USA

U.S. equities experienced a volatile week as markets navigated a mix of strong early gains and later losses amid mounting geopolitical and tariff concerns. With Presidents’ Day keeping markets closed on Monday, trading began on Tuesday with stocks surging and the S&P 500 Index reaching record highs on Tuesday and Wednesday, buoyed by FOMC minutes that reaffirmed the Fed’s commitment to steady rates until inflation and employment show further progress. Later in the week, sharp declines wiped out these gains as headlines focused on President Trump’s plans for additional tariffs on automobiles, pharmaceuticals, and lumber products, alongside efforts to influence the Russia-Ukraine conflict. Meanwhile, the housing market also showed signs of stress, with existing home sales in January 2025 falling by 4.9% to a seasonally adjusted annualized rate of 4.08 million, the sharpest decline in seven months even as year-over-year sales posted a modest 2% increase.

U.S. initial jobless claims faced mounting pressure as the labor market showed modest signs of easing amid persistently tight conditions. In the week ending February 15th, initial claims increased by 5,000 to 219,000, surpassing market expectations of 215,000. Recurring claims held at 1,869,000, aligning closely with the forecast of 1,870,000. The four‐week moving average, which smooths short‐term volatility, decreased by 1,000 to 215,250. Although the data reflects a slight softening from the post‐pandemic peak, it still underscores a historically tight labor market consistent with recent FOMC commentary. It is also important to note that federal employees dismissed by the newly created Department of Government Efficiency (DOGE) are excluded from these state figures, as their claims are processed separately under the Unemployment Compensation for Federal Employees (UCFE) program.

U.S. business activity nearly came to a halt in February. The flash Composite Purchasing Managers’ Index (PMI) registered a 17-month low of 50.4, with readings above 50 indicating expansion and those below signaling contraction. Services activity slipped into contraction with its lowest PMI reading in over two years at 49.7, partially offsetting gains in the manufacturing sector. The report attributed the overall decline to uncertainty surrounding federal government policies and rising input cost pressures.

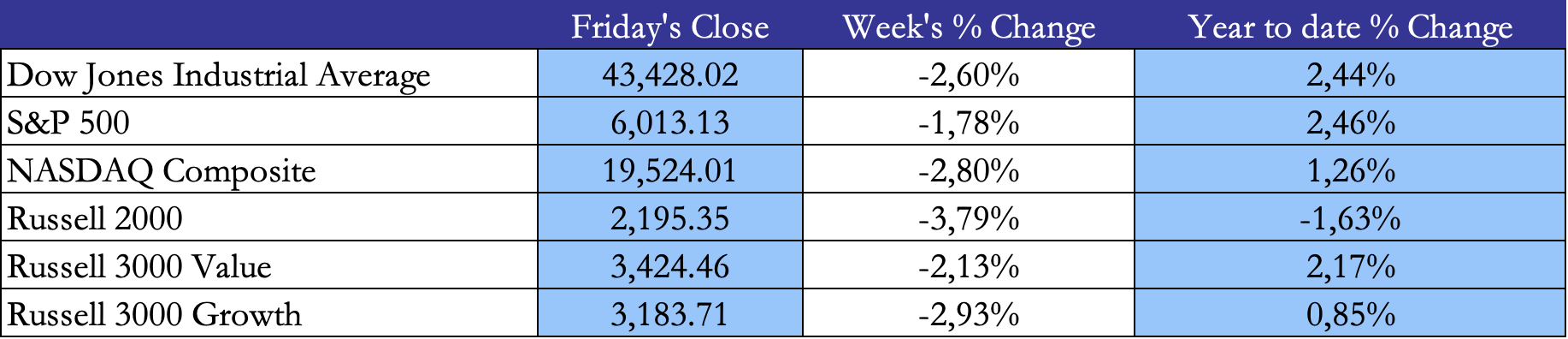

In summary, U.S. equities advanced significantly this week, with all major indices closing in positive territory. The Dow Jones Industrial Average fell 2.65% to 43,428.02 points, decreasing its year-to-date gain to 2.44%. The S&P 500 fell 1.78% to 6,013.13, highlighting current uncertainty concerning tariffs and geopolitical conflicts. The Nasdaq Composite experienced the sharpest decline for large cap indexes, falling 2.80% to 19,524.01. Meanwhile, small cap were the most negatively impacted this week with the Russell 2000 falling 3.78% to 2,195.35, whipping out its YtD gains with the index currently experiencing a YtD loss of 1.63%. Similarly, growth companies fell this week, with the Russell 3000 Growth index down 2.92% and the Russell 3000 Value index down 2.13%.

