USA

The start of the week can be described as the calm before the storm in major US stock indices, as investors digested last week’s higher-than-expected inflation print and were waiting on the Federal Reserve to announce their policy decision on Wednesday. Accordingly, no index posted significant gains or losses before the announcement of the decision, with the most notable movement being a sharp drop on Tuesday as investors braced for another large rate hike.

Though fears of a 100bps rate hike did not materialize, main stock indices dropped by about 1-1.5% after the decision to increase policy rates by 75 bps was announced. Shortly thereafter, this drop was eradicated again after the market noticed that the Fed did not take a materially more hawkish stance and the SEP policy rate projections were tipped slightly higher by only few votes. Namely, median projections for the end of this year were 4.4% and 4.6% for next year. However, this recovery was short-lived as stocks ended the day with slight losses. These losses continued into the rest of the week as markets continue to adjust to the rate hike of the Fed.

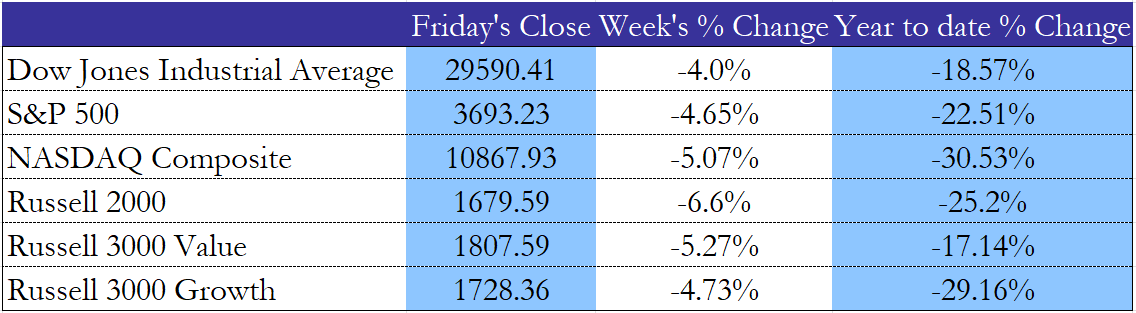

In numbers, the Dow Jones closed the week down 4.0%, continuing its relative resilience compared to other stock indices, only losing 18.57% since the beginning of the year. It narrowly avoided going into bear market territory, although it did fall below the 30,000-points level, closing at 29,590.41. The S&P 500 and NASDAQ are firmly in a bear market, with the former losing 4.65% and the latter losing 5.07% just last week. Small cap stocks have also been hit quite hard by the rate hike decision with the Russell 2000 posting the biggest loss this week, namely 6.6%. Small cap value and growth stocks have fared somewhat better this week, even though value lost some of its relative outperformance compared to growth, dropping 5.27% while growth stocks lost 4.73%.

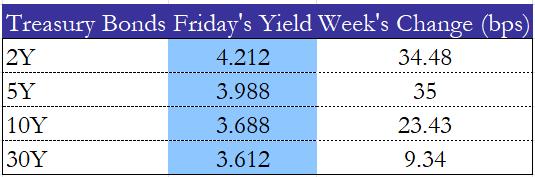

The bond market painted a similar picture this week. Yields trended slightly upwards in anticipation of another large rate hike; however, no drastic movements were recorded before Wednesday. After the announcement, yields on 2- and 5-year maturities followed the pattern of stocks with both experiencing a sharp selloff with a quick recovery afterwards that then turned into selling pressure which continued to the end of the week. Seemingly, investors are taking Powell’s remarks on the Fed’s determination to bring inflation down to 2% serious and are anticipating even more rate hikes and/or later rate cuts for the future.

Bonds of longer maturity did not experience quite the same pattern, however. While both 10-year and 30-year maturity bonds started out the week with rising yields, prices increased after the rate hike announcement on Wednesday. Nevertheless, they joined their short maturity counterparts on Thursday and Friday with yields rising to multi-year highs for 10-year bonds.

The US housing market has also shown more signs of weakness as prices are starting to fall slightly and average 30-year mortgage rates now hover well above 6%. This can be seen as evidence that the Federal Reserve’s rate hikes are beginning to affect the economy, although Powell reiterated once more, “monetary policy does famously work with long and variable lags”.

