Introduction

This week Merck & Co. announced one of the biggest healthcare deals disclosed so far in 2023. The US drug maker reached an agreement with Prometheus Biosciences to acquire the company in an all-cash transaction that values Prometheus at $10.8bn, a 75% premium to its market cap of $5.4bn. Merck expects the deal to close by the third quarter of 2023, but it is still subject to approval from Prometheus shareholders and regulators. The deal echoes the latest trends in the healthcare industry. Several drug companies are hunting for acquisitions to add new products to their pipeline as they risk losing patent protection on their top-selling products, facing significant revenue drops. Ahead of the possible loss of exclusivity over its cancer drug later this decade, Merck is entering the lucrative market for autoimmune treatments through Prometheus Biosciences.

About Merck

Merck & Co. [NYSE: MRK] traces its origins back to Merck Group, a German company founded in 1668 that over the years evolved from a pharmacy to a drug manufacturing company. In 1891, George Merck first established the company to distribute chemicals in New York City. The firm develops and produces medicines, vaccines, biological therapies, and animal health products. The firm laboratory was founded in Rahway, New Jersey in 1933 and it represented Merck’s first incursion into pharmacological research.

In 1936, the company first synthesized vitamin B1 leading to the reduction of vitamin B1 deficiency. From that year they started focusing on synthesizing vitamins to make them more widely available. In the 1940s Merck supported research for the first effective treatment of Tuberculosis and entered the field of animal health. In 1950, Dr Sarett – a research scientist at Merck & Co. – developed CORTONE (cortisone) which was used in the treatment of chronic diseases that were often fatal. In 1955, the company emerged as a leading cardiovascular company after the release of DIURIL, a drug used to treat the symptoms of edema and high blood pressure (hypertension). The firm research team discovered Thiabendazole, in 1961 – the first known drug to kill the trichinella parasite in several species. In 1966, the FDA approved CRIXIVAN – for the treatment of HIV. Later in the 1980s, the FDA approved VASOTEC – for high blood pressure and heart failure treatment – which became the firm’s first billion-dollar product by 1988.

The company also worked on several vaccines. Among the most important ones: Combined Vaccine (MMR) for children against measles, mumps, and rubella, PNEUMOVAX for pneumonia and the Recombinant Hepatitis B Vaccine. Other notable vaccines include GARDASIL for the prevention of cervical cancer and ERVEBO (Ebola Zaire Vaccine) – for the prevention of disease caused by Ebolavirus.

Between 1929 and 2021 the firm conducted multiple mergers and acquisitions including the acquisition of Sharp Dohme Inc. in 1953 and the merger with Schering-Plough in 2009. This allowed the company to become the second-largest pharmaceutical company in the US by revenue. Merck’s recent activity includes its acquisition of Acceleron Pharma in 2021. The transaction was valued at $11.8bn and had a purchase price of $180.00 per share.

Overall, 2022 was an extremely strong year for Merck as they saw strong revenue growth across 4 quarters. In the final quarter of the year, their sales increased 2% YoY to $13.8bn, which signified an increased growth of 8% when disregarding forex. Holistically, 2022 saw sales of $59.3bn which was a 22% increase relative to 2021. This was mainly driven by some key medications including Lagevrio, Keytruda and Gardasil whose sales represent a large portion of Merck’s revenue. Looking forward, Merck expects revenue to dip slightly hovering around the $58bn mark for the year 2023.

About Prometheus Biosciences

Founded in 1995 as Precision IBD, Prometheus Biosciences [Nasdaq: RXDX] is a Californian clinical-stage biotech company pioneering a precision medicine approach for the treatment of inflammatory bowel diseases (IBD).

