Introduction

In the following article we will present a short in Datadog. We will give an overview of the business, dive into what the street is currently pricing in and then outline our contrarian view. In the appendix the most important additional material is attached.

Business Overview

Datadog [NASDAQ: DDOG], headquartered in New York City and founded by Olivier Pomel and Alexis Lê-Quôc, is a global observability SaaS company serving organizations across the Americas, EMEA, and Asia-Pacific. The company offers a wide variety of monitoring services, catering to a broad range of customers, including tech-startups and large firms in the financial services, retail, and tech sectors.

Datadog has an expansive product portfolio, all delivered through their unified SaaS platform. The core products include Infrastructure monitoring for cloud services, servers, and containers, APM for code optimization, Log Management, Security monitoring for hack detection, and User monitoring. Infrastructure monitoring, APM, and Log management are by far the most desired products, accounting for $2.25bn of Datadog’s $2.9bn annual recurring revenue. The firm has also recently expanded into AI observability as a way to offer a more complete product offering for their most important AI native clients.

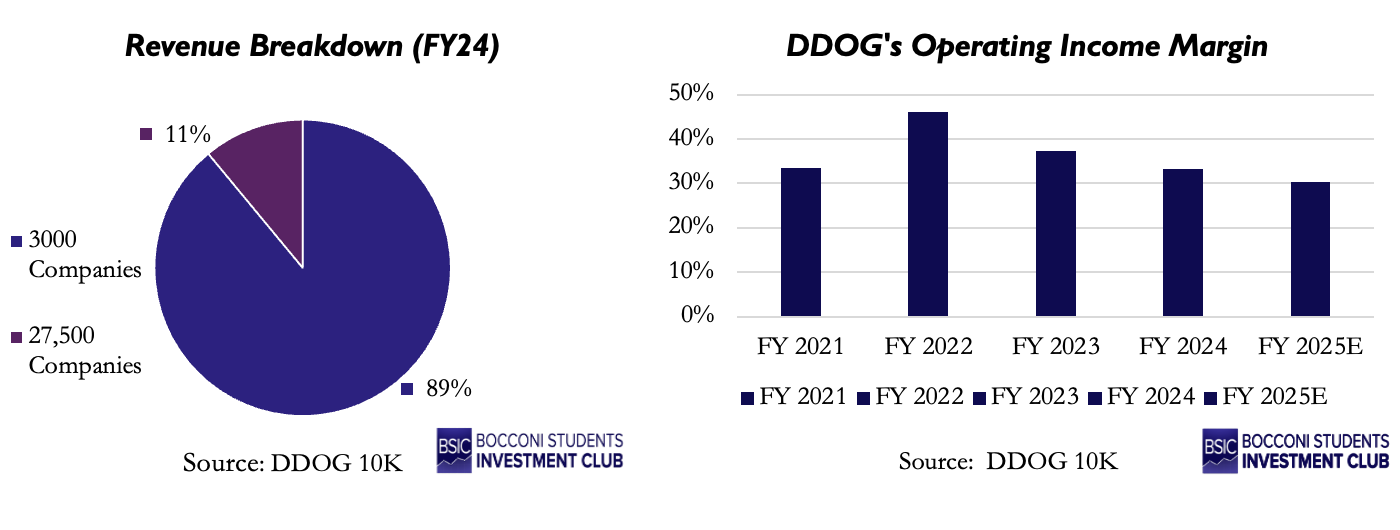

Financially, as seen in the graph below, Datadog’s revenue is extremely concentrated in a small number of big AI native companies, raising serious concerns about the potential consequences if a few of these companies decide to go in-house. Additionally, Datadog’s operating margin has been consistently decreasing over the last few years from its high in 2022.

Datadog’s pricing model includes an annual subscription fee, in addition to a usage-based fee. On top of the committed base, Datadog charges an additional, uncapped amount based on usage e.g. number of servers monitored, number of users tracked. In order to further increase their revenues, Datadog uses a high-water mark model, meaning you pay based on the highest usage in a billing period, not the average. Datadog’s “Land and Expand” business model is highly complementary to its pricing structure. Clients initially start with one or two of their products and then over time, increase the number of products used. This leads to significantly higher usage over time and therefore much higher fees as well.

