Standard Life plc (SL.: LSE) – market cap as of 10/03/2017: £7.52bn

Aberdeen Asset Management PLC (ADN: LSE) — market cap as of 10/03/2017: £3.77bn

Introduction

On March 6, 2017, it was announced that Standard Life plc (“Standard Life”) has agreed to acquire Aberdeen Asset Management PLC (“Aberdeen”) in an all-share transaction. Based on the current number of Aberdeen shares in issue (1.32 billion), the deal is estimated to be worth £3.78bn, valuing each share of the target at a 0.07% bid premium over its closing price of £286.40 per share on March 3, 2017. The deal will give rise to Europe’s second largest fund manager, with £581bn AUM (i.e. assets under management) and £660bn AUA (i.e. assets under administrations which include custodial and tax-related duties.).

About Aberdeen Asset Management PLC

Aberdeen Asset Management PLC is a leading and pure-play provider of asset management services with £302.7bn AUM as of December 31, 2016. The Company is headquartered in Aberdeen, UK, and was established in 1983. The business of Aberdeen is split between two divisions: (1) investment management, involving several investment strategies of equities and fixed income securities, and (2) property asset management, managing direct property portfolios for institutions and pooled vehicles. Moreover, a solutions business provides ancillary services. All those strategies are pursued across a range of products, distribution channels, and across 25 countries. The company’s clientele includes governments, private banks, foundations, and charities.

Aberdeen’s latest financial results were not very satisfactory. Net outflows of £32.8bn negatively impacted both revenues, which, compared to the previous year, fell by 13.8% to £1bn, and margins, which slipped from 42.7% in 2015 to 32.6% in 2016. However, year-end net cash of £548.8bn highlights a very strong balance sheet and a healthy headroom over regulatory capital requirements. Year-end AUM were £312.1bn

About Standard Life plc

Standard Life plc, formerly known as Standard Life Assurance Company, is a United Kingdom-based investment company with £357bn AUM as of December 31, 2016. The Company was established in Edinburgh in 1825 and serves about 4.5 million customers and clients in 45 countries across the globe.

Standard Life operates a variety of businesses across three main segments: (1) Standard Life Investments, (2) Pensions and Savings, (3) India and China. The Standard Life Investments segment specializes in active asset management, offering investment solutions and funds to clients in the UK, Europe, North America and Asia. The Pensions and Savings segment provides a range of long-term savings products and money management solutions to individual and corporate customers in the United Kingdom, Germany, and Ireland. Finally, the India and China segment offers a range of insurance and savings products. It comprises associate and joint venture life businesses, and a wholly-owned business in Hong Kong, serving over 25 million customers.

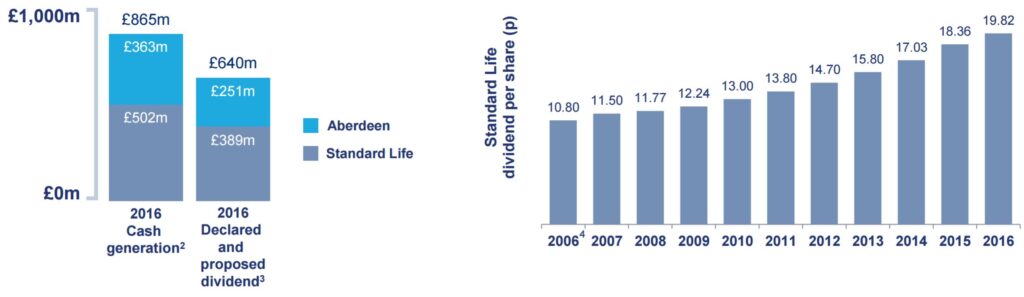

Thanks to an increase in fee based revenues, a decrease in unit costs and balance sheet optimization, both FY2016 operating profits and cash generation show a 9% increase compared to 2015, reaching £723m and £502m respectively. As of 2016, AUA topped £357.1bn, up 15% from the previous year.

Deal Structure

The transaction is structured as an all-share merger, with an exchange ratio of 0.757 new Standard Life shares for each Aberdeen share. Existing Standard Life shareholders will own 66.7% of the combined group, which will have a pro-forma market cap. of £11.3bn, while Aberdeen stockholders will control the remaining 33.3%.

Thanks to diversification benefits as well as cost and revenue synergies, the combined entity will enjoy a solid balance sheet, a reduced pro-forma leverage and an improved ability to generate cash. This will be key in maintaining Standard Life’s commitment to its progressive dividend policy.

Source: BSIC

From a governance perspective, Standard Life is ceding a lot of control: the board of the new entity will be equally composed of top management from both organizations, with Mr. Skeoch (CEO of Aberdeen) and Mr. Gilbert (CEO of Standard Life) to serve as Co-CEOs.

The merger, which is expected to close in Q3 2017, will be implemented by way of a court-sanctioned scheme of arrangement between Aberdeen and its shareholders. This type of structure requires approval from 75% of those holding voting rights, contrary to the usual 50% threshold of takeover offers. This signals that Standard Life is confident that target management and shareholders will support the deal and, indeed, Aberdeen’s two largest stockholders have both already given their non-binding support to the transaction.

Deal Rationale

The all-stock deal between Aberdeen and Standard Life will be strategically and financially beneficial to both firms. Indeed, the Combined Group will result in a truly global distribution platform, having increased scale, enhanced proximity to clients, and combined AUM of £581bn.

From the financial perspective, the merger is expected to create a diversified world-class investment company both in terms of revenues and in terms of earnings. Incremental revenue synergies are expected to result from complementary product capabilities and minimal client overlap. Additionally, for what concerns value creation, the announced merger is expected to generate approximately £200m annual pre-tax run-rate cost synergies, full run-rate synergies to be achieved three years after completion, and, finally, incremental revenue synergies coming from the improved strategic positioning of the Combined Group.

Source: BSIC

Mr. Keith Skeoch, CEO of Standard Life, stated: “We strongly believe that we can build on the strength of the existing Standard Life business by combining with Aberdeen to create one of the largest active investment managers in the world and deliver significant value for all of our stakeholders.” At the same time, Mr. Martin Gilbert, CEO of Aberdeen, confirmed how the Combined Entity shall bring financial strength, diversity of customer base and global reach to the firms so that the increased-scale business will be able to effectively compete on the global stage. Indeed, this transaction reflects the mission of both players to deliver first-class service to their customers while investing in diversification and growth, and focusing on financial discipline.

Market Reaction

On March 6, 2017, Aberdeen’s stock price jumped by 6.8% from £285.7 and Standard Life’s shares rose by 8.7% topping £412. Interestingly, in the 3 days after the announcement both stocks have declined in value and, as of March 9, 2017, are now trading at pre-deal levels.

Advisors

JP Morgan, Cazenove Capital, and Credit Suisse served as financial advisors to Aberdeen, while Goldman Sachs advised Standard Life.

0 Comments