Introduction

The Danish Compromise is a regulatory provision within the Capital Requirements Regulation (CRR) which allows banks to apply favorable capital treatment to their equity investments in insurance subsidiaries. This mechanism has a significant impact on capital allocation strategies for financial conglomerates active in both banking and insurance sectors. By reducing the capital burden associated with insurance holdings, it allows banks to optimize their Common Equity Tier 1 (CET1) while maintaining regulatory compliance.

This provision was developed as part of the broader Basel III regulatory reforms, which aim to strengthen financial stability by allowing more efficient capital management. Through a more flexible approach to the treatment of insurance holdings, the Danish Compromise supports the growing trend towards bancassurance, where banks integrate insurance operations into their financial structure.

The Danish Compromise was introduced in 2012 as part of the European Union’s Capital Requirements Regulation (CRR), established during the Danish Presidency of the EU Council, from which it takes its name. It was initially conceived as a temporary measure aimed at facilitating the formation and expansion of financial conglomerates by reducing capital constraints on insurance holdings. This regulatory flexibility has been particularly relevant for European banks with large insurance subsidiaries, avoiding excessive capital deductions that could have limited their growth and international competitiveness.

Over time, the provision has become an essential regulatory tool, recognized for its role in optimizing capital allocation without compromising the overall resilience of financial institutions. As a result, the CRR3 review entered into force in January 2025 had formalized the Danish Compromise as a permanent element of the EU’s financial regulatory framework.

How Does the Danish Compromise Work?

Under Basel III rules, banks holding equity stakes in insurance companies must fully deduct these participations from their Common Equity Tier 1 (CET1) capital. This deduction is meant to prevent double counting of capital across banking and insurance entities, ensuring a more conservative capital framework. However, the Danish Compromise introduces an alternative approach that enables banks to hold insurance stakes with reduced capital impact:

1. Deduction Method (Standard Approach)

- In the traditional Basel III framework, the full value of a bank’s participation in an insurance subsidiary is deducted from CET1 capital.

- This leads to a lower CET1 ratio, reducing the bank’s ability to leverage its capital for lending and investments.

2. Danish Compromise Treatment

- Instead of applying a full deduction, banks using the Danish Compromise assign a risk weight to their insurance holdings.

- Before CRR3, this risk weight was 370%, meaning that for every €1 of insurance stake, €3.7 had to be accounted for in risk-weighted assets (RWAs). Under CRR3 (effective January 2025), this weight is reduced to 250%, significantly lowering the capital burden and making insurance holdings more capital efficient.

