USA

Major stock indexes ended the week on a positive note, recouping some of the losses from the prior week despite ongoing uncertainty surrounding the policies of the incoming Trump administration and heightened geopolitical tensions arising from the Russia-Ukraine conflict. The week’s gains were broadly distributed, with smaller-cap indexes outperforming their large-cap counterparts, and the equal-weighted S&P 500 Index surpassing the performance of the more widely recognized capitalization-weighted version.

With a relatively quiet economic calendar for the week, attention centered on NVIDIA’s third-quarter earnings report released on Wednesday. The chipmaker’s shares closed the week relatively flat, as investors seemed generally pleased with the results, despite slightly softer-than-expected fourth-quarter guidance. In a related development, the utilities sector outperformed, buoyed by optimism about increasing artificial intelligence-driven demand for clean energy, sparked by comments during NVIDIA’s earnings call. Meanwhile, communication services stocks underperformed, partly due to a decline in shares of Alphabet, Google’s parent company, following news that the Justice Department had filed a proposal to break up the internet search giant.

Additionally, Trump has nominated Scott Bessent to lead the US Treasury Department, one of the most influential roles in government with wide oversight of tax policy, public debt, international finance and sanctions. The choice of Bessent, who has spent his career in finance, gives Wall Street an advocate for tax reform and deregulation. Some strategists said his nomination was a relief as he understands markets and his appointment could reduce the chance of severe tariffs.

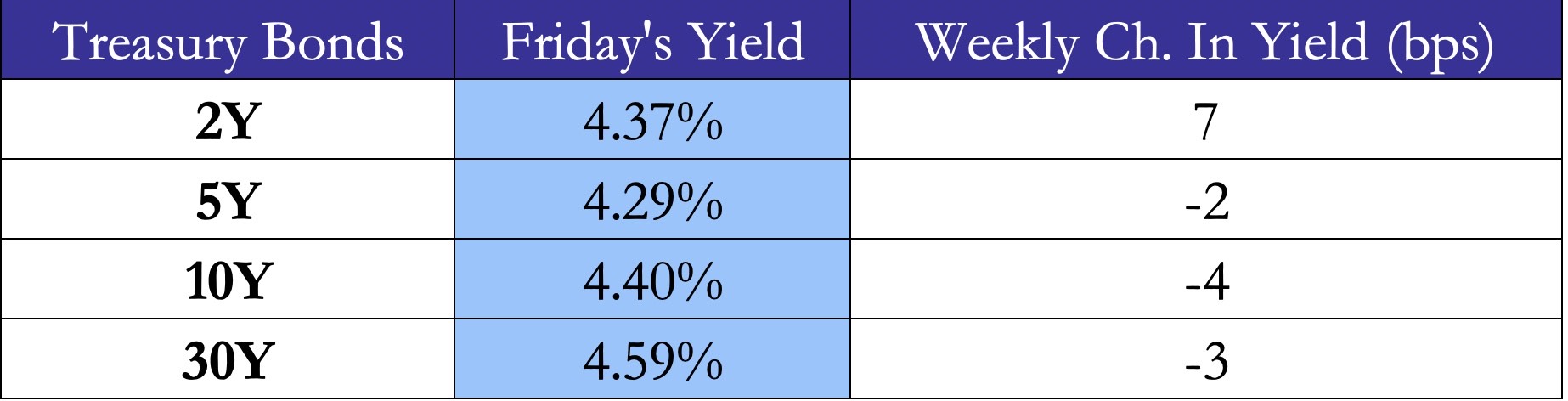

In the rates market, U.S. Treasuries delivered positive returns heading into Friday amid mixed movements across the yield curve. As of Friday morning, short-term yields had risen compared to the previous week, while long-term yields declined. This is a reflection of a decreasing likelihood of rate cuts in the short term, as Trump’s policies could be inflationary. Municipal bond yields were slightly lower across most of the curve, in line with periods of declining Treasury yields. However, traders observed that most demand for municipal bonds was concentrated in the primary market, with some new issues being oversubscribed by as much as 20 times. Weekly new issue volumes were elevated as issuers accelerated deals ahead of the upcoming holiday-shortened week. In the investment-grade corporate bond market, spreads generally tightened over the week. Issuance exceeded expectations, with most offerings heavily oversubscribed.

Source: Yahoo Finance, Bocconi Students Investment Club

Europe and UK

The European STOXX Europe 600 Index gained 1.06%, driven by optimism that the European Central Bank might lower borrowing costs in December following purchasing managers’ surveys indicating a weakening economic outlook. Among major stock indexes, performance was mixed. Italy’s FTSE MIB declined by 2.04%, and France’s CAC 40 Index slipped 0.20%. In contrast, Germany’s DAX rose 0.58%, while the UK’s FTSE 100 Index posted a strong advance of 2.46%.

