Introduction

Renewable energies are derived from natural resources that can be replenished faster than they are consumed. They are considered renewable sources, also known as clean energy, as they produce minimal greenhouse gases, as well as emit low levels of pollution. Today, the main renewable energy sources are wind, solar, hydroelectric, bioenergy, geothermal, and hydrogen, among others.

While renewables are believed to be a modern development, they date back to 3200 BC. Reports show that ancient Egyptians harnessed wind to sail up the Nile, and by 200 BC, windmills appeared in China and the Middle East. Then, Romans were known for using solar and geothermal energy to heat their homes and baths, while Greeks used hydropower to grind wheat into flour. Hydropower went on to become the most important source of energy in the medieval world. Later on, by the 19th century, when electricity was discovered, scientists began developing ways to generate electricity using renewables. Nonetheless, the rise of the Industrial Revolution, which brought energy sources as coal, led to a decline in the nascent renewable efforts. Fossil fuels then went on to dominate the world’s energy supply, maintaining their leadership today. Nonetheless, since the late 20th century, the green transition began as the world became more aware of the climate crisis and the potential economic advantages of renewables.

Global renewable electricity is expected to grow to over 17,000 terawatt-hours (TWh) by 2030, a ~90% increase from 2023. Moreover, several milestones are expected to be reached over the next few years. By 2025, renewable electricity is set to overtake coal, by 2026 wind and solar energy are each expected to surpass power generation from nuclear energy, and by 2029 solar energy is expected to surpass hydropower, becoming the largest and most important energy source.

Wind Energy

Wind energy has become one of the fastest growing and most mature forms of renewable energy. According to the Global Wind Energy Council, 2024 was the wind industry’s best year so far with 117GW of new wind power capacity added to the global grid. This brings the total installed wind capacity to 1,136GW, an increase of 11% from 2023. Wind generation has tripled since 2015, setting a new high of 2,494 Terawatt hours (TWh) in 2024. This figure is up 182TWh (+7.9%) from 2023.

Source: Global Wind Energy Council (GWEC), BSIC

Wind turbines generate power by converting the kinetic energy of moving air into electricity. Each turbine has three propeller-like blades attached to a hub on top of a tall tower; as wind blows, it creates lift on the blades and causes the rotor to spin. The rotor drives a low-speed shaft into a gearbox and generator, producing alternating-current (AC) electricity. A useful metric is the capacity factor: the ratio of a turbine’s actual energy output to what it could produce at full power. Modern onshore turbines typically have capacity factors of around 30–40%.

There are two main types of wind farms: offshore and onshore. Offshore wind farms are built in bodies of water, often several kilometres from shore. Offshore wind taps stronger, more consistent winds than onshore, boosting each turbine’s productivity. It also has fewer visual or noise impacts on people. However, offshore turbines require special foundations (or floating platforms) and are much more expensive and complex to install and maintain.

By contrast, onshore wind is cheaper to build and makes up the majority of current capacity. Onshore wind must contend with weaker or more variable winds and faces land-use and community constraints: turbines need open land and may create disturbances due to their appearance and sound.

Wind energy has many benefits, the most obvious of which is its clean and renewable nature—it emits no air pollutants during operation, and wind is an abundant resource. Furthermore, advances in turbine design have driven down costs, and wind energy has become one of the most affordable sources of renewable energy. Onshore wind now produces some of the cheapest power ($30–40/MWh), and costs continue to decline with larger turbines and more experience.

Despite the benefits that come with wind power, there are multiple challenges that must be navigated. The main downside of wind power is that wind is a variable resource (i.e. wind turbines only generate power when wind is blowing). This leads to power fluctuations and the need for backup generation and energy storage to ensure reliability. Furthermore, optimal wind sites are often isolated and far out from large population centres—wind farms require extensive transmission lines to transmit power to cities.

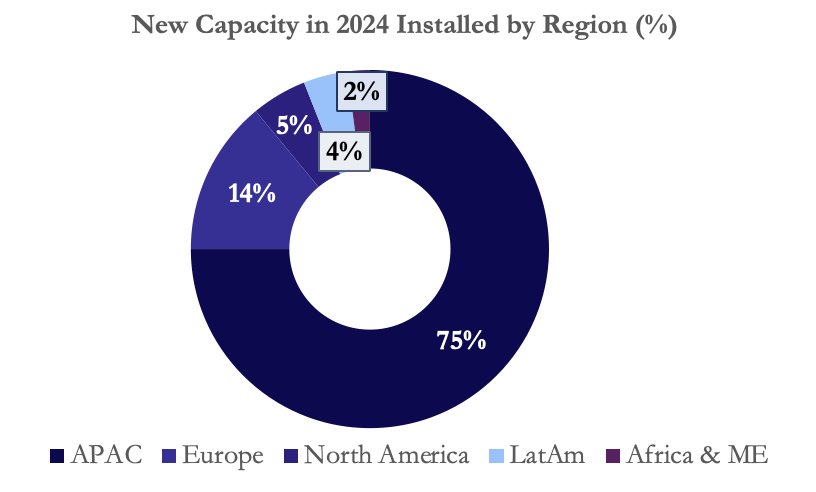

By country, China is by far the largest wind energy producer—it accounted for about 68% of the 117GW of new wind power capacity installed in 2024. This explosive growth in China, along with a steady recovery of installations in India, solidified Asia Pacific as the leading region for wind power development in 2024 with a market share of 75% (7% YoY growth).

