Introduction

Last month, we published an article focusing on the APAC IPO market, with particular attention to India, and decided to extend our exploration of equity capital markets in different regions as there is a lot going on right now. This article will examine the European IPO market, with a special focus on the UK. In 2024, the European IPO market experienced a significant uptick, raising €14.6bn from 57 IPOs, compared to €7.2bn in 2023. This rebound was driven by some of the largest IPOs of the year, such as Galderma’s [SIX: GALD] €2.6bn IPO in Switzerland and CVC Capital Partners’ [AMS: CVC] €2.3bn IPO in the Netherlands. This surge indicates growing investor interest and offers a positive outlook for 2025. However, the same cannot be said about the UK, considered the main capital market in Europe. Only 18 companies listed their shares on the London Stock Exchange (LSE) in 2024, while 88 delisted or moved their primary listings elsewhere. This represents the largest net outflow of companies from the UK since 2009 and the lowest number of new listings in 15 years. Despite efforts by the UK government to enhance the LSE’s appeal through various reforms, the outflow of funds is expected to continue. While other European stock exchanges have seen some companies shift their listings, the LSE is particularly vulnerable to departures of major companies to the US. Here a reasonable question arises: why is this the case? Let’s dive deeper into the market to understand the reasons behind it.

Why is UK Equity Market Declining?

