Intro

The race to become the leading Electric Vehicle (EV) producer has just shifted into the next gear with the introduction of newer and faster charging systems. The race is now not only about range but also about which company can provide the fastest way to charge their vehicles. Furthermore, regional differences as well as the trade war by the Trump administration increases difficulty in analysing a clear winner. This article focuses on the Nordic countries, the Asian market, as well as the rest of the world and provides an overview over different new technologies.

The Nordic countries

The Nordic region has historically been at the storefront of technological innovation, with early adoption of digital infrastructure, mobile technology, and cashless transactions providing a foundation for leadership in emerging industries such as electric vehicle (EV) charging and cloud computing. Despite economic slowdowns in Sweden and Finland in recent years, Nordic tech firms continue to thrive. However, challenges remain, as Chinese competitors and larger global firms pose threats to Nordic EV charging businesses, while AI advancements could disrupt the B2B SaaS sector by fully automating previously software-assisted tasks.

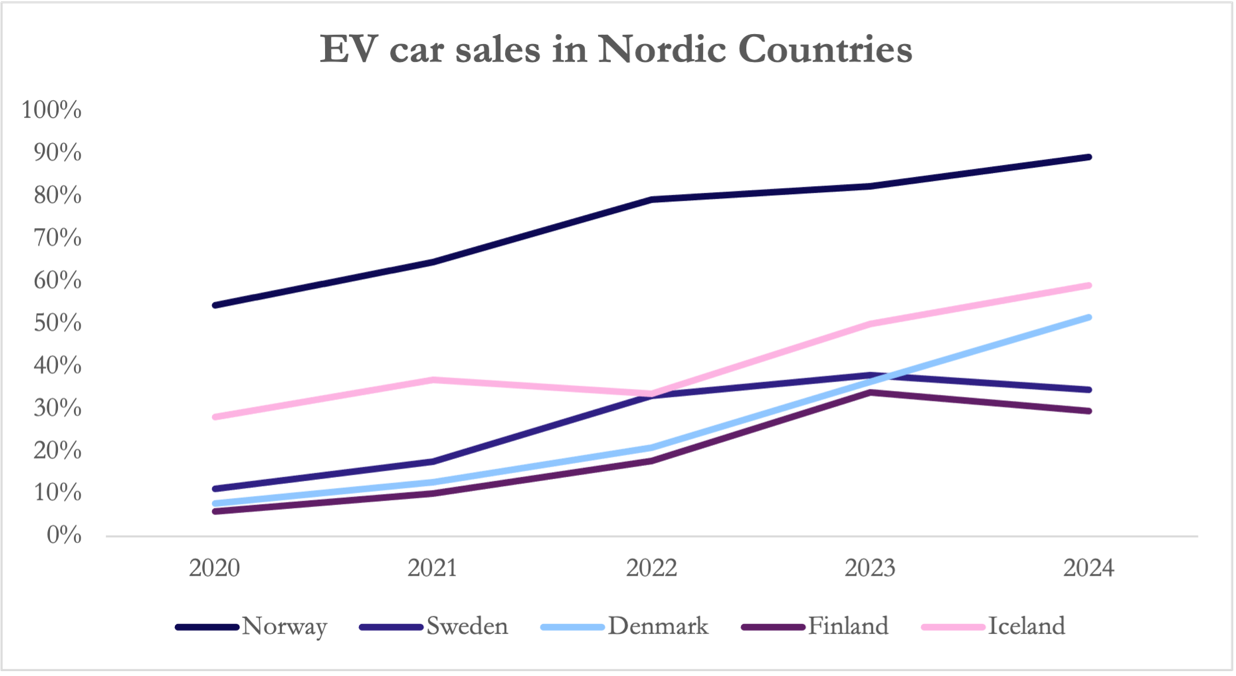

In the market for EV charging, the Nordic region has become a dominant force, leading the world in innovative and sustainable charging solutions. Businesses from Finland, Norway, Sweden and Denmark have not only benefited from the early adoption of EV technology in the area but have also set benchmarks in design, technology,and environmental responsibility. Norway has been the global leader in the transition to EVs since 2013, as it can be seen by the 89 per cent car sales being pure electric in 2024. At a EU level, the number was almost 7 times less, at a 14% of electric cars sold over the total number (10.6m). New car registrations rose slightly, increasing by 0.8%, with Spain continuing to show resilience with a solid 7.1% growth rate; in contrast, declines were observed in France (-3.2%), Germany (-1%) and Italy (-0.5%). Over the past 4 years, there has been an increasing trend of EV sales across Nordic countries, with Norway maintaining the highest adoption rate, while Denmark and Iceland have experienced the most significant growth.

