Introduction

Challenged by innovation technology, artificial intelligence, fierce competition, stricter emission regulatory frameworks and the effects of Covid-19, the automotive industry is currently going through tough yet prosperous times. As the analysis will highlight, major trends and challenges are not only endangering the system, but also stimulating innovation and further growth.

The paragraphs that follow will walk the reader through the above-mentioned aspects of the industry under scrutiny, also addressing main M&A trends and core drivers of success within the car producers’ business models.

Industry overview

Driven by a fierce competition, the industry is reacting to extant challenges, by mainly pushing on innovation technology and engaging in strategic acquisitions.

As of the end of 2019, total global revenue amounted to $2.2t, with 90m vehicles sold globally, representing a 4% decrease, compared to the previous year. The historical 5-year revenue CAGR was estimated at 31.8%.

As for the financials, the industry is characterized by an average Debt/EBITDA of 3.7x, a Total Debt/EV of 0.39x and an Average EBITDA Margin of 11.3%.

In terms of valuation metrics, the mean EV/EBITDA was 9.4x, EV/Sales 1.3x and EV/EBITDA 9.4x, before the market turmoil that followed the outbreak of Covid-19.

As of today, competition is mainly defined through strong supply chains, strong barriers to entry, and software competence.

The first and most relevant driver of competition is undoubtedly represented by supply chain efficacy, which can be measured in terms of relationships with suppliers and distribution channels, and is aimed at minimizing costs. As such, the lack of a well-defined and consolidated supply chain represents one of the major obstacles for new players. The role of this factor for the success of firms in the automotive industry will be better addressed in the dedicated paragraphs that follow, which will also point out the difficulties that a carmaker might encounter, when macroeconomic distressed conditions hit this aspect of the business model.

As a second driver of competition in the industry under scrutiny, barriers to entry represent a further obstacle for incumbents. As a matter of fact, the investments required for the establishment of proper production facilities make the business significantly capital intensive.

The last driver of competition is nowadays found in software competence which, to some extent, represents a core factor of differentiation. As the next paragraph on industry trends will point out, innovation technology and artificial intelligence are currently re-shaping the industry; as such, the level of software development and integration on vehicles will sharply distinguish successful from unsuccessful firms.

Coming to the sector’s main players, this paragraph will address some of the most relevant corporations worldwide.

The biggest group is undoubtedly the Toyota’s, which has recently also stepped in Suzuky and Uber’s equity.

After Toyota, Volkswagen represents the second-biggest corporation worldwide in the sector, thanks to the aggressive M&A policy that the Group has followed over time. Indeed, the German conglomerate also owns Audi, Bentley, Bugatti, Ducati, Lamborghini and Porsche, among the many carmakers that it has acquired over the latest years. It is worth highlighting that Volkswagen has devoted significant effort for the production of fully-electric vehicles for the masses, perfectly in line with its vocation.

Focused on innovation and technology, BMW also enjoys an outstanding global reputation, even leveraging Mini and Rolls Royce’s brand reputation. The firm’s business strategy is defined by the acronym “ACES”, recalling the business model’s goal of achieving Autonomous, Connected, Electrified Shared Services. As a matter of fact, the German carmaker under scrutiny is currently engaged in a joint venture with Daimler, aimed at collaborating for developing the next generation mobility, i.e. car sharing. This latter player (Daimler) also represents one of the main firms within the automotive environment, worldwide known especially for owning Mercedes-Benz.

Based in Europe as some other above-mentioned competitors, the PSA Groupe owns some major low-cost car producers, such as Peugeot, Citroën and Opel. This French conglomerate is currently signing a merger agreement with FCA, aimed at promoting and increasing the market share of the two involved parties in the US and European battlefields, respectively. As a matter of fact, FCA has devoted significant financial resources to M&A transactions over the last decades, thus becoming a leading firm worldwide. As of today, FCA can count on Fiat, Chrysler, Alfa Romeo, Maserati and Jeep’s brand recognition.

The list would never be exhaustive, if it neglected Ford, Nissan, Honda and General Motors, which represent further major players within the industry that the analysis targets.

The value chain

The automotive industry is known for investing largely in value chain management. It is not difficult to guess where the most value is added, along the path from the provision of raw materials to the delivery of the final product. But as a capital-intensive industry, the analysis of the value chain becomes crucial in suggesting improvements at each stage of the chain, to cut the massive costs and gain competitive advantage.

