Introduction

We continue our series on NIRP with the focus on the rates in the UK and the prospect of them becoming negative, that has kept markets professionals on their toes for the last year. Then we go on to discuss the UK outlook on the back of Tuesday’s 2021 budget announcement. To materialize our discussion, we construct a trade idea around our views.

- UK Rates

The First Negative Yielding Gilt

May 20, 2020 marked the first time in history that the UK government was rewarded for its borrowing at an auction of 3.75BGBP worth of gilts with Jul 2023 maturity that sold at an average yield of negative 0.3bps. Despite the investors receiving an annual interest of 75bps, they paid above face value such that should they hold the debt to maturity, they will have a lesser absolute cash return to what they have lent. The market could have seen this coming since as of May 13 certain SONIA (GBP OIS) swaps have been trading in negative territory and as of May 19 there was 95BUSD notional worth of Fed Funds (USD OIS) swap trading below zero with the lowest level at negative 7bps and with the shortest tenor at one month and longest at 3 years. The rhetoric of the BoE changed from the mid-May governor Andrew Bailey’s statements that “negative rates were not something the central bank was planning or contemplating”, to the late May build up in the statements of the BoE Chief Economist, over the one of Monetary Policy Committee (MPC) member, to the governor himself saying that the policy was now under “active review”. Market reaction can be assessed through the size of total notionals of the negative yielding SONIA swaps traded in that period since April which was at 55BGBP with tenors ranging from 1 month to 4 years. Despite the fact that the lowest SONIA swap yield seen as of May was at negative 5.8 bps, the more surprising information was that of a total of 7BGBP in notional that has been traded in longer-term SONIA swaps, from 1 to 4 year tenors, all at negative rates. (For purposes of completeness, The Sterling Overnight Index Average, SONIA, is the effective overnight interest rate paid by banks for unsecured transactions in the British sterling market. It is used for overnight funding for trades that occur in off-hours, represents the depth of overnight business and as such is regarded as a near risk-free interest rate benchmark.)