In the market for EV charging, the Nordic region has become a dominant force, leading the world in innovative and sustainable charging solutions. Businesses from Finland, Norway, Sweden and Denmark have not only benefited from the early adoption of EV technology in the area but have also set benchmarks in design, technology,and environmental responsibility. Norway has been the global leader in the transition to EVs since 2013, as it can be seen by the 89 per cent car sales being pure electric in 2024. At a EU level, the number was almost 7 times less, at a 14% of electric cars sold over the total number (10.6m). New car registrations rose slightly, increasing by 0.8%, with Spain continuing to show resilience with a solid 7.1% growth rate; in contrast, declines were observed in France (-3.2%), Germany (-1%) and Italy (-0.5%). Over the past 4 years, there has been an increasing trend of EV sales across Nordic countries, with Norway maintaining the highest adoption rate, while Denmark and Iceland have experienced the most significant growth.

In Finland, Virta is a leading supplier of smart EV chargers. Founded in 2013, Virta offers a full-featured platform that allows businesses to efficiently deploy, operate and scale up their EV charging networks. With its technology, the company serves over 1,000 private and public organizations in retail, hospitality, real estate, parking, petrol, and utilities sectors in more than 35 countries. Together, these entities operate a network of over 120,000 chargers, which form the vast “Connected to Virta” ecosystem. Virta has distinguished itself by its strong focus on technological innovation, holding 34 patent families, mainly for energy-using devices, which play a key role in the emerging interconnected mobility ecosystem. The Finnish government’s early strategic support, which included a €110mn fund in 2011 to finance research into EV charging technologies, is partially responsible for the company’s success. Both Virta and its preferred hardware partner KemPower [HEL: KEMPOWR], a Finnish leader in DC fast-charging solutions, were founded as a direct result of this initiative.

Norway is unquestionably a pioneer in EVs, with its electric revolution spanning more than three decades, starting with the introduction of a tax on petrol and diesel vehicles in the early 1990s. Today, the Nordic nation of 5.5mn people has 27,000 public charging stations. By contrast, the United Kingdom, with a population 12 times larger, has 73,699 chargers, which translates into a significant gap in availability: 447 chargers per 100,000 inhabitants in Norway, compared with only 89 in the UK. Among Norway’s key industry players, Zaptec [OSE: ZAP] has emerged as a leader in user-friendly and efficient EV charging solutions since its funding in 2012. Its flagship product, Zaptec Go, is renowned for its design and durability, adapted to the harsh Nordic environment. The charger is a fusion of form and function and has won awards such as the Red Dot Award. Another Norwegian innovator, Easee, quickly gained a reputation for its compact and smart EV chargers. The company’s products are recognised for their safety, efficiency and high-quality engineering, underpinned by a strong commitment to local development and production.

The purchase of electric cars by companies for their employees, supported by tax incentives, has helped to drive the market in Sweden, with EV share of business purchases increasing from 16% in 2018 to 74% in 2023. Swedish company Charge Amps has carved out a niche by combining cutting-edge technology with sustainable materials and a Scandinavian design aesthetic. Founded in 2012, Charge Amps manufactures chargers such as Charge Amps Halo and Charge Amps Aura, which are made from recycled aluminium and can withstand a variety of weather conditions. These products not only offer smart charging capabilities but also contribute to environmental sustainability.

Northvolt Bankruptcy

The Swedish market for electric vehicles has experienced notable volatility in the past few years. In 2024, battery electric vehicles (BEV) accounted for 35% of new registrations (94,332 units), down from 37% the previous year. This downfall was due to economic uncertainties and policy gaps, resulting in a total drop in sales of 7%. These trends highlight the challenges in the Swedish automative sector, including uncertain demand and the increasing need for policy support for EV development.

Northvolt, a private Swedish battery producer, filed for bankruptcy in March 2025, capping the downfall of a company once regarded as Europe’s best hope at competing in an industry dominated by China. The start-up founded in 2016, whose backers included Volkswagen [FSE: VOW], Goldman Sachs [NYSE: GS]and Blackrock [NYSE: BLK], had produced more than 1m batteries in its factory just below the Artic Circle but was still losing large amount of money as it had yet to fully expand production. The aim was to establish a sustainable battery production infrastructure to support EU’s transition to full electric mobility, including the construction of several gigafactories across Europe.

