USA

This week in USA equities, the S&P500 closed 3% lower than last week but nonetheless still +4.73% YTD. The main take-aways from earnings season results released this week include Paramount Global and American Express Co emerging as top gainers, exhibiting the highest percent gains over a single day. Netflix’s quarterly results surpassed expectations, reporting increased earnings and revenue, coupled with a 16% surge in subscribers compared to the previous year. However, Netflix has shifted its focus towards profitability rather than solely expanding its subscriber base which explains why Netflix was one of the drivers behind the fall in S&P this week. Meanwhile, in the pharmaceutical sector, pharma groups are concerned about potential disruptions to supply chains due to challenges in certifying manufacturing sites in China and tightening anti-espionage laws imposed by Beijing. This poses risks to global drug supply, given China’s significant role as a major producer of active pharmaceutical ingredients and antibiotics.

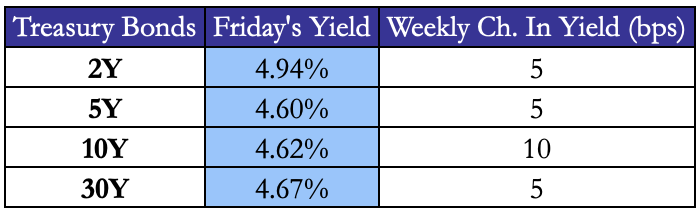

Last week’s core CPI growth for March exceeded expectations by a slight margin which prompted the panicked reassessment of anticipated US Federal Reserve rate cuts for 2024. However, a more in-depth analysis shows that CPI is noisy and despite its reflection of the perceived cost of living, recently particularly impacted by housing costs, experts advocate for patience and a focus on PCE to better observe underlying inflation pressures, aligning with the Fed’s objectives.

Over the past two weeks, investors still expecting several cuts this year are starting to be deemed ‘stubborn’. Over recent months, there’s been a significant shift in interest rate expectations in the US, gradually aligning with the Fed’s forecast of three cuts. However, following a third consecutive above-expectation reading for US CPI inflation in March, expectations have further adjusted, with traders now anticipating between one to two rate cuts, and even the possibility of none. This shift has prompted Powell to acknowledge the need for potentially higher rates to curb inflation, contrasting with his previous outlook. This has global implications with regards to currency fluctuations, and Powell faces the challenge of navigating uncertainty and persistent volatility.