Stock Performance and Setup

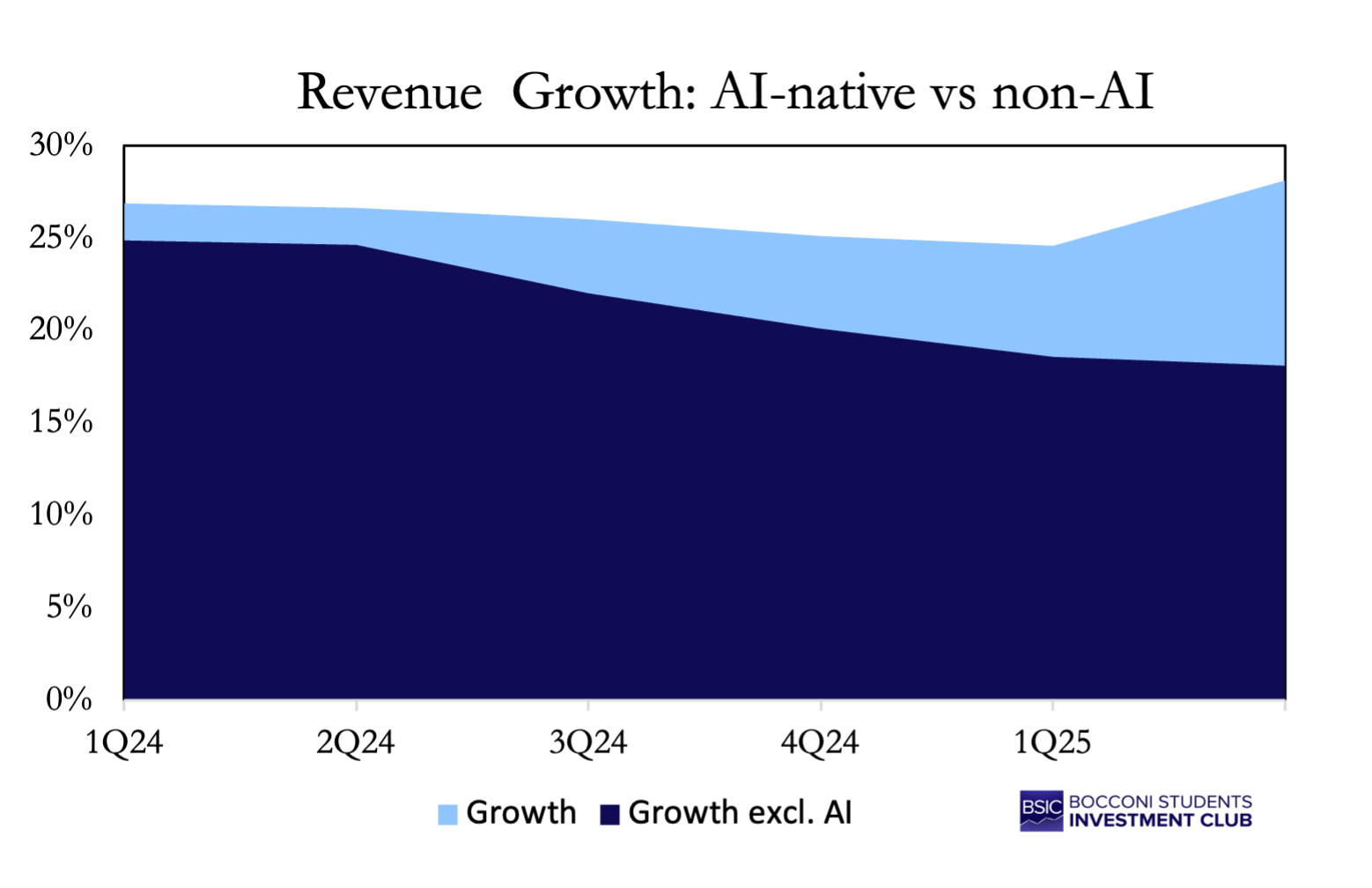

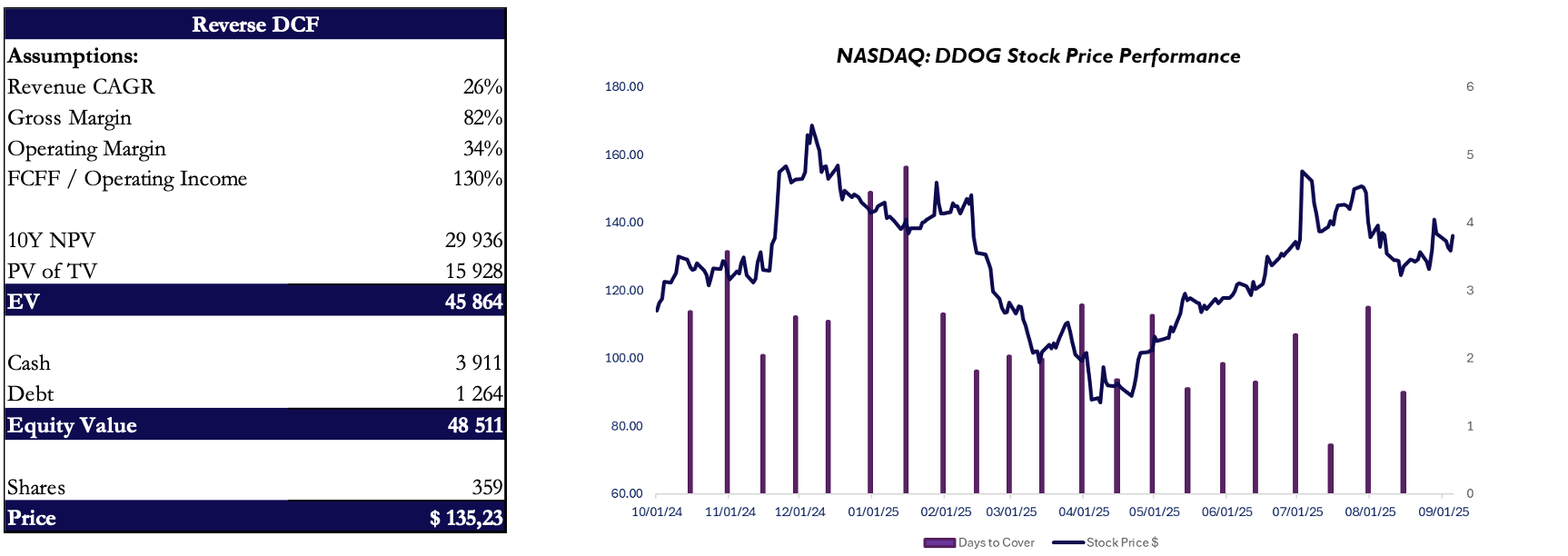

Before building a thesis around the stock, the first thing we looked at was the set-up. For DDOG, the story has always been around growth. More precisely, revenue growth decelerating post-COVID due to a wave of client optimisations on observability spending. As can be seen in the diagram, the growth rate dropped from 80s to 40s, eventually reaching mid-twenties. In terms of stock price performance, it has been quite volatile over the last couple quarters. After very mediocre 4Q24 results and poor Q1 guidance, the stock traded down from 130s to low 100s (-25%) into the Q1 print. Then, on the back of macro headwinds easing and positive signals on the demand side from DDOG’s customers, the stock traded back up to 130s into the Q2 print and that’s where it is right now. In Q2, DDOG reported a record-breaking beat, growing revenue by 28% and beating consensus by 455 basis points. At the same time, it reported NRR rebounding from 110s to 120s. All in all, extremely positive earnings. After Q2, consensus remains very bullish and it seems as though the market views the Q2 growth number as an inflection point in the long-term trend of deceleration. The current bull case for DOOG relies on two premises.

