Tesco plc (LSE: TSCO) – market cap as of 13th November 2020: €22.00bn

Charoen Pokphand Group Co. (Privately held) – estimated revenue in 2018: $63bn

Introduction

Early in 2020, Tesco solicited bids for its southeast Asian Operations. The British grocery chain was looking to simplify its business and to focus on its core market where it was facing increased competition from German discount chains such as Lidl and Aldi. The first round of bids was received on February 6th and it included all of the big Thai retail players––Charoen Pokphand (CP), Central Group, and TCC all submitted bids for Tesco’s operations. All three bidding companies are owned by Chinese-Thai business dynasties that had modest beginnings in Bangkok’s Chinatown.

After evaluating the bids, Tesco announced on March 9th that it would sell its nearly 2000 locations in Thailand and its 74 locations in Malaysia to Charoen Pokphand for $10.6bn in cash. For years, the Thai conglomerate had expressed its interest in buying the retailer’s operations. In 1997 at the peak of the Asian financial crisis the billionaire owner of CP was forced to sell the Lotus supermarket chain to Tesco for $180m to free up liquidity. Tesco has stated that it wants to use the proceeds to give a special payout to shareholders, to fund its pension liabilities, and to bolster its balance sheet to better face its competition in the UK.

It was clear from the beginning that any deal involving any of the existing big retail players would involve scrutiny from the regulator. After almost 7 months of evaluating the deal, on November 6th the Thai Office of Trade competition gave green light to the proposed merger. This marks the final exit from Asia for Tesco, which has been disposing of its Asian assets since 2015.

About Tesco plc

Tesco is a multinational grocery chain founded in 1919 and is the 9th largest retailer by revenue. The company is the leading supermarket brand in the UK with a market share of 28.4% and about 3430 locations. Tesco also has operations in central Europe and recently divested its operations in Asia. In addition to its grocery business, Tesco also operates Petrol stations and a retail bank. In 2019 its £64bn in revenues were split as follows: Retail UK and Ireland 70%, Retail Central Europe 8.5%, Retail Asia 8.5%, Fuel 11%, and Tesco Bank 2%.

The retailer is amid a turnaround that started after an accounting scandal in 2014. After inflating its profits, the company was fined by the regulator and it was forced to reshuffle its leadership team. This led to a net loss of £6.4bn in 2015. Since then Tesco has sought to improve its relations with suppliers, shareholders, and customers. Part of the turnaround plan is to focus on its core markets and to divest from Asia and some markets in Central Europe.

2020 marks the end of Tesco’s international ambitions with three major divestitures. Besides selling its assets in Thailand, it sold its joint venture in China for £275m to China Resources Holdings in February, and it sold most of its Polish operations to the Danish Selling Group in June for £181m. While its Thai stores were able to generate solid margins stronger than those in the UK, the Polish operations had been lossmaking for years––in 2019 the company lost £109m in Poland. This series of divestitures follows earlier exits from unprofitable markets, such as the US and Japan in 2013 and the sale of its profitable Korean business in 2015.

About Charoen Pokphand Group Co.

Charoen Pokphand Group (CP) is the largest privately-owned Thai company and it is an international conglomerate operating in over 21 countries. The company is controlled by the Chearavanont family, one of the big five Sino-Thai business families and in 2018 its revenues were estimated to be approximately $63bn. The company started as a poultry producer and was soon one of the major food producers in South East Asia. Today the conglomerate is divided into three main divisions––Food production (CP Foods), Retail (CP All), and telecommunications (True).

The retail growth in Thailand is driven by convenience stores and CP All is the franchise owner for 7-11 in Thailand. In 2019 it had over 11,700 locations in Thailand and CP All is already the largest grocery retailer in the country. The Tesco acquisition which includes 1600 convenience stores and 200 hypermarkets will further add to its massive size. The recent deal with Tesco follows the major acquisition of the Siam Makro plc in 2013 for $6.3bn that was made to consolidate the Makro Cash and Carry convenience stores into its retail network.

The retail market worldwide is one of the most important sectors of the global economy, representing 31% of global GDP, and continuously growing, registering a sale revenue of 24.78trn in 2019. Sales revenue are expected to lower to 23.36trn in 2020 but rebound in 2021 and 2022 at 25.04trn and 26.69trn respectively, overall, registering an average annual growth of about 6%. Its main driver of growth is the digitalization of the sector, allowing consumers to purchase through online and mobile solutions. In fact, the online retail market registered an average CAGR of 25-28% in the last 5 years. China accounted for 54.7% of the global online retailing, and the Asia-Pacific region hosts the 10 most fast-growing markets of the world, led by India and the Philippines.