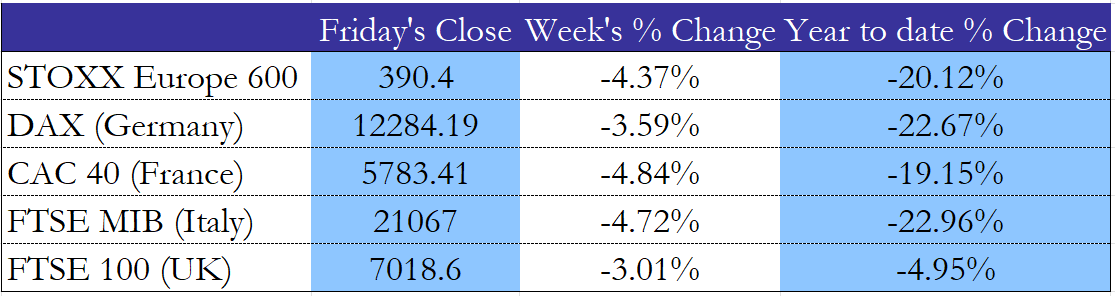

While European equities initially ticked higher at the start of the week, these gains were eradicated in the lead-up to the FOMC meeting. As the meeting took place after market close, stocks opened considerably lower on Thursday and most indices ended the week with substantial losses, continuing the trend of the previous week. This has led the STOXX Europe 600 into bear market territory, as it has now experienced more than a 20% drawdown from its all-time high. Some of the most notable single-stock events were the following:

Over the last weekend, Volkswagen announced their anticipated valuation of €70bn to €75bn for the IPO of Porsche, below the previous goal of €85bn. However, investors are still cautious about this figure given the current IPO drought and overall financial conditions. German gas importer Uniper experienced a turbulent week, as the German government announced it would take over a 98.5% stake in the company. Lastly, Credit Suisse stocks fell 13% on Friday, as rumors of a capital raise spread, which would dilute current shareholders’ earnings.

Meanwhile, the European Union is struggling to find common ground on a possible coordinated price ceiling on Russian gas, as Russia announced the mobilization of 300,000 soldiers from its reserve. However, the European Commission plans to release a document next week outlining more details on lowering volatility and increasing trading volumes in energy markets. Nevertheless, pressure is mounting on the already negative economic outlook for the Eurozone as key economic indicators such as the Purchasing Manager Indices have slid even further below neutral territory.

The DAX has dropped 3.59% this week amidst rising interest rates and an escalating energy crisis to its lowest reading since November 2020, closing the week at 12,284.19 points. The Italian FTSE MIB closed the week 4.72% lower, as the upcoming election spur fears of more political instability. The CAC 40 had the worst week of main European indices, down 4.84%. While it started out the week at over 6,000 points, it ended it at 5,783.41. The FTSE 100 lost the least of the bunch, only 3.01% and while it had a more resilient start to the week than other indices, most of the week’s losses came on Friday, after the newly presented mini-budget left investors dissatisfied.

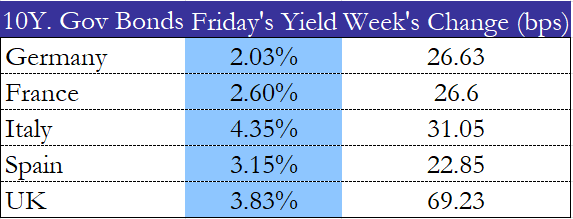

Though the European bond markets were not as strongly affected by the FOMC rate decision, they closed the week with substantially higher yields across the board. In Germany, both 2-year and 10-year yields crossed the 2%-mark for the first time in over ten years with the 2Y-10Y spread coming close to inverting as the ECB is also increasing its pace of rate hikes. French 10Y yields also saw a moderate increase of 26.6 bps this week, ending the week at 2.6%. With political uncertainty surrounding the upcoming election, Italian yields have climbed to multi-year highs, firmly solidifying their position above the 4% mark as yields increased by 31.05 bps to 4.35%. Spanish government bonds ended the week with a modest increase in yields of 22.85 bps to 3.15%.