- AI-driven demand for larger and larger workflows will fuel growth in the AI-Native cohort, allowing for sustained revenue growth.

- The land & expand model offers a massive cross-sell opportunity to increase the number ARR without having to obtain new clients.

A reverse DCF implies a revenue CAGR of 26-27.5% through 2035, which seems to be the growth rate that the market is expecting from the two bull thesis elements materialising in the next years. Now, of course growth likely won’t be distributed evenly and one could make an argument that the real implied growth rate for the next 2-3 years is closer to low 30s as DDOG is still in the fast growth phase. Regardless, this number makes us believe that the market sees the 28% YoY growth number as a permanent inflection in DDOG’s growth. Our analysis found that there exists a number of factors related to pricing and inevitable churn in the AI-Native cohort that will make the bull case story highly unlikely and cause the real growth rate to be in high teens / low 20s vs market-implied high 20s / low 30s.

Thesis 1.1: Pricing pressures will slow down growth

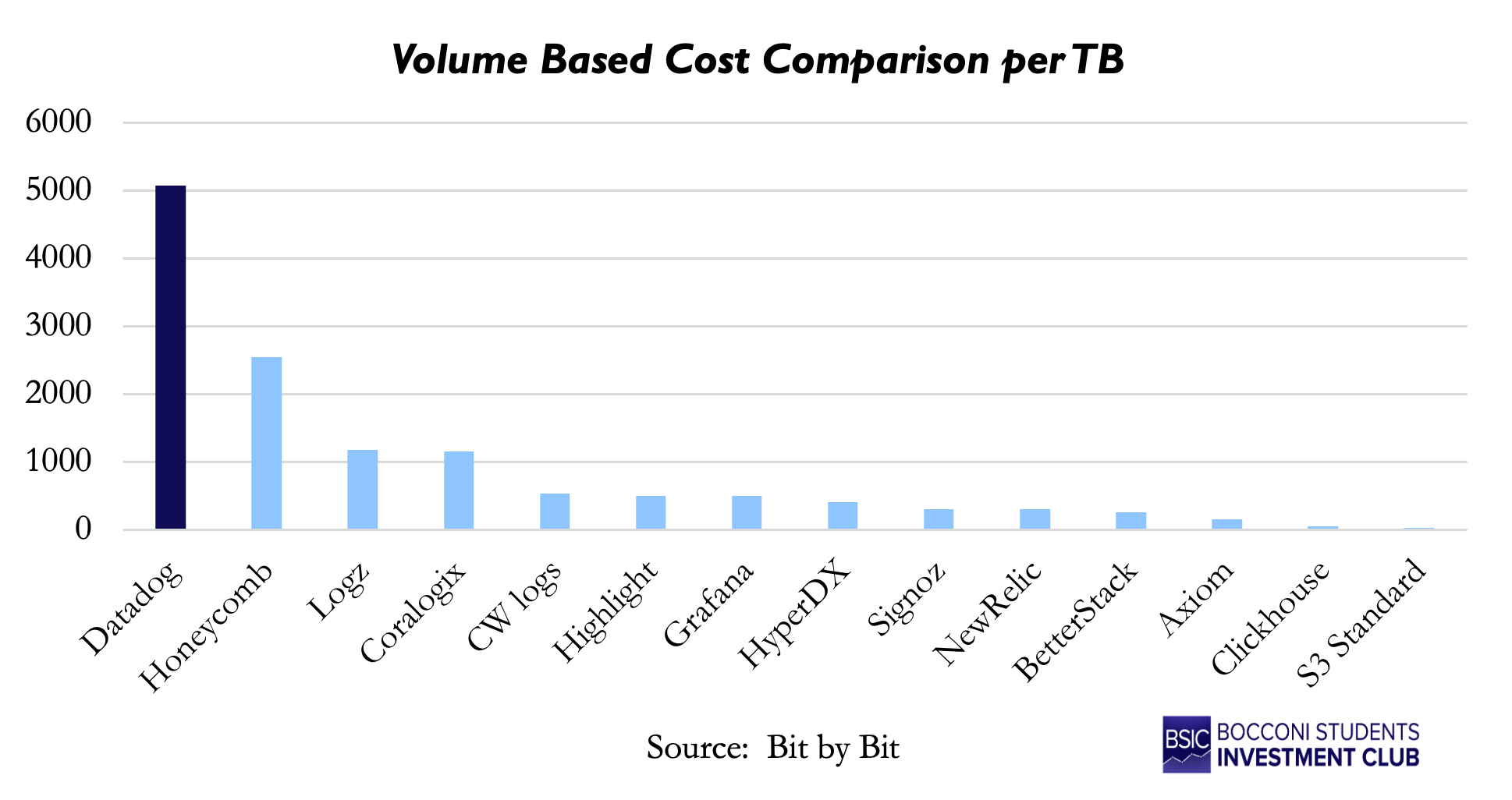

As mentioned, sentiment for DDOG has turned bullish after the 2025 Q2 print, and consensus is that revenue will keep growing in the high twenties to low thirties. However, we believe that Datadog’s pricing is too high, and repricing will be inevitable, making it highly unlikely for DDOG to maintain that growth rate. Unit-economics show a clear picture: Datadog’s logs are much more expensive than competitors.