Disappointing PMI data seemed to strengthen expectations that the ECB might further ease monetary policy in December. However, an increase in negotiated wage growth, a key indicator monitored by the ECB for signs of underlying inflationary pressures, could support a more cautious approach. Negotiated wages rose by 5.4% in the three months ending in September, compared to a 3.5% annual increase in the previous quarter.

The FTSE 100 Index reached a level of 8262, a level last seen in late October. Traders had focused on economic data, including flash PMI surveys and corporate updates, while also factoring in geopolitical risks. Regarding the UK economy, recent data revealed an improvement in consumer confidence, alongside an unexpected contraction in the private sector and a sharper-than-expected drop in retail sales. On the corporate side, UK-listed international firms like AstraZeneca, Unilever, and Reckitt Benckiser were among the top performers, benefiting from a weaker pound. In contrast, banking stocks were the biggest underperformers, dragged down by disappointing PMI data. For the week, the FTSE 100 advanced around 2.5%, marking its strongest weekly gain in over six months.

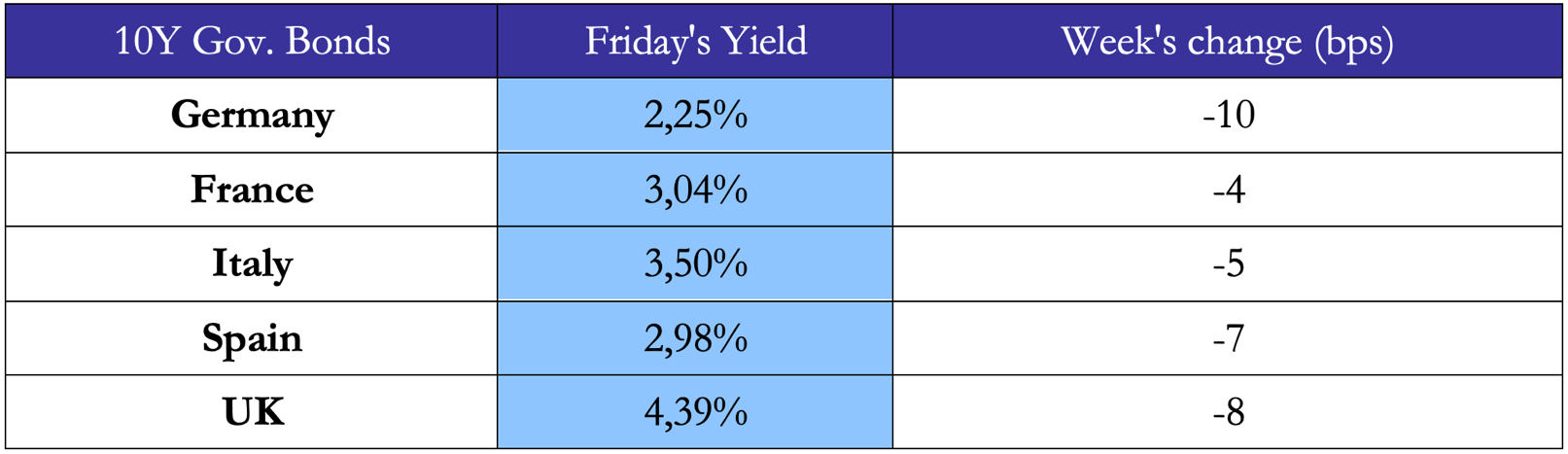

In the rates market, bond yields dropped across all of the major European countries this week off the back of the disappointing economic data. German yields dropped the most to 2.25%, the lowest level in about a month, after weaker than expected PMI data. This economic data prompted investors to increase their expectations of a 50bps cut in the ECB’s deposit facility rate next month, up from just a 15% probability previously.

Source: Yahoo Finance, Bocconi Students Investment Club

Rest of the World

The Nikkei 225 index dropped 0.93% this week off the back of another potential rate hike. BOJ Governor Ueda hinted at the potential for another rate hike as early as December, attributing the move to the yen’s recent weakness. Meanwhile, Prime Minister Shigeru Ishiba’s administration is weighing a $90 billion stimulus package to mitigate the effects of rising prices on households. Including anticipated private sector spending, the package is projected to inject JPY 39 trillion (USD 250 billion) into the economy. Key measures include subsidies to offset rising energy costs, cash handouts for low-income households, and an increase in the tax-free salary threshold to enhance disposable incomes.