Yields on UK-Gilts jumped twice this week, with 10-year maturity yields increasing by 69.23 bps, ending the week at 3.83%. The first move came on Thursday after the Bank of England announced an increase of its policy rate by 50bps, less than the 75bps that some traders were expecting. The second jump followed just one day after as new tax cuts, as well as plans for more government borrowing were presented which led to increased speculation on even higher rate hikes and inflationary pressures.

Central Banks of other European countries made notable policy rate decisions this week too. To start out, the Swedish Riksbank surprisingly increased policy rates by 100 bps to 1.75% after inflation had reached 9% in August. Meanwhile, the Norwegian Central Bank increased its policy rate to 2.25%, an upwards move of 50bps and the Swiss National Bank increased rates by 75 bps, moving rates out of negative territory to a level of 0.5%.

Rest of the world

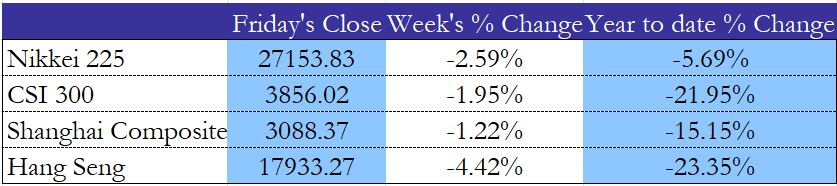

Asian stocks have joined other equity markets in a significant downward correction this week after the Fed announced its rate hike decision. Many Asian markets have now posted the sixth straight week of negative returns. The Nikkei 225 closed at 27,153.83 this week, down 2.59% from last week’s close, as the country continues to struggle with the depreciation of the Yen. However, the stock index is still significantly more resilient this year than most other indices.

Chinese stock indices had a mixed week. The CSI 300 ended the week 1.95% lower at 3,856.02. It returned to four-month lows as foreign investors pulled out capital and fears mounted that the global liquidity drain could prevent the People’s Bank of China from engaging in more monetary stimulus. The Shanghai Composite Index, which does not include stocks from Hong Kong, fell 1.22% this week and ended at 3088.37 points, down 15.15% since the start of the year. Hong Kong’s Hang Seng Index closed the week particularly poorly, as the large amount of technology stocks included in the index have experienced increased selling pressure after the Fed’s rate decision. It lost 4.42% this week and is the worst performing Asian index covered here, falling 23.35% since the year started.

In other news, the more than two-week long lockdown of Chinese megacity Chengdu has been lifted and businesses, public transportation and public administration offices are allowed to open again. Schools should follow in an “orderly manner” while mass testing will continue in the province. Furthermore, more than 20 cities have started rolling out support for low-income households to alleviate some of the hardships coming from higher inflation rates.

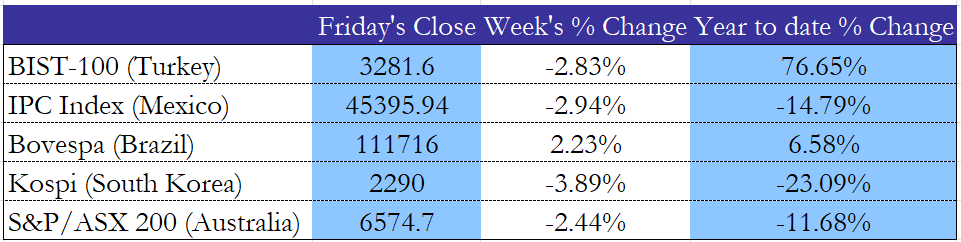

This week’s trading activity was relatively calm in Turkey as the market continued its correction from the recent stock market rally even though the index has still climbed by 76.65% this year. However, the Turkish opposition has called for an investigation into the recent stock market turbulences in the banking sector, citing concerns over market manipulation. Additionally, two important banks have bought back millions of shares in their own company in order to stabilize their stock prices. In the midst of this, the Turkish Central Bank has cut policy rates by 100 bps once more, defying economic wisdom and causing international outcry since the country is currently battling high dual-digit inflation rates.