Thailand’s economy is the 2nd largest in South East Asia, with annual growth rates moving around 3%. Its modernization is driven by Bangkok’s booming markets, where the retail market plays a significant role in attracting foreign retailers to invest in the country. In fact, the retail market growth is expected to reach $127.2bn by 2023 with a CAGR of 5.3%, exceeding the country’s industries average. The market is moderately fragmented, major players are The Mall Group, 7-Eleven (CP), Tesco Lotus, Unilever, and FamilyMart.

Online shopping is the major driver for the industry growth as access to mobile devices is still novel and fast-growing in the younger generations, allowing a shift from traditional local store shopping to more modern online solutions. Currently, Thailand’s online commercial retail market is ranked in the top 10 globally in size, as 13.1m users purchased online in 2019, expecting the number to grow to 13.5m in 2020 and 13.9 in 2021 according to Statista. Users in the age brackets between 16-24 and 25-34 account for 3.9 m and 4.4 m, respectively, making up two thirds the total number of online shoppers. Despite the number of users growing, also the average online retail spending per head is increasing, expecting a Thai consumer to spend $382 per year in 2021, 57% more than the average for 2017.

The Covid-19 pandemic has also played a major role in determining the industry’s future. In fact, due to the halt in international movement in 2020, the lack of tourism in Thailand caused, in the first quarter, a 5-10% contraction in the retail industry. The persisting spread in the US and a severe second wave in Europe is decimating the hopes of an eventual rebound of tourism in Thailand, as new lockdown restrictions prevent travelling. The only possible positive effect of the pandemic is the incentive for retailers to keep improving their online services as consumers who prefer staying home or avoiding crowded areas will be more likely to shift consuming habits to the most convenient online store.

Deal Structure

The bid for Tesco’s operations in South-East Asia (including the Lotus chain) in March 2020 saw Charoen Pokphand Group (CP), a local family conglomerate, coming out on top offering £8.2bn (about $10.6bn). The recently approved takeover will be Thailand’s biggest M&A deal to date, making CP the most powerful retailer in the country and marking the end of Tesco’s presence in Asia.

The Lotus chain was forcibly sold by CP to Tesco in 1998 for $180m after the Asian Crisis. Ever since, CP’s leaders wanted to see their business coming back home. Despite the higher price, CP is now welcoming over 2,000 supermarkets in Thailand and 74 in Malaysia, beating the bids of their rivals TCC Group and Central Group.

The Thai Office of Trade Competition Commission’s approval doesn’t come alone, but with noticeable conditions as the commission saw a potential threat to market competition. These include a ban on mergers between CP All retail unit and Tesco for a duration of 3 years. Also, CP’s other retail businesses will not be able to share supplier and price information and Tesco will need to keep existing commercial terms with its producers and distributors for the next 2 years as long as eventual changes don’t benefit the suppliers. Nor CP nor Tesco made any comments on these conditions.

The transaction involving different CP Group sub-entities will pay $10.6bn on a cash and debt-free basis, $9.9bn for Tesco Thailand business and $0.7bn for Tesco Malaysia, awarding a 12.5 EV/EBITDA for the total operations sold. Upon completion, Tesco pledged to redistribute $5bn of the return to its investors in form of a special dividend and to reduce its indebtedness using $2.5bn of the deal’s proceeds through a pension contribution.

Finally, the deal will be funded through CP’s available cash and a 12-18 months bridge loan of $7.5bn underwritten by JP Morgan, Siam Commercial Bank, and UBS. The transaction is expected to complete within the first half of 2022.

Deal Rationale

The acquisition of Tesco’s businesses in Thailand and Malaysia will allow CP Group to access a significant market of the convenience store and mini-mart format, creating Thailand’s modern trade champion and strengthening CP Group’s position in Malaysia. In the result of the acquisition, CP Group will achieve up to 75%+ of the modern trade market in Thailand and obtain a significant share of the fastest-growing convenience segment of the mass retail sector with 12,500 stores under management.

Taking into consideration that CP Group was a major supplier to Tesco’s Thailand’s and Malaysian businesses, acquisition synergies will be supported by the vertical compatibility of businesses. Both vertical compatibility and market dominance in Thailand will allow CP Group to further explore offline retail innovations within the modern trade sector. Overall, the deal supports the current trend in Thailand’s growing modern trade sector, dominated by conglomerates, with a focus by key players on developing extensive distribution networks supported by internal supply. Further control over the business process will provide greater flexibility to store formats, size and product range resulting in greater ability to meet customer needs in the face of broad consumer trends of diversification and sophistication.

