USA

A mixed performance in equities this week, as the inflation debate continues to bemuse investors. Indications of continued strong economic growth, such as the 1.7% monthly increase in retail sales, prompted the superior performance of consumer discretionary firms’ shares. The sector, which rose by 3.81% this week, was aided by the partial recovery of Tesla’s stock price from a recent drawdown and hopes that the upcoming holiday shopping season will help firms’ sales growth in the latter part of the year. This is contrasted by investors’ worries of continuing surges in inflation, which may spur the Federal Reserve to accelerate its tapering process and bump interest rates earlier than anticipated, hurting equities as a whole.

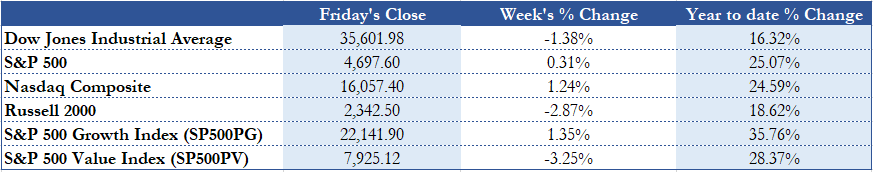

The S&P 500 appreciated by 0.31% with the DJIA shedding 1.38% and the tech-heavy Nasdaq Composite – aided by gains in the Information Technology sector – reached all-time highs on Friday, closing up by 1.24% at 16,057.40. Continued supply-chain bottlenecks and the omnipresent anxiety surrounding inflation harmed smaller firms, as seen in the remarkable 2.87% decrease in the Russell 2000. These developments caused Growth to beat Value substantially, handing shareholders 1.35% and -3.25% returns respectively. The choppiness in returns pushed the VIX up by 1.62.

Energy stocks had the worst showing this week, losing 5.22% in value due to the cooldown in energy prices from recent highs, as well as President Biden’s request of the FTC to launch an inquiry into oil and gas companies’ activities, alleging “anti-consumer behavior”. The 46th President also faces a closely watched decision regarding the appointment of the central bank’s next Chair. It is expected that he will choose between the incumbent, Jerome Powell, and a serving member of the Fed’s Board of Governors, Lael Brainard. Both, especially Brainard, are dovish, meaning they prioritize achieving full employment over price stability and will keep rates low, implying lower bank profitability – this caused a notable 2.82% depreciation in their total market value.

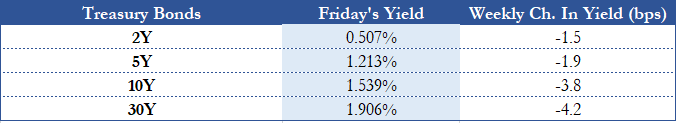

The looming announcement also showed effects in the Treasury market with rates throughout the yield curve dropping as a result of slower growth forecasts for 2022 and a relatively tranquil tightening expected.

On Friday though, the short side of the yield curve saw jumps higher following the Fed’s vice-chair’s hawkish comments, stating that speeding up the tapering process is his current policy preference.

Additionally, Biden’s flagship $1.2trn infrastructure bill was signed into law and an even more liberal $1.75trn social spending package passed the House of Representatives, now needing a majority in the House’s upper chamber before it arrives in the Oval Office. As the Senate is evenly divided and not a single Republican voted in favor in Congress, presumably every Democrat will have to vote in union to pass the bill. This is unlikely in the bill’s current state because more moderate Senators, already cautious of profligate spending, are sure to instigate vigorous intra-party debate and eventually strip-down the bill to a lesser sum.

Europe and UK

Europe experienced uneven returns this week, marking an uncertain market environment as the fourth wave of the pandemic is hitting Central and Western European countries particularly hard. “The pandemic of the unvaccinated” is giving rise to yet another round of restrictions, with some extraordinarily extreme in their nature like in Austria, where the declaration of a lockdown for the unjabbed was quickly adjusted to a full, nationwide lockdown. The Netherlands and Germany also imposed new rules. On the other hand, European exports showed strong performance for Q3 and are projected to continue to do so.

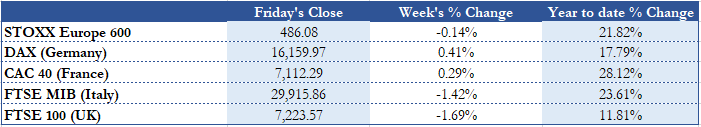

The main European indices mostly traded flat: STOXX Europe 600 dropped by a meagre 0.14% while the German Xetra DAX and the French CAC 40 saw moderate 0.41% and 0.29% increases respectively. Italy’s FTSE MIB fell by 1.42% and the UK’s FTSE 100 concluded the week down 1.69%. This came on the back of surging price increases: UK CPI data exceeded expectations, with October’s yearly inflation rate of 4.2% towering over September’s figure of 3.1% as a result of high energy costs, supply-chain issues, and a troublesome labor market.