Europe is the second-largest wind market, installing 16.4GW of new wind capacity in 2024, of which 84% was built onshore. Europe now has 285GW of wind power capacity, a figure that is expected to grow by 187GW between 2025 and 2030. The EU-27 is expected to install 140 GW of this—an average of 23GW per year.

Source: Global Wind Energy Council (GWEC), BSIC

Most of the top turbine suppliers are Chinese. According to BloombergNEF, the 2024 leaders were Goldwind (China) with 19.3GW installed, Envision (China) with 14.5GW, Windey (China) 12.5GW, and Mingyang (China) 12.2GW. The Danish company Vestas [CPH: VWS] was the largest European player with around 10GW installed in 2024.

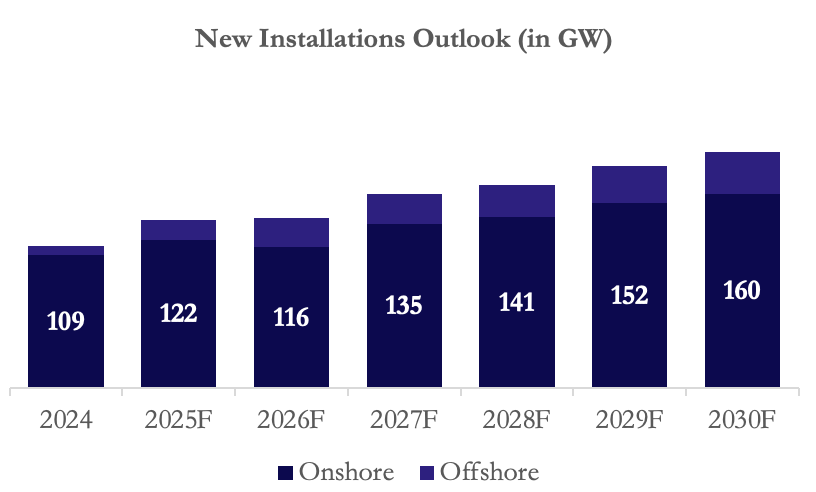

Despite growing uncertainty in the global energy markets, there remains an optimistic and confident outlook for the long-term growth of the wind energy sector. The GWEC expects new installations to surpass the previous record set in 2024, and forecasts project a total of 982GW of new capacity will be added between 2025 and 2030. This anticipated growth translates to a projected compound annual growth rate (CAGR) of 8.8% for the 2025-2030 period.

Key factors driving this positive outlook include Europe’s acceleration of renewables development for energy security, the US need for more power generation capacity to support advancements in manufacturing, and AI and maintained commitments to offshore wind development. Growth in emerging markets in regions like Southeast Asia, the Middle East, and Africa is also expected to gain momentum with anticipated record installations annually between 2025–2030.

Source: Global Wind Energy Council (GWEC)

Onshore wind shows a CAGR of 6.6% for the period 2025-2030. An expected average of 138GW of onshore wind capacity will be added annually, resulting in a total of 827 GW added over the six-year period. China and Europe are expected to remain the backbone of global onshore wind development, collectively accounting for 73% of the total capacity built from 2025 to 2030. China is anticipated to be the primary growth engine in the near term, contributing 66% of total installations in 2025. However, by the end of the decade, the global onshore wind market is projected to become more diversified, with roughly half of the annual growth originating from markets outside of China.

The outlook for offshore wind anticipates a much steeper growth rate with a CAGR of 27% for the 2025-2030 period. This growth is expected to lead to a quadrupling of annual offshore wind additions by 2030 compared to 2024 levels. China and Europe are expected to dominate growth in the near term, holding an 87% global market share in 2025. However, offshore wind deployment is projected to pick up momentum in the US from 2026 and in Asia Pacific’s emerging markets from 2028. The forecast predicts an average of 26GW of offshore wind capacity will be added annually, totalling 156GW worldwide between 2025 and 2030.

Yet, the recent accession of Donald Trump as US President may diminish the confidence that analysts have in the wind energy sector’s future growth. Wood Mackenzie, a prominent energy research firm slashed its five-year

outlook for new US wind projects by 40% in April 2025. Originally, Wood Mackenzie had forecast installations of 75.8GW but—due to ongoing uncertainty surrounding future US wind policy and President Trump’s January order to pause new federal wind leasing and permitting—slashed expectations to only 45.1GW of installations through 2029.

Solar Energy

Solar energy is a key renewable that harnesses sunlight to produce electricity or heat. The two main technologies that convert sunlight into energy are photovoltaic (PV) systems, which convert light directly into electricity using semiconductor cells, and concentrated solar power (CSP) systems, which use mirrors to focus sunlight into heat, which spins the turbines.

The main applications of solar energy include residential and commercial rooftops, ground-mounted solar farms, and floating solar systems. For residential and commercial rooftops, individuals and businesses install photovoltaic panels, which help them with their energy demands. Large solar farms install thousands of panels on racks which feed power directly into the grid. Floating solar consists of PV panels being mounted on floating platforms in typically calm sources of water, including lakes and reservoirs. Placing solar panels on water not only helps reduce the quantity of land being taken up but also means that the panels can be actively cooled by the water.

