As the Financial Times has very precisely coined it, “The end of the Chinese miracle” is referred to the end of an era where Chinese villagers, precisely 277 mn of them, migrated from rural areas to the cities in order to work for factories. This was an unprecedented flow of mammals from one area to another in the history of the world. It resulted in an unparalleled cheap working force and led China to become one of the worlds’ largest exporters. This has helped fuel the rapid growth of the Chinese economy to take the front position of economic powers worldwide. This is all about to end as there are not much villagers left in the rural areas to migrate. The most prominent sign of insufficient supply with respect to demand is given by the sharp increase of city workers’ wages: since 2007 their salaries have doubled. Some companies are moving their low-skill parts of production to now cheaper lands such as Bangladesh.

The fact is that this has naturally caused the growth of the Chinese economy to slow down in the past years. In January Chinese officials announced its lowest growth rate since the 90s’ of “just” 6.9%, which, although expected, set the world and market in turmoil. Everyone was bearishly tuned to those news as a slowdown in China most of all meant less consumption of the world’s most valuable commodities and resources. As even George Soros went against the renminbi, the Chinese government was forced to use its accumulated foreign reserves in order to prevent massive capital flight and panic around a depreciating renminbi. The overall uncertainty surrounding the Renminbi was caused by growing concerns of the depreciation of the mainland’s currency making several companies rush to pay out their dollar denominated debts, which caused the PBOC to eat through its foreign reserves in order to keep the renminbi from losing its value during the first quarter of this year. Also, by keeping the offshore peg the government reassured many industries and markets of the overall strength of China and the world as a whole. This “stunt” cost the bank around $120bn in terms of their foreign capital reserves, but in the last month its reserves appreciated on a monthly basis for the first time since October (although this could be attributed to the weakening dollar in response to the dovish FED).

Another problem currently facing the Chinese economy is that the PBOC has allowed the creation of the so called “Zombie” companies. These are mostly large inefficient state owned companies which are kept alive only by loads of debt provided by the PBOC. The firms grossly overproduce and actually turn a loss, but due to the inflow of debt money they can continue operations. For example the Chinese Shipping Group Cosco made a $580mn loss during 2015, but still managed to have a debt to equity ratio of 206%. This has the consequence of distorting competition, as privately held firms, which do not have access to such sources of debt and cannot keep pace with their competitors’ low prices, are driven out of the market. Consequently, after having forced everyone else out, the only producing company left is the one financed by the state owned bank, which in fact causes it to produce even further and amass even more hardly payable debt.

It all began in 2008 after the global financial crisis when the dispersed Chinese economy was facing serious threats. Government officials resorted to fiscal stimulus and devoted to spend around $506bn dollars in the upcoming two years in order to stimulate both growth and consumption of the companies themselves. It did in fact lead to an average growth of 9.8% percent during the years 2009-2011 and to a boost in consumption of raw materials, which helped other economies, such as Brazil, by increasing their industrial commodities exports.

Source: FT, BSIC

Source: FT, BSIC

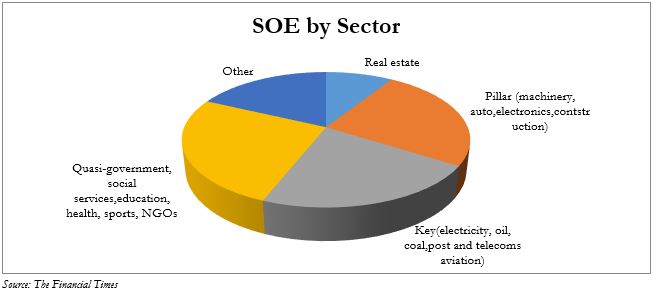

The state owned enterprises (SOE) are big in the Peoples Republic of China: they employ roughly 10% of the population and represent 40% of the GDP, with the biggest of them being exactly in the most investment heavy electricity, oil and telecoms sectors but also in other pillar sectors such as machinery. There is a lot of overproduction in commodities (especially the steel industry) and most of the companies reached ridiculously leveraged levels, like the state-owned machinery company Zoomlion which has a debt multiple of 83. Another example is Cofco International which has debt that is 52 times its EBITDA. The profits of such SOEs’ have fallen by a staggering 9.5% for the last year while they have accumulated an additional debt of 18.2%. The government is reluctant about shutting down some production plants, as this leads to workers being laid off, and several bail-outs of its 112 biggest SOEs’ have been performed. Investors expect that this overproduction is starting to generate a deflationary spiral inside the country, which in turn would weaken the offshore currency in the near future. This causes fear of dollar-denominated debt holders who rush out to pay their debt and even further weaken the renminbi. Paired with the insolvency of said zombie companies no wonder Soros was betting against the bank of China: he expected a crash of the renminbi and still does. But compared to the Bank of England it will probably be later than sooner, as the PBOC still has another $3.3trn of cushion.

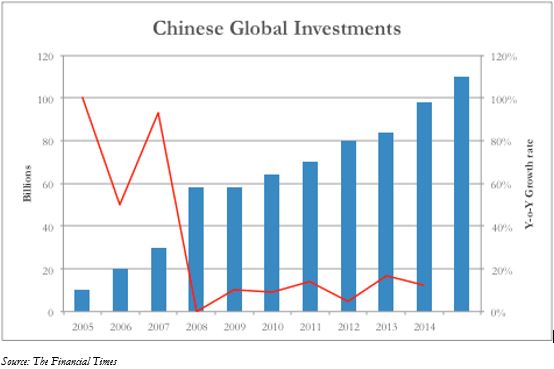

Just like in the movies, zombie firms are on the rise and want to take over the world, but instead of pink brains, they are, like most of us, after green papers. Virtually unlimited debt, hunger for diversification and uncertainty in the Chinese market has spawned an unprecedented spree of Chinese companies to acquire foreign firms, most often not even in their own sector.

Only for the month of January this year Chinese companies spent about $22bn on foreign companies. For the first quarter of the year of the $638bn in deals, around $101bn were carried out by mainland firms. Just for comparison, the amount spend for the year 2015 was roughly $109bn. Of special interest is ChemChina which after acquiring Pirelli for $7.3bn last year has passed its attention on Syngenta, the Swiss agrichemical giant and wants to acquire it for $44bn. Also the Chinese insurance group Anbang was in a furious bid to acquire Starwood hotels proposing $14bn, but it was blocked by regulators over solvency issues. These investments may be at first interpreted as a capital flight of investors, but the reasons are deeper. Most of the times the cash is provided by the PBOC or other smaller banks, which use the newly acquired assets as collaterals for loans.

As a matter of fact, current businesses of the enterprises carried out in China itself might prove too risky and that’s why companies really strive to diversify so that, if one of their home endeavors fails, the firm can still be considered solvent.

Given the facts laid out it is easy to see that some turbulence awaits the Chinese economy in the upcoming years. Whether it will be a glamorous forex catastrophe, or a mild further decline in growth is up to fiscal decisions, which should first and foremost limit the amount of debt available to the SOEs’. And even if some of them will go bankrupt and workers will be laid off, it is the necessary sacrifice for the stability not only of China but the world itself. Source: FT, BSIC

Source: FT, BSIC

[edmc id= 3823]Download as PDF[/edmc]

0 Comments