The automotive industry is on the verge of renovating itself completely. So how will the value chain and its management change as new technologies disrupt the market?

In the car-manufacturing industry, the Primary Activities of the value chain are known to be five:

1.

To start, the Inbound Logistics is where the raw materials are distributed to the suppliers, which are expected to elaborate them and provide car manufacturers with the requested components, such as aluminum, other fabrics, pneumatic or electric units. Among the biggest suppliers, we find Bosch (DE), Denso (JP), Michelin (FR) and Goodyear (US). These are disseminated all around the world, to save on labor and logistic costs. The suppliers’ average and median EV/EBITDA are 9.2x and 7.7x, respectively (Duff and Phelps Study Winter 2019).

Not many automakers attempted vertical integration at this stage, but Toyota, Hyundai, and their respective conglomerates are currently being provided with car-components in part by their respective subsidiaries.

2.

At the second stage, Operations widely cover all the production processes from the skeleton to the final road-ready vehicle, under the car manufacturer’s control. Automotive value chain experts may divide this step of the line of production into: chassis, engine, electronics and so on, so to have a more comprehensive cost analysis. As for logistics, automakers have their plants scattered over different continents, thus saving on labour and shipment costs.

3.

Outbound logistics is the third stage, involving the distribution of the road-ready cars from the plants to the retailers. Car-manufacturers often have their own showrooms, while others, such as Mercedes-Benz, find it more convenient to also use a network of franchisees. Also, Online Retail is an upstream trend, despite not being very appreciated, due to the loss of customer loyalty and powerlessness in upselling associated products, considered more profitable than saving costs on physical retailers.

4.

The fourth stage focuses on Marketing and Sales, embedding promotion and advertisement, sales force management and customer relationship management. This step is decisive in the value chain, as it increases competitiveness, by ensuring that the road-ready cars display their features and potentials in the targeted market and that they reach the targeted customer segment.

5.

The last stage of the Value Chain is After-Market Services. This step is thought to guarantee customer retention, by adding value to the product also in the post-sale phase, through customer support, vehicle maintenance and other complementary services.

Beyond these five listed activities, the value chain within the automotive industry also includes four additional support functions. First, Infrastructure is needed to manage organizational structure, management, finance, as well as the culture, which often is considered as the main characteristic that identifies each automaker. Then, the Human Resources management ranges from recruiting to training and performance assessment, and essentially focuses on who will design and build cars; as such, this activity turns out to be key for success. Second last, Technology increasingly plays a crucial role in the industry, as it affects more and more different primary activities, such as the Operations (by improving on production rate and on products’ quality) or the Marketing and Sales activities (by increasing their reach and bargain). Lastly, Procurement management allows cost and quality controls over the raw materials provided by the suppliers.

Going forward, the value chain will undoubtedly undergo deep changes, challenged by some extant major trends. A study by Deloitte considered four different scenarios for the development of the industry and the respective effects on the value chain. For sake of simplicity, we are going to consider just two of them, i.e. the most and the least optimistic.

In the former, technology thrives in the market; hence, E-mobility, Autonomous Driving, and integrated mobility are actualized. Very significant and exciting changes would reshape the value chain.

In the “Operation” stage of the value chain, manufacturing could renovate the process that transforms raw materials in road-ready cars, for example, by implementing 3D printing. As a side effect, an estimated 20% of the employees will become redundant; however, it is not to be excluded that more jobs would be created within some newly-developed segments of mobility digital services (such as “Shared Autonomous Vehicles Fleet”), which would be provided to support the technology implemented in autonomous vehicles.

Moving to the “Inbound Logistics” side, car-manufacturers will establish strategic bonds with IT companies and start-ups specialized in big data analytics, connected services, and the like. Hence, the group of suppliers from which each automaker will be purchasing components and software will expand horizontally, due to the increased range of needs.

Lastly, in the case of a rapidly-growing shared car fleet, the “Outbound” would face great challenges from the “clever” logistics and distribution of vehicles; successful manufacturers will be the ones developing smart digital logistic channels.

In the second and less optimistic scenario, instead, innovative technologies are left out of the market; under these circumstances, the market would still grow in sales revenue, but at a slower pace, and the value chain would have limited changes.

Competition between automakers, at the “Operations” level of the value chain, would evolve around R&D through more efficient combustion systems, limited driving aid software, or superior drivetrain and interiors. Larger demand and higher production capacities would allow vehicle sales to increase over time.

