Introduction

The Body Shop is a British cosmetic, skincare and perfume company known for selling ethically sourced products made with natural ingredients and free of animal testing. Throughout its +50 years of existence, the company grew from a small family business based in the UK to being owned by some of the largest personal care companies in the world as L’Oréal or Natura, and having a presence across the globe. However, following different acquisitions and owners, and losing a large portion of its value, the company went into special administration in February 2024. This process resulted in many locations being closed and employees being laid off. Moreover, in September 2024 the company was acquired from special administration by Mike Jatania’s Auréa Group. With his expertise in body care products, makeup, and other consumer goods products, the company is hoping to go back to its glory days, when they were globally regarded as one of the global leading natural cosmetic companies.

Companies Descriptions

The Body Shop

The Body Shop, founded by Anita Roddick in 1972 in Brighton, United Kingdom, made its brand a household name by being the first to use manmade musk in fragrances and ethical ingredients in skincare. It stuck to its roots, and today it is known for anti-animal testing campaigns and an environmentally conscious approach. The brand helped in changing 24 laws in 22 countries since its inception by mobilizing customers to campaign against animal testing in cosmetics. Today, The Body Shop offers a diverse range of products in skin, body and hair care, make up, and fragrances. When you go to a drug or cosmetics store, you may recognize some of the UK-based brand’s bestseller products, such as White Musk Eau De Parfum, Vitamin Moisture Day Cream, Hemp Hand Protector, and Ginger Anti-dandruff Shampoo, among others. The retailer operates around 1300 stores in more than 60 countries under both chain and franchise business models. In the first half of 2023, it aggregated a turnover of €273.4m and an EBITDA of €7.9m according to Statista, representing an EBITDA margin of 2.9%.

Auréa Group

Founded in 2021 by Mike Jatania, the British cosmetics tycoon with 35 years of experience in the industry, and Paul Raphael, former executive vice-chairman at UBS and Managing Director at Credit Suisse and Merrill Lynch, Auréa Group is focused on investments into digitally native brands in new age beauty, wellness and longevity. The group focuses on early-stage investments into firms with a strong unique selling point in the luxury market segment, a capability to embrace digital sales models, and a focus on sustainability and diversity. While the group’s assets under management are not disclosed, the private equity platform has an eye for firms with revenues between $5m and $25m. Their current portfolio includes The Body Shop, Herbivore, a plant-based skin and body care products producer, Dcypher, a fully customizable makeup foundation brand, and Scandinavian Biolabs, a hair care and regrowth goods manufacturer.

