Introduction

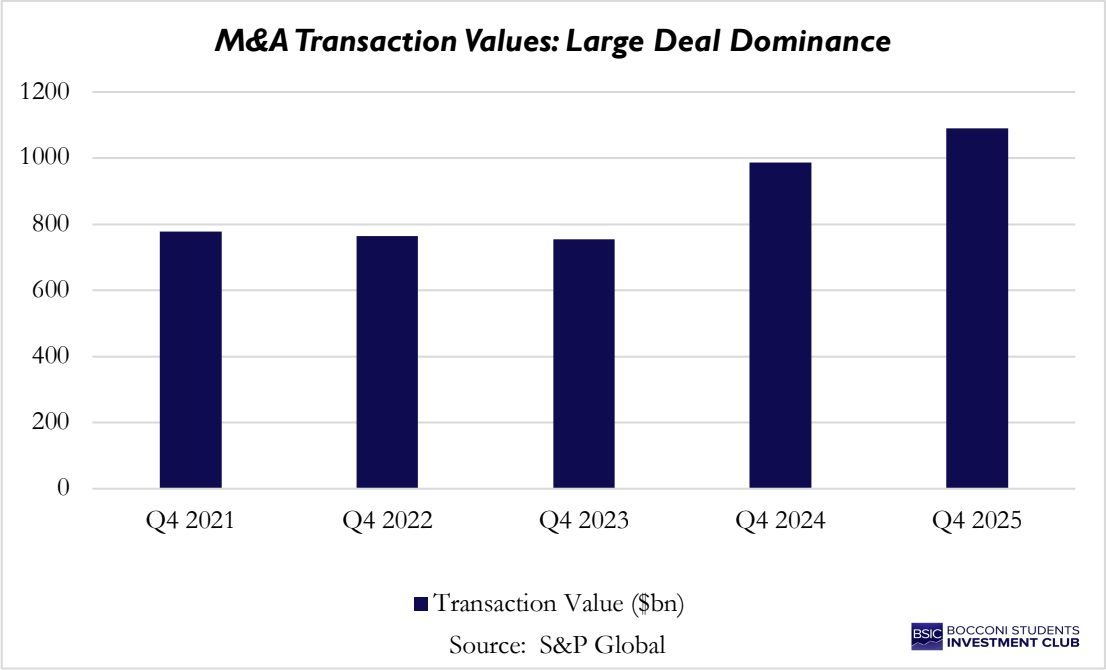

2025 concluded with the resurgence of megadeals (transactions valued over $5bn), as encapsulated by headlines such as Netflix’s [NASDAQ: NFLX] $82.7bn bid for Warner Bros. Discovery [NASDAQ: WBD]. In contrast to Q4 2024, total deal value has increased by 127.6%, with M&A activity rising by 19.1% for transactions exceeding $100m. The resurgence in top-end dealmaking was supported by declining interest rates and strong equity markets, as well as the pursuit of vertical integration of AI by companies. According to analysis by PwC, a third of the 100 largest corporate M&A transactions in 2025 cited AI as part of their strategic rationale. Notably, the trend of megadeal activity was most concentrated in the TMT sector, as seen with deals such as IBM’s [NYSE: IBM] acquisition of Confluent [NASDAQ: CFLT], while the Consumer and Retail sector demonstrated weaker performance. However, while high deal value was observed at the upper end of the market, volumes and value at the lower end remained muted, given continued uncertainty in execution risk and valuation gaps. Thus, a K-shaped market has emerged, whereby activity mainly favoured US-based and technology-led megadeals.

Sector Dynamics: TMT and Infrastructure Consolidation

Sector Dynamics: TMT and Infrastructure Consolidation

Winter 2025 M&A activity across TMT and infrastructure signals a shift towards scale and control, as major technology companies fight for an advantage in the AI race. Dealmakers concentrated capital on fewer but larger transactions, prioritising AI-enabled technologies as well as energy and grid infrastructure to support the growing demand for clean power and data services. According to S&P Global, the average implied EV/EBITDA multiple for the Information & Technology sector climbed substantially, from 18.0 in Q4 2023 to 29.6 in Q4 2025, highlighting rising valuations for strategic targets.