Source: Marketwatch, Bocconi Students Investment Club

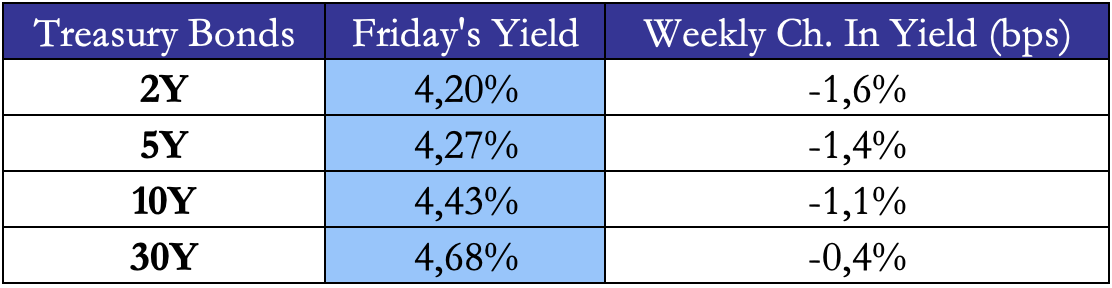

U.S. Treasury yields moved lower this week, even as investors remained concerned about the possibility of the Federal Reserve extending its restrictive policy stance. The 10-year yield slipped by roughly 8 basis points to 4.42%, staying within a historically elevated range as market participants weighed ongoing inflation pressures and mixed economic signals.

Shorter-term rates followed suit, with the 2-year yield declining about 8 basis points to 4.18%, while the 5-year yield dropped to 4.26%, and the 30-year yield eased to 4.67%. These modest declines highlight continued uncertainty surrounding the timing of any future rate cuts, particularly given solid economic data and the Fed’s cautious rhetoric.

Source: Marketwatch, Bocconi Students Investment Club

Europe and UK

European equities ended the week on a mixed note as investors remained cautious amid a flurry of regional PMI data, corporate earnings releases, and evolving geopolitical developments. Concerns over the U.S. government’s trade and economic policies added to the uncertainty, while Germany’s upcoming snap election also captured market attention. The pan-European Stoxx 600 advanced by 0.52%, with France’s CAC 40 increasing by 0.39%. In contrast, the U.K.’s FTSE 100 and Germany’s DAX experienced slight declines of 0.04% and 0.12%, respectively, while Switzerland’s SMI stood out with a gain of 1.1%. Over the course of the week, both the FTSE 100 and DAX fell by about 1%, and the CAC 40 recorded a marginal loss.

On Wednesday, UK YoY inflation data was published. In January 2025, the U.K. annual inflation rate accelerated sharply to 3%, its highest level since March 2024 and exceeding forecasts of 2.8%. This marked an increase from 2.5% in the previous month, driven primarily by rising transport costs, which surged to 1.7% from a previous decline, and by higher prices for food and non-alcoholic beverages, which climbed to 3.3% from 2.5%. Notable upward pressures were seen in air fares, motor fuels, meat, and bread and cereals, while a slight offset came from falling secondhand car prices. Prices also rose more quickly for recreation and culture, reaching 3.8% compared to 3.4%, and for education, which jumped to 7.5% from 5% due to the inclusion of a 20% VAT on private school fees. Services inflation increased to 5% from 4.4%, just below the Bank of England’s forecast of 5.2%, whereas growth moderated for restaurants, hotels, housing, and utilities. Annual core inflation moved up to 3.7% from 3.2%, matching expectations, and the Consumer Price Index fell by 0.1% month-on-month, less than the anticipated 0.3% drop.

On Friday, it was announced that in February 2025, the HCOB Germany Manufacturing PMI improved to 46.1 from 45 in January, surpassing market expectations of 45.5, according to preliminary data. This reading, the highest in 24 months, suggests that the drag from falling manufacturing production is easing, as the rate of contraction slowed to its slowest in nine months, with factory production holding at an index of 48.5. Although the sector continued to weigh on overall private sector performance, the decline in new orders also moderated, even as job losses deepened with further cuts in manufacturing employment. On the pricing front, purchase prices fell at an accelerated pace, and manufacturers’ confidence in the outlook diminished compared to the previous month.

