The Blackstone Group L.P. (NYSE:BX) – market cap as of 23/02/2018: USD41.1bn

Thomson Reuters Corporation (TSX:TRI) – market cap as of 23/02/2018: CAD35.8bn

Introduction

On January 30, 2018, Thomson Reuters announced the agreement to sell a 55% stake in its Financial and Risk unit to the US private equity firm Blackstone for more than $17bn. The unit, which provides data, analytics and trading to Wall Street and financial professionals around the world, accounted for more than half of Thomson Reuters’s adjusted earnings before interest, taxes, depreciation and amortization in 2016. The deal – which doesn’t include any newsgathering operation, thus allowing Thomson Reuters to maintain complete editorial freedom – adds to the $105bn worth of private equity deals targeting the media and technology industries over the past 12 months.

Industry overview

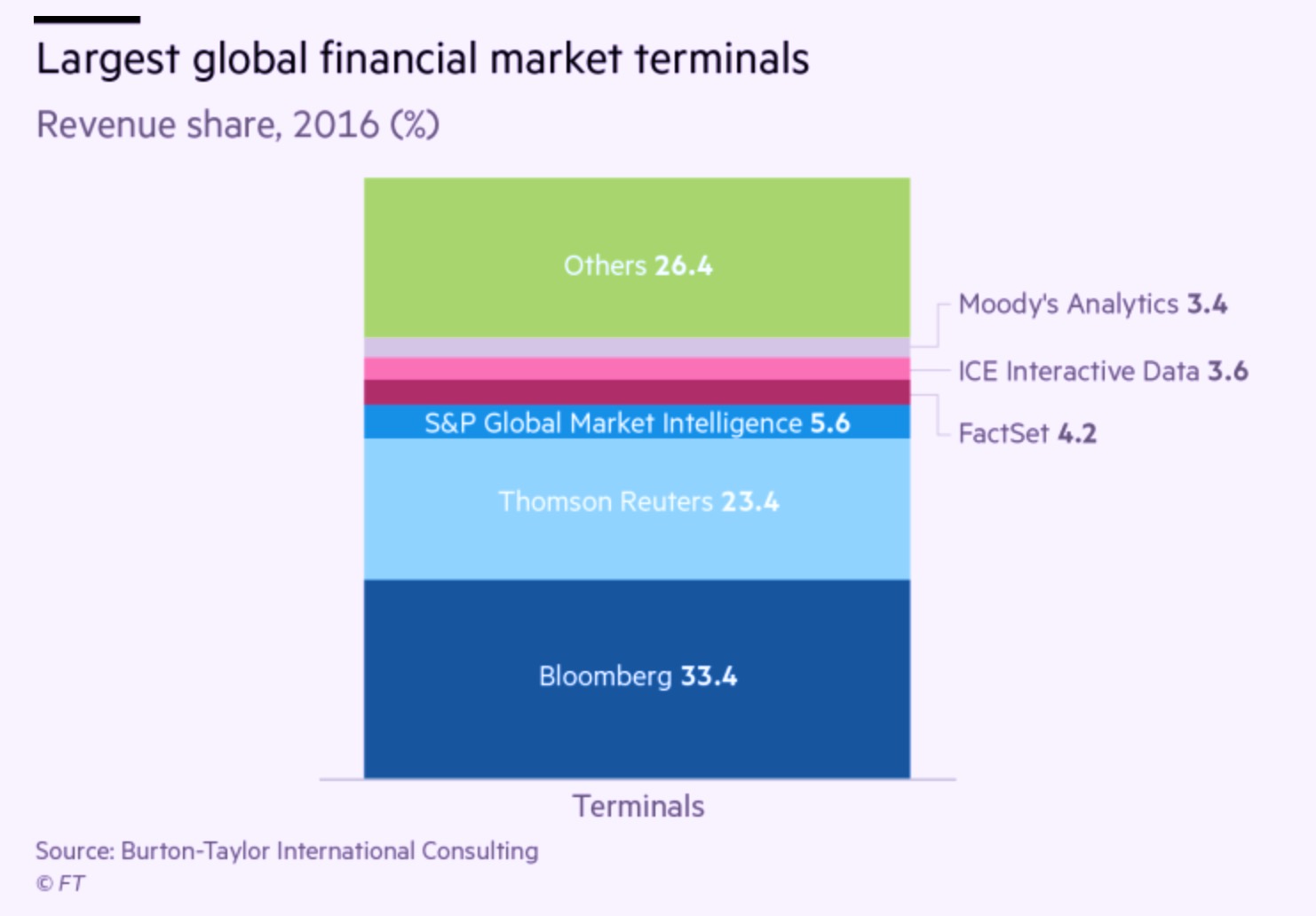

Right after the 2008 stock market crash, the financial data and news sector totaled around $23bn in value, with Bloomberg and Thomson Reuters holding a virtually even market share, 29.2% and 29.4% respectively. Recently, the spending for financial data and news has been increasing and topped $27bn in 2016 for the first time ever, up 3.45% from the previous year. However, sales of data terminals to banks and asset managers have come under increasing pressure due to a shrinking customer base. On top of that, investment banks are expected to reduce their expenditures on financial data products in the next years, following the introduction of MiFID II: indeed, the equity research business is expected to lose about 20% of current revenues, thus putting stronger pressure on information costs.