IBM’s Acquisition of Confluent

Deal Value: $11bn | Deal Type: Acquisition | Date: December 8th, 2025| Nationality: USA| Premium: 34%

On December 8th, 2025, International Business Machines Corporation [NYSE: IBM] announced it would acquire Confluent [NASDAQ: CFLT] for $11bn, an offer price of $31 per share, representing a 34% premium to Confluent’s last close. The Californian company Confluent, founded in 2014, has over 6,500 customers and operates an open-source data streaming platform that processes data, an increasingly essential element for AI systems. For IBM, which has invested heavily in AI software and services in recent years, this acquisition would mark a major step towards strengthening its position as an end-to-end software and AI platform. This acquisition would be IBM’s most significant since 2019, when they purchased Red Hat for $34bn, and follows IBM’s prior takeover of cloud software provider HashiCorp for $6.4bn. The agreement will also allow IBM to streamline its product offering because of overlapping technologies, while expanding Confluent’s services to a wider range of customers. For Confluent, the acquisition provides global enterprise distribution and deeper integration into large-scale AI products. This deal reflects a broader wave of consolidation in the data infrastructure sector, where large software vendors are seeking to build vertically integrated AI stacks. IBM will fund the Confluent deal with cash on hand, and the transaction is expected to close by mid-2026, trading close to the offer price, signalling the likely completion of the deal.

Alphabet’s Asset Acquisition of Intersect Power

Deal Value: $4.75bn | Deal Type: Asset Acquisition | Date: December 22nd, 2025| Nationality: USA| Premium: N/A

On December 22nd, 2025, Alphabet [NASDAQ: GOOGL] announced it will acquire clean energy and data centre infrastructure developer Intersect Power for $4.75bn. Prior to this announcement, Alphabet, formerly Google, was already a minority owner of Intersect, following the 2024 agreement between the companies to develop data centres in co-located energy parks, with $20bn of renewable energy and battery storage. The deal is driven by Alphabet’s goal to decarbonise and lower emissions, following recent partnerships with utility and energy developers to bring clean power generation and increase their data centres and generation capacity; an acquisition driver seen by many tech companies. Alphabet’s CEO Sundar Pichai stated, “Intersect will help us expand capacity, operate more nimbly in building new power generation in lockstep with new data centre load”. The deal structure differs from typical acquisitions; Alphabet is not acquiring Intersect Power itself, but it is acquiring a portfolio of clean energy projects. Alphabet will acquire energy assets that emerged from the partnership between Intersect and Google, including projects currently under construction in Texas and California. The Texas projects consist of 3.6GW of solar and wind capacity and 3.1GWh of battery energy storage, designed to supply large-scale clean electricity for Google. This will enable Alphabet to gain greater control over its energy costs and sustainability performance by using carbon-free energy to power AI infrastructure and hyperscale data centres. Thus, Intersect Power will continue operating as an independent energy developer, separate from Alphabet and Google. For Intersect Power, the deal monetises mature projects to recycle capital, reduce balance sheet risk, and fund its next wave of large-scale renewable energy and storage projects, while remaining an independent developer. In parallel with Alphabet’s acquisition, a separate investor-led entity backed by Intersect’s existing financial partners will purchase another set of assets.

