USA

The week started with a mixed performance for US stocks with Dow Jones hitting a new record high and investors treading carefully ahead of the Federal Reserve key policy meeting on Wednesday. Monday was a bad day for the tech sector with Apple shares dropping 2.8% on concerns over a weaker demand for the iPhone 16. Also, chipmakers slid as investors reduced their positions leading to 2% declines for Nvidia and Broadcom. On the flip side, energy and financial sector outperformed led by a 1% rise in Chevron and 1.7% increase in JP Morgan shares.

On Thursday all main indexes reached a record high level as traders started to digest the latest FOMC decision. The Fed delivered a jumbo 50bps rate cut, the first decrease in borrowing costs in four years, and signaled further reductions ahead for this year and next. At the same time, new economic projections showed the central bank still sees the US economy growing steadily while revising its inflation forecasts lower.

The S&P 500 closed the week with a 1.36% gain and both the NASDAQ (+1.49%) and the Dow Jones (+1.62%) registered positive performance Among stocks, FedEx plunged 15.2% after posting weak earnings and lowering its revenue forecast, while Nike shares surged 6.9% following the announcement of Elliott Hill as the new CEO.

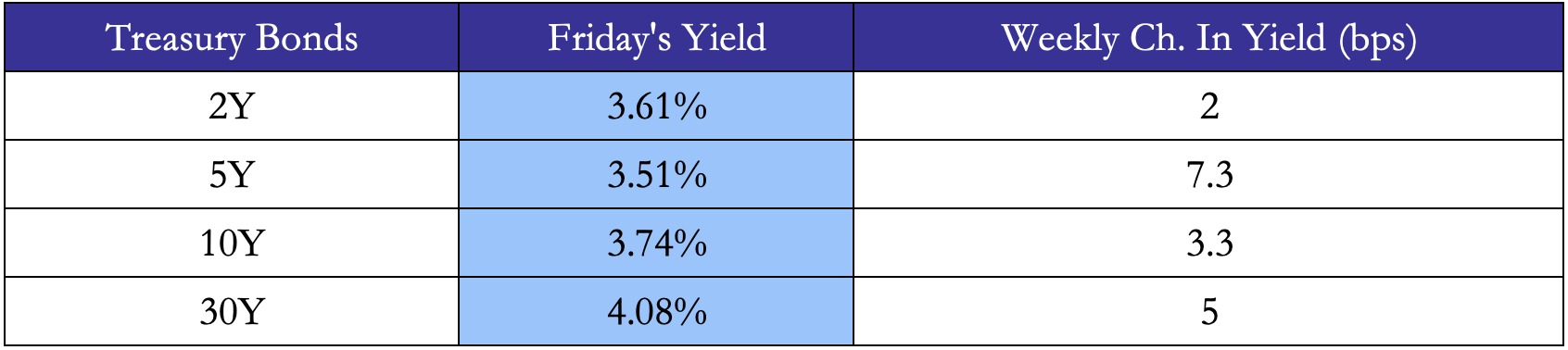

Treasury yields rebounded from last week’s 15-month low as markets evaluated the outlook for U.S. monetary policy following the Fed’s initiation of its rate-cutting cycle. While bonds initially rallied after the Fed reduced interest rates, the gains were quickly reversed after Fed Chair Powell reaffirmed the strength of the U.S. economy. He also indicated that the FOMC is not in a hurry to further ease monetary policy, despite today’s aggressive 50bps cut, stressing that such reductions should not be interpreted as a new trend.

Source: Marketwatch, Bocconi Students Investment Club

Europe and UK

European Stocks opened the weak lower than expected with the Stoxx 50 down 0.4% on Monday and the Stoxx 600 down 0.2%. Losses rebounded on Tuesday as expectations that US Federal Reserve will deliver a 50-basis point rate cut on Wednesday increased. On Friday the week was closed firmly lower on Friday, erasing the sharp gains from the prior session as markets continued to assess the outlook for the year’s financial conditions following a series of central bank decisions this week. Auto manufacturers led the losses in the session, led by a 6.7% slump for Mercedes after the company lowered its financial forecast for the year due to a rapid deterioration of its business in China. Stellantis, Volkswagen, and BMW fell above 3%.