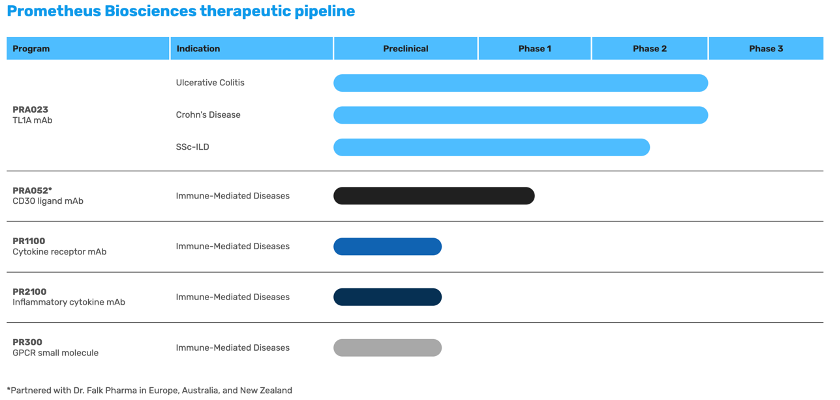

By combining its proprietary machine learning-based analytical approach with a very large gastrointestinal bioinformatics database, the company identifies therapeutic targets and develops therapeutic candidates (products) to engage these targets. For example, PRA023, its lead product, is a humanized monoclonal antibody (mAb) directed to tumour necrosis factor (TNF)-like ligand 1A (TL1A), a target associated with both intestinal inflammation and fibrosis. In December 2022, the company announced positive results for PRA023 from ARTEMIS-UC, a Phase 2 study evaluating the safety and efficacy on patients with moderate to severely active UC.

Other than PRA023, Prometheus Biosciences also develops PR300, a G-protein coupled receptor modulator for IBD and potentially other immune-mediated diseases; PRA052, an anti-CD30L mAb for IBD; PR1100, an anti-cytokine receptor mAb for IBD and other immune-mediated diseases; and PR2100, an anti-inflammatory cytokine mAb for IBD, and inflammatory and fibrotic diseases.

Source: Prometheus Biosciences

Prometheus Biosciences has a diagnostics development and collaboration agreement with Takeda Pharmaceutical Company Limited and a co-development and manufacturing agreement with Dr Falk Pharma GmbH for PRA052. It also has a license agreement with Cedars-Sinai Medical Centre, and a strategic collaboration agreement with Millennium Pharmaceuticals, Inc.

As expected, Prometheus Biosciences’ revenues remain low: they only reached $6.8m for the full year 2022, up from $3.1m in 2021, and $1.2m in 2020. On the other hand, R&D costs were $113m (2022) and $62m (2021), hence the company posted a net loss for both years – $141m and $90m respectively. Prometheus Biosciences’ cash and short-term investments accounts in 2022 were relatively strong, with $695m reported in December. The corporation’s current main shareholders are Cedars Sinai Health System (8.42%), Nestlé S.A. (7.85%) and RTW Investments LP (7.06%).

