Introduction

The landscape of weight loss medication is currently undergoing a significant transformation with the emergence of highly effective new drugs. These innovative pharmaceuticals are designed to aid individuals dealing with obesity in shedding substantial body weight, and their performance in clinical trials is exceptionally promising. A notable player in this field is Novo Nordisk [NOVO-B:CPH], a company at the forefront of combatting various chronic conditions, including diabetes. They have introduced Ozempic (semaglutide), a glucagon-like peptide-1 (GLP-1) agonist that replicates the effects of GLP-1, a gut hormone involved in blood glucose regulation, digestion, and appetite management. In a pivotal phase 3 study, individuals administered semaglutide at a daily dose of 50 mg experienced remarkable weight loss results, with up to 15% reduction in their initial body weight over a period of approximately 15 months. Furthermore, Novo Nordisk also manufactures Wegovy (semaglutide), an FDA-approved anti-obesity medication used for long-term weight management. Wegovy functions by regulating appetite and reducing calorie intake, leading to effective weight loss and aiding in weight management. It is prescribed for weight loss in obese adults and teenagers, as well as overweight adults with other weight-related medical concerns. Wegovy is administered via a subcutaneous injection once a week. Eli Lilly [NYSE: LLY], another prominent contender in the weight loss drug market, has introduced an experimental medication known as Retatrutide. This groundbreaking drug has demonstrated its potential by helping patients with obesity lose an impressive average of 24% of their body weight over a 48-week period, marking a substantial advancement in this emerging class of medications. While Retatrutide shares similar side effects with approved drugs in the same category, primarily of a gastrointestinal nature, its efficacy in promoting weight loss is indeed a remarkable achievement. In addition to these established players, there are several other noteworthy companies actively involved in the development of innovative treatments for obesity. These potential contenders include Pfizer Inc., Takeda Pharmaceutical Company, VIVUS Inc., Bayer AG, F Hoffmann-La Roche, GlaxoSmithKline, Arena Pharmaceuticals, and Eisai Co. Ltd. Their ongoing efforts hold the promise of shaping the future of the weight loss drug market significantly. These new-generation weight loss medications not only provide hope for individuals seeking effective weight loss solutions but are also reshaping our understanding of obesity and its treatment. The progress in this field is both exciting and transformative, offering a potential path to addressing the obesity epidemic more effectively.

History of Weight Loss Drugs

The evolution of weight loss drugs has been a fascinating journey, characterized by remarkable breakthroughs alongside significant failures. During the early stages, weight loss medications primarily consisted of stimulants like amphetamines. Their widespread use during the 1950s and 60s gradually waned due to their addictive properties and severe adverse effects. Another notorious instance from this period was the adoption of dinitrophenol, initially utilized in explosive production. Following observations of weight loss in workers exposed to it, it was marketed as an “anti-obesity therapy” in the 1930s. However, the detrimental health consequences associated with these early medications led to their eventual prohibition or removal from the market. The landscape of weight loss drugs witnessed a transformative shift in the early 2020s with the introduction of glucagon-like peptide-1 (GLP-1) agonists. Semaglutide, known under the brand names Ozempic and Wegovy, operates by imitating a hormone that regulates blood sugar levels and retards the rate at which food exits the stomach, imparting a prolonged feeling of fullness. The surge in demand for these weight loss drugs has increased multi-fold. In the last quarter of 2022 alone, U.S. healthcare providers wrote over nine million prescriptions for these obesity drugs. This surge in popularity has even sparked a wave of illegal sales. Projections indicate that by 2030, the global weight-loss drug market is anticipated to reach a staggering annual valuation of $77bn.

This surge in demand is attributable to several factors. First, the drugs have shown significant efficacy in weight loss and diabetes management. Second, the power of social media cannot be underestimated, with celebrities and influencers sharing their weight loss success stories. Lastly, insurance companies’ willingness to cover Wegovy prescriptions has certainly played a part. However, this high demand has led to supply constraints, making it difficult for some people to fill their prescriptions. In response, Novo Nordisk, the maker of Ozempic and Wegovy, is investing up to $4bn a year to expand its manufacturing capacity. Nonetheless, it is imperative to acknowledge that these modern drugs are not devoid of side effects. Commonly reported adverse effects include gastrointestinal disturbances, low blood sugar, constipation, headaches, fatigue, dizziness, and elevated lipase levels. Furthermore, recent research has established a link between weight loss medications like Ozempic and Wegovy and an elevated risk of severe gastrointestinal complications. The trajectory of weight loss drugs exemplifies the strides made in medical science, from perilous and often ineffective treatments of the past to the safer and more efficient alternatives available today. However, it remains crucial to recognize that these medications are not magical solutions for weight loss. They should be integrated into a comprehensive weight management plan that encompasses a healthy diet and regular physical activity.

