USA

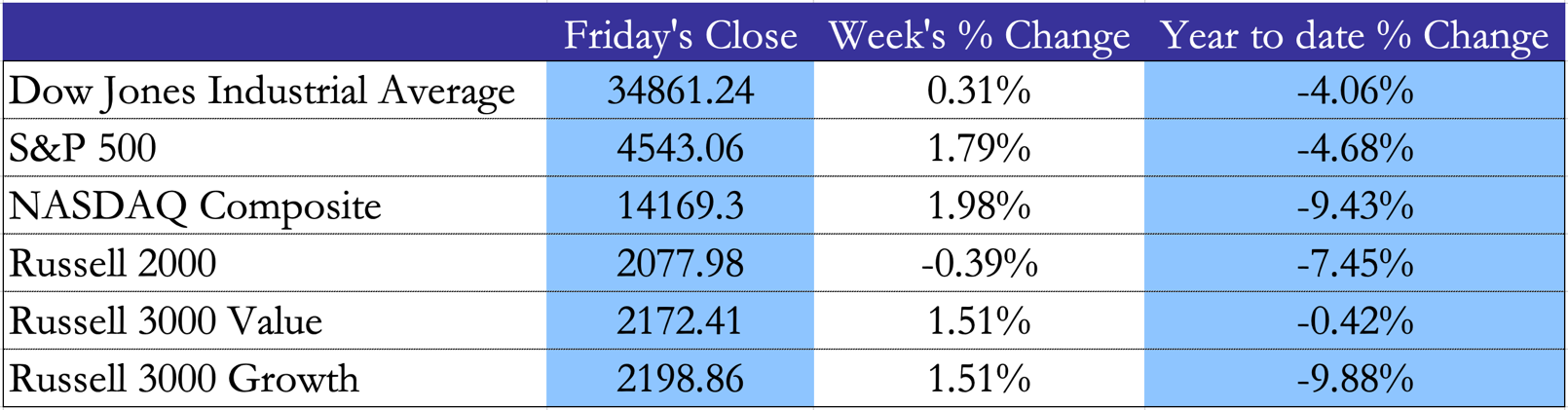

Major US indexes advanced this week, extending large gains achieved during the previous 5-day session, with the S&P 500 now back at a level last seen on February 10. The VIX continued pointing lower due to this positive trend, closing the week at just above 20. Investors seem to have well digested the increasingly hawkish tone of the FED. On Monday, President Jerome Powell opened the door to a higher-than-25bps increase in the next May meeting, if deemed necessary to curb inflation. Economic data for the week were mixed. Both Durable Goods Orders and Pending Home Sales fell short of expectations. On the other hand, new Jobless Claims were surprisingly low, reaching their lowest level since 1969.

The war in Ukraine remains in the foreground. On Thursday, US President Joe Biden joined allies in three key meetings – NATO, G7 and European Council – to announce new sanctions against Russia, such as prohibiting gold transactions with the country, and discuss the European energy crisis: the US will provide Europe with 15bn of cubic meters of LNG by the end of the year. Moreover, Biden warned China of consequences if it starts supporting Russia during its invasion, potentially weakening the effectiveness of western sanctions. Lastly, an Omicron subvariant – named BA.2 – is being closely watched as it takes hold in the US, as it is now estimated to account for over half of the nationwide Covid cases.

The current inflationary environment continues to weigh on the FED’s monetary policy. Powell’s hawkish tone sent Treasury yields up at all maturities during the week. In particular, the 2-year Treasury rate rose almost 20bps to its highest level since 2019, while the 10-year yield had the highest increase since March 2020. However, the yield curve is flattening. Eurodollar futures seem to be pricing a retreat of interest rate hikes as soon as next year – incorporating almost two 25bps rate cuts by December 2024 – suggesting that investors believe that a continuous path of increasing rates is not sustainable for the economy in the medium to long term.

