USA

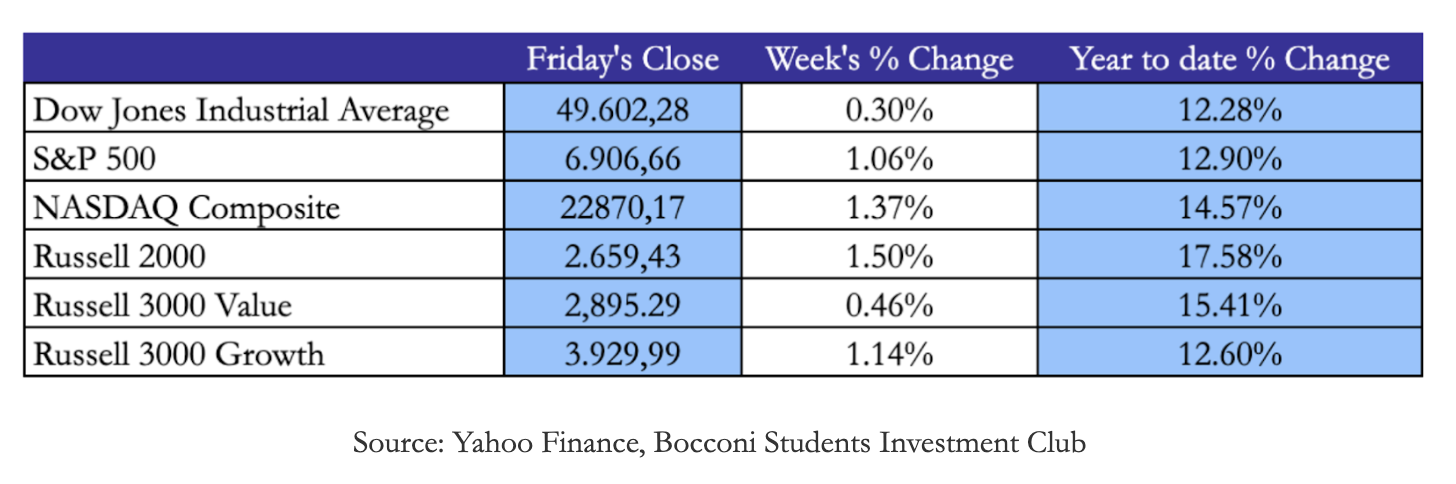

Following Monday’s bank holiday, U.S. equities posted solid gains through the remainder of the week. The S&P 500 advanced 1.06%, while the NASDAQ Composite outperformed with a 1.37% increase. The Dow Jones Industrial Average rose more modestly by 0.30%. The Russell 3000 Growth (+1.14%) outperformed the Russell 3000 Value (+0.46%).

As of Wednesday, the FOMC meeting highlighted a sharp divergence in policy outlook. While the decision to hold the central bank’s benchmark rate steady was mostly met with approval, the path ahead appeared less certain, with members conflicted between fighting inflation and supporting the labor market. Further in the year, The FED path then will be dependent on the degree in which inflation cooperates. Currently, markets are pricing a 96% probability of holding the rates steady for March. Please use the sharing tools found via the share button at the top or side of articles.

On Friday, reported by the Bureau of Economic Analysis, US GDP growth fell to just 1.4% as of Q4. This figure was sharply down from 4.4% in the previous three-month period and fell well short of expectations of 2.8.

It comes after an unprecedented 43-day federal government shutdown in October and November that the BEA said knocked a point off growth. A slowdown in consumer spending also weighed on GDP, offset slightly by an uptick in business investment. Additionally, on Friday’s data, The S&P Global US Manufacturing PMI fell to 51.2 in February from 52.4 in January, below expectations of 52.6, marking the weakest expansion in the last 7 months. the Services PMI retreated to 52.3 from 52.7 missing expectations that it would increase to 53. A combination of weakened demand, high prices, and adverse weather colluded to dampened business activity in February, resulting in the slowest expansion of output for ten months. Customer demand growth has softened, with orders even falling in factories, curbing jobs growth to a crawl across both manufacturing and services. Despite Trump’s additional 10% tariff announcement on Friday, markets rose as Supreme Court ruled Trump exceeded powers in imposing tariffs.

