Introduction

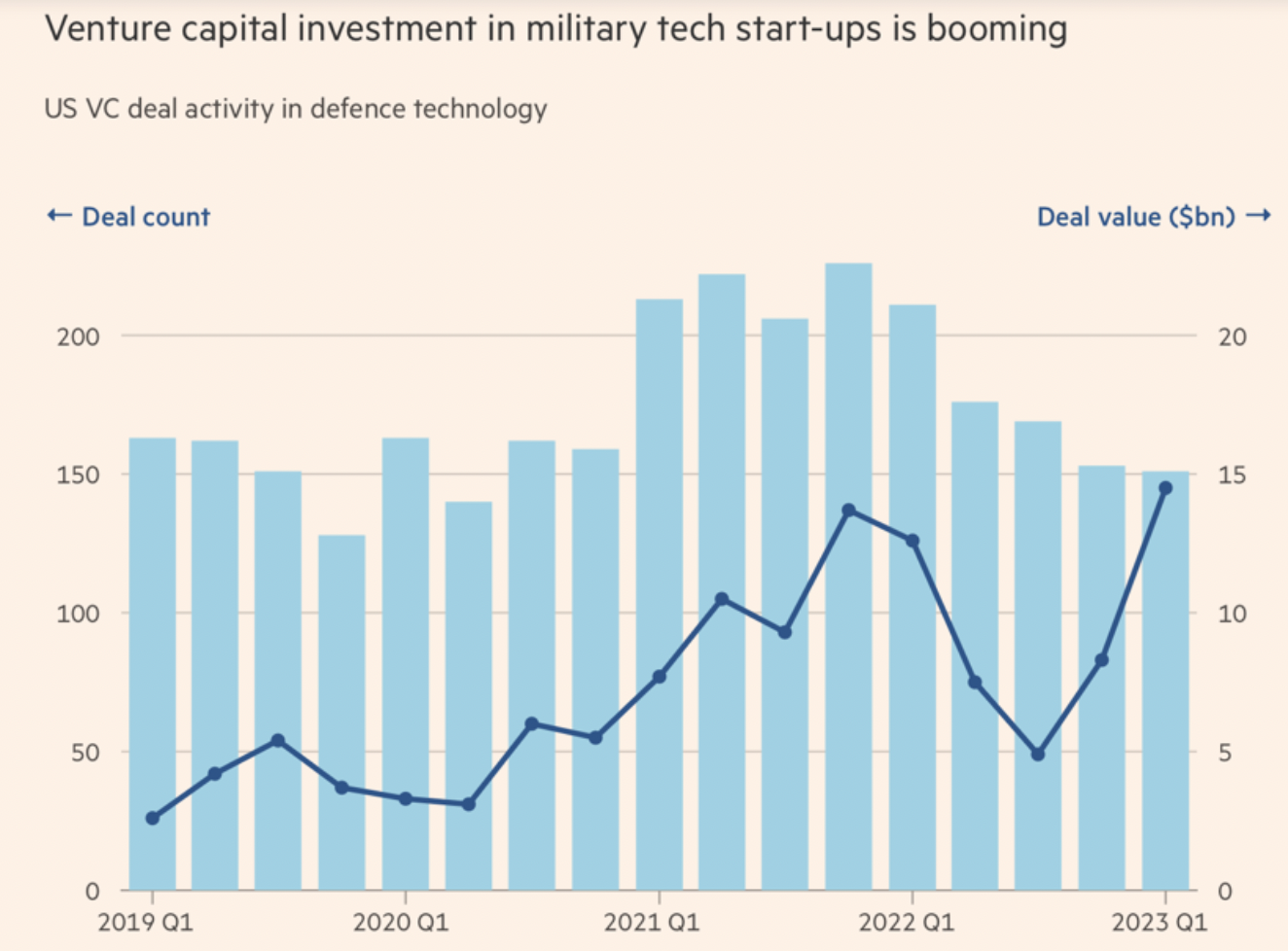

Investment in defence tech start-up companies has surged over the past years as geopolitical tensions across the globe keep escalating. US venture capital firms raised their investments in defence start-ups from less than $16bn in 2019 to $33bn in 2022. The first five months of 2023 alone recorded more than 200 defence and aerospace deals worth nearly $17bn carried out by US venture capitalists.

