Introduction

In recent years, major water suppliers in England, privatized by Margaret Thatcher’s government in 1989, have encountered significant financial difficulties due to critical level of leverage in the higher interest rate environment and substantial fines for sewage pollution. As of 2023, 8 companies had debt-to-capital ratios exceeding the regulator Ofwat’s recommended maximum of 60%, with Thames Water leading at a gearing of 80%. Investors’ refusal to inject promised equity into Thames Water and the parent company’s default on its debt have deteriorated already poor position of the water supplier, resulting in ongoing debate on the potential renationalization of the company and the inefficiency of England’s privatized water system in general. Additionally, first in July and then in September 2024, S&P and Moody’s downgraded Thames Water’s credit rating, marking it as the first non-investment-grade water supplier, which has put other utility companies under increasing pressure in debt markets. In its latest business update, Southern Water, which serves 4.7m customers in southeastern England, announced plans to borrow up to £3.8bn from investors over the next five years and raise £650m in equity as part of a revised business plan. While Southern Water is not in such critical situation as Thames Water, its investment-grade rating and its debt covenants have both come under pressure as the group’s total debt has exceeded £6bn. Since 2021, Macquarie Asset Management, the majority owner of the group, has invested £1.6bn into Southern Water, which helped the company to deliver its turnaround plan on reducing pollution. However, there is no certainty that Macquire will provide much needed equity this time if the company continues to deliver low returns. In this case we might see Southern Water following a troubling path of its major competitor, Thames Water.

Widespread Problems in the British Water Utility Sector

The British water industry was privatized in 1989 as part of the neoliberal privatization wave under the Thatcher government, which targeted formerly public companies, particularly in the energy, utilities, and transportation sectors. While the aim was improving efficiency and raising the necessary capital for infrastructure improvements, over the years, privatized water companies have accumulated significant debt. Simultaneously, they often decreased investment, prioritizing dividends and executive pay. This underinvestment has led to continuously decreasing service quality and a rising number of environmental issues, which have raised significant concerns among regulators, investors, and the public. On top of that, inflation, especially in labour, energy and chemicals costs, pushed up operating expenses while higher interest rates have increased financial expenses, significantly endangering the financial stability of the highly leveraged sector.

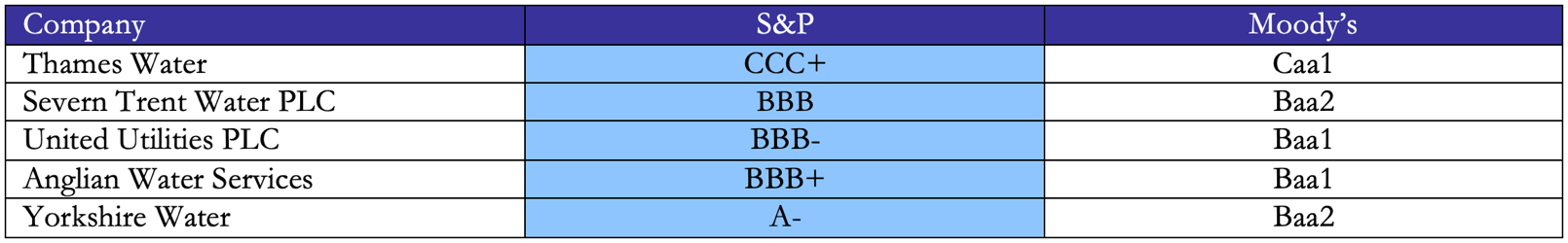

In addition to Southern Water, the other large privately held water utilities are Thames Water, Severn Trent Water (LSE: SVT), United Utilities (LSE: UU), Anglian Water, Yorkshire Water, Wessex Water and South-West Water. Most of them face financial problems to varying degrees. Regulation by the British authority responsible for the water supply and sewage, Ofwat, requires the providers to maintain an investment grade credit rating to ensure financial stability, which explains the high amount of BBB ratings on the boarder of junk status. However, especially over the last two years, there have been several rating downgrades, putting the utilities at risk of losing their license to operate or regulatory fines if they were to fall into junk territory. South-West Water, for example, has received a special dispensation by Ofwat, which exempts it from the obligation to maintain an investment grade credit rating. This was put forth because the company faces such a debt load and operational problems resulting from underinvestment that maintaining the credit rating without a major restructuring was simply not possible and the company now faces increased direct oversight by Ofwat.