Solar energy produces zero emissions during use and is also an inexhaustible resource, meaning it can be consumed indefinitely without the risk of depletion. In addition, cost reductions over the last decade have made solar energy more price competitive with fossil fuels. Finally, increased solar energy production reduces the reliance on other countries for energy, an especially relevant factor today given the current geopolitical climate in Europe.

The main disadvantage of solar energy is that it is weather-dependent, relying on sunlight for energy generation. This can be extremely problematic for countries that do not receive frequent sunlight and means that a significant amount of battery storage is needed to help deal with cloudy days. Solar farms also require a lot of land, which can be extremely expensive, particularly in densely populated regions. Finally, solar panels use some scarce materials like silver and indium, requiring mining which can come with severe environmental consequences in the extraction process.

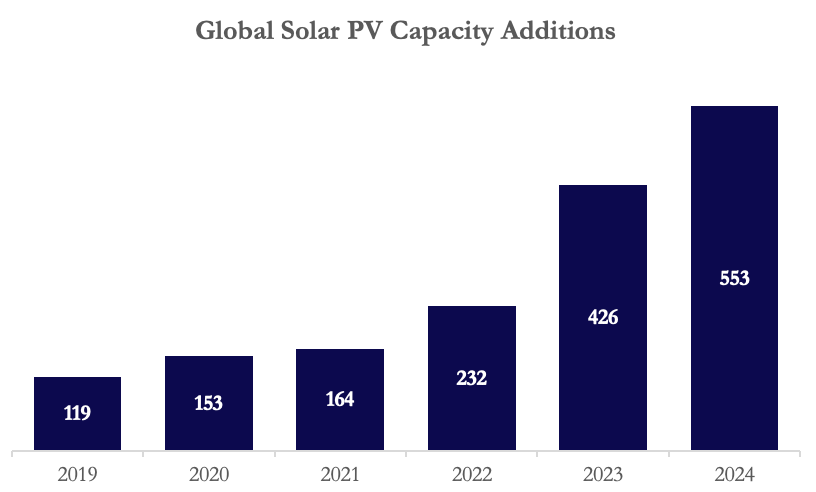

China is by far the world’s largest solar energy producer, with 610 GW of installed PV capacity. Other notable large producers include the US (139 GW), Japan (89 GW), and Germany (82 GW). While countries like Australia, Italy, and Spain don’t produce the most solar energy, proportionally solar energy accounts for a very significant amount of their country’s electricity. In Australia, solar energy already accounts for over 15% of electricity while in European countries like Italy and Spain the figure is 9-14%, highlighting the growing influence solar energy is having on global electricity generation. The graph below helps highlight how fast global solar capacity has grown over the last few years.

Source: IEA, BSIC

In the near future, solar energy is likely to struggle in the US due to Trump’s very anti-renewable stance on energy. Trump getting rid of the Inflation Reduction Act is also likely to curb solar energy growth in the near term as not many companies will be able to stomach the high fixed costs needed to get the technology off the ground. Furthermore, the ongoing trade war with China is likely to have an impact of solar energy as the majority of solar panels are produced in China.

However, in the longer term, the future is bright. Solar energy costs are likely to continue to fall, spurred by technological advancements and improved infrastructure, which will make solar panels even more competitive versus fossil fuels. The reduction in inflation and interest rates is also likely to provide a fertile ground for investment in solar energy technologies like PV cell efficiency, resulting in increased adoption of solar energy.

Hydroelectric Energy

The water-driven machine is an ancient invention: the waterwheel was the first application of power-driven machinery made by the Romans more than 2,000 years ago. After that, prior to the invention of electricity, wheel-powered machines had to be directly coupled to moving water by shafts or belts. As a result, factories were constructed next to rivers. The elevation difference is now the fundamental idea behind hydroelectric energy production, which transforms potential energy stored in water at height into mechanical energy via turbines and electrical energy. There are two main types of hydropower plants. The first is a run-of-the-river plant, which relies on the natural flow of the river and uses little or no stored water to generate electricity. Because it depends directly on river conditions, its power output can vary with seasonal changes in stream flow and weather patterns. The second type is a storage or reservoir plant, which provides a more consistent electricity supply. In this system, a dam is built across a river to create a reservoir, and the stored water acts like a battery, holding energy in reserve until it’s needed to produce power.

Hydropower is an affordable source of energy that costs less than most. States in the United States that rely primarily on moving water to generate their electricity, such as Idaho, Washington, and Oregon, have lower energy costs than the rest of the nation, demonstrating the affordability of hydropower. Compared to other electricity sources, hydropower also has relatively low costs throughout a full project lifetime in terms of maintenance, operations, and fuel. Like any major energy source, significant upfront costs are unavoidable, but hydropower’s longer lifespan spreads these costs out over time. Additionally, the equipment used at hydropower facilities often operates for longer periods without needing replacements or repairs, saving money in the long term. The installation costs for large hydropower facilities consist mostly of civil construction works (such as the building of the dams, tunnels, and other necessary infrastructure) and electromechanical equipment costs (electricity-generating machinery). Since hydropower is a site-specific technology, these costs can be minimised at the planning stage through proper selection of location and design. Furthermore, hydroelectric plants can provide power to the grid immediately, serving as a flexible and reliable form of backup power during major electricity outages or disruptions. Hydropower also produces several benefits outside of electricity generation, such as flood control, irrigation support, and water supply.

