Renesas Electronics [TSE: 6723] – market cap as of 19/02/2021: ¥2.14tn

Dialog Semiconductor [FWB: DLG] – market cap as of 19/02/2021: €4.99bn

Introduction

Renesas Electronics has agreed to buy the Anglo-German Dialog for €4.9bn in an all-cash transaction. The offer priced Dialog at €67.50 per share, a 52% premium above the average company’s stock trading price registered in the previous three months. The transaction represents an important step for Renesas’ plan to expand its product portfolio, in order to achieve substantial strategic and financial benefits in the coming years. The deal has been unanimously approved by the boards of directors of both companies and is expected to close by the end of 2021. In a press release, Renesas communicated that the operation will deliver earnings accretion and cost savings respectively as a result of cross-selling and operational efficiencies. Renesas’ revenues are expected to grow by approximately $200m (¥21.0bn) whereas overall costs are expected to decrease by $125m (¥13.1bn).

About Renesas

Renesas Electronics is a Japanese semiconductor manufacturer with headquarters in Tokyo. Renesas Electronics was created in April 2010 after Renesas Technology and NEC Electronics merged. Renesas mainly focuses on the production of semiconductors for the automotive industry but still manufactures an extensive portfolio of microcontrollers, analog, power, and SoC products. In recent years Renesas has been investing aggressively to broaden its footprint beyond cars to areas such as data centers and consumer devices. In 2019 it bought Integrated Device Technology for $7.2bn, and in 2017 it bought for $3.2bn the chipmaker Intersil. The two acquisitions pushed the company to highly increase its net debt to 3.2x EBITDA. As of 2020, the company’s interest-bearing liabilities stood at ¥693.7bn, while total assets reached ¥1609bn.

In the last financial year, Renesas generated more than ¥715.7bn of revenues, with gross profit that reached ¥65.1bn resulting in a 9.1% marginality. Depreciation and Amortization topped ¥140bn while R&D expenses for FY 2020 amounted to ¥135.1bn.

About Dialog

Dialog Semiconductor is an American but UK-domiciled company that manufactures semiconductors. The company is headquartered in Reading and it went under the spotlight in 2007 when it became the exclusive supplier of power management integrated circuits (PMICs) for several Apple products. As of today, Apple comprises more than 70% of Dialog’s sales. The company is based on fabless manufacturing, a business model often used in the semiconductor industry. A company adopting a fabless system directly operates its sales and design departments while outsourcing the fabrication of devices to a specialized manufacturer (foundry).

Dialog Semiconductor was founded in 1985 as the European subsidiary of the U.S. International Microelectric group. After being acquired several times, the company was separated from Daimler AG and established as an independent firm in 1998. Dialog went public on the Frankfurt Stock Exchange in 1999. Throughout the last decade, Dialog has entered in 9 M&A transactions to strengthen the quality of its technology and the number of products offered. In 2020, Dialog acquired Adesto, a provider of embedded systems for the Industrial Internet of Things (IoT) and application-specific semiconductors, for $500m.

During the first three quarters of 2020, the company registered more than $937m of revenues, which decreased from the $1,185m of the first nine months of 2019. Overall, operating profit reached $51m, resulting in an 84% decrease from the $326.2m of 2019. The huge drop was mainly caused by a big decrease in revenues while expenses were constant in the period.

Industry Overview

Semiconductors have become a vital part of our daily life in recent years, as the technology sector grows more and more reliant on the industry and as demand for electronics rises. In essence, when we talk about semiconductors, one should picture chips: the chips in our mobile phones, computers, TVs, automobiles, and all the other advanced technology such as AI, VR, and Automotive Electronics that use them.

