USA

Overall US equities rallied, propelled by the softer than expected CPI print for the month of October that came out on Tuesday. All major US indices registered a third consecutive week of gains, with the S&P 500 up 2.24%, with Energy as the biggest percentage gainer among the 11 major S&P 500 sectors finishing up 2.1%; the NASDAQ Composite increased by 2.37%, while DJI is up 1.94%, and Russell 2000 registered a 5.42% compared to last week close. For the S&P and the Dow, it marked the longest winning streak since July, while for the Nasdaq, it was the longest since June.

This week’s rally was driven by the hopes that the Fed is done tightening after the reports of several economic data.

On Tuesday, the consumer price inflation showed no changes (0.0%) on a monthly basis and a 3.2% YoY figure, lower compared to market expectations of 0.1% MoM and 3.3% YoY. Whereas core inflation increased 4.0% YoY (0.2% MoM) compared to consensus of 4.1% YoY (0.3% MoM). On a yearly basis it is worth highlighting that Energy costs dropped by 4.5%, with utility (piped) gas service falling 15.8% and fuel oil sinking 21.4%. Moreover, prices increased at softer pace compared to September for food (3.3% vs. 3.7%), shelter (6.7% vs. 7.2%) and new vehicles (1.9% vs. 2.5%) and continued to decline for used cars and trucks (-7.1%). On the other hand, prices rose faster for apparel (2.6% vs. 2.3%), medical care commodities (4.7% vs. 4.2%), and transportation services (9.2% vs. 9.1%).

Wednesday instead, showed the biggest MoM decline in PPI in three and half years in October on the back of cheaper gasoline, offering more evidence of easing price pressures. Whereas retail sales data for October showed a decline of 0.1%, falling short of the expected 0.3% increase.

While on Thursday the weekly jobless claims showed that the number of Americans filing for unemployment benefits were 231,000, the highest in nearly three months, and well above market expectations of 220,000. The data pointed to a softening of the US labor market, aligning with the Fed’s recent warnings of a slowing economy, and may be the sign of the first effects of the restrictive financial conditions on business conditions. Furthermore, on the same day Biden signed a stopgap spending bill which the US House of Representatives passed the day before, thus averting a government shutdown, but only for about two months.

Other important developments include the quarterly earnings releases of Cisco Systems (CSCO) and Walmart (WMT), which raised some concerns about consumer behavior and the state of the technology sector. Cisco’s executives cut their full-year guidance for revenues and earnings due to slowing demand for its networking equipment, thus causing the stock price to plunge by 9.8%. On the other hand, Walmart shares after earnings release sank by 8.1%, as the retail giant cited that US. consumers are acting more cautious with spending, while its executives said that higher interest rates and lower household savings have made sales “somewhat uneven” over the past two months.

