USA

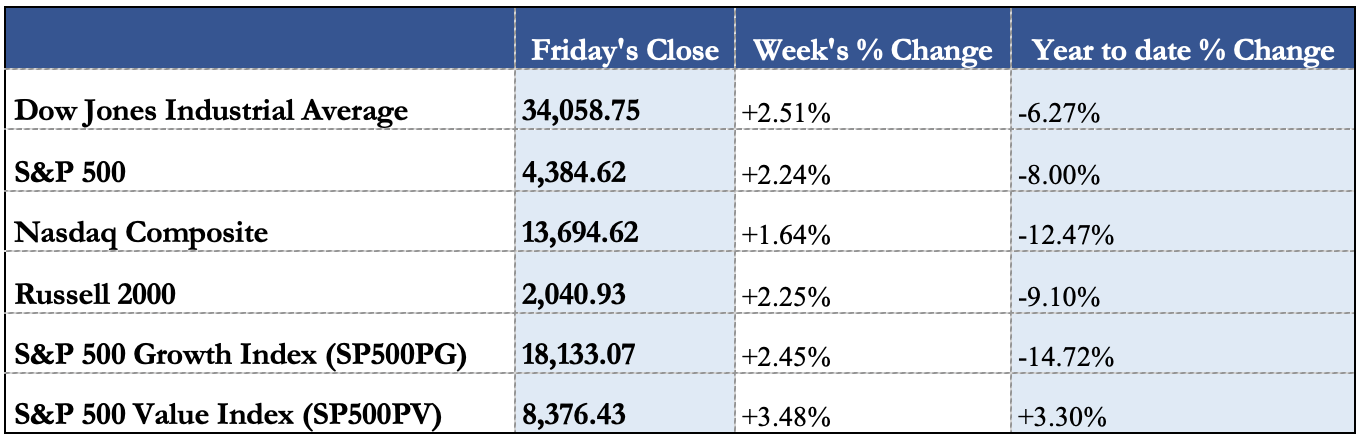

This Monday was Presidents day in the United States, therefore markets only opened on Tuesday for what would turn out to be an eventful week. In general all major US indices are up with health and communication services leading the pack and consumer discretionary underperforming. The S&P 500 increased by 2,24% over the course of the week and the tech heavy NASDAQ Composite increased by 1,64%. The Dow Jones Industrial Average gained some 2,51% during this week of trading. Even though the indices are all up, during the week there was elevated volatility as the S&P 500 for example shed as much as 5% from Monday to Thursday, declining nearly 15% from its peak at the start of the year, as uncertainty was high due to the Russian invasion on Ukraine. Also Markets had not yet fully priced in a war in Europe even though it was highly anticipated by the US government.

The rally at the end of the week was mainly because sanctions were not as severe as previously thought, especially in regards to the energy sector. Furthermore, investors also liked that a Russian spokesperson said that Russia was ready to start negotiating with Ukraine.

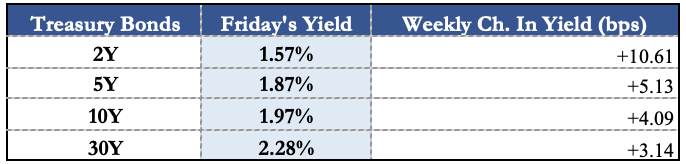

In anticipation of sanctions and volatile markets, many investors rushed for safe havens and bought US Treasury bonds which can be seen in a sharp drop in yields of the 10 year United States Government Bond on Wednesday and Thursday. But the benchmark ten-year Treasury note yield rose again above 2% after the prospects of talks between Russia and Ukraine emerged and investors’ anticipation of higher interest rates. The 2 Year U.S. Treasury bond yield was at 1.57% on Friday evening. The 5Y yield currently sits at 1.87% closing below its weekly peak of 1.91%. The 10Y and 30Y yield both increased to 1.97% and 2.28% respectively.