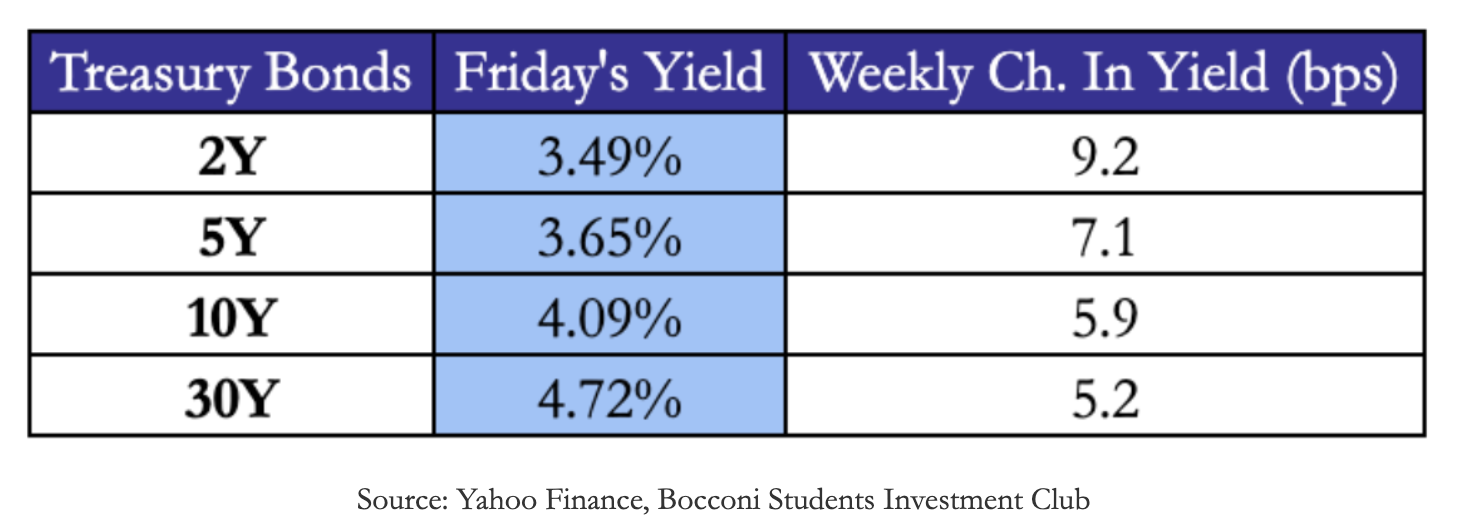

US Treasury yields moved higher across the curve during the week, with short maturities leading the advance. The 2-year yield rose 9.25 bps to 3.491%, the 5-year increased 7 bps to 3.652%, the 10-year gained nearly 6 bps to 4.085%, and the 30-year climbed 5.23 bps to 4.722%, resulting in a flattening of the yield curve. The more pronounced move at the front end followed Wednesday’s FOMC meeting, which prompted a modest repricing of near-term rate expectations. While longer maturities retraced slightly after the announcement, the overall weekly dynamic reflected a shift in expectations primarily concentrated at the front end.

US Treasury yields moved higher across the curve during the week, with short maturities leading the advance. The 2-year yield rose 9.25 bps to 3.491%, the 5-year increased 7 bps to 3.652%, the 10-year gained nearly 6 bps to 4.085%, and the 30-year climbed 5.23 bps to 4.722%, resulting in a flattening of the yield curve. The more pronounced move at the front end followed Wednesday’s FOMC meeting, which prompted a modest repricing of near-term rate expectations. While longer maturities retraced slightly after the announcement, the overall weekly dynamic reflected a shift in expectations primarily concentrated at the front end.