1Q2021 Rates Perspective

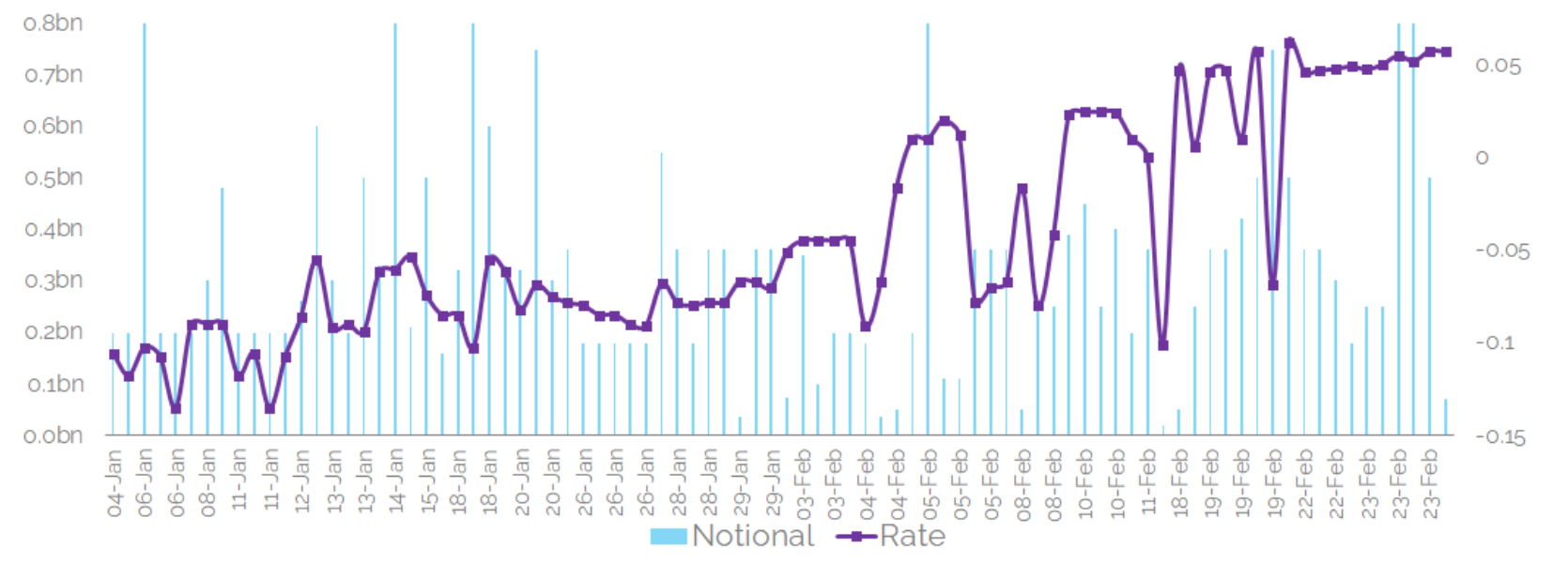

The new year has brought in even greater notional levels of SONIA OIS traded at negative rates that has ultimately reached the number of 673BGBP (which is likely much higher given the regulation dealing with capped notional reporting). The most active tenor was that of 3 months and the longest one was at 4 years.

Source: CFT

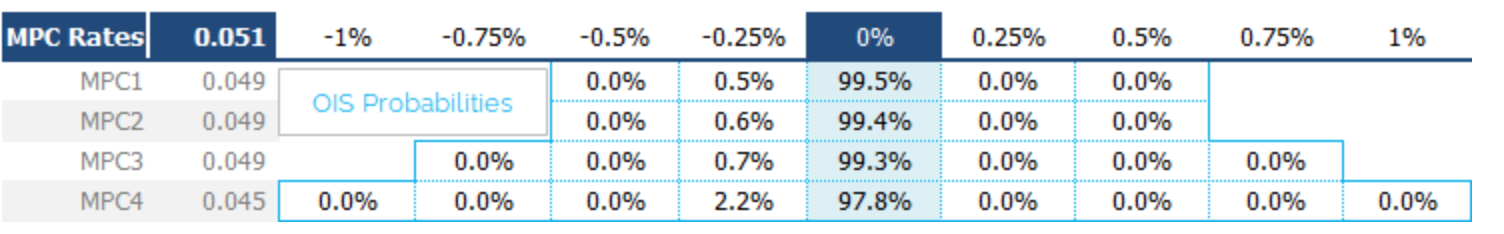

At the 3 Feb MPC meeting, the monetary policy was set to meet the 2% inflation target to help sustain growth and employment. The Committee then judged that the existing stance of monetary policy remains appropriate as they unanimously voted to maintain Bank Rate at 10bps.

Although the yield curve has steepened this month, it was the latest MPC meeting that caused the short-end to trade back positive. Let us use 1Y1Y forward in SONIA as a short-end proxy that sharply corrected into positive territory after the meeting with significant enough volume traded to be the consensus expectation. The trend has thus been towards an increase in rates, with 1Y1Y now expecting SONIA to be pretty much unchanged at 5bp in a year from now which lets us reasonably conclude that the short-end of the curve has steepened locally, and with respect to all the tenors has gone from inverted to flat.