Mexican stocks have sold off this week as investors prepared for another rate increase of the Mexican National Bank next week. The central bank is expected to hike rates by 75 bps, but 100 bps are not out of question yet, after inflation data for the first half of September came in higher than expected. The smaller increase would mean that policy rates match the all-time highs of 9.25%. The movement of the Mexican 10-year government bond yield further accentuates this development as it crossed 9.4% for the first time since 2008.

As one of only few winners this week, the Brazilian Bovespa increased by 2.23%, while bond yields have edged lower. The stock market’s gain is mostly attributable to the decision of the Brazilian Central Bank to keep its policy rate at 13.75% instead of increasing it even further. Still, energy stocks have taken a hit this week, as global oil and commodity prices have decreased.

The Korean KOSPI has decreased substantially by 3.89% this week, closing at 2,290, lower than the 2,300 mark for the first time in two months. This recent weakness is driven by the Fed’s tightening, a weak currency and lower demand for stocks due to bond yields reaching 10-year highs, offering increasingly attractive rates. There is some positive news though, namely PPI decreased substantially to 8.4% in August, 0.8% lower than in the previous month.

The Australian ASX 200 decreased by 2.44% this week and ending trading at 6574.7 points. While markets were closed on Thursday to commemorate the passing of Queen Elizabeth II, the largest losses came on Friday after the Fed’s rate hike decision. This also caused bond yields to hit 13-year highs. Economic indicators painted a mixed picture for Australia this week: the country’s leading economic indicator dropped for the fifth month in a row, but PMIs increased to slightly above neutral territory.

FX and commodities

A lot went on in FX and commodities this week. The elephant in the room is the British Pound Sterling, which fell 3.5% against the US Dollar and about 2% against the Euro on Friday after the mini-budget was announced. The budget adds to the gloomy economic outlook for the country, paired with all-time high inflation rates of over 10% which in total lead to an exceptional weakness of the British Pound: It is now trading at multi-decade lows as USD is continuing its relentless climb against all other major currencies. The Dollar Index has now increased to 113.02, gaining nearly 3% this week, as the US economy continues to show resilience compared to other major economies. This increases safe-haven demand for the currency, adding to expectations of higher interest rate differentials after the updated dot plot was released.

While the Euro started out the week above parity to the US Dollar, it has since moved down to a rate of 0.97, due to the aforementioned strength of the US Dollar but also due to political uncertainty in Italy as well as the dim economic outlook for the Eurozone.

With the Japanese Yen approaching an level of 145 to the US Dollar, the Bank of Japan has shocked markets by announcing it had intervened in the exchange markets in order to stabilize the exchange rate and prevent the currency from depreciating even further. Nevertheless, investors still have extremely bearish positioning on the Yen as the Bank of Japan continues to hold on to yield curve control while the US Federal Reserve continues to increase interest rates. While the move has propped up the currency in the short run, the general market reaction to this intervention has been that until either the Fed lowers rates or the Bank of Japan abandons yield curve control, the intervention can only be a temporary solution. This has left the exchange rate to the Dollar at about the level it started the week off at.

Gold prices have continued their downward trend this week and have now fallen nearly 20% from their peak in March. While there are some factors that traditionally would speak against this drastic decrease in price, namely the global economy experiencing a significant slowdown, high geopolitical uncertainty due to the war in Ukraine, and scorching hot inflation numbers, gold prices have fallen due to the resounding commitment of central banks around the world to increase interest rates to bring down inflation.

European natural gas prices have ended the week slightly below last weeks close, continuing their drop since July. Natural gas reserves are being filled at a good pace and governments of numerous European countries such as the Netherlands, Germany and the United Kingdom have set aside reserves and credit lines to support households or have rolled out plans to do so.

Both Brent and WTI oil have dropped quite significantly this week with the former decreasing by more than 5% and the latter dropping by nearly 7%. The US has announced it could release up to 10 million barrels of crude oil from its strategic reserves in order to stabilize the flow of oil to the European Union which plans to ban imports of Russian oil completely by December. On the other hand, OPEC countries have moved to decrease output by 100,000 barrels per day starting in October.