Europe and UK

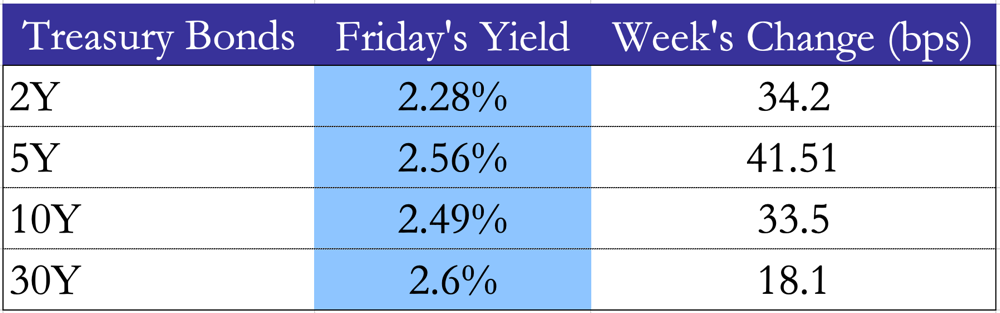

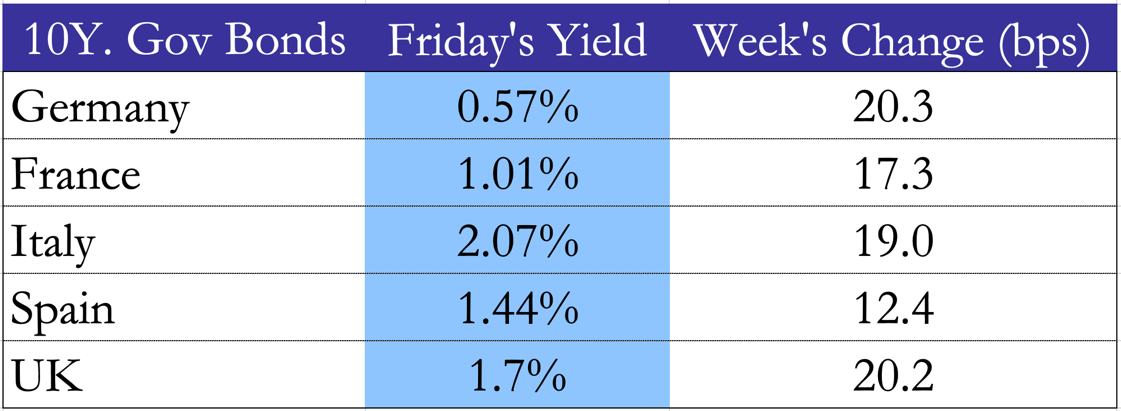

After 5 days of sharp gains, European stocks closed slightly lower this week, with major indexes reporting mixed results across countries. German DAX and French CAC 40 lost 0.74% and 1.01% respectively, while Italian FTSE MIB gained 1.39%. The week has been dominated by lateral trading, as the war in Ukraine remains a major source of uncertainty, with over 3.4 million Ukrainians already fled from the country, following increasingly brutal military actions from Russia against populated cities: more than 900 Ukrainian civilians have been already killed, the UN reported on Tuesday. On Monday, The EU started evaluating a ban on oil imports from Russia, with Germany already closing a deal with Qatar for additional gas supplies, as the bloc is trying to end its historical dependence on Russia for its energy sources. To this regard, on Thursday several key meetings took place, with NATO, the G7 and the European Council reuniting in Brussels. Europe secured 15bn cubic meters of LNG supplies from the US by the end of the year, and up to 50bn by 2030. However, the energy crisis is expected to carry a heavy economic toll on European countries. According to JP Morgan, the most hit will be Spain and Italy: on Wednesday the investment bank downgraded their GDP growth forecasts for 2022 to 4.2% and 2.5% respectively. Moreover, the World Health Organization raised attention on the still existing threat of the Covid pandemic, as it reported that as much as a third of European nations are witnessing a surge in cases after a swift move to ease widespread restrictions.

On the other side, Putin is trying to leverage his dominance in the energy market to limit downward pressure on his home currency. In fact, on Wednesday he announced that ‘unfriendly’ countries would have to settle gas payments in Russian rubles thereafter. Still, the Russian economy is expected to suffer tremendously from western sanctions: the Institute of International Finance projected its GDP to shrink by 15% in 2022. On Thursday, the Moscow stock exchange partially reopened for the first time since its closure on 25th February; 33 stocks out of 50 resumed trading for a shortened session lasting from 9:50am to 2pm (local time). The MOEX index closed up 4.4% for the day, but erased most of the gains in the subsequent session on Friday. Regarding the war in Ukraine, a ray of hope unleashed on Friday, when President Putin announced that its army would start focusing on taking control of the Donbas region, suggesting that military pressure on the rest of the country may start to wane.