Economic consequences of the weight loss drugs craze

Over the last 6 months, the approval and distribution of weight loss drugs have had significant economic consequences, with several executives reassuring investors of their share in the future success of the drugs. As patients start to understand the efficacy of the medications, Barclays predicts that the global market for Ozempic and Wegovy, as well as up to 10 competing products, could reach $100bn by 2035. Eli Lilly is bound to be the major player in the US market, in case Mounjaro gets approval for obesity, after already being approved for diabetes, while demand for Wegovy has resulted in a shortage. Moreover, Morgan Stanley analysts changed their projections on the obesity market, from $54bn in 2030 to $77bn.

The market predictions improve as public health authorities and pharmaceutical companies attempt to solve the growing obesity health crisis. According to the World Health Organization, worldwide obesity has nearly tripled since 1975, with 1.9bn overweight adults, of whom over 650mn are obese. This brought the overweight rate to 39% and the obesity rate to 13% of adults. However, Novo Nordisk’s Wegovy is approved for adolescents 12 years and older, with a market that includes some of the 124 million children and adolescents (6% of girls and 8% of boys) who are obese. The US is expected to account for as much as 90% of sales due to higher pricing and a higher number of potential patients. Specifically, obesity affects almost 42% of adults and 20% of children in the US, accounting for $147bn in annual healthcare costs, while in Europe only 17% of adults are considered to be obese.

The potential demand for weight loss drugs is driving the growth and valuations of their developers. Novo Nordisk A/S is currently the most valuable European company, with a market capitalization of DKK2.44tn ($450bn), surpassing LVMH, currently at €355bn ($381bn). In September, the pharma giant surpassed, in value, the Danish GDP, which stood at DKK2.83tn in 2022. Novo Nordisk is transforming the Danish economy: in the first half of 2023, Danish GDP rose 1.7% year-on-year, but without the pharmaceutical industry, dominated by Novo Nordisk, it would have fallen by 0.3%. With its 157% growth in anti-obesity treatments sales, its revenue is predicted to grow 30% in 2023 from DKK176.95bn ($25bn) in 2022.