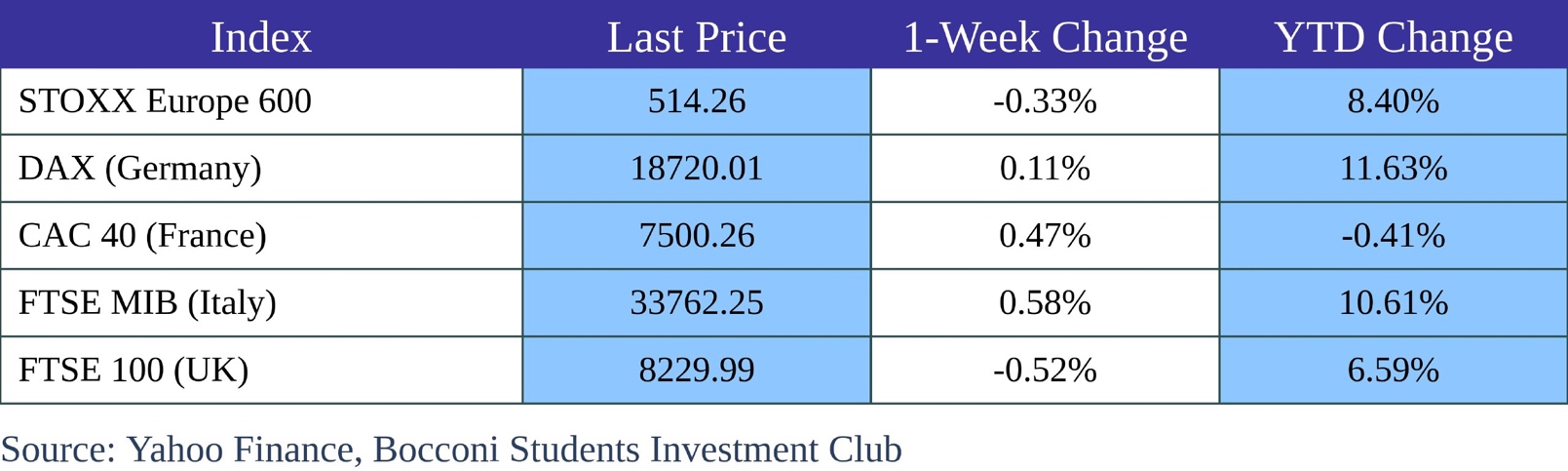

European stocks ended with mixed performance, as the STOXX Europe 600 Index slipped slightly by 0.33%. Despite this, all major indices posted modest weekly gains, with Germany’s DAX up 0.11%, France’s CAC 40 rising by 0.46%, and Italy’s FTSE MIB advancing by 0.58%.

In the UK the FTSE 100 closed at 8229 reporting a weekly loss of -0.52% after the decision that arrived on Thursday of the Bank of England to keep the rate unchanged at 5% reflecting Market’s expectations. FTSE 100 reacted well to the news reporting a daily change of +1%. The mining sector led the way, with companies like Anglo American, Glencore, Rio Tinto, and Antofagasta seeing gains between 3% and 5%. Although on Friday’s session The FTSE 100 fell 1.2% to close at 8,230 on Friday, retreating from solid gains the previous day. Among the biggest losers were Spirax Group (-4.8%), Frasers Group (-4.5%), and Next (-4%)