Europe and UK

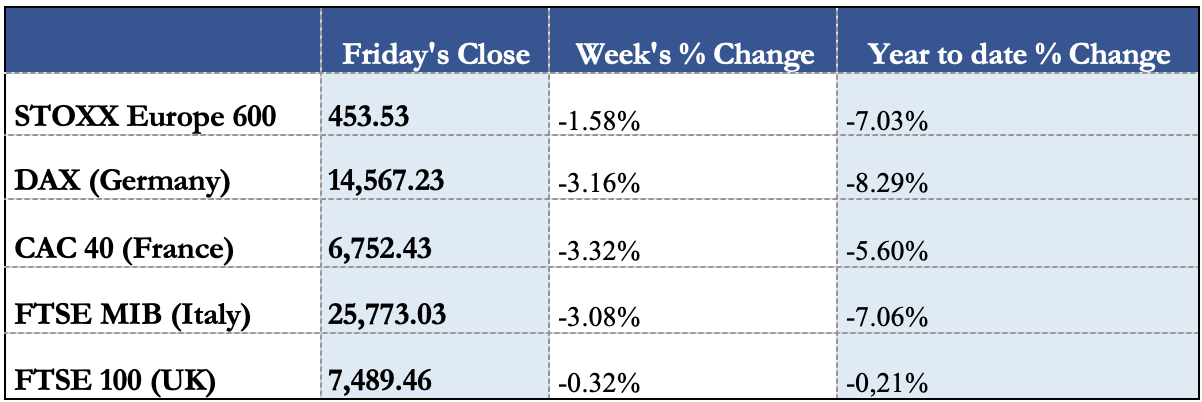

European equity indices continued their path downwards as Russia launched their large-scale invasion on Ukraine, further increasing the uncertainty in the markets as the EU together with their allies levied severe sanctions on Russia. Adding to that is the increasing possibility of rate hikes by the European Central Bank as ECB policymaker Robert Holzmann said that the ECB could begin increasing interest rates even before ending Quantitative Easing. As mentioned above all major European Indices declined this week with the Indices of Countries more exposed to Russia slipping the furthest as the European STOXX Europe 600 Index ended 1.58% lower and Germany’s DAX Index, declined 3.16%. France’s CAC 40 Index gave up 2.56%, while Italy’s FTSE MIB Index lost 2.77%. The UK’s FTSE 100 Index slipped 0.32%.

The response of the Western allies regarding the Invasion of Ukraine by Russia was specifically severe as there are now new export controls on certain technologies and an abundance of financial restrictions on Russian oligarchs and their families, parliamentarians, Russian banks as well as on the Russian President Putin. Adding to that is the UK’s restriction on Russian companies to raise capital in Britain and the ban of Russian airline Aeroflot. Germany took a decisive stance itself by halting the certification of Nord Stream 2, a step that was highly unpopular among German politicians before the crisis. The imposed sanctions will probably also have an impact on the EU and UK economy which for now is expanding strongly after easing coronavirus restrictions and less supply chain problems helped accelerate Eurozone business activity, an IHS Markit survey showed (estimated composite PMI of 55,8). Business activity also increased in February after the disruptions caused by the outbreak of the new Covid-19 variant lessened. In light of that, the EU is now asking its member states to withdraw pandemic-related fiscal support because the economy has recovered and is growing strongly.

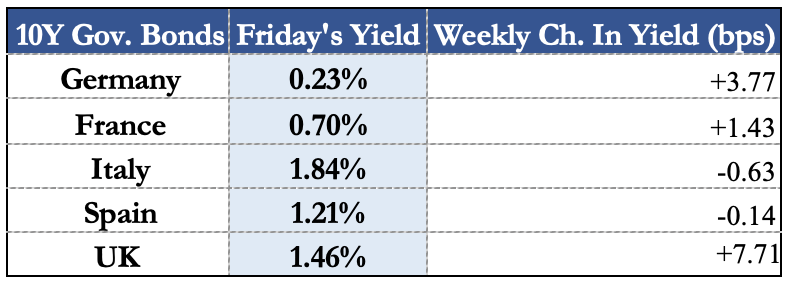

Because of the ongoing war in the Ukraine investors rushed to buy European bonds which led to the French 10-year OAT yield falling below 0,7%, the lowest in nearly three weeks. The yield of the German 10-year Bund hovered at lows of 0,16%, mainly due to investors being cautious in light of the crisis in Ukraine. The same picture unfolds on all of the main European Bonds even though the odds are rising that the ECB will increase interest rates faster than expected as Money Markets now expect the central bank to deliver a 10bps rate hike in July. In light of the above mentioned sanctions on Russia, the yield of the 10-year OFZ bond surged to above 14%, the highest since January 2015 and is now trading at 12.19%.

Rest of the world

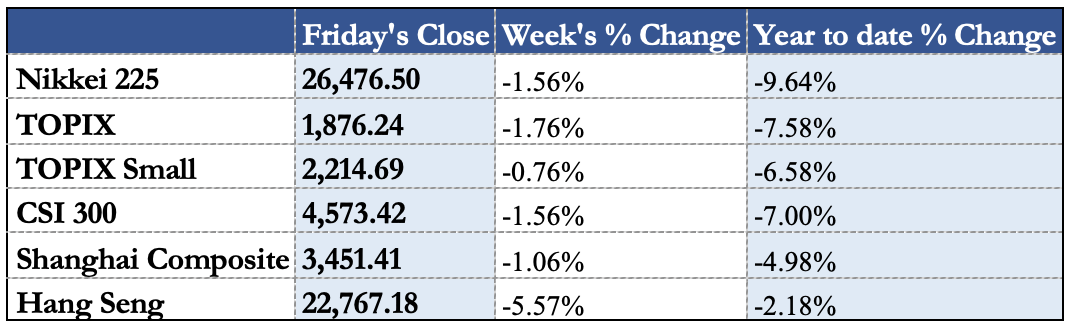

All major Asian indices declined this week as the selloff in European and the United States stock markets continued. In Japan the stock market also slipped this week with the Nikkei 225 Index down 2.38% and the broader TOPIX Index 2.50% lower. The yield on the 10-year Japanese government bond fell to 0.20% from 0.22% at the end of the previous week as the Japanese central bank showed no sign of reducing its monetary stimulus, more so the Bank of Japan Governor said it would purchase unlimited quantities of bonds to keep yield within its target range. Japan also follows suit regarding sanctioning Russia, with two sets of sanctions announced which are in line with the sanctions announced by the EU and UK. In particular, Japan has now levied export controls on semiconductors and other high-tech products.