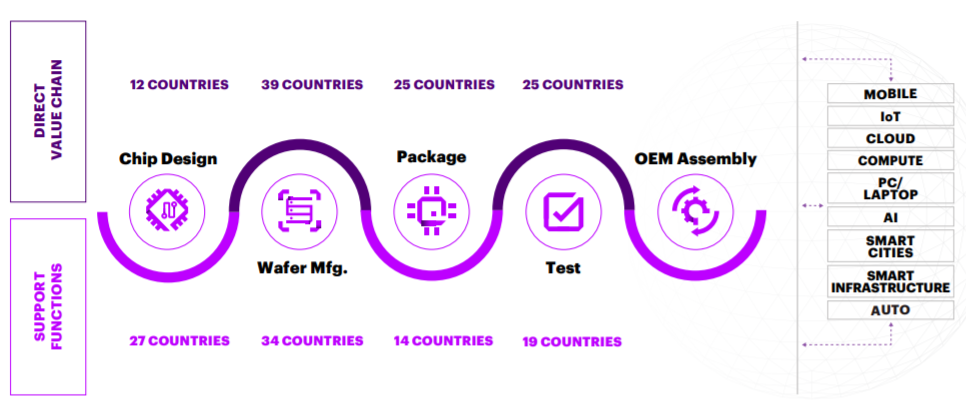

The semiconductor value chain is impressively long and saturated. According to research by Accenture and The Global Semiconductor Alliance (GSA), every segment of the value chain has on average 25 countries involved in the direct supply, and 23 countries in supporting market functions.

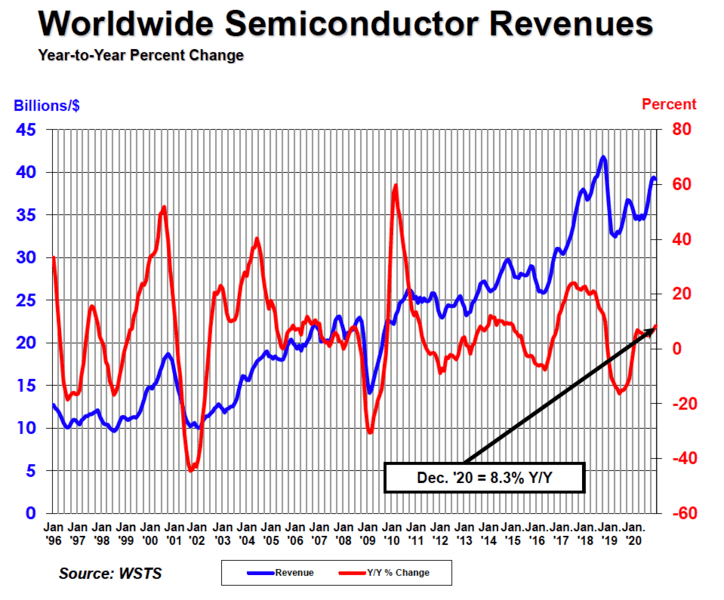

Despite a challenging macroeconomic environment due to the COVID-19 pandemic, sales in the industry witnessed a moderate uprise in the past year. For 2020, semiconductor sales accounted for $439bn, compared to $412.3bn in 2019, an increase of 6.5%. Q4 sales increased by 8.3% compared to Q4 2019, according to Semiconductor Industry Association (SIA) data.