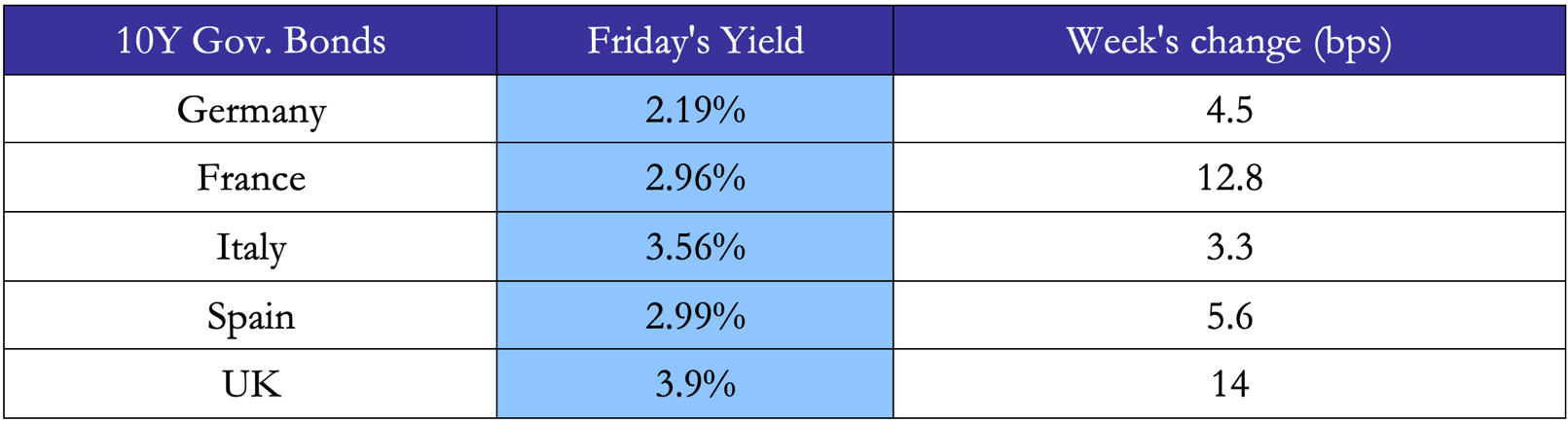

European government bonds topped the highest level in about two weeks as traders digest the latest monetary policy decision from the Fed and the BoE. Indeed Chair Powell noted that the Fed is not in a rush to ease and 50bps is not the new pace of rate cuts. Instead in Europe, the European Central Bank cut interest rates by 25 bps early in the month and hinted at further reductions ahead due to slowing inflation and weak economic growth

Source: Marketwatch, Bocconi Students Investment Club

Rest of the World

The Nikkei 225 Index surged 1.53% on Friday, closing at 37724 with a weekly gain of 3.12%. The rally was fueled by an outsized U.S. rate cut and expectations of a “soft landing” for the U.S. economy. Domestically, the Bank of Japan held its policy rate steady at 0.25% and reaffirmed its view that the economy was steadily progressing toward a modest recovery. Recent data showed Japan’s core inflation rate accelerated to 2.8% in August from 2.7% in July, reinforcing a hawkish stance on BOJ policy.

The Shanghai Composite ended at 2,737 on Friday, breaking a two-day winning streak as investors responded to the latest central bank policy decisions. The People’s Bank of China held its one- and five-year loan prime rates steady at 3.35% and 3.85%, respectively, after making surprise cuts to key lending rates in July. This left investors disappointed, as they were hoping for additional policy easing following the U.S. Federal Reserve’s 50 basis point rate cut earlier in the week. Despite this, markets remain optimistic that Chinese policymakers will introduce more stimulus to support the economy amid disappointing August economic data. On the other hand, the Hang Seng Index jumped to 18,258 on Friday, marking its highest level in 10 weeks.

Other global markets delivered mixed performances. Brazil’s Bovespa fell by 2.83%, hitting a one-month low. In contrast, Australia’s S&P/ASX 200 surged to a record high of 8,209 points. South Korea’s Kospi also performed well, posting a 0.70% weekly gain. In Turkey, the Central Bank held its benchmark one-week repo rate steady at 50% for the sixth consecutive meeting in August 2024, as expected. This keeps borrowing costs at their highest levels since 2002. The BIST-100 reacted positively, showing signs of recovery with a 2.22% weekly increase, closing at 9,900 points, after a sharp foreign sell-off last week had pulled it down to 9,600.