According to Shield AI co-founder and president Brandon Tseng, “the appetite has changed significantly since we started in 2015” when they pitched to 30 seed investors and only received ‘no’s’ as an answer. Since the Russian invasion of Ukraine, Shield AI and five other defence tech start-ups have emerged reaching valuations above $1bn. The Ukraine war has been fought through a combination of traditional trench equipment and high-tech systems like autonomous drones, satellite communications and data intelligence. Technology is changing how wars are fought, boosting investors’ confidence that tech start-ups are finally in line to receive a considerable share of the US’s defence budget, which has grown over two decades and will reach $886bn in 2024. Many, in fact, observed that while America’s largest weapons manufacturers lack highly skilled programmers, Silicon Valley has them in spades.

The contribution of Silicon Valley’s tech start-ups to the defence sector has been almost non-existent since the Vietnam War. The Department of Defence did play a significant role in supporting Silicon Valley’s early technologies, such as radar and semiconductors, however, anti-war sentiment and protests during the Vietnam War resulted in Silicon Valley’s start-ups and universities, such as Stanford, pulling back from their research and development in the defence and military sector. The US has since then attempted to encourage more private sector development of technology with national security applications by setting up several government agencies, such as the Defence Innovation Unit and Afwerx in 2017. The Defence Innovation Unit (DIU) aims to accelerate the adoption of commercial technologies throughout the military directly engaging with technology companies and VC funds. The DIU partners with organisations across the DoD, and through its streamlined process, it acts as an intermediary between its DoD partners and the technology companies. Afwerx is a technology directorate of the Air Force Research Laboratory. Through multiple programs supported with relatively small amounts of funding, the agency connects innovative technology developers with Airmen and Guardian talent to engage these new entrepreneurs in Air Force activities.

Political Tensions

Even before Russia’s invasion of Ukraine reminded the West that large-scale conflicts can still occur, an escalating sense of insecurity was causing countries to increase their defence budgets. The total of all the nations’ defence budgets exceeded $2tn for the first time in 2021. Escalating geopolitical tensions across the world urged governments to not only improve their defence budgets but also to understand how they can use technologies to overpower their counterparties.

The tensions between the West and Russia have been a topic of discussion since the fall of the Soviet Union. More and more countries, previously part of the East Bloc, joined NATO, thus increasing the presence of NATO bases close to the Russian borders. The tension between Russia and these newly independent countries surged when an armed conflict in eastern Ukraine erupted in early 2014 following Russia’s annexation of Crimea. Years of tension, months of intelligence gathering and observations of Russian troops’ movements culminated in a White House briefing with US Intelligence and diplomatic leaders in October 2021. The only remaining question was when the attack would take place. It was answered in February 2022 when Russian forces invaded Ukraine. The current conflict has critically strained US-Russia diplomatic relations and increased the risk of a wider European conflict. Tensions are, in fact, likely to rise between Russia and neighbouring NATO members that would likely involve the US due to alliance security commitments. NATO is preparing its largest live joint command exercise since the Cold War. The training will take place in Spring 2024, assembling more than 40,000 troops to practice how the alliance would attempt to repel Russian aggression against one of its members. The conflict will likely have broader ramifications for future cooperation on critical issues like cybersecurity and arms controls.

Following Nancy Pelosi, former speaker of America’s House of Representatives, visit to Taiwan, China launched a series of war games around the island. China has since kept chipping away at American military superiority, including its technological edge. Pushing this edge is, therefore, a priority for the Department of Defence. This explains US tech start-ups’ rising contribution to the defence sector.

Further fuelling the geopolitical tensions across the globe is the Israeli-Palestinian conflict, one of the world’s most enduring conflicts, which dates to the end of the nineteenth century. The concern is that a third intifada could break out and the renewed tensions will escalate into large-scale violence. The US is interested in protecting the security of its long-term ally, Israel, and achieving a lasting peace between Israel and the Palestinian territories, which would improve regional security. Like the US with Israel, Saudi Arabia is protecting Palestinians’ interests. Crown Prince Mohammed bin Salman said that if they are to carry out a deal with the White House to normalise ties with Israel, Palestinians’ conditions would play a “very important” role in the agreement. As part of the deal, the US would help the kingdom develop a civilian nuclear program with uranium enrichment on Saudi soil and Israel would make some concessions to the Palestinians. While neither the US nor Israel has so far agreed on allowing uranium enrichment in Saudi Arabia, doing so would represent a change of direction from decades of policy in both countries, where leaders have worked to prevent Middle Eastern countries from developing this capability.

