At the beginning of 2020, BSIC members took a first glance at NIRP in the article “Negative interest rate policy – friend or foe?”. The piece discusses the impact of negative rates in the Euro area and the possible unintended consequences. This year we try to go through each asset class and find examples of negative rates’ impact.

At the moment, there are four Central Banks that have their main policy rate in negative territory:

- The European Central Bank (ECB) deposit facility rate, which defines the interest banks receive for depositing money overnight, stands at minus 50 basis points.

- The Bank of Japan (BOJ) interest rate applied to the Complementary Deposit Facility, excess reserves of financial institutions held at the account with the Central Bank, is at minus 10 basis points.

- The Denmark Nationalbank sets the certificates of deposit rate at minus 60 basis points.

- The Swiss National Bank (SNB) policy rate is at minus 75 basis points.

- The Swedish Riksbank used to have NIRP in place, but decided to terminate it in 2019. Currently, the repo rate is zero. Riksbank Governor Stefan Ingves said negative rates have worked well, boosting inflation and the economy.

Currencies

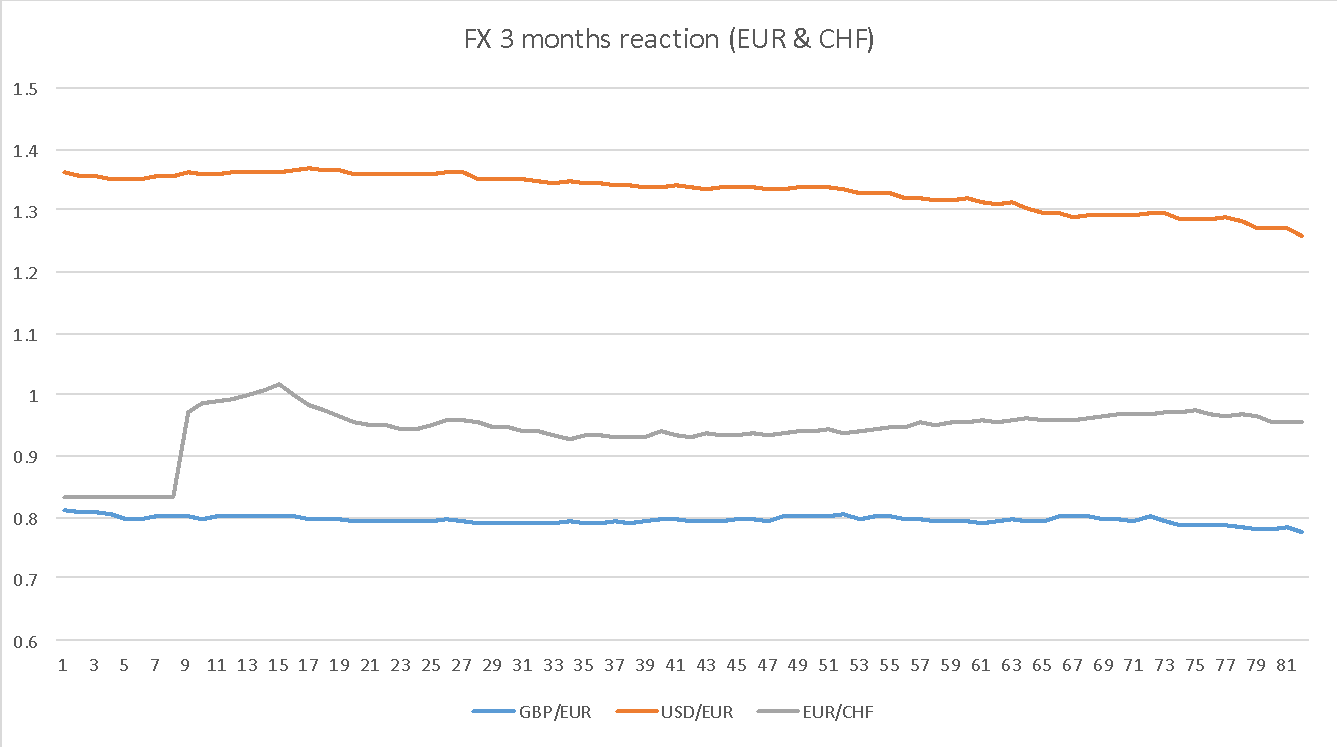

First of all, we take the FX market in consideration. When interest rates go negative, we should expect increased inflation expectations and, as a consequence, currency depreciation movements. We look at the FX movements after the NIRP announcement, choosing a 3-month window as other factors might come into play on longer time horizons:

EUR shows appreciation both relative to USD and GBP, YEN sharply increased in value after NIRP announcement and CHF was the only one depreciating. Danish krone (DKK) and Swedish krona (SEK) exchange ratios versus EUR are not represented since they remained fairly stable.

Counterintuitively, these are our findings:

- FX markets have typically responded to a move into negative rates with a strengthening of the currency.

- Market’s evaluation is that the monetary policy has been tightened, not loosened as it was intended.

Since the real driver of currency movements are real interest rates, should we derive that negative rates increase deflation expectations?

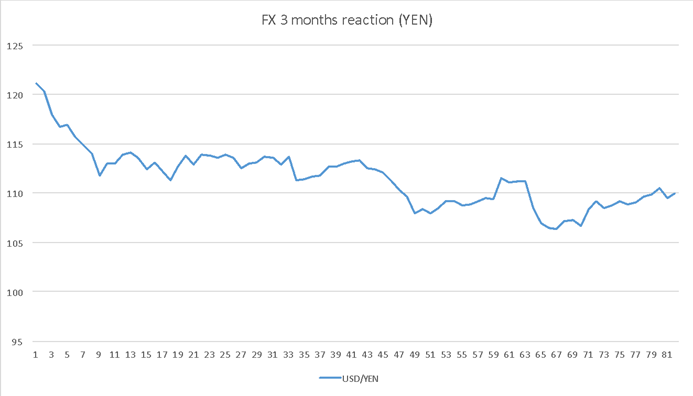

As illustrated above, there is no clear sign of currency depreciation when interest rates go negative. This should imply a decrease in inflation expectations. Christensen and Spiegel (2019) assessed the impact of monetary policy changes using the information contained in nominal and inflation-adjusted, or real, Japanese government bond yields. This market is the second-largest bond market in the world — surpassed only by the U.S. Treasury market in terms of size and liquidity. It therefore can be used to accurately gauge market expectations from financial data.

From the announcement of negative rates on 29th January 2016, the graph above shows a downward trend. Market-based estimates (break-even inflation rate, inflation risk premium, CPI…) imply that negative rates policy actually contributed to a decline in inflation expectations.

Why have market participants reacted in such a way?

- Initially, negative rates were not seen as stimulatory because they were interpreted as a tax on the banking system and potentially able to restrict the provision of credit.

- A move into negative rate territory was indicative that the central bank had a pessimistic view for the outlook for economic growth.

However, reading the previous BSIC article on NIRP, we can see how financial institutions, at least in the Euro area, were able to pass negative rates on deposits (mainly to corporations) and increase the provision of credit from 2015 onwards.

Financials

Negative interest rates impact banks’ profitability in many different ways. Net Interest Income is reduced but credit quality of loans portfolio improves, while values of assets held by banks rise. So what? Should we invest in financial institutions or avoid them?

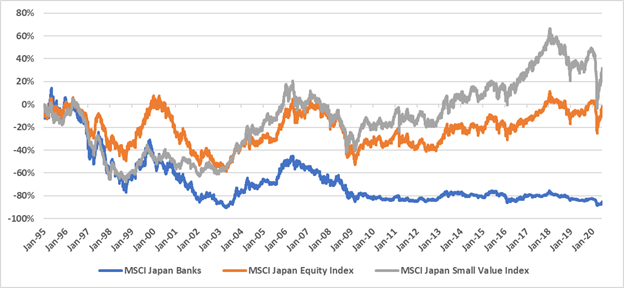

One thing we can expect is that low interest rates, even if not negative, will remain in the short to medium term. To support our investment decision process, we look once again at Japan, where low interest rates policy has been in place for 20 years.