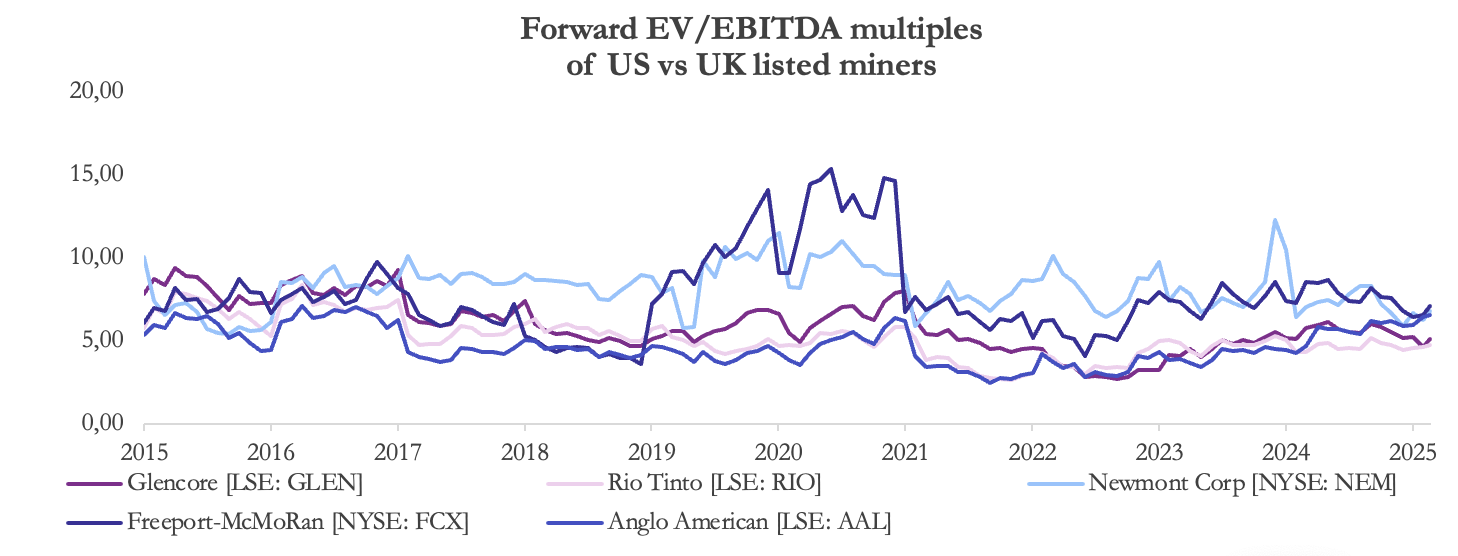

The UK market is facing multiple challenges, including high interest rates, inflation, and political instability. These factors make the US market more attractive thanks to its higher valuations and greater liquidity. For example, the forecast P/E ratio for the FTSE100 in 2025 is just above 11x, compared to the S&P500’s 22x. This drives companies like Paddy Power Betfair [LSE: PPB.F], TUI [DE: TUIAG] and Ashtead Group [LSE: ASHTY], to delist from the LSE and to move to more capital-intensive and higher-valued exchanges. The total number of de-listings on the LSE was 88 in 2024, a number steadily increasing over the past few years. Meanwhile, US stock market valuations are more robust, dominated by high growth companies and led by the Big Seven. However, if we take companies with similar profiles, the multiples of ones listed on the LSE compared to those on the NYSE would not be much different. What sets the US market apart is the strong presence of high growth, high margin companies, leading to higher multiples. Meanwhile, British market is dominated by the so-called old-economy sectors: mining and oil. These types of investments are usually not seen as attractive as tech and AI.

Another critical factor influencing market tendencies is liquidity. Bloomberg’s research made in 2022 shows that the average trading volume on US exchanges is significantly higher than in the UK. The total volume traded in the S&P500 and NASDAQ100 indices amounted to over $50tn and $20tn in 2022 respectively, while the FTSE indices traded under $5tn each in the same year. For instance, CRH [NYSE: CRH], which moved its primary listing from the LSE to the NYSE in September 2023, benefited from the change with a 68% increase in trading volume and a daily volume of 2.8x its previous averages. The same benefit has been seen in about 1.3m shares of US-listed Flutter, having changed hands every day since it joined the New York Stock Exchange in January – more than double the number traded in the UK during the previous year. These results may appear definitive but might be misleading. While in absolute terms liquidity is much higher in the US, relative liquidity, calculated by the LSE using the average daily free float adjusted turnover ratio, appeared to be nearly the same. The ratio shows the percentage of shares traded daily out of all shares outstanding. Although the US market is still more liquid on a share basis, the UK is much closer than the Bloomberg statistics might suggest: 97.5% compared to 100%.