ServiceNow’s Acquisition of Armis

Deal Value: $7.75bn | Deal Type: Acquisition | Date: December 23rd, 2025| Nationality: USA, Israel| Premium: N/A

ServiceNow [NYSE: NOW], the US enterprise software company, will acquire cybersecurity startup Armis for $7.75bn in cash, aiming to increase its AI cybersecurity capabilities. ServiceNow stated this deal would triple its market opportunities for security and risk solutions, with the deal expected to close in the second half of 2026. This follows a growing consensus that increasing integration of AI tools into business workflows creates vulnerabilities to cyberattacks. The ServiceNow deal follows an acquisition spree, including the purchase of AI agent platform Moveworks for $2.85bn in March last year, followed by the announced acquisition of identity security platform Veza for more than $1bn. This increased activity has drawn scrutiny, as ServiceNow has historically positioned itself as reliant on organic growth, prompting investors to question whether this shift represents strategic expansion or growth stabilisation. Prior to the transaction, Armis raised $435m in a funding round that valued the company at $6.1bn, with plans to go public in late 2026 or early 2027. The acquisition provides a meaningful premium over that valuation and accelerates liquidity for Armis’ private investors while mitigating IPO risk. Another key driver for Armis was accelerating scale and expanding its global reach. The deal reflects a broader wave of cybersecurity consolidation, as large platform vendors seek to build end-to-end security stacks while adapting to the risks associated with AI adoption.

Meta’s Acquisition of Manus

Deal Value: ~$2bn | Deal Type: Acquisition | Date: December 29th, 2025| Nationality: USA, Singapore| Premium: N/A

Meta [NASDAQ: META] stated at the end of 2025 it would acquire Chinese-founded AI startup Manus, which has now relocated to Singapore due to geopolitical risks, for an estimated value between $2-$3bn. Manus drew attention after unveiling its general AI agent. Following its relocation, US venture capital firm Benchmark invested $75m. Meta aims to operate and sell Manus’s services and integrate its technology into consumer and business offerings, such as the Meta AI assistant. The acquisition is driven by Meta accelerating AI investment amid competition from OpenAI, Google, and Anthropic. This acquisition was desirable for Manus due to global scalability and greater resource access. However, the deal has drawn scrutiny from China, concerning whether Meta’s purchase violated technology export control. This scrutiny mirrors that of TikTok, emphasising how AI transactions are increasingly subject to national security and industrial policy considerations, and are a form of strategic competition. It also demonstrates the growing trend of Big Tech buying AI capabilities.

Netflix Acquisition of Warner Bros. Discovery

Deal Value: ~$82.7bn | Deal Type: Acquisition | Date: December 5th, 2025| Nationality: USA| Premium: 121%

In December, Netflix [NASDAQ: NFLX] agreed to acquire the studios and streaming division of Warner Bros. Discovery [NASDAQ: WBD] for $27.75 per share, for an equity value of ~$72bn and enterprise value of ~$82.7bn. Reuters reported the deal represents a 121.3% premium to WBD’s closing share price on September 10th, 2025. This high premium comes from WBD shares being under pressure amid streaming losses and heavy debt. For Netflix, the deal is less about near-term earnings multiples and rather about gaining intellectual property. Strategically, this acquisition gives Netflix ownership of major franchise universes and premium brands, reducing dependency on third-party licensing. Netflix also cited $2-$3bn in annual cost synergies in technology and marketing by the third year. The original financing for the deal was composed of a mix of cash and Netflix shares; however, in January 2026, it was revised to 100% cash, due to fluctuating Netflix shares and Paramount Skydance’s [NASDAQ: PSKY] counterbid. Paramount Skydance offered an all-cash hostile offer of $30 per share, valuing Warner Bros. Discovery at $108.4bn, far higher than Netflix’s proposal, but Netflix remained the preferred acquirer. While Paramount’s bid covered the entirety of WBD outside the core studios and streaming, there were board concerns around Paramount’s financing risk to avoid this deal. For Warner Bros. Discovery, this transaction provides an exit at a substantial premium and relieves its debt burden and struggle to compete in global streaming. This deal also fits a broader industry trend from media groups moving from licensing models to permanent control.