EMEA Sphere

With Russia’s invasion of Ukraine, private investors in defense technologies have started to look at the growth opportunities provided by the conflict. According to Serge Weinberg, chairman at Sanofi, “There is a need for additional production capacity, ability to build up stocks, and therefore there is a need to strengthen the financial structures”. Weinberg is one of the private equity executives in France who are leading the consolidation of the country’s fragmented defence supply chain, which was impacted by the COVID-19 pandemic through its many small companies and fragmented aerospace. Meanwhile, in London, Shonnel Malani, managing partner at private equity firm Advent International, said that the geopolitical risks posed by China and Russia were already causing the private capital to be flowing into the defense sector, which was considered a priority. He highlighted his interest in “innovative technologies focused in hypersonic, cyber, space and submarine defense”.

As a result, deal activity for European private equity and defense-focused companies reached €3.8bn in 2021, the second highest in the past decade after €5.3bn in 2019. Advent International was responsible for the two largest PE defense deals, when it purchased UK-listed group Cobham for £4bn in 2019, as well as its acquisition of Ultra Electronics for £2.8bn in 2022. Venture capital funds are also investing more in European defense-related companies and invested €96m in 2022, a 50% increase from a year earlier and the highest level in a decade. Weinberg Capital Partners has raised more than $100m towards new French defense companies and is hopeful that the fund will double that amount as fundraising continues.

Among all start-ups, Munich-based Helsing has raised €209m in a round of series B funding led by US venture capital firm General Catalyst with the participation of Swedish defense group Saab, which claimed that it was paying €75m for a 5% stake in September 2023. This would imply a valuation of €1.5bn for Helsing, whose aim is to develop its AI software to boost electronic warfare, cybersecurity and intelligence analysis. Founded in 2021, the company uses AI to create real-time pictures of battlefields, catching the attention of governments across Europe. As a matter of fact, the German Air Force decided to collaborate with Helsing to develop electronic warfare upgrades for its Eurofighter jets. The Combat Air System program, supported by France, Germany, and Spain, also made a deal to secure the supply of AI capabilities.

In the meantime, Tekever, a Portuguese drone company, was one of the European defense start-ups that attracted the most interest from investors since the start of the war. The company, which has operating branches in the United Kingdom, USA, Brazil and China, was able to raise €20m through a funding round in 2022. The round was led by Ventura Capital, a global growth fund that specializes in pre-IPO technology companies and was joined by Iberis Capital, and unnamed strategic investors from the maritime industry and shipping OEMs.

However, strictly defense-focused companies are not the only ones to receive funding for defence purposes. Improbable, a UK-based metaverse company, raised $100m in November 2022 at a valuation of $3bn. Founded in 2012 by Herman Narula, the start-up offers virtual gaming experiences, as well as infrastructure for defense simulations, for example to the UK’s Ministry of Defence. The company is working to develop a synthetic training environment with live, virtual and practical mediums, which will give the British Army greater exposure to complex scenarios by tailoring the training to their precise needs. In June 2023, the company sold its defence division to NOIA Capital for an undisclosed amount.

North American Sphere

As tensions with China and the war in Ukraine persists, investors in the US are becoming increasingly confident that the US government will recognize the development of the defence sector, giving lucrative contracts to Silicon Valley companies to secure cutting-edge technology. Some private companies such as Virginia-based defence group HawkEye 360 and SpaceX are already actively playing their part, providing Ukraine with satellite radar imaging to detect Russian convoys and jamming-resistant internet connectivity. The industry seems to be surging almost mirroring the boom of the artificial intelligence sector, which was one of the few parts of the tech industry that did not experience a plunge in activity as part of a broader economic downturn. As a matter of fact, US venture capital firms agreed to more than 200 deals in the defence and aerospace industry in the first half of the year, for a total worth of $17bn. According to PitchBook, that is more than what the sector was able to raise in the whole of 2019.

Source: PitchBook 2023 data via the FT.