Source: Marketwatch, Bocconi Students Investment Club

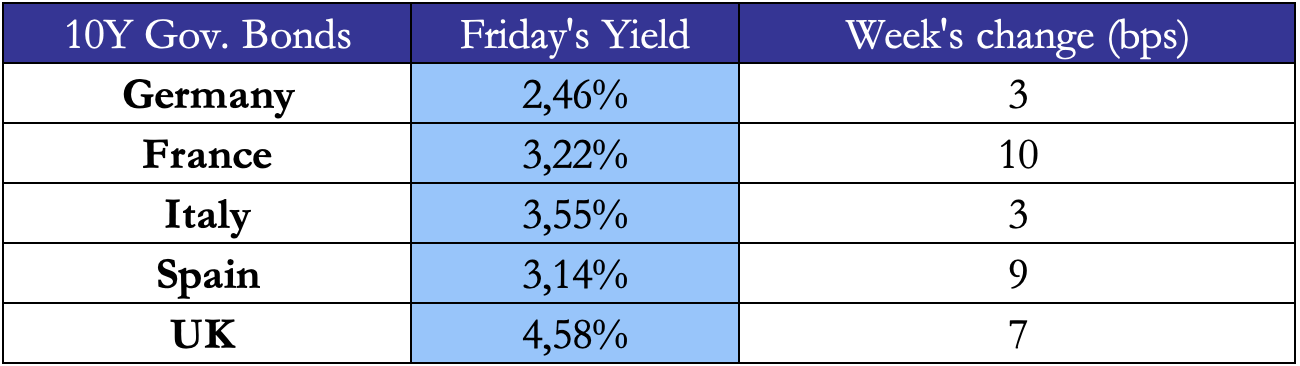

Germany’s 10-year yield fell below 2.5% after fresh data suggested that the ECB might need to cut rates more aggressively to support the economy. In the broader Eurozone, business activity remained largely stagnant in February, with Germany recording a modest acceleration in expansion and France enduring its sharpest contraction in over a year. Consequently, market expectations for easing have risen to 78 basis points for the year, up from 74 basis points earlier. Investors are now turning their focus to Germany’s general election on Sunday, where polls indicate that the conservative CDU/CSU bloc is likely to lead, although coalition partners will be necessary to form a government.

Russian fixed income markets experienced notable shifts as the yield on the 10-year OFZ dropped to 15.3% after testing three-year lows of 17% earlier in the month. This decline came as strong momentum built across all classes of Russian assets, driven by growing expectations that the conflict in Ukraine may be approaching a ceasefire. Meanwhile, the Bank of Russia held its benchmark rate at 21% in February while warning that further evidence of persistent inflation could prompt a resumption of its tightening cycle in March.

Source: Marketwatch, Bocconi Students Investment Club

Rest of the World

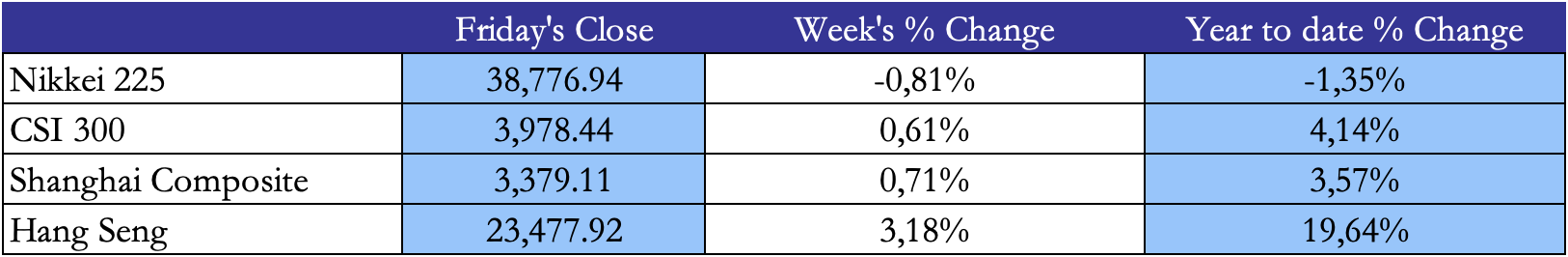

Mainland Chinese stock markets advanced over the week, supported by strong performances in technology shares following better-than-expected earnings from leading firms. The onshore benchmark CSI 300 Index climbed 0.61%, while the Shanghai Composite Index added 0.97% in local currency terms. In Hong Kong, the Hang Seng Index surged by 3.18%, driven by a rally in Alibaba shares after the e-commerce and cloud computing giant reported faster-than-projected sales growth in the December quarter.

