Introduction

The US Dollar Index was created by the Federal Reserve in 1973. The index was initially intended to provide an external bilateral trade weighted average of the US Dollar as it freely floated against major global currencies. Consequently, the US Dollar Index [ticker: U.S.DX® ] (USDX hereon), is a geometrically weighted average of six currencies against the USD. The six component currencies are Euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. The index is calculated with the following formula:

![]()

Note that the upper-script in each currency represents the weight that each respective currency has in the index. Also, for each respective currency, when the U.S. dollar is the base currency, the value is positive; and when the U.S. dollar is the quote currency, the value is negative. Since its inception, the USDX has only been rebalanced once during the introduction on the Euro. 1 contract is $1000 * index value; i.e. if the index is currently at $89.10, 1 contract to buy will be of $1000 * 89.10 = $89,100.

Over the years, there have been multiple arguments for and against the respective index and the weight allocations of the currencies that constitute the index. Criticisms around the inclusivity/exclusivity of index are subject to two broad intentions for usage of the index. These are:

- If the index is viewed (solely) as investment and consequently for trading purposes;

- If the index is viewed as a representation of USD’s true value against other major currencies of the world.

This article will tackle both aforementioned points and conclude that while USDX is still an interesting investment asset if viewed under point (1) while not best representing the true value of USD against other currencies if viewed under point (2).

USDX as an investment asset

Through its structure, the USDX provides investors a convenient way to invest in the dollar and hedge FX exposure relative to USD. To check if the USDX continues to satisfy requirements of the needed investment class, we can build on Schneeweis, Spurgin and Georgiev [2003] and see whether:

- USDX offers comparable returns with lower risk premia against standalone currencies that constitute the index;

- USDX is an asset that can be included in a portfolio to be represented on the efficient frontier;

- USDX is a good proxy for structured products tracking capital flows, trade balances.

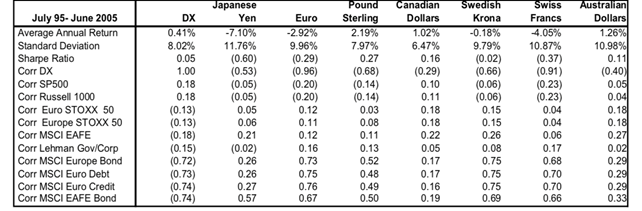

In a further study on USDX for the period 1995-2005, respective authors found that over the sample period of 10 years the dollar index had a return of 0.41% whereas the Euro had a return of -2.92%. In addition, DX had much lower volatility, 8.02%, compared to that of the Euro, 9.96%. Of the seven currencies analyzed only the British Pound and Canadian Dollar had higher returns and lower volatilities than the dollar index. While the Canadian Dollar had a return of 1.02% and a volatility of 6.47%, the British Pound had 2.19% and 7.97% respectively.

Source: Schneeweis, T., Gupta, B., & Mustafokulov, E. (2006), ‘The USDX as an investment and trading vehicle: An update’, Working paper, CISDM/Isenberg School of Management, University of Massachusetts.

Historically, the USDX has shown weak positive correlation with the US indices and negative correlation with the bond indices. This means that investors can alter a traditional stock and bond portfolio (50/50 composition) by adding USDX (40/40/20 composition). In their study, the authors found that volatility of portfolios with USDX decreased in the range 5-10 basis points against portfolios that did not contain USDX.

The USDX must relate well to capital flows. Exchange rate fluctuations affect the competitiveness of currencies in world goods markets. For instance, if the USD appreciates, goods denominated in the USD become more expensive for non-US consumers while goods produced in other countries become cheaper for US consumers. As a result, the US balance of trade worsens. In previous respective study, when the USDX was regressed against 42-month bilateral trade data, R^2 for resulting regressions were able to explain around 80% of the US- trade deficit.

Having established that USDX fulfilled all three criteria for point (1) in the time period 1995-2005, an investor can run the same regressions for the years after the Great Financial Crisis. To increase the robustness of the results, an investor can run regressions for periods of stress and see if the resulting outcomes are still statistically significant. This can be done as follows:

- Divide all observations into deciles based on performance; i.e. if you have 120 observations, each decile would consist of 12 observations and 1 decile would represent the worst return while the 10th decile would represent the best return;

- Similar deciles can then be created for broader stock and bond indices

- Running regressions with respective deciles (from worst to best decile) should show the investor if returns on USDX are as volatile as other broader index.

USDX as a measure of the USD intrinsic value

Majority of the critics of the USDX argue against the index being representative of the true USD value. The notion is intuitive since the in comprising of only 6 currencies, the index does not truly represent the competitiveness of the US goods in the world market. Additionally, the weights are not rebased and therefore do not reflect the changes that might have occurred in productivity, industrial growth/contractions, wage growth/contraction, etc.

