USA

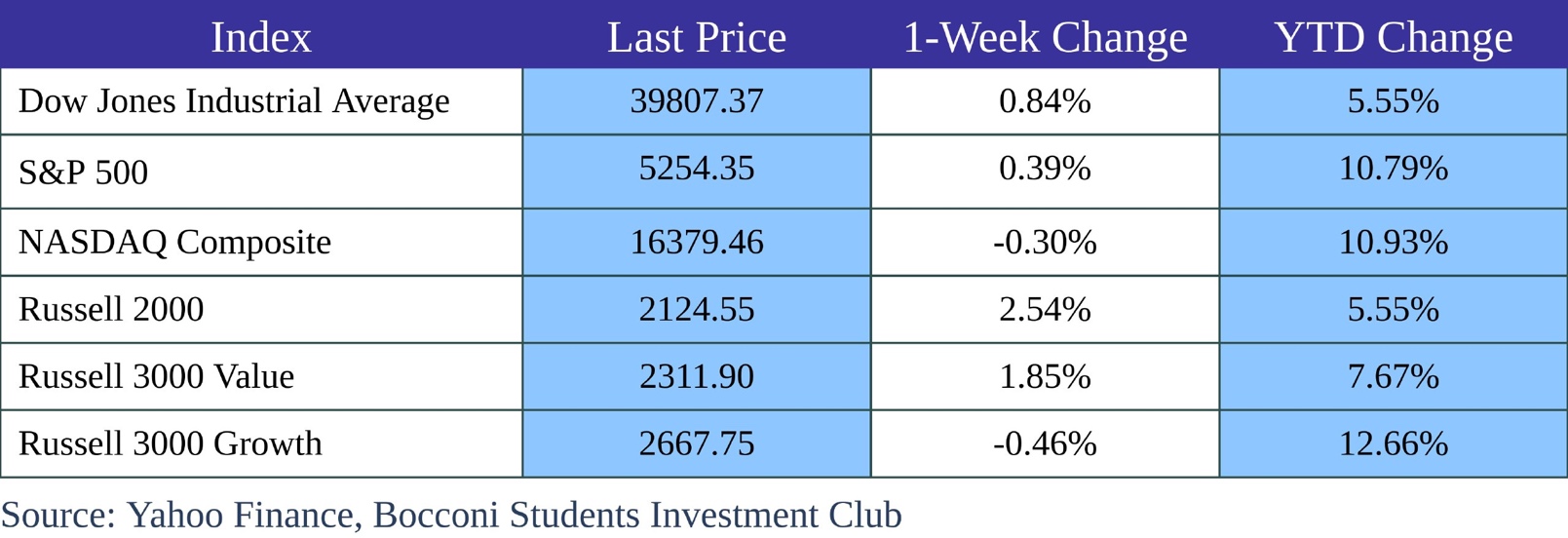

In a holiday-shortened week, the U.S. market exhibited strength as both the S&P 500 and Dow Jones reached record-high closing levels. With the S&P 500 closing at 5254 points, adding 0.4% and the Dow Jones closing at 39807 points, up 0.1%. This comes, after a better than expected fourth quarter economic growth report with GDP increasing, from a 3.4% annual rate, rather than the earlier estimate of 3.2%. Also, initial jobless claims declined by 2,000 to 210,000 slightly outperforming economists’ estimates.

On Friday, the PCE came in slightly below estimates, increasing by 0.3% in February, reaching an annualized rate of 2.5%. The report was mostly in line with expectations, however the increase of 0.3% was slightly lower than the expected 0.4%. Since, the core PCE report matched estimates, the Fed outlook is unlikely to change with still three cuts expected this year. As Jerome Powell emphasized in his speech in San Francisco at the Macroeconomics and Monetary Policy Conference, officials are unlikely to act until further positive inflation reports.