AWS: Basic features, AWS native: $0.02 / GB

Grafana Cloud: open-source, flexible, less reliable $0.50 / GB

Datadog: Best user experience, easy adoption $3.32 / GB

We see that DDOG’s logs are priced at 166x hyperscalers and 6.6x open source. Despite higher functionality and better user experience this premium is not sustainable. However, bulls argue that DDOG’s product offerings are highly entrenched, making them immune to pricing pressures. Looking at the data, we see that this is not the case, because in 2Q2025 48% of users deployed only 3 products or less (logs, traces, and infrastructure monitoring) which can be partially or fully replaced by other vendors.

This thesis is backed up by real-world evidence: In 2021 Coinbase spent $65m on Datadog after which it spun out a special team to manage the complete transition out of Datadog’s products into open-source infrastructure. Furthermore, we see that price sensitivity is still and issue and the trend of large scale enterprises moving in-house or migrating is continuing. For example, just now, in in 1H25 Delivery Hero ($7.95bn market cap) migrated its observability infrastructure from Datadog onto Grafana Cloud, showing that a move onto cloud is economically rational and feasible. Pricing pressures are not only felt at large enterprises but also at SMB’s and startups. Experts portray a clear picture:

“From seed-stage startups to Fortune 500s, I keep hearing the same thing: a ‘huge observability bill’ that’s ‘a real drag.’” — Kevin S. Lin (observability expert and now OpenAI)

”His company doesn’t use Datadog for security because it’s too expensive […] there are other options available in the market that have similar services to what Datadog provides” — JPM Source Interview (SV start-up)

Thesis 1.2: Pricing is a problem beyond logs and will hinder the cross-sell ramp

While the pricing issue is most severe for logs, DDOG is the most expensive vendor across the entirety of its product portfolio. We think this will affect Datadog through multiple channels. Firstly, the high pricing will result in loss of customers to cheaper competitors. We’ve already seen large enterprises move to open-source solutions which are more efficient at scale, while start-ups don’t expand beyond basic features due to costs. In the future, we see even more disruption coming. Firstly, hyperscale’s have robust offering of storage solutions and if they move in with their own observability products, price competition will become even more intense. Secondly, start-ups like Nimbus are disrupting the way data companies use providers like DDOG: they offer pre-screening of the data to decrease the volume sent to expensive vendors by 50-60%.

In terms of how this will affect DDOG, we see multiple equally problematic scenarios, all coming down to the simple effect of pressure on growth. Firstly, the simple option of repricing across the product portfolio would instantly put downward pressure on ARR and growth. The less abrupt option of users migrating to much cheaper and lower quality “flex logs” DDOG introduced recently would effectively have the same effect as direct repricing. Finally, the scenario where companies like Nimbus decrease the volume of data DDOG receives would similarly put pressure on ARR and growth but through a volume instead of pricing effect.

Thesis 2: OpenAI is the first domino to fall

A growing part of OpenAI’s revenue mix has recently come from their AI-native cohort. AI-native companies are startups and firms whose core products are built directly on AI models (e.g., LLM apps, generative AI platforms, AI infrastructure providers). Unlike Datadog’s traditional customers, who mainly use observability to monitor standard web apps and enterprise IT, these firms rely on observability to track highly dynamic, compute-intensive AI workloads (GPU usage, model latency, pipeline failures). As mentioned, growth has been driven by these companies which can be observed below (CFO David Obstler: “Key Growth in Q2 2025 from AI Native-Cohort”)  Bulls argue that Datadog’s Q2 beat marked a key inflection point and expect revenue growth to sustain this trajectory. We, however, believe the AI-native setup is built on shaky ground and could trigger a domino effect leading to an ARR wipeout for Datadog. Stepping back, this revenue stream is extremely concentrated: OpenAI alone accounts for roughly 50% of AI-native ARR, with the remainder spread thinly across about ten other players, which is due to the highly specialized nature of this line of business. Over the past quarters these players have drastically increased their bills with DDOG, making an in-house move economically rational. We believe that OpenAI is the first domino to fall and evidence suggests that OpenAI is already building out its in-house capabilities.

Bulls argue that Datadog’s Q2 beat marked a key inflection point and expect revenue growth to sustain this trajectory. We, however, believe the AI-native setup is built on shaky ground and could trigger a domino effect leading to an ARR wipeout for Datadog. Stepping back, this revenue stream is extremely concentrated: OpenAI alone accounts for roughly 50% of AI-native ARR, with the remainder spread thinly across about ten other players, which is due to the highly specialized nature of this line of business. Over the past quarters these players have drastically increased their bills with DDOG, making an in-house move economically rational. We believe that OpenAI is the first domino to fall and evidence suggests that OpenAI is already building out its in-house capabilities.

- Hiring Kevin S. Lin

- Clickhouse Partnership

- Rockset Acquisitions

- 2024 Chat GPT Outage

As listed above, they hired Kevin S. Lin (an observability expert), have partnered up with Clickhouse (an open-source, high-performance OLAP database) and just recently acquired Rockset (a real-time indexing and search engine for streaming dat). This allows them to build a fully integrated, in-house observability pipeline tailored to AI workloads, reducing reliance on external vendors like Datadog. Furthermore, in 2024, we have seen an outage in ChatGPT, which was triggered by a rollout of custom telemetry service for Kubernetes clusters, showing that OpenAI is actively developing in-house observability pipelines.

