USA

US indexes ended a busy week higher after recovering from a Monday crash caused by the contagion risks of Evergrande’s default. On Monday, the S&P 500 fell the most since May, though it pared some losses during the last hours of trading. Another important event was the gathering of the Federal Open Market Committee, which gave more details about the timing of tapering and economic projections. The market didn’t react negatively to the announcement by Powell that tapering could start soon as most investors were expecting the move.

The S&P 500 closed the week 0.51% higher at $4,455.48, not far from its all-time highs reached at the beginning of the month. Similarly, the Russell 2000, gained 0.50% ending the five days at $2,248.07. The Dow Jones Industrial Average advanced 0.62%, heading towards $35,000.00 and the Nasdaq Composite ended the five days flat slightly above $15,000.00 level. Looking at the YTD performance, the S&P 500 kept its first place with a 18.62% increase. Both value and growth stocks rallied supported by a general positive environment created by dip-buyers during Wednesday and Thursday sessions. Sector-wise, the Energy and Communication Services outperformed the benchmark and the Real Estate underperformed. The CBOE Volatility Index (VIX), which measures volatility based on S&P index options, decreased throughout the week after a spike on Monday.

On the macroeconomic side, the week started with an approval by the Democratic-House of a bill that would suspend the U.S. debt ceiling into December 2022. The measure will now be presented to the Senate, setting up a standoff as Republicans have vowed to block it. The measure is urgently needed by mid-October, before the government runs out of money to pay its bills. In that hypothetical scenario, a government shutdown and a default could be possible. On Wednesday, at the end of the two-day gathering of the FOMC, Fed Chair Jerome Powell said that tapering could begin in November and end by mid-2022. He also emphasized that the timing and the pace of the reduction in asset purchases should not be intended as a direct signal regarding the timing of interest-rate liftoff. This cycle will be faster if compared to the last cycle of tapering in 2014, which lasted 10 month. Moreover, officials published updated quarterly economic projections, the median estimate of FOMC participants showed that they don’t see any rate increases until 2023. The view for inflation didn’t change, the Fed estimated that it was 4.2% in the 12 months through July and that it will return to 2% after temporary supply-chain disruptions have been resolved. Regarding the job market, this week’s initial jobless claims were at 351k, higher than the 320k forecasted. Nevertheless, the underlying trend is still consistent with a steadily recovering labor market. During the week the 10Y yield increased by 9 basis points, reaching 1.454%, the highest since July.

Generally speaking, the Fed seems to have achieved its goal of announcing tapering without creating too many concerns among investors. “The muted market reaction is a very good outcome for the Fed in terms of signaling their intent to get the market information well ahead of the tapering decision”, said Jeffrey Rosenberg, senior portfolio manager for systematic fixed income at BlackRock Inc.

Europe and UK

Europe’s major indexes increased for the first time since the beginning of the month despite most of Markit PMI and Business Confidence reporting below expectations. The continent-wide Stoxx Europe 600 gained 0.31% after rebounding on Monday’s sell-off. The German DAX increased 0.27%, ending the week at €15,521.75. It is worth noticing that the German index has been pretty stable in the past months. Indeed, it is at the same levels reached in May, one of the reasons is surely the upcoming German Federal Elections that will be held today. The market expects that the next coalition will be less committed to the draconian application of fiscal restraint rules that was the hallmark of Merkel’s government.

Similarly to US Treasuries, European bond and UK Gilt yields rose during the week. The German 10Y Bund yield kept rallying towards the 0 level, surging almost 20 basis points this month. The UK Gilt yields, which were under the focus of investors as the Monetary Policy Committee gathered on Thursday, grew 8 basis points to 0.836%. At Thursday’s policy meeting, the Bank of England raised the prospect of hiking interest rates as soon as November to contain a surge in inflation led by a spike in energy prices. The central bank announced that any future tightening should start with an interest-rate increase. Deutsche Bank and Bank of America updated their expectations to a first rate hike in February 2022. Other banks such as HSBC, see a rate hike happening as soon as December. “This appears to open the door to a rate rise by the end of this year, even while the BOE is injecting net stimulus into the economy via quantitative easing”, said Liz Martins, a senior economist at HSBC Holdings Plc in London.

Traders are now expecting that the BOE will move earlier than the Fed, despite deploying less in the way of rate hikes in coming years. While the BOE targets inflation of 2%, officials said the rate may temporarily exceed 4% in the final three months of the year. The BOE’s hawkishness is also motivated by stronger-than-expected jobs data that show unemployment will peak well below worst-case scenarios predicted at the onset of the pandemic.

Rest of The World

Asian indexes saw a negative performance during the last week as they were hit harder than European ones from Monday’s crash. The various indexes were also affected by the different holidays that took place around Asian countries. China resumed trading on Wednesday after a two-day holiday, Hong Kong was shut on Wednesday while Tokyo was closed on Thursday. Indexes in Mainland China ended almost flat with the CSI300 and the Shanghai Composite losing 0.13% and 0.02% respectively. The Nikkei 225 declined 0.82% retreating from last week’s all-time-highs. The worst performer was the Hang Seng Index, decreasing 2.92% after losing almost 4% in Monday’s session only. What helped investors throughout the week was probably the injection of $71bln by China’s central bank in the past five working days. The aim of pumping liquidity seems to be the one of helping ensure sufficient liquidity throughout the Evergrande crisis. Bondholders didn’t receive the interest payments that were due on Thursday. Now, Evergrande must make the payments within the 30-day grace period before the bondholder can call a default.