The “Inbound Logistics” stage of the value chain would somehow remain unaltered, as the components required by the car manufacturers would not change significantly; as such, the automakers would continue collaborating with innovative start-ups on a very modest measure.

As for the other stages of the value chain, involving workforce-intensive processes, the lack of innovation would not lead to redundancy of workers; on the contrary, it might even be the case that additional workforce will be needed, as the production capacity increases.

Industry trends

Broadly speaking, the automotive sector is currently shaped by three major trends, namely electric vehicles, autonomous driving and the evolution of the regulatory framework.

The first trend, with electric engines progressively substituting their diesel equivalents, works in the same direction as the evolution of the regulatory framework, which promotes low-emission policies and environmentally friendly solutions. Within this domain, some US companies are ahead of the path in terms of research and results; however, more recently also Norway, Germany, France, the Netherlands and the UK have been driving adoption of electric vehicles, by means of significant investments in charging infrastructures and large subsidies. This depicted incentive-based approach is expected to be the core driver of the future success of electric vehicles; indeed, such products will supposedly gain a broader market share especially in developed dense cities, under strict emission regulations and with favourable consumer incentives (e.g. tax breaks, dedicated parking, driving privileges or lower electricity fares). As of today, the market for these mentioned electric vehicles appears rather concentrated, with some key models accounting for roughly two thirds of the total market share.

The ultimate smart, safe, and green driving is thought to be achieved with the implementation of “Autonomous Driving”, constituting the second major trend under scrutiny. “Self-driving” or “driverless” vehicles will take on road-traffic in the years to come. As a common practice, these products are currently being tested. Once tested, candidate vehicles are assigned a score in the range 0 to 5, increasing in the actual level of automation achieved. As a matter of fact, cars get trained on specific training sites, allowing algorithms to collect data. While the relevant technology already exists, it has not been regulated yet in several countries; hence, minimum standards for certain software features are still to be settled. Still reluctant to this level of automation, most countries in Europe have not allowed autonomous driving vehicles to be used on public roads and highways yet but are expecting to do so between 2020 and 2022.

The ultimate goal of autonomous driving is undoubtedly that of making the driving experience progressively more pleasant and safe. As a matter of fact, vehicle innovation is not only promoted by an emission-based regulatory framework, but also by safety-based regulations; these latter are indeed pushing for systems capable of warning drivers about drowsiness or distraction (e.g. smartphone use while driving), speed and lane-keeping assistance, or advanced emergency braking. As a matter of fact, all the new safety features that are currently being implemented will become mandatory in the European Union in 2022.

One last interesting point about self-driving vehicles is definitely not financial in nature. It is the legal and ethical dilemma about letting cars decide on human lives. Indeed, an algorithm is expected to take decisions about whether to kill or not an endangered third party, in case of accidents.

The last trend, which is nowadays challenging the industry’s status quo, is represented by the evolution of the regulatory framework in terms of emission requirements. As a matter of fact, regulations are expected to drive the M&A activity in the sector, also multiplying joint ventures, as tariffs and emissions compliance costs squeeze automakers’ profit margins.

According to studies carried out on behalf of the European Commission, cars account for 12% of the total EU emissions of CO2. Also, in the European Union, air pollution causes 310,000 premature deaths per year, more than road accidents. With the goal to prevent this, for the first time in 2009, European regulations on emissions forced car manufacturers to promote greener technologies, so to achieve a target emission of 130 grams of CO2 per kilometer by 2015, which actually was achieved in 2013. In 2018, the European average emissions level was 120.4 g CO2/Km, representing a 14.2% reduction from 2010. The European Union is currently ready to lower the target, as in the past two years average emissions have slightly increased, still remaining below the currently imposed thresholds. From 2020 onwards, newly produced cars will have to respect a general maximum emission standard of 95g CO2/Km, which corresponds to fuel consumption of 4.1L/100 km oil, or 3.6L/100 km Diesel. Also, the maximum emissions standards will change depending on the weight of the vehicle, so that lighter vehicles will have even lower emissions standards than heavier vehicles.

It is also worth mentioning the incentivization system that was already in place between 2012 and 2015, and that will be reimplemented between 2020 and 2022. In such a scheme, car manufacturers are awarded with “credits” and “super-credits” for, respectively, equipping cars with new greener technologies or producing cars emitting less than 50g CO2/km. These credits consist of allowances on the manufacturers’ maximum overall emissions.