Ouch! Investing in Japanese financial institutions would have been extremely painful, with losses reaching minus 80%.

Listed Equities

A clear effect of negative interest rates on corporations is that parking cash now has a cost. What are companies doing with that extra cash?

Japanese firms have accumulated cash reserves, with 53% of companies in the Topix having Net Cash on their books (the same figure is 14% for S&P 500). Share buybacks activity also increased, going from ¥2 trillion in 2013 to ¥6 trillion in 2019. However, that cannot be mainly attributed to NIRP, as BOJ announced negative rates in January 2016. The real driver seems to be changes in corporate governance adopted by Japanese firms. Furthermore, capital investment by Japanese remained sluggish over the last decade.

European companies have followed a similar path. Cash holdings increased at non-financial firms, even though there is more dispersion, with the top ten companies accounting for a quarter of the total cash reserves (mainly energy companies such as Shell, EDF…). Share buybacks rose but not as much as in Japan.

To conclude, we can say there is no clear evidence that negative interest rates push companies to significantly reduce capital investments and increase share buyback activity massively. Capital expenditure remains flat as growth does not pick up, especially in Japan and Europe. Low or negative interest rates are more of a consequence rather than a cause of the problem.

Negative rates, or low rates in general, shape another market theme related to equities: the divergence between growth and value stocks. Using the discounted cash flow (DCF) method to value growth stocks, as r (discount rate) and g (long term growth rate) converge, the TV (terminal value) grows dramatically not only in value but also in weight compared to the first 10-year cash flows. However, investors must recognize that 100% of the company’s value is based on far-off speculation 10+ years in the future.

Government Bonds

When it comes to govies, a surprising case study looks at how Japanese government bonds have fared since ZIRP was implemented in February 1999. As it has been extensively written and said during the past years, heavy-bond portfolios are seen to be losing their golden touch of diversification and returns should be expected to be meager. “Upside is limited, and downside risks are excessive” chants the reports willing to screw the typical 60/40 portfolio. However, a thorough historical analysis on the case, conducted by Verdad Advisers, wants to have the upper hand. For instance, if you invested ¥100 in the Japanese bond market in 1995 you would now have about ¥187, outstripping the return in the respective equity market which sits at ¥105. Even though yields were low, the upward slope of Japan’s bond yield curve offered the opportunity for capital gains through “roll-down”, which involves buying and holding a bond for a period of time and then closing the position before it gets to maturity. Despite frequent concerns over Japan’s debt/GDP levels and bond yields starting at 1.4%, Japanese bonds returned 1–2% over the period with almost no volatility, negative correlation to equities, and a Sharpe Ratio greater than one. The same allocation strategy could be played today, investing in countries where there is a steep yield curve, meaning that short term rates are negative but positive in the long term.