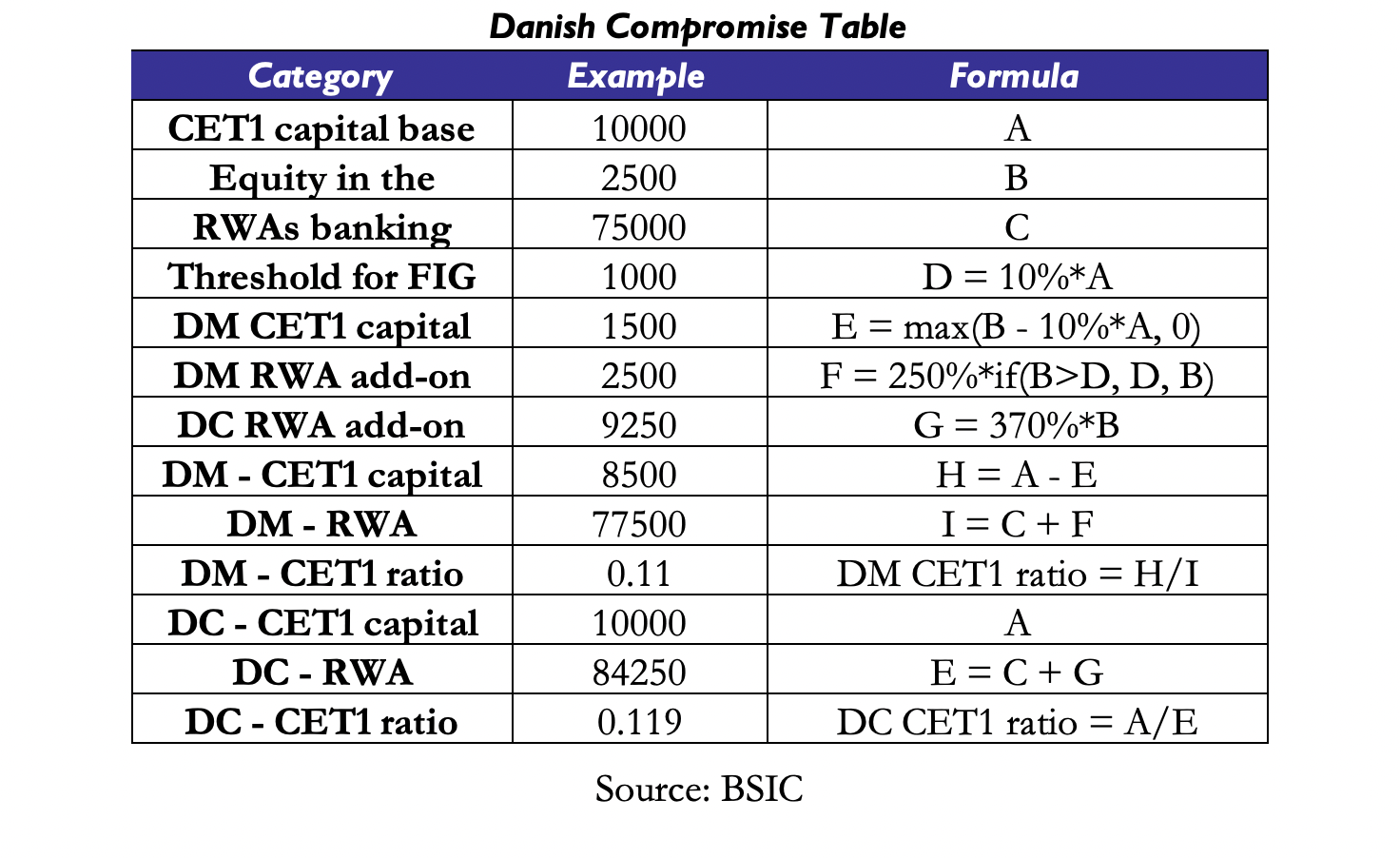

Danish Compromise vs. Deduction Method

For simplicity we assume the 10% threshold level is equal to the reported CET1 capital in this example.

Strategic Choice: Why Banks Can opt in or out of the Danish Compromise

The framework of the Danish compromise explained above is more beneficial for some banks than for others.

Banks must make a choice based on several factors when deciding whether to opt for a Danish Compromise. One of them is the scale of insurance operations relative to banking activities. A bank with significant insurance operations can benefit more from the Danish compromise as an ability to risk-weight these investments will enhance their CET1 more than a bank with a less significant share. This benefit is less pronounced for banks with a minor portion of insurance overall. It might not justify the complexity and regulatory scrutiny necessary to apply the Danish compromise.

Another factor is the risk-weighted asset density, as banks with a high density have a more significant proportion of assets that are considered risky and require more capital to offset potential losses. Adding insurance to their mix might expand their capital requirements above a sustainable limit, even with favourable risk-weighting of the Danish compromise applied. Furthermore, banks might already operate with pre-optimized capital structures under the default method involving a full deduction of insurance holdings from their CET1. They would only find limited advantages from switching the assessment to the incorporation of the Danish compromise, which comes with a burden of operational adjustments and compliance approvals.

One must mention that the Capital Requirements Regulation (CRR3) from January 2025 has solidified the Danish Compromise in EU law, which before had to be assessed on a case-by-case basis. This clarification makes the decision of opting in or out, at least on this part, more attractive for banks as they do not have to make this decision under uncertainty. However, it should not be disregarded that a potential future regulatory tightening, then, despite CRR3 providing clarity, future Basel IV or EU regulatory changes could tighten capital treatment for insurance holdings, making the current benefits temporary.

As for an example, CaixaBank [BIT: 1CABK], a leading Spanish financial group offering a wide range of banking, insurance, and investment services, has opted out of the Danish compromise as of November 2024. CEO Gonzalo Gortazar mentioned that the bank would emphasize organic growth and sustainable profitability over capital optimization via regulation. The full deduction of insurance holdings ensures a transparent but rather conservative capital base.