The industry is extremely concentrated, with just 2 players accounting for 56.8% of revenues in 2016: Bloomberg represents 33.4% of the market and Thomson Reuters 23.4%. Other players comprise S&P Global Market Intelligence (5.6%), FactSet (4.2%), ICE Interactive Data (3.6%) and Moody’s Analytics (3.4%), with the remaining 26.4% of the market represented by smaller players like Dow Jones & Co.

The business model of the companies operating in this industry heavily relies on the efficiency with which they can mine, present and monetize the data they stream to banks, asset managers and other financial institutions. Because of the need for reliability and accuracy of the information provided, revenues are highly recurrent in this industry, EBITDA margins are around 30% and the cash generation power is strong and consistent throughout the years. Personnel, especially in expensive locations such as Europe and the US, represents one of the largest cost lines in this business. In fact, Blackstone is closely looking at ways to reduce staff and offshore jobs at Thomson Reuters, following a trend that has witnessed a 33% decline in the number of employees over the last 5 years. According to experts, the industry is set to experience a wave of M&A activity among smaller and nimble competitors.

About Blackstone

The Blackstone Group is an American multinational private equity firm that was founded in 1985 as an M&A boutique by Peter G. Peterson and Stephen A. Schwarzman. The company, that has become one of the largest Private Equity funds in the world, also offers alternative asset management and other financial services. The business comprises investment vehicles dedicated to Private Equity, secondary Private Equity funds of funds, non-investment grade credit and multi-asset class strategies. Blackstone went public on the New York Stock Exchange in 2007 with a $4bn IPO – one of all-time biggest IPOs for a financial sponsor – and is based in New York City.

The company represents one of the biggest leveraged buyout investors of the last decade, with $387bn of assets under management as of 30 September 2017.

The firm is divided into four major segments: Private Equity, Real Estate, Hedge Fund Solutions and Credit. In the Private Equity segment, Blackstone holds several funds ranging from sector-focused corporate private equity funds, like Blackstone Energy Partners, to its core Private Equity fund. The Blackstone Real Estate Partners has historically carried out several important investments in the real estate sector. Some of Blackstone’s largest acquisitions include Hilton Worldwide, Merlin Entertainment Group and Performance Food Group.

The company’s TTM revenues amount to $7.12bn; the net income attributable to Blackstone amounts to $1.47bn for the same year. The 2017 Advisory fees reached $2.73bn and the performance fees for managers $3.71bn. Its 2017 P/E ratio stands at 6.87x and the diluted EPS at $2.21.

About Thomson Reuters

Thomson Reuters Corporation is a Canadian multinational company active in the mass media and information industry. The company was founded in Toronto in 2008 as a result of the acquisition of the British Reuters from Thomson Corporation, which is owned by Woodbridge – Thomson family’s holding company. Its shares are listed both on the Toronto and New York exchanges.

The company has three main lines of business: Financial and Risk, Legal and Tax & Accounting. The Financial and Risk unit provides news, information and analytics to finance professionals, allowing them to quickly obtain critical data related to financial and corporate investments as well as trading. The Legal unit focuses on providing targeted news, information and materials in the field of law, investigation, business and government. The Tax & Accounting segment mainly offers services and data to accounting and audit firms. Besides that, the company publishes textbooks, provides regulatory information, software, knowledge-based tools and technology applications.

The company reported revenues for $11.3bn and net income for $1.4bn in the fiscal year 2017 – year-on-year net income fell by 55.0% from $3.1bn despite rather constant revenues; the operating margin amounted to 15.5% during the same year. Thomson Reuters’s current D/E ratio stands at 55.9% and its 2017 EPS at $1.5, up 13.4% from 2016.

Deal structure

According to the terms of the transaction, Blackstone will acquire a 55% stake in Thomson Reuters’s Financial and Risk divisions. The two business units will be carved out of the company and constitute a new entity valued around $20bn; Thomson Reuters will retain the remaining 45% stake. As part of the consideration, Blackstone has agreed to pay to Reuters News a minimum of $325m per year for 30 years.