Despite the benefits of hydropower having been recognised and harnessed for thousands of years, there are some downsides. The first and most visible is that it could have significant environmental impacts, such as habitat disruption and fish migration issues. In addition to the already mentioned high upfront costs, there are long construction times, and this type of energy is vulnerable to droughts and climate change. The last disadvantage is the small but existing risk of catastrophic failure of the dams, which would cause massive downstream flooding, property and environmental damage, and deaths.

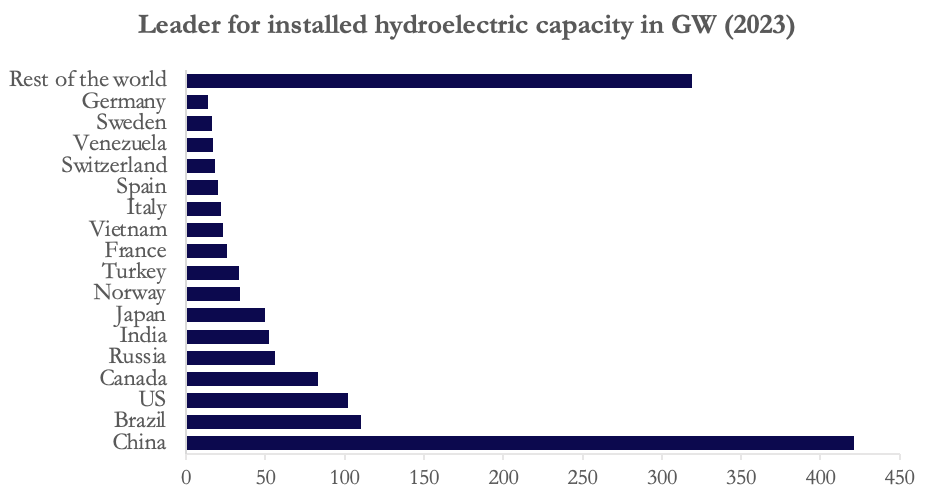

According to the International Energy Agency (IEA), global hydropower capacity exceeded 1,360 GW in 2023, representing ~16% of global electricity generation. It has, however, experienced a decrease of over 100 terawatt-hours (TWh)(-2%), bringing the total to around 4,250 TWh. The main reason for the downturn was the persistent drought conditions affecting the main producing countries, including China, Canada, the US, and India. Despite the challenges, China retains its position as the world’s largest producer, with 115bn kWH in May 2024, up from 82bn kHW the previous year. However, since most of the key locations have already been developed, there is little chance for further growth. Another major producer is Brazil, which depends heavily on hydroelectricity (~45% of the total supply). The US ranks among the top producers, accounting for 27% of total U.S. utility-scale renewable electricity generation and 5.86% of total U.S. utility-scale electricity generation, with 2,200 plants in operation.

Source: IEA, BSIC

Hydropower remains a cornerstone of renewable energy strategies, particularly in regions with abundant water resources. Although the newly installed capacity over the past five years is disappointing, mainly due to the slowdown in China, the IEA projects moderate growth through 2030, largely driven by emerging economies in Asia and Africa and by the more than 1,000 large hydroelectric projects in various stages of planning, preconstruction, and construction. The real challenge is to ensure that policies and market mechanisms are in place to make investing in sustainable hydropower attractive.

Bioenergy

A prominent strategic renewable resource is bioenergy, which comes from biomass, organic materials such as wood, agricultural residues, food waste and animal manure. These materials can be collected from sectors such as agriculture, forestry and waste treatment, and converted into useful energy in the form of heat, electricity or transport fuels. The conversion of biomass into energy can take place through different technological processes: direct combustion to produce heat or electricity, gasification in a low-oxygen environment to obtain a fuel gas, anaerobic digestion to produce biogas through the decomposition of organic waste by micro-organisms, or fermentation and transesterification, which respectively allow the production of bioethanol and biodiesel from vegetable sugars and oils.

One of the main advantages of bioenergy is its renewability and, under certain conditions, the possibility of being carbon neutral, since the 2 emitted during use is theoretically offset by that absorbed by plants during growth In addition, bioenergy can reduce waste through the exploitation of agricultural, food and industrial by-products, and is a versatile source capable of generating heat, electricity and liquid fuels. This flexibility makes it particularly useful for enhancing energy security and reducing dependence on fossil fuel imports.

However, bioenergy also has its challenges. The cultivation of crops dedicated to energy production can compete with food and generate conflicts in land use. Moreover, not all bioenergy systems are truly zero-impact, as land conversion, the use of fertilisers and industrial processes can generate significant greenhouse gas emissions. Biomass also has a lower energy content than fossil fuels, which means that more is needed to obtain the same energy Bioenergy has a lower energy density than oil—for example, bioethanol provides about 21.1 MJ/l, biodiesel 34.5 MJ/l, and biogas 23 MJ/m³, compared to crude oil which delivers around 42–45 MJ/kg, meaning nearly twice as much bioethanol or five times more biogas is needed to match the energy from the same amount of oil. Finally, the combustion of biomass can produce air pollutants, and the logistics associated with collection, transport and storage can be complex and costly. Bioenergy represents a stable, programmable, and potentially low-emission source, essential to complete the intermittent supply of solar and wind.