In China, equity markets also recorded a weekly loss with the Shanghai Composite Index dropping 1.1%, and the large-cap CSI 300 Index shedding 1.6%. The yield of the Chinese government bond declined to 2.806% as the People’s Bank of China follows his decision to keep interest rates steady for now.

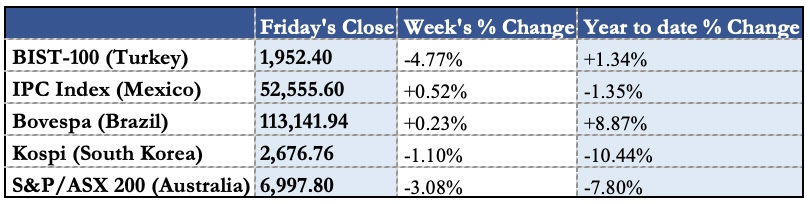

In Brazil the government reported that its mid-month inflation was higher than expected as there was an upside surprise in the cost of industrial goods and a higher than expected food inflation print. Experts now expect the inflation in Brazil to plateau at elevated levels for the rest of the quarter at least. Moreover, the Brazilian Stock market (Bovespa Index) increased some 0.23% over the course of the week. The BIST-100, Turkey’s most important index, decreased by 4.77% and is among the worst performers of the selected indices, one of the main reasons for that are Turkey’s strong economic ties with Russia.

FX and Commodities

Since Russia is one of the largest suppliers of oil and gas, the conflict in Ukraine is having a great impact on commodity prices, as expected. The Brent Crude retreated to 97.93$ after peaking at 99.08$ on Monday, exactly when Russia started its invasion on Ukraine. WTI crude oil futures on the other hand hit 100$ per barrel in the face of the global geopolitical tensions but slipped from these elevated levels to $90 per barrel.

The US Dollar Index (DXY) reached a yearly high of 97.74 as investors are looking for a safe place to store their money due to the crisis in the Ukraine. The dollar strengthened against the Euro and traded as high as 0.90 EUR on Thursday, but is now down at 0.89 EUR. The same holds for USD against the Japanese Yen where the dollar closed up 0.80% over the course of the week. The Russian ruble was down about 4% against the dollar as sanctions are being levied on the Russian economy.

As is often the case in times of geopolitical tensions, gold rallied up to 1961,92 USD per ounce but the gold price fell back to 1.889,28 USD per ounce at the end of the week. Silver followed a similar pattern as it increased about 4.7% on the 24th of February but ended the week at 24.27 USD per ounce.

Next week main events

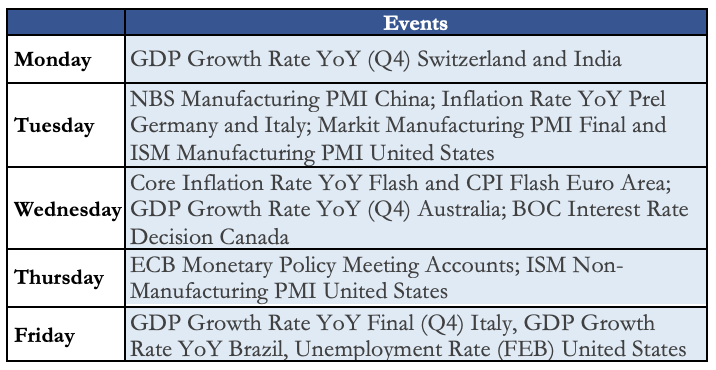

Next week is going to be a very busy week for Markets regarding the upcoming economic events. On Monday Switzerland and India will report their GDP Growth Rate YoY for the 4th Quarter followed by publication of the NBS Manufacturing PMI in China on Tuesday as well as the Markit Manufacturing PMI Final and ISM Manufacturing PMI in the United States. On Wednesday one of the main events will be the Core Inflation Rate YoY Flash and CPI Flash in the Euro Area.

Followed by that is the ECB Monetary Policy Meeting Accounts on Thursday when also the United States will report their ISM Non-Manufacturing PMI. Finally, to sum up a busy week, Italy and Brazil will report their GDP Growth Rate YoY (Q4) followed by the United States’ publication of the Unemployment Rate (FEB).

Brain Teaser #18

Prove that the number of people (from the universe) who have shaken hands an odd number of times is even.

Solution:

The total number of handshakes is the sum of the handshakes by every person in the world. This total is even because each handshake involves two people, as the total number increases by two every time. Considering this, the number of people who have shaken hands an odd number of times must be even. Otherwise, we would add an odd number (odd times odd) to the total.

Brain Teaser #19

In a deck, there are n cards. Some of them lie upside, the rest – downside. In one move, it is allowed to take several cards from the top, turn them over and put them again on top of the deck. What is the minimum number of such moves, given any initial arrangement of cards, to ensure that all the cards face downsides?

TAGS: Europe finance market recap MARKETS US

0 Comments