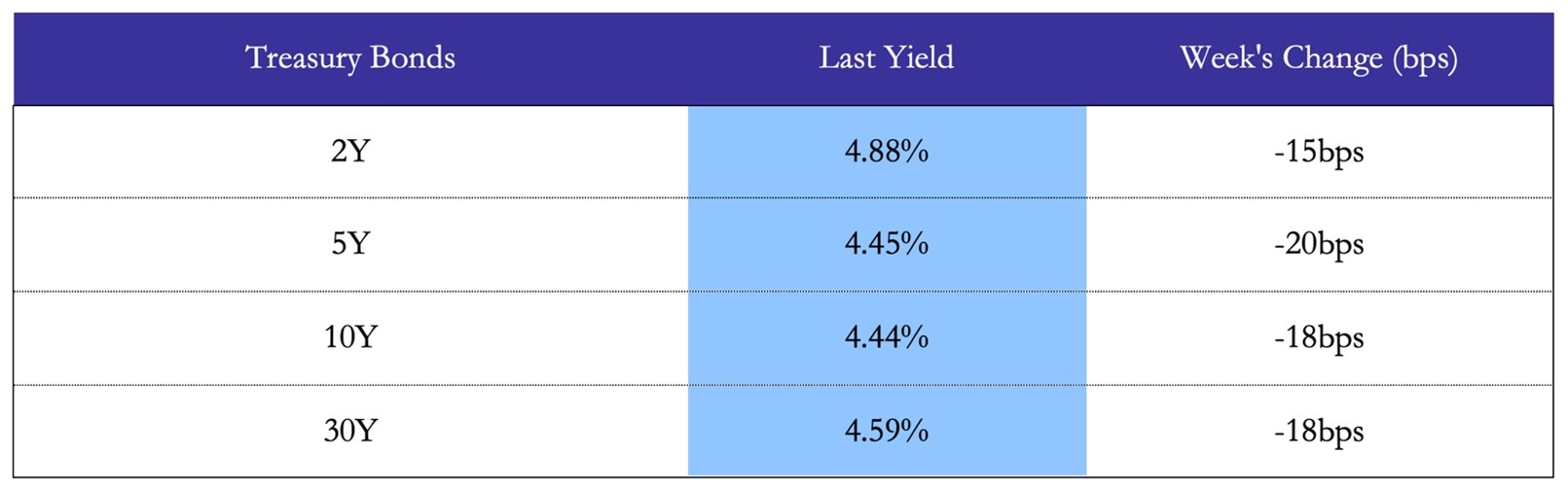

Regarding US rates, following the softer CPI and PPI data of the week yields have declined all over the curve, with the 10-year rate falling by 18bps, reaching the lowest levels since September 21st. Investors as of Friday are fully pricing in odds that the Fed will keep rates steady in December, as per CME Group’s Fedwatch tool. The market is also seeing a 61.0% chance the Fed could cut rates by quarter-point or more in May, up from 33.0% a week ago.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

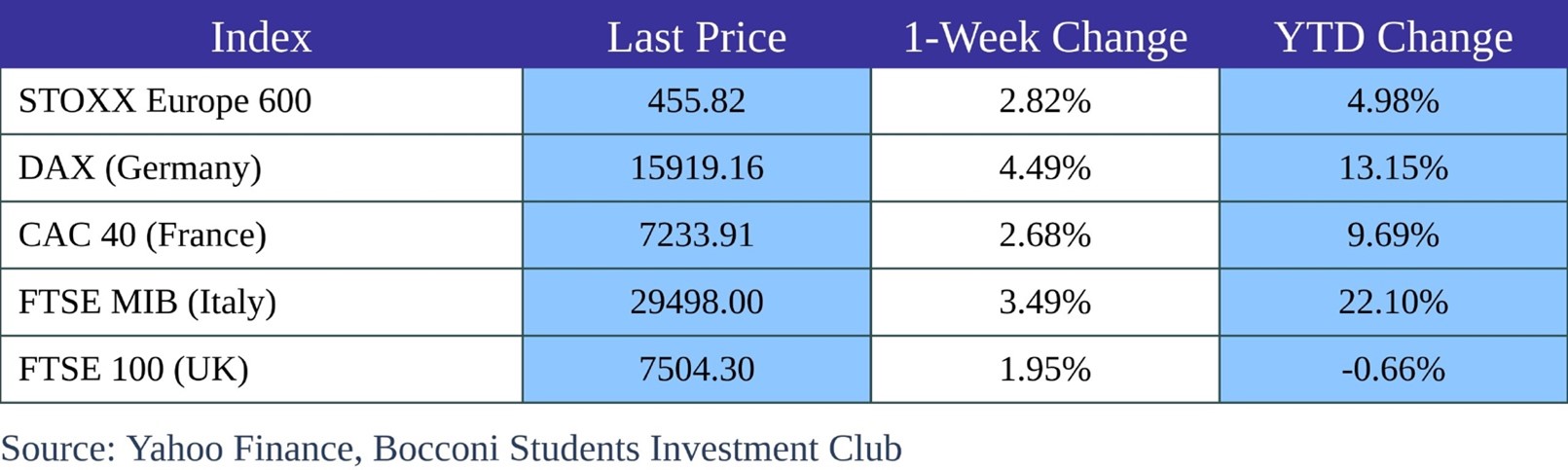

European indexes followed the same path as their US counterparties, ending the week in green. The FTSE 100 ended 1.95% above last week’s close, while the STOXX Europe 600 was up 2.82% climbing to a more than one-month high, and the DAX performed strongly, increasing of 4.49%, the largest weekly increase since March 2023.