SpaceX’s acquisition of xAI

Deal Value: ~$1.25trn | Deal Type: Acquisition | Date: February 2nd, 2026| Nationality: USA| Premium: N/A

At the start of February, SpaceX, the private space exploration company founded by Elon Musk, acquired its AI startup, xAI, for around $250bn, in an all-stock merger. This valued the combined entity at ~$1.25tn, while the transaction used a triangular merger structure to allow xAI to become a subsidiary with certain liability and debt protections preserved. xAI shareholders will receive 0.1433 SpaceX shares per xAI share; some xAI executives were reported to have an option to receive cash at around $75.46 per share instead. This structure is a tax-free reorganisation, enabling xAI investors to defer tax on their SpaceX shares until later sale. Musk’s rationale is to build a vertically integrated technology stack, and market analysts view this deal as a step towards a SpaceX IPO. Although this deal is a consolidation of two companies by the same founder, it fits the trend of AI becoming a priority for major tech giants and the movement towards AI’s involvement in defence, telecommunication, and energy.

Struggling Consumer and Retail and the Role of PE

The closing quarter of 2025 saw the Consumer and Retail mirror a broader trend: total deal value increased to $120.2bn (up 143% YoY), characterised by fewer (711) but higher-value deals rather than a widespread recovery. The caution among buyers stems from concerns about inflation, high interest rates, and tariff-related supply chain disruptions. These issues continue to affect the sector, especially subduing the middle market segment, which saw only 42 deals last quarter. Private equity has played an increasingly central role in deal activity within the sector, with 50% of large-cap and 40% of EMEA deals involving a PE buyer in Q4 2025, buoyed by rising economic confidence and renewed interest in undervalued consumer companies with strong brands. Consumer health remains an attractive arena for strategic and private equity investors, supported by favourable demographic trends, ageing populations, strained healthcare systems, and consumers’ heightened focus on wellness and improved health. Within the global consumer markets, there is confidence of an improving outlook for 2026 emanating from a more stable macroeconomic backdrop: real GDP expectations are strengthening, interest rates are easing, and regulatory friction, particularly in the US, has moderated.

UPS’ acquisition of Andlauer Healthcare Group (AHG)

Deal Value: $1.6bn | Deal Type: Acquisition | Date: November 4th, 2025| Nationality: USA, Canada | Premium: ~31.1%

On November 4th, United Parcel Service (UPS) [NYSE: UPS] concluded its acquisition of Canada’s Andlauer Healthcare Group [TSX: AND] for CAD $2.2bn (USD $1.6bn), providing Andlauer shareholders CAD $55 per share in cash. This represents a premium of ~31.1% over the last closing price prior to the transaction announcement. The deal is the latest move in the global shipping and logistics giant’s push to grow its healthcare business and handle more temperature-sensitive products worldwide, as the Ontario-based company specialises in logistics operations for medical and pharmaceutical customers. The rationale is the same as the 2024 acquisition of European companies Frigo-Trans and BPL: to strengthen UPS Healthcare’s network and broaden its presence in cold supply and pharmaceutical shipping across North America.

Kimberly‑Clark’s acquisition of Kenvue

Deal Value: $48.7bn | Deal Type: Merger | Date: November 3rd, 2025| Nationality: USA| Premium: 46%

In November 2025, Kimberly-Clark [NASDAQ: KMB] agreed to acquire Kenvue [NYSE: KVUE], the 2023 spun-off consumer health segment of Johnson & Johnson [NYSE: JNJ], worldwide renowned for brands such as Neutrogena, Aveeno, Tylenol, and Band-Aid, in a cash and stock combined deal valued at $48.7bn. The transaction created a consumer health and wellness giant and was structured to bring together complementary portfolios, aiming to generate more than $30bn in annual revenues and deliver substantial cost and scale synergies upon completion. For now, both companies’ shareholders have approved the merger, with the closing estimated for the second half of 2026. Kenvue shareholders will receive approximately $21 per share, comprising $3.50 in cash and a portion of shares in Kimberly-Clark. The rationale reflects Kimberly-Clark’s push to diversify beyond its core hygiene and tissue businesses into higher-growth, higher-margin health categories. On the other hand, the deal will provide Kenvue with a stable global platform to accelerate innovation and distribution to ease the pressure created by price-conscious households.