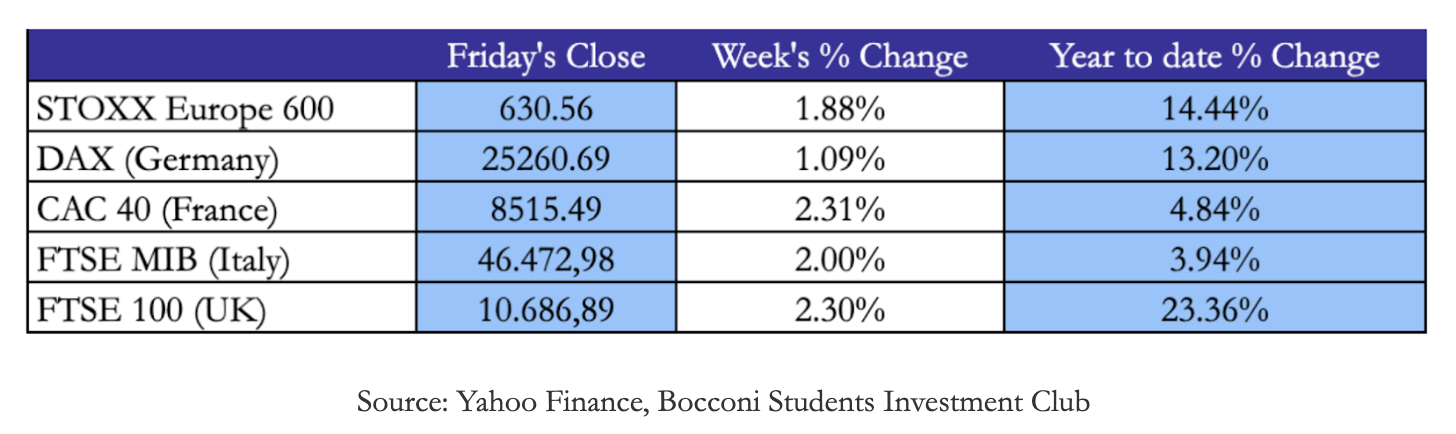

European equities closed the week higher, with broad-based gains across major benchmarks. It was another busy day of earnings on Thursday with Airbus, Nestle, Rio Tinto, Zurich Insurance, and Renault among the European companies reporting. Airbus shares dropped about 7% after it said that it expects to deliver 10 commercial aircraft less than expected. The STOXX Europe 600 advanced 1.88% on the week to a record high, bringing its year-to-date performance to +14.44%. Germany’s DAX rose 1.09%, maintaining solid momentum with a +13.20% gain since the start of the year. France’s CAC 40 outperformed on a weekly basis, climbing 2.31%, though its year-to-date increase remains more modest at +4.84%. In Italy, the FTSE MIB gained 2.00% during the week but the index was very volatile with the last day accounting for 1.50% of the growth. The UK market also delivered strong results, as the FTSE 100 rose 2.30% over the week and stands out with a robust +23.36% year-to-date return, the strongest performance among the major European indices listed. Overall, European markets continue to demonstrate resilience, with the UK leading year-to-date gains while Italy remains comparatively more volatile.

On Friday the HCOB Flash Eurozone Manufacturing PMI was released. It increased to 50.8 in February 2026 from 49.5 in January, beating forecasts of 50. The reading pointed to the strongest improvement in manufacturing business conditions since June 2022 and business sentiment reached a four-year high. On the other hand, manufacturing staffing levels continued to fall, input costs rose at the fastest pace since December 2022 and selling prices also accelerated.