Source: CFT

UK FIG and NIRP

Should there ever be any prospect of negative rates however, we must note that part of the UK financial institutions might not be ready to take on the negative quotes. From a letter dated 4 February 2021 published on the Bank of England website, we can read the final assessment of bilateral discussions, started in October 2020, between the Prudential Regulation Authority and the CEOs of UK banks on their readiness to cope with NIRP. At the time, BoE asked financial institutions if they would have any problem dealing with negative interest rates and how much time they would need to implement a negative rate in their IP systems. When it comes to wholesale banking business (services sold to large clients, large corporations, government agencies and other banks) most firms are ready to implement negative rates as they have dealt with them in other countries. On the retail banking side, legacy systems are not prepared to accomodate a negative Bank Rate. Some firms would need six months of time, others would need more, up to eighteen months. The area that would need more preparatory work would be tracker mortgages, or simply put variable rate mortgages, where customer rates are directly determined by the policy rate. Therefore, we can reasonably expect that should BoE ever adopt NIRP without having ensured that the entire financial system can technologically support its decision, that could lead to material risks to safety and soundness of the banks. Conversely, should the BoE rhetoric and actual structural instructions to the retail banking system touch upon the implementation of systems that can support the prospect of negative rates, that might be a (weak) market signal to follow that a cut might be on the way.

Rates Prediction Verdict

To conclude, with the current prospect of recovery there is no rationale for negative rates although it is prudential and more than reasonable that the BoE should keep it in its toolbox. Any further negative rates rhetoric coming from the March MPC in our view should not be overly interpreted and should be thought of as cautious rather than market-moving in any way. We are safe to conclude that the market expectations for negative rates in GBP have significantly decreased since the 3 Feb MPC. Coupled with the recent global sell-off in bond markets and with 1Y1Y SONIA already back in positive territory, it looks like negative rates are not on the agenda for UK market participants in the near future all things equal.