Background on The Body Shop

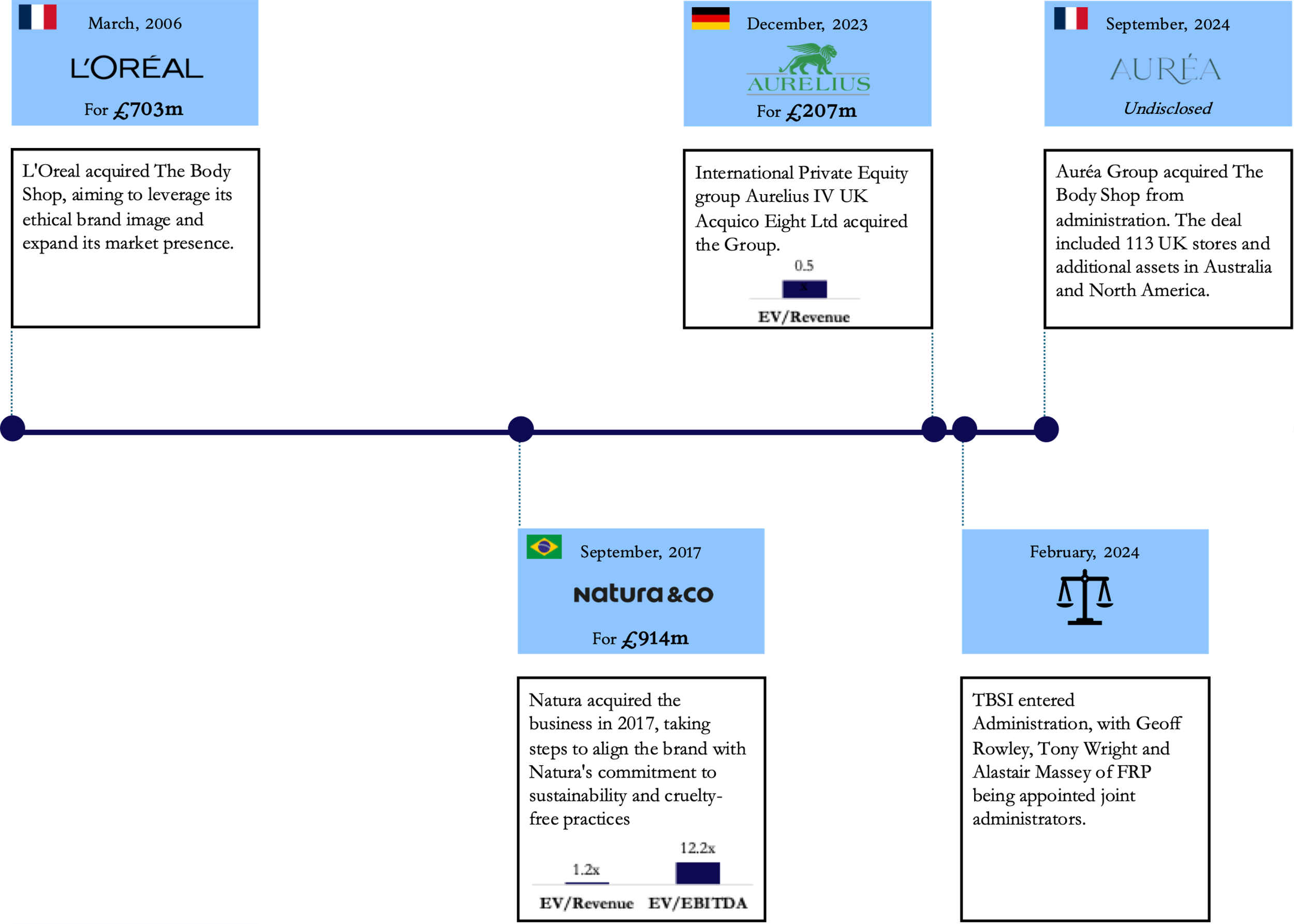

In 1984, 12 years after The Body Shop started its operations, it went public on the London Stock Exchange. The company traded for 22 years until L’Oréal [EPA: OR], the French cosmetics giant, acquired a 100% stake in the company in 2006. The company was purchased at an EBITDA multiple of 11.5x, valuing it at £703m. L’Oréal’s goal was to leverage The Body Shop’s strong ethical identity to enhance its own portfolio, capitalizing on its socially conscious brand image. While L’Oréal intended to expand The Body Shop’s market appeal, critics argue that the brand’s ethical foundation was diluted under L’Oréal’s stewardship. As a major player in the beauty industry, L’Oréal faced scrutiny over its animal testing policies, which clashed with The Body Shop’s core values. This led to a boycott by some consumers, further tarnishing the brand’s reputation. Despite some expansion under L’Oréal, with revenue growing from £435.7m in 2013 to £754m in 2016 (a CAGR of c.20.1%), The Body Shop struggled with profitability. EBITDA margins dropped from 11.7% in 2013 to 6.9% by 2016. By 2017, it was clear that L’Oréal had not managed to sustain The Body Shop’s appeal to a new generation of eco-conscious consumers. Its reputation, once a hallmark of ethical beauty, was being overshadowed by new entrants to the market like Aesop and Lush, which embraced transparency and ethical consumerism in ways that resonated more effectively with millennials and Generation Z.

In 2017, Natura & Co [BVMF: NTCO3], the Brazilian cosmetics giant, acquired The Body Shop for £914m, valuing the deal at 1.2x EV/Revenue and 12.2x EV/EBITDA. The acquisition seemed like a natural fit, with Natura aiming to revitalize The Body Shop by aligning its operations with Natura’s strong sustainability-focused ethos. Despite the strategic synergies, The Body Shop’s challenges continued. The company’s reliance on its physical store network, with over 3,000 outlets globally, was proving untenable in the face of changing consumer behaviour, especially post-pandemic. Online beauty retailers were growing rapidly, while The Body Shop, burdened by high rents in markets like the UK, struggled to compete in the new digital economy. Sales continued to decline, and by 2022, The Body Shop recorded pre-tax losses of £71m, with revenues falling to £408m from £507m in 2020. While Natura’s direct-to-consumer model had been highly successful in South America, it struggled to manage a global retail network, particularly in markets like the UK, US, and Europe, where its expertise was limited.