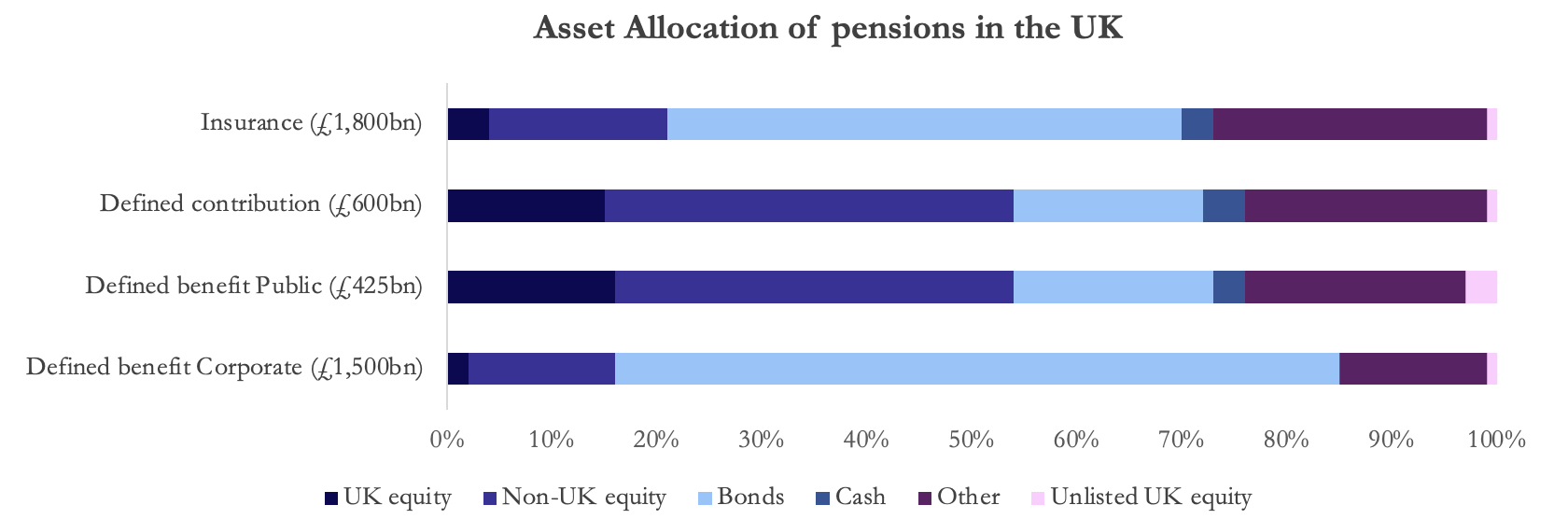

Moreover, the UK market is facing structural challenges worsened by Brexit and outdated listing regulations. The number of companies listed on the LSE has halved since 1997, and IPOs have declined precipitously, with only 18 new IPOs in 2024 against 183 in the US. The main issue impacting the IPO market is the UK’s flawed pension system. The United Kingdom has the second largest pool of pension fund assets in the world, but it is poorly structured and cannot be mobilized easily. The pools from which capital is obtained are the old-style defined benefit pension scheme, the new-style contribution scheme and the pool of insurance capital. The main problem with the system is that insurance companies and defined benefit pension funds are reluctant to invest in riskier projects and younger firms, preferring to focus on bonds. Risk aversion of the system resulted in a decline in equity investments. Since 2016, £150bn has flowed out of UK active equity funds, driven by poor performance, high fees, and a desire to invest in alternative markets. The reason for the fall in equity investment can be traced back to Robert Maxwell’s publishing empire collapsing after his death in 1991, after revelations that he had misappropriated pension funds to finance his business. In response to the scandal, regulators have introduced stricter rules to limit the level of risk pension funds could take on in their investments. These new regulations have encouraged pension funds to allocate a greater portion of their assets to bonds, which are generally considered lower-risk investments than equities.

Source: New Financial, LGPS Advisory Board, PPF, Willis Tower Watson, UBS, BSIC

Although UK’s market dynamics have remained like those of its European counterparts, it has historically had a less regulated and more accessible environment for listings. It offers a lower-cost, less bureaucratic alternative to markets like the US and France, making it a desirable destination for companies seeking to go public. But despite these benefits, the UK has had trouble retaining high-growth companies: over the past decade more than 5,000 startups have been acquired by corporate buyers, many of them from outside the UK, highlighting the ongoing difficulty of retaining attractive businesses in the home market.

Reforms: What Has Been Done and What Else Can Be Done?

Given the multiple challenges of public listing, many companies choose to remain private to avoid volatility and pressure. As noted by Goldman Sachs CEO David Solomon, the private sector offers considerable capital and investment opportunities before an IPO. One of the main obstacles to public listings in London has been the rigidity of the rules. To overcome this problem, regulators have approved the most significant overhaul of the listing rules in recent years, aimed at revitalizing the UK’s equity markets. The reforms, which entered into force on July 29, 2024, provide companies’ owners with greater control, making them able to take decisions without shareholders’ votes, and introducing a dual class share structure that allows owners and venture capital firms stronger voting rights than other investors. These measures were adopted to encourage the most innovative companies to list in the United Kingdom rather than seek opportunities elsewhere. Moreover, the simplification of governance requirements by reducing the number of meetings requiring shareholders’ votes is expected to make the public listing process simpler and more efficient. Supporting businesses at every stage of their development — from startups funding, through growth capital for scaling up businesses, to support for companies as they become mega-caps — is vital to sustain the UK’s economic growth and avoid stagnation. The British government must step up its support for start-ups in the scaling-up process, providing the capital needed to grow domestically rather than being forced to seek funding abroad. By introducing tax incentives and government-backed funding mechanisms, the UK can better retain innovative and technology-focused companies that have recently been tempted to list on NASDAQ.

Another key reform involves unlocking capital from pension and insurance funds. Current regulations encourage low-risk investments, pushing funds to invest primarily into bonds rather than equities. To address this, on December 9, 2022, the Chancellor of the Exchequer announced the Edinburgh reforms, a set of reforms to boost growth and competitiveness in the financial services sector. They offer a more flexible strategy by focusing on returns net of fees rather than headline charges, by redirecting more money into private assets, and by consolidating smaller pension funds. By increasing liquidity in the equity markets, these measures can ensure long-term returns for pension holders while at the same time increasing the attractiveness of the UK market by reducing bureaucratic hurdles and encouraging investment.