We observe again that this is backed up by expert opinions:

“A lot of customers like OpenAI have scaled back their usage of external vendors, creating a revenue hole for those vendors.“ – Kevin S. Lin

This is again backed up by experts: “IF OpenAI decides to go that route, it’s [conceivably] do-able, HOWEVER, it’s more about the HR hours and Engineering hours and those aspects” – JP Morgan Expert Interview

If OpenAI—representing roughly 50% of Datadog’s AI-native ARR—moves fully in-house, it would immediately wipe out close to $170mn of high-margin revenue. Given that the rest of the AI-native cohort is similarly concentrated among just ~10 players, the risk of follow-on defections is material. This concentration leaves Datadog exposed to a domino effect that could slash a significant portion of incremental growth, compress margins, and derail the bullish revenue trajectory implied by the Q2 beat. In other words, what bulls view as a new inflection point may instead prove the peak of AI-driven growth.

Thesis 3: Security will not gain market share

Datadog’s security platform will struggle against fierce competition from pure-play security firms. Datadog’s security business competes with specialized security vendors, including CrowdStrike, Palo Alto Networks, Wiz, and Splunk, who are able to offer significantly more advanced and extensive features. Furthermore, Datadog is seen as an observability company, so it has a worse reputation and less brand trust than companies focused exclusively on cybersecurity. Cloud-native security startups, including Orca, Lacework, and Synk, are also growing rapidly and gaining market share, making it even more difficult for Datadog to meaningfully penetrate the industry.

Moreover, Datadog’s pricing model puts the company at a disadvantage to competitors. Datadog’s usage-based and “high-water mark” billing make its security offering expensive and unpredictable, especially at scale. Competitors like Wiz and SentinelOne offer flat, predictable pricing based on cloud footprint with no extra fees for cloud traffic increases. This is especially important given the fixed budgets security teams operate under. Due to these reasons, customer adoption has been weak, with the majority of consumers taking the cautious approach and favouring established or pure-play tools.

The cybersecurity industry has also seen significant M&A activity recently with big tech players like Alphabet [NASDAQ: GOOG], Cisco [NASDAQ: CSCO], and Cyberark [NASDAQ: CYBR] all choosing to acquire cybersecurity companies in multi-billion-dollar deals. This highlights the trend of big tech deciding to build their own cybersecurity offerings in-house as opposed to looking to outsource to third party companies like Datadog.