The main catalyst for market were the softer than expected economic data in the major economies, showing that inflation is slowing down.

The UK saw a 4.5% YoY CPI print (previously 6.7%) lower than market consensus of 4.8%, driven by lower energy prices following Ofgem’s decision to lower the cap on household bills. Whereas UK core inflation rate in October was 5.7% YoY (exp. 5.8%). Further signs of softening come from Friday’s retails sales figures, showing a decline of 0.3% MoM, falling short of the market consensus of a 0.3% growth, reflecting the UK consumer’s weakness this year.

Euro Area CPI data for October 2023 confirm that inflation slowed sharply, which increased at yearly rate of 2.9% (previously 4.3%), marking the lowest figure since July 2021, primarily driven by lower energy costs (-11.2%) and a slowdown in food inflation.

Germany’s wholesale prices fell by 4.2% YoY (-0.7% MoM) in October, marking the seventh straight month of decline and the steepest drop since May 2020, another sign of easing inflationary pressures in Europe’s largest economy.

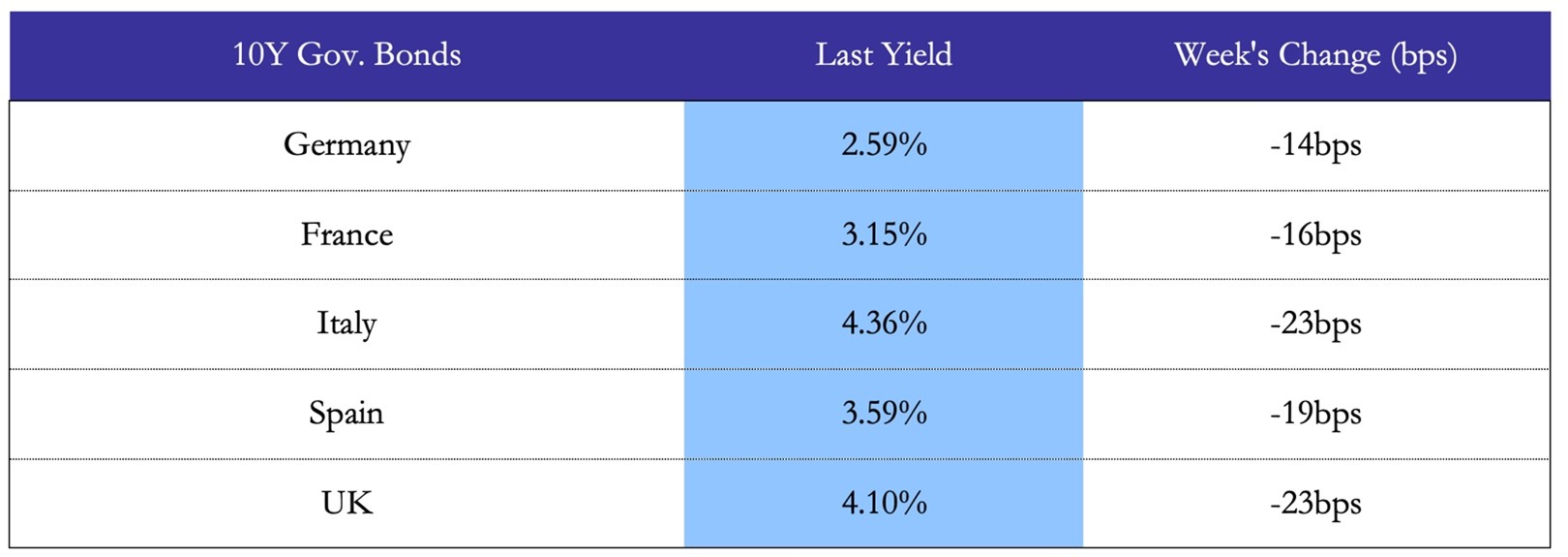

Following the economic releases bond yield across the major European economies fell, notably the UK 10-year Gilt ending the week 23bps lower at 4.10%, and the German 10-year Bund currently at 2.59%, down more than-40bps since its October peak.