The Private Intermittent Securities and Capital Exchange System (PISCES), introduced by Chancellor Rachel Reeves, enables private companies to leverage stock exchanges to facilitate one-off trades, without the long-term commitments of a full public listing. The success of similar platforms in the US, such as Nasdaq Private Market and Forge Global, suggests a strong precedent for such a system, reinforcing the optimism about the potential UK equivalent. However, while this initiative could improve market competitiveness by introducing more flexibility, it is unlikely to solve London’s liquidity problems. PISCES is expected to primarily attract small to mid-sized enterprises rather than large, consolidated ones, helping to fill the funding gap for scaling companies. Despite its potential, however, the implementation of the plan has been delayed since it was initially proposed by the Conservative government in 2022. It was later also adopted by the Labor party, demonstrating that both parties see boosting the stock exchange and helping the growth of private companies as a core part of their shared agenda, but since then, progress has been slow, and the formal launch has yet to be scheduled. Moreover, the initiative has faced criticism from venture capital and private equity executives, who argue that the initiative is unlikely to solve the heart of London’s financial market challenges. Some investors have also compared it to a new version of AIM, the UK’s junior stock market, which has struggled in recent years, suggesting that it may not achieve the desired success. There is also uncertainty regarding demand, with skeptics questioning whether founders of fast-growing companies would be willing to participate, given the potential risks of losing control over their company’s ownership structure.

Latest Setbacks for London’s Stock Market

Efforts to build a bull case for the LSE have been underway, but recent setbacks have cast a shadow over its resurgence. One such blow is the decision of the financial markets’ infrastructure provider TP ICAP [LSE: TCAP] to pursue a New York listing for its data unit – Parameta Solutions. The global leader in OTC data and analytics has been a major driver of the group’s success with a 96% subscription-based revenue model and a 98% client renewal rate. The division’s 8% revenue growth in 2023, which accelerated to 11% in the second half of the year, highlights its strong momentum. However, investor pressure and valuation concerns have led TP ICAP to consider spinning off a minority stake in Parameta via an IPO. The decision to target New York over London is strategic: CEO Nicolas Breteau pointed out that the key factors are US’s deeper liquidity, stronger analyst coverage and the fact that 93% of Parameta’s revenue is dollar-denominated. Investors believe Parameta could be worth as much as £1.5bn, potentially exceeding TP ICAP’s entire market capitalization of £1.46bn.

More and more fintech companies are also eyeing the US for their listing. The Swedish payments giant Klarna, once Europe’s most valuable private fintech, has been preparing for a highly anticipated IPO. Known for its “buy now, pay later” model, the company has recently announced that it has chosen the NYSE for its long-anticipated IPO, targeting a raise of around $1 billion. This doesn’t come as a surprise since top management has hinted at an American listing for years, citing better visibility, regulatory advantages and strategic fit given that the region is the company’s largest market by revenue. Another major European company looking to tap into deeper capital markets across the Atlantic is Revolut. Valued at $45bn, the British startup is one of the region’s crown jewels and is widely regarded as one of the most significant IPO candidates in the pipeline. While no timeline has been set, CEO Nik Storonsky has openly stated that the US is the preferred listing venue, citing the UK added friction like stamp duty on trades. “If I get a better product from the UK, I’ll list in the UK,” he openly said, “but so far, if you just compare these products, one is far ahead of the other.”

Monzo, another UK-based online bank with over 10m UK customers, is also weighing its IPO options. While its board leans toward a London float, CEO TS Anil — a former Visa executive with strong ties to the US market — has been pushing for a New York listing. The neobank recently reported its first annual profit and is expanding into the US and Ireland, making it a more global story than ever before. The internal debate over listing venue reflects the strategic dilemma many UK-based growth companies face — whether to stay loyal to their home market or chase superior capital access abroad. Meanwhile, eToro, the Israel-based trading platform best known in the UK, has confidentially filed for a US IPO, aiming for a $5bn valuation. Though it has struggled to match the growth of rivals like Robinhood and Coinbase, it is seizing the current boom in equities and crypto markets to make another push into public markets. Unlike Robinhood, eToro doesn’t sell user order flow but earns revenue from bid-ask spreads — yet its brand recognition in the US remains limited, and its recent growth has been modest. Still, after abandoning a SPAC deal in 2021 that valued it at over $10bn, eToro is now taking a more conservative approach, hoping that a leaner float and improved sentiment in the US tech sector will support its public debut.