Many cities in Europe are imposing increasingly stringent regulations on the traffic within the city centre and for specific days of the week, or times of the day. Low-Emission Zones aim to decrease the number of fine particles, nitrogen dioxide, and ozone in the air.

As of today, some common European standards classify vehicles into categories ranging from EURO1 to EURO6, from the most to the least polluting, respectively. Most cities have already introduced EURO4 restrictions, meaning that any vehicle from EURO 3 to EURO 1 cannot enter the city/area.

M&A trends

Since the beginning of the decade, with the financial pressures of the Credit Crisis, the automotive industry has reinvented itself over and over again, starting its sales recovery only halfway through the decade. In the last five years, the eagerness to developing new technologies following the reinvention of future mobility has accelerated market growth and created optimism in sales revenues and, more broadly, in the future of the industry. M&A transactions in 2019 proved that the automotive industry was getting more competitive than ever before.

Indeed, according to a PWC research, despite the first three quarters being lower than 2018’s records, in the Q4 2019 the deals’ value made it to its historic peaks. In fact, although 2019’s overall deal value and deal volume both dropped by 19% and 18% YoY, respectively, Q4 saw eight deals, for more than $1bn each. Moreover, 2019 experienced a 63% higher deals value than 2016 and 2017’s averages.

The recent historical record showed that the industry was still fostering M&A transactions and promoting the emerging technologies, talents and sharing costs solutions. In 2019, EV/EBITDA (NTM) and EV/Revenue (NTM) averaged at 5.4x and 0.8x, respectively. These valuations were driven by the relevant presence of automakers involved in newest technologies, as well as of luxury names, which tend to have higher ratios (e.g. 13.9x EV/EBITDA for Tesla, or 13.4x EV/EBITDA for Ferrari).

Let’s now see the top 5 deals of FY2019:

- Merger $30.1bn: Fiat Chrysler Automobiles NV – Peugeot SA (December 2019)

The “super” merger between two car manufacturers that contributed about 40% to 2019’s total deal value was finalized in the last quarter of the year. The Italian-American automaker struck a deal with its French counterpart with the main objective of sharing the costs connected to increasing competition and technology bets, in the attempt to keep up with the electrification challenges, since both the two companies were laggards in the domain. This transnational deal has been described as a “50-50 merger”, carried out by means of shares only, but best viewed as a takeover, despite the equal division of the shares. According to the terms of the deal, shareholders in PSA would have retained FCA’s Comau automation subsidiary, so to reduce by 3% the 29% control premium that PSA was paying (Jefferies). Investors did not expect much value creation, and for this reason, PSA’s market value fell by €2.5bn in the aftermath of the announcement, even though FCA’s capitalization instead surprisingly increased by €2.9bn.

- Acquisition $7.4bn: WABCO Holdings Inc. acquired by ZF Friedrichshafen AG (March 2019)

The acquisition involved manufacturers of parts and components for passenger and commercial vehicles. WABCO, in particular, produced known electric systems for vehicles stability control. ZF Friedrichshafen, instead, was a well-established producer of new technologies, such as electric mobility or autonomous driving. The reason behind their move was to be found in the race towards autonomous vehicles; indeed, thanks to the acquisition under scrutiny, ZF would have gained access to Wabco’s commercial vehicles safety systems, which could then be combined with ZF’s driveline and chassis technology. According to the terms of the deal, Wabco’s stockholders received $136.50 per share, involving a 13% premium to the company’s closing share price on February 26th, 2019; ZF plans to fund the deal involved cash that the company had on the balance sheet, combined with new borrowings, backed by a commitment from JP Morgan Chase. In the aftermath of the announcement, Wabco’s share price fell by 10%, even though the company’s chief executive Jacques Esculier declared the step was necessary for the firm to compete with new rivals, such as Alphabet, which was developing Waymo, a self-driving car unit.

- Acquisition $3.1bn: Careem Networks FZ LCC acquired by Uber Technologies Inc. (March 2019)

Careem and Uber were competitors in the domain of passenger transport and food delivery across the Middle East, North Africa and South Asia. Careem Networks is a Middle-East established ride-hailing internet platform that is expanding its services also to mass transportation, deliveries and payments. Uber Technologies, the American counterpart, is a popular ride-hailing focused platform for private and business users. For actualizing the deal, Uber paid $1.4bn cash and $1.7bn in notes, converting to Uber equity at $55 per share. What Uber had in mind when signing the deal was to absorb its main competitor in the Middle-East, so to put hands on the target’s market share. As a matter of fact, Careem will continue to operate as a standalone company, becoming a subsidiary of its American buyer; indeed, the company expressed its interest to maintain its brand recognition, despite the acquisition.

