Introduction

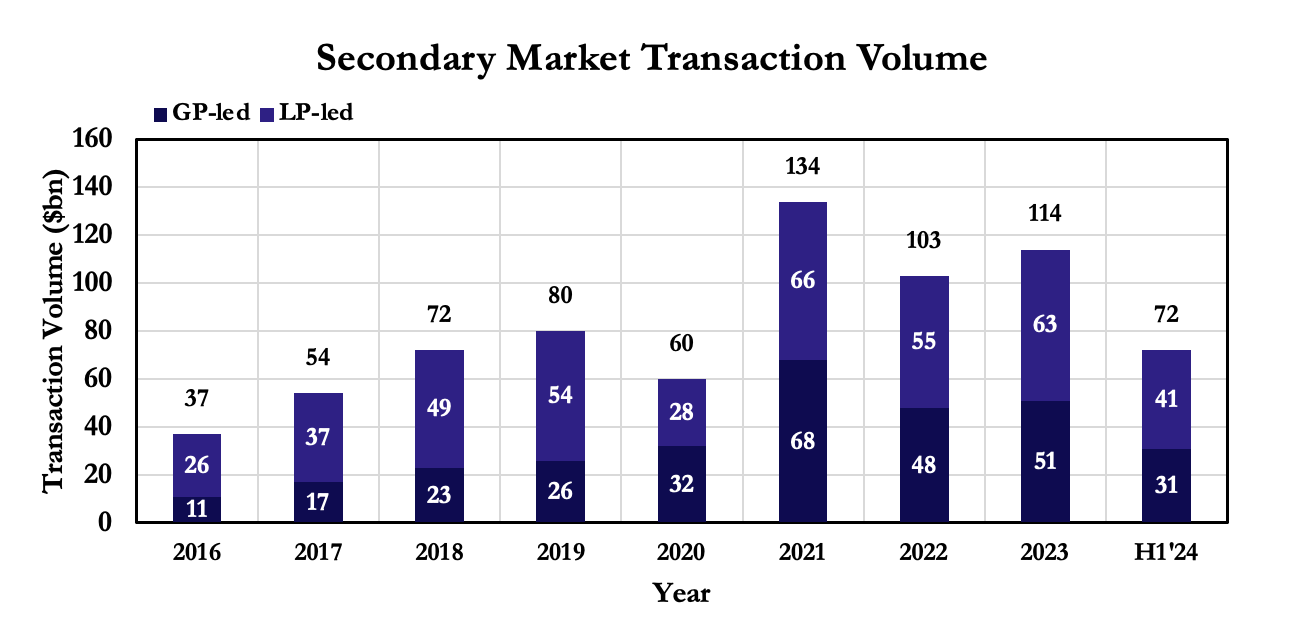

Undoubtedly private markets are inherently illiquid. When an investor wants to cash out of private funds, they must navigate ambiguous pricing mechanisms, information asymmetries, and reliance on intermediaries. In the usual course of events, liquidity in private market investments is realised through planned exits. However, unforeseen circumstances can leave investors in sudden need of cash before a fund’s end date. Entering secondary funds, simply referred to as secondaries, help general partners (GPs) and limited partners (LPs) to sell existing private equity interests to other investors. In addition to increased liquidity needs, sluggish distributions from private market funds and narrowing bid-ask spreads have contributed to the rising attractiveness of the second-hand market for fund stakes in recent years. Transaction volume has increased fourfold in the last 10 years, reaching the second highest level of $114bn in 2023, in line with broader private market growth.

In private market investing, an allocator such as a pension fund, sovereign wealth fund or a wealthy family commits capital to a private market fund (private equity, venture capital, etc). In these funds, the committed capital is not transferred immediately but is drawn down gradually as the fund manager identifies suitable investment opportunities. By making this commitment, the allocator becomes a limited partner (LP) under a limited partnership agreement (LPA), while the fund manager takes on the role of the general partner (GP). Such close-end funds typically have a fund term of 10 years with an option to add two 1-year extensions until all investments are liquidated. Noteworthy, that LPs only receive their capital and profits when the GP exits investments, making liquidity dependent entirely on the GP’s discretion. According to who “leads” (sells) their interest, secondary transaction can be of two main types – LP-led or GP-led. In an LP-led transaction, a limited partner sells their stake in a fund including their entire portfolio of assets and liabilities to a secondary buyer. Thus, the structure of the fund doesn’t change, just one LP is substituted by another with the consent of the GP. Instead, in a GP-transaction, a general partner sells part or the whole of their fund to a secondary investor and the existing LPs generally have the option to roll their assets over to the new vehicle or cash out. There are two main subtypes of GP-led secondaries: continuation funds and single-class. In the former, a GP can retain their asset portfolio, while some LPs hold their investment and others exit. Instead, the increasingly popular single-asset transactions allow GPs to focus on their preferred individual assets while divesting those they no longer want to hold.