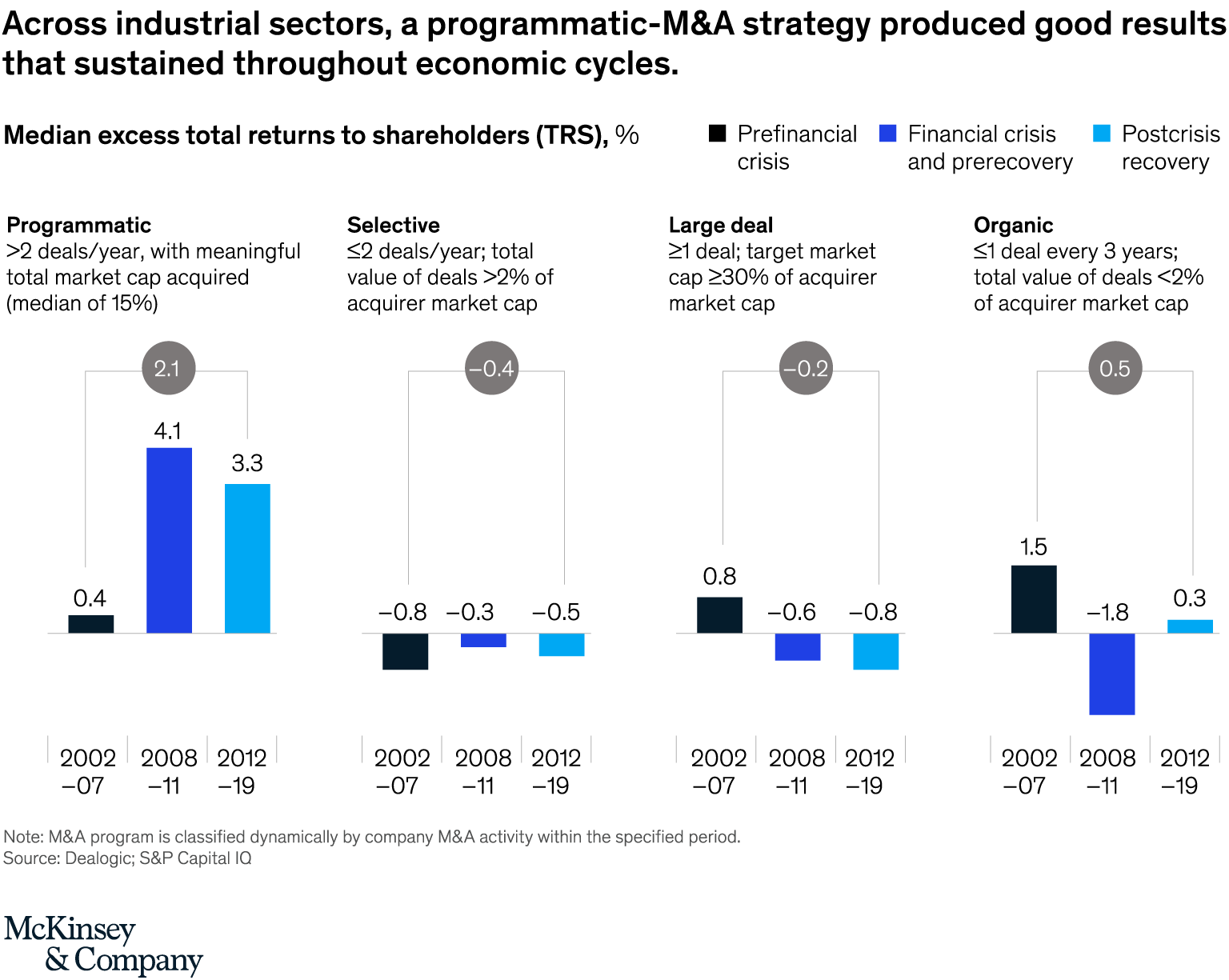

The ongoing trends in the industry include smaller and faster transistors, Asian dominance, national security concerns, and rapid consolidation as the pandemic continues, with more than $330bn in M&A deals from the past few years. Indeed, M&A activity has been intense recently, especially for some industrial companies. According to a McKinsey research, programmatic M&A, when a company makes more than two small or midsize deals within a year, with a meaningful market cap acquired, a median of 15%, was the most successful strategy, on average bringing more returns to shareholders than other approaches, with less risk and less volatility.

