US

The main driver of US market returns this week was the U.S. core personal consumption expenditures price index that surged to 0.6% MoM in January far higher than the 0.4% expected and double the previous months. The year-on-year increase was revised higher to 4.7% compared to the 4.3% consensus. The prolonged upwards pressure on the Federal Reserve’s inflation gauge proves to investors that higher inflation and with it higher interest rates are here to stay for longer than previously expected.

Additionally, a broad-based increase in sales as seen by the higher-than-expected nominal retail sales reading which recorded a jump of 3% MoM in January supports this view. This may have been partially due to one of the largest cost-of-living adjustments to Social Security for some decades and some seasonal factors but was also supported by far broader influences.

However, both the US GDP price index QoQ and the US GDP growth rate quarter on quarter came in less hot than previously with 3.9% vs 4.4% and 2.7% vs 3.2% respectively. Vehicle sales contributed the most to the growth numbers that were reported this week, and food services jumped to 7.2% making it the largest increase since the reopening in 2021. Nevertheless, the sustainability of this spending should also be questioned with the rising credit card balances that are observed.

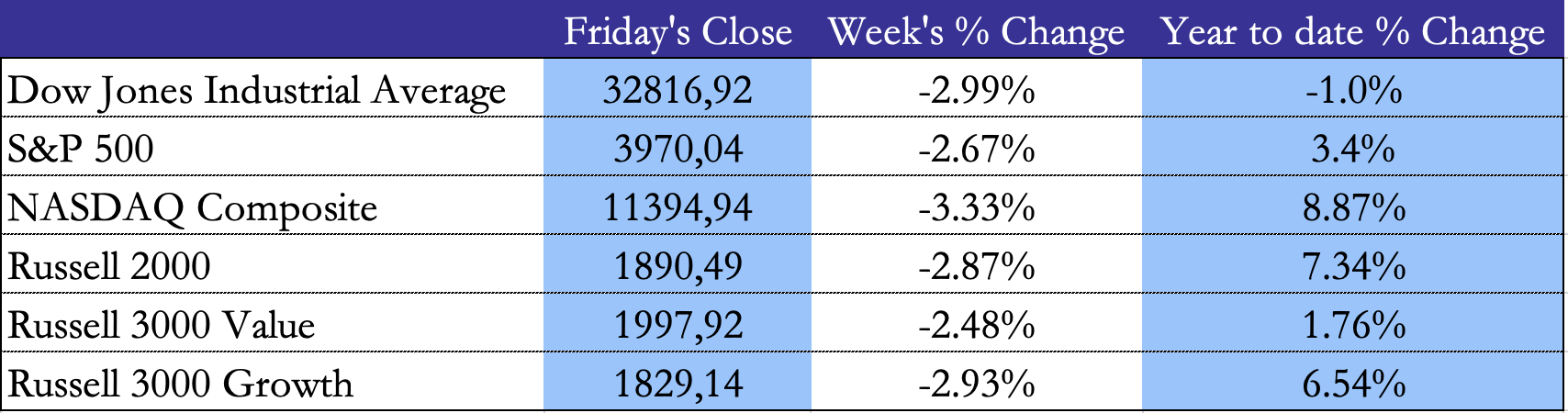

Following strong growth and sticky inflation figures, the markets have started moving in the same direction the Fed has been trying to point them for the past few months and the narrative of a soft landing has started to shift decisively. Therefore, this week had a noticeable effect on the expectations of future rate hikes, the chance markets have priced in so far of a 5.50% to 5.75% terminal rate has increased to 38%, and a 50bps hike in next month’s policy meeting seems to be on the table with a 27% chance. This caused stocks to close on Friday with the largest weekly loss of this year with the Dow Jones Industrial Average closing nearly 3% lower than the previous week, the S&P 500 posting a loss of 2.67%, and the NASDAQ down 3.33%.

Like equities, bond prices fell with yields reaching their highest levels for over 3 months. Short-term treasury yields on Friday surged to a level last seen in 2007 with a two-year yielding 4.80%. The 10-year approach of 4 % was last seen in mid-November. Corporate bonds were also trading lower due to retail earnings, and weaker risk sentiment. Issuers seem to be waiting for market conditions to improve as very little primary market activity was to be observed. The dollar index also had a seven-week high. The tightening of market conditions observed this week shows a distinct move of the market in line with Fed expectations and statements.