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Money markets are fully pricing in 100bps rate cuts by the European Central Bank by end-2024, although ECB policymaker Robert Holzmann this week reiterated that the central bank stands ready to raise rates again, if necessary, while pushing back against speculations that the ECB will start cutting rates in 2024Q2.

Italy exits Moody’s Junk Danger zone on Friday, as Moody’s, the US ratings agency, provided a significant update for Italy’s economy by affirming its credit rating at Baa3 and upgrading the country’s outlook from “negative” to “stable”. This upgrade reflects a stabilization in the prospects of Italy’s economic strength, the health of its banking sector, and the government’s debt dynamics. This affirmation and outlook upgrade by Moody’s, offers a much-needed boost to the economic plans of Prime Minister Giorgia Meloni’s government. Despite the challenges, including a higher public deficit forecast and concerns over economic slowdown, this positive rating outlook could influence investor confidence and potentially impact the bond markets.

Rest of the World

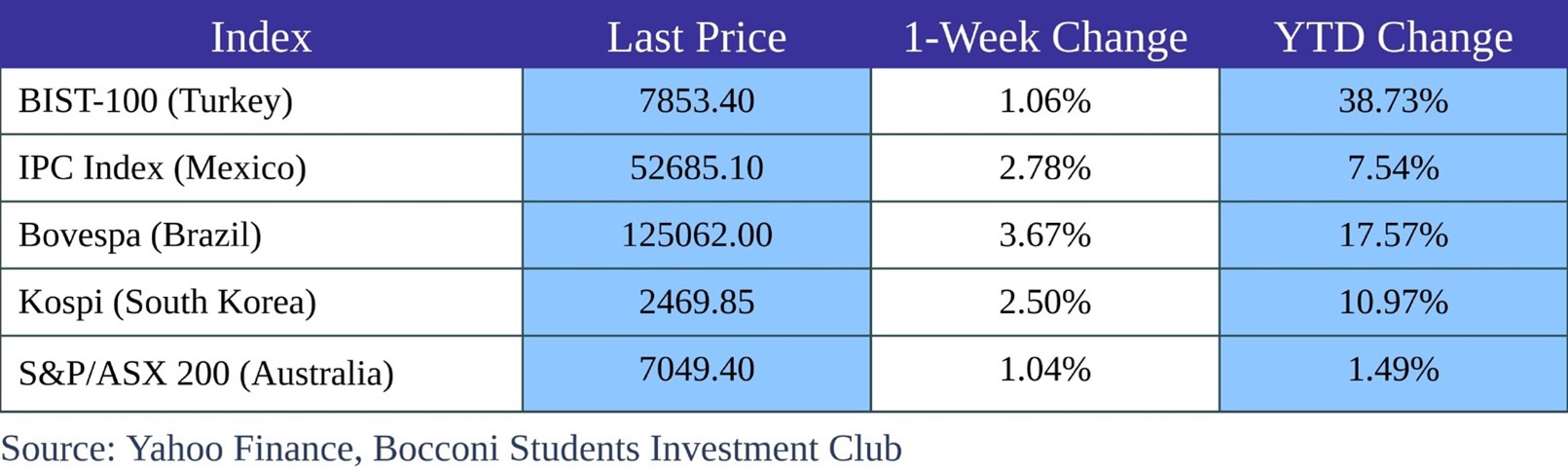

Asian indices performance was mixed, with the CSI 300 losing 0.51%, while the Shanghai Composite and Hang Seng saw gained 0.51% and 1.46% respectively. Instead, the Nikkei followed the movements of the other major western indices by adding a 3.12% gain.