Corporate Bonds

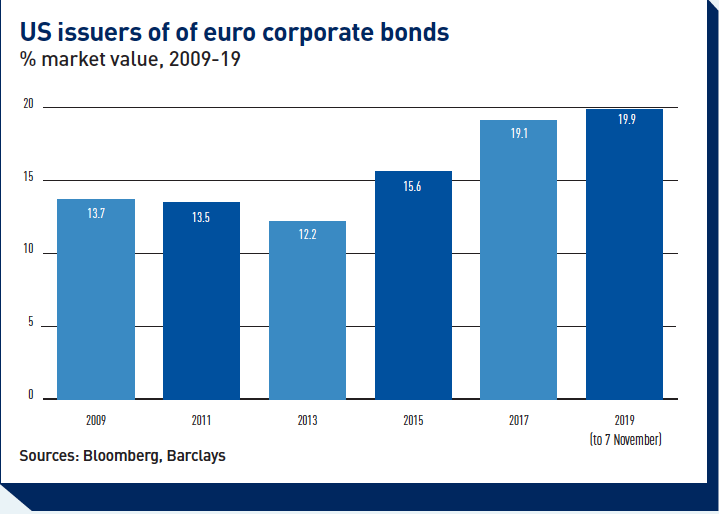

Besides the benefit that low rates have given to corporations to stay afloat during the COVID-19 pandemic, we should be inching closer to the scene of the deed: what do we mean by corporate bonds giving negative yields? While it is enticing to generalize and give a grim outlook of an upside-down world, most such cases have been encountered in Europe recently. The most notable “culprits” have been the diligent companies in the investment grade rating, namely Siemens, LVMH and Dassault Systèmes. The pharmaceutical sector has been particularly prevalent with Sanofi, the champion of negative-yielding issuances, and GSK also issuing a negative-yielding euro-denominated bond. This begs immediately a trading idea that can be suggested to exploit the facets of globalization. Did it not come to your mind? Most probably, it is because you are not the manager of a large multinational company. In a setting that reminds the USD/JPY carry trades of the last decades, many American companies are exploiting the interest rate asymmetries by issuing “Reverse Yankee” bonds – i.e. Euro-denominated bonds issued by US companies. It is somewhat puzzling that the issue has not been tackled by the regulator, since it appears a rare case of free lunch in the financial world:

- US companies can easily finance their EU operations and distort the coveted “level playing field” of politicians.

- They can swap the euro loans back to dollars and pocket a profit driven by the short-term borrowing rate differential between US and Europe.

- Some companies have been eligible for the ECB Corporate Sector Purchase Program (CSPP) if there were to be found European-based revenues.

Source: Bloomberg, Barclays

Last but not least, sometimes the issues of negative-yielding bonds get more down-to-Earth than a worrisome macroeconomic prediction. What is currently happening, for instance, with Floating-Rate Notes (FRN), whose value is linked to an index? Currently the six-month Euribor is sitting at -0.52%, therefore the note could deliver a negative coupon. These are unlikely to ever be imposed, though, as market infrastructure is not set up to collect coupon payments from multiple investors to an issuer.

The awkward spot is not unanimously resolved:

- Adding a “floor”, but the FRN would get more expensive for that protection-

- Issue “sinkable” FRNs such that negative coupons are netted with early maturity/redemption payments.

Not surprisingly, some governments and agencies have stopped issuing FRNs.

Alternative Investments

From one hand, bonds are failing to give decent real returns, while, on the other, equity valuations are raising some eyebrows for investors particularly concerned with their risk-adjusted returns. A good number of institutional investors such as pension funds, sovereign wealth funds, insurances have grown tired of wavering between the optimal portfolio of stocks and bonds and, instead, decided to opt for alternative investments: Infrastructure, Private Equity, Venture Capital and Hedge Funds. The path has already been carved out by university endowments, namely when David Swensen has ventured into these asset classes successfully as the manager of Yale’s endowment.

Low borrowing costs are particularly helpful in Private Equity activity to conduct Leverage Buyouts. According to PitchBook, for instance, Apollo’s assets under management increased by nearly $100 billion between the first and second quarters of 2020 largely because of insurance transactions executed by European insurer Athora and life insurance provider Athene, for which Apollo manages assets. However, there seems to be some trouble on the horizon as well. This can be observed from the fact that, despite a good level of capital raising, the level of “Dry Powder” – the amount of money that has not been invested – still has a generalized upward trend. This is probably due to the high valuation of stocks, which makes it difficult for PE firms to achieve the desired IRR from the investments.

This opens a very intriguing chapter for the future, regarding pension funds. Low returns have created a general mismatch between assets and liabilities of these firms. In the Netherlands, the Central Bank has estimated that each 1% fall in interest rates has led to roughly a 12% fall in the coverage ratio between assets and liabilities in pension pots. In Canada, meanwhile, the pension funds of Ontario and Quebec have just passed solvency reforms that give more leeway for alternative investments. Back to the Old Continent, 64 percent of plans across Europe were in negative cash flow territory in 2019 — there was more money going out to retirees than was coming in from investments and monthly contributions. And 91 percent of them are now forced to raid their capital base to bridge the gap, bearing a worrying resemblance to a Ponzi scheme.

Bibliography

Christensen, Jens H. E., and Mark M. Spiegel. 2019. “Assessing Abenomics: Evidence from Inflation-Indexed Japanese Government Bonds.” FRB San Francisco Working Paper 2019

0 Comments