Keurig Dr Pepper’s acquisition of JDE Peet’s

Deal Value: $18.4bn | Deal Type: Acquisition | Date: January 15th, 2026| Nationality: USA, Netherlands | Premium: 33%

US Keurig Dr Pepper [NASDAQ: KDP] has recently agreed to buy Dutch coffee firm JDE Peet’s [AEX: JDEP] for €15.7bn ($18.4bn) all cash, with JDE Peet’s shares valued at €31.85 each, a 33% premium to the 90-day volume-weighted average stock price, though still below their 2020 peak. The companies plan to split into two US-listed firms after the merger, with one focused on coffee brands including Douwe Egberts and L’Or, while the other on soft drinks such as Schweppes, Snapple, and 7 Up. The underlying rationale of the deal is to create a diversified and competitive coffee business (a “global coffee champion”) in a time when the industry is facing both tariffs and high prices for coffee beans, setting the stage for a global coffee company that could rival market leader Nestlé [SIX: NESN].

Soho House Go-Private Deal

Deal Value: $2.7bn | Deal Type: Privatisation | Date: January 29th, 2026| Nationality: UK, USA | Premium: ~18%

In August 2025, an investor group led by New York-based MCR Hotels, the third-largest hotel owner-operator in the US, struck a deal to take the members-only hospitality group Soho House private. Shareholders will receive $9 per share in cash, and the acquisition price per share is a 17.8% premium on Soho House’s share price at press time (August 15, 2025) of $7.64 per share. The deal values the London-based firm at $2.7bn, and a major contribution is made by Apollo Global Management [NYSE: APO], providing more than $700m in equity and debt financing. The plan encountered a setback in early January when MCR announced it couldn’t fully meet its $200m equity commitment to close the deal, according to an SEC filing. In a rush to close by the month’s end, the investors came up with the funds through new arrangements, including a $50m equity commitment from Morse Ventures Inc., owned by MCR Chief Executive Tyler Morse, and an additional $50m in equity from MCR. The company delisted less than five years after going public in July 2021, when it listed on the NYSE with the ticker SHCO at a price per share of $14. By taking the company private, MCR aims to provide the English operator with greater strategic flexibility to streamline its cost base and an expansion pipeline. Soho House clubs are often found in central locations of major cities globally and include 46 hotels under the brand name, as well as 3 The Ned Hotels and two Scorpios Beach club properties in Mykonos and Bodrum. For a few thousand dollars in annual fees, chosen members (now more than 200,000) get access to private dining, lounge, and bar areas, and cultural events such as live music, book readings, and film screenings. Despite strong membership revenue, Soho House had reported nothing but net losses in its 30-year history until the first half of 2025, when its net income rose to $33m. However, in Q4 2024, it posted a roughly $19m loss.

Conclusion: 2026 Outlook

As evidenced by the SpaceX and xAI deal announced on February 2nd, megadeal momentum persists into 2026, with AI acting as a catalyst for dealmaking. TMT will likely be the most dynamic sector, continuing its pace from Q4 2025, with healthcare also predicted to observe further consolidation as companies seek promising targets against competitors. Optimism is pronounced in the consumer and retail sector, with a prediction for revival in M&A activity given the easing of tariffs and the company’s focus on growth and synergies. However, we shall expect private equity to outbid companies for some deals and private markets to become “the epicentre” of M&A dealmaking, given an increase in 31% of global take-private volumes YoY.

Thus, while 2026 shows signs of renewed confidence with stabilising rates, one must remain cautious given the potential for unexpected political developments. Moreover, while deal value is expected to remain elevated in 2026, anticipated volumes remain muted.

0 Comments