UK based FTSE 100 reported a positive week, up 1.06% and now in green territory since the beginning of 2022. On Tuesday, the US and UK reached a deal to ease tariffs on British exports of aluminum and steel, posing an end to a longstanding litigation; the UK, thus, ended a number of retaliatory tariffs against the US. A negative note arrived on Wednesday from the CPI figure of 6.2% YoY, which beat expectations and put further pressure on the Bank of England to raise interest rates, as UK inflation has now reached a 30-years high.

Source: BSIC, Yahoo Finance

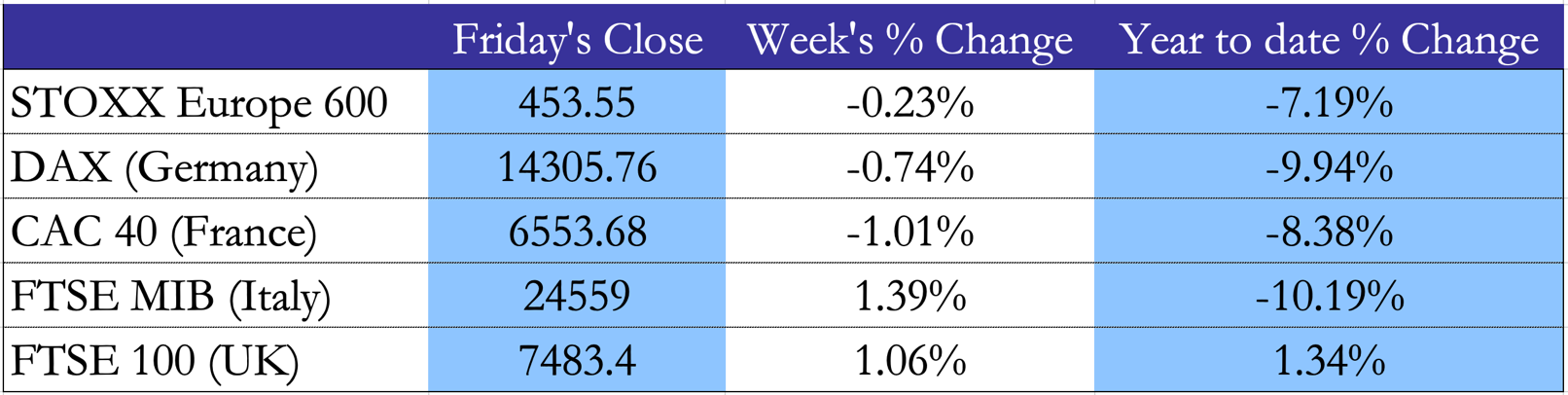

On the echo of rising US yields due to the FED increasingly hawkish tone, rates of 10Y Government Bonds across the European area rose substantially and quite uniformly. Fears of rising inflation are posing a challenge to the ECB mandate of price stability, especially in light of a looming energy crisis. Therefore, investors have dropped bonds to avoid being harmed by a tighter monetary policy.

