia to redirect global order “in a more just and reasonable direction”. President Xi met Putin in person, on Thursday, for the first time since the war began. Their intentions remain unclear, as China hasn’t provided material help to the Russian troops so far, which are losing ground amidst the Ukrainian northern counteroffensive.

With respect to Australia, the ASX 200 fell -3.35% WoW. This Friday, Australia’s top central banker, Philip Lowe, revealed that interest rates are closer to being normalized with a 2.5%-3.5% target range. He also declared that further hikes are still required to tame inflation, with markets pricing in a terminal rate around 3.85%. The key cash rate for the Royal Bank of Australia now stands at 2.35%.

Brazil’s Bovespa Index fell 2.69% on a weekly basis. GDP growth for the beginning of the third quarter, however, remains impressively solid for a country that has experienced such high interest rate hikes. The service sector has performed better than expected, together with the labor and credit markets. It remains to be seen how the economy will come out of the election in October. For the moment being, Lula continues to maintain his lead over Bolsonaro.

Source: BSIC, Yahoo Finance

FX and commodities

After the hot inflation reading on Tuesday, FX markets reasonably started betting on the aggressiveness of the Federal Reserve for its next meeting. Once again, the U.S. Dollar dominated the week, gaining over all other major currencies that remain behind in terms of their central banks hiking rates. However, the U.S. Dollar closed above the previous week’s highs only against the Canadian and New Zealand dollar, signaling that momentum might be temporarily slowing down.

Gold prices fell 2.45%, closing at $1674 per ounce and hitting a two-year low, mainly due to expectations of significant rate hikes from the Federal Reserve, which affect the attractiveness of an investment in gold.

Oil prices were almost flat for the week: WTI fluctuated around $85-$90 per barrel, while Brent Crude oscillated between $90-$96, as concerns around global demand and the strength of the dollar combat supply concerns.

U.S. crude inventories beat expectations with more than 2.4 million barrels; however, the releases from the Strategic Petroleum Reserve are set to end in October.

Worth to mention that this week Ethereum completed an ambitious update called “The Merge”, which represents a milestone for the cryptocurrency. The update is supposed to reduce its energy consumption by an estimated 99%, also allowing for faster and cheaper payments. Nonetheless, Ethereum is, as of this writing, at -19.33% for the week, more than -70% down from its all-time-high of November 2021.

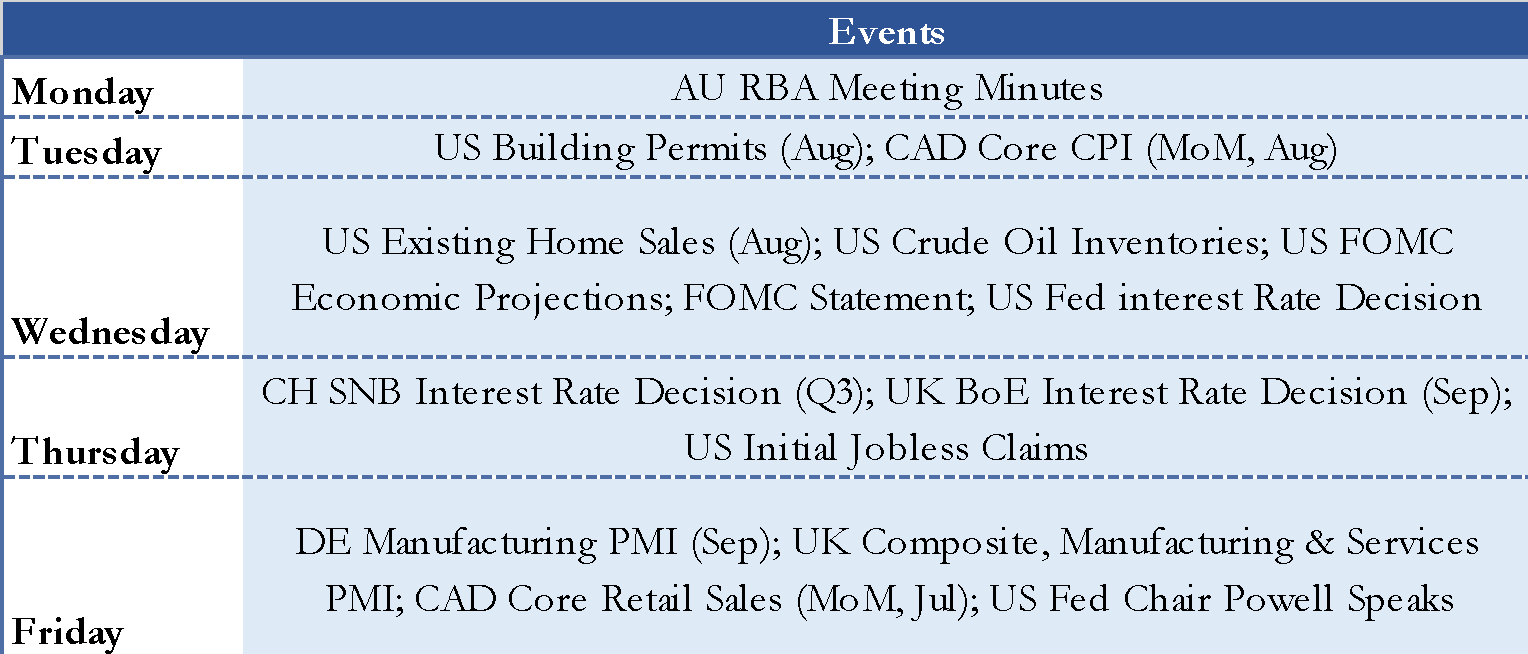

Next week main events

Next week there are plenty of interest rate decisions to follow. Above all, the Federal Reserve will reveal the next rate hike on Wednesday, followed by the Bank of England and the Swiss National Bank on Thursday.

Brain Teaser #24

Positive real numbers are arranged in the form:

![]()

![]()

![]()

![]()

![]()

Find the number of the line and column where the number 2022 stays.

Problem source: JBMO 2002 shortlist

Solution: First we notice that when we rotate the figure by 45 degrees, it becomes a pyramid of consecutive numbers. Then, we can observe that the first number of each column can be written as ![]() . Because

. Because ![]() is in the first row and 63rd column, 2017 will be in the first column and 64th row. Moving forward with the same logic, we can deduce that 2022 will be in the 6th column and the 59th row. Curiously, we can notice that the sum of the row and column number in each row of the rotated figure (pyramid) is invariant.

is in the first row and 63rd column, 2017 will be in the first column and 64th row. Moving forward with the same logic, we can deduce that 2022 will be in the 6th column and the 59th row. Curiously, we can notice that the sum of the row and column number in each row of the rotated figure (pyramid) is invariant.

Brain Teaser #25

There are two piles of coins, each containing 2022 pieces. Two players A and B play a game taking turns (A plays first). At each turn, the player on play has to take one or more coins from one pile or exactly one coin from each pile. Whoever takes the last coin is the winner. Which player will win if they both play in the best possible way?

Problem source: JBMO 2010 shortlist

0 Comments