The Nikkei scores its third week of consecutive gains, up more than 10.0% since its October lows, surpassing the key psychological level of 33,000.00, and it is currently flirting with the 33,600.00 level. The price action of this week was helped by a strong domestic earnings season that just wrapped up, further boosted by the optimism in US equities due to a more dovish Fed.

Chinese indexes started the week with some decent gains thanks to optimism and the hopes that the meeting between President Biden and President Xi Jinping could have resulted in reduction in US tariffs and an easing of technology curbs. Further improving the mood were also the better-than-expected economic data. China’s industrial output grew 4.6% YoY in October, accelerating from the 4.5% pace seen in September, beating expectation of 4.4%. It was the strongest growth since April. While retail sales rose 7.6% vs market consensus of 7.0%, making it the tenth consecutive month of growth in retail turnover and the fastest expansion since May. Nevertheless, Chinese stocks retreated on Thursday due to (1) lack of any major breakthrough in talks between Xi and Biden which disappointed investors, and (2) weak data coming from the property sector, as new home prices dropped by 0.1% YoY in October, marking the fourth consecutive month of decline, as demand remained sluggish. On Friday Chinese indexes diverged as Hang Seng declined by 2.1% as the tech sector was hit by the disappointment over Alibaba’s scrapped cloud spinoff, mentioning that US chip export curbs have “created uncertainties for the prospects of Cloud Intelligence Group”.

The S&P/ASX 200 throughout the week increased at a modest rate of 1.04%. The index saw some positive momentum in the first half of the week, gaining 1.14% on Tuesday, but reversing after the Australian labor force report which highlights continued tightness in the labor market and illustrates the RBA’s dilemma as it looks to end its rate hike cycle in line with its global central bank peers.

LatAm equity markets gained some ground during the week, with the IPC and the Bovespa increasing respectively 2.78% and 3.67%. These gains attributed to easing concerns over interest rates and a weakening dollar, which boosted overall emerging market assets.

FX and Commodities

The dollar experienced its biggest one-day drop in a year as investors dumped the currency following the release of softer than expected US inflation data, with the DXY index declining 150bps on Tuesday, and closing at 103.82 on Friday, reaching the lowest level since early September.

The weakening of the dollar following the signs of cooling inflation was the major driver behind the relative strengthening of the Euro against the greenback, gaining 1.75% for the week, similarly the British Pound gained 1.62%. Meanwhile the US Dollar lost 2.01% against the Swiss Franc, and 0.43% of its value relative to the Japanese Yen closing at 150.71.

During the week Oil prices continued to decline on Thursday despite support from the OPEC+ cuts and conflict in the Middle East, reaching their lowest levels since mid-July. This downward movement was caused by the US Energy Information Administration, which reported that crude inventories in the country grew by 3.6mm barrels last week to a total of 421.9mm, far exceeding a market expectations of 1.8mm-barrel increase. Oil prices dropped around 5.0% as investors worried about global oil demand following weak data from the US and Asia, with Brent crude reaching $77.84 a barrel, and the WTI $73.23 a barrel. Prices rebounded on Friday after Saudi Arabia considered prolonging its production cuts into 2024.

This week, precious metals prices experienced a notable rise as the dollar and treasury yields dipped following the CPI data and the jobless claims. These indicators bolstered expectations that the Fed might pause its interest rate hiking cycle, signaling a slight slowdown in the U.S. economy. Gold and silver benefited from this week, gaining 2.54% and 7.18% respectively.