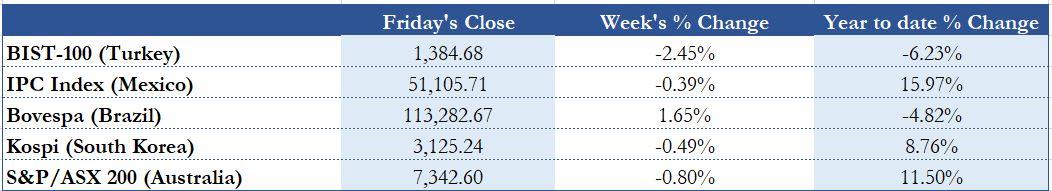

Turkish BIST-100 Index slid 2.45%, returning below the 1,400.00 level. In South Korea, Kospi closed the week 0.49% lower. Brazilian Bovespa ended the week positive for the first time in a month by gaing 1.65%. Brazil’s central bank pledged to deliver a third consecutive interest-rate hike of 100 basis points next month, saying such a pace of monetary tightening is convenient to bring inflation back to target. The central bank has launched the world’s most aggressive tightening cycle this year, raising borrowing costs by 425 basis points since March, with only a limited impact on prices. Annual inflation hit 9.68% in August, the fastest since February 2016. The central bank projected inflation to close 2021 at 8.5%, before slowing to 3.7% next year. “They are signaling they are comfortable with the current pace of tightening,” said Alberto Ramos, chief Latin America economist at Goldman Sachs Group Inc. “It isn’t clear if it is enough to tame inflation expectations.”

FX and Commodities

Oil prices increased for the fifth straight week with the global energy crunch set to boost demand for crude as stockpiles decline from the U.S. to China. Brent crude advanced 2.27% closing at $77.20 a barrel, up by 49.27% year-to-date. West Texas Intermediate(WTI) crude gained 2.77%, ending at $73.95 a barrell. “The market is pricing in a prolonged impact of supply disruptions, and the likely storage draws that will be needed to fulfill refinery demand,” said Louise Dickson, oil markets analyst at Rystad Energy.

Gold futures were almost flat at $1,750.60, down by 7.24% YTD. The precious metal continued its downward trend despite inflationary pressure still present, especially in Europe due to surging energy prices.

The U.S Dollar Currency Index, which measures the greenback against a basket of six currencies, was flat at 93.28. EUR/USD ended 0.67% lower at 1.1717. GBP/USD fell 0.41% at 1.3685 and USD/JPY closed 0.67% higher at 110.73. The Chinese Yuan closed almost flat against the dollar at 6.4667. Bitcoin/USD plunged to 42,789.00 after China banned all crypto transactions and vowed to root out mining of digital assets.

3 Biggest Movers

Aehr Test Systems (AEHR), a worldwide provider of test systems for burning-in and testing logic, optical and memory integrated circuits headquartered in Fremont, California, saw its share surge by 33.7% after it reported better-than-expected results. The company reported net revenue of $5.6m in the quarter, a 181% jump year over year.

Clearwater Analytics Holding Inc. (CWAN), a company based in Idaho focused on investment accounting solutions, data management and reporting, soared by more than 40% on its trading debut. The shares, which were priced at $18.00, are now at $25.37. The bookrunners of the IPO were Goldman Sachs, JP Morgan and Morgan Stanley.

Marin Software. (MRN), a cloud-based digital advertising management company located in San Francisco, surged more than 50% after it announced a revenue share agreement with Google. The existing revenue share agreement is set to expire on Sept.30, the new one will be effective on Oct.1. Marin Software will receive revenue payments from Google based on revenue generated on its tech platform. The shares, traded at $5.57 on Tuesday, are now at $10.21.

Next week main events

The following week starts with some general economic data from the U.S. and then moving to European ones. U.S. Jobless claims on Thursday will be under focus as it is highly relevant for the timing of tapering. The U.S. PCE Price Index and the Michigan Consumer Sentiment on Friday are also closely watched to get an overview on inflation and demand from consumers.

Brain Teaser #8

You and your colleagues know that your boss ’s birthday is one of the following 10 dates:

Mar 4, Mar 5, Mar 8

Jun 4, Jun 7

Sep 1, Sep 5

Dec 1, Dec 2, Dec 8

told you only the month of his birthday and told your colleague only the day. After that, you first said: “I don’t know ’s birthday; doesn’t know it either.” After hearing what you said, replied: “I didn’t know ’s birthday, but now I know it.” You smiled and said: “Now I know it, too.” After looking at the 10 dates and hearing your comments, your administrative assistant wrote down ’s birthday without asking any additional questions. What did the assistant write?

Solution:

Don’t let the “he said, she said” part confuses you. Just interpret the logic behind each individual’s comments and try your best to derive useful information from these comments.

Let D be the day of the month of A’s birthday, we have D∈{1,2,4,5,7,8}. If the birthday is on a unique day, C will know A’s birthday immediately. Among possible Ds, 2 and 7 are unique days. Considering that you are sure that C does not know A’s birthday, you must infer that the day the C was told of is not 2 or 7. Thus, the month is not June or December. (If the month had been June, the day C was told of may have been 2; if the month had been December, the day C was told may have been 7.)

Now C knows that the month must be either March or September. He immediately figures out A’s birthday, which means the day must be unique in the March and September list. It means A’s birthday cannot be March 5 or September 5. Thus, the birthday must be March 4, March 8, or September 1.

Among these three possibilities left, March 4 and March 8 have the same month. So, if the month you have is March, you still cannot figure out A’s birthday. Since you can figure out A’s birthday, A’s birthday must be September 1. Hence, the assistant must have written September 1.

Source: “A Practical Guide to Quantitative Finance Interviews” by Xinfeng Zhou

Brain Teaser #9

Suppose you have an N x N x N cube made up from 1 x 1 x 1 smaller cubes. The outside of the larger cube is completely painted. On how many 1 x 1 x 1 cubes is there any paint?

TAGS: market recap, finance, markets, Europe, US.

0 Comments