Source: S&P Global, Moody’s Investors Service, BSIC

With the high levels of debt, very tight interest coverage ratios and significant investments needed, many of the utilities have a bleak financial outlook for equity investors. Considering the capital structure waterfall, a significant increase in revenues would be needed to make additional equity injections worth it for owners, as the investments would have to generate high enough returns to first serve the creditors already in danger now. Simultaneously, the regulator expects the owners to cure high gearing ratios and operational problems by such investments and threatens to impose further fines should current conditions continue. To compensate for the significant financial risk with investments in the current landscape, the water companies requested a 33% real rise in water bills by 2030 while Ofwat proposed a 20% increase in July. With the strained relationship between companies and the regulatory body, the parties are currently locked in a stalemate with no quick resolution foreseeable. If the situation sours further, the last resort would be a renationalisation, which is discussed among leading labour party members and backed by the public opinion. However, the design of such renationalisation efforts is not fully drawn out yet.

The most prominent example of these widespread and often very similar problems is Thames Water, the largest water provider in England. The company’s financial instability became evident in mid-2023 when it struggled to meet its debt obligations, technically defaulting on some of its holding level debt. Across its highly labyrinthian capital structure, the company has accumulated close to £19bn in debt with negative cash flow and risks running out of cash by May 2025 if it does not manage to raise new funds. Advisor Rothschild has been hired to raise new equity financing at first, but investors deemed the company un-investable, and the process has not shown any sign of success yet. Therefore, current efforts are centred around negotiations with creditors to extend maturities of £530m due December this year and possibly tapping £550m of reserve liquidity facilities, which would be considered a technical default on its bonds but bring the company at least through this year. Additionally, the company negotiates a new super senior facility to be raised at its OpCo, reportedly of up to £1bn, from existing creditors such as distressed debt fund Elliott. Thames Water’s second lien debt due in 2027 currently trade at around 15 pence on the pound, meaning that investors expect close to no recovery in case of default. By the end of September, Thames Water’s safest Class A debt has been downgraded to CCC+ by Moody’s due to its inability to raise equity financing. This has been a quite rare incident of a five notches downgrade since July, when these bonds were still rated investment grade. The rationale behind those rating actions were mainly the loss of trust in Thames Water’s ability to cover liquidity needs by more than 1.1x with recent expectations even lower, imposing imminent default risks without the planned equity injection.

These financial pressures led to a very public debate of renationalisation of Thames Water, with the change in power to the labour party making this a more likely outcome, should the restructuring negotiations not be successful quickly. The water utility tries to prevent this, but at the time being, its options are very limited outside the difficult equity injection. This is because its operational problems are closely linked to underinvestment over the last years, making its pledge to decrease its pollution incidents such as sewage discharges into rivers highly dependent on its ability to raise new financing. Simultaneously, the utility company tries to improve its public image and relations with the regulator, which is contradicted by its efforts to increase water bills, putting it into a difficult position where it simply cannot achieve both goals. This crisis of Thames Water led to increasing pressure on other water companies in debt markets.

Southern Water: from History to Present

Southern Water is a private utility company that handles public wastewater collection and treatment in the southern English counties of Hampshire, the Isle of Wight, West Sussex, East Sussex and Kent. Established in 1989, the company was created as part of the privatisation of the water industry in England and Wales with the privatisation of nine other publicly owned water providers. This move had the aim of improving service efficiency through private sector investment. Southern Water currently serves an area totalling 4,450 square kilometres and approximately 2.3m customers. Ever since its creation, the company has experienced a number of takeovers and operational issues that have led to the current shaky situation.

In 1996, Southern Water underwent a hostile takeover by Scottish Power, an electric power distribution company based in Glasgow. It is also a subsidiary of Spanish utility firm Iberdrola. The acquisition by Scottish Power reflected a trend of diversifying investments across utilities, combining water and electricity operations under one corporate umbrella. Under Scottish Power ownership, a number of Southern Water’s in-house scientific laboratory services and assets were shut down. In 2002, after a relatively short period as owner of Southern Water, Scottish Power sold the company to First Aqua Limited, a consortium led by the Royal Bank of Scotland and other investors, for £2.05m. This acquisition signalled the beginning of a series of transitions that would characterize Southern Water’s operational history, notably a shift towards financial restructuring rather than operational improvement. In 2007, the company changed hands once again, this time being acquired by Greensands Holdings Limited, owned by a consortium of infrastructure investment funds, pension funds and private equity firms. These include UBS Asset Management, JP Morgan Asset Management and Hermes Infrastructure funds. Greensands was established specifically to manage Southern Water’s ownership structure and financial strategy, aiming to maintain a stable and long-term management approach. Despite this, Southern Water continued to face ongoing operational challenges that would impact its reputation and relationship with regulatory authorities such as the Water Services Regulation Authority (Ofwat) and the Environment Agency.

