Introduction

Private credit denotes any debt or extended to privately held companies. It comes in many different forms, but often involves non-bank firms making loans to private companies or purchasing their debt on the secondary market in a variety of ways. To be more specific, Private credit, also called private debt, non-bank lending or alternative lending, is an asset class that consists of high-return and illiquid investment opportunities which varies from senior secured debt with fixed income-like features to distressed debt with equity-like risk and returns. In private debt both parties benefit, as investors get competitive interest rates and borrowers get capital without strict covenants that are usually required by banks.

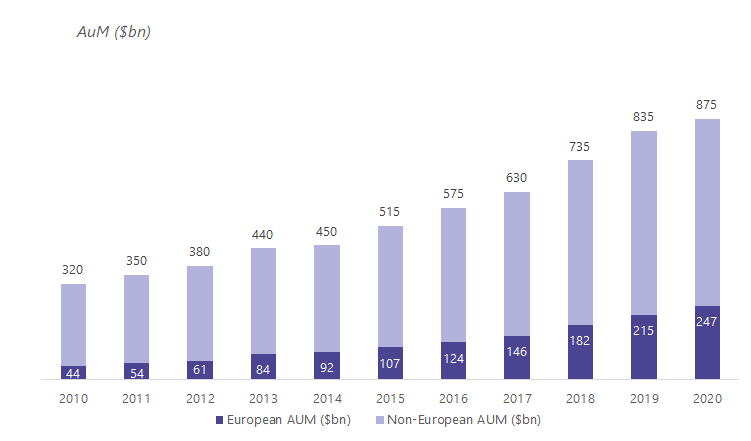

After the Global Financial Crisis, private debt has started its rise to unprecedented heights. Indeed, total global private credit assets under management (AUM) has risen to almost $900bn in 2020, marking more than a decade of significant growth from $240bn at the end of 2008. As a result, private credit has overtaken infrastructure and natural resources as the third-largest asset class in the private market after Private Equity and Real Estate.

Prior to 2008, private debt was considered a non-core asset class in the portfolio of the typical institutional investor. However, since then it has gained traction mainly because of two major factors. The first was Basel II’s Directive IV, which implemented a set of capital requirements that pressured banks to exit risky loan investments in order to strengthen their balance sheet following the 2008 credit crisis. The second factor was the extensive quantitative easing (QE) programmes implemented by central banks, which boosted the price of bonds, causing investors to look for better yields in non-traditional assets.

Global and European-based Private Debt Asset Under Management (Source: Preqin)

Different forms of lending

There are several private debt strategies, each with its own set of characteristics. We will now go through the major private debt strategies.

Direct Lending consists of senior and junior loans that are made directly to mid-market companies without the use of an intermediary bank underwriter. A senior secured loan, which pays a floating rate coupon and matures in five to seven years, is the most popular loan form originated via a direct lending strategy. However, revolving credit lines, second lien loans, and unitranche facilities, which group together various debt instruments under a single umbrella, are also adopted. In 2019, direct lending funds accounted for $286bn (36%) of the total private debt asset under management.

Distressed Debt refers to loans that are made to companies that are either bankrupt or on the verge of going bankrupt. Distressed funds also purchase debt, work with creditors to restructure their debt, and profit from the resulting economic recovery. In a bankruptcy proceeding, a fund manager acquires a controlling interest in a distressed company in order to ultimately purchase ownership of the target business. In several ways, the distressed debt position is only the beginning of a much longer phase, since once the fund manager has control of the goal, he will usually begin the process of optimizing profitability by consolidation, mergers, or other means. In 2019, distressed debt funds accounted for $207bn (26%) of the total private debt asset under management.

Mezzanine debt is a form of semi-equity financing that could use different notes, from preferred equity with fixed dividends to junior notes with warrant that allow the lender to convert to an equity stake after a few years and under certain conditions. It has higher returns than more senior notes but naturally it is more risky because in case of default it is senior only to common equity and, in case of low cashflow generation, the lender can often suspend interest payments due to the contractual set up. Mezzanine financing is often linked with leveraged buyouts, and it can be used to give new owners priority over current owners in the event of bankruptcy. In 2019, mezzanine debt funds accounted for $158bn (20%) of the total private debt asset under management.