The Shanghai Composite index dropped 1.91%, marking its lowest level in 3 weeks. Investors faced growing doubts about the effectiveness of China’s stimulus measures in spurring economic growth, while concerns over the potential for higher tariffs under the incoming Trump administration further weighed on the economic outlook.

Since late September, Beijing has introduced a range of stimulus measures aimed at revitalizing the struggling housing sector and boosting consumer demand. Officials have also hinted at additional easing steps in the near future, such as a potential reduction in the reserve requirement ratio for domestic banks. However, some analysts suggest that policymakers may hold off on further action until after President-elect Donald Trump assumes office in January, when U.S. policies are expected to become clearer.

The Bovespa Index rallied 1.04% this week, rebounding from a fifteen-week low and reversing previous losses on the week to post a weekly gain of 1%. This rally came after confirmation of fiscal package’s release scheduled for the next week. State-owned oil giant Petrobras led the gains, with shares surging 5% on optimism surrounding its newly approved business plan.

The BIST 100 Index climbed to approximately 9,500, reaching a seven-week high as traders closely observed Turkey’s shift toward more conventional economic policies. In November, the central bank maintained its key interest rate at 50% for the eighth consecutive meeting, while inflation eased slightly to 48.58% in October from 49.38% in September. Despite the decline, inflation exceeded market expectations for both months, leading investors to delay their expectations for central bank rate cuts until next year.

On Thursday, Turkey’s central bank convened for its scheduled monetary policy meeting and, as widely anticipated, decided to maintain the one-week repo auction rate at 50.0%. In the post-meeting statement, policymakers noted that the underlying inflation trend “registered a decline” in October, while various economic indicators indicated that “domestic demand continues to slow down, reaching disinflationary levels.” However, they emphasized that “inflation expectations and pricing behaviour can continue to pose risks to the disinflation process,” which justified their decision to leave rates unchanged.

Central bank officials reiterated their confidence that a “tight monetary stance will reduce the underlying trend of monthly inflation through moderation in domestic demand, real appreciation of the Turkish lira, and improved inflation expectations.” A notable addition to the statement was their expectation that “greater coordination of fiscal policy will also play a significant role in this process.” Policymakers reaffirmed their commitment to maintaining a tight monetary stance “until a meaningful and sustained decline in the underlying trend of monthly inflation is observed, and inflation expectations align” with their forecast range.