Source: Marketwatch, Bocconi Students Investment Club

Europe and UK

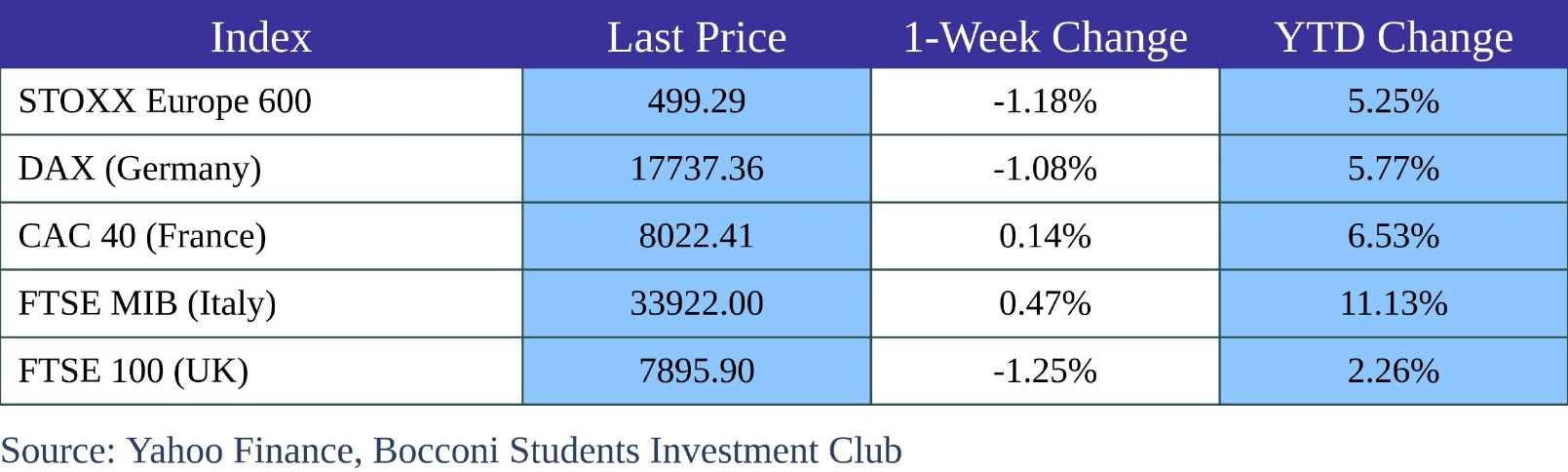

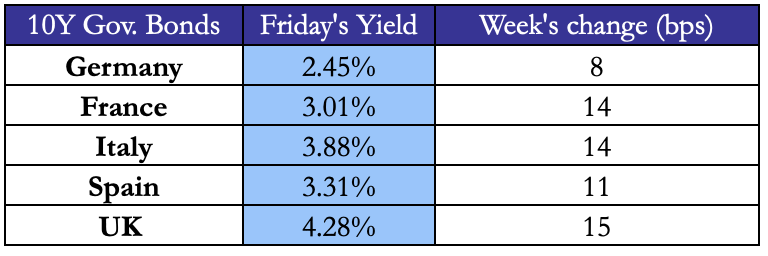

The pan-European STOXX Europe 600 Index closed -1.18%, driven by Germany’s DAX dropping 1.08% and the UK’s FTSE 100 falling by 1.25% (however it is still up 0.24% YTD). These results differ from last weeks’ as France and Italy’s indexes did not fall.

Within Europe, investors have turned their eyes to Sweden’s successful capital market ecosystem that has outshined many European counterparts struggling with IPOs and stagnant trading volumes. Policymakers in Europe are looking to emulate Sweden’s strategies, including changing listing rules and incentivizing investments. Over the past decade, Sweden has seen more IPOs than France, Germany, the Netherlands, and Spain combined, with a significant portion comprising smaller domestic businesses.

This week, CNBC spoke to 12 members of the European Central Bank’s Governing Council in New York and two key messages emerged: anticipate an interest rate cut in June, but remain cautious about potential repercussions from the Middle East. ECB President Christine Lagarde mentioned the likelihood of an interest rate reduction soon, emphasizing the need to bolster confidence in the ongoing disinflationary trend, contingent upon the absence of significant unforeseen developments. Lagarde’s remarks align with her recent statements, signaling an overall shift towards a less restrictive monetary policy stance as economic conditions evolve.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

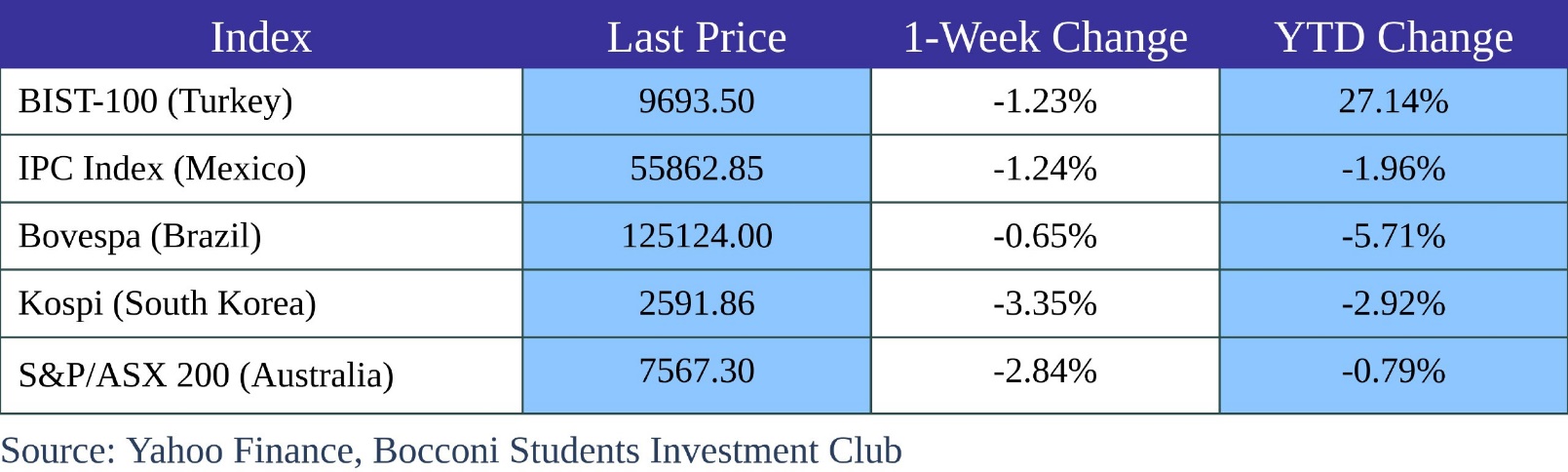

The week ended with mixed performances across the main Asian indices, with the Nikkei losing more than 6%, giving up some of the yearly gains, the Hang Seng down around 3% while the CSI 300 and Shanghai Composite up 1.89% and 1.52% respectively.