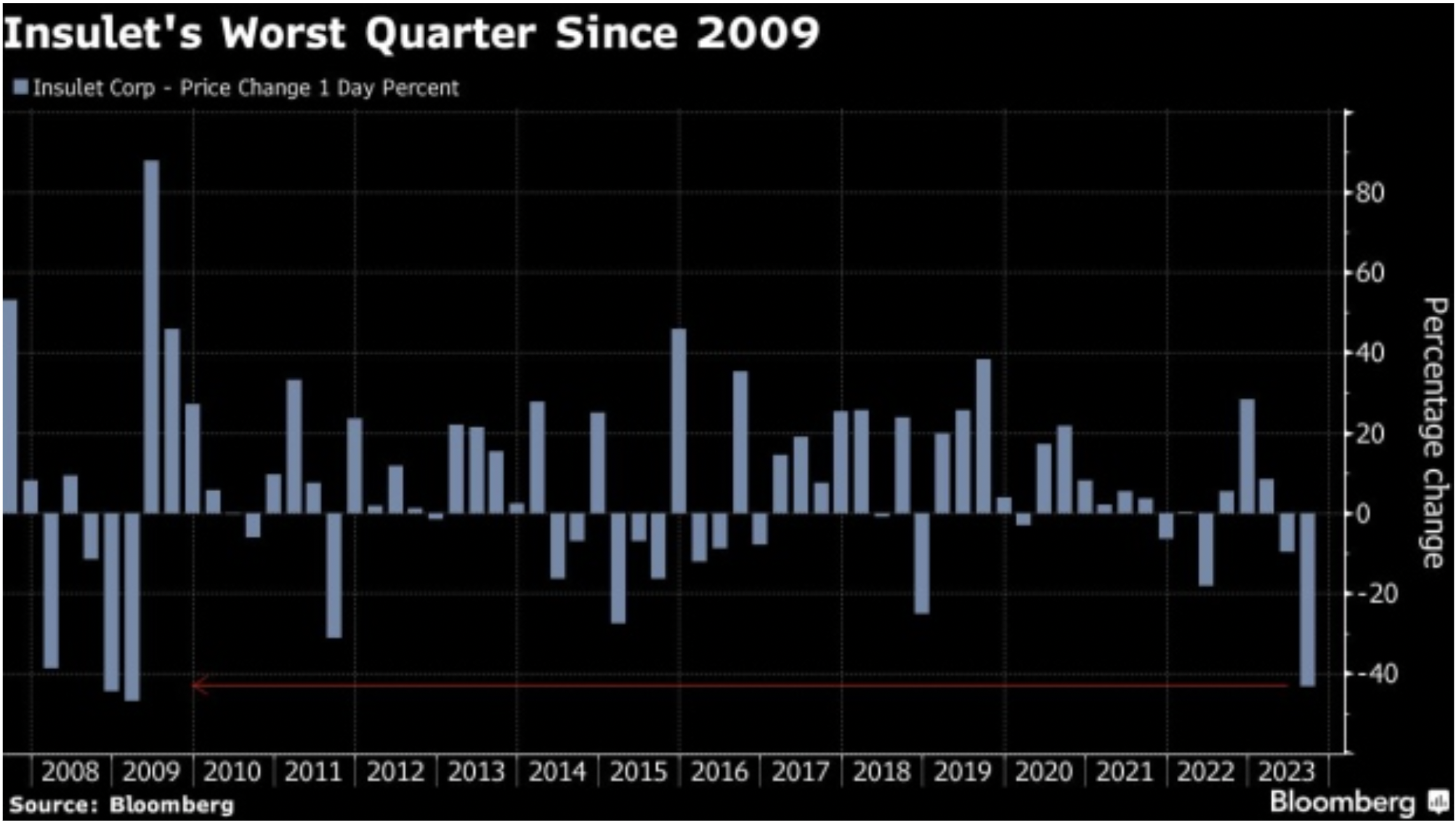

However, as demand and sales of weight-loss drugs increase, the consequences of their approval start to unravel in other markets. With weight loss drugs potentially decreasing the risk of heart attacks and diabetes, stock investors have started choosing sides and assessing the impact of these treatments on other healthcare companies. Those that produce devices to treat conditions associated with diabetes registered the highest decline. Among all, insulin pump maker Insulet Corporation [PODD: NASDAQ] lost more than 45% of its value over the past two quarters with its worst quarterly performance in 15 years. While sell-side analysts note that the companies are unlikely to be impacted in the near term, other medical device companies saw share prices fall in fear that sales could be impacted by these new medications. ResMed [RMD: NYSE], which makes breathing machines for sleep apnea – a condition often tied to excess weight – lost more than 34% of its stock value in the past 6 months.

The medical devices market is not the only one impacted by the rising popularity of weight loss drugs: Truist Bank downgraded its outlook for shares of donut chain Krispy Kreme [DNUT: NASDAQ], due to the recent surge in popularity of GLP-1 semaglutide drugs. In the meantime, diet companies are looking to adapt to this new era, with Simply Good Foods Co [SMPL: NASDAQ] looking to market Atkins as “a perfect complement to people thinking about using the drugs”.

Possible challenges going forth

As the world tries to adapt to the potential of these new treatments, companies face resistance of different sorts from both Europe and the US. Novo Nordisk’s Wegovy was only available in the US, Norway, and Denmark, before it was introduced in Germany at the end of July. However, although the potential of selling in Germany is itself high, a decades-old German law bans public health insurance from paying for weight-loss drugs, categorizing them as a lifestyle choice rather than a health necessity. Thus, Germans will have to pay €328 (around $352) per month to use the drugs, with a starting price of €170 ($190). Public health insurance plans cover 90% of Germans, and for the 10% with private health insurance, coverage will vary, with Allianz saying it will pay if a physician diagnoses a medical need, while Debeka confirms that its plans exclude weight-loss treatments.

Similarly to Germany, Denmark’s public health care system does not allow reimbursement of any weight-loss drugs, and the country’s largest private health insurer, covering roughly half the country’s population, will stop reimbursing weight-loss medication from January next year due to high demand. Costs to reimburse Wegovy in Denmark are estimated at around $4bn each year. The situation appears to be the same in Norway, where the Norwegian Medicines Agency stated it would not subsidize the drug to treat obesity, as the price would be too high in relation to the documented health effects.

In the US, Novo Nordisk and Eli Lilly have spent nearly $1.3mn in 2023 lobbying the U.S. Congress on obesity and specifically on a bill reintroduced in July that would allow the Medicare health plan to reimburse these medicines. The U.S. list price for Wegovy, which launched in the country in June 2021, is around $1,300 per month, but most U.S. patients with health insurance coverage taking Wegovy are paying less than $25 per month, while Medicare does not cover weight loss drugs.

Another problem that arises from the surge in demand for weight loss medications and, specifically, Wegovy, is the ongoing shortages in the US. While the treatment was launched in 2021, it was not until December 2022 that all doses were available there because of an initial production outage. Now, shortages are predicted to continue, as about 50mn Americans with obesity could be eligible for Wegovy coverage under their health plans. Novo Nordisk has warned that U.S. shortages will continue in the short to medium term and the company has limited the availability of the three lowest doses, effectively slowing the pace of people starting the drug, as patients must begin with a low dose that is gradually increased. The shortages bring the risk of “weight cycling”, with patients regaining the weight lost if they are unable to access the medication after they started using it.

0 Comments