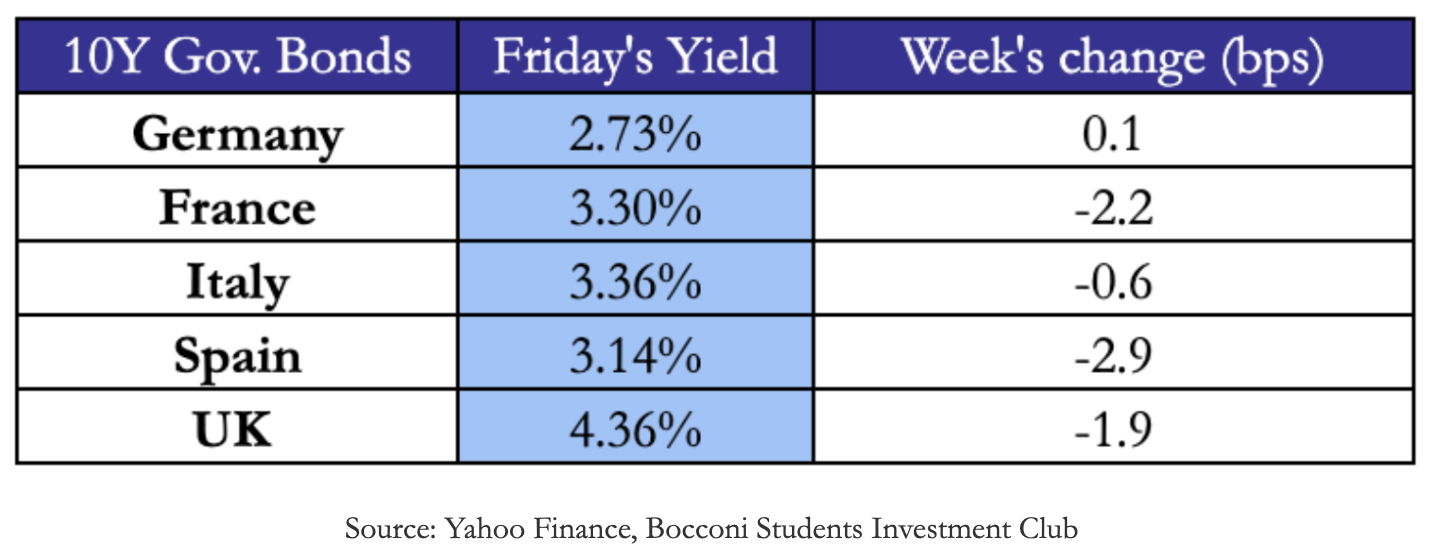

European sovereign bond markets were broadly mixed over the week, with peripheral yields easing while core markets remained relatively stable. Germany’s 10-year Bund yield edged marginally higher to 2.73%, posting a modest weekly increase of 0.1 bps, suggesting limited repricing in core euro-area rates. In contrast, France and Italy saw yields decline, with the French 10-year OAT falling 2.2 bps to 3.30%, and Italy’s 10-year BTP easing 0.6 bps to 3.36%, despite being very volatile during the week. Spain outperformed among peripherals, as its 10-year yield declined 2.9 bps to 3.14%, reflecting improving investor appetite for higher-yielding euro-area debt. In the UK, the 10-year gilt yield moved lower by 1.9 bps to 4.36%, indicating a slight pullback in rate expectations amid ongoing assessment of the Bank of England’s policy outlook. Overall, the modest compression in peripheral spreads versus Germany suggests continued confidence in euro-area fiscal stability, while Bund yields remained anchored due to the ongoing fiscal policy.

European sovereign bond markets were broadly mixed over the week, with peripheral yields easing while core markets remained relatively stable. Germany’s 10-year Bund yield edged marginally higher to 2.73%, posting a modest weekly increase of 0.1 bps, suggesting limited repricing in core euro-area rates. In contrast, France and Italy saw yields decline, with the French 10-year OAT falling 2.2 bps to 3.30%, and Italy’s 10-year BTP easing 0.6 bps to 3.36%, despite being very volatile during the week. Spain outperformed among peripherals, as its 10-year yield declined 2.9 bps to 3.14%, reflecting improving investor appetite for higher-yielding euro-area debt. In the UK, the 10-year gilt yield moved lower by 1.9 bps to 4.36%, indicating a slight pullback in rate expectations amid ongoing assessment of the Bank of England’s policy outlook. Overall, the modest compression in peripheral spreads versus Germany suggests continued confidence in euro-area fiscal stability, while Bund yields remained anchored due to the ongoing fiscal policy.