Next week main events

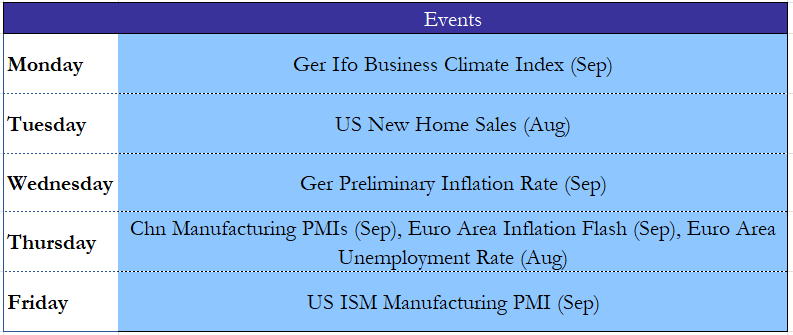

On Monday, the German Ifo Business Climate Index for September is released which is expected to move slightly lower compared to last month’s print. The week continues on Tuesday with important US New Home Sales figures being released for August which are expected to corroborate the view of a weakening housing market in the US and could be an important sign of monetary policy having an impact on the economy. August’s preliminary inflation rate for Germany is released on Wednesday and both the NBS and Caixin Manufacturing PMIs are released on Thursday. Furthermore, the Euro Area inflation rate flash for September as well as the Euro Area unemployment rate for August are also released on Thursday. While inflation is predicted to move up slightly to 9.6%, the unemployment rate is forecasted to stay at 6.6%. The week ends with the US ISM Manufacturing PMI for September being released, which is forecasted to be broadly in line with the August number.

There are two piles of coins, each containing 2022 pieces. Two players A and B play a game taking turns (A plays first). At each turn, the player on play has to take one or more coins from one pile or exactly one coin from each pile. Whoever takes the last coin is the winner. Which player will win if they both play in the best possible way?

Problem source: JBMO 2010 shortlist

Solution: In fact, we will show that A will lose if the total number of coins is a multiple of 3 and the two piles differ by not more than one coin (call this a balanced position). To this end, firstly notice that it is not possible to move from one balanced position to another. The winning strategy for B consists in returning A to a balanced position (notice that the initial position is a balanced position).

There are two types of balanced positions; for each of them cosider the moves of A and the replies of B.

If the number in each pile is a multiple of 3 and there is at least one coin:

– if A takes 3n coins from one pile, then B takes 3n coins from the other one.

– if A takes 3n + 1 coins from one pile, then B takes 3n + 2 coins from the other one.

– if A takes 3n + 2 coins from one pile, then B takes 3n + 1 coins from the other one.

– if A takes a coin from each pile, then B takes one coin from one pile.

If the numbers are not multiples of 3, then we have 3m + 1 coins in one pile and 3m + 2 in the other one. Hence:

– if A takes 3n coins from one pile, then B takes 3n coins from the other one.

– if A takes 3n + 1 coins from the first pile (n ≤ m), then B takes 3n + 2 coins from the second one.

– if A takes 3n + 2 coins from the second pile (n ≤ m), then B takes 3n + 1 coins from the first one.

– if A takes 3n + 2 coins from the first pile (n ≤ m − 1), then B takes 3n + 4 coins from the second pile

– if A takes 3n + 1 coins from the second pile (n ≤ m), then B takes 3n − 1 coins from the first one. This is impossible if A has taken only one coin from the second pile; in this case B takes one coin from each pile.

– if A takes a coin from each pile, then B takes one coin from the second pile.

In all these cases, the position after B’s move is again a balanced position. Since the number of coins decreases and (0, 0) is a balanced position, after a finite number of moves, there will be no coins left after B’s move. Thus, B wins.

Brain Teaser #26

Two people play the following game: there are 40 cards numbered from 1 to 10 with 4 different signs. At the beginning, they are given 20 cards each. Each turn one player either puts a card on the table or removes some cards from the table, whose sum is 15. At the end of the game, one player has a 5 and a 3 in his hand, on the table there’s a 9, and the other player has a card in his hand. What is its value?

Problem source: ITAMO 2006 Q1

0 Comments