Facilitation of Bancassurance Growth and M&A Activities

After a period of high interest rates that allowed banks to increase significantly their profit margin and earnings, strong M&A activity kicked in within the Italian FIG market. Starting off from the proposed takeover by UniCredit [BIT: UCG] of Commerzbank [ETR: CBK], several takeover bids have been launched during the end of 2024 and the beginning of 2025. Among all these possible transactions, the Danish compromise is playing a very interesting role.

First, in August 2024 BNP Paribas [EPA: BNP] announced that it had entered exclusive negotiations with AXA Investment Managers, the asset management branch of the AXA Group [EPA: CS], for a potential acquisition. The French investment manager was valued at approximately €5.1bn, and the two parties found a definitive agreement in late December. To take advantage of the Danish Compromise, though, the transaction was structured so that the insurance branch of the BNP group would acquire AXA Investment Managers. Specifically, the acquisition was carried out by BNP Paribas Cardif, indeed the insurance subsidiary of the group. As a result, BNP Paribas announced that the transaction had an anticipated impact of just 25bps on the CET1. Equity research analysts following the stock reportedly commented that if the Danish compromise approval had not been in place, the erosion of the CET1 would have been much higher.

A similar scenario emerged also within the takeover proposal from Banco BPM [BIT: BAMI] of Anima Holding [BIT: ANIM]. In November 2024, the Milan-based banking group announced a takeover proposal for the prominent asset management firm, of which it already held a 22.4% stake. The consideration was to be paid fully in cash and value the investment firm at around €1.5bn. Also in this case, to leverage the Danish Compromise, the effective acquirer would not be Banco BPM itself, but rather the insurance branch of the group, namely Banco BPM Vita. As a result, the expected erosion of the CET1 would only be 30bps.

Following the announcement of this takeover offer, UniCredit responded by launching its own bid for Banco BPM, further intensifying market scrutiny of the potential acquisition of Anima and its impact on regulatory capital requirements. The relevance of the Danish Compromise in this transaction was highlighted by a press release published by UniCredit over the last week. In the statement, UniCredit stressed the possibility that Banco BPM might not be able to obtain regulatory approval from the competent authorities to benefit from the Danish compromise. According to UniCredit’s calculations, without this approval, the CET1 impact of acquiring Anima could rise dramatically to 268bps. Such a possibility was though promptly dismissed by a subsequent press release of Banco BPM. Furthermore, adding to the complexity, the proposed takeover bid on BPM by Unicredit triggered the passivity rule. As a result, Banco BPM was required to obtain approval at the shareholders’ meeting to increase its offer share price for Anima from €6.2 to €7.

Additionally, UniCredit has also disclosed a 4.1% stake in Generali [BIT: G], the largest insurance company in Italy. This move comes at a time when Generali is trying to complete a joint venture with Natixis Investment Managers, which is part of the BPCE Group, one of the largest banking groups in France. This deal would combine the two asset management divisions and create a leader entity with €1.9tn of assets under management. However, the deal has encountered resistance by the Italian government, which has demanded more information regarding the transaction and that could block the deal thanks to the “golden power” rule.

UniCredit disclosed that it has no strategic intention regarding this stake, but it might still play a role within the General Shareholders Meeting, where two other relevant investors, Caltagirone and Delfin, have openly opposed Generali’s current management.

With the motivations of each player remaining uncertain and the outcome of these transactions still unclear, it will be crucial to monitor developments closely.

The Future of the Danish Compromise

In conclusion, the Danish Compromise, now solidified in CRR3, has been transformed into a central element of EU financial regulation, offering banks greater predictability in their capital management. Its adoption is significantly influencing bancassurance and M&A strategies, allowing more efficient acquisitions from a regulatory capital perspective. However, some uncertainties remain: possible future tightening with Basel IV or further regulatory changes could reduce the current benefits, making continuous assessment by banks necessary. Furthermore, the case of UniCredit, Banco BPM and Anima shows how the use of the Danish Compromise can become a key element in strategic negotiations, with implications in the governance side as well. As M&A activity intensifies and regulators’ attention grows, the future of the Danish Compromise will be crucial in determining the stability and competitiveness of Europe’s leading financial institutions.

0 Comments