Venture capital investment in defence start-ups rose from $16bn in 2019 to $33bn in 2022, with a record $14.5bn in just Q1 2023. As a result of the influx in funding, there are now six promising defence tech unicorns: Shield AI, HawkEye 360, Anduril, Rebellion Defense, Palantir and Epirus. Two of those – Shield AI and Anduril – have received financial support from the U.S. Innovative Technology Fund, a new multibillion-dollar fund launched by film producer Thomas Tull, who said that the war in Ukraine has created a sense of urgency among investors.

Among the most relevant defence tech start-ups is Anduril, a US-based defence technology start-up, which raised almost $1.5bn at the end of 2022 in a round of series E funding led by Valor Equity Partners, a long-time investor, with participation from several others, including Toll’s U.S. Innovative Technology Fund. This resulted in a valuation of nearly $8.5bn, almost double its 2021 valuation. With the new funding, Anduril will be able to accelerate R&D to deliver new products and technology, as well as scale its current business lines with the US Department of Defense and its allies. In 2022, the company closed a $967m contract to become the Systems Integration Partner (SIP) for the U.S. Special Operations Command over 10 years, providing counter-UAS (Unmanned Aircraft System) technology. In the same year, the company expanded to Australia to work alongside the Australian Defence Force and the Australian government and signed a $100M contract for a co-funded program for Extra Large Autonomous Undersea Vehicles (XL-AUVs) with the Royal Australian Navy.

Anduril recently combined its technology with that of another defence tech unicorn – Epirus, Inc. – to develop a system to identify and defeat swarming drones. The project, which combined Anduril’s Lattice command-and-control technology and Epirus’ high-power microwave (called Leonidas), was put together for a recent U.S. Marine Corps Warfighting Laboratory demonstration. Epirus, an AI-powered counter-UAV systems provider, was founded in 2017 and has received $289m in total funding, with its last $200m funding round in February 2022, when the company was valued at $1.35bn. Alongside Leonidas, some of its products include a software-defined electromagnetic pulse system, which has defence and public safety applications, and several precision detection systems to detect unauthorized vessels in waterways.

On the public side, Palantir [NYSE: PLTR], a big data analytics start-up, was founded in 2003 and it offers software applications designed for integrating, visualizing, analysing data, and fighting fraud. It aims to combine enterprise data foundation with end-to-end AI and Machine Learning deployment infrastructure. The company is mostly known for three projects: Palantir Gotham, a predictive policing system used in offices of the United States Intelligence Community (USIC) and United States Department of Defense; Palantir Apollo, an operating system for continuous delivery and deployment across all environments, used to update to configurations and software in the Foundry and Gotham systems through microservice architecture; Palantir Foundry, a data analytics system whose target are corporate clients, such as Morgan Stanley, Airbus and Fiat Chrysler Automobiles. As a matter of fact, Palantir’s clients were initially federal agencies of the USIC, but the company has expanded to state and local governments, as well as private companies in the financial and healthcare industries. The company received $3bn over 19 funding rounds before going public in September 2020, and its market capitalization is now over $31bn.

The Shift to Software

The main difference between start-ups and established companies in the defence sector is start-ups’ focus on software. The bridge between software and the more established defence companies is crucial looking forward and will be the main determinant of successful military applications for defence companies. The Department of Defense has been focused on the partnership of top technology start-ups into their fleet of arms dealers and the VC industry has noticed.

“Pushing that edge is therefore a priority for the Department of Defence. And that would be easier if America’s world-beating software developers worked more closely with its equally formidable arms makers, thinks Michael Brown, who heads the department’s Defence Innovation Unit. Katherine Boyle of Andreessen Horowitz observes that America’s largest weapons manufacturers lack top-flight programmers.”

Established tech giants such as Amazon [NASDAQ: AMZN] and Microsoft [NASDAQ: MSFT] have been gunning for government sponsored contracts, the VC industry has kept flooding the defence-tech industry with funding, causing the standoff between America’s technological future and the Pentagon what might “reshape America’s mighty military-industrial complex.”

The prevalent geopolitical turmoil across the world has led to blurred lines between innovative technology and traditional warfare. The need for artificial intelligence has rised throughout the years and militaries have been switching their focus from traditional contractors to more innovative start-ups, less burdened by traditional industrial delays. Developments in Machine learning have switched the balance of strength amongst defence companies towards technology start-ups leaving established companies like Raytheon [NYSE: RTX] or Lockheed Martin [NYSE: LMT] lagging.