Both internal and external factors contributed to Northvolt’s bankruptcy; the company was struggling with production delays and operational inefficiency while also dealing with intense competition from Asian manufacturers. In September 2022, the company announced that it would not meet the 16 GWh target set the year before, delaying it to 2024. But in the first three quarters of 2023, the company just delivered 79.8 MWh of batteries, which is less than 0.5% of the planned annual capacity. Financially, between the year 2023 and 2024, the losses grew from SEK 1.3bn (€113m) to SEK 11bn (€950m). Vain efforts were made to raise additional funds, including a $5bn loan in January 2024, and moreover BMW cancelled a €2bn order in June 2024, further straining Northvolt’s financial position. Externally, Northvolt had stiff competitors, particularly Chinese firms like CATL, that already has plans for factories in Germany, Hungary and Spain. In addition, the Swedish company’s reliance on Chinese suppliers of machinery and components has introduced vulnerabilities, as there were issues with equipment quality affecting production efficiency. Moreover, a Financial Times investigation revealed that the group, led by two former Tesla managers, had tried to open up to six factories at the same time, underlying a poor management. The broader European EV market’s deceleration combined with the unfulfilled promise of Sweden’s government to help Northvolt find a new owner for the factory also impacted Northvolt. Neither Sweden nor the EU had provided the company with much financial support while China’s battery markets have benefited from substantial government subsidies for years.

In response to its financial distress, Northvolt filed for Chapter 11 bankruptcy protection in the United States in November 2024, citing the need to restructure approximately $5.8bn in debts. In order to support operations throughout the bankruptcy process, the company managed to secure $100m. CEO Peter Carlsson resigned, acknowledging that Northvolt required between $1bn and $1.2bn to restore its business.

There are other European companies developing EV batteries, but they are at an earlier stage than Northvolt. There have also been other failures, including the Norwegian group Freyr [NYSE: FREY], which abandoned its battery plans to become a solar power company instead. Despite these setbacks, there remains optimism about the future of Nordic’s battery industry, and in general, the European one. The recent bankruptcy underscores the complexity of establishing a sustainable battery manufacturing within the growing competitive industry.

The Asian Market

With Europe and the U.S. struggling to catch up, China has managed to take a dominant global position in the electric vehicle market, a process driven by a mixture of advances in charging infrastructure, government incentives, and rapid expansion of manufacturing. Since 2023, in addition to controlling its domestic market, China has become the world’s largest auto exporter, mostly due to increasing EV shipments. For example, China’s leading player BYD [HKG: 1211] sold 4.27m cars in 2024 (including hybrids), an increase in sales of 41% YoY, dwarfing Tesla’s [NASDAQ: TSLA] 1.7m sold cars in the same period.

Market Overview

The domestic market is dominated by a few companies, most notably BYD, which in 2024 had a 32% share of China’s total market. Overall, the industry has experienced ever increasing market concentration with entry for new companies becoming more difficult each year. Other major players are Li Auto [HKG: 2015], NIO [NYSE: NIO], Xpeng [NYSE: XPEV], and joint ventures like SAIC-GM-Wuling [HKG: 0305] (state-owned), whereas U.S. giant Tesla occupies a 6.1% market share, producing 0.75m cars in China in 2024.

BYD reported an increase in revenue by 29% to $107bn in 2024, outpacing Tesla’s $97.7bn, with net profit climbing to $5.6bn (+24% YoY). The impressive earnings announcements are mirrored by a strong stock performance, which roughly doubled over the last 15 months and increased the market cap to ~$150bn as of 04/04/2025. As of April 2025, BYD had a trailing P/E ratio (last 12 months normalized EPS) of 34.9, highlighting investor confidence in continuous future growth. This is supported by heavy investment in R&D, with the company spending $7.5bn in 2024 (+36% YoY) on massive projects such as its new super factory spanning 129 km2 – this makes it 10x larger than Tesla’s Gigafactory in Nevada. The incredible growth, when placed in perspective with the struggling car industry in Western countries like Germany, is an indicator for the progression of Chinese EV production. BYD can grow its competitive advantage and market share through vertical integration, as it controls the manufacture of its batteries, semi-conductors, and most major parts of its cars, reducing its susceptibility to supply-chain issues and ensuring reliable production.

Still, not all companies can mirror the success of BYD. For example, NIO, which focuses on premium, tech-intensive EVs increased its revenue by 18% to $9bn in 2024 but recorded an increase of its net loss by 8% to around $3bn YoY, even though it was able to increase deliveries. The company faces intrinsic structural challenges, as it invests largely in R&D, but is constrained by thin margins arising from price competition with Tesla, BYD, and others.