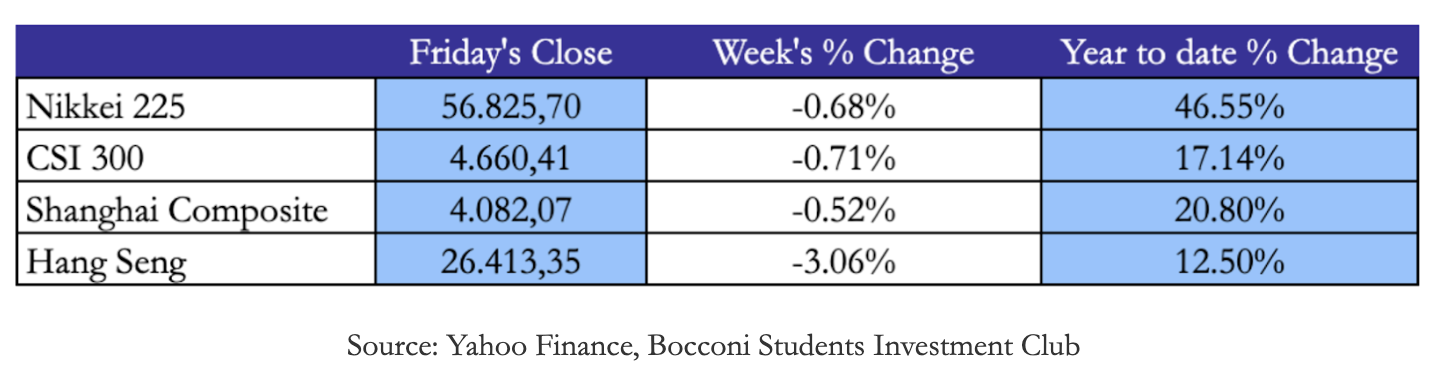

Asian equity markets closed the week broadly lower due to rates uncertainty. Japan’s Nikkei 225 declined 0.68%, suggesting a cooldown after Takaichi’s surge. Chinese benchmarks also slipped, with the CSI 300 down 0.71% and the Shanghai Composite falling 0.52%. Hong Kong underperformed the region, as the Hang Seng dropped sharply by 3.06%, marking the weakest weekly performance among major Asian indices. Despite the short-term pullback, year-to-date performance remains strong across the region. The Nikkei 225 continues to lead with a gain of 46.55% since the start of the year, followed by the Shanghai Composite (+20.80%) and the CSI 300 (+17.14%). The Hang Seng, while down for the week, remains up 12.50% year-to-date.