Although not properly taking place in 2019, another deal which we find worth mentioning was the one announced in October 2018 between Honda and GM. With this mentioned deal, the Japanese company acquired a 5.7% stake in GM, by targeting the firm’s self-driving unit (Cruise) for $2.75bn; specifically, Honda will carry out an upfront payment of $750m as an equity investment, then additionally invest $2bn, gradually over the following 12 years. The idea behind this deal was for the companies to share the costs (and risks) connected to the domain of autonomous vehicles. Indeed, with the deal, Honda was expected to gain a competitive position in the market, while GM would have had access to further engineering expertise and capital. Broadly speaking, this acquisition came as way to strengthen the joint venture that the two companies already had in place at the time, thanks to which they would have been able to produce hydrogen fuel cell systems by 2020.

Another form of acquisition and shift in shareholder base was represented by the following two major events:

- Acquisition $3.1bn: Faurecia SA acquired by Shareholders

In this case, one of the world’s leaders for innovation in the supplies of several vehicles components (Faurecia SA) was subject to a transaction with financial activity purposes. Faurecia SA is the supplier of many big names in the industry, such as the Volkswagen Group, Peugeot SA, Renault, FCA, Toyota, and many more.

- Acquisition $2.9bn: Rivian Automotive Inc. acquired by some investor groups (December 2019)

Rivian is a US car manufacturer specialized in sustainable technology, producing vehicles exclusively with cutting-hedge technologies and designs. This funding round was led by the fund advised by the American investment firm T. Rowe Price Associates Inc., while participating investors are Blackrock’s funds, Ford Motor Company, Amazon.

In the months to come, M&A restructuring strategy should become crucial to already-established car manufacturers, who wish to secure their competitive advantage; indeed, this comes as the fastest way to transition to electrification and digitalization. Hot sectors for auto-tech acquisitions are autonomous driving, connected vehicle technology, CRM solutions, and mobility and fleet management. M&A transactions could target attractive assets such as Quanergy for autonomous driving, SK Innovation for electrification, or Mobileve for mobility and fleet management.

Most of the transactions above mark a trend, as most car manufacturers are racing to put money on the newest and most advanced technologies. In fact, the automotive industry is changing its shape alongside the changes in the nature of the products, and 2020 is expected to provide evidence of this tendency. However, due to the extant Health Crisis, this year car manufacturers are being more cautious with their balance sheets, causing a slowdown also in the innovation and growth of their suppliers. However, this will be discussed more deeply in the paragraph hereafter.

The impact of Covid-19

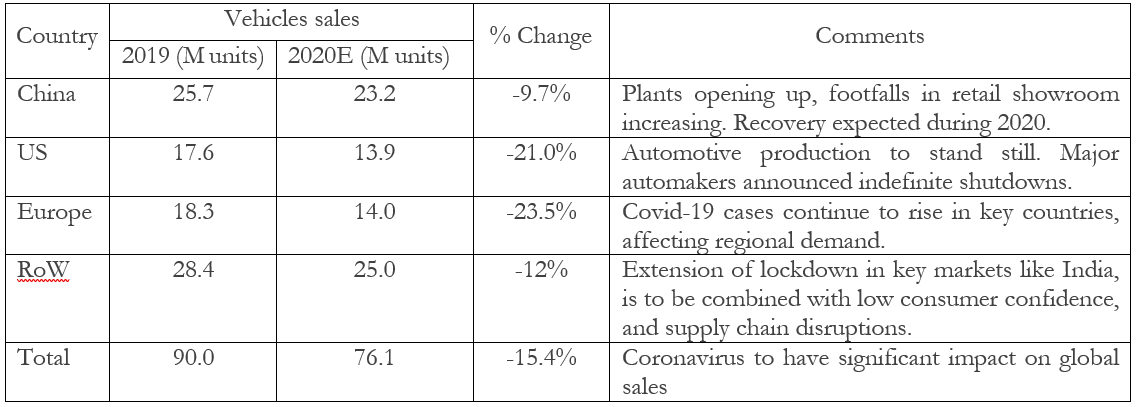

Dropping by 55% in March 2020, car sales are expected to record even worse results in April. Due to the safety measures imposed as a consequence of the Coronavirus spread, production facilities worldwide have closed and suspended their business for several weeks during Q1 2020. So far, the most severely hit companies seem to have been Honda and its state-run, joint-venture partner Dongfeng Motor, since all their plants are based in Hubei (Wuhan), and have been completely shut for several weeks. Looking at the broader picture, the table here below helps us assess the effects of the lockdown worldwide for the industry:

Source: Counterpoint, April 2020.