As a result, there are multiple other indexes that have emerged that claim to better represent the true value of USD. Mico Loretan (2005) provides excellent background to the construction and methodology of such an index. First, for the index to best represent USD value, its must capture the effects dollar depreciation and appreciation against foreign currencies and its subsequent effects on competitiveness of US goods with US’ major trading partners. To capture the dynamic state of competitiveness, any such index, unlike the USDX, must in regular intervals recalculate the weights accorded to each foreign currency constituting the index.

Choice of index formula

The formula for index can be given by:

where It −1 is the value of the index at time t −1, ej,t and ej,t − 1 are the prices of the U.S. dollar in terms of foreign currency j at times t and t − 1, wj,t is the weight of currency j in the index at time t, N(t) is the number of foreign currencies in the index at time t, with sum of weights adding to 1. The standard practice by financial institutions is to use exchange rate indexes that are geometrically weighted averages of bilateral exchange rates for this helps to remove the upward bias that exists if indexes are calculated using arithmetic average.

Selecting currency and currency weights

In selecting the weights, the idea should be to arrive at a single number that best represents flow of goods between the US and country ‘i’. Several methods have been suggested for the respective purposes. Assuming that there are j economies being considered, one such method used by the Federal Reserve calculates the weights based on the following three factors:

- Economy j‘s share of total U.S. merchandise imports is chosen as that economy’s bilateral import weight during period t:

where MUS, j,t represents the merchandise imports from economy j to the USA in year t. The calculations are based on annual data.

- Economy j may be a direct purchaser of U.S. products. This form of trade competition is measured by that economy’s U.S. bilateral export share:

where XUS, j,t represents the merchandise exports from the USA to economy j in year t.

Third factor reflects the competition existing betweenUS and country j that both export goods and services to the same countries. This market relation is incorporated using the equation:

with notation as previously and intuitive aim of summing all the ratios of export from US to country j multiplied by the import from country j to country k (assuming that k is not equal to j) divided by the metric informing about the relative importance of the export to k from j out of all the exports originating in j.

The three

aforementioned factors are linearly weighted to arrive at a number that would

represent the weight for each currency pair of the j economies in

consideration.

This methodology grants relatively higher importance to the goods imported to, rather than exported from US.

Criticism

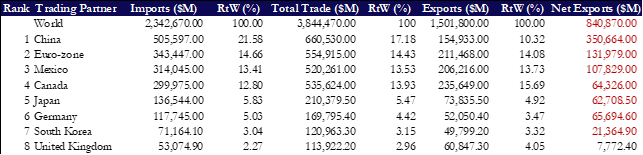

USDX index is a subject of criticism due to its scarce number of components. Indeed, at the time of its inception in

Quick comparison is enough to spot that EUR, formally representing 0.576 of the index is part of the transaction involving less than 15% of US import. Importance of Chinese renminbi is not taken into account, neither is the Mexican peso. It has been calculated that ignoring those currencies is presenting USD as relatively stronger currency than it actually is, at least from the perspective of international trade. On the other hand, including Yuan with the weight representing the importance of Chinese import would make the new index susceptible to volatility due to exchange rate manipulation, of which China was historically accused on many occasions.

Other methods

Other proxies to calculate weights could include cross border financial flows, percentage of US dollar currency to domestic currency of bank cross-border asset positions as reported by Bank for International Settlements (BIS), percentage of USD-denominated international money market instruments, percentage of USD outstanding amounts of OTC single-currency interest rate USD.

According to Essayyad, M., Albinali, K., Al-Titi, O. & Sauceda, M.J. (2009), in choosing different variables to determine the weights of each currency, the reader can use Principal Component Analysis. Reasoning for the respective is as follows. The principle of this method lies in the fact that when different characteristics are observed about a set of events, the characteristic with higher variation explains a higher proportion of the variation in the dependent variable compared to a variable with lesser variation in it. Therefore, the issue is one of finding weights to be given to each of the concerned variables. Weight to be given to each of the variables is determined on the principle that the variation in the linear composite of these variables should be the maximum. Once the weight to be given to each of these variables is decided, we can focus on the important variables in order to reduce the noise in the data.

Conclusion

Fundamental question that needs to be asked is: is the revision of the index demanded by the investors? In fact, existence of broader, annually adjusted dollar indexes seems to indicate negative answer. The reason for USDX popularity might be attributed to its constant composition. There are many statistically justified ideas as to how could the index be reformed. If the primary reason for the USDX to exist would be to provide purely informative data on USD competitive strength, that would probably be necessary. However, the criticism, more academic in nature, does not seem to scare away investors willing to bet on this assed characterized by high liquidity and lower risk than pure investment in USD. For those reason the question about possible revision remains open and theoretical.

0 Comments