Source: CFT

2. UK Outlook

Chancellor’s Budget Statement

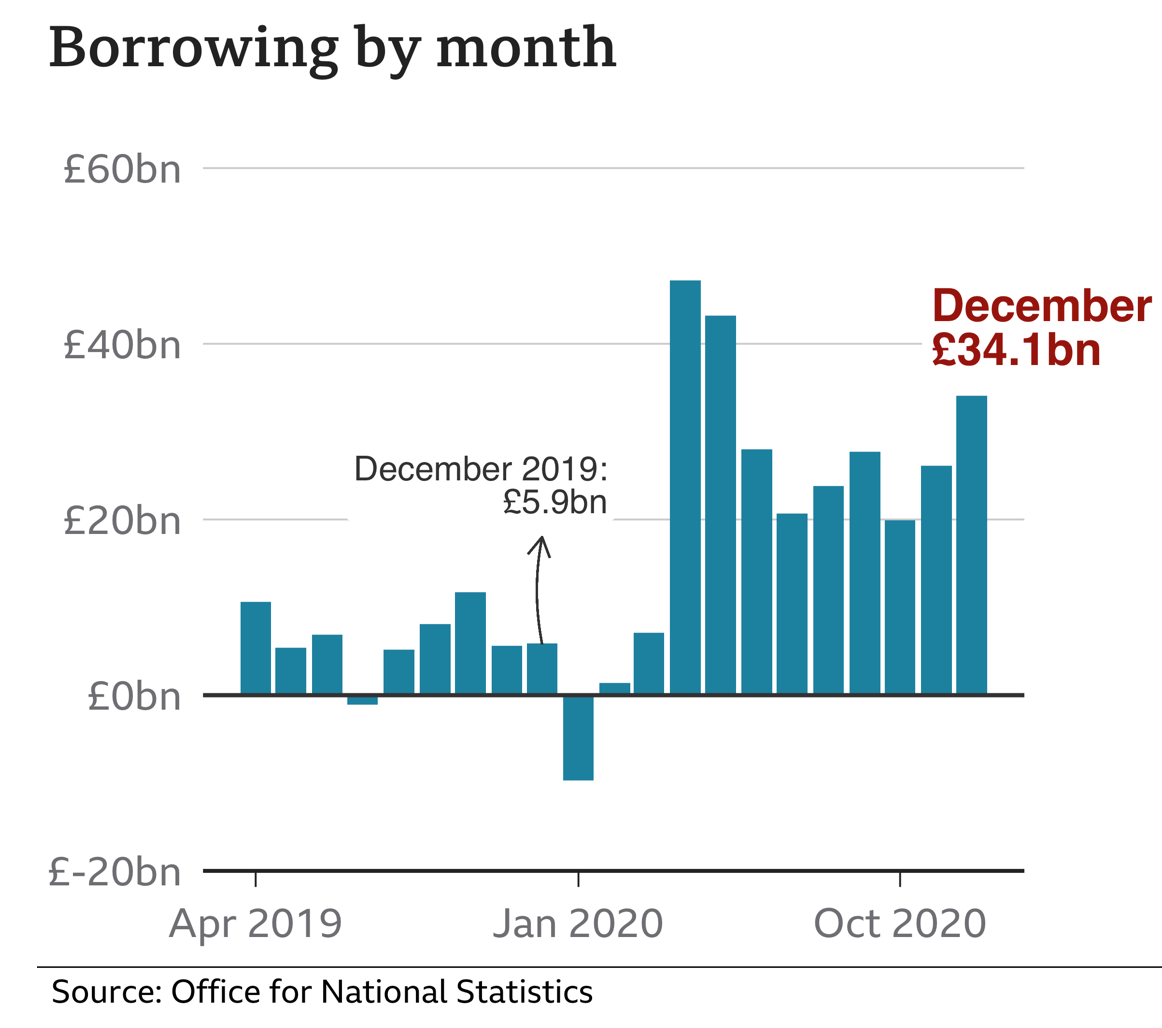

On 3 March 2021, Rishi Sunak, the Chancellor of the Exchequer, delivered the Budget statement in front of UK MPs. There are four main takeaways: continuation of furlough scheme, additional £65 billion to support jobs, 2-year tax break offered to corporate investment and tax burden to rise later. The furlough scheme will be maintained until September, with workers receiving 80% of their salary for hours not worked. The state will cover the scheme entirely for the whole period. July, August and September will be the only exceptions, with corporations having to provide 10% and 20% of the total cost. The £65 billion will bring the total stimulus erogated since the pandemic to £407 billion and forecast for 2021 borrowing are at 10.3% of GDP. Last, the Chancellor hopes to attract foreign investments in the next two years, with companies able to deduct 130% of their investment from their taxable income. After the tax-break period, plans to raise corporate taxes will leave Britain with its highest tax burden at 35 per cent of GDP.