Latest Trends in the Healthcare Industry

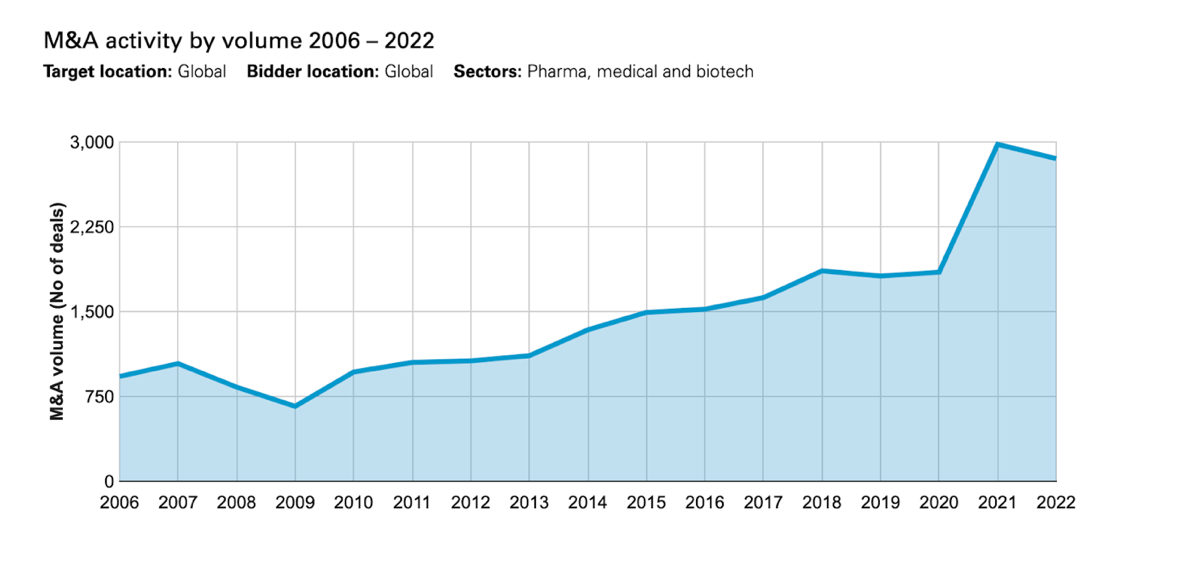

The start of 2023 has brought with it a ramp-up in M&A activity within the healthcare sector. Ranging from CVS Health’s acquisition of Oak Street Health in the drugstore industry to the largest players in the industry acquiring large companies for inflated multiples. At the start of March, we saw Pfizer announce its intention to acquire the biotechnology company Seagen for a sum of $43bn. Thanks to its oncology-focused business with 24 approved cancer medications and over 30 programmes that are in the clinical development stage, Seagen was an intelligent acquisition for Pfizer as biotech companies have suffered from suppressed valuations. The Covid-19 pandemic led to extremely low valuations within the healthcare industry. This enabled big pharma to benefit through investing as there were more than twenty $5bn deals concluded in 2021. However, 2022 saw a decline in M&A activity as the number of transactions above $5bn dropped to nine.

The largest healthcare deal of 2022 was Amgen’s acquisition of Horizon Pharma for $28.3bn, followed by General Electric’s spin-off of their healthcare technology business for $22bn, Johnson & Johnson’s acquisition of Abiomed for $19.3bn and finally, Pfizers activity in the biotechnology space through their $11.6bn acquisition of Biohaven. As we have seen at the start of 2023, Pfizer has eagerly utilized their leverage from the Covid-19 vaccine to reinforce its pipeline, with a particular focus on the biotech industry.

On the other side of the Atlantic, dealmakers in the UK have taken an aggressive approach in their pursuit of foreign pharmaceutical, medical, and biotech enterprises. There were 118 outbound deals completed in 2022 which exceeded 2021 levels. The uptick in cross-border M&A in this sector was led by GlaxoSmithKline (GSK) through their acquisition of Affinivax for $3.3bn. The company increased its presence in the oncology market by acquiring Sierra Oncology for $2bn.

Cross-border M&A towards continental Europe was prevalent as one of the major players in the UK private equity sphere, Ardian, acquired the Italian specialist medical device company Biofarma. Another trend we witnessed is the increased investment in the biotech sector due to its rapidly expanding nature. The private equity firm Permira together with the Abu Dhabi Investment Authority (ADIA) participated in the acquisitions and subsequent merger of the Italian company Kedrion and the UK company Bio Products Laboratory (BPL) at the start of 2023. The newly created joint corporation will generate yearly sales more than €1.1bn due to a portfolio of 37 items sold in more than 100 nations.

Source: White Case

Deal Rationale

President Joe Biden ratified the Inflation Reduction Act (IRA) on August 16, 2022. According to projections from the Congressional Budget Office, the legislation’s provisions allowing Medicare to alter some prescription costs and capping drug price rises at the rate of inflation are estimated to save the US government $164bn over the course of ten years.