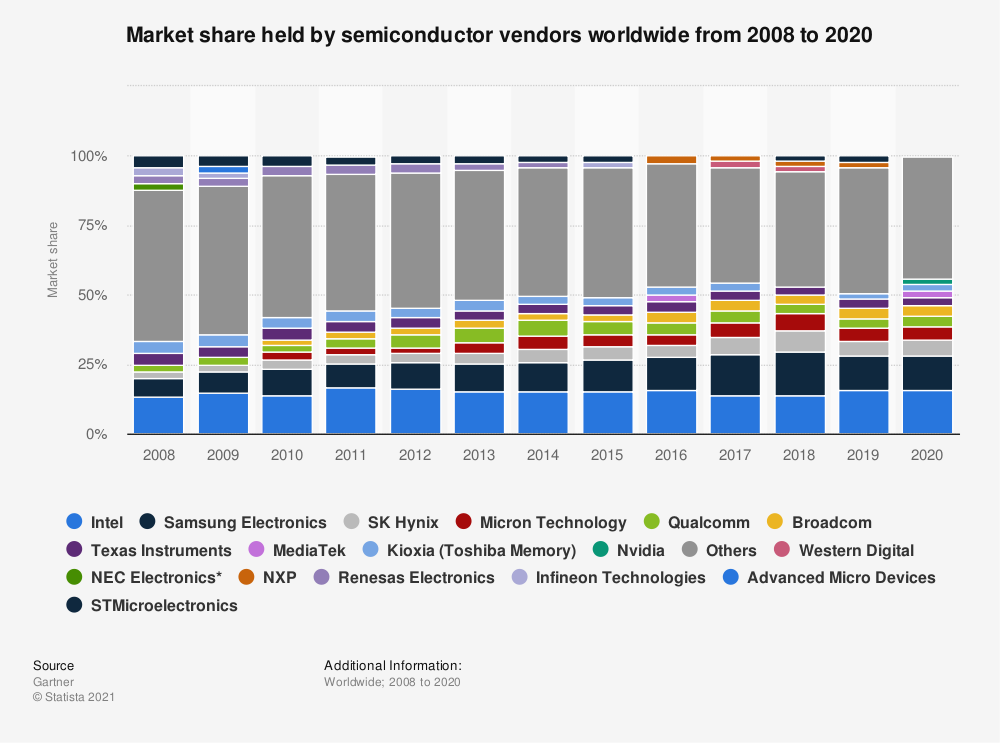

Further consolidation is expected at OEM (Original Equipment Manufacturers, such as Samsung Electronics, Huawei, and Xiaomi) and supply-chain levels to reduce costs, strengthen supply chains, thus gaining competitive advantage. Other expected developments within the industry include divestment of unprofitable business and locations, expansion into new products and services, such as maintenance and repair and the parts business, further digitalisation (implementation of data analytics to improve customer experience) and more sustainability.

Source: Accenture

Source: World Semiconductor Trade Statistics organization

Source: Gartner

Deal structure

The €4.9bn (¥615.7bn) deal for the acquisition of Dialog (Anglo-German semiconductor specialist) is set to be all-cash, at €67.50 per share, a 20% premium on Dialog’s €56.12 closing price on Feb 5th, 2021. Renesas is planning to fund the transaction through bank loans of approx. ¥735.4bn and through a stock issuance.

The deal is expected to close by the end of calendar 2021. It will be structured as a court-approved scheme of arrangement under the UK Companies Act from 2006. Regulators and Dialog shareholders shall approve the completion of the transaction.

Deal Rationale

At no surprise, Renesas and Dialog had existing collaborations since August to join forces on developing automotive computing platforms. However, their alliance weakened soon as disruptions in semiconductors production forced car companies to decrease production. As a result, new forms of strategic alliances were made. According to Renesas, the acquiring entity, the deal is only a part of the long-term growth plan they have been working on with other previous acquisitions such as Intersil Corporation and Integrated Device Technology Inc., which has the aim of accelerating innovation. In fact, disclosing the details of the deal, Renesas also declared to the market its strategic and financial rationale, which consists in getting access to greater growth opportunities mainly in the targeted IoT (Internet of Things), industrial, and automotive industries, all central players of today’s highly connected world. Their rationale is summarised in four key points:

- Make use of Dialog’s low-power technologies to competitively enrich their IoT sector. Dialog’s low-power connectivity and mixed-signal technologies are complementary to Renesas’ highly developed power-management solutions. Their combination could significantly enhance the efficacy, market competitiveness, and value of Renesas’ IoT products, which are applied in automotive, wearables, medical, smart home and more connectivity technologies, allowing for great market advantage.

- Differentiation in key high-growth sectors: automotive, industrial infrastructure, and IoT. Renesas doesn’t only want to improve its existing products, but it also sees the acquisition as an opportunity to develop new products, increasing its market share in highly paced industries. In industrial infrastructure, Renesas plans to develop better IoT applications for smart home and building automation than the ones currently available on the market. As for the automotive industry, which is currently projected to revolutionise within the next ten to twenty years, the company mentioned to be looking into security connectivity applications.

- Enhancement of internal business features. Despite looking into improving and creating products, Renesas believes the acquisition of Dialog to bring in some key features that could expand the business, on one side, by bringing in the diverse and distinctive technology-specific talents and its robust R&D, and on the other side, by exploiting Dialog’s existing geographic presence and relationships with the world’s largest clients.

- Earnings accrual and cost-cutting. Finally, Renesas predicts that within 3 years upon closure of the acquisition, they will be able to cut non-GAAP $125m in operating costs through integrated efficiencies, and within 4 to 5 years, to increment non-GAAP operating income by approximately $250m. In addition to this, the company expects instant 0.6 percentage points increase in gross margins and a 0.4 percentage points rise in core earnings.

Market Reaction

The market had contrasting reactions for the two companies. In respect to Renesas, the market reacted negatively, with its shares falling 6.9%, but then closing the day at -3.9%. This outcome can be explained by investors’ concern that Renesas will accumulate too much debt to finance the deal. Renesas’ CEO, Hidetoshi Shibata, said that the leverage ratio will, in fact, increase to 3.5 times core earnings, but is expected to fall back at 1 within the next two years. As for Dialog, the market reaction was very positive, shooting its shares up by 16% to approximately €65 and remaining in the whereabouts ever since.

Advisors

Renesas was financially advised by Nomura International Plc. On the other side, J.P. Morgan and Qatalyst Partners were Dialog’s financial advisors.

0 Comments