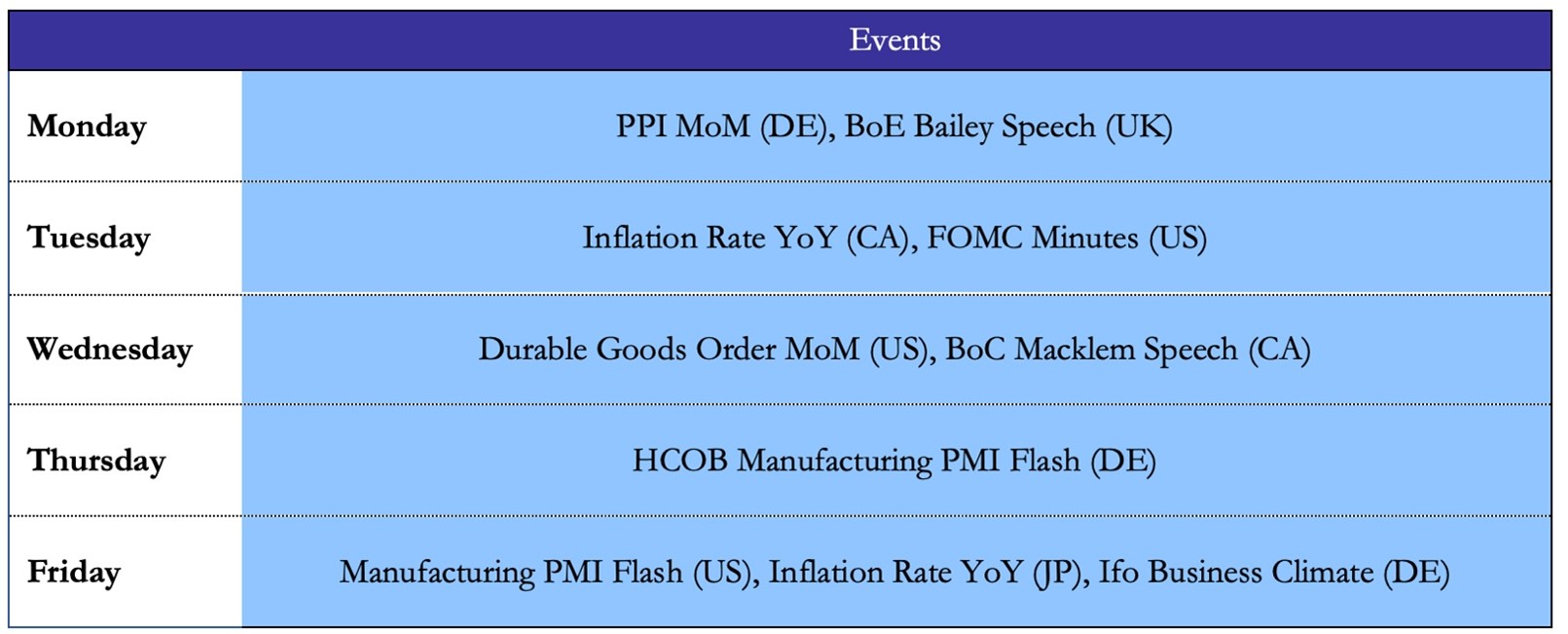

Next Week Main Events

Source: TradingEconomics

Brain Teaser #06

Suppose you’re on a game show, and you’re given the choice of three doors: Behind one door is a car; behind the others, goats. You pick a door, say No. 1, and the host, who knows what’s behind the doors, opens another door, say No. 3, which has a goat. Now, do you want to pick door No. 2? What is the probability of winning the car if you switch?

SOLUTION: If you don’t switch, whether you win or not is independent of the host’s action of showing you a goat, so your probability of winning is 1/3. What if you switch? Using a switching strategy, you win the car if and only if you originally pick a door with a goat, which has a probability of 2/3 (You pick a door with a goat, the host shows a door with another goat, so the one you switch to must have a car behind it). If you originally picked the door with the car, which has a probability of 1/3, you will lose by switching.

So, your probability of winning by switching is actually 2/3.

Brain Teaser #07

Given that p and q are two points chosen at random between 0 & 1. What is the probability that the ratio p/q lies between 1 & 2?

0 Comments