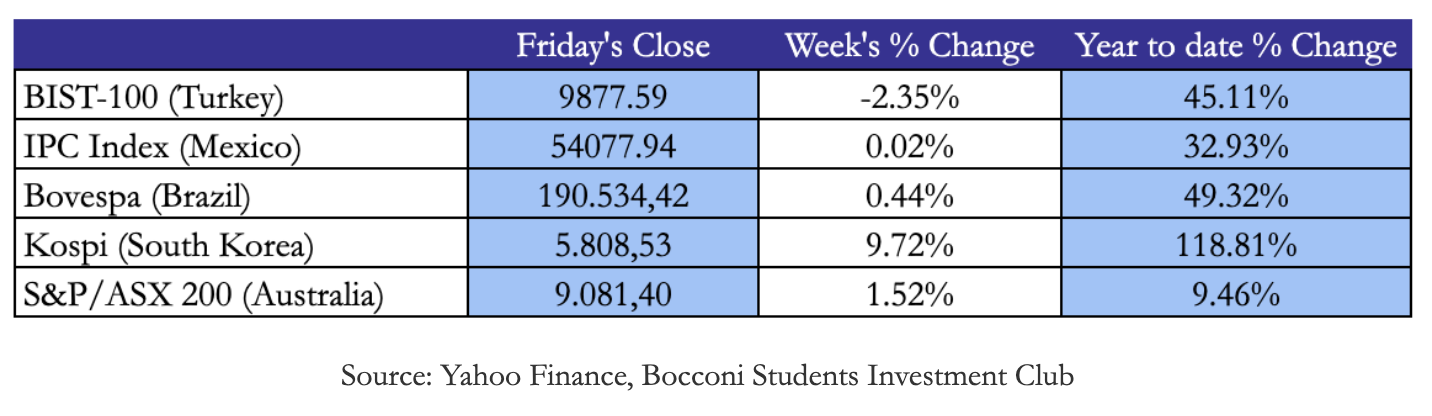

Emerging markets delivered a broadly positive performance this week, led by strong gains in Asia. South Korea’s Kospi surged 9.72%, extending its year-to-date return to an exceptional 118.81%, making it one of the strongest-performing indices globally. Australia’s S&P/ASX 200 also advanced 1.52%, bringing its year-to-date gain to 9.46%. In Latin America, performance was more moderate. Brazil’s Bovespa edged higher by 0.44%, while maintaining a robust +49.32% year-to-date return. Mexico’s IPC Index remained broadly stable, rising 0.02% over the week and posting a +32.93% gain since the start of the year. In contrast, Turkey’s BIST-100 declined 2.35%, though it remains up 45.11% year-to-date. Overall, emerging markets continue to exhibit strong year-to-date momentum, with dispersion across regions reflecting differing domestic macro and policy dynamics.

Emerging markets delivered a broadly positive performance this week, led by strong gains in Asia. South Korea’s Kospi surged 9.72%, extending its year-to-date return to an exceptional 118.81%, making it one of the strongest-performing indices globally. Australia’s S&P/ASX 200 also advanced 1.52%, bringing its year-to-date gain to 9.46%. In Latin America, performance was more moderate. Brazil’s Bovespa edged higher by 0.44%, while maintaining a robust +49.32% year-to-date return. Mexico’s IPC Index remained broadly stable, rising 0.02% over the week and posting a +32.93% gain since the start of the year. In contrast, Turkey’s BIST-100 declined 2.35%, though it remains up 45.11% year-to-date. Overall, emerging markets continue to exhibit strong year-to-date momentum, with dispersion across regions reflecting differing domestic macro and policy dynamics.

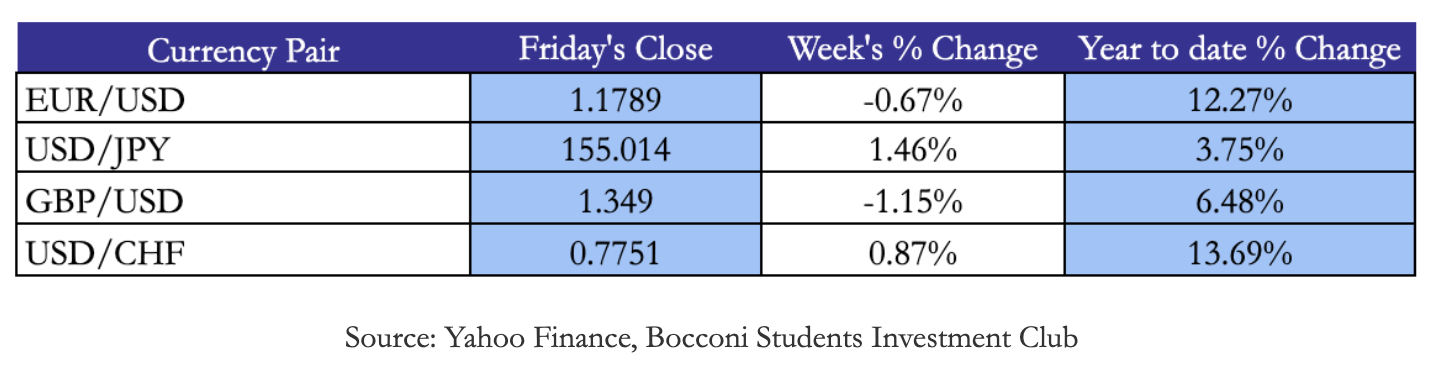

Currency markets saw more pronounced moves this week, with the US dollar strengthening against some of the major counterparts. The EUR/USD declined 0.67% to 1.1789, trimming its year-to-date gain to 12.27%. Similarly, the GBP/USD fell 1.15% to 1.349, while remaining up 6.48% since the start of the year. In contrast, the dollar advanced against the Japanese yen, with USD/JPY rising 1.46% to 155.014, extending its year-to-date increase to 3.75%. The greenback also gained against the Swiss franc, as USD/CHF climbed 0.87% to 0.7751, pushing its year-to-date performance to +13.69%. Overall, the weekly price action suggests renewed dollar strength after the weakening pressure of the previous period, likely reflecting shifting rate expectations and relative growth dynamics, even as broader year-to-date trends remain mixed across major currency pairs.

