USA

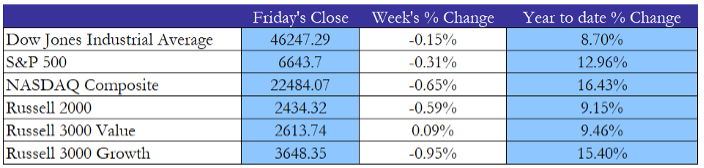

U.S. equities ended the week on a weaker note, despite a Friday rally that helped recover some of the losses. The major indices remained under pressure from rising Treasury yields and renewed trade announcements, leaving investors concerned with further volatility. On Friday, the major indices managed to break a three-day losing streak: the S&P 500 gained 0.6%, the Dow Jones Industrial Average climbed 0.7%, and the Nasdaq added 0.4%. The recovery followed the release of inflation data that matched expectations and calmed fears of a sudden intensification in prices.

For the week, however, the S&P 500 still slipped 0.3%, the Nasdaq fell 0.7%, and the Dow edged down 0.1%. This slight decline got added on top of losses in the prior week, leaving the technology heavy Nasdaq in particular struggling to regain momentum after its previous late-summer highs. The technology sector remained under pressure as higher yields undermined growth stocks, while industrials and financials offered more stability. Energy companies also benefitted from commodities prices rising, as crude futures logged their largest weekly gain in about three months, with Brent and WTI both advancing on supply concerns tied to Russian fuel export cuts and U.S. inventory drawdowns.

One of the week’s most notable market stories was the reaction to President Trump’s new tariffs. On Friday, he announced 100% duties on branded pharmaceutical drugs produced by companies that do not manufacture in the United States, 25% on heavy trucks, 30% on upholstered furniture, and 50% on kitchen cabinets and vanities, all set to take effect on October 1. Although narrower in scope than the previous tariffs, they nonetheless worried global investors by reviving concerns over trade policy. As a consequence, U.S. truck maker Paccar surged more than 5% on expectations that domestic producers would benefit, while Asian pharmaceutical stocks fell sharply on worries about losing U.S. market share. Contrastingly, U.S. and European pharma names proved more stable and resilient, though the uncertainty highlighted once again how sensitive markets remain to policy developments.

Investor sentiment was also affected by the August reading of the PCE price index, which rose 2.7% year-on-year, up slightly from 2.6% in July and in line with the consensus. The data confirmed that inflation remains above the Fed’s target, but it did not come as a surprise, giving equities room to rebound on Friday. Still, the trajectory of inflation and the central bank’s response remain the main themes in U.S. markets.

Source: Yahoo Finance, Bocconi Students Investment Club

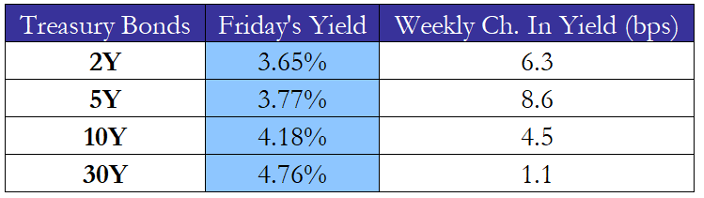

The rates market remained at the center of global attention this week. On September 17, the Federal Reserve cut the fed funds rate by 25 basis points, lowering it to 4.00%–4.25%. Despite this cut, Treasury yields rebounded from earlier lows, reflecting stronger economic data and a change in investors expectations on future monetary policy.

The yield on the 10-year Treasury note closed at 4.17% on Friday, holding the week’s rebound from the five-month low touched on September 16. The move came as strong August data reduced the need for more aggressive action from the Fed: both personal income and spending accelerated more than expected, while mid-September jobless claims pointed to a more resilient labor market. At the same time, the headline and core PCE indices showcased that inflationary pressures remain embedded in the economy.

Shorter-dated yields behaved similarly. The 2-year Treasury yield, highly sensitive to policy expectations, ended the week around 3.66%, while at the long end the 30-year yield reached 4.75%, reinforcing a mild steepening of the curve. The spread between the 10-year and 2-year yields increased to about 0.57%, a notable change after months of inversion.

Market pricing still anticipates another rate cut at the Fed’s October meeting, but the combination of resilient spending and firmer labor market data has led traders to scale back bets on a December move. Yields were also supported by the continuation of the Fed’s quantitative tightening program, which officials chose to maintain this month despite the near exhaustion of its overnight reverse repo facility.

Source: Yahoo Finance, Bocconi Students Investment Club

Europe and UK

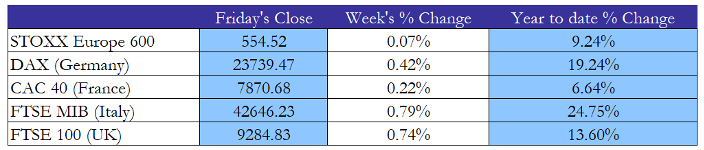

European markets showed signs of resilience this week. Though markets began on weaker note, the STOXX Europe 600 index ended the week basically flat, up just 0.07% at 554.52. On Friday, shares rebounded from three-week lows, with financials and industrials leading gains while healthcare stocks underperformed.