The world’s leading producers of bioenergy are the United States, which is a leader in the production of bioethanol from maize, and Brazil, which uses sugar cane in a highly efficient system. Followed by China, which is active in the biogas sector and in the exploitation of agricultural waste; Germany, a pioneer in the use of biomethane through anaerobic digestion; India, growing thanks to the exploitation of organic waste with advanced biomass district heating networks and second-generation biofuel production systems.

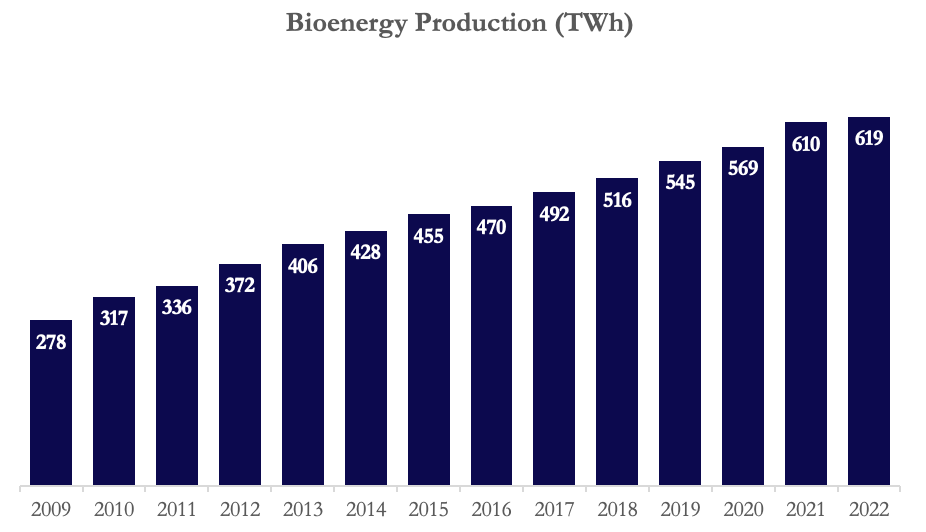

Source: Statista, BSIC

The bioenergy market is experiencing strong growth and is projected to expand significantly in the coming years. In 2024, the market was valued at $296.09 billion and is expected to grow to $323.44 billion in 2025, with a compound annual growth rate of 9.2%. By 2029, it is forecasted to reach $473.49 billion, growing at a CAGR of 10%. This growth is driven by increasing environmental awareness, concerns over fossil fuel dependency, energy security initiatives, and the growing use of agricultural and urban waste for energy production. Key trends include the transition to biorefineries, decentralised energy systems, the growing use of biofuels in transportation, and strong policy support with public-private partnerships. Technological innovation plays a central role, with

companies and start-ups introducing new products that promote sustainability and reduce carbon emissions. The market is segmented by type (biomass and municipal waste, biogas, liquid biofuels), technology (such as gasification and fermentation), and application (power, heat, transportation).

Geothermal Energy

Geothermal energy is a renewable source that uses heat from the earth’s interior to generate electricity and provide heating. This heat comes from the natural decay of radioactive elements and the residual heat of planet formation, which keeps the Earth’s core extremely warm. In areas where this geothermal heat is accessible near the surface which is usually close to tectonic plate boundaries, engineers can drill wells to reach underground hot water or steam reservoirs. The steam can then be channelled to turbines to generate electricity, while geothermal sources at lower temperatures can be used directly for district heating, greenhouses or building heating utilising geothermal heat pumps. In all these applications, the underlying idea is to transfer the Earth’s internal heat into a usable form of energy without burning fossil fuels.

The main advantage of geothermal energy is that it represents a constant and reliable source of energy, available 24 hours a day, 7 days a week, unlike other renewable sources such as wind or solar, which are intermittent. It also has a very low environmental footprint in terms of land use and emissions, making it a clean and sustainable choice. Once operational, a geothermal power plant provides energy at a relatively low cost over time and can last for decades if managed properly. By not requiring fuel, it reduces vulnerability to market fluctuations and supply disruptions.