The Department of Defense has stated that moving forward they would rather “buy isolated “platforms”—aircraft, tanks and other advanced systems—to build more networks of cheaper battle units.” A plan that has worked as demonstrated by Israel’s utilization of connected drones in the Gaza strip. Through its Joint All-Domain Command and Control system – JADC2 (A software allowing real time data sharing among battle units and sensors), the Pentagon has realized the value of innovative technology, and has tipped the scales on the shift towards software in warfare.

Big tech is no stranger to government revenue and providing software to law enforcement, expanding their reach past the traditional cloud storage, admin work and logistics, Industry titans are looking to expand their horizons further into the application of the technology to the battlefield. Several important contracts in the past few years have gone to Silicon Valley giants like Alphabet [NASDAQ: GOOGL], Amazon, Microsoft and Oracle [NYSE: ORCL] who will split the $9bn five-year contract to manage the Pentagon’s Joint Warfighting Cloud Capability software. Additionally, Microsoft won a $22bn for an augmented reality training device called HoloLens. These companies are evolving to supplement the public sector and are slowly shutting out more established players. Alphabet recently announced their new unit, Google Public Sector, to win the Department of Defense’s battle networks contacts.

Start-ups such as Anduril, compared to large defence companies such as Lockheed Martin and Northrop Grumman [NYSE: NOC], take up all the research-and-development risk on their own, avoiding the Pentagon’s established “cost-plus” procurement system. “Cost-plus contracts pay a contractor for all its allowed expenses, typically up to a set limit, with the ‘plus’ referring to an additional payment that allows a contractor to make a profit.” Although large projects like F-35 deliveries and more unique requests such as aircraft carriers benefit greatly from the system. The usual consequence is that it weakens incentives and creates a costly business model that is weighed down by bureaucracy. Instead of simply waiting to win a contract, Anduril manufactures products itself and then aims to sell them directly.

The Future

One possible solution to companies’ whose revenue is entirely derived from the public sector, is what’s known in the industry as a “dual use” business model. One of the companies that has successfully implemented it has been Palantir, by working with both private clients and governments who have friendly geopolitical relations with the United States. Its software sifts through large pools of data to help make quick decisions and has proved to be a successful player in what people deemed a saturated industry. Other firms with similar business models have increased their share of defence contracts, mostly thanks to the Pentagon’s Defence Innovation Unit that stimulates the use of commercial technology thanks to its rapid ability to respond to global threats.

Robert Stallard, analyst at Vertical Research Partners, said the problem was not so much the defence industry but the structure of government defence departments. “Governments are just not geared up to develop and procure stuff faster, or to pay industry the sort of returns that you can get in the commercial world. Just compare Apple’s margin to Lockheed Martin’s,” he said. The shift has been particularly evident in the plunge of giant Lockheed Martin’s stock. Delays in the delivery of tens of F-35 jets are going to cause the company to lose $210 – $350 million this year according to their CFO. This brutal problem can be attributed to their software issues which prohibited delivery of an updated internal processing power which would have yielded nearly 25 times more computing power. Following the announcement on behalf of the CFO, the stock dropped 17.5% from its all-time high to of 500$ per share.

Conclusion

Although the defence sector has evolved in recent years thanks to non-traditional players breaking in and innovative business models evolving, the technology industries market share in the sector is far from assured. Rising geopolitical tensions across the globe ranging from the Middle East to European conflicts have seen an increase in start-ups and consequently the funding of them. The static defence sector may be shifting, but we’re yet to see whether it will be successful. The largest technology companies in the world have tried their luck in the warfare game before, with mixed results. The Department of Defense and Apple collaborated on a project that would have seen them develop wearable battlefield technology in 2015, but the partnership wasn’t fruitful. Lawsuits between Amazon and Microsoft relating to past Department of Defense contracts have stalled advancements on their side. The HoloLens deal, although promising has suffered from long delays and has been a topic of discussion in politics as a waste of tax money. Palantir, the driving force of the dual-force business model has reported several losses and disappointed investors leading to several drops in its stock price. The future of the industry is unclear, but one thing is certain: Software will radically change the way the game is played.

0 Comments