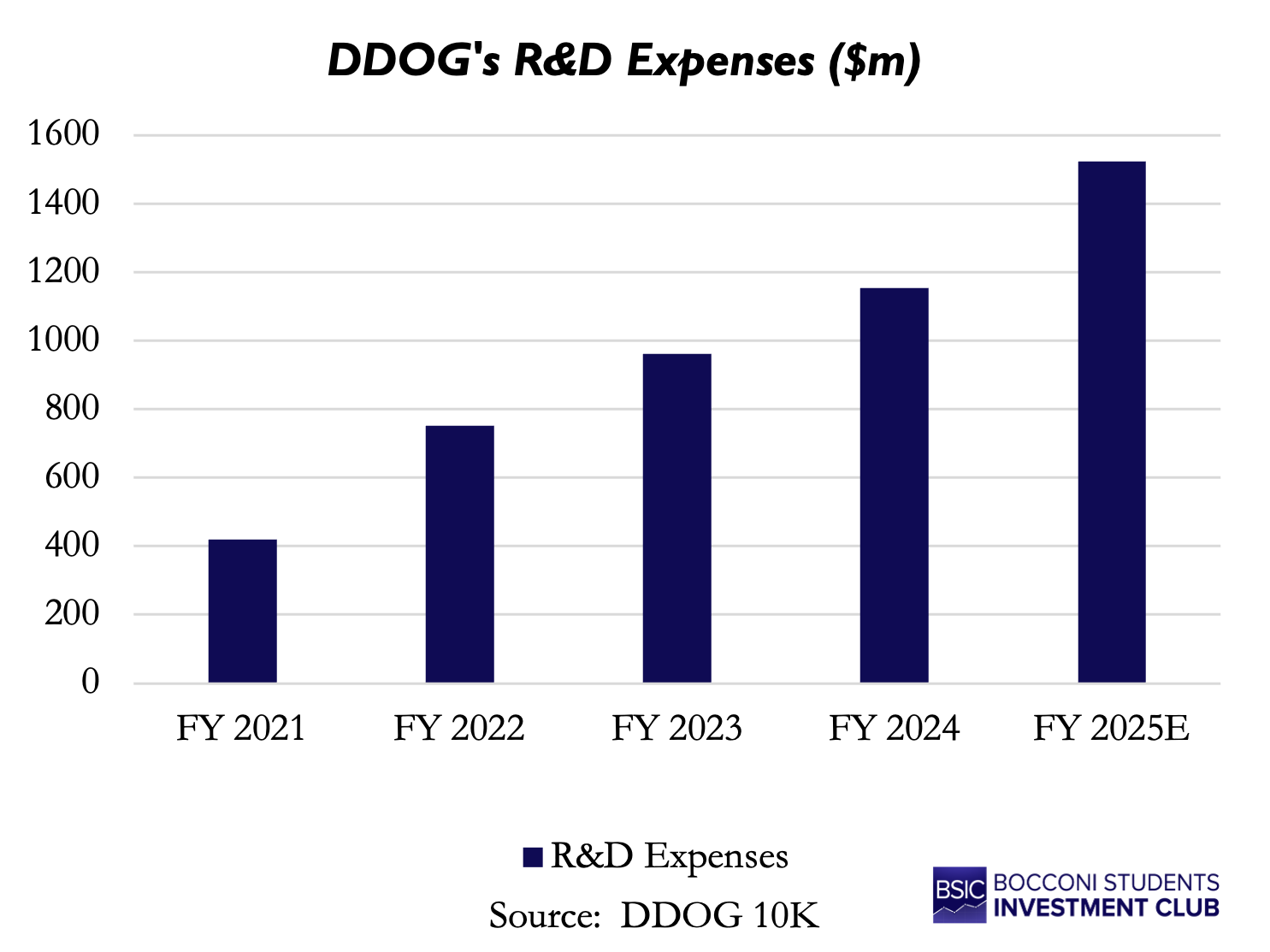

Finally, as seen in the graph below, Datadog has been investing extensively in R&D over the last five years without making much headway in the cybersecurity sector. Currently, the firm’s security business accounts for only $100m of the total $2.9bn annual recurring revenue.