A major turning point for Southern Water came in 2008, when the company was fined £20.3m for deliberately misreporting data concerning water quality and the performance of wastewater treatment plants, as well as poor customer service. Ofwat also ruled that Southern Water would not be able to pass the cost of the fine onto its customers. This fine, one of the largest in the water sector at the time, exposed serious regulatory breaches. Investigations in 2005 found that Southern Water had submitted false figures concerning the company’s response times to customer queries. Hence, some customers had not received their owed compensation. Southern Water’s struggle with operational issues extended beyond data manipulation. A 2011 report by Ofwat found that Southern Water was one of six water companies to fail its leakage reduction targets for 2009-10 and 2010-11, a serious failure according to the regulatory body. Reports indicated that despite raising water bills multiple times, the company had not properly addressed its leakage issues, which accounted for a significant annual water loss. Ofwat’s scrutiny led to performance commitments being imposed on Southern Water, along with a requirement to invest in improved infrastructure.

Southern Water underwent significant changes in senior management trying to address its many issues. The firm periodically brought in new leadership teams with the hopes of revamping the company’s strategy and operations. However, the turnover in leadership also led to inconsistencies in policy implementation and corporate direction, which negatively affected long-term progress. Alongside its operational issues, concerns about Southern Water’s financial practices surfaced in October 2020. The company was criticised for using offshore subsidiaries based in the Cayman Islands, which allowed it to reduce its tax liabilities. Although these offshore arrangements were completely legal, they attracted public and regulatory disapproval as they raised questions about the company’s financial priorities amid ongoing service failures and poor infrastructure. The most significant regulatory setback came in 2021 when Southern Water faced a £90m, the largest ever imposed on a UK water company fine for illegally discharging untreated sewage into the sea. Following a comprehensive investigation by the Environment Agency, it was revealed that between 2010 and 2015, the company had deliberately bypassed proper wastewater treatment processes, resulting in the pollution of coastal waters and rivers. This failure to adhere to environmental standards was part of a broader pattern of non-compliance, making the record fine a reflection of systemic issues within the company. Recently, Southern Water CEO Lawrence Gosden told the BBC that this fine was a direct result of under-investment into company infrastructure: “The company just hadn’t adequately invested in the capacity of its sewage works to be able to deal with the volume of sewage,”

In response to the regulatory and environmental challenges that it faced, Southern Water was acquired by Macquarie Asset Management in a deal finalised in 2021. The acquisition saw Macquarie taking a majority stake in the company, with a commitment of a £1bn equity investment over four years to improve Southern Water’s water network and address persistent infrastructure problems. The takeover was not just a financial transaction, but a strategic move intended to recapitalise the company and implement a more sustainable strategy. To make these intentions clear, Macquarie wrote an open letter to Ofwat highlighting its commitments to Southern Water up until 2025. These commitments include approximately £230m of funding to upgrade the company’s infrastructure so that it can reduce leaks, as well as a commitment to ensure that average water bills do not rise by more than inflation. Despite early signs of progress under its new Australian ownership, Southern Water continued to operate under scrutiny from Ofwat and the Environment Agency, with regulators monitoring the company’s ongoing efforts to meet its performance commitments and environmental obligations. As Southern Water approached 2023, the company was still struggling with the legacy of its past, including financial penalties, public mistrust, and regulatory pressure. The Macquarie investment brought a renewed focus on long-term improvements, but the company’s historical struggles with compliance and operational efficiency continued to present significant obstacles.

Is Southern Water following the path of Thames Water?