The secondaries market emerged in the early 1960s as a way to provide liquidity to limited partners. Venture Capital Fund of America (VCFA) was the pioneer, investing in secondaries as early as 1982, while most of the current industry leaders set up their funds later in the 1990s. Since then, the market has undergone significant transformation from a tactic to sell distressed assets to a powerful tool for both LPs and GPs. The global financial crisis was the turning point. Although transaction volumes halved to $10bn in 2009, the crisis gave birth to fresh opportunities as financial institutions offloaded private equity exposures to comply with new regulations. In the years leading to the coronavirus pandemic, secondaries gained mainstream acceptance, while COVID-19 itself accelerated innovation in the industry with GP-led deals surging as private equity firms used continuation funds to manage exit delays and provide optional liquidity to LPs.

Rationale

The benefits for LPs go far beyond meeting liquidity needs. Secondaries can also be a vehicle for active portfolio management – through LP-led transactions, they can reduce exposure to certain sectors and GPs by selling and buying certain stakes, while in a GP-led ones they have the flexibility to choose whether to cash out or remain invested in continuation vehicles. GPs instead leverage secondaries as a way to hold onto most promising assets longer and access additional exit options. From an investor’s perspective, the primary advantage lies in gaining access to funds at a discount. While periods of heightened secondary market activity may sometimes require buyers to pay a premium, assets are typically acquired at a price lower than their NAV. Additionally, unlike investors in primary funds, secondary investors are not “blind” to what the investment pool of the funds will be. Thus, they are able to make informed decision and build a diversified portfolio with exposure across GPs, sectors and geographies. However, they don’t come without risks. Investing in secondaries is a complex and resource-intensive process, particularly for single-asset deals, which require extensive due diligence and negotiation with multiple stakeholders. While they improve liquidity compared to primary private equity investments, they remain an illiquid asset class relative to public markets, and thus, investors should be prepared for extended holding periods. Moreover, inherent information asymmetry in private markets lead to poor underwriting of secondaries. High level of expertise and skills are required to gain a true understanding of assets fundamental, while a strong relationship with GPs is vital in accessing high-quality opportunities and completing deals successfully.

Current state of the market

Amidst a period of illiquidity worsened by the pandemic, major declines in M&A activity and public market volatility, recent years have posed several challenges for asset managers and investors. Nevertheless, the secondaries market has remained resilient and is currently on track for a record year. The secondaries market has undergone a major transformation over the past 15 years. From PE Secondaries AUM comprising only ~4.5% of total PE AUM in 2008 to over 8% in 2022, secondaries have developed into a powerful tool for LPs and GPs to manage portfolios and provide liquidity opportunities in different situations. While there are signs of increasing activity across the M&A and IPO markets, the secondaries market has done more than just persist. With $72bn in overall transaction value in H1 2024 (73% transaction volume growth YoY), the market is projected to reach all-time highs of over $140bn by the end of the year – surpassing the 2021 record of $134bn. This surge in activity can be attributed to accelerating momentum on the sell-side; with the LP-led market accounting for 57% of transaction volume in H1 2024 and a GP-led market gradually gaining momentum. Moreover, pricing improvements and record capital formation on the buy-side are increasing the attractiveness of secondaries as an asset class.

Source: Evercore, Lazard, BSIC

LP-led Market

In recent years Private Equity firms are facing significant liquidity challenges, with LPs constantly receiving lower than expected distributions from GPs. Thus, investors have experienced increasing pressure to diversify portfolios and seek liquidity, which has become increasingly challenging. The secondaries market offers a practical solution due to its flexibility. Supported by rising prices and strong demand for capital that far exceeds distributions from most portfolio managers, the LP-led market reached record volumes in H1, with 330+ estimated transactions completed (~200 in H1 2023). The increasing number of LPs entering the market has brought transaction volumes to all-time highs. Most notably, transactions at the smaller end of the scale (<$250m) have experienced the largest uptick, likely supported by the increasing AUM of ’40 Act funds. These evergreen vehicles, authorised under the 1940 Investment Company Act in the U.S., offer some advantages over traditional private equity funds. Primarily, they require lower investment minimums and allow a small percentage of investors to take cash out as often as quarterly, instead of requiring them to lock up their capital for 10 years or more. These structural features make ’40 Act funds particularly attractive to private wealth investors, who seek more frequent liquidity, that can only be achieved with a significant LP component in their portfolios. As a result, these funds have increasingly turned to the secondaries market for deployment, with over $5bn of capital raised over the past year. Furthermore, given the rising capital inflows into such funds, there is growing pressure on these vehicles to deploy capital quicker than traditional secondary funds. This has resulted in exploration of opportunities on a smaller scale, with highly diversified exposure to funds with nearer-term or more regular cash flows.