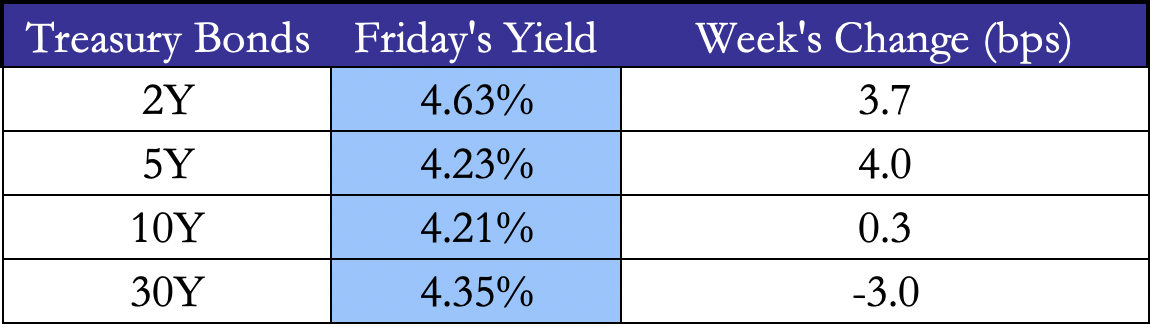

Despite, rate-cut expectations, Treasury yields saw their most significant increase since September for 10- and 30-year durations and since, June for 2-year durations. This stems from inflation readings coming in firmer than expected for January and February. As a result, investors have been forced to scale back on their expected rate cuts, to align more with the Fed’s projection.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

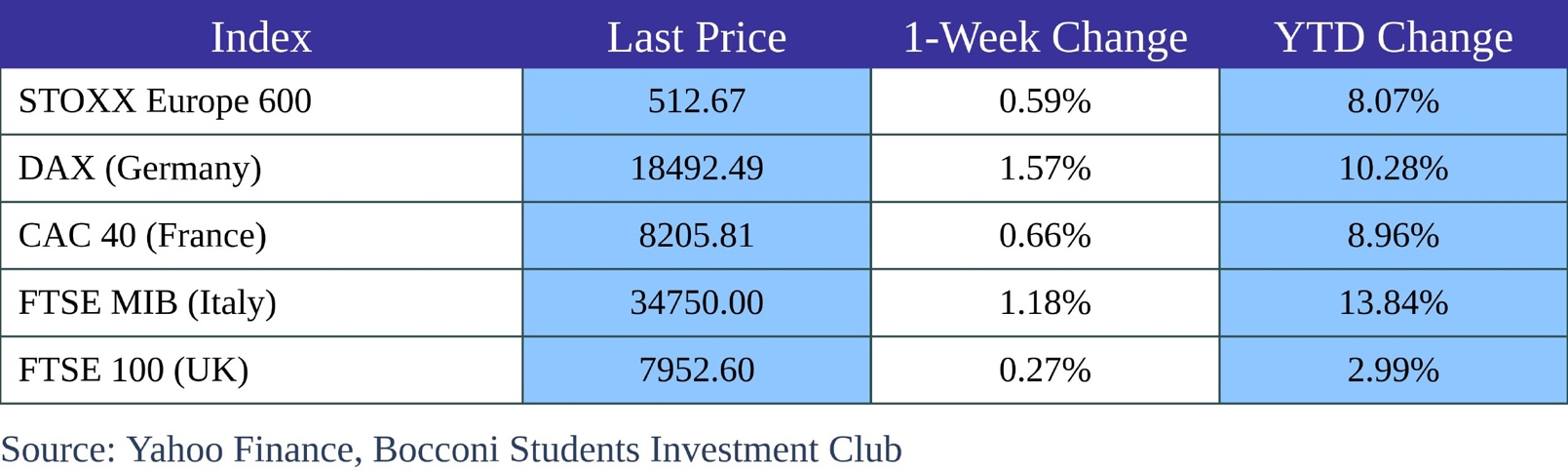

Most European markets made gains ahead of the Easter holiday weekend. The STOXX Europe achieved a record intraday high and rose by 0.59%, despite a significant slowdown in major economies. The UK’s Office for National Statistics announced on Thursday that the economy had shrunk by 0.3% in the last quarter of 2023, following a 0.1% decline in the third quarter, putting the nation into a technical recession for the first time since early 2020. The FTSE 100 rose 0.37% from 7931 to 7960 by the end of the week.

The German Federal Statistical Office revealed a sharp decline of 1.9% in retail sales in February, significantly below consensus expectations. Also, leading economics institutes in Germany downgraded their growth forecast for the country’s economy in 2024 to 0.1%, instead of the envisioned 1.3%. This stems from the high interest rates, as well as weak global demand. Nonetheless, the DAX set another record high, rising to 18492 points. This marks the seventh record high in a row for the Frankfurt stock exchange barometer and the 26th record high this year alone. This rise is mainly driven, by speculation that the ECB is going to cut rates in the coming months.