Throughout the 2010s, China has seen dozens of EV startups being formed, laying the foundation for major activities and consolidation moves. In 2023, Xpeng, which went public at the NYSE in 2020 raising $1.5bn, acquired Didi’s, a Chinese ride-hailing firm, EV unit for an all-stock deal valued at $744m. Xpeng used it to focus on producing a cheap EV for the ride-hailing market, providing it with a significant customer base. Simultaneously, Volkswagen [XETRA: VOW3] invested $700m (buying a 4.99% stake) in Xpeng, marking a strategic partnership to develop EVs for the Chinese market. As established global players enter unprecedented transactions, this highlights the technological superiority and importance of China’s domestic companies in the future of the EV market.

Technological Edge

A major downside of EVs is the need to charge the car instead of being able to fill the tank with gas. Chinese manufacturers exploit this problem and invest heavily in charging technology to get advantage over their international competitors. Most notably, in 2025 BYD unveiled their new “Super e-Platform”, a charger that can reach speeds of 1,000 kW, adding 400km of range in just 5 minutes. In comparison, Tesla’s newest supercharger only reaches 250 kW and 320 km of range in 15 minutes. By closing the gap between charging and fuelling times, BYD opens the market to new, previously hesitant, customers and enhances mass adoption potential. Another, arguably even more innovative approach, is carried out by NIO, which offers to switch empty batteries for a fully charged battery in about 3 minutes, eliminating the need to charge the car.

Still, developments in charging technology need to be translated into developments in infrastructure for them to have an effect. China has been doing exactly this, building the world’s largest EV charging network of 12.82m chargers installed nationwide, an increase of 49% YoY. Throughout the nation, 3.05m are publicly installed (mostly in urban regions) marking a ratio of 2.7 EVs per charging point – major European nations vary between 5 and 20 EVs/charging point.

The technological developments are mostly enabled by public investment through the central and local governments. During the 2010s the primary focus was on consumer subsidies for EV purchases but has now shifted to support industry and infrastructure. For example, authorities subsidise the construction and operation of charging points by offering electricity discounts through partnerships with state-owned providers. Furthermore, all newly constructed real estate projects are mandated to have EV charger installations, there are trade-in programs, purchase bonuses, and free license plates (locally). For consumers, since 2014, China has offered tax exemptions on the purchases of EVs. This program has recently been extended until 2027 and marks one of the largest tax break packages in history, lowering upfront prices and increasing the popularity of the cars for the consumer. This has been reflected in the purchase trends, with EVs making up over 50% of all new cars sold in July 2024. China’s commitment to electrification is unequivocal, marking not just a short-term trend, but a structural transformation of the world’s most populous country.

Geopolitics and Trade

The Chinese expansion and rapid growth presents a significant challenge to Western car industries, many of which struggle to keep up with the technological developments and cost advantages of their Asian competitors. Under the Biden administration in 2024 the U.S. raised their existing 27.5% import tariff to a staggering 102.5%, justifying the increase with unfair Chinese trade practices and subsidies advantaging the industry. This measure doubles the cost of Chinese EVs in the U.S., effectively cutting them off from one of the world’s largest consumer markets. As a result, EV makers like BYD plan on opening international factories, for example in Mexico, thus circumventing the tariffs. Similarly, in October 2024 the EU imposed tariffs of up to 35% on Chinese EVs (also on cars produced by European manufactures in China), on top of an existing rule which mandates 10% import duties on all foreign cars. Europe aims at supporting domestic firms, which are largely struggling, arguing that Chinese companies benefit from extensive subsidies, raw material control, and cheaper labour. This allows them to undercut prices and flood the market with low-price products. Again, Chinese companies responded by planning to produce directly in Europe and extend their local sales network.

Overall, in response to the protective measures, Chinese officials were outraged and protested publicly. They also imposed retaliatory tariffs on several EU goods, but excluded the car market, which many believe was to avoid a trade war that would hurt China’s EV makers operating in Europe. Still, they tightened their export controls on graphite, a substance that is essential to produce batteries and of which China controls 75% of the world supply. This emphasizes the Chinese possibility of weaponizing its supply chain superiorities and increase its competitive advantage globally. EV has not just become a growing market, but a focal point of geopolitical tensions and power. This has become evident after Trump’s “liberation day” during which he announced 34% additional tariffs on all Chinese imports into the U.S., also hitting EV makers. As a response, on 04/04/2025, China imposed a retaliatory tariff totalling an equal 34% on all U.S. imports into China. This strikes all sectors, but also the $6.4bn of vehicle and automotive components that the country has imported from the U.S. in 2024, threatening the beginning of a global trade war, which would have a major impact on the growth of the EV industry.

