The investment banking industry is expected to announce lacklustre returns for 2013, despite an improving global economy, soaring asset prices and abundant liquidity. According to Deutsche Bank, the overall revenue pool is forecasted to be down by 6% (FICC down by 18%, Equity up by 28% mostly driven by equity derivatives, while IB up by 7%).

YoY changes in Inv. Banking revenue total

European banks in particular have lost market share in FICC. Rates have suffered more in Europe because of the run-down of LTRO, in comparison to the damage that taper talk has done to rates business in US. Also, regulatory changes and harsher leverage constraints compared to their US counterparts have left their mark. The same holds for the equities business, though on a less dramatic scale than in FICC.

The winners for 2013 seem to have been the global powerhouses such as JPMorgan, HSBC and Citigroup, lending even more credibility to their business model, i.e. commercial banks with fortress balance sheets.

What about 2014?

In our view, the next year will be characterized by less policy uncertainty, which will benefit the investment banking industry. Banks will continue to focus on what they do best (the UBS and SocGen example), and thus be willing to retreat from areas where they cannot compete with the top tier players. Though of course, there are also those banks which are capable of being a genuinely successful full-scale universal bank (ex. JPM).

We think revenues in FICC will continue to go down, or at best, remain flat. This is driven by tougher regulatory regulation and higher capital requirements from Basel III, regulatory drive for clearing and exchange trading, and tight spreads. Though there might be possible exceptions for banks that can win FICC market share fast enough to offset industry losses. More banks may continue to exit FICC, thus leaving a larger pie for the remaining competitors.

Equity is also expected to grow (by 10% according to Thomson Reuters), though the performance in equity derivatives is unlikely to be repeated. Also gains in Advisory & Underwriting may surprise as M&A activity picks up, and ECM activity is bolstered into Europe as well.

Swiss Banks

UBS has provided the industry with a dramatic example of radical change in strategy. It has focused on sectors where it has been traditionally strong: advisory, equities (about 5% of global market share), research, FX and precious metals. We think UBS will continue to shut down the remaining of its FICC businesses and thus experience negative growth in FICC revenues for 2014. Being a Swiss bank, it is more at risk as regards to regulatory leverage problems, though at the moment there is no current public discussion on the leverage ratios and ‘too big to fail’ legislation is set for review only in 2015. Credit Suisse has followed a niche strategy as well, even though not as radical as UBS. It has concentrated on equities, emerging markets/high yield, advisory. It is also particularly strong in equity derivatives. However, Credit Suisse has lost share in the global revenue pool in equities; it has gone from a 7.5% to 5%, which might have been a result of aggressive competition from MS and GS. Both UBS and Credit Suisse face the usual banking sector risks. However their heavy mix of investment banking and private banking may create larger exposures to market risk. Finally, a strong CHF is a major risk as it reduces dollar and euro revenues.

French Banks

French banks have been focusing on cost discipline and restraint. They have focused on deleveraging earlier than their peers, probably due to the difficulties experienced for dollar funding access early in the Eurozone crisis. SocGen has enjoyed an especially good year in its equity derivatives business. It has a narrow focus on its IB division. SocGen is looking to integrate more its investment banking division with its private banking, asset management and investor services. However details on the strategy are not yet published by the bank. Neither is the strategy for BNP Paribas. BNP is looking to control costs through its ‘Simple & Efficient’ programme, thus a lower cost:income ratio is expected. Both these banks face risks in case of worsening macro situation in Europe and weaker capital markets.

UK Banks

Barclays is top 3 in G10 FX, flow credit and flow rates and highly ranked in commodities and emerging markets. Half of its revenues are generated by FICC. Though revenues generated from advisory and equities are growing as a payback since the investment in the Lehman Brothers acquisition. IB is undergoing restructuring under a new management team. £40bn of RWA in legacy assets are being run-down. Also, the contribution of IB to group leverage is being reduced. They were required to do a capital increase after the regulators imposed a higher stressed core tier 1 capital requirement. The new team has undertaken to reduce group leverage by £65 – 80bn by the end of June, and IB will deliver a large part of this effort. They are also dramatically reducing costs under the ‘Transform Plan’. Barclays may gain market share in equities and FICC next year as it is still far from its 7%-peak share of global revenues.

HSBC’s Global Markets Division is probably one of the broadest in the industry. They have dramatically more than doubled their market share in FICC from pre-crisis levels. That is why we predict good returns for FICC HSBC, even though the industry trend is not so cheerful. HSBC would profit from a steeper yield curve and Emerging Markets growth, as it is highly exposed to EM through its trade finance, structured and project finance, and lending activities.

Source: BSIC

Source: BSIC

A ‘quick and dirty’ overview (data from Bloomberg)

Trade idea:

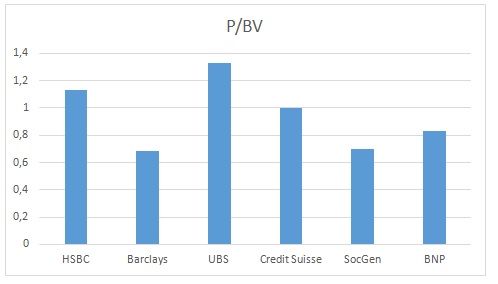

Long Société Générale: SocGen’s share of equities has been sable over time at about 2% of global revenues and has notably outperformed its French rivals. It is now trading at close to a P/BV of 0.7, and we think this is undervalued.

Long Barclays: This may seem peculiar because of the controversial FICC business (half of Barclays inv. bank revenues come from FICC). Though we believe the efforts undertaken by the Management are being undervalued. Barclays is now trading at close to a P/BV of 0.69.

0 Comments