The French stock market index, the CAC 40, has gained 0.712% this week. It has exhibited a consistent rising trend over the last 12 months, hitting a year-to-date high of 8254 points, which is an 8.96% increase since the start of 2024. The indicator indicates confidence for the future, despite the difficult financial conditions in France brought on by high ECB interest rates. This optimism may be attributed to forecasts of rising private spending and ECB rate decreases.

On Thursday, the European Commission reported that consumer confidence has increased to its highest level in two years. As per the report, consumers’ intentions for major purchases remained stable, while there was also a slight improvement in industry confidence.

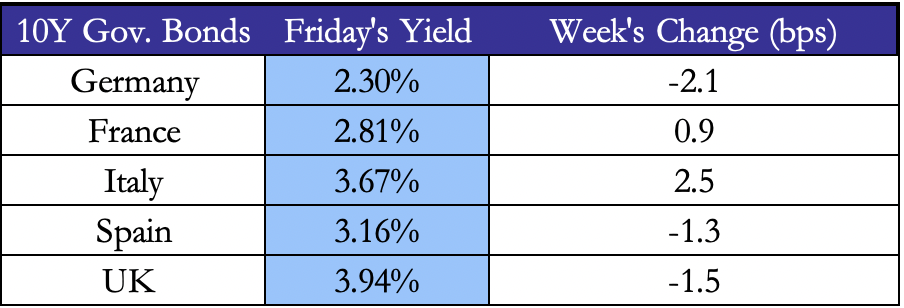

European government bonds experienced a decline. The European Central Bank has indicated that it may lower interest in June, depending on how wages continue to rise. Data show that bank lending in the eurozone stayed unchanged in February, which led ECB council member Fabio Panetta to hint at a possible change in the rate cycle.

Source: worldgovernmentbonds, Bocconi Students Investment Club

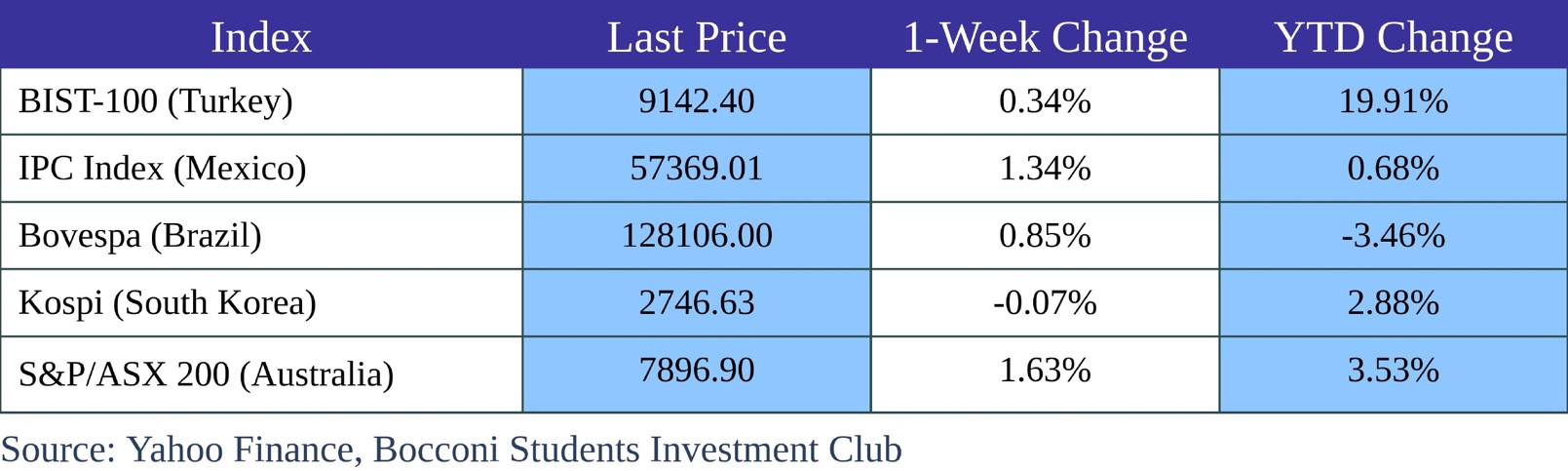

Rest of the World

The Chinese market declined, as the ongoing concerns surrounding the property sector weighed on investors’ confidence. The Shanghai Composite Index saw a decline of 1.23%, while the blue-chip CSI 300 dropped by 0.68%. On the other hand, the Hang Send Index increased by 0.25%. To counteract, the drop in the market, the Chinese Premier Li Qiang reassured global business leaders at the China Development Forum, that the country is open to foreign investments. Furthermore, he pledged that the government would increase its measures to support growth in several sectors, including artificial intelligence.

