Introduction

With the rise of generative AI and the increasing importance of saving and sharing information across the globe, data centers have become an increasingly critical asset class for investors, constructors, and energy providers, as well as big tech companies and sponsors.

Data Centers as an Asset Class

Data centers (“DC”) are driving technological progress worldwide, as digitalization and the AI boom call for exponentially increasing amounts of data. They combine elements of both infrastructure and real estate. As infrastructure, they provide essential services like digital connectivity, data storage and computational capacity. They also present high barriers to entry, mainly due to power bottlenecks and the high technical standards required for operation, as well as relatively predictable long-term revenue streams resulting from the medium- to long-term nature of contracts. On the other hand, DCs present some elements typically found in real estate, the most obvious being that they are physical buildings often leased to third parties. Furthermore, location, land and power access all impact performance. Power access is one of the main gating factors for DCs worldwide, as access to power grids is strictly regulated. Secondly, specialized technical expertise is required by Big Tech (which in the US accounts for almost half of total DC occupancy), cloud providers and telecoms for power, cooling and backup security.

As for the revenue model, tenants effectively rent power ($kW-month) with space and connectivity as complements. DCs can be divided into four main categories: enterprise, where the infrastructure is owned and operated by the company it supports, and is usually found on the corporate campus; retail colocation, when companies rent racks or cabinets, and energy costs are included in the rent; wholesale colocation, which is similar to retail colocation, but typically with longer-term contracts (5-20 years) and energy costs are not included in rent; hyperscale, a larger and more advanced facility designed to meet the needs of the biggest users. The last category of DCs has been growing at an incredible pace. Globally, 900 have been built, accounting for 37% total global capacity and with the expectation to grow 50% of global capacity in the following year.

From an ownership-type point of view, the current split between lease and build is approximately 50/50, but the ratio should increase to 70/30 if big players such as Amazon, Google, and Meta shift towards lease contracts.

As demand for DCs is booming, driven by AI trends, global IT spending is increasing rapidly but a significant supply-demand imbalance is emerging. Power supply remains the biggest constraint on the construction of new facilities. In the US, DCs account for 2.5% of electrical consumption and could reach almost 7.5% in 2030. Furthermore, permitting, grid interconnection, and local utility constraints pose additional challenges. Other supply constraints include sustainability concerns and the scarcity of developable sites in primary markets, which leads to rising construction costs. Due to these constraints, construction timelines are being pushed to 2027 or beyond. As a result, vacancies in key markets have dropped considerably, as signaled by the global weighted average DC vacancy rate falling by 2.1%, and after a decade of stagnation, rents are increasing: pricing rose 3.3% on a weighted inventory basis Y-o-Y in Q1 to US$217.30 per kilowatt (kW) per month.

A further element that must be taken into consideration when analyzing the potential construction of new DCs is the concept of “data gravity”, which is described as the pull that large data sets exert, as they tend to attract applications, services and smaller data sets closer to them; this is to make the most efficient use of bandwidth and reduce latency. More simply put, it is ineffective and costly to move large datasets; hence, infrastructure is drawn towards data and not the other way round. Data gravity is often coupled with the concept of “data velocity”, which encapsulates the speed at which data is generated, processed, and moved. As organizations expand across geographies, data velocity becomes increasingly critical. Data gravity and data velocity are essential factors driving digital infrastructure investments in the following years.