High-expediency, single-source medications are primarily covered by the Medicare Price Negotiations. Before the IRA, the Social Security Act’s non-interference provision forbade the Secretary of Health and Human Services from engaging in negotiations with pharmaceutical companies. With a brand-new framework provided by the IRA, this ban is lifted, allowing the Centers for Medicare & Medicaid Services to annually negotiate a “maximum fair price” for a select group of expensive, single-source medications. To start the government’s drug pricing scheme in 2023, 10 Medicare-eligible pharmaceuticals will be chosen. The fee will be put in place starting in 2026 after two years of negotiations, scheduled to last seven months. Starting in 2029, there will be a total of 20 medications chosen for negotiation each year. Therefore, as time goes on, eventually the government’s drug pricing reform will cover all qualifying medications.

In accordance with the law, Medicare will be able to negotiate rates for 10 medications starting in 2026 and up to 60 by 2029. AbbVie and Johnson & Johnson’s “Imbruvica,” Pfizer’s “Eliquis,” and Gilead Sciences’ HIV treatment “Biktarvy” are amongst the drugs that could be severely affected by the IRA. According to Moody’s, AbbVie, and Johnson & Johnson’s “Imbruvica,” Pfizer’s “Ibrance” are the drugs that have “high spending connected more to their high prices than to their wide usage” which makes them “most likely to be damaged by a redesign of Medicare.” As its main competitor’s flagship drugs are heavily affected by the IRA, Merck has utilized this as a unique opportunity to capitalize and significantly increase its market share.

In general, a single-source pharmaceutical product is eligible for selection and negotiation if at least seven years have passed after the FDA approved it, or if it is a biologic and 11 years have passed since the FDA licensed it. Small-molecule drug manufacturers and biologic manufacturers are given at least nine and thirteen years, respectively, before they must sell their product under Medicare as applicable, at the negotiated price, given that a pharmaceutical drug is chosen for negotiation two years prior to the negotiated price taking effect.

The IRA excludes several product categories from qualifying even though it targets expensive pharmaceuticals that have been on the market for a while without generic or biosimilar competition. Goods with only one Orphan Drug indication (drugs used to treat rare and uncommon disorders), plasma-derived products, and certain small biotech products are among those that are excluded. The price negotiation has no bearing on patient co-pays, deductibles, co-insurance, or other out-of-pocket expenses, nor does it apply to any drug sales reimbursed by private insurance or paid for out-of-pocket by patients.

Pharmaceutical innovators who are concentrating on small-molecule therapies may continue to re-evaluate research and development goals considering the IRA to take into consideration the prospective favourable treatment of biologics. Any pharmaceutical drug product that is produced in, extracted from, or partially synthesized from biological sources is referred to as a biologic, sometimes known as a biopharmaceutical. The regulatory exclusivity term for biologics is already longer than that for small-molecule medications. Biologics will now be given additional time on the market under the IRA before being qualified for price-reduction discussions. Biologic producers now have an additional four years to recover investments before being compelled to sell their drug goods at or below the market fair price, as opposed to a small-molecule drug company.

Merck’s rationale behind their acquisition of Prometheus is the idea of expanding their research and development efforts towards biotech, biologics, and orphan drugs rather than small-molecule drugs. This transaction allows the S&P 500’s 4th-largest healthcare company to purchase the biotech behind several winning autoimmune disease drugs. Prometheus should be able to develop Merck’s autoimmune practice as well as help push along medications for ulcerative colitis and Crohn’s disease. The specific nature of Prometheus’ medications allows it to be excluded from major legislation regarding the healthcare industry. Additionally, Merck is under risk of losing patents, which would ultimately lead to a considerable decrease in revenues. Therefore, Merck’s acquisitions are an to diversify its pipeline.