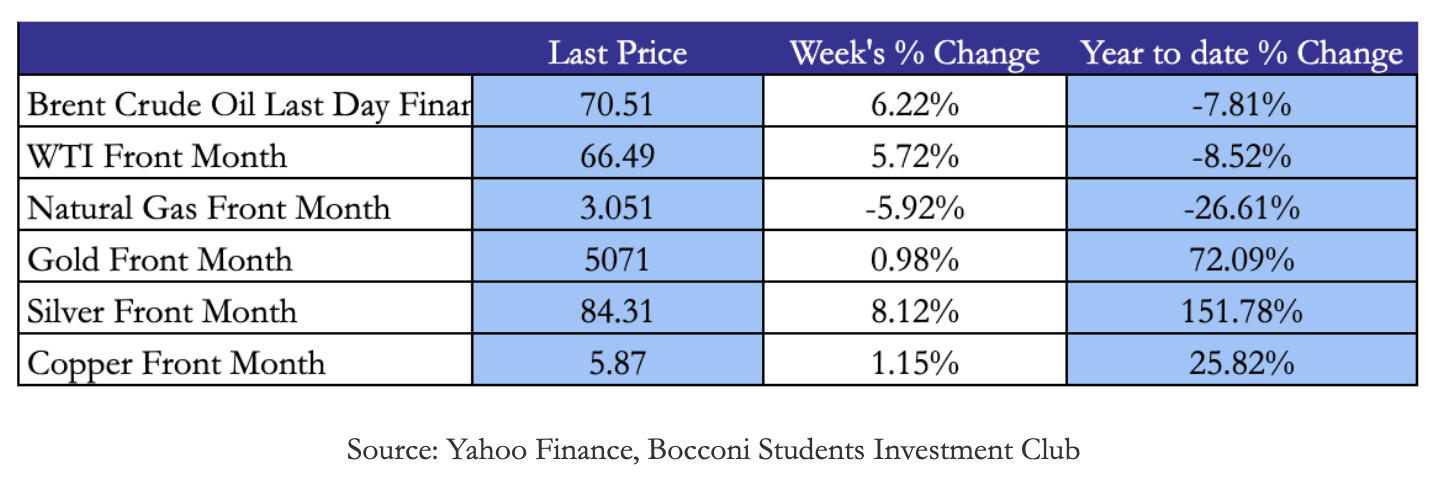

Markets delivered a broadly positive performance this week, led by strength in energy and precious metals. The momentum was further reinforced by increasing geopolitical tensions with Iran. Brent crude advanced 6.22% to $70.51, while WTI gained 5.72% to $66.49, partially recovering from earlier year-to-date declines (−7.81% and −8.52%, respectively). The rebound suggests renewed optimism in the energy complex following recent price weakness. Natural gas, however, moved in the opposite direction, falling 5.92% to $3.051 and extending its year-to-date decline to −26.61%, reflecting softer demand dynamics and ongoing supply pressures. Precious metals remained firmly supported. Gold rose 0.98% to $5,071, lifting its year-to-date performance to +72.09%. Silver outperformed markedly, surging 8.12% on the week to $84.31 and extending its year-to-date gain to an impressive +151.78%, underscoring strong investor positioning in the broader metals complex. Meanwhile, copper climbed 1.15% to $5.87, maintaining a solid +25.82% year-to-date increase, supported by expectations of resilient industrial demand despite persistent global growth concerns.

Markets delivered a broadly positive performance this week, led by strength in energy and precious metals. The momentum was further reinforced by increasing geopolitical tensions with Iran. Brent crude advanced 6.22% to $70.51, while WTI gained 5.72% to $66.49, partially recovering from earlier year-to-date declines (−7.81% and −8.52%, respectively). The rebound suggests renewed optimism in the energy complex following recent price weakness. Natural gas, however, moved in the opposite direction, falling 5.92% to $3.051 and extending its year-to-date decline to −26.61%, reflecting softer demand dynamics and ongoing supply pressures. Precious metals remained firmly supported. Gold rose 0.98% to $5,071, lifting its year-to-date performance to +72.09%. Silver outperformed markedly, surging 8.12% on the week to $84.31 and extending its year-to-date gain to an impressive +151.78%, underscoring strong investor positioning in the broader metals complex. Meanwhile, copper climbed 1.15% to $5.87, maintaining a solid +25.82% year-to-date increase, supported by expectations of resilient industrial demand despite persistent global growth concerns.