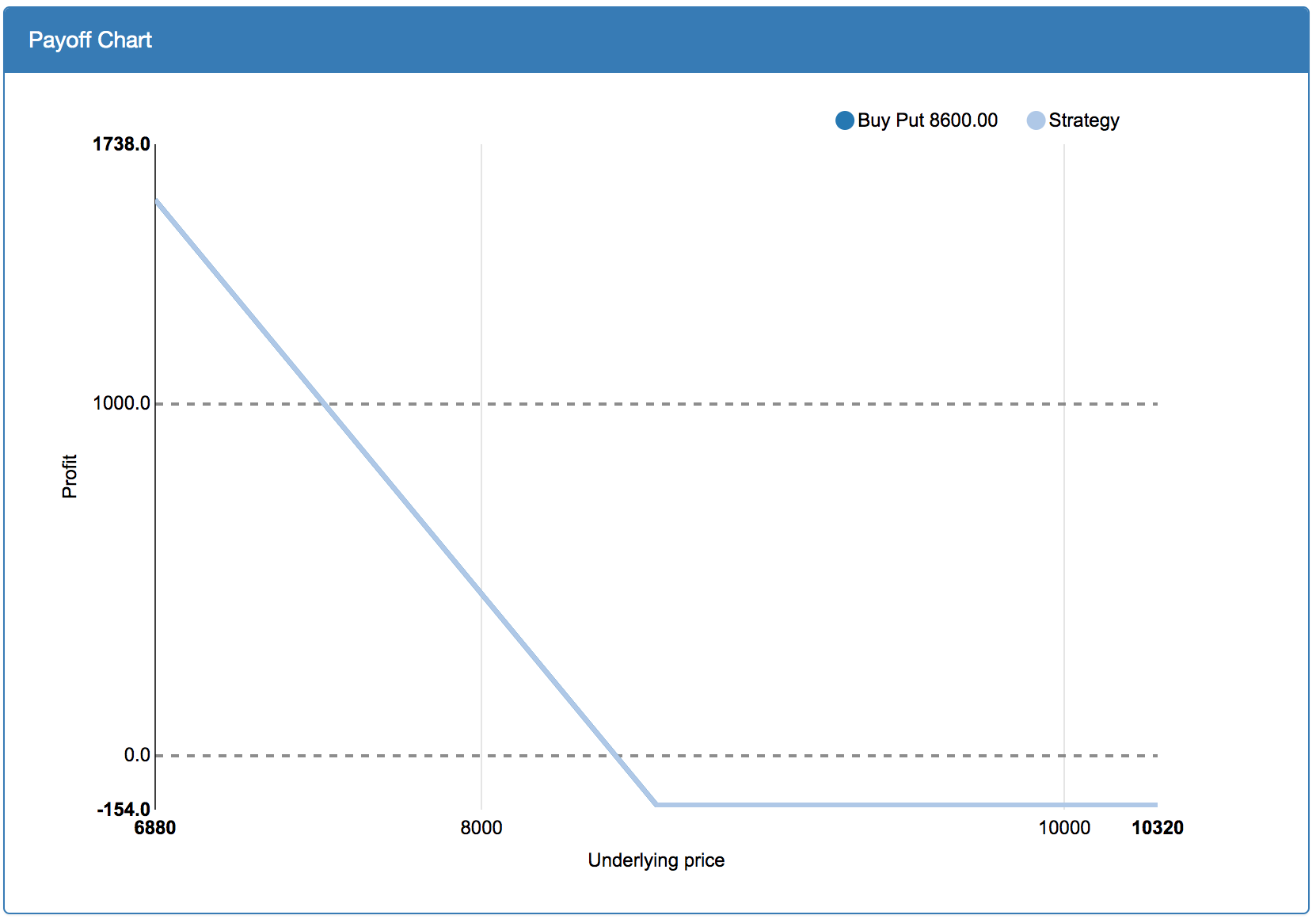

3. Bullish sentiment on GBP/EUR

There are many factors driving us to think about GBP appreciating versus EUR in the short term: higher vaccination rates, upward moves in the SONIA OIS swap market and UK Budget for 2021. Moreover, on February 26 Andy Haldane, BoE Chief Economist, addressed inflation in a recorded lecture named “Inflation: a tiger by the tale?”. He said that confidence intervals around the MPC’s two-year-ahead inflation projections are twice as large as normal, indicating increased uncertainty. This is consistent with the two states of the world that could probably be realized in the future. The negative scenario, where COVID variants become more aggressive, vaccination rollout program is not much effective and further lockdowns are imposed will depress economic activity once again and increase downward pressures on prices. The positive scenario, where vaccination is effective and restrictions are eased, will bring high levels of inflation due to the large output gap generated during the pandemic and huge fiscal and monetary stimulus provided. The Consumer price inflation data for January 2021 released by the Office for National Statistics on February 17 saw all three measures of inflation (CPIH, CPI and OOH) increase from the previous calculations for December 2020, confirming the upward trend from November 2020. The same day pound sterling broke the 1.15 cap level versus the euro. We expect inflation data releases for the month of February published by ONS on March 17 to show once again rising prices. Therefore, our recommendation is to buy an ATM put option on EUR/GBP futures. The option contract’s expiration on March 19, the third Friday of the month, would be just two days after inflation data announcement. Currently, EUR/GBP is at 0.86 and the size of the contract is 10,000 EUR. This is how the payoff chart would look like:

0 Comments