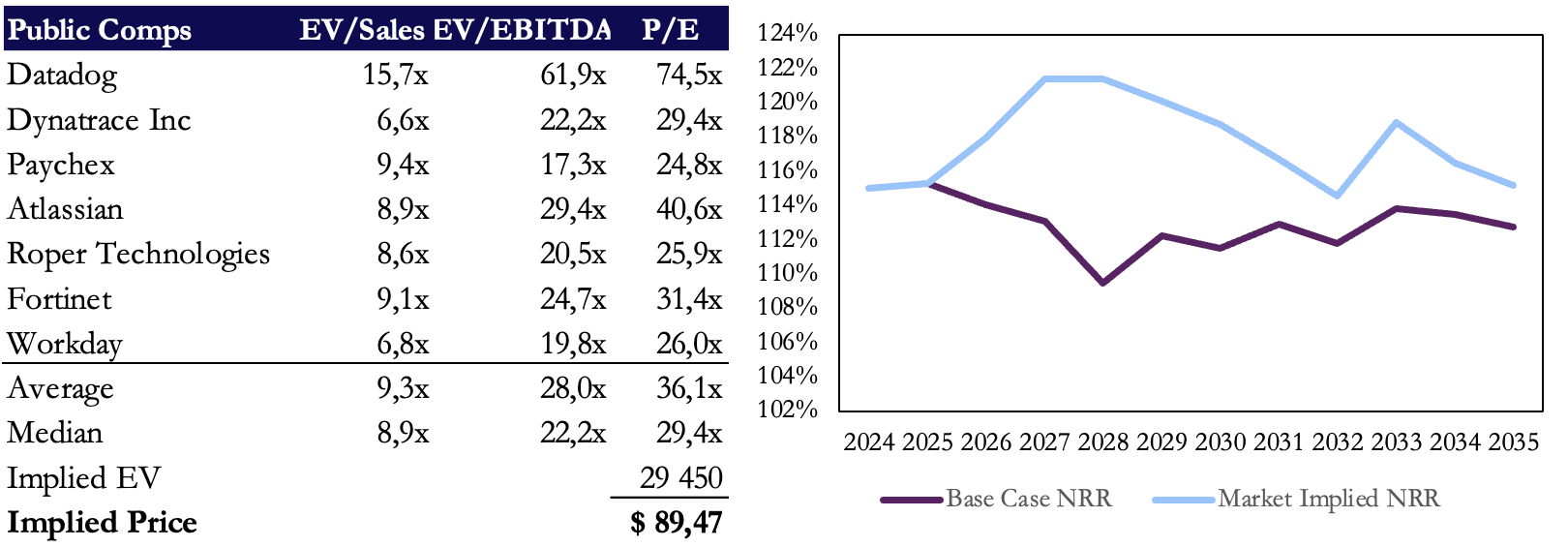

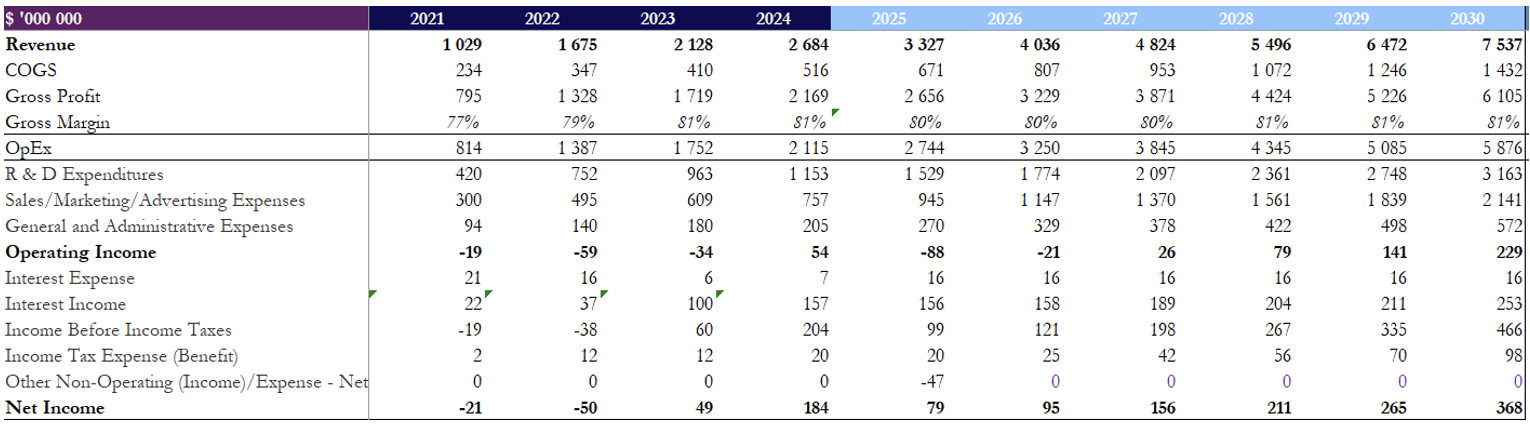

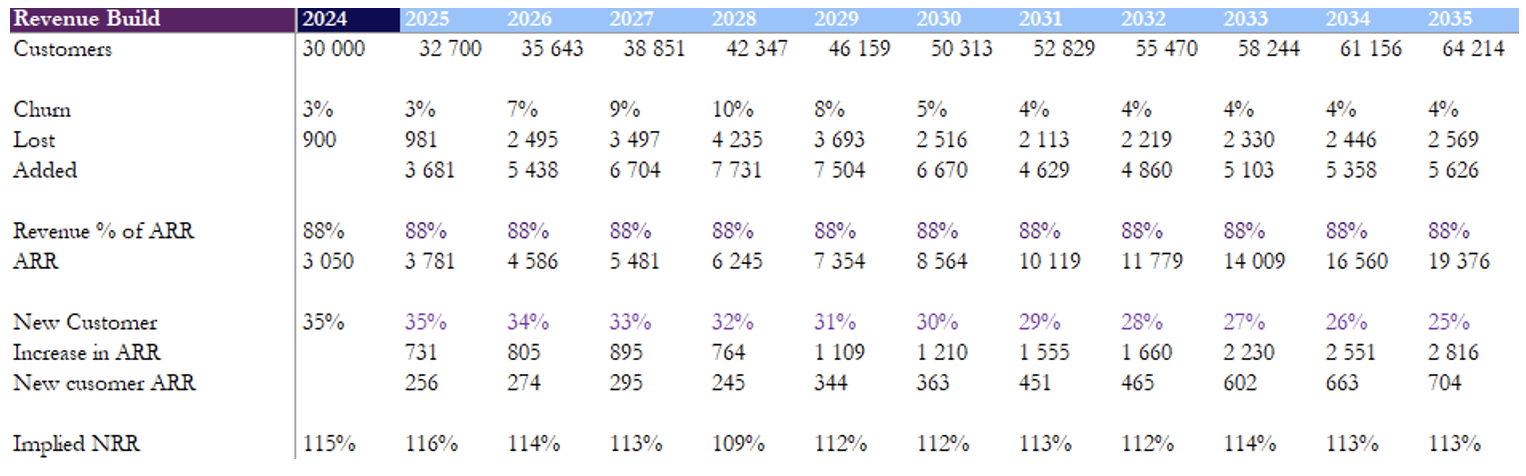

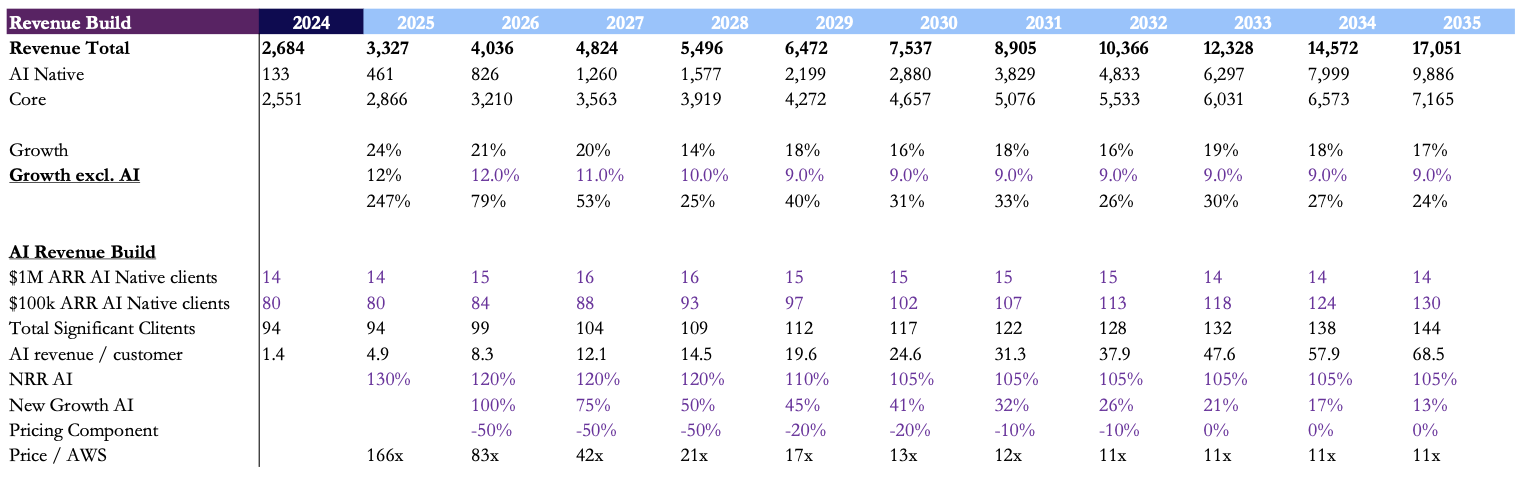

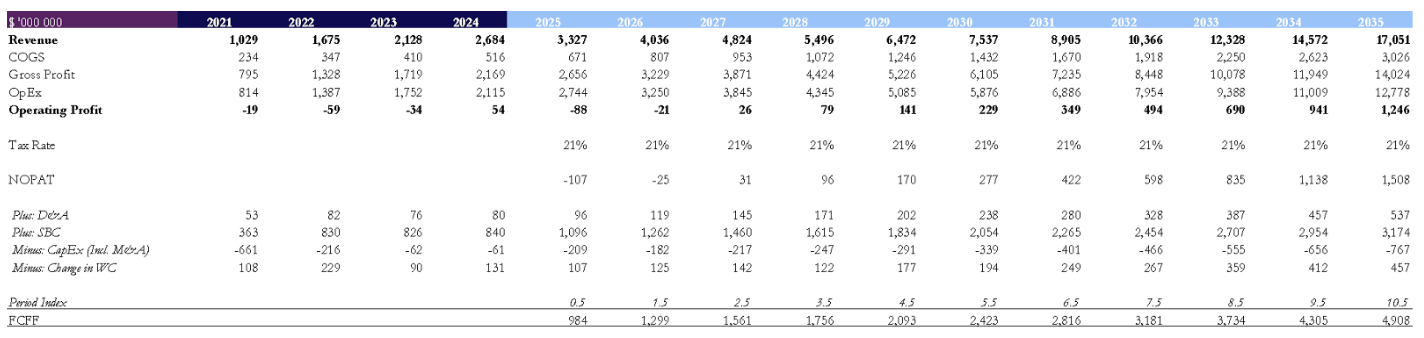

Valuation and growth assumptions are stretched

In terms of modelling, we primarily think of the revenue build and implied CAGR & NRR. Considering a wide range of repricing scenarios and different churn rates for the AI-native cohort, DDOG presents an asymmetric bet on the growth rate underperforming market expectations. For our base case, we assume repricing of logs from 166x to 10x AWS by 2031 and loss of OpenAI (50% of AI Native revenue) by late 2027. In this case, the 2035 CAGR is 19% – well below the market’s 26%. In terms of implied NRR, this scenario implies the NRR reverting from current 120s to mid-110s in the long-run, with a low-point of 104% at the high-point of AI-Native churn and peak of 119%, which we deem as reasonable. While we see DDOG as a bet on the growth rate, we do also think there’s a fundamental argument behind the thesis. Both on DCF and comps basis, DDOG’s fair value is closer to $ 90 than the current $ 135. Hence, due to the elevated valuation, we see a lot of room for a downward rerating of DDOG as our thesis plays out.

Event Path – How do we make money?

We have already observed customers price pushback on log management, with DDOG having to introduce cheaper “flex logs”, however we see many catalysts ahead that will further compress Datadog’s revenue growth rate.

First, pipeline compression and stricter sampling/retention practices are becoming more common with the rise of startups like Nimbus. This means that the effective GBs in the observability process are being reduced, meaning that Datadog can charge much less just naturally even if we assume that repricing does not happen.

Second, the domino effect of in-house solutions could prove particularly damaging. As AI-native firms like OpenAI become more cost-conscious, they are increasingly developing their own observability pipelines. If such a move gains traction, it could accelerate a broader trend of hyperscalers and sophisticated enterprises following suit, further eroding Datadog’s share of wallet.

Third, hyperscaler enterprises and cloud-solutions discount will amplify the pressure. Once hyperscalers push discounted observability bundles, core enterprises may follow, forcing Datadog to lower prices and accept margin compression.

Risks – Where might we be wrong?