Deal Structure

Merck [NYSE: MRK] announced the acquisition of Prometheus Biosciences on April 16th. Under the terms of the agreement, Merck will acquire in cash all the outstanding shares of Prometheus [Nasdaq: RXDX] at a price of $200 per share. This represents a 75% premium to the company’s closing stock price of $114.01 on Friday 14th. As of Friday’s market, close, Prometheus had a market capitalization of $5.4bn, while the deal values the firm at $10.8bn. Merck will acquire Prometheus through a subsidiary, a procedure that it has already undertaken with recent acquisitions, such as Imago’s acquisition in January. The transaction is subject to approval from Prometheus Biosciences shareholders and regulators. Still, in their statement, Merck’s management announced that a definitive agreement has been made between the two companies, and the deal will most likely be concluded by the third quarter of 2023. The closing of the proposed transaction is also subject to specific conditions, like the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act.

Market Reaction

The announcement of Merck’s acquisition and the recent activity in the sector sent healthcare equities into a frenzy. Prometheus [NASDAQ: RXDX] had a market cap of $5.42bn as of Friday’s close. Its stock is up 3.7% year to date, and over the past 12 months, it has skyrocketed 225%, with much of the gains coming after PRA023 advanced to Phase 3 clinical trials in December. Following the deal announcement, its shares were up 69.73% in early trading on Monday. Over the past week, Prometheus also experienced a higher-than-average number of shares changing hands. Interestingly, Merck [NYSE: MRK] shares dipped slightly on the deal news. This might reflect investors’ uncertainty as Merck is betting on a company with no approved drugs.

Source: Trading View

As mentioned, other biopharma companies are witnessing alterations in their stock prices due to the recent activity in the industry. Moderna [NASDAQ: MRNA] dropped 8.36% on April 18th as its partnership with Merck to develop a combined cancer vaccine showed insignificant data in improving melanoma patient outcomes alongside Merck’s Keytruda. Moderna’s stock price took a hit also in February when the company forecasted declining COVID-19 vaccine sales and rising costs for 2023 that might result in Moderna posting a loss this year. On April 19th, Johnson & Johnson’s stock [NYSE: JNJ] fell by 2.81% following a disappointing year despite an increase in EPS. The company is also being sued for their talc powder, alleging that it might cause cancer.

Outlook

Merck has been looking for deals to move into immunology to offset the inevitable slump in revenues it will face towards the end of the decade as patents on its blockbuster cancer immunotherapy (Keytruda, $21bn of sales in 2022) begin to expire. Revenues from the Prometheus acquisition should materialize around that same time. This bold move to strengthen its immunology pipeline is Merck’s attempt to align itself with the other large pharmaceutical companies that are already significantly exposed to this domain. “This is allowing us to move into immunology in a strong way and will allow us sustainable growth, we think, well into the 2030s given the long patent life,” said Merck’s Chief Executive Robert Davis.

Robert Davis also said that PRA023, which could treat ulcerative colitis (UC) and Crohn’s disease (CD) amongst other autoimmune conditions, could be a multibillion-dollar seller for Merck. He confirmed that it’s the recent release of encouraging mid-stage trial results (in terms of safety and efficacy) that drove Merck to make an offer. The drug’s patent exclusivity in the United States extends into the 2040s, and UC and CD indications each have the potential for multi-billion-dollar peak sales. This is because the UC and CD market is expected to experience a very large market expansion: from $22bn in 2022, it could increase to almost $30bn by 2028. Merck plans to initiate PRA023’s Phase 3 UC trial by early 2024. It also plans to collect the data from PRA052 this year and to start Phase 2 of the drug MK-6194.

Advisors

Merck’s financial advisor is Morgan Stanley & Co. LLC, and its legal advisor is Paul, Weiss, Rifkind, Wharton & Garrison LLP. Centerview Partners LLC and Goldman Sachs & Co. LLC are acting as financial advisors to Prometheus, and Latham & Watkins LLP as legal advisor.

0 Comments