EU

European equities and bonds experienced very similar drivers to U.S. markets this week, with stock indices falling across the board and yields rising. On Monday, EA construction output year on year fell out worse than expected with -1.3% compared to 1.6% in the last recording and the 2.1% growth that was expected, and the EA consumer confidence flash was out expectations with a reading of -19 vs the previous minus 20.7 reading. Inflation in the eurozone fell from an annual rate of 9.2% to an annual rate of 8.6% but nevertheless was higher than expected. The underlying price pressures continued trending upward with a 0.1% increase to a 5.3% annual core inflation measure.

However, Germany’s GDP shrank by 0.4% in the fourth quarter which was more than the -0.2% that was expected. DE ZEW’s current conditions rose by 13.5% from -58.6 to -45.1 better than the -50.5 expected, this makes it the highest level recorded since June. The ZEW Indicator of Economic Sentiment for Germany also came in better than expected with +28.1. Forward-looking PMI supports stronger future eurozone business activity, with the composite Purchasing Managers’ Index reaching 52.3 in February up 2 from January. This increase was supported by stronger service activity and growth in manufacturing output.

The mostly above-expectations macroeconomic data combined with relatively strong corporate earnings caused markets to change their view slightly on future ECB interest rate hikes. The STOXX Europe 600 closed 1.42% lower, the DAX showed a 1.76% decrease, and the CAC 40 a 2.18% decline this week. Although this week might be too little to say that the new year’s rally in European stocks is over, it clearly shows a weakening in the underlying movement. Potential earnings downgrades, the uncertainty of monetary policy, and the Ukraine-Russia conflict have passed its first year this week, shares face significant headwinds for the rest of 2023.

European bond yields continued to increase and on Wednesday the Italian 10-Year BTP Short Term Auction had yields of 3.67%, while the 10-Year Bund Auction had 2.56% yields. In the UK, the manufacturing and services sectors reported an unexpected increase in business activity, the S&P Global/CIPS also showed a slight easing in price increases and the need to continue passing on the higher production costs.

Rest of the world

Incoming Bank of Japan Governor Kazu Ueda supported markets with a dovish tone made both in a parliamentarian hearing as well as in comments made on Friday. He mainly supported the policies set in place by his predecessor albeit admitting the side effects of the current monetary policy by arguing that to reach the inflation target monetary easing remains appropriate. Hints regarding the BoJ’s yield curve control after reaching the inflation target and going into somewhat of a normalization were to be heard as well. The yield of the Japanese 10 years remains close to the 0.5% upper limit and the yen weakened with regards to the dollar.

Japan reported a 4.2% YoY increase in core consumer prices in January, the highest in decades, due to rising import prices and not other underlying factors such as wage growth. Japan’s flash PMI data reported continued growth in its services sector as demand increases steadily after its reopening following a recent coronavirus wave. The weakening yen increased expectations for higher earnings for Japanese exporters causing sustained capital inflows into Japanese equities and due to the dovish comments made by the incoming BoJ governor the stock market exhibited a lower weekly downward move compared to Europe or the U.S.

In China, stocks rose after three weeks of sustained losses as regulatory support seemed more likely. The PBoC kept its one-year and five-year loan prime rates on the same level which was along expectations and was supported by economic growth following the reopening and macro indicators that were exceeding expectations. The PBoC reportedly gave guidance to lenders to decrease new loans after they reached records last month, these include infrastructure projects that are state backed. The accommodative monetary policy is expected to be kept due to ongoing problems with the property sector, lower exports, and a lack of consumer confidence. U.S.-China relations pose downward pressure on the yuan, the outlook is further deteriorating with reports of increased U.S. training for Taiwanese groups, the four new U.S. bases in the Philippines, and Chinese countermoves. Foreign direct investment into China increased 10% in dollar terms last month.

The Turkish BIST-100 Index rose by 0.6% this week. Facing the devastation arising from the earthquake in early February and the deaths following it, the Turkish Central bank cut its key interest rate by 50bps from 9 to 8.5%. This was not unexpected due to the massive scale and effect this event will have on the Turkish economy in the medium term, and Turkey’s rather unconventional use of cutting rates in recent years while facing sky-high inflations with the January measure clocking in at 57.7%. Whether the rate cut, and its subsequent easing of monetary conditions will have a meaningful impact on the recovery from the earthquake is to be seen in the following months. The stimulative monetary policy is likely to prevail at least until the upcoming elections.