Special situations consist of loans that are issued to companies when a specific contingency compels executives to raise debt, necessitating the inclusion of specific features. In 2019, special situation funds accounted for $132bn (17%) of the total private debt asset under management. The flexible nature of credit funds is perfectly suited for these circumstances and it is a very remunerative investment.

Venture debt consists of forms of debt financing issued by private debt funds or non-bank lenders to venture-backed companies to finance working capital or capital expenditures such as equipment purchases. Fast-growing businesses and their investors will benefit from venture debt as a supplement to venture capital. Unlike conventional bank lending, venture debt is open to entrepreneurs and growing businesses with no positive cash flow or significant assets to use as leverage. As a result, to compensate for the higher risk of default, private debt funds pair their loans with warrants, or rights to buy equity. In 2019, special situation funds accounted for $14bn (1.5%) of the total private debt asset under management (Preqin).

Bank Lending vs. Direct lending

In 2020, a year marked by market volatility, private credit remained a valuable part of investors’ portfolios, and it is believed that this structural trend will continue in 2021. Institutions are increasingly investing in private credit strategies because of a feedback loop of money flowing in new funds, which over time found and built a specific segment. in the industry which made it into an established and sought after product. Indeed, in the past private credit was mostly used to finance business operations, while today it often finances leveraged buyouts. Borrowers are attracted by the speed, flexibility and predictivity of private debt, which banks in most cases lack. Lenders, on the other hand, consider private credit as more lucrative, achieving a yield of around 8-9%, compared to 3% for the typical government bond. For business, private debt is regarded as more expensive,

After the 2008-2009 crisis, banks were unwilling to meet the demand for flexible loan terms. Eventually, this offered middle-market businesses the possibility of private debt, which was more responsive in the given environment. The economic downturn presented opportunities to enter into private debt investing agreements, which have higher yields and thus higher profit outcomes. This opened the debt market for small and middle-sized companies, which were not usually granted credits, without some other proven company stepping in and acknowledging the credibility of the smaller business. This marked the gradual decrease in the role of traditional financing institutions. In 2019, assets in private debt reached $812 billion and expectations were that in 2020 the investments would reach $1tn.

There are 3 main reasons why investors would prefer private credit: it reduces the risk through diversification in non-traditional asset classes, it offers a great risk-return combination with an overall volatility much lower than Private Equity and most importantly it has high return due to an illiquidity premium. Indeed, investors need to be able to hold their investments until maturity, as opposed to traditional fixed income investors, who can count on the liquidity of deep markets such as the ones for government and corporate bonds. This, however, has in the past years been more of an advantage than a disadvantage, because pension funds and other institutional investors have very long time horizons and can easily tolerate these conditions in exchange for the illiquidity premium on returns. Furthermore, in a volatile market such as the 2020 market, not having to mark-to-market their position was incredibly valuable and prevented inconvenient losses.

Private Credit also allows companies to streamline the process of raising new funds, especially for mid-cap companies that don’t have relationships with investors established over the years. Indeed, banks’ capacity to help them raise funds depends on market circumstances as they cannot hold the entirety of that exposure on their balance sheets. In fact, due to the increasingly strict requirements, banks can freely operate only when when the high-yield market is favourable or if they can find investors to syndicate it in a club deal or through similar solutions. However it will take time, resources and the negotiations could fail at any moment of a lengthy and complex process with multiple counterparties.

Furthermore, if the company intends to maximize leverage, banks will be reluctant due to the additional capital buffers required,, while a direct lender can be more flexible in terms of looking at the prospects of a specific business and supporting it even with a high leverage profile. Moreover, having one credit provider instead of a syndicate can be positive, given the simplification of decision-making and changing documentation. However, the company’s destiny depends on that particular investor, which could go bankrupt or not renew the financing contract, while a syndicate of banks might prove more resilient. However, when a company has the so-called “buy and build strategy”, i.e. a business has an aggressive acquisition strategy, resorting to private debt lowers the risk of banks not willing to support the deal and help the company grow.