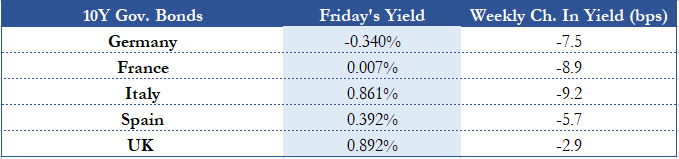

Trends in the US rates market and the prospect of sluggish economic growth pushed Eurobonds’ yields down. The ECB’s Chair, Christine Lagarde, proclaimed on Wednesday that Eurozone inflation is transitory and hinted that asset purchases are here to stay, contributing to the uptick in bond prices.

Rest of the World

Dovish sentiments expressed by the world’s central banks were continued in Japan this week as BoJ Governor Haruhiko Kuroda ensured that ongoing expansionary policies will remain, especially as inflation will undershoot the central bank’s target, unlike in other major economies. Japan’s newly elected government led by PM Fumio Kishida is planning to support the plodding economy with a fiscal stimulus package of around $490bn, including transfers of ¥100,000 (c.a. $880) to each child and aid to low-income households, students, and small businesses.

The country is still riddled with ongoing structural challenges, for example, the semiconductor shortage which is hurting big and small players in its technology sector. This can be seen in Japan’s third quarter GDP figure released this week, which showed a quarterly contraction of 0.8%, producing an annual reduction of 3.0%.

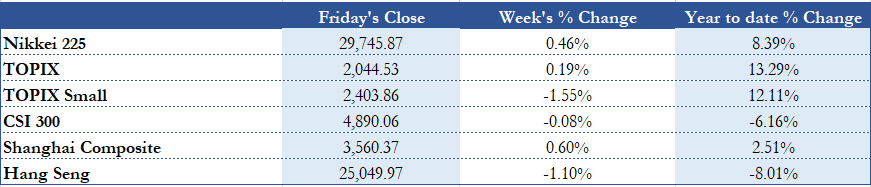

Mixed signals yielded mixed results for domestic equities, similar to those in the US and Europe. The Nikkei 225 Index grew the most, expanding by 0.46%, whereas the TOPIX rose by 0.19% and the TOPIX Small Index lost 1.55%, pointing to the adverse economic growth developments.

In China, Alibaba reported disappointing earnings, marking a difficult period for Chinese firms in the wake of the Evergrande fallout. The beleaguered developer announced that they unloaded their entire 18% stake in internet services company HengTen Networks to investment group Allied Resources Investment Holdings Ltd. at a significant discount. Their scramble for cash to avoid a default is representative of what an agonizing number of real estate firms are going through. The repercussions of these developments are widely felt: data released this week presented a massive decrease in property sector activity and lower prices throughout the mainland.

Nevertheless, on the back of this year’s declines and comparatively cheap valuations, mainland equities were largely unchanged, with the CSI 300 Index falling 0.08% and the Shanghai Composite growing by 0.60%. The Hang Seng, Hong Kong’s major index, dropped by 1.10%.

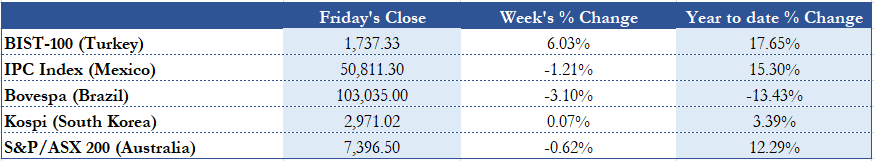

In emerging markets, all eyes were on Turkey this week as the central bank, influenced by the notorious President Erdoğan, decided to cut the benchmark interest rate – the one-week repo auction rate – by an additional 100 bps, the third of its kind since September. This sent the Lira to a new nadir, now trading at around $11.24 per Lira, marking a weekly decrease of 11.27% and a year-to-date plunge of 33.84% for the currency against the Dollar. This augurs well for exporters that continue to sell at more competitive prices, thus contributing to the positive performance of the nation’s key index, the BIST-100, which leapt by 6.03%, however it worsens the country’s inflation problems by raising the price of imports and continuing to stimulate demand for goods.

Dwindling oil prices hurt energy stocks all over including in Brazil, where the industry is of particular importance. The Bovespa Index shed 3.10% this week. Similar reasons can be attributed to performance in Mexico and Australia, where losses of 1.21% and 0.62% were incurred.

FX and Commodities

The uncertainty of inflation, the persistence of supply-chain issues and semiconductor shortages, and central banks’ due policy decisions provided plenty of fodder for movement in Foreign Exchange markets. The US Dollar index rose by 0.99% to 96.07, concluding another positive week for the Greenback. After surprising inflation data in the UK, the Pound Sterling rallied 1.69% against the Euro, now standing at €1.19. Similarly, the Pound is 0.35% above last week’s standing against the US Dollar, currently sitting at $1.35.