Market Performance and Returns

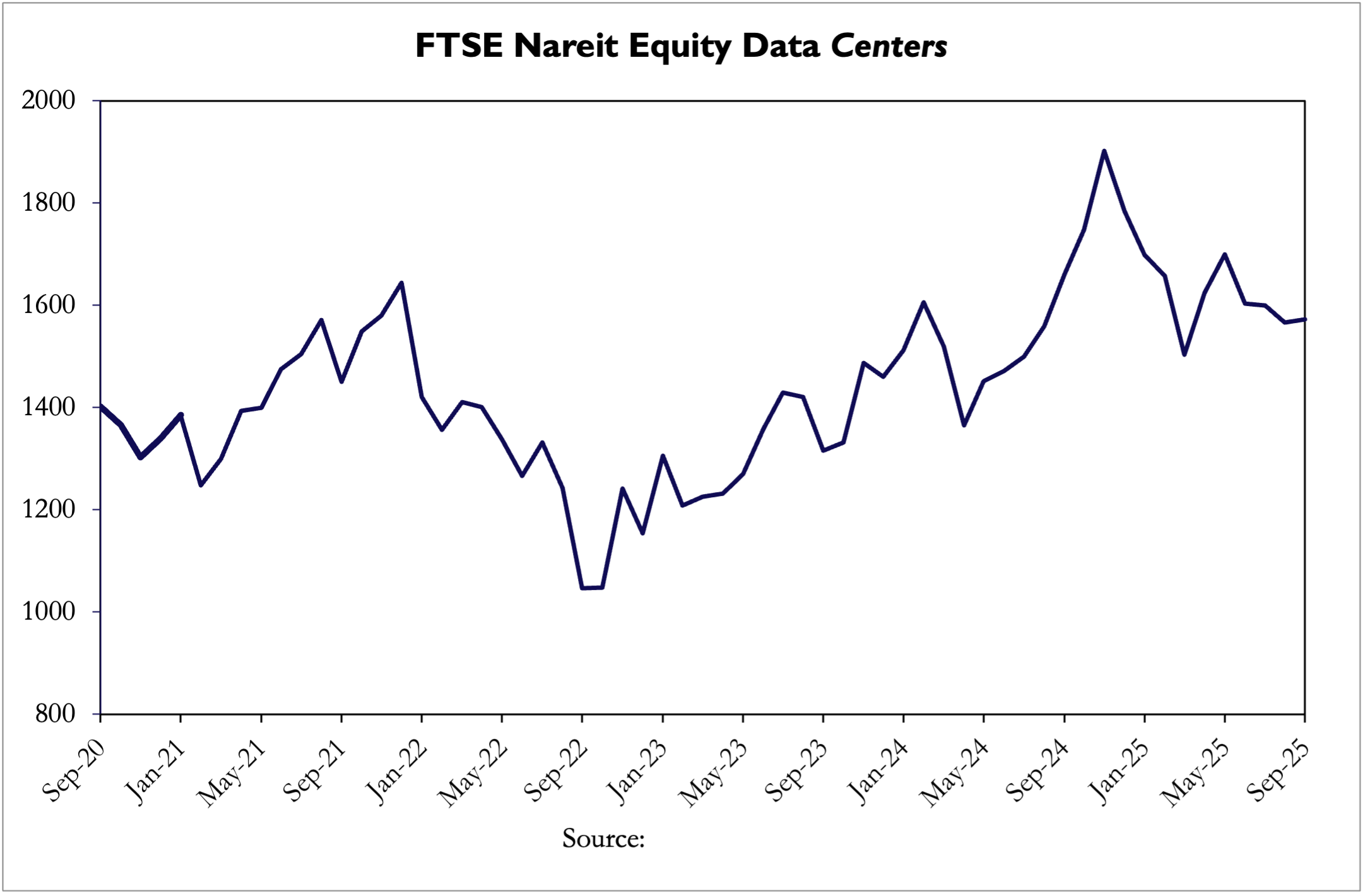

The DC industry has seen tremendous growth over the last couple of years. When looking at the FTSE NAREIT Data Centers index, which can be used as a proxy for the sector performance, we see strong growth in the sector since the low in November 2022. The index itself saw a peak in November of 2024 with €1.901,99 and has since fallen off to a value of around €1580,52 in August 2025. Since the low of €940,33 in 2022 we see a return of 68% to the current value (as of September 17th, 2025), demonstrating the surge in demand and valuation of the specific sector. The total REIT market index contributes 10% of its total holdings to the DC market, further underlining the strategic importance of the sector.

Albeit showing strong growth, the DC industry is struggling to cover all demand due to limited supply. The development of a DC portrays a costly project with a market average cost of $10mn per MW. Yet, the benefits once the facility is developed lie in resilient and secure cash flows driven by long-term contracts with the companies in need of DC solutions. Furthermore, as the space for DCs is limited and given the high opportunity costs, the market seems safe before overcrowding and looks to capitalize on the current AI boom and DC demand.