Germany’s DAX and France’s CAC 40 both recovered ground lost earlier in the month, supported by cyclical sectors, while Italy’s FTSE MIB advanced as its banks and insurers rallied.

In the UK, the FTSE 100 finished the week higher, helped by large multinationals benefiting from sterling’s fall, with industrials and financials providing the strongest support.

Source: Yahoo Finance, Bocconi Students Investment Club

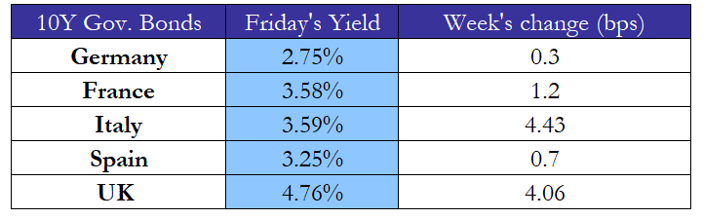

The 10-year German Bund yield hovered around 2.7%, edging back toward highs seen earlier in September as investors weighed monetary prospects against renewed trade fears. Italian debt showed strong demand, with the 10-year BTP yield easing to 3.62%, narrowing spreads over Bunds. Markets are increasingly convinced that the ECB is nearing the end of its easing cycle, after leaving rates unchanged for a second consecutive meeting this month. While services PMIs showed tentative recovery, manufacturing weakness deepened, highlighting the fragility of the eurozone outlook.

Trade policy also featured prominently. Following U.S. tariffs on branded pharmaceuticals, the European Commission said it had secured a ceiling of 15% on U.S. tariffs for drug exports, limiting the direct impact on European firms. At the same time, Brussels was reported to be preparing tariffs of 25%–50% on Chinese steel imports, underscoring its defensive stance toward global trade frictions.

In the UK, sterling endured its steepest weekly fall since July, sliding to $1.3355 as weak GDP revisions and fiscal concerns scared investors. The drop weighed on sentiment but simultaneously boosted large exporters, cushioning the equity market. Gilt yields, however, reflected the strain, the 10-year gilt climbing towards 4.74%.

Source: Yahoo Finance, Bocconi Students Investment Club

Rest of the World

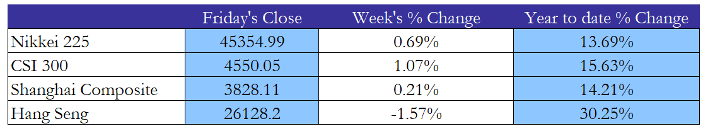

Asian markets delivered a mixed performance, with Japan standing out for both weekly gains and sharp sector swings. The Nikkei 225 advanced nearly 0.9% for the week, closing at 45,355, but dropped 0.87% on Friday, snapping a three-day rally as stronger-than-expected U.S. data lowered hopes for further cuts and President Trump’s new tariffs weighed on investor sentiment. Domestically, Tokyo’s core inflation held at 2.5% in September, undershooting forecasts of 2.8%, while minutes from the Bank of Japan’s July meeting suggested policymakers remain open to tightening further if growth and prices evolve as expected.

In China, equities retreated into the weekend. The Shanghai Composite slipped 0.65% to 3,828 and the Shenzhen Component dropped 1.76% to 13,209 on Friday, after a two-day advance, reflecting pressures from the US tariff announcements. Trading volumes were thin as markets prepared for the Golden Week holidays. Looking ahead, investors are waiting on new industrial profit and PMI readings next week for clearer signals on the trajectory of the world’s second-largest economy.

Source: Yahoo Finance, Bocconi Students Investment Club

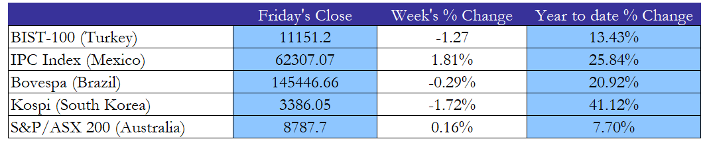

Elsewhere, Brazil’s Ibovespa fell about 0.3% on the week, weighed down by fiscal worries and global rates outlook, whilst Turkey’s BIST 100 fell about 1.3%, giving back some of its recent gains, due to inflation worries and political uncertainty.

Overall, emerging markets mirrored the uncertainty of developed peers, with local fundamentals influencing day-to-day moves but global yields, currency swings, and trade policy setting the broader tone.