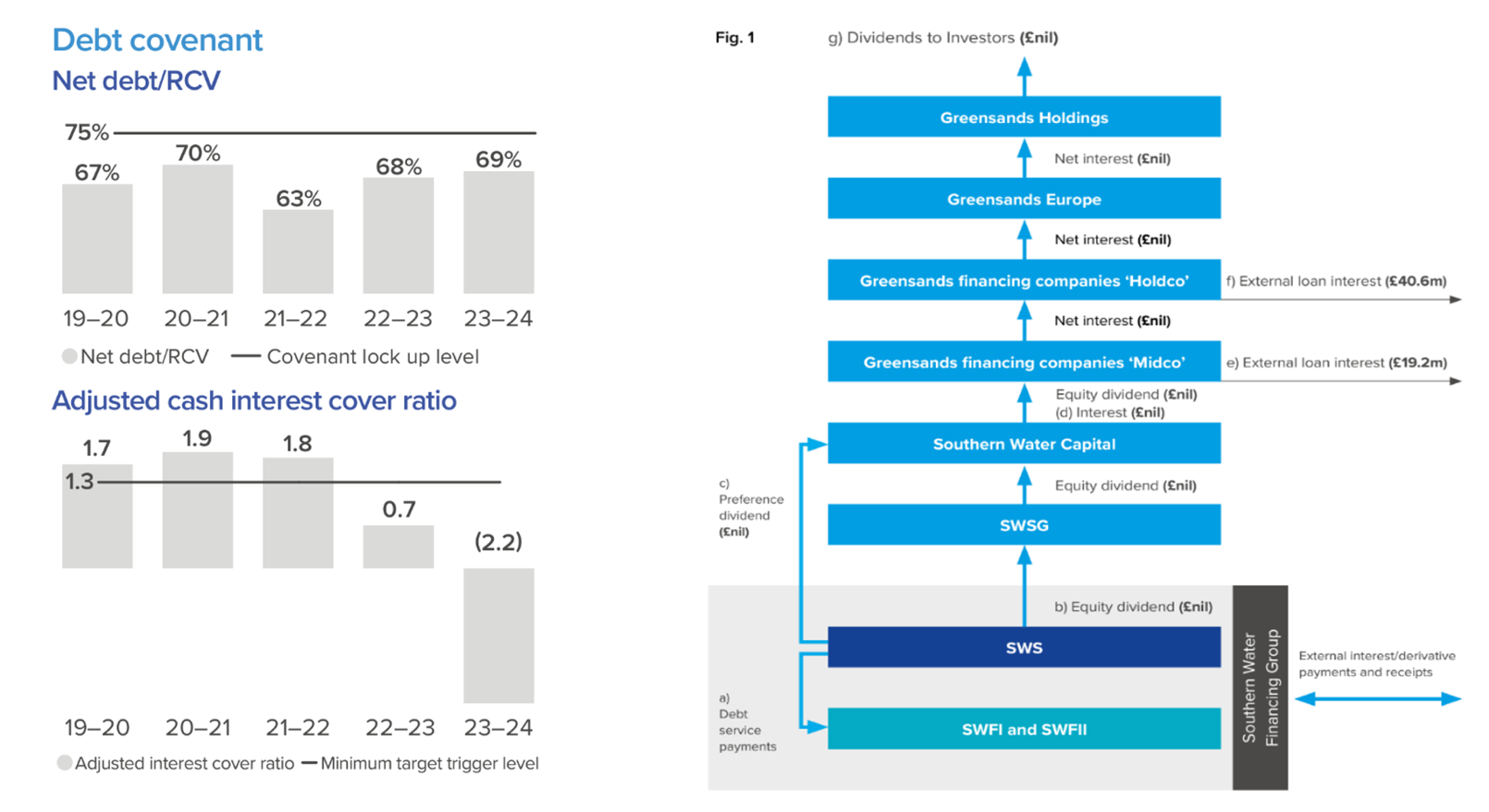

For the first time significant concerns about Southern Water financials were raised in July 2023 when Fitch downgraded the company’s debt to triple B, thus, the water provider had to suspend dividend payments at least until 2025. The next month the company’s lenders had to waive a loan covenant breach after its credit ratings and its interest coverage ratio fell below key thresholds. Southern Water has 2 main covenanted financial ratios: the ratio of net debt to Regulatory Capital Value (RCV), which is set by Ofwat at each five-year review and reflects initial market value plus subsequent capital investment and inflation, and the ratio of adjusted net cash income to net interest cost, which is measured as the ratio of net cash inflow from operating activities less RCV depreciation to net cash interest expense for the consolidated group of Southern Water Services Limited (SWS). The group is in a debt covenant trigger event as adjusted interest cover ratio dropped below the minimum target level of 1.3 in financial year 2022-2023, which restricts the payment of dividends and requires the preparation of a remedial plan for the lenders. Southern Water has obtained a waiver from its lenders to continue to access all its available borrowing facilities and raise new financing, while also being able to increase the limit on its debt-to-equity ratio from 74% to 75%. Moreover, SWS with a credit rating of triple B by S&P’s and Fitch, and Baa3 by Moody’s, is in a credit ratings trigger event, which also restricts the payment of dividends. While the reported debt-to-equity ratio of 69% includes £4.7bn of debt at Southern’s operating company SWS, it leaves out almost £1.2bn of liabilities relating to its inflation-linked swaps. But if included, they would take the company’s gearing level up to 85%, even higher than 80% gearing of Thames Water. Furthermore, the yield on Southern’s short-dated bonds, due in 2026, has reached 13.5%, as investors now require a large premium to hold debt of the company.