On Friday, Japanese inflation March data came in at 2.6%, down from the previous read of 2.8% on the back of a weaker Yen, which caused a sustained increase in import prices. Amid the weakening of the Japanese currency, BoJ governor Kazuo Ueda signaled on Wednesday that the BoJ stands ready to increase rates again if the depreciation becomes “too big to ignore”. In the meantime, the IMF urged Japanese policymakers to raise rates gradually.

China published measures aimed at promoting overseas investment, easing the issuance of Yuan-denominated bonds and to extend its support especially for the technology sector.

The Chinese benchmark lending rates are expected to remain unchanged on Monday as the encouraging first quarter economic data for the country reduced the need for further stimulus in the near future, with the 5-year LPR currently at 3.95% after a 25bps cut in February and the 1-year LPR at 3.45%.

The rest of the world saw a week mostly in the red, with all main indices down from the previous Friday: the BIST-100 lost 1.23%, the IPC 1.24%, the Bovespa 0.65%, the Kospi 3.35% and the Australian ASX 200 was down 2.84%. This week’s lackluster performance happened as tensions in the Middle East increased following Israel’s retaliation against Iran.

On Thursday, South Korea’s financial authorities urged companies to pay more attention to shareholders’ voices in a plan to boost shareholder returns in the domestic markets. During the week, Seoul’s LG (066570.KS) raised a $800mn bond as Korean corporates continue to issue record amounts of dollar bonds to diversify funding.

FX and Commodities

This week saw different impacts of the increased tensions in the middle east in commodities markets, with energy mostly down and metals up for the week: Brent and WTI were down 3.49% and 2.94% respectively and natural gas futures were down 1.02% while Gold, Silver and Copper were up 1.79%, 1.96% and 5.74% respectively.

Oil prices settled slightly higher on Friday, despite a weekly decline, following a reported Israeli attack on Iranian soil. Brent futures edged up 18 cents to $87.29 a barrel, while the front-month U.S. West Texas Intermediate (WTI) crude contract for May rose 41 cents to $83.14 a barrel. Meanwhile, U.S. lawmakers added sanctions on Iran’s oil exports in response to recent events. Despite expectations of increasing oil output from OPEC+ in July, concerns remain about potential supply disruptions in the Middle East.

Gold closed its fifth consecutive positive week as fears of escalation in the middle east triggered demand for the precious metal as a safe-haven asset. The recent surge in gold prices reflects the higher-than-expected inflation in the US and concerns ranging from geopolitical tensions to upcoming elections.

Traders are increasingly betting on the euro’s potential decline to parity with the dollar, driven by persistently high inflation and robust U.S. economic growth, which delay expectations for Federal Reserve rate cuts compared to the European Central Bank. Market activity reveals a notable increase in options purchases and analysts indicate a more than 10% chance of this scenario within the next six months, a stark shift from expectations earlier in the year. The euro has already depreciated 3.5% against the dollar since January, with achieving parity requiring a further 6.5% drop. This sentiment reflects market reassessment, with growing certainty that the ECB will commence easing measures in June, contrasting with diminishing expectations for significant rate cuts in the U.S.

With regards to Asia, central bankers are preparing for turbulence driven by a stronger U.S. dollar, as the fading possibility of U.S. interest rate cuts this year is affecting regional currencies like the yen, renminbi, and others. This recent pressure explains the plummet of the yen of ¥154 against the dollar. Policymaking in the currency area will be especially challenging due to the shifting currency landscape and unexpected inflation data. Central bankers’ attempts to guide markets through public statements and forward guidance may not be enough to influence currency values in the face of external pressures.

Next Week Main Events

Brain Teaser #16

How many trailing zeros are there in 100! ?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

SOLUTION

Each pair of 2 and 4 will give a trailing zero. Performing a prime number decomposition for each number in 100! it’s clear to see that the frequency of the 5 is the one that constrains the number of trailing zeroes the most (as their frequency is much less than that of the 2). There are 20 numbers in 100 that are divisible by 5 (5, 10, 15, …, 100), and 4 are divisible by 5^2 (25, 50, 75, 100). Therefore the total frequency of 5 is 24 and we conclude there are 24 trailing zeroes.

Brain Teaser #17

If x^x^x^x^x···=2 , what is x?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

0 Comments