Source: Yahoo Finance, Bocconi Students Investment Club

FX and Commodities

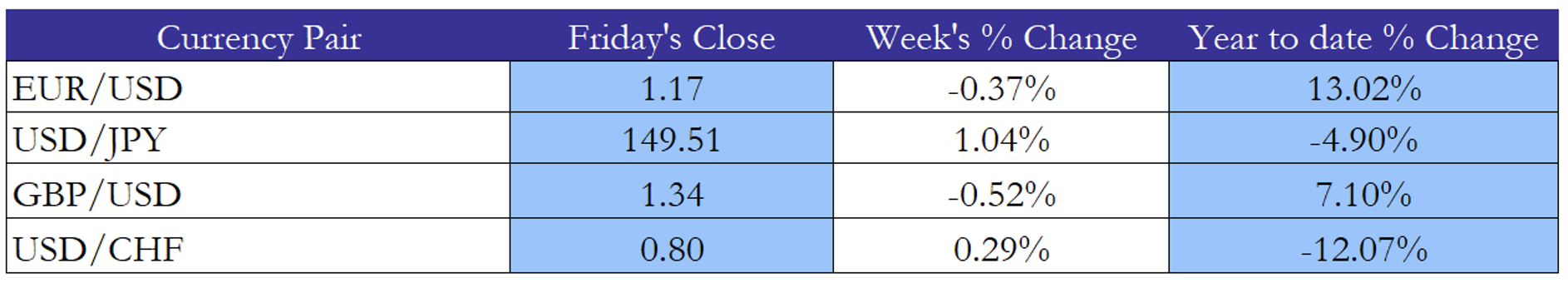

The foreign exchange market was dominated by renewed strength in the U.S. dollar. The dollar index hovered near 98–99, consolidating earlier gains as firmer Treasury yields and resilient U.S. data reinforced confidence in the greenback. Rate futures still price in further easing from the Fed, but traders pared back expectations for a December cut, giving the dollar additional support.

The British pound slipped below $1.335, its weakest level in weeks, reflecting both domestic and global pressures. Markets weighed conflicting signals from the Bank of England: policymaker Megan Greene urged caution on further easing, hinting at a pause in November, while Governor Andrew Bailey argued that more cuts will still be required. The divergence underscored uncertainty as UK inflation, the highest among the G7, stood at 3.8% in August and is expected to peak at 4% before gradually coming down toward target in 2027.

Elsewhere in major currencies, the euro eased modestly against the dollar, reversing some of its early September strength, while the yen closed near ¥150 per dollar on Friday, under pressure from increase in dollar strength from the new US data.

Source: Yahoo Finance, Bocconi Students Investment Club

Commodities painted a contrasting picture, with both oil and precious metals prices raising significantly. Brent crude prices rose towards $70 per barrel, while WTI hovered near $65, with both benchmarks achieving their strongest weekly gains in about three months thanks to Russian supply cuts and U.S. inventory drawdowns. The rebound supported energy exporters and commodity-linked currencies.

Gold once again remained near record highs around of $3,800 per ounce, benefitting from safe-haven demand in an environment of volatile currencies and yields. Similarly, silver had significant gains, surging past $45 per ounce to a 14-year high, caused by expectations of lower interest rates and expectations that supply cannot keep up with demand.

In base metals, copper climbed toward $4.75 per pound, near a two-month peak, after the second largest copper source, the Grasberg mine in Indonesia, halted production following a deadly accident, compounding supply risks alongside disruptions in Peru. Aluminum, by contrast, fell to roughly $2,65 per tonne, back from six-month highs as North American demand slipped, though losses were limited by Chinese capacity curbs and uncertainty over supply from Guinea.

Source: Yahoo Finance, Bocconi Students Investment Club

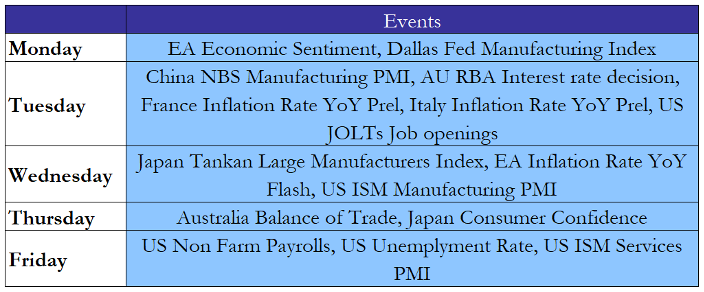

Next Week Main Events

Source: Yahoo Finance, Bocconi Students Investment Club

Brain Teaser #33

You are invited to a welcome party with 25 fellow team members. Each of the fellow members shakes hands with you to welcome you. Since a number of people in the room haven’t met each other, there’s a lot of random handshaking among others as well. If you don’t know the total number of handshakes, can you say with certainty that there are at least two people present who shook hands with exactly the same number of people?

Solution: there are 26 people at the party and each shakes hands with from 1-since

everyone shakes hands with you—to 25 people. In other words, there are 26 pigeons and

25 holes. As a result, at least two people must have shaken hands with exactly the same

number of people.

Brain Teaser #34

There are N distinct types of coupons in cereal boxes and each type, independent of prior selections, is equally likely to be in a box. If a child wants to collect a complete set of coupons with at least one of each type, how many coupons (boxes) on average are needed to make such a complete set?

0 Comments