The Legal, Tax & Accounting and the Newsgathering activities divisions are not part of the deal.

A consortium of private equity funds constituted by Canada Pension Plan and the Singapore state fund GIC will provide $1bn in preferred equity, to which Blackstone is adding $3bn in equity cash. In addition to that, $13.5bn of new debt will be provided by a consortium of banks: the loan-and-bond financing arrangement is led by JP Morgan, Bank of America Merrill Lynch and Citigroup for 72% of the total amount financed, in addition to more than 20 banks invited to underwrite the remaining 28% of debt. The financing of the deal, at the current USD/EUR exchange rate, consists of $8bn term loan (split between $5.5bn denominated in US dollars and $2.5bn in euros) in addition to $3bn of secured bonds (split between $2bn denominated in US dollars and $1bn in euros) and $2.5bn of unsecured bonds (split between $1.8bn denominated in US dollars and $0.7bn in euros). On top of that, a $750m revolving credit facility is being provided. Leverage for this operation is expected to be around 4.5x for secured debt and 5.6x overall with respect to Adjusted EBITDA.

It is noteworthy to remember that the cash provided by Blackstone for the deal is the largest non-real-estate-related cheque it has ever written, thus constituting a landmark deal for the private equity group.

The transaction is expected to close in the second half of 2018.

Deal rationale

The deal fell into place after years of massive expansionary monetary policy, which has filled the market with hefty liquidity injections. Thus, too much money on one side coupled with a scarcity of investment opportunities on the other have allowed private equity funds – which are struggling to find targets – to accumulate roughly $970bn of “dry powder”, or cash yet to be invested, facing pressure to produce attractive returns for their investors.

The deal pushes Blackstone into the battle for financial data hegemony: a battle in which Blackstone has already gained experience thanks to the $975m acquisition of Ipreo in 2014 – a deal data provider specialized in software for capital markets.

For more than a decade, the Thomson family has struggled to fix a severe integration problem. Since the acquisition of the Reuters business, Thomson management has faced enervating headwinds in combining the two apparatuses. Therefore, after the financial crisis, it has found itself dealing with a growth problem amid lower spending by banks and other clients and has faced fierce competition from nimbler rivals. Nevertheless, the Financial and Risk (F&R) division boasts incredible assets, including a world-leading data business, risk and compliance solutions, OTC trading venues, wealth management software, and a strong desktop business, which, together combined, include fundamentals, estimates and primary and secondary research.

The partnership with Blackstone provides an opportunity to increase both efficiency and revenue growth through innovation and a new focus on creating uniquely compelling products for F&R’s customers. The deal aims to enhance F&R’s core strengths, accelerate its growth and benefit its customers across the sell-side, buy-side and trading venues. Furthermore, Blackstone may bring certain hard-to-replicate advantages in terms of increasing revenues. Given its heft on Wall Street, Blackstone is better placed than other investors due to its longstanding relationships with the world’s most important financial institutions, to boost the sales in terminals persuading big banks to switch to Thomson Reuters’s financial-data service from the competing, ubiquitous Bloomberg terminals.

On the other side, Thomson Reuters itself has already publicly announced what it will do with the proceeds. First of all, strong emphasis has been placed on the independence of the data provider, which is keeping complete editorial freedom, as it has firmly claimed. Then, the estimated $17bn of gross proceeds from the transaction are to be used to pay down sufficient outstanding debt, in order to allow the company to remain below its target net debt-to-EBITDA leverage ratio of 2.5x, to pursue organic and inorganic opportunities in the key growth segments of the company’s Legal, Tax and Accounting businesses, to pay cash taxes, transaction expenses and other costs required to establish F&R as a standalone company and minimize the resulting stranded costs for Thomson Reuters (estimated at $1.5 – $2.5bn). Finally, Thomson Reuters retained an important stake in the sold business, which is also expected to bring benefits over time.

On top of this, the deal could also pave the way for further deal making in the financial information sector providing an excellent exit strategy. Indeed, if successful, the monetization of the investment for Blackstone will be relatively easy given the interest already expressed by the Intercontinental Exchange and the London Stock Exchange Group.

Market reaction

Thomson Reuters’s New York-listed shares were up 8.5 percent at 17:15 GMT on 30 January 2018, touching their highest level since October at $46.3 per share, giving it a market value close to $32bn and an enterprise value of around $40bn. Blackstone shares were down 1.9 percent to $35.8 on the same day.

Financial Advisors

Canson Capital Partners, Bank of America Merrill Lynch, Citigroup and JP Morgan were financial advisors to the Blackstone-led consortium. Guggenheim Securities, TD Securities Inc. and Centerview Partners advised Thomson Reuters, while Lazard advised Woodbridge, the Thomson family holding.

0 Comments