GP-led Market

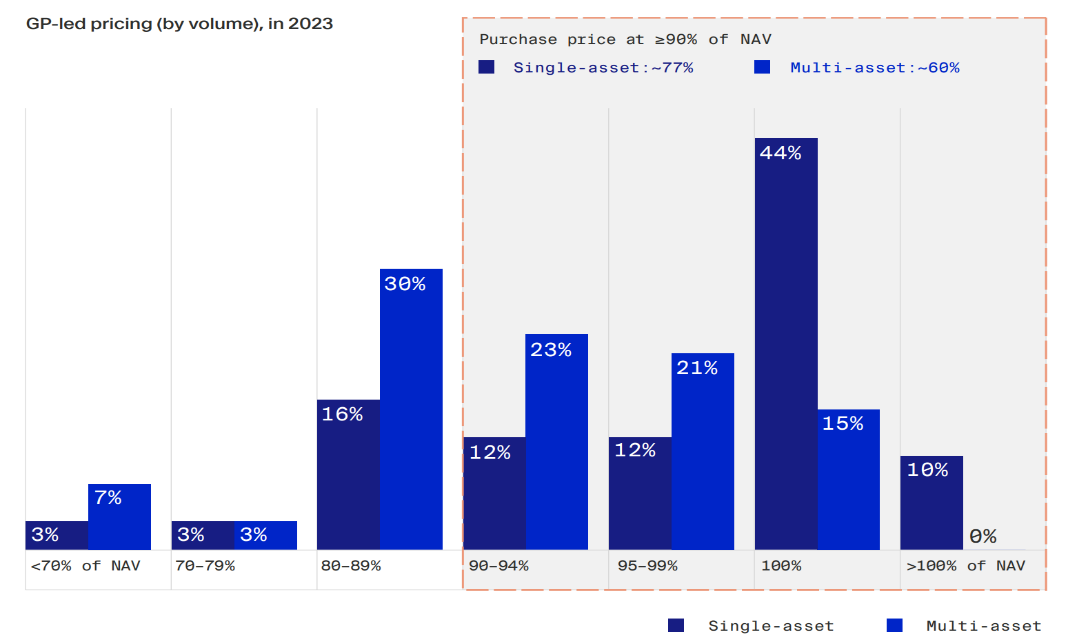

The GP-led market remained very active in H1 2024. With interest rates remaining high and M&A and IPO environments largely depressed, there has been increasing acceptance of continuation funds as a way for sponsors to provide liquidity and reset the holding period for better-performing assets. Continuation funds represented ~80% of all activity in the GP-led market in H1 2024, with tender offers experiencing a significant decline in volume. Notably, steady increases in pricing strength and a trend towards single-asset deals (investments in one company) have resulted in Single Asset Continuation Vehicles (SACVs) remaining the largest transaction type by volume at 47%. Although ~90% of SACVs were priced at or above 90% of their NAV, given the portfolio concentration limits of secondary investors, Multi-Asset Continuation Vehicles have remained a significant portion of GP-led activity. Another interesting trend in the GP-led market is the rise of middle-market sponsors. In 2023, 52% of GP-led deals were priced at $50m or less. Traditionally, middle-market sponsors have exited their more profitable assets by selling them to larger sponsors. However, the continuation fund approach has allowed these sponsors to provide liquidity for limited partners while maintaining control and governance over their top-performing assets. This strategy has enabled significant growth in AUM for these sponsors, with approximately 55% of continuation funds launched by middle-market players (with fund sizes up to $2bn) being equivalent to 50% or more of the size of their most recent flagship funds.