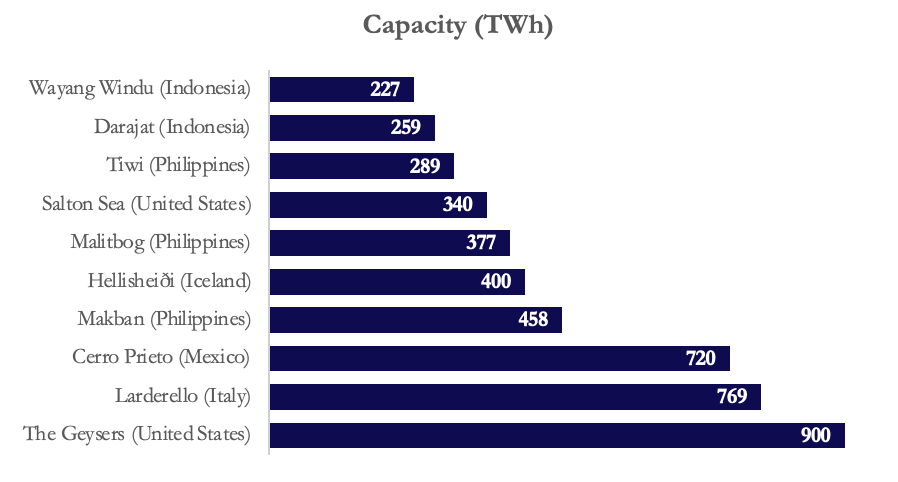

However, geothermal energy is not without its limitations. Its availability is geographically limited, as high efficiency geothermal power plants can only be built in regions with favourable geological conditions, such as Iceland, some areas of the USA, the Philippines or Italy. Initial costs for exploration and drilling are high, and development involves a financial risk if heat sources do not turn out to be as productive as expected. In addition, although emissions are low, there may be small releases of greenhouse gases such as 2 and methane from underground depths. In some cases, the extraction process can induce small earthquakes, known as induced seismicity, especially in advanced geothermal systems (EGS). Despite these challenges, geothermal energy remains one of the most stable and environmentally friendly sources available today.

Source: Statista, BSIC

Source: IRENA, BSIC

The future of geothermal energy is promising, especially as technological advances are reducing the risks associated with drilling and improving energy recovery through systems such as EGS. Global capacity is expected to grow steadily, particularly in developing economies with untapped geothermal potential (for example, in East Africa or South-East Asia). More and more countries are including geothermal energy in their climate neutral strategies, thanks to its reliability and the energy independence it can offer. In addition, international funding and innovation in subsoil mapping and closed-loop systems could allow geothermal to expand beyond traditionally favourable areas. According to the International Renewable Energy Agency, global geothermal capacity could double by 2030 if investment and development trends continue as planned.

Tidal Energy

Tidal energy represents a substantial untapped European energy resource. It is a renewable energy source that is predictable and reliable, as tides are generated through the gravitational coalescence of the Earth, Sun, and the Moon. The technology to capture tidal energy has shifted over time from large-scale “Tidal Barrages”, which exploit the rise and the fall of sea levels, to smaller devices that capture the kinetic energy of a tidal flow. The theoretical global tidal energy potential is estimated at over 1 TW, enough to meet 10-15% of the world’s energy demand if fully harnessed. How much of this energy will be utilised in the future, however, is a matter of great debate.

The system works through two main technologies: tidal stream systems and tidal range systems. The streams use underwater turbines placed in fast-flowing tidal currents, working in a similar way to wind turbines, while the ranges (such as tidal barrages) trap water in an estuary during high tide and release it through turbines during low tide. An advantage of both systems is the already mentioned predictability, with daily, bi-weekly, biannual and even annual cycles over a longer period of several years. Furthermore, energy can be generated both day and night, and the systems are hardly influenced by weather conditions, making energy generation more consistent than wind or solar. Additionally, tidal systems have a low visual impact as they are mainly submerged and don’t produce any gas emissions during operation.

Tidal energy still has different barriers to overcome. The installation costs of tidal barrages are great and the unit cost of electricity for tidal current devices is initially likely to be less competitive with more mature technologies such as wind. Thus, the tidal energy sector is reliant on government investment to remain solvent. Developing sites for tidal energy can also be decidedly difficult. The plain fact is that good sites are scarce, and therefore you have little choice but to meet the challenges presented to you by the site. This can include public opposition related to the potential disruption to marine life and sediment transport, but also several technical difficulties. In addition, equipment used to collect tidal energy is in contact with water, so maintenance is difficult due to corrosion.

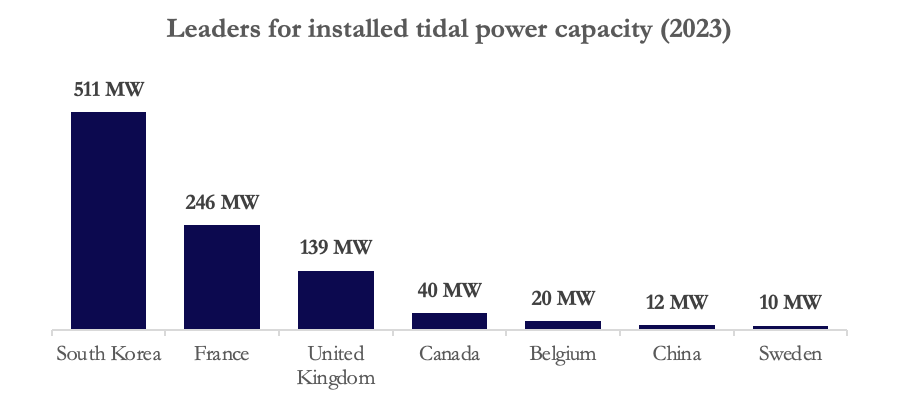

Even if tidal energy is not new, it has experienced a significant boom in recent years, when governments and businesses have begun to see its potential as a highly stable renewable solution. Over 40 tidal energy pilot projects are currently in development or testing stages worldwide, including in China, Canada, Chile, and Australia. The growth has been fuelled by a mix of factors: the increasing awareness of climate change, the need for clean energy, advances in technology that have reduced investment costs, government incentives and the need for energy independence in many regions. Many countries are betting heavily on this energy, including South Korea (511 MW), France (236 MW) and the United Kingdom (139 MW).