Link: https://www.counterpointresearch.com/weekly-updates-covid-19-impact-global-automotive-industry/

The overall effect that the spread of Covid-19 has had on the automotive sector is a general weakening in the supply chains. As a matter of fact, while main car producers and largest component providers can rely on multibillion credit lines, financing from capital markets or government loans during turmoil, smaller, family-owned part makers generally cannot. As such, weaker components of the supply chain are currently undergoing liquidity crisis, in some cases even already activating bankruptcy procedures. This depicted abruption in supply chains worldwide will severely undermine the success of the recovery process, making it hard for car producers to restart in the weeks to come. Indeed, as already stressed throughout this analysis, supply chains constitute the main driver of success within the industry. Car producers should therefore start envisaging opportunities for re-shaping their relationships with potentially new suppliers. As an alternative scenario, stronger suppliers might find some good opportunities to buy out smaller players, thus leaving supply chains (nearly) unaltered.

On the grounds of the general slowdown in the sector growth, some careful observers might have noticed that also some other aspects of the industry’s business have been amended. Indeed, car advertising has currently been almost suspended, since it was thought to be meaningless to keep devoting resources to promote something which, for the time being, cannot be sold nor produced.

Facilities worldwide have temporarily suspended the car manufacturing activity, causing just in Europe a production loss of 2,195,430 motor vehicles. However, some major players worldwide have decided to convert their plants, in order to bring a positive contribution to the healthcare system.

Ferrari, for instance, devoted €2m to produce valves for respirators and fittings for protective masks at the Maranello plants, in the department where car prototypes were usually developed. The company has also contributed with emergency cars and devoted significant resources for helping families in need, in Modena and the surroundings. For the benefit of its skilled workforce, Ferrari has also implemented the so-called “running-slow approach”; accordingly, the company will restart the production very slowly, losing on efficiency but not giving up on quality nor on the safety of the employees. The Ferrari example is currently being followed within all the production facilities which are re-opening worldwide. Indeed, as Volvo’s CEO H. Samuelsson correctly observed: “We cannot wait for a vaccine, so we have to learn how live and work in a safe environment”.

Similar to what Ferrari did, also FCA converted car plants in China, so to start producing masks, in mid-March. Moreover, the Group donated Jeep cars and ambulances.

Another major joint-effort has come from the “Pitlane Project”, which sees the University College of London, together with Aston Martin Res Bull Racing, BWT Racing Point 1 F1 Team, Haas F1 Team, McLaren F1 Team, Mercedes-AMG Petronas F1 Team, Renault DP World F1 Team and ROKiT Williams Racing involved; this F1 skilled workforce has converted the Brixworth plant (where F1 teams’ power units are produced), in order to develop and produce innovative engines, which ideally can pump oxygen in lungs, with no need for additional breathing equipment.

On the other side of the Atlantic Ocean, the US President Donald Trump provoked the country’s major carmakers on Twitter: “Ford, General Motors and Tesla are being given to go ahead to make ventilators and other metal products, FAST! Go for it auto execs, let’s see how good you are?” In response to this message, Ford has teamed up with GE Healthcare and 3M, thus designing modified respirators, using fans, batteries and other parts that Ford typically uses for its vehicles.

One last effect that Covid-19 will have on the industry and on the production concerns the introduction of Covid-19 specific safeguard features on prototypes. Geely Motors in China, for instance, has recently been talking about some N95 certified Air Purification Systems, preventing bacteria and viruses from entering the car’s interior environment. The OEM is also developing self-cleaning and anti-bacterial surface treatments for commonly used touchpoints, like grab handles. Jaguar Land Rover, then, is working on some ultraviolet light, capable of sanitizing some car’s units. Moreover, MG Motors has recently partnered with Medklinn (Singapore) to work on some sterilization mechanisms for car’s interiors. Furthermore, via means of IoT, smartphones are expected to also communicate to car drivers potential infected zones, so to provide the car users with additional alert systems.

Hence, we expect the future M&A activity to strongly reflect all the trends highlighted so far, in terms of regulatory changes, AI and IoT challenges, also coping with the effects of Coronavirus.

0 Comments