Rest of the World Outlook: Can Tesla and Europe keep up?

The outlook looks bleak for Tesla and Europe to remain competitive within the EV market. EV sales are stagnating, expected to grow a meagre 7.4% YoY in 2025 versus 48% growth in 2024, and consumer pressures are mounting, concerning “range anxiety” and limited charging infrastructure. As the West falters, Chinese players excel. BYD, now the leading EV maker, poses a significant competitive challenge for Tesla and Europe, driven principally by its technology superiority, notably its charging capabilities.

BYD versus Tesla

It is unsurprising that following BYD’s shock announcement of “megawatt flash-chargers,” substantially quicker than Tesla’s V4 Superchargers, and its expansion of charging infrastructure, Tesla sales crashed by 49% in the EU and 14.5% in the US. These two factors both lend BYD a clear competitive edge, threatening Tesla severely. Tesla’s supercharging system, one of the most expansive worldwide with 60,000+, initially allowed for its leading position within the EV industry. However, with BYD’s “flash-chargers”, which are time-efficient and alleviate range anxiety for consumers, and its growing charging network, Tesla needs to innovate, or it will continue to trail behind.

Europe’s Knowledge Transfer and Sovereignty Dilemma

As mentioned, BYD’s intellectual property, notably its battery and charging technology, is key to its success. Yet, despite many of Europe’s biggest automakers forming partnerships with Chinese firms, there seems to be a void of IP transfer, which it desperately needs to keep itself in the game.

For instance, in December 2024, Stellantis announced it would build a €4.1bn lithium battery factory in Spain in partnership with China’s CATL (the world’s largest battery maker). The project received approximately €300m in state aid from the Spanish government, yet no IP transfer occurred. Another example is Volkswagen’s partnership with Gotion High-tech, another Chinese battery maker, to build a battery plant in Germany. Volkswagen invested €1.1bn into Gotion, becoming its largest shareholder, but again, there was little to no IP transfer.

These two examples demonstrate the EU’s wasted opportunities in leveraging their position to benefit from superior China’s technology which they can integrate into EV production. To compete technologically against China in the EV industry, it is necessary that the EU undergoes regulatory reform to enforce IP transfer in foreign partnerships.

Another issue Europe faces that worsens the technological gap with China is its dependency on battery production. It is a particularly pressing issue following the collapse of Northvolt, the EU’s biggest battery hope in the green transition. At present, 90% of EV batteries are produced by Chinese and South Korean firms, and 25% of Europe’s battery investment comes from Chinese companies. This poses the risk that Europe will lose its competitive position to simply become an assembly plant for Chinese technology, a concern stressed in recent FT reports. Thus, localising battery production should be principal priority for Europe.

Further afield: Asian Consolidation

Outside of the US and Europe, Japanese and South Korean automakers are also adjusting to face the dominant Chinese forces, seeking potential mergers and acquisitions, and shifting towards hybrid production.

In December, Honda, Nissan, and Mitsubishi were in serious discussions on a potential merger. The merger would have combined Japan’s second and third-largest automakers with the smaller Mitsubishi to create the third-largest car manufacturer worldwide by annual sales after Toyota and Volkswagen. It would have allowed the Japanese firms to benefit from synergies and technological innovation, proving mergers and acquisitions attractive in the current climate.

Moreover, South Korea’s Hyundai announced its “Hyundai Way” strategy, doubling its hybrid offerings by 2030. Hybrids are an attractive compromise to EVs, offering lower emissions and tackling range anxiety concerns, as they do not require complex charging infrastructure. They pose a strategic transitional solution, as focusing on hybrids allows Hyundai to compete less directly with Chinese EV giants like BYD, moreover, hybrid sales are expected to grow by 23% in 2025.

Compete or Collapse?

Overall, the key question facing global EV makers in 2025 is how to keep technological pace against China. It is evident that unless strategies are revised to embrace innovation and sovereignty, it seems likely that Chinese companies like BYD will continue to outperform their peers.

Conclusion

China seems to have an edge over the rest of the world in terms of technology but suffers from tough trade restrictions. Interestingly, the Nordic countries in Europe happen to demonstrate a steep momentum, however not all ventures are successful. While Tesla is under threat as well, the race will continue and the next few years as well as various new technologies call for continued disruption.

0 Comments