Adding to the pressure on London, Glencore [LSE: GLEN] is also considering shifting its primary listing from the UK to New York and with mining companies’ historically borderless corporate structure, what’s now a consideration could easily become a reality. The rationale is familiar: valuation uplift and greater liquidity. London-listed diversified miners currently trade at an average 28% discount to their US-listed peers like Freeport-McMoRan and Newmont. While this basic comparison overlooks the more specialist nature of American peers, the deeper capital pools and lower cost of capital in New York remain strong draws. Although Glencore hasn’t committed to a move, its exploration of the option is yet another signal that the LSE is fighting to retain its relevance even in sectors where it has historically held ground.

The British advertising giant WPP [LSE: WPP] has also been “keeping a watching eye” on the idea of moving its primary listing to the US, according to CEO Mark Read. With 38% of business already in the US, renewed market confidence amid the return of a Trump administration and a historically high valuation discount, the appeal is clear. WPP’s share price has fallen by around a third since 2018, in sharp contrast to French rival Publicis [XPAR: PUB] whose stock has nearly doubled over the same period despite also being listed in Europe.

Source: FactSet, BSIC

Source: FactSet, BSIC

Joining the moves from London, Ashtead Group [LSE: AHT] – one of the capital’s 30 most valuable listed companies has announced plans to also shift its primary listing to New York. The construction equipment rental giant, which generates nearly all its profits in North America, cites deeper US capital markets, improved liquidity, and greater appeal to American investors as key reasons. CEO Brendan Horgan describes the move as a natural progression since the company is “to all intents and purposes, a US business.” Once complete, Ashtead will rebrand as Sunbelt Rentals, further cementing its transatlantic pivot. Together, these moves paint a clear picture: despite reform efforts, the gravitational pull of U.S. markets continues to lure some of London’s biggest names across the Atlantic.

Major UK Companies Adding a Listing in US: Mixed Reactions

The impact of such moves, however, has not been universally positive. While large European companies that add a US listing often see a substantial boost in trading liquidity, the expected valuation uplift doesn’t always materialise. In fact, an FT analysis on a sample of 12 such companies including Ferguson, Flutter, and CRH found that half saw their valuations fall, and in many cases, analyst coverage did not improve. For example, Flutter Entertainment [LSE: FLTR] shifted its primary listing to New York in early 2024, doubling daily trading volume, but the price-to-earnings ratio dipped, falling from an average of 29.8x in the UK to 29.1x post-move. This suggests that a US listing doesn’t guarantee a higher share price, despite the deeper capital markets. As analysts and the LSE have pointed out, liquidity may be London’s Achilles’ heel, but valuation gaps are often overstated, and listing venue alone is rarely the decisive factor.

That said, positive experiences are also documented where expectations of boosted liquidity and valuation gains were indeed met. A prime example is CRH [NYSE: CRH], the Irish building materials group, which has enjoyed a sustained uplift in its share price since switching its primary listing to New York. The average price-to-earnings ratio rose from 12x in the 18 months prior to the move to 15x in the 18 months following it. On top of that, CRH’s trading liquidity in New York is now around seven times higher than it was in London, demonstrating how for the right company at the right time the US market can offer both greater investor attention and better capital access.

Source: Bloomberg, BSIC

However, smaller companies often struggle to replicate that success. The same FT analysis found that while most firms saw improved liquidity, valuation uplifts were inconsistent especially for those with a market cap under $10bn. On average, those experienced a 7% decline in their forward P/E ratios post-move and many failed to attract additional analyst coverage. In the vast US market, attention tends to gravitate toward the biggest players, meaning mid-cap or niche European companies often struggle to gain visibility even after going through the cost and complexity of a US listing. Those costs can be disproportionately burdensome for such companies and not justifiable by the limited benefits achievable. Analyst coverage and investor attention are finite resources, typically reserved for companies with significant scale, strong US operations or established global brands. Naturally, US investors tend to gravitate toward companies they already know, while smaller firms without a major American presence often are not included in that list. In addition, they rarely qualify for inclusion in key indices like S&P 500, meaning they miss out on passive investment flows that drive much of the liquidity and valuation premium in US markets. As a result, many find that the theoretical advantages of a New York listing don’t translate into meaningful investor interest or valuation uplift, leaving them with the expenses of being public in two markets but few of the benefits.