Source: IEA, BSIC

In 2011, South Korea inaugurated the world’s largest station in Sihwa (254 MW), which generates electricity for around 500,000 people and helps improve water quality in the lake located on the west coast of China by promoting water circulation. The second largest station is La Rance (France) which has a capacity of 240 MW and has been operational since 1966, proving long-term viability and remaining one of the most efficient plants in the world, covering around 0.12% of France’s electricity needs. The project MeyGen, located in Scotland, is one of the most advanced facilities in the world, featuring underwater turbines that generate energy thanks to the powerful currents of the Pentland Strait. Currently, it has a capacity of 6 MW but is expected to reach a capacity of 398 MW.

Despite the promise, tidal energy contributes only a small fraction to global energy production (<0.1% of global electricity as of 2023). However, the outlook remains cautiously optimistic. As technology improves and environmental concerns are better addressed, tidal energy has the potential to play a more significant role in the renewable energy mix, with the market projected to reach $1.3bn by 2030, growing at a CAGR of over 7% from 2023.

Hydrogen can be produced in several different ways and is typically classified by colour based on its carbon footprint. Gray hydrogen is made from fossil fuels without CO2 capture through steam methane reforming of natural gas or gasification of coal. Blue hydrogen is produced in the same way but includes carbon capture which can trap the majority of the CO2 emissions. Green hydrogen, on the other hand, is made through the electrolysis of water powered by renewables or nuclear energy, making it virtually carbon-free at the point of production.

While green hydrogen provides truly clean energy, it is very expensive in comparison to both blue and gray hydrogen with a price of $3-7/kg compared to $1.5-3/kg and $1-2/kg respectively, largely due to the cost of electrolysers and renewable capacity. It also requires significant renewable capacity to help power the electrolysis process. As a result of this, gray hydrogen currently dominates the amount of hydrogen produced, accounting for 99% of the 97 million tons of hydrogen produced every year.

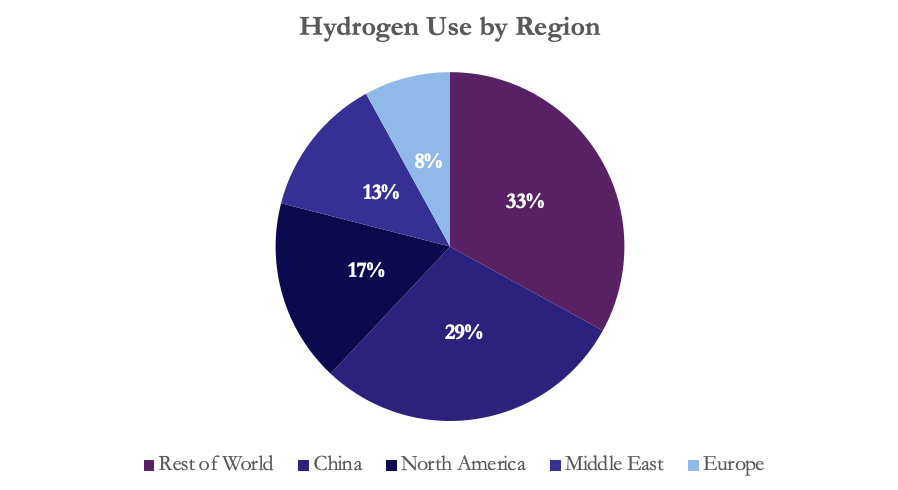

China, the United States, and Russia are the three biggest producers of hydrogen worldwide, accounting for 53% of global output. China alone produces over 30 million tons per year with the US producing around 10 million.

Other significant producers include the Netherlands, Germany, Belgium, France, and Canada who collectively make up another 37% of the production. China and the US are also the two countries that consume the most hydrogen. The graph below shows the different regions around the world that consume the most hydrogen.

Source: IEA, BSIC

Hydrogen is viewed as a key future decarbonization tool for certain industries. Hydrogen fuel cells are viewed as a viable solution for car engines as companies continue to look for alternatives to diesel and petrol-powered vehicles. Hyundai and Nikola, for example, have developed fuel-cell trucks, and several fuel-cell buses which are now in operation. Hydrogen is also being trialed in both shipping and aviation as an alternative, more sustainable fuel source.

Hydrogen’s use in industry for both refining and ammonia production is also likely to continue to increase as companies look to cut emissions further. The gray hydrogen which is currently being used in these processes is likely to be slowly phased out and replaced by blue and green hydrogen.

In addition, global hydrogen costs are falling rapidly due to economies of scale and electrolyser manufacturing capacity growing substantially. This is likely to make hydrogen an even more attractive alternative to fossil fuels from a price standpoint.

Finally, the European Union has aggressively supported hydrogen through research and project funding. This funding is likely to increase at an even faster rate as the EU looks to reduce its energy reliance on other countries, especially Russian gas.