The AI boom goes hand in hand with the DC demand surge. Almost simultaneously with the release of ChatGPT, the DC demand has recovered from its low and has ridden the AI wave since. It is no surprise that the index shows an extreme drop and as extreme a recovery after the release of DeepSeek in early 2025, which promised the same results as leading AI providers with less data demand. Additionally, besides the announcement of DeepSeek, more and more hyperscaler DC users like Amazon announced that they will invest into building their own DC, moving away from the REIT concept. This further led the index to remain below its former high and raised questions about the future of the REIT DC industry under the uncertainty that big investors will move away from the current system.

Lastly, when taking another look at the DC Reit index and comparing it to individual projects, we can identify some differences in the potential returns. The index, which sums up the market, has a 5-year return of 14% and a 1-year return of -3%, which shows a significant growth in the long period and a recent correction due to the factors mentioned before. However, a single project’s IRR appears to be even more profitable, justifying the high development costs. According to recent research by Investment Bank Houlihan Lokey, the average return lies in the 30% range for a project. However, this can be further broken into Tier 1 US market as well as Hyperscalers. Tier 1 markets earn an IRR of 50-65% while hyperscalers range from 25-40%. This difference can be attributed to the initial development costs, as hyperscalers do appear to be generally more costly due to specific requirements surrounding the data terminals.

Going forward, due to increasing AI and data storage demand, we still expect the returns to be in the double-digit percentage range but eventually move more towards 20% or lower. This will be driven by a further increase in the development of DCs, which will eventually lead to more competitive pricing and lower markups. Additionally, the development of their own hyperscale DC by the likes of Amazon and others will once more drive down markups, further decreasing potential returns.

Key Risks and Mitigants

Like many infrastructure investments, the DC industry is exposed to certain risks and difficulties that it needs to address to ensure smooth future development.

The leading DC markets, namely the US and EU, are currently facing key bottlenecks that hinder the rapid expansion of DCs. The first half of 2025 represented the lowest colocation vacancy rate in the US at a record low of 2.3%, highlighting the strong demand for the industry. However, this also means that the opportunity to expand is limited, as not a lot of free lots are available. Other issues are the growing queues for DC and the lack of high-voltage gear that supports the facilities. Those, together with growing waiting times for grid connections (currently around 4 years), limit the development of new DCs and are driving up the current prices of DC services.

Europe, on the other hand, is facing a different structural issue in the creation of its DCs. As a growing demand for DC and expansion of AI usages drives denser terminal distribution, the topic of cooling becomes as prevalent as ever. The current spacing and data demand do not allow the existing air-cooling systems to operate efficiently anymore, and DCs are increasingly pushing towards liquid cooling. As hyperscale DCs consider it an important requirement, the provision of enough water is necessary to ensure sufficient cooling. However, due to drought conditions and other natural disasters, Europe currently lacks an extensive water supply to ensure adequate cooling systems.

According to current data, direct liquid cooling (DLC) only represents around 22% of the market, making it still a minority technology, which is expected and needed to be widely implemented soon to further drive DC demand growth. DLC also appears to be more complex than the traditional air cooling, as the terminals will chill down the chips handling the data. This requires an even higher upfront development capital investment, further driving costs and lowering project margins.

A last hurdle of current risks surrounding the DC industry is the scheduling and later execution of the construction and its contractual obligations. As previously mentioned, DCs are capital intensive projects and require complex structure and agreements to function. To protect themselves against potential delays or damages, DC operators agree to upfront fees for liquidated damages to protect against potential downsides. Especially as the backlog for customers is growing rapidly, timely execution is needed and expected by the operators.