Other European Stock Exchanges Doing Better than London or Just Particular Companies Bear Fruit?

Having analyzed the problems with the London Stock Exchange, let us now look at the broader European IPO market, which began to reopen last year, thanks to an improving macroeconomic environment, decreasing inflation, and interest rate cuts across the region. European IPO proceeds more than doubled in 2024 compared to 2023, driven by the return of significant private equity-backed IPOs. While overall post-IPO performance in Europe was mixed, some of the largest IPOs of 2024 delivered solid returns. For instance, the PE firm CVC [AMS: CVC] completed a €2.3bn IPO in Amsterdam in April 2024, and its shares are now up 9%. Trading began at more than €17, above the €14 offer price, underscoring strong investor appetite and leading to the offering being oversubscribed multiple times. Here are the main factors contributing to the deal’s success: the quality and size of the company, alignment of interests, and the tactical decision to prioritize offer size over price. Firstly, CVC is a well-known asset manager with a strong track record, and its over €2bn free float on a €15bn market cap provides liquidity to investors, which is highly demanded in times of uncertainty. Secondly, the interests of the different parties were strongly aligned, as current employees, who own around 75% of the firm, were not selling shares in the IPO, and existing shareholders, like Blue Owl, bought new shares in the IPO. Last but not least, the offer was priced at a significant discount to its peers, at around 13x the estimated 2025 P/E, compared to EQT’s nearly 18x, which allowed the company to increase the deal size by €500m. Therefore, the tremendous success of the deal can be explained by the unique combination of factors and smart strategic decisions, rather than general market conditions or the situation on a particular stock exchange.

Another prominent deal delivering strong returns to investors is the Swiss dermatology company Galderma’s [SIX: GALD] €2.6bn listing. The IPO priced at the top of the range, with shares jumping 21% in its trading session, and now the share price has gained 84% since its listing. EQT-backed Galderma showed robust revenue growth and came at an appealing valuation, while its market cap of over SFr12bn attracted investors keen on secondary market trading liquidity. Galderma’s growth has been driven by specialist skincare products such as Cetaphil, as well as treatments for acne, rosacea, and sensitive skin. The group has three “blockbuster franchises” that generate more than $1bn in annual sales and aims to add another in therapeutic dermatology. The company said it wanted to use the proceeds from the IPO to repay and refinance its debts, which should help it reach an acceptable 2.5x Debt/EBITDA multiple, compared to 5x before the IPO.

However, not all IPOs of European companies last year showed such impressive results. For instance, shares in the beauty group Douglas [FRA: DOU] are down 55% since private equity group CVC floated it in March 2024. Despite the IPO of Douglas having the same rationale of decreasing leverage as Galderma’s offering, the former did not manage to attract robust investor demand. Due to its market cap being lower than €3bn, high leverage, and the longer-than-standard holding period of 9 years by CVC, the IPO of Douglas faced reluctance from big fund managers and was eventually priced at the bottom of the range. These transactions illustrated that private equity firms must bring leverage down before considering an exit via IPO and that a lower price does not necessarily attract fund managers, as they want to invest in the best companies during uncertainty, rather than buy something cheap.

Moreover, although UK companies are most at risk from departures to the US, other European exchanges are also not immune. For instance, Italian machinery group CNH Industrial [NYSE: CNH] completed its voluntary delisting from Euronext Milan in January 2024 to make New York its sole listing. Finally, there were a lot of cancelled European IPOs due to the unfavorable market environment, including the highly anticipated listing of luxury trainer brand Golden Goose in June 2024, which was pulled by Permira after bookrunners suggested it would price near the bottom of an anticipated range, valuing the company at less than €2bn. Furthermore, in October 2024, Spanish group Europastry, which was heading for the world’s biggest “frozen croissant IPO,” delayed its planned flotation for the second time in less than four months, as some investors viewed the valuation of €1.5bn as too high.

Outlook: Key Tests for European IPO Market in 2025

Positive equity market performance, lower volatility, falling interest rates, and inflation returning to central banks’ targets have laid the foundation for a strong European IPO environment in 2025. However, uncertainty still remains, and the above-stated factors need to be watched closely, alongside the following transactions, which will serve as key tests for the European IPO market in 2025.