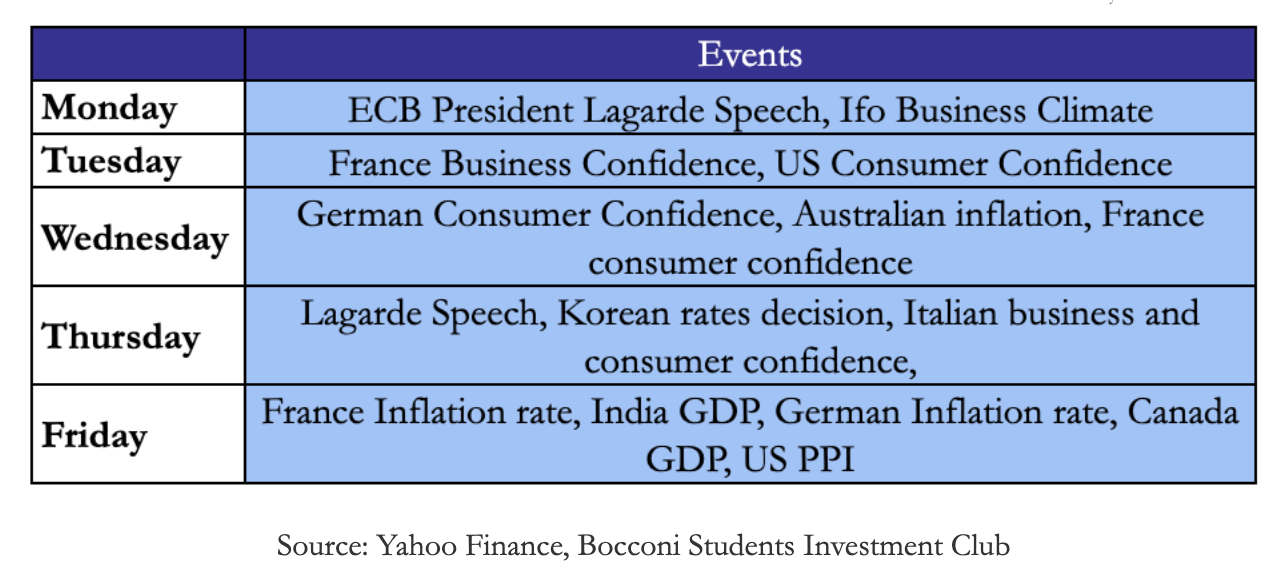

The upcoming week will be event heavy across major economies. We begin on Monday with remarks from ECB President Christine Lagarde. Tuesday will focus on confidence indicators, including France Business Confidence and US Consumer Confidence data. Midweek brings further sentiment readings, with German Consumer Confidence, Australian inflation data, and France Consumer Confidence scheduled for Wednesday. On Thursday, markets will digest another speech from Lagarde, alongside the Korean rate decision and Italian business and consumer confidence figures. The week concludes with a busy Friday featuring key macro releases, including France’s inflation rate, India and Canada GDP figures, Germany’s inflation reading, and US PPI data.

In a primitive society, every couple prefers to have a baby girl. There is a 50% chance that each child they have is a girl, and the genders of their children are mutually independent. If each couple insists on having more children, what will eventually happen to the fraction of girls in this society?

Solution: the answer is 50 % since progressively the percentage of girls will approach 50% and so it will for boys. The bias in this case doesn’t affect the outcome, since they don’t stop having children after having a girl.

Brain Teaser #43

Horse race! In a race there are 25 horses competing and the track is composed by 5 lanes. You’re interested in finding the fastest horses in the group. What is the minimum number of runs to find the top three horses?

0 Comments