Prominent deals

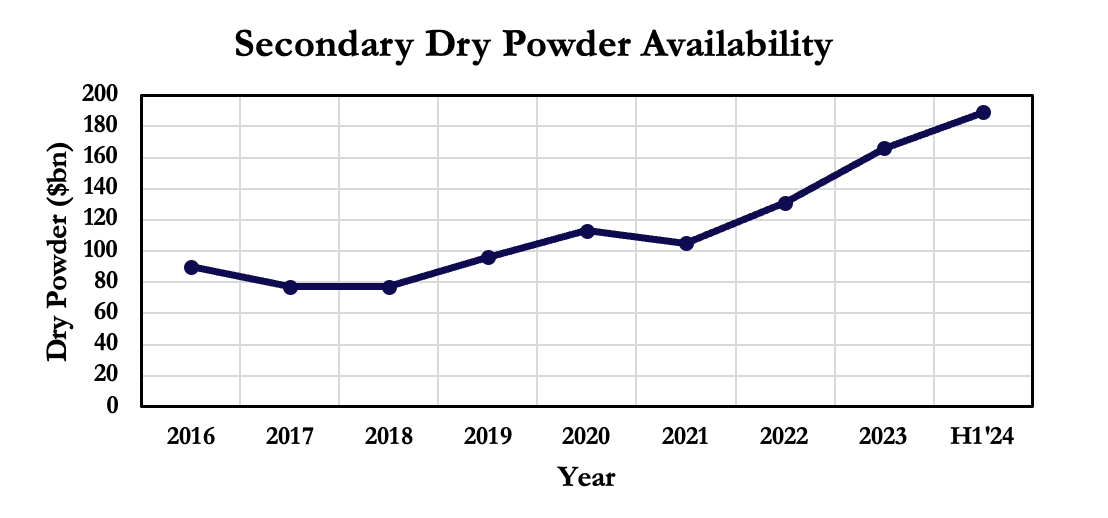

When examining the buy-side dynamics in the secondaries space, dry powder remains elevated at $189bn despite an incredibly active H1 2024. This surge in available capital can largely be attributed to the abundance of opportunities in the secondaries market.

Source: Evercore, BSIC

One investor taking advantage of these plentiful opportunities is Pantheon. In November 2023, the leading global private markets investor announced the successful closing of the Pantheon Global Secondaries Fund VII and associated vehicles (PGSF VII), securing commitments of $3.25bn. The fund far exceeded the initial fundraising target of $2.0bn and marked the firm’s largest ever pool of capital. When looking at the investor base, Pantheon’s deep expertise in the secondaries space played a key role in attracting investors. Notably, the firm’s private wealth platform drove significant inflows as well as commitments from wealth management clients, seeking to leverage Pantheon’s extensive relationships, particularly across middle market secondaries. Reflecting the continuously evolving secondaries market and its diverse investment opportunities, Pantheon has already deployed over 86% of the fund and is integrating secondary investments into other funds, including their Global Infrastructure Fund IV.

Record breaking capital raises in the secondaries market are further underscored by Blackstone’s Strategic Partner’s IX. The fund, which closed at $22.2bn in January 2023, together with Blackstone’s $2.7bn inaugural GP-led continuation fund strategy, Strategic Partners GP Solutions, represents the largest dedicated secondaries fund ever raised. For Blackstone, such a monumental capital raise has strategic sense. Strategic Partners IX is the firm’s ninth secondaries flagship and is yet another vehicle through which Blackstone can provide liquidity, diversify and capitalize on valuation differences, showcasing the firm’s private markets expertise. With that being said, the appeal of the secondaries market has inevitably attracted other players to the market.

For the first time since 2020, Ardian has regained the title of the world’s largest secondaries fundraiser, raising $49.6bn in total funds over the past five years, surpassing Blackstone. The France-based investment firm has deployed increasing amounts of capital to dedicated secondaries programmes and is expected to close the Ardian Secondary Fund IX by the end of the year. At a target of $25bn, but with projections of around $29bn, the fund would become the largest secondaries programme ever raised. Moreover, Ardian has also expressed a desire to launch a single asset CV-focused vehicle, further illustrating the range of opportunities within the secondary market. These impressive capital raises in an asset class once overlooked reflect an environment that values innovative financial solutions and a strong desire to engage in transactions.