Firstly, shares of a major global B2B Travel Tech company, HBX [MCE: HBX], started trading at €11.50 on the Spanish Stock Exchange, implying a valuation of €2.84bn. The primary component of the offering consisted of 63,043,478 new shares, resulting in approximately €725m in primary gross proceeds for the company, which will be used to settle the deferred sale consideration due, pay the cash outflows linked to admission, and refinance the debt. In addition to the new offer shares, 2,000,000 existing shares have been placed by the selling shareholders to obtain total gross proceeds of €23m. The over-allotment option of up to €112m, granted by the selling shareholders, may be exercised by the stabilising manager until 14 March 2025. The offering was oversubscribed multiple times across the offering price range, outlining strong demand from international and domestic institutional investors. HBX’s IPO gave a partial exit for existing shareholders, such as the PE firms Cinven and EQT and the Canada Pension Plan Investment Board, while they retained 63.7% of the company’s stock. The shares were down 10% on the first trading day but have gained some value back since then. Analysts expect the share price to rise after the first financial results are published in May 2025, as HBX is a unique, tech-focused business that owns and operates Hotelbeds, Bedsonline, and Roiback, offering a network of interconnected travel tech products and services to partners such as online marketplaces, tour operators, travel advisors, and airlines.

Another potential deal that could test market conditions and investors’ interest is the long-awaited IPO of Shein. The company initially planned to go public in New York in late 2023 but shifted to the UK after facing rejection from the US Securities and Exchange Commission. While Shein’s executive chair, Donald Tung, stated that the company is not going public at this moment, he also emphasized that the UK would be their preferred location: “London is an excellent capital market. It offers the best time zone, the best language, and the best separation between law and politics, with some of the highest standards for accountability.” If it goes ahead, the listing would be one of the largest on the London Stock Exchange this decade. Additionally, prosthetics maker Ottobock is looking to raise as much as €1bn in an IPO later this year, though no final decision has been made. The company, which benefits from steady healthcare system revenues and increased demand due to the Ukraine war and other conflicts, has seen growth in both revenue and EBITDA. Ottobock had previously aimed for an IPO in 2022 with a valuation of up to €6bn but withdrew after Russia’s full-scale invasion of Ukraine and a sharp decline in share prices of other listed medical device firms like Denmark’s Coloplast and Switzerland’s Straumann. However, the timing may now be right, as the company is in a strong position and needs to repay a €1.1bn debt that its owner, Näder Holding, took on last year to buy back a 20% minority stake from private equity firm EQT. Meanwhile, Strada, a company selling generic drugs and consumer health products, is preparing for an IPO in Frankfurt, which could become one of the largest in European pharmaceuticals in recent years. The company is aiming to raise up to €1.5bn at a valuation exceeding €10bn, with plans to go public by the second quarter.

Last but not least, Vivendi’s decision to split into four separate entities, including a London listing for its pay-TV operator, Canal+, was anticipated to provide a significant boost to the London stock market. Canal+ stated that the listing would help expand its footprint in the English-speaking world, which is a key growth market, although it will still be headquartered and taxed in France. However, the Canal+ debut was much weaker than expected, with its shares falling 20% on the first day of trading, leading to a £2.3bn valuation and indicating that the London Stock Exchange has not fully rebounded. Vivendi, which remains listed in Paris, also listed its advertising subsidiary Havas in Amsterdam, reaching a €1.8bn valuation, and its publishing division, the Louis Hachette Group, in Paris, with an implied valuation of €1.4bn. These valuations were much lower than JPMorgan’s earlier estimates: analysts had valued Canal+ at around €6bn, Havas at €2.5bn, and Louis Hachette at approximately €2.2bn.

In conclusion, the European IPO market began to recover in 2024, driven by the return of significant private equity-backed IPOs. This success is expected to pave the way for more PE listings in 2025. While the London equity market showed little progress in 2024, with many companies delisting from the LSE, there is a sense of growing stability and investor confidence, as evidenced by relatively strong secondary markets with large follow-on equity transactions. Hopefully, we will see more successful debuts in the UK in the second half of 2025.

0 Comments