While the risks seem daunting and do represent big tasks for the DC operators, there does exist a plan going forward to execute successfully and protect against potential risks of rising energy prices. One big protection is pre-leasing contractual agreements, as seen by Duke Energy. These can take the form of up-front infrastructure contributions, where the DC operator is gaining energy by paying for parts of the DC infrastructure development in exchange for data handling. Another possibility is the take-or-pay agreement, where the DC pays whether they require the energy service or not. With these agreements, the DC operator can guarantee energy prices and protect from fluctuations. Like the first derisking opportunity, the DC provider should lock in these liquidated damages fees to protect itself from the possibility of receiving damaged or late products and losing potential revenues. For DLC, the provider should also specify clear acceptance criteria and commissioning tests to avoid problems with its cooling systems.

DC financing is now a core de-risking lever. Early phases blend sponsor equity with construction loans and equipment facilities to pre-buy long-lead OFCI. Master trusts enable repeat, series issuance and pair term notes with variable funding notes to bridge phased energizations, of which many are green labelled. CMBS fits large, fully let assets but is less modular, so issuers mix formats. Europe has adopted green ABS structures aligned with EU-taxonomy goals. At the corporate layer, sustainability-linked RCFs ratchet pricing to PUE, renewable coverage, and water KPIs. Credit committees underwrite tenant strength, lease minimum-takes, power pass-throughs, and thermal reliability. Structures add DSCR triggers, cash traps, capex/O&M reserves, hedging, and collateral substitution.

DC as an asset class presents a front-loaded and technical risk, as high amounts of capital are required, and technical prerequisites like grid access and cooling systems must be in place to operate successfully. However, if executed correctly and by choosing the right financing and agreeing on predevelopment contracts, some risks can be hedged, and the positive average IRR of 30% can be achieved in this growing market with equally high demand.

Power procurement & the grid

One of the biggest inflection points in DC investing today is how operators procure power, how contracts are structured, how tariffs evolve for very large loads, and how the grid is coping with the surge in AI and cloud demand.

Power purchase agreements (PPAs) allow companies, including DC operators, to ensure their operations’ energy demands are matched by an equivalent amount of renewable energy generation. The specifics vary with project, location, and local energy market regulations, but at its simplest, a company agrees with an energy provider to invest in a renewable project such as a wind or solar farm and then procures its output to cover some or all the energy requirements of one or more DCs once the project is live.

There are multiple types of PPAs:

- Physical PPAs: Companies buy electricity directly from a renewable project (wind/solar/or others) via the grid and receive certificates proving its origin. They offer price certainty and strong sustainability credentials but can be limited by transmission line congestion or delays in being connected to the grid.

- Sleeved PPAs: Power is routed through a utility, which manages balancing and delivery. Similarly, Utility Green Tariffs are where the utility sources energy on behalf of the customer under regulated tariffs. These models reduce operational burden but add regulatory complexity and limit flexibility compared to direct, physical contracts.

- Virtual PPAs: Also known as contracts for difference with renewable energy certificate (REC) delivery, these are financial agreements where the buyer agrees on a fixed strike price with a renewable project while the power is sold into the wholesale market. If the market price falls below the strike price, the buyer pays the difference; if it rises above, the buyer receives the surplus. The buyer secures renewable certificates but remains exposed to market volatility. This model is particularly attractive for companies with dispersed sites.

- 24/7 Carbon-Free Energy: Beyond annual consumption matching, this model ensures that every hour of consumption is met by carbon-free generation on the same grid. Companies such as Google have committed to this model by 2030. However, implementation requires a diverse portfolio across renewables, energy storage, and advanced tracking, making it technically and commercially challenging.

Tariff evolution for mega-loads

Utilities are redesigning rates for very large, fast-growing customers like DC that draw hundreds of megawatts of power. Rather than one-size-fits-all pricing, new “large-load” tariffs do several things: they include the actual costs of connecting such large sites to the grid, serving them reliably, and upgrading infrastructure; they give incentives for flexibility, allowing the customer to shift when they use power (peak vs off-peak) or maintain onsite energy storage to ease load on the grid; and they allow companies to procure clean power at scale through long-term contracts or dedicated projects. Essentially, these tariffs combine predictable pricing over years with obligations or benefits tied to using renewable energy and being flexible with demand. Many entities demanding mega-loads put strain on existing electricity infrastructure in cities, which often lack spare capacity or sufficient reliability, so these tariff reforms help ensure cost recovery, reduce grid stress, and promote fair treatment between big and small users alike.