FX and Commodities

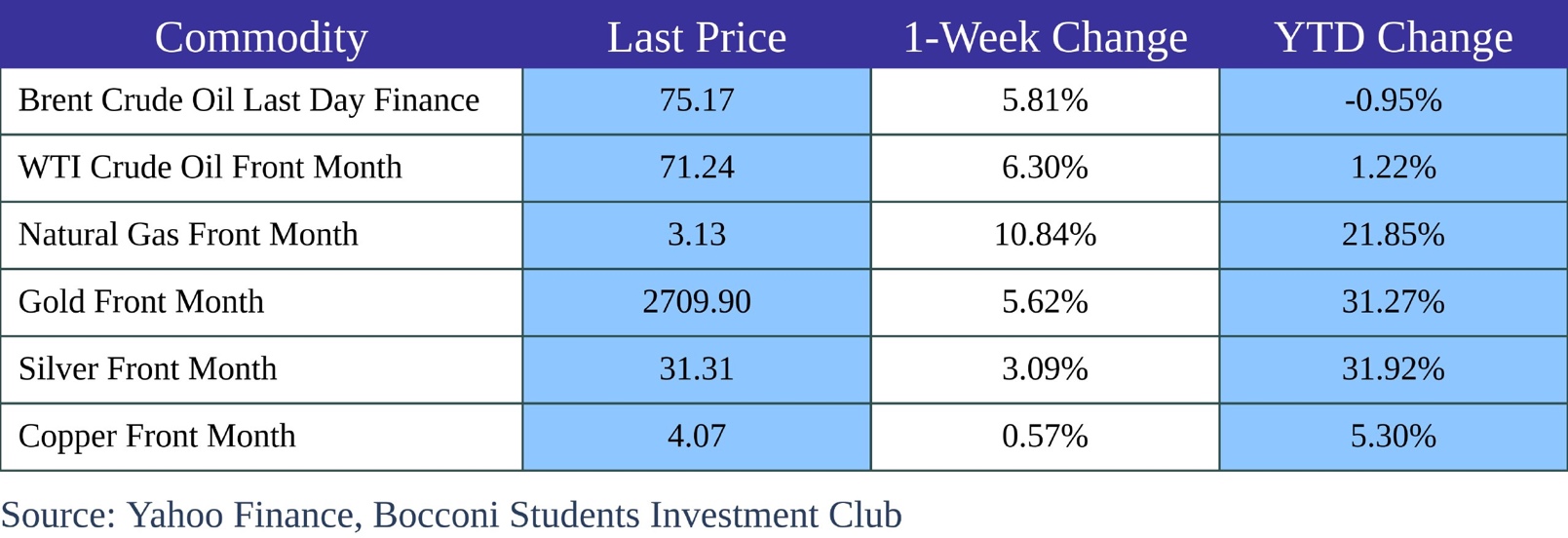

Both Brent and WTI crude futures rallied this week driven by the intensifying conflict in Ukraine, which added a geopolitical risk premium to all oil prices.

Moscow intensified its offensive after the US and UK permitted Ukraine to strike deeper into Russian territory with missiles. In response, the US imposed further sanctions on Russia’s Gazprombank and banned imports from over 30 Chinese companies accused of using forced labor tied to the Uyghur minority. Meanwhile, China introduced new policies to boost trade, including measures to support energy product imports, amid concerns about potential tariffs under Trump. On the economic front, the US S&P PMI for November climbed to 55.3, the fastest expansion in the private sector since April 2022, bolstering demand prospects in the world’s largest fuel consumer. In contrast, softer flash PMI data from the Eurozone pointed to worsening business conditions in the region.

Additionally, gold and silver futures also rallied this week as investors turned to safe-haven assets amid the increasing geopolitical risks. Traders also considered comments from Fed Bank of Chicago President Goolsbee, who indicated that interest rates could decrease “a fair bit” and expressed optimism that inflation is moving closer to the target level. The majority of the market continues to anticipate a 25-basis-point rate cut in December, which would reduce the opportunity cost of holding non-yielding precious metals.

Natural gas prices rallied over 10% this week off the back of storage issues and colder than expected weather forecasts. EIA data revealed that gas storage declined by 3 billion cubic feet in the week ending November 15th, defying expectations of a 5 billion cubic feet increase, as prior week’s relatively low prices prompted producers to reduce output. Meanwhile, updated forecasts indicated colder-than-normal temperatures across the West Coast and most of the U.S., excluding the Gulf Coast. Additionally, supply concerns in Europe as the year-end approaches pushed LNG feed gas flows to a 10-month high, further constraining domestic supply.

The Euro plunged to $1.05, its lowest point since November 2022, after the release of PMI data highlighted continued weakness in Eurozone business activity. The HCOB Flash Eurozone Composite PMI fell to 48.1 in November from 50 in October, well below the expected 50. This decline reflects a contraction in the services sector for the first time in ten months, alongside a persistent downturn in manufacturing.

The British pound dropped below $1.26, its lowest level since mid-May, driven by disappointing economic data. Retail sales in October declined by a larger-than-expected 0.7%, while flash PMIs missed forecasts, signaling a slight downturn in business activity for November. The slowdown was primarily attributed to a sharp decline in the services sector and continued contraction in manufacturing.

The dollar index climbed further, surpassing 107.5 on Friday, marking its highest level in over two years. This increase was driven by renewed demand for safe-haven assets amid escalating tensions between Russia and Ukraine, as well as expectations that President-elect Trump’s policies, particularly on tariffs, immigration, and taxes, could fuel inflation and constrain the Federal Reserve’s ability to reduce borrowing costs.

Next Week Main Events

Brain Teaser #26

You and I are to play a competitive game. We shall take it in turns to call out integers. The first person to call out 50 wins. The rules are:

- The player who starts must call out an integer between one and 10 inclusive

- A new number called out must exceed the most recent number called by at least one and by no more than 10. For example, if the first player calls out “nine” then the range of valid numbers for the opponent is 10 to 19 inclusive.

Do you want to go first and, if so, what is your strategy?

Solution

The key winning positions are numbers where I can eventually force 50, such as: 40, 29, 18, 7. If I can get you to call one of these numbers, I win. I must start with a number that allows me to eventually force these positions. For example, if I start with 1, I can ensure I control the sequence: 1 → 12 → 23 → 34 → 45 → 50.

Each turn, I call a number that keeps you from reaching the winning path.

Brain Teaser #27

You are standing at the center of a circular pond with a radius of 100 meters. A crocodile is on the edge of the pond and can run 4 times as fast as you can swim. However, you can run faster than the crocodile on land. The crocodile is hungry and will always move directly toward you in the shortest path possible (straight-line motion). You want to escape to the edge of the pond and then run to safety on land. What is your strategy to ensure you escape, and how far must you swim to guarantee that you reach the edge of the pond safely?

0 Comments