Oil prices dropped after the US and China began weighing the release of the nations’ strategic oil reserves. This sent Brent Crude down 4.01% on the week to $78.89 and WTI 4.82% to $75.71. Natural gas, however, gained 5.74%, finishing the week at around $5.16, as a result of the German government’s order to temporarily deny certification of the Nord Stream 2 pipeline, which would directly connect Gazprom’s supply to Germany. The decision was made by Germany’s energy regulator because Gazprom failed to properly establish the German subsidiary they must found by law. It is unclear how long it would take for this hurdle to be passed but it is clear that this will not be the only legal challenge facing the project as it approaches completion, considering the mounting political pressures felt by the German government and the complications that will produce.

Gold shed 1.12% this business week to $1,846.80 per ounce after a positive streak earlier this month. A stronger Dollar also gave rise to poor performance for Silver, which dropped by 3.05% to around $24.64 an ounce.

A clause in President Biden’s recently passed infrastructure bill details new reporting requirements to the IRS by Crypto-related “brokers”, aiming to raise upwards of $27bn in the near future. The term, “brokers”, is very broadly defined in the document, and thus could not only force exchanges and traditional brokers offering Crypto asset trading to record their clients’ transactions, but potentially other parties as well, such as Cryptocurrency miners and developers. This, industry participants, lobbyists, and some governors say, would stifle innovation through increased costs that are inherently unequitable to smaller entities. It also damages the Crypto space’s reputation as a “wild-west” sort of environment where governmental entities lack a presence. The bill’s passage rocked Crypto markets, wiping out gains reached in the latest bull run for assets like Bitcoin, which had its price cut all the way down to $57,844.91 as of Friday night, marking a 9.84% seven-day decrease.

Next Week Main Events

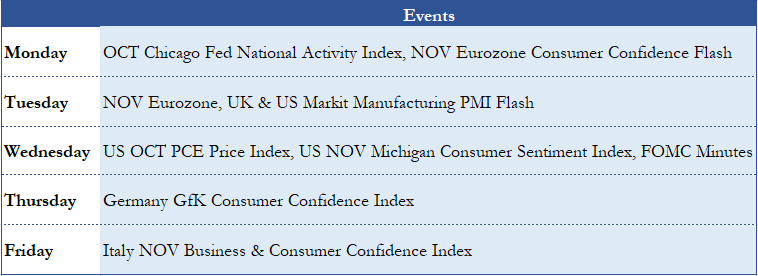

Next week entails several bellwethers of the economic recovery as well as the development of prices throughout the world’s biggest economies. America’s closely watched PCE Price Index releases data on Wednesday for October, where analysts are bracing for a 0.5% increase on September’s figure of 3.6%. If the real figure were to exceed the expected value, increasing pressure will pile up on the Fed to abandon its dovish stance and consider greater tapering. Additionally, consumer confidence figures will shed light on output as the holiday season nears in the Eurozone and in the US, again having policy implications.

Brain Teaser #14

Four people want to cross a bridge across a river during the night. Due to the narrowness of the bridge, only two people can pass simultaneously. Besides, they have only one torch and need to use it when crossing the river. The first person can cross the bridge in one minute, the second – in two minutes, the third – in five minutes, and the fourth – in eight minutes. When they cross, they need to go with the pace of the slowest person. What is the fastest time in which they can all cross the river?

Solution:

Although most people would initially think to make the first person (the fastest one that crosses the bridge) the one that carries the torch for everybody, this strategy does not provide the optimal time. Instead, you can find the best approach if the two slowest people cross together. This strategy would yield a time of 15 minutes, which is indeed the fastest time in which they can all cross the river. You can check it by trying all the possible combinations, and you can find the correct crossing method below.

First, the 1st and the 2nd person cross together, and the 1st returns – 3 minutes.

Next, the 3rd and the 4th person cross the river, while the 2nd person returns – 10 minutes.

Finally, the 1st and the 2nd person cross the bridge and finish their mission– 2 minutes.

Brain Teaser #15

Four prisoners are allowed to go free if they succeed at solving a puzzle. A queue with three prisoners is created, such that the tallest prisoner is the last and the shortest the first. This organization allows each prisoner to see all the people ahead of him. On the other hand, the fourth prisoner is in a prison cell such that the others cannot see him, and he cannot see the others. Then, each of the four prisoners is given either a white or black hat, in total two white and two black hats. The rules are such that if any prisoner tells the color of their hat, they are all four released. Instead, if one makes a mistake, they are all executed. What would be a winning strategy for the prisoners?

0 Comments