Source: BSIC, Yahoo Finance

Rest of the world

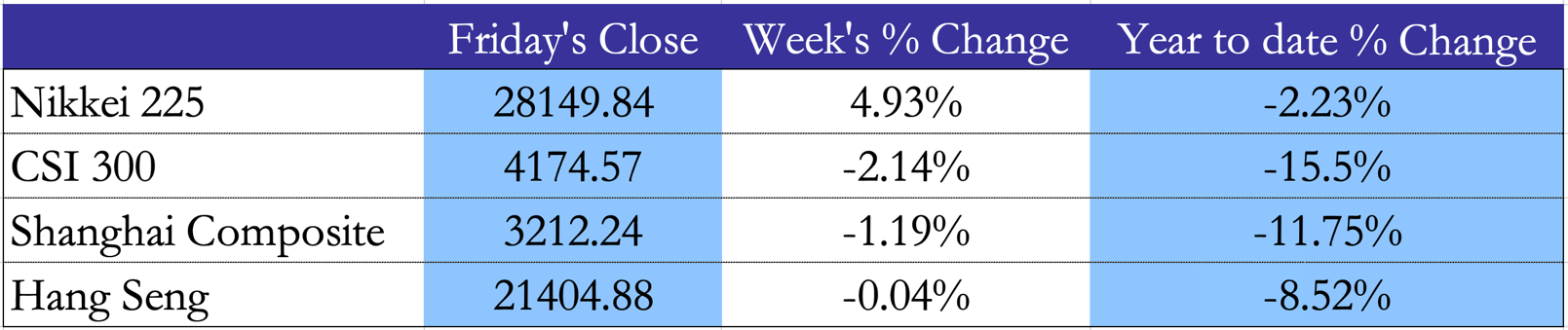

Chinese markets had a negative week, with the CSI 300 Index losing 2.1% and the Shanghai Composite Index falling 1.2%. To worry investors is especially the threat of western sanctions due to the ambiguous position of China over the Ukrainian crisis. The Institute of International Finance reported on Thursday that international investors have been pulling capital from China on an “unprecedented” scale since the beginning of the war. Moreover, fear tainted Chinese skies on Monday when a Boeing plane operated by China Eastern Airlines crashed near the province of Guangxi, with 132 people onboard. The company said it would ground all its Boeing 737-800 for further inspections.

The Hong Kong’s Hang Seng Index closed the week almost unchanged, as the country is planning to unleash measures aimed at lifting strict Covid restrictions. On a similar note, Indonesia lifted all quarantine rules to foreign visitors, ending two years of border closure. The Japanese Nikkei 225 shined, gaining almost 5 percentage points as the government announced further economic stimulus and the Bank of Japan assured markets that it would keep the current easy monetary policy.

Source: BSIC, Yahoo Finance

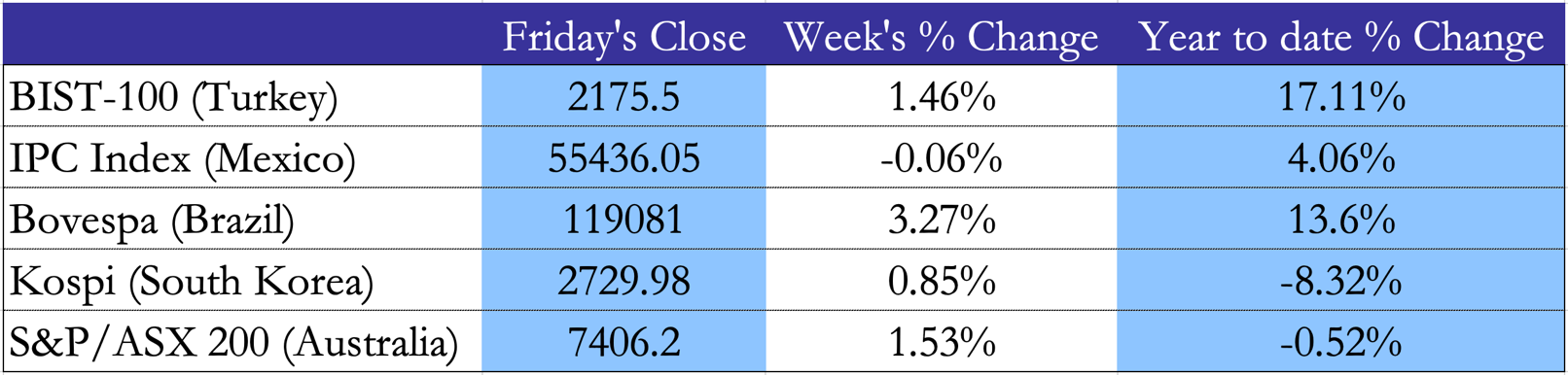

In the rest of the world, Brazil and Turkey did particularly well, extending their gains during the current solar year. Bovespa and BIST-100 indexes advanced 3.27% and 1.46% respectively. In Turkey, investors are being reassured by the government’s recent efforts to stabilize the value of the Lyra, which have shown to be somewhat effective. In South Africa, the Reserve Bank raised its main rate by 25bps to 4.25%, as inflation is poised to surpass the 3-6% target.