Recent Deals

Brookfield’s Acquisition of Neoen SA for €9.2bn

In December 2024, Brookfield [NYSE: BN], a Canadian-based leading global alternative asset manager, took a majority stake of 53.12% in Neoen SA, a French renewable energy producer. In January 2025, Brookfield launched a mandatory public offering, raising its stake in Neoen to 97.73%. The deal closed in March 2025 at an agreed share price of €39.85 (26.9% premium), valuing Neoen at around €6.1bn in equity. The acquisition of Neoen represents a colossal addition to Brookfield Renewable’s already impressive renewables portfolio.

Neoen is an independent renewable energy developer headquartered in Paris, specialising in solar power, wind power, and storage. An international player, Neoen operates in 14 countries and has grown rapidly in strategic markets, attaining a total capacity in operation or under construction of 8.9GW, with a goal to reach over 10GW during the course of 2025. Recently, Neoen has displayed strong financial performance and generated revenues of €533.1m and an adjusted EBITDA of €479m.

Brookfield cited the deal as an opportunity to “accelerate Neoen’s development and strengthen its position as a global leader in renewable energy”. The acquisition gives Brookfield entry into Neoen’s high-growth markets, such as Australia and Europe, and adds Neoen’s large development pipeline to its portfolio. Through Brookfield Renewable Partners [NYSE: BEP], Brookfield runs one of the largest public renewable platforms of around 34 GW generating capacity with a portfolio spanning hydro, wind, and solar energy. Brookfield Renewables’ chief, Connor Teskey, noted that acquiring Neoen “strengthens Brookfield’s global scale, while diversifying into key renewables markets and adding expertise in battery storage technology”. The deal aligns Brookfield’s large global asset base with Neoen’s dynamic project platform, creating synergies in capital access and development execution.

Equinor’s acquisition of ~10% of Ørsted A/S for $2.3bn

In December 2024, Equinor ASA [NYSE: EQNR] completed its acquisition of 10% of outstanding voting shares in Ørsted A/S [CPH: ORSTED] for a volume-weighted average price of DKK 398.5 per share. Based on an exchange rate of 7.15 DKK/USD, the total consideration for the deal was $2.3bn. Through the acquisition, Equinor becomes Ørsted’s second-largest shareholder, behind the Danish state.

Equinor, a Norwegian energy company that has historically focused on oil and gas, is now aggressively expanding in renewables and low-carbon solutions. The company is Europe’s largest energy supplier and aims to become net-zero by 2050. In 2024, Equinor’s revenues amounted $103.8bn with a market cap of about $61.6bn. Ørsted is a Danish renewable energy firm and is the global leader in offshore wind power. It owns and operates around 10.4GW of renewable energy generation, mostly offshore wind, and has an offshore pipeline of 7GW.

The deal fits Equinor’s strategy of “value-driven growth in renewables”. Equinor described the investment as a “counter-cyclical investment in a leading developer, and a premium portfolio of operating offshore wind assets”. Anders Opedal, Equinor CEO, noted the stake “complements Equinor’s operated offshore wind portfolio of large projects under development,” giving Equinor exposure to Ørsted’s 10.4 GW of existing renewable capacity. The acquisition accelerates Equinor’s shift toward clean power, enlarges its European presence and ties its offshore-wind pipeline to Ørsted’s cash-generating assets.

Masdar’s acquisition of Terna Energy for €3.2bn

In November 2024, Masdar (Abu Dhabi Future Energy Company), the UAE’s renewable energy leader, successfully completed its acquisition of Terna Energy SA, a leading Greek renewables developer, for a price of €20 per share. The largest energy transaction in the history of the Athens Stock Exchange, the deal valued Terna at an enterprise value of €3.2bn.

Masdar, backed by Abu Dhabi National Oil Company (ADNOC) and private equity firm Mubadala, is one of the world’s fastest-growing renewable energy investors with projects across 40+ countries and over 31GW of capacity in operation or under construction. Terna Energy [Athens: TENERGY] holds the largest and most diversified portfolio in Greece, along with projects in Bulgaria and Poland. Terna operates clean energy projects across wind, solar, biomass and hydro technologies. As of 2024, the company operates a capacity of 1.2GW with a target of 6GW by 2029.

The acquisition reflects Masdar’s confidence in Terna’s impressive growth potential and is an important step in attaining Masdar’s goal of 100GW global capacity by 2030. In its press release, Masdar stated that the acquisition “supercharge[s] Terna Energy’s growth plans” and positions it as a core regional platform. Masdar bring substantial capital and know-how to help to Terna to reach its 2029 goal of 6GW. Furthermore, both firms’ committed vision and long-term capital unlock significant opportunities for further growth in Terna’s expansion.

Conclusion

Renewables are the future of energy. If the world wants to transform into a more sustainable and environmentally friendly place, help mitigate climate change, reduce air pollution, and improve public health, a change must happen now. Nonetheless, while the shift towards renewables is essential, it must be implemented carefully to avoid unintended consequences. Rapid and uncoordinated shifts can strain the energy grids, disrupting communities and leading to gaps in energy reliability. Strategic planning is crucial to ensure energy security and equitable access during the transition. Despite the existing, and growing challenges, the urgency of addressing climate change and reducing emissions makes this shit not only necessary, but inevitable.

0 Comments