The robust earnings from Alibaba and other tech companies were complemented by impressive displays from local AI startup DeepSeek in January, which rekindled investor interest in the country’s internet sector. Market sentiment was further boosted by a high-profile meeting on February 17 between President Xi Jinping and prominent tech entrepreneurs, signaling a more supportive stance toward private sector companies. State media widely circulated photos from the meeting, showing Xi alongside Alibaba founder Jack Ma and other industry leaders.

Japan’s equity markets encountered headwinds over the week, weighed down by a strengthening yen and rising yields on Japanese government bonds. The Nikkei 225 Index fell by 0.81%, while the broader TOPIX Index slipped by 0.82%. Investor sentiment was further dampened by tariff threats from U.S. President Donald Trump, adding to the overall uncertainty in the market.

Source: Marketwatch, Bocconi Students Investment Club

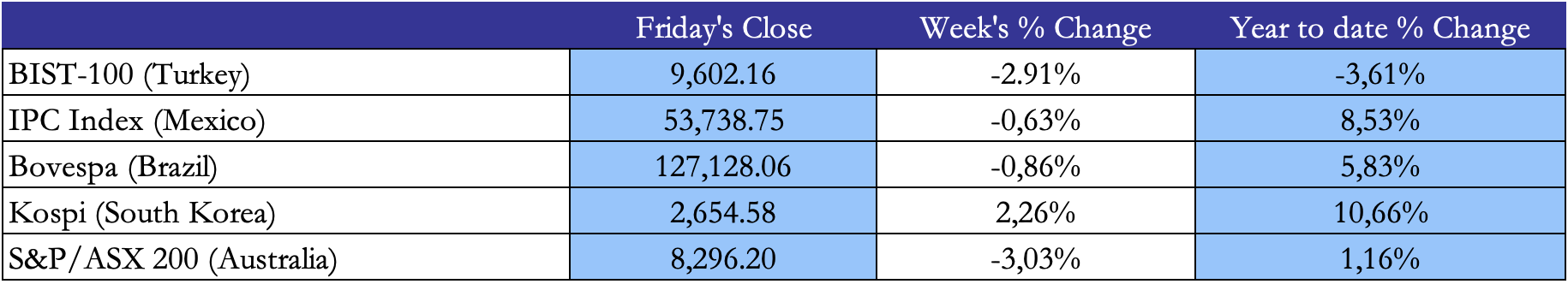

Mexican and Turkish markets faced contrasting pressures this week amid ongoing economic uncertainty. In Mexico, the peso steadied around 20.3 per USD, recovering from a three‐year low of 20.85 observed since early 2024, even as dovish signals from \Banxico prevailed. The economy contracted sharply in Q4, with GDP shrinking by 0.6%, its steepest decline since Q3 2021,underscoring significant weakness and highlighting vulnerability to U.S. trade uncertainties and potential tariffs. Meanwhile, Turkey’s BIST 100 slid to 9,800 in February, marking a 2% decline since the start of the year. This drop was driven by persistent concerns over lower growth and elevated inflation, as slower-than-expected easing in inflationary pressures has cast doubt on the central bank’s prospects for delivering further aggressive rate cuts over the coming meetings.