Much as the deal is synergetic for CP Group, there also exist behaviorally biased reasons for the acquisition. Closing the deal will mark a symbolic victory for the family-controlled CP Group and especially its 81-year-old senior chairman Dhanim Chearavanont (Thailand’s 2nd richest man, after the Thai’s King), as CP Group will eventually reclaim the assets that Mr. Chearavanont was forced to sell to Tesco for $180m in 1998, due to the Asian financial crisis. In total three Thai’s wealthiest family-owned conglomerates were bidding for Tesco’s assets (CP Group, TCC group and Central Group), with the auction being initially triggered by Central Group approaching Tesco. However, taking into consideration clear synergies as well as “personal interest”, CP Group offered the most compelling value resulting in business valuation of 12.5x EV/EBITDA (FY2019 basis), which was considered by Tesco’s management a very attractive valuation and presented a higher value than could be achieved by continuing ownership. Finally, CP Group could be considered the most favorable bidder for Tesco not only due to lucrative valuation offered, but also due to CP Group being one of the core stakeholders (supplier) and having significant strategic influence over Tesco’s operations in Thailand.

As for Tesco, the deal marks the final exit from the Asian market and final stage of its turnaround plan following massive losses incurred in 2014 and accounting scandal resulting in the wipeout of over 25% of Tesco’s market cap, one-off write-down of assets by over £4.5bn and substantial fines. For H1 2014 Tesco overstated its profit prediction by £250-263m (~31% from the actual result) due to aggressive accounting policies applied in relation to transactions with suppliers when expenditure on costs associated with the deals was delayed, resulting in artificial inflation of profit. Application of inconvenient accounting practices was potentially forced by Tesco seeing its dominant market position in the UK grocery sector come under threat from discounter rivals with a substantial decline of the market cap during H1 2014 (decline by £3.6bn, 13.5%) caused by growing profit pressure and worsening financial performance, that peaked after the announcement of Tesco’s first profit drop in profit (FY 2013, FY 2014) in two decades. Eventually, rather than address the underlying operational problems and fix the declining profit problem, Tesco pushed up its numbers to make things appear healthier than they actually were and demonstrate profit improvement in short-term. The scandal highlighted the core issues of being a publicly traded company with a focus on short-term results. In the result of the scandal, Tesco formed a turnaround plan that included exit from several markets and launched a series of divestments in 2015, taking the first steps of exiting the Asian market by divesting its South Korean HomePlus business.

Even though Tesco’s Asian operations comprised an important part of the business, with market-leading positions in Thailand and Malaysia, the valuation proposed by CP Group substantially exceeded the value that could be potentially realized from continued ownership of operations. Following the completion of the deal, Tesco plans to utilize proceeds from the deal by returning £5.0bn to its investors via a special dividend and using approx. £2.5bn to largely eliminate the deficit on the defined benefit pension scheme. The pension contribution will enable further de-risking of the scheme, eliminate current funding deficit, and will significantly reduce the prospect of having to make further deficit contributions in the future, resulting in the release of approx. £260m of annual FCF. Finally, Tesco reassured shareholders that after exiting Asia no review (in terms of asset divestiture) of European business will be held and even more focus will be paid to performance on the European market to further strengthen local positions.

Market Reaction

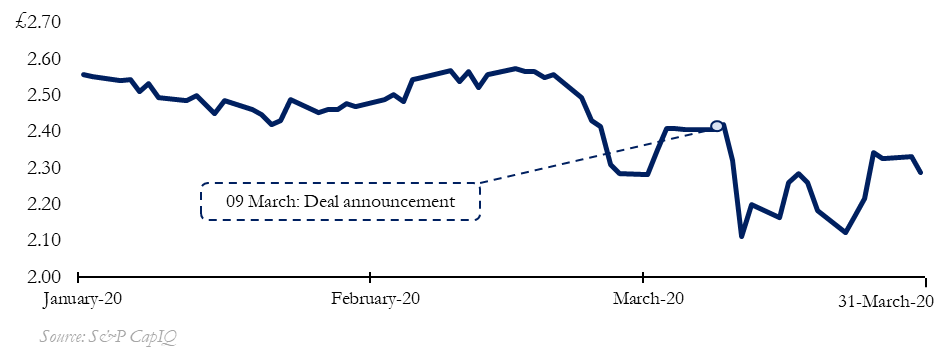

With the deal being initially announced on 9th of March 2020, the market lacked reaction with share price gaining 0.7% on 10th of March. However, in the following days the share price was negatively affected and fell in value by 4.1% on 11th of March and subsequently 9.0% on 12th of March, resulting in a total decrease of share price by 12.2% from the closing price of the announcement day. The lagging reaction of the market is rather surprising, however, there were no other significant events that could cause such a drop in the share price. For the rest of March 2020, the share price was relatively volatile, with improvement towards the mid/end of March. Though, it is hard to attribute further share price development to the deal effect solely, due to the bias caused by the start of the COVID-19 pandemic. Broker’s mean and median target prices were not affected by the deal announcement whatsoever, staying at the level of £2.72 and £2.78 respectively.

Financial Advisors

On the Tesco side, Greenhill & Co. and Goldman Sachs acted as Joint Financial Advisors with Barclays as a Joint Financial Advisor as well as Corporate Broker and Sponsor. CP Group was solely advised by JPMorgan Chase.

0 Comments