Source: Southern Water Annual Report 2024

In October 2023, Macquarie injected £550m in equity into Southern Water, helping the company to show progress on delivering its Turnaround Plan, which has seen pollutions cut by over 35% and customer complaints reduced by nearly 60% in the last year. However, its holding company also has £300mn of debt maturing next year, meaning it might need to negotiate an extension on its debt. This once again reminds of a situation with Thames Water, when its holding company Kemble, which itself was established by Macquarie during its 2006 buyout of the utility company, defaulted on its own debt in April 2024, after its present shareholders refused to put fresh equity into the business. Despite the same complex structure and indebtedness of the holding company, Southern Water is in a better position, as in 2021 Macquarie Asset Management made a commitment to invest in the water company’s long-term transformation during the regulatory period, which runs until March 2025. Moreover, MAM already has an 82% stake in Southern Water which is nearly impossible to sell on favourable terms in current conditions, thus, the firm is likely to inject further equity to help the water provider.

Given the high leverage and coverage ratios of Sothern Water, Moody’s changed the Baa3 senior secured ratings of its financing subsidiary, SW (Finance) I plc, from stable to on review for downgrade in July 2024. The firm’s CFO Stuart Ledger stated: “This change has no material impact on Southern Water, or SW (Finance) I plc, and as highlighted by Moody’s in their report, Southern Water has an excellent liquidity position with £513m of cash and deposits and £350m of undrawn credit facilities”. However, solid cash balance comes mostly from borrowing, rather than the firm’s operating activity. Following the Moody’s review, in a presentation to debt investors, Southern Water announced it plans to raise £3.8bn of debt over the next five years, stating it had a “proven track record of capital raising”, having raised £550m of equity from Macquarie in the past financial year. The water provider also plans to raise £650m in equity to ease the pressure on its credit ratings and operating business. This injection would bring gearing to below 70% for the 2025-2030 period and help to achieve the target credit rating of BBB+. Furthermore, in its updated business plan Southern Water mentioned that the company will invest £4.1bn in its wastewater services between 2025 and 2030, contribute £682m to reduce its use of storm overflows, and invest £600m to upgrade 38 wastewater treatment sites to improve the quality of water the company puts back into the environment.

In this five-year period Southern Water has already invested £1.17bn more than the regulatory allowance as part of their commitment to ongoing transformation. The company has not paid dividends to external shareholders since 2017, which implies that over £400m of allowed returns will be retained in the company to support the planned investments in current financial period, ending March 31, 2025. Although Southern Water reassured investors, that their turnaround plan can be financed, it is clear that it would be impossible without further equity injections as the company’s leverage is already close to critical level and its EBIT was negative for two consecutive years. To increase its revenues, Southern Water also asked water regulator Ofwat to allow it to raise the average annual household water bill to £734 by the end of the next regulatory period, higher than the charge of Thames Water and other competitors. Although, Southern Water proposed 45-90% discounts for those who are struggling to pay their bills, this initiative was met with strong outrage among customers. Indeed, people in England are not happy with the water bills which already increased by 7.5% to an average of £448 last year. Consumer groups said that further increases could be dramatic for the 20% of customers who were already struggling to pay. That is why the proposed raise in bills is unlikely to be approved by Ofwat and Southern Water needs to look for other ways to increase its revenues.

Conclusion

In conclusion, Southern Water is currently not in the same degree of financial issues as Thames Water as the former has raised £550m in equity from MAM, which helped the company to deliver progress on its Turnaround Plan, cutting pollution by over 35% and reducing customer complaints by nearly 60% in the last year. Moreover, Macquarie is expected to inject £650m of new equity as it made a commitment to invest in the water company’s long-term transformation during the regulatory period, which ends in March 2025. This would ease the pressure on Southern’s credit rating and bring gearing to below 70%, helping the company to improve its operations. However, the group has a structure of the same complexity as Thames Water, with holding company having £300m of debt maturing next year. Moreover, the requested increase in the average annual household water bill to £734 will most likely be rejected by Ofwat, meaning Southern Water needs to find other ways to improve its operating business and increase profits.

0 Comments