The Nikkei Index was down 1.27% at 40369 points, due to the sharply depreciating yen. As a result, Japan’s inbound tourism levels have surpassed pre-pandemic levels, with travelers from various countries aiming to capitalize on the weakness of the yen.

Other global markets showed mostly positive results. The KOSPI benchmark recovered from early losses on Friday, closing at 2747, with a 0.03% increase, mostly due to increases in chipmakers. Leading the way were industry giants in chips, Samsung Electronics and SK Hynix, with increases of 2.7% and 2%, respectively, helped by a spike in demand from exports. Furthermore, Celltrion’s stock increased by almost 4%. Conversely, industry titans LG Energy Solution and Hyundai Motors saw decreases of about 1.6% and 1.7%, respectively. South Korean stocks fell 0.07% for the week, but they had a strong 3.44% gain for the quarter. Regarding the economy, South Korea reached a six-month high in industrial production. On the other hand, retail sales fell 3.1% in February, which was the biggest loss since July 2023.

Turkish stocks continued to rise, with the BIST 100 breaking beyond 9050 to get closer to the record high set last month. Investors assessed the outlook for the economy as the central bank unexpectedly decided to start up its tightening cycle again. When the TCMB increased its benchmark interest rate to 50% in March, most market players were unprepared because they had expected successive holds. The rate increase came as a surprise to them.

FX and Commodities

On Wednesday, Japan’s three key currency authorities held an emergency meeting, to discuss the weakened yen. They hinted that they were ready to intervene in the market, as the JPY hovered near 152 against the U.S. dollar, marking a 34-year low. Finance Minister Shunichi Suzuki said that they would take decisive steps against excessive currency movements. The historic weakness in the yen has benefitted many of Japan’s large-cap exporters, who derive a large share of their earnings from overseas.