Confidentiality is one of the main drivers of private credit. Some businesses might not want to disclose their margins (when a company goes public, it should provide quarter statements resulting in the public being aware of the profitability of the business). Through private debt, operating margins and leverage measures are not disclosed and the amount of information available to the competitors is vastly reduced.

Considering the differences between direct and bank lending, they both provide a different basket of advantages and disadvantages. Given that, according to some UBS estimates, there is a nearly 10:1 demand/supply imbalance in the credit market, private credit will inevitably continue to rise.

Relationship with banks – love and hate

As Private Debt funding increased especially in the last decade, investors in this new reality became more and more involved in bigger projects, though creating a reciprocal need of collaboration with banks to serve the needs of bigger clients. In fact, when funding leveraged buyouts in particular, which account for almost 70% of direct lending, Levfin and Sponsors divisions within banks usually serve as the underwriters of the loan but syndicate to other entities such as private debt institutions, keeping only about 10% (only senior debt). In this way all parties are content with their involvement, as the bank shares the loan burden and receives a premium fee for being the underwriter, while Private Debt funds provide most of the financing and the client enjoys the benefits of PD funds flexibility on the junior notes. In addition, as by example of UBS, few banks decided to merge the alternative investments division (which collaborates with PD funds) and financial sponsors division (which serves PE funds) in order to service jointly both the offer and demand of funding. In this way, the bank takes the form of an exchange of private debt funding which necessitates as many PD funds to serve PE funds, and PD funds use this facility to reach investment opportunities, tightening further the relationship between the two.

However, this love affair between PD funds and banks is limited in particular to LBOs situations. In fact, when it comes to more traditional financing, such as non-LBO direct lending, PD funds and banks turn their backs on each other and compete to provide most of the funding and accessing underwriting privileges. The clients are the decision-makers on who to accommodate and make their decisions principally on the terms and flexibility that the potential underwriters offer.

Credit Protection and resilience of the asset class

With the rise of private debt funds, hungry for yield and confident in their analysis of their clients, we have seen a change in the nature of the credit market, in particular at mid-cap level. Funds are willing to grant their portfolio companies more flexibility and favourable conditions in exchange for higher yields. One of these consequences of this increasingly borrower-friendly environment, which is not controlled by banks anymore, is that now borrowers can bargain for much looser limitations in the form of so called covenant-lite (or cov-lite) loans.

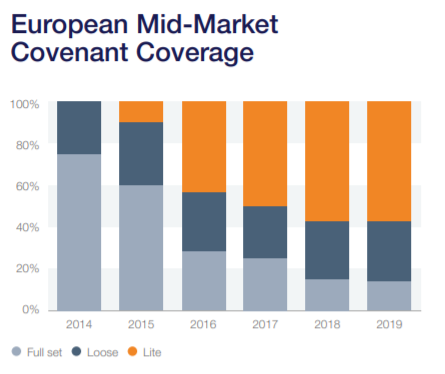

This is an overarching trend in the credit markets mostly due to low interest rates that force investors to concede more flexible agreements in an attempt to reach higher returns. However, private credit funds, with their in depth due diligence are willing even more than banks to customize their contracts, thus exacerbating the trend. We can clearly see it in the European mid-cap market, where, right after the sovereign debt crisis and exactly when Private credit funds gained traction, we saw a sudden drop in credit protections.

Source: Tikehau Capital expert insight report

This phenomenon raised concerns from the investors community, but if we look more in depth, even though formally the loans have less covenants, they are just more refined and only the essential is kept. In particular one that is deemed by Blackstone credit as the key one is a covenant controlling the EBITDA adjustments. Earnings Before Interest Taxes Depreciation and Amortization is not a regulatory accounting line, thus can be adjusted (some might say manipulated) to achieve specific results. The key debt proxy Net Financial Position/EBITDA would become unreliable if EBITDA is unreliable.

Regulators after the crisis have pressured banks to have stricter credit protection policies and banks can keep up less and less in this environment, thus positioning themselves in a more conservative low return but high profile segment. The space is thus open for funds able to pick and choose their risks to achieve significantly higher returns.

0 Comments