Grid Stress

Grid stress means electricity demand is growing so fast or concentrating so heavily that the existing network struggles to supply reliable power without risking outages, making costly upgrades, or increasing emissions. This has already occurred in a few cities around Europe.

In Ireland, DC consumed about 21% of the nation’s metered electricity in 2023, up from 5% in 2015. That surge forced the grid operator near Dublin to pause most new DC connections until 2028, over fears of supply shortfalls and that the demand would outstrip what the grid can deliver safely. The concern includes cost pressure for consumers and risk to climate goals if clean supply cannot keep pace with the rapid establishment of data centres.

In Amsterdam, on the other hand, the issue is more about planning and physical limits: limited space, constrained grid capacity, and approval hurdles mean the city has stopped approving new DC builds or expansions unless already well advanced in the permitting process.

This matters because concentrated growth of data centres in areas with weak grid resilience can lead to moratoria, delays, or higher costs for developers.

Open AI-Oracle Deal

In September 2025, OpenAI signed a five-year agreement with Oracle, reported to be worth about $300bn, beginning around 2027. The deal is tied to “Project Stargate” and involves securing roughly 4.5 GW of compute capacity. That level of demand is immense, comparable to two large hydroelectric dams or enough electricity to power millions of homes, depending on the region. The agreement clearly signals to utilities, regulators, and grid operators that demand from DC and compute workloads is not only growing rapidly but also concentrating in specific regions. As previously discussed, meeting this demand will require grid upgrades, transmission expansion, renewable procurement, and greater flexibility through storage, demand shifting, and onsite generation.

Without such measures being taken promptly, electricity networks may soon become overwhelmed, and interconnection delays may lengthen, causing consumer costs to rise and reliability and climate targets to be compromised. The deal also highlights the urgency of creating bespoke large-load tariffs, fostering closer planning between utilities and customers on the siting of new capacity. It also explains why 24/7 carbon-free energy models are becoming more important, since they require companies to match their electricity use with a clean supply on an hourly basis and also to invest in flexibility and firming resources.

Investing and What to Diligence

Investors can enter the DC sector through a range of structures, each with its own risk and return profile. Publicly listed real estate investment trusts (REITs) that specialize in DCs provide exposure to diversified portfolios of operational assets, usually with stable cash flows and high liquidity. On the private side, investors often participate through joint ventures (JVs) or dedicated development platforms, which can offer higher returns, but also expose investors to construction delays, power interconnection risk, and uncertainty regarding tenant leasing. Another option is asset-backed securities (ABS), where bundles of stabilised, income-generating DCs are packaged and sold to investors, providing liquidity for operators and predictable, bond-like returns to investors once facilities are operational.

When evaluating opportunities, investors must look at a variety of factors:

- Contracted MW: Indicates how much capacity is already committed to tenants and, therefore, how reliable future cash flows will be.

- Sequencing risk: Misalignment between power purchase agreements or utility tariffs and lease start dates can mean paying for electricity before rental income begins.

- Grid interconnection status: A fully leased facility without timely grid access will underperform; position in transmission queues can be as valuable as the land itself.

- Cooling infrastructure: Air cooling dominates but is water- and energy-intensive, while liquid and hybrid cooling are emerging as better options for high-performance computing.

- Scalability and expansion: The strongest projects pair current demand with land banks for growth and a clear transformer procurement plan, as transformers are long-lead, supply-constrained components.

Finally, we cover how such investments are financed. Many DC projects use green bonds or asset-backed securities, which typically include covenants on leverage, refinancing flexibility, cash flow allocation, and sustainability reporting. These covenants shape the capital structure by capping leverage and influence borrowing costs, as compliance with green standards often lowers yields. They also affect the ability to raise further funding, since strict terms may restrict new debt or require lender approval for refinancing. Crucially, they determine whether an operator can access environmentally linked capital pools, increasingly favored by institutional investors, offering cheaper and more stable funding than conventional debt.

0 Comments