In Antarctica, a massive ice shelf – about as big as the city of Los Angeles – collapsed following record high temperatures in the region, hitting minus 11.8 degree Celsius, more than 40 degrees above normal. This event is the first of its kind since satellites began observing Antarctica nearly half a century ago, and is another worrying example of the catastrophic consequences that global warming entails.

Source: BSIC, Yahoo Finance

FX and Commodities

In the commodity market, some relevant events took place in the weekend preceding last Monday. Between Saturday and Sunday, in Saudi Arabia, Yemen’s Houthi rebels attacked at least six oil-producing sites across the country, including some run by Saudi Aramco, causing a temporary reduction in oil production; crude oil futures rose 6.7% on Monday. On Sunday, Australia – the world’s biggest exporter of alumina – announced a ban on shipments to Russia, adding upward pressure on the price of aluminum, which rose more than 33% in the last two months. Finally, Gold futures rose during the week, gaining 1.9% among war-related fears.

In the FX market, the Japanese Yen weakened to an over six-year low of around JPY 121.58 per US$, as the Bank of Japan told investors that it will maintain a very accommodative monetary policy in the foreseeable future. The Euro lost further ground against the US$, closing at around US$ 1.098 per Euro, down 0.6% from the previous week.

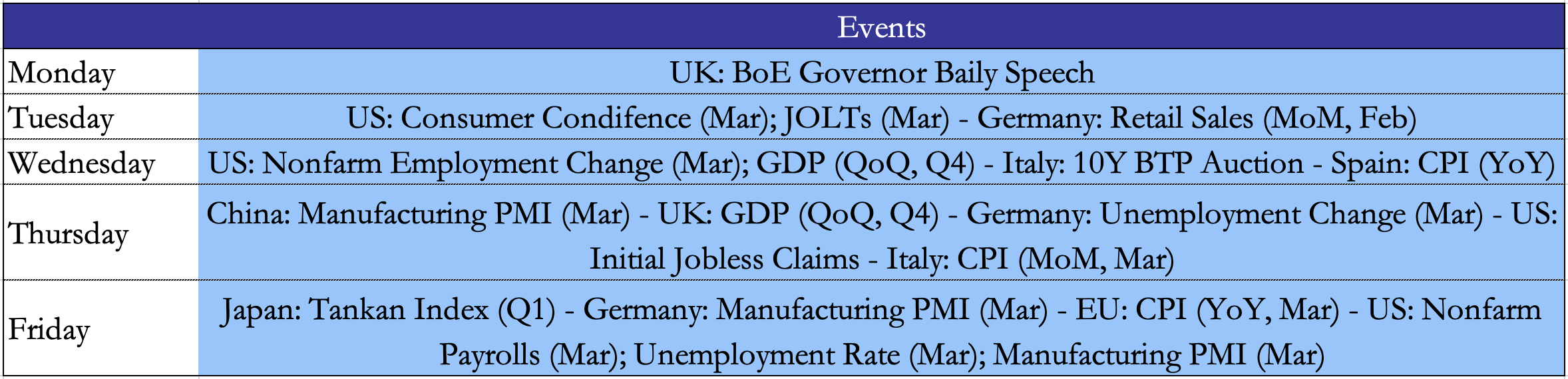

Next week main events

Global markets are set for a busy week, with major economic data to be released from the US, Europe, and China. Moreover, particular attention will be devoted to the evolutions of the Ukrainian crisis, especially to whether Putin will stick to its announcement of refocusing his invasion onto the Donbas region.

Brain Teaser #20

Inside a square with a side length of 1, there are 51 dots. Given any initial configuration of the dots, can you draw a circle with the radius of that contains at least 3 dots?

Solution:

We start by dividing the square of side length one into 25 squares of side length 1/5, applying the pigeonhole principle, and obtaining that at least one of the squares must contain three dots. Next, we can compute the diagonal of the small square, which is sqrt(2)/5, smaller than the diameter of the circle 2/7. Thus, the square with the three points inside can be covered by a circle with a radius of 1/7.

Brain Teaser #21

1972 IMO P1. Prove that from a set of ten distinct two-digit numbers, it is possible to select two disjoint subsets whose members have the same sum.

0 Comments