To be fair, there are risks to this bear case. Things to monitor are, whether integration will help protect DDOG’s pricing, and observability tied to AI/LLM’s of non-native AI companies could accelerate demand. Macro tailwinds from AI investments also remain strong. However, our rebuttal is straightforward: most enterprise already run multiple tools, so consolidation has already taken place. We already see that, alternatives like Grafana, Chronosphere, and hyperscaler-native tools integrate smoothly into Datadog’s ecosystem, making switching easier. Moreover, AI observability still faces challenges such as limited skilled talent, data quality concerns, and compute availability. Real-world production use cases will take time to scale.

Narrative Summary

Following weak Q4 2024 guidance, investor confidence in Datadog deteriorated as long-term revenue growth deceleration became visible. The stock dropped into the low $100s before re-rating into the $130s ahead of Q2 results, where a 28% revenue beat (vs. consensus 22%) and a rebound in NRR from the 110s to the 120s were taken as inflection points. Consensus has since turned wildly bullish, with short interest below 5% of float and a reverse DCF implying a 27% revenue CAGR through 2035 and NRR sustained in the 120s. Bulls argue this is achievable given Datadog’s perceived pricing power (160x AWS), the stickiness of bundled products, rising AI spend, and opportunities to cross-sell products such as security.

We take the opposite view: Datadog’s growth narrative is fragile and built on unsustainable assumptions. Its pricing is far above competitors and resets are only a matter of time. In practice, roughly half of the user base utilizes just three or fewer basic features, making them easily replaceable with lower-cost vendors or in-house solutions. The largest AI-native firms, who already account for ~11% of ARR, are especially incentivized to internalize observability given Datadog’s unsustainable pricing at scale. SMBs remain limited by high costs, while larger enterprises face strong economic incentives to optimize spend. Finally, Datadog’s push into security enters an extremely competitive arena dominated by entrenched specialists, where cross-sell potential is overstated.

Altogether, the stock is priced for perfection despite clear structural headwinds. With consensus expectations embedding hypergrowth far into the next decade, even modest resets in pricing or customer behaviour could trigger significant downside — making Datadog a compelling short.

References

[1] Datadog, Inc., Form 10-K Annual Report, 2024

[2] Datadog, Inc., Q2 2025 Earnings Call Transcript, 2025

[3] Datadog, Inc., Q4 2024 Earnings Call Transcript, 2024

[4] Datadog, Inc., Investor Presentation – Datadog Investor Day, 2024

Appendices

Income Statement

NRR Build

Revenue Build

DCF Base Case

0 Comments