Source: Marketwatch, Bocconi Students Investment Club

FX and Commodities

Source: Marketwatch, Bocconi Students Investment Club

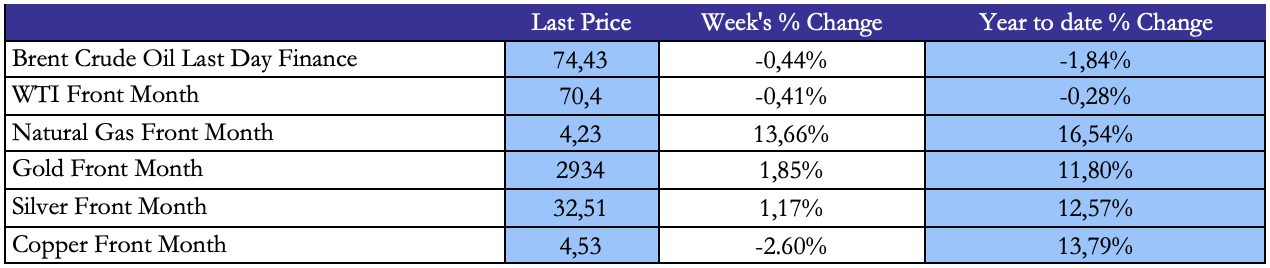

Gold traded around $2,930 per ounce on Friday, remaining close to its record high of $2,950 from the previous session and setting the stage for an eighth consecutive weekly gain, a testament to its safe-haven appeal amid escalating global uncertainties. Earlier in the week, President Donald Trump announced plans to impose additional tariffs on lumber, cars, semiconductors, and pharmaceuticals, supplementing existing measures of 10% on Chinese imports and 25% on steel and aluminum, which further intensified global trade tensions. Heightening geopolitical risks, reports emerged suggesting that Trump might withdraw US support for Ukraine during negotiations with Russia, potentially sidelining Kyiv and its European allies. Meanwhile, US Treasury Secretary Scott Bessent dismissed speculation regarding the revaluation of government bullion holdings, and Swiss customs data indicated that gold exports from Switzerland surged year-on-year in January, with shipments to the US reaching their highest level in at least 13 years.

WTI crude oil futures slipped nearly 2.9% to settle at $70.4 per barrel, marking a 0.4% decline for the week. This downturn unfolded even as concerns over Russian supply disruptions provided underlying support amid uncertainty surrounding a potential peace deal in Ukraine. Supply issues intensified following Russia’s report of a 30-40% reduction in Caspian Pipeline Consortium flows after a Ukrainian drone attack, though Kazakhstan managed to post record-high output despite damage to its export route. In the United States, rising crude inventories contrasted with declines in gasoline and distillate stocks, as refinery maintenance constrained processing levels. Looking ahead, analysts anticipate that colder US weather and increased industrial activity in China will help boost oil demand in the coming weeks.

US natural gas futures advanced more than 2.5% to reach $4.3 per MMBtu, marking a 25‐month high as an Arctic blast intensified heating demand while freezing oil and gas wells disrupted production. Forecasts indicate that colder-than-normal temperatures will prevail across the Lower 48 states through February 22, keeping consumption elevated. At the same time, output declined by 6.7 bcfd over the past 15 days, falling to a four‐week low of 100 bcfd on Thursday. Supply constraints were further exacerbated by record gas flows to LNG export plants, which averaged 15.5 bcfd in February, up from 14.6 bcfd in January,with daily LNG feedgas reaching a new high of 16.4 bcfd on Wednesday, surpassing Tuesday’s 16.2 bcfd. Additionally, EIA data revealed a larger-than-expected storage draw of 196 bcf last week, significantly tightening supply.

Source: Marketwatch, Bocconi Students Investment Club

Next Week Main Events

Source: Trading Economics, Bocconi Students Investment Club

Brain Teaser #29

A casino offers a card game using a normal deck of 52 cards. The rule is that you turn over two cards each time. For each pair, if both are black, they go to the dealer’s pile; if both are red, they go to your pile; if one black and one red, they are discarded. The process is repeated until you two go through all 52 cards. If you have more cards in your pile, you win $100; otherwise (including ties) you get nothing. The casino allows you to negotiate the price you want to pay for the game. How much would you be willing to pay to play this game?

Solution

In the card game, there are always 26 red and 26 black cards. Whenever a pair is discarded, one red and one black card are removed. So, the number of red and black cards that go to you and the dealer remains balanced. You can never end up with more red cards than the dealer has black cards, ensuring that the dealer always has an equal or greater number of cards than you. Therefore, no matter how the game plays out, you will never win. You should not pay anything to play the game.

Brain Teaser #30

Three lightbulbs are installed in a room with no windows. You’re standing outside the room, in front of three switches, each of which controls one of the lightbulbs. So, if you only have one chance to enter the room, how are you supposed to figure out which switch controls which lightbulb?

0 Comments