Source: BSIC, Companies House

Source: BSIC, Companies House

In December 2023, Aurelius Group, a German private equity firm specializing in distressed assets, acquired The Body Shop for £207m, paying 0.5x EV/Revenue, including a £90m earn-out contingent on certain performance targets. Notably, Aurelius was also a significant creditor to the business, which gave the firm an additional stake in its financial restructuring. The sale included most of The Body Shop’s global operations, though Natura retained control over the Brazilian market, continuing as a master franchisee. While Aurelius has a reputation for successfully restructuring underperforming companies, The Body Shop presented unique challenges. Immediately after the acquisition, The Body Shop experienced a significant cash flow crisis, driven by the withdrawal of a crucial line of credit from HSBC. Without access to this funding, the business was left with a £100m shortfall, far exceeding what Aurelius had anticipated. Compounding the financial strain, The Body Shop’s performance in the key winter sales in December 2023 was notably poor, highlighting the brand’s over-reliance on holiday shopping seasons. Aurelius attempted to restructure the company, shedding loss-making units across Europe and Asia.

By February 2024, The Body Shop entered administration under FRP Advisory [LON: FRP]. The administrators immediately began closing stores and shedding jobs in a bid to stabilize the business. Approximately half of the 198 UK stores were shuttered, and the company began divesting operations in regions like Europe and Asia. Suppliers, particularly those involved in The Body Shop’s fair-trade initiatives, faced uncertainty about unpaid contracts, with some estimates suggesting over $1m in unpaid orders.

In September 2024, Auréa Group, co-founded by Mike Jatania, acquired The Body Shop from administration. Instead, Auréa’s focus was on the UK, North America, and Australia, while Natura retained control of The Body Shop in Brazil. Auréa Group’s vision for The Body Shop is centered on returning to the brand’s roots in ethical consumerism while modernizing its operations to appeal to younger consumers. However, significant challenges remain, as the brand continues to compete in a saturated market. Under the leadership of Mike Jatania and Charles Denton, Auréa Group aims to expand The Body Shop’s digital presence and enhance product innovation to recapture market share.

Source: BSIC, Companies House

Special Administration

A company in the UK goes into administration when it becomes insolvent and is unable to pay its debts. Administration is analogous to filing for Chapter 11 in the US, with the key difference of not having the “debtor in possession” concept. As a result, it is the main kind of procedure under UK insolvency law, where the management is replaced by an insolvency practitioner, FRP Advisory in The Body Shop’s case. The statutory duty is to rescue the company as a going concern, or, in the worst-case scenario, achieve a better outcome for creditors than liquidation would provide. Administration is typically seen as a critical restructuring phase during which the practitioner examines the company’s financial health, operations, and market conditions to formulate a rescue plan. This move can lead to store closures, job losses, negotiations to secure lower rents and asset sales in efforts of resolving cash flow issues and revitalizing brands. This provides a timeframe where creditors are temporarily restricted from taking legal action, and the business is given another opportunity. If rescuing a brand proves unfeasible, the company may enter a company voluntary arrangement, where it is allowed to reach a voluntary agreement with business creditors for a repayment of all, or part of its corporate debts, averting complete liquidation.

Some notable firms in the UK have recently gone into administration. Thomas Cook Group, operator of travel and tourism products, went into administration in 2019 after 178 years in business. A day after going into administration, the company collapsed due to an unsustainable mix of debt and weak demand, causing 150,000 travelers to be stranded abroad and the biggest peacetime repatriation effort in British history. Debenhams, a luxury retailer, similarly went into administration in 2020 due to declining footfall in high streets and rising online competition. The brand would later be sold to Boohoo after multiple administration rounds and closure of physical stores.

A company usually successful in the administration process is saved through an acquisition or commendable restructuring efforts, however, this is far from common. Generally, a company in administration will end up in a bankruptcy or liquidation process, as significant debt, unsustainable business models and changing trends make the businesses unattractive to buyers and investors. While restructuring is the last lifeline, only companies with a feasible path to profitability or those with enough appeal to investors can successfully come out of administration.

Conclusion

Considering the currently held companies, Jatania’s acquisition of The Body Shop appears to signal an aggregation of a portfolio of beauty and wellness brands that emphasize sustainability and innovation. Mike Jatania has an exceptional track record, he transformed his family business, Lornamead, into a global powerhouse in personal care products in the 1980s, completing major acquisitions of well-known brands, some purchased from major players like Unilever and P&G. It is unlikely that he sees The Body Shop as just another acquisition; instead, he sees an opportunity to revive a brand that once pioneered ethical beauty and will use his extensive experience to revitalize it. Together with the brand’s new CEO Charles Denton, former CEO of Molton Brown, they have pledged to honor The Body Shop’s heritage while modernizing its operations in today’s dynamic market.

0 Comments