FX and Commodities

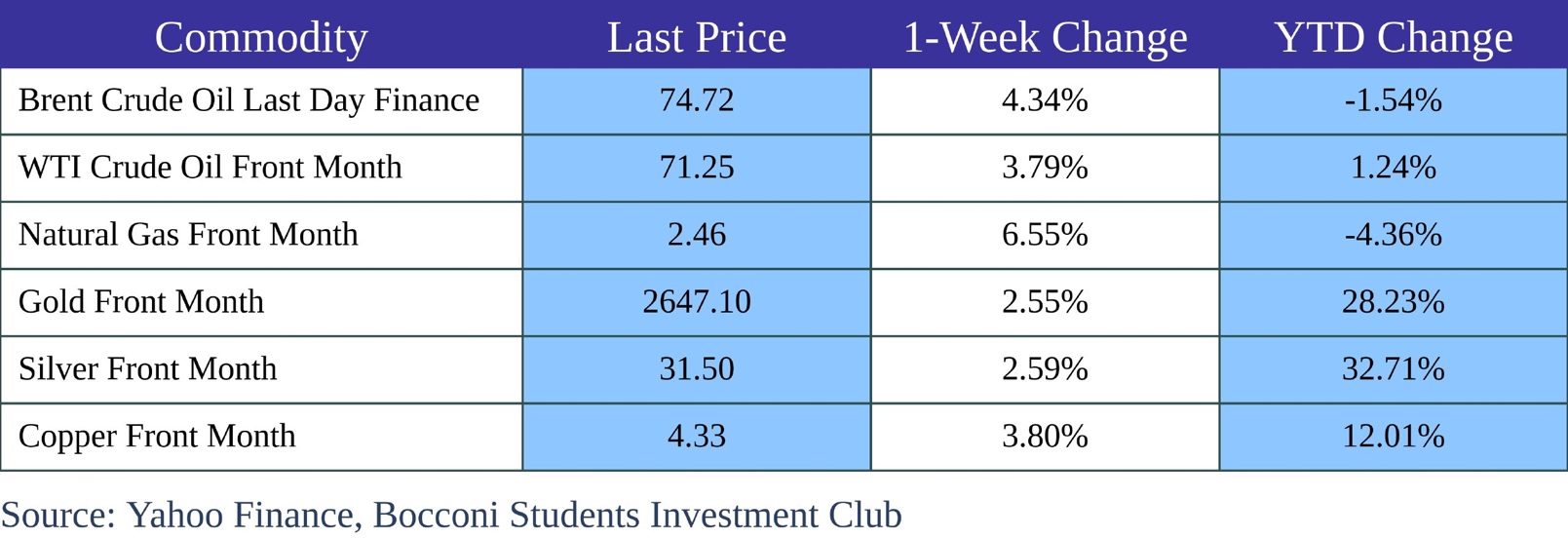

This week both Brent and WTI crude oil futures regained some traction after the 15-month low registered on 10th of September amid expectations of stronger global energy demand and higher risk premiums from rising tensions in the Middle East. The 50 basis points cut delivered by the FED also helped stimulating the outlook for fuel consumption in the US and major economies.

Gold passed the week trading above $2700 per ounce fter retreating from record levels in the previous session closing at $2647 with a weekly gain 2.55%, as markets continued to assess the Federal Reserve’s decision. Fed officials also project that the benchmark rate could decrease by another half percentage point by the end of the year. This move is seen to increase appetite for gold by reducing the opportunity cost of holding non-yielding assets.

Silver jumped 2.59% this week closing at $31.50 per ounce on Friday, reversing losses from the previous sessions as the dollar pulled back from recent highs, removing downward pressure on commodity prices. Also Copper registered a positive performance closing at $4.33 with a weekly gain of 3.80%, while Natural Gas rised by 6.55% despite the Energy Information Administration (EIA) reported a larger-than-expected storage increase.

The U.S. dollar weakened this week following the Federal Reserve’s decision to cut interest rates. In contrast, the British pound surged to $1.33, its highest level since March 2022, after the Bank of England held interest rates steady at 5% during its September 2024 meeting. The euro closed Friday at $1.12, while the Japanese yen depreciated again, slipping past 143 per dollar after recovering earlier in the session. This came as Bank of Japan Governor Kazuo Ueda acknowledged “some weakness” in the economy, adopting a slightly more dovish tone compared to previous statements.

Next Week Main Events

Brain Teaser #18

You are tossing a fair coin and writing down the outcomes. What is the probability that you will see the sequence HTH before you see the sequence HHT?

SOURCE: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

SOLUTION

You can think of it this way: eventually, the coin will show heads (H) for the first time. Now, let’s analyze what happens in the following two flips after that first heads. There are four possible outcomes:

- HHT

- HHH: This outcome guarantees that as soon as the next tail (T) appears, you will have seen the sequence HHT.

- HTH

- HTT: This outcome effectively resets the process, and you must start over.

Given these possibilities, there is a 2/3 chance that you will observe the sequence HHT before seeing HTH. For the reverse case, where HTH appears first, the probability is 1/3.

Brain Teaser #19

You are invited to a welcome party with 25 fellow team members. Each of the fellow members shakes hands with you to welcome you. Since a number of people in the room haven’t met each other, there’s a lot of random handshaking among others as well. If you don’t know the total number of handshakes, can you say with certainty that there are at least two people present who shook hands with exactly the same number of people?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

0 Comments