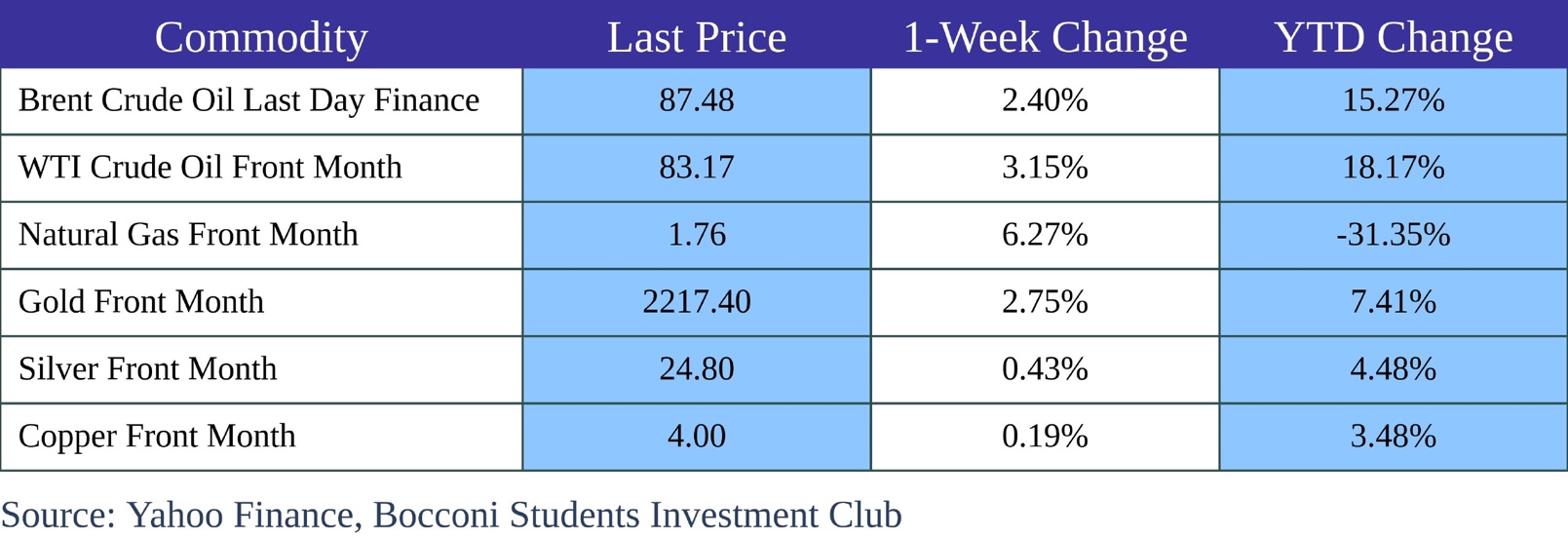

WTI oil futures saw their third straight month of gains on Thursday, rising 2.24% to close at $87.48 a barrel. The OPEC+ alliance’s continuous attempts to limit production as well as the ongoing geopolitical unrest in the Middle East and Eastern Europe were the main drivers of this upswing. OPEC+ decided at the beginning of March to prolong the voluntary production cutbacks until the end of the second quarter. At its meeting the following week, it is expected to keep the present output policy in place. Drone assaults by the Ukrainians on Russian refineries, which affected more than 10% of the nation’s oil processing capacity, have also contributed to the recent spike in oil prices.

Considering forecasts of interest rate reduction by major central banks this year, gold held steady at around $2217 per ounce in Friday’s limited holiday trading, close to all-time highs. The safe-haven metal’s demand was further stimulated by heightened international tensions, as well as investors continued aim to hedge against geopolitical uncertainties in Eastern Europe and the Middle East. The metal advanced more than 9% in March.

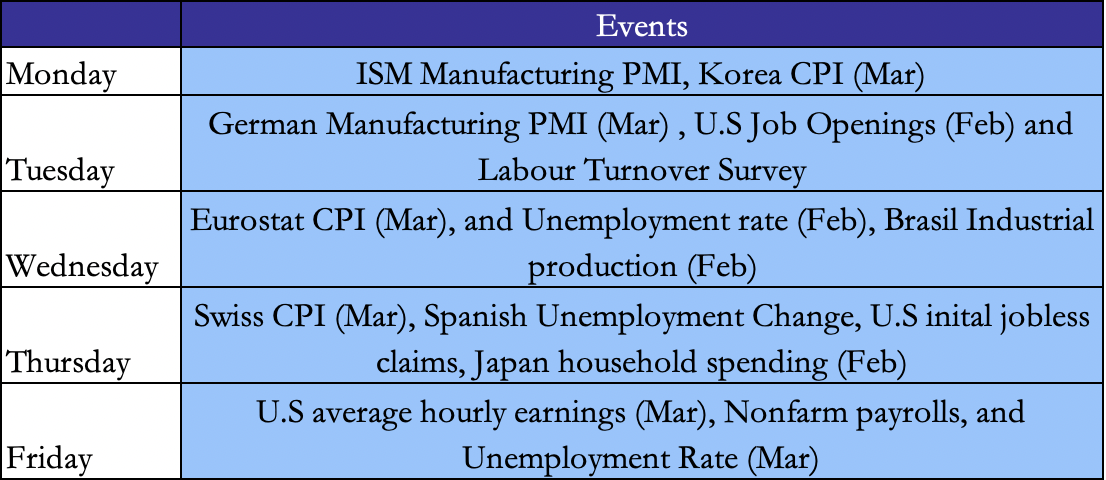

Next Week Main Events

Brain Teaser #14

Mary learns that John’s sister has three children. “How old are the children?” asks Mary. “Well,” replies John, “the product of their ages is 36.” Mary thinks for a while and says, “I need more information.” “Hmmm, the sum of their ages is the same as this figure right here,” says John pointing at the spreadsheet. “Still not enough information,” says Mary after thinking for a minute. “The eldest is dyslexic,” says John. How old are the children?

Source: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

SOLUTION

The possible triplets are 1,2,18), (1,3,12), (1,4,9), (1,6,6), (2,2,9), (2,3,6), and (3,3,4). These potential triplets sum to 21,16,14,13,13,11, and 10, respectively.

Knowing the sum was not sufficient for Mary to pin down the triplet, so it must be a triplet with the non-unique sum: 13. This reduces the possibilities to (1,6,6) and (2,2,9). John says the eldest is dyslexic, so there must be an eldest, which just leaves (2,2,9).

Brain Teaser #15

Players A and B are alternately picking balls from a bag without replacement. The bag has k black balls and 1 red ball. The winner is the one who picks the red ball. Who is more likely to win, the one who starts first, or second?

0 Comments