FX and Commodities

As the U.S. is likely to have to remain with interest rates higher and longer and newfound strength in the dollar following a slight weakening in the previous months, emerging markets will continue to be under increasing pressure due to the mainly dollar-dominated debt they hold. Countries like Pakistan and Egypt that devalued their respective currencies in attempts to receive IMF emergency funding and are at high default risk will experience significant troubles if dollar strength increases significantly. In commodities, slowing down grain exports from Ukraine led to an increase in global grain prices accompanied by shipping delays, and the impending expiration of the safe passage deal for food cargoes.

One year after the start of the conflict, there are doubts about whether Russia would be willing to extend the grain deal expiring on March 19th. In January grain exports decreased from 3.7m tons to 3m tons of grains and oilseeds. Wheat prices rose around 10% last month to nearly $8 a bushel, however, remain lower than the $12.9 a bushel in March following the start of the conflict. Traders are currently hesitant in taking positions in Ukrainian grain due to the significant uncertainty surrounding the deal and the expected increase in fighting after regrouping on both ends observed over the past months.

New support in promised main battle tanks and other material as well as discussions surrounding a new stage in the West’s economic war against Russia may cause Russian retaliation against the West in some ways, making the decision not to extend the deal a relatively probable way to do so as this would inflict significant economic harm.

Next Week’s Main Events

Next week’s main events will include the EA Economic Sentiment, MX Balance of Trade, US Durable Goods MoM, FR Inflation Rate YoY Prel, IN GDP Growth Rate YoY, CA GDP Growth Rate QoQ, AU GDP Growth Rate QoQ, CN NBS Manufacturing PMI, DE Inflation Rate YoY Prel, JP Consumer Confidence, and EA Inflation Rate YoY Flash.

Brain Teaser #35

The director of a prison offers 100 death row prisoners, who are numbered from 1 to 100, a last chance. A room contains a cupboard with 100 drawers. The director randomly puts one prisoner’s number in each closed drawer. The prisoners enter the room, one after another. Each prisoner may open and look into 50 drawers in any order. The drawers are closed again afterward. If during this search, every prisoner finds their number in one of the drawers, all prisoners are pardoned. If even one prisoner does not find their number, all prisoners die. Before the first prisoner enters the room, the prisoners may discuss strategy but may not communicate once the first prisoner enters to look in the drawers. What is the prisoners’ best strategy?

Source: The cell probe complexity of succinct data structures – Peter Bro Miltersen

Solution: To describe the strategy, not only the prisoners but also the drawers, are numbered from 1 to 100; for example, row by row starting with the top left drawer. The strategy goes as follows:

Each prisoner first opens the drawer labeled with their own number. If this drawer contains their number, they are done and were successful. Otherwise, the drawer contains the number of another prisoner, and they next open the drawer labeled with this number. The prisoner repeats steps 2 and 3 until they find their own number or fail because the number is not found in the first fifty opened drawers. By starting with their own number, the prisoner guarantees they are on the unique permutation cycle of drawers containing their number. The only question is whether this cycle is longer than fifty drawers.

The prison director’s assignment of prisoner numbers to drawers can mathematically be described as a permutation of the numbers 1 to 100. Such a permutation is a one-to-one mapping of the set of natural numbers from 1 to 100 to itself. A sequence of numbers that after repeated application of the permutation returns to the first number is called a cycle of the permutation. Every permutation can be decomposed into disjoint cycles, that is, cycles that have no common elements. So with this strategy, the 100 prisoners are successful if the longest cycle of the permutation has a length of at most 50. Their survival probability is therefore equal to the probability that a random permutation of the numbers 1 to 100 contains no cycle of length greater than 50, which turns out to be a little over 30%.

Brain Teaser #36

Four points are chosen at random on the surface of a sphere. What is the probability that the center of the sphere lies inside the tetrahedron whose vertices are at the four points? (It is understood that each point is independently chosen relative to a uniform distribution on the sphere.)

Source: Putnam 1992

0 Comments