Pricing of Secondaries

When it comes to valuing secondaries transactions, it s not straightforward as deals occur privately and involve stakes in underlying portfolio companies that are not publicly traded and therefore do not have a ready market price. Secondaries portfolio valuations can vary considerably depending on the prevailing conditions, such as the supply of deals and capital in the market, public markets movements and the economic outlook, which can affect underlying companies’ future trading performance and exit prospects. In 2022, for instance, average LP fund portfolio valuations fell to a decade low, reflecting public market volatility and buyers’ projections that realisations would be difficult in 2023. Pricing also depends on the buyer’s and seller’s motivations. The former may pay more if it is seeking exposure to a specific strategy, region or GP, while the latter may accept a lower than market value in return for speed or certainty that the deal will be completed. However, most secondary deals are valued at a discount to the net asset value (NAV), which often attracts investors to the secondary markets.

There are other, more specific to the secondary market, factors that determine pricing, such as funds’ vintage year and type of assets. For instance, in LP-led deals, older funds tend to trade at lower prices than more recent ones as the underlying companies would normally have been exited by this stage. An LP might be selling to clean up its portfolio, while the buyer has a new investment horizon and can wait for exit, while acquiring the assets at a discount. For example, in 2023, buyout funds that were 10 or more years old priced at an average 72% of NAV, as buyers expected limited upside and delayed exits, given the poor market environment. By contrast, buyout funds that were up to 3 years traded at an average 99% of NAV as they provided plenty of time for value creation and upside. Moreover, asset quality and asset types play a crucial part in secondaries valuation. In 2023, average buyout funds priced at 91% (vs 87% in 2022), while venture capital funds reached only 68% of NAV, reflecting buyers’ caution around some of the technology deals completed in the robust 2021 market. Additionally, over recent years, some secondaries funds have broadened their expertise beyond traditional private equity deals and their strategies now include infrastructure, real estate and private credit. Secondaries valuations here tend to be lower than for buyout funds, not only because they are typically lower returning strategies, but also because the buyer segment for these funds is smaller and arriving at a valuation can be a more complex task than for more traditional private equity funds. Regarding GP-led deals, the more concentrated nature of such deals results in more accurate pricing compared to that of LP-led deals, which might contain several hundred underlying portfolio companies. Nowadays, most GP-led deals involve some of the fund manager’s best performing companies, leading to some transactions priced at par or even at a premium to NAV. While many deals still trade at a discount, single-asset transactions generally have higher pricing than multi-asset deals, because investors can conduct more in-depth due diligence on one company. For instance, in 2023, around 77% of single asset GP-led deals priced at par or above 90% of NAV, while only 60% of multi-asset deals reached this level of pricing.

Source: Lazard estimates 2024, Moonfares secondaries report 2024, BSIC

Outlook: What is next for secondaries?

The secondaries market has grown strongly over recent years and this trend is likely to continue over the coming period. With srong fundraising in 2023, secondaries funds today have plenty of firepower to capitalise on opportunities through next years, and demand for that capital may be much higher than it has been to date. The need for liquidity and a desire to rebalance and reshape portfolios will continue to drive LP-led activity. Given significantly lower distributions from GPs last year as exit markets were challenging, many LPs will be seeking to realise value from their existing portfolios to reinvest capital into new commitments. Improved pricing for portfolios will attract more sellers, some of which have waited for better valuation conditions before going to market. Meanwhile GPs will also seek secondary market solutions as in a challenging exit market, they need to find other ways of returning capital to their investors to improve the distributed capital to paid-in ratio (DPI). We think tha GP-led deals will continue to be an attractive option for achieving this as they offer existing LPs the choice of keeping their investment or receiving a return of capital. Moreover, GP-led deals have an advantage over new deals in a high interest rate environment as debt packages agreed in a more favorable environment roll over into the new continuation vehicle, keeping lower costs for the companies involved. Therefore, even when the M&A and IPO markets improve, GP-led deals will remain attractive as they allow fund managers to hold some of their best assets and extend the value creation runway, as opposed to selling them to a new owner.

Furthermore, there are many reasons to expect strong growth in the secondary market also in the longer period, as secondary transactions currently account for only a small portion of overall private markets activity, with only around 2% of the markets’ NAV being traded annually. There is a long way for growth as GPs increasingly access the secondary market as an alternative exit route and LPs start to take more sophisticated approaches to portfolio management. Additionaly, private markets as a whole have expanded rapidly over recent years, making a range of opportunities much broader for secondaries funds. While AUM in private markets have grown by a compound annual growth rate of 20% since 2018, in secondaries, it has only increased by 17% a year. This all means that secondaries are under-capitalised relative to the broader private markets industry, therefore, the market still has some catching up to do. Finally, we expect to see further innovations from secondaries players as they come up with new liquidity solutions for LPs and GPs and offer new products to their investors.

0 Comments