Introduction

In this article, we look at the yield curve of US govies, and in particular we will try to understand its flattening upon rate hikes.

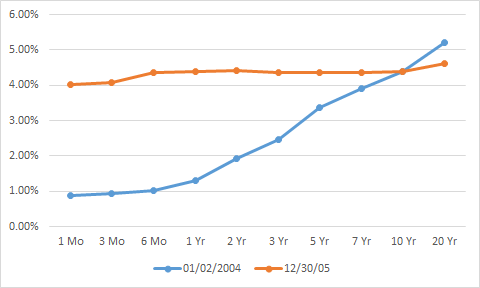

This puzzling phenomenon is not something new under the horizon. The same effect was observed under the Greenspan led of the FED. Between June 2004 and December 2005, the Federal Open Market Committee (FOMC) substantially tightened monetary policy by increasing the federal funds rate from 1% to 4.25%. Over this same period, long-term Treasury yields, which typically move in the same direction as short-term rates, did not follow suit and instead declined. Back then was named “conundrum”, which means “riddle”, confusing effect.

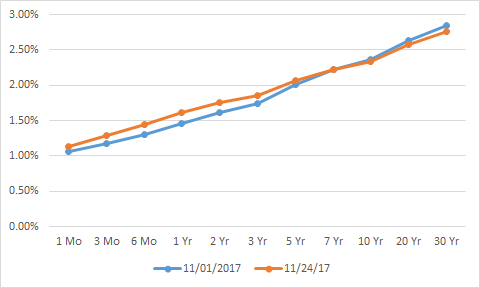

Yield curves in Jan 2004, Dec 2005, Jan 2017, Nov 2017 (Source: )

How can we make sense of this strange phenomenon?

In a more traditional scenario, an increase is short term interest rate is the consequence of positive GDP outlook, which might bring inflation with it. The central bank reaction in this case is to counteract this inflationary push, in order to maintain equilibrium in prices.

The curve would then probably have a parallel shift, if no other reasons affect the term premium of the bonds with longer maturities.

The yield will invert in times of recession such as during the Global Financial Crisis. Central banks will take action to lower rates on the short end, which is done with the intention of flattening the curve at first. Then raising rates again on the short end, in hopes of growth and inflation again acting on the long end of the curve – steepening it up. However, please be reminded that this is all in theory.

In practice, how the flattening yield curve narrative is presented to investors is incredibly important. Fed Chair Yellen and the US Federal Reserve have been particularly keen on labelling their recent rate hike path as a counter to an economy successfully revived from post Global Financial Crisis quantitative easing efforts. This is a reminder that interest rates can rise for good and bad reasons.

In 2017, after clear signs that the economy had been improving, the Federal Reserve increased the federal funds rate twice (in March and in June) to a current range of 1% – 1.25%.

In addition, the FOMC began reducing the sizable holdings of Treasury and mortgage-backed securities (MBS) that the Fed had accumulated through its large-scale asset purchase programs between 2009 and 2014.

Currently its balance sheet size is $4.45 trillions: more or less 24% of US GDP.

Monetary policy is the Federal Reserve’s actions, as a central bank, to achieve three goals specified by Congress: maximum employment, stable prices, and moderate long-term interest rates in the United States.

Inflation has stayed remarkably low throughout the whole of 2017 between 2.5-2%. Core inflation, which is the one that does not include more volatile components like food and energy prices, has stagnated at a very low level since May 2017 and since then has fallen short its expectations. As it was seen in May 2017 as a response to these low inflation releases, long-term Treasury yields have been pushed down, the report released on June 14 led to a decrease of about 0.1% in the 10-year yield.

Analysts forecasts for the near-term outlook on inflation have been pushed down as a response to the recent data releases. However, these expectations for the next few quarters do not play an important role when it comes to long term yields. Inflation expectations over 10 years are the most crucial. Nevertheless, surveys conducted show that long-term inflation should be targeted at the 2% as noted by the Fed, thus there is no survey evidence that shows that low inflation expectations influence the decrease in long-term yields.

Moreover, the difference between nominal treasury yields and real inflation indexed yields, which is called inflation compensation, has decreased considerably. From the 12th December 2016 until the 7th of November 2017, 10-year inflation compensation fell by 0.13%, half of the decreased in the nominal 10-year yield. Furthermore, this considerably impacted the yield curve flattening in 2017 as inflation compensation fell at the same time as the below expectations inflation data was released.

Absolute changes in basis points between December 12, 2016, and November 7, 2017 (Source: Federal Reserve Bank of San Francisco)

Therefore, a fact that brings together the steady 2% long-term view on inflation survey with the reduce in inflation compensation and nominal yields is that risk premium has decreased. The risk premium gives investors a higher return in exchange for the uncertainty on these bonds due to fluctuations in inflation. The difference between inflation compensation and expectations over 10 years can be positive or negative if investors worry more about high or low inflation. Since March 2017, the concern was with low inflation and that this would push down even more the inflation risk premium. Thus, as a hedge against low inflation, investors are choosing to pay a higher premium for nominal bonds.

According to Bauer and Rudebusch 2017, real interest rate is the major component which explains the fluctuation in long-term interest rates, especially over a long period of time. The low estimates of real interest rate have become widely discussed and market participants may have adjusted their expectations accordingly. In addition, the longer-run Fed Funds rates have gradually moved down, from a range of 3.0%-3.3% in June 2016 to 2.8%-3.0% in June 2017, as well as survey expectations on Fed Funds rates as Blue Chip Financial forecasters have lowered their estimates of real interest rate.

The term premium encompasses inflation risk premium and any effects on changes in supply and demand which are not related to expectations, for example safe-haven demand for treasuries, market sentiment and mispricing. Declines in term premium have been even bigger than the declines in in yields, therefore this is consistent with the observations of stable inflation expectations, a slight decrease in perceived real interest rate and a considerable decrease in inflation risk premium.

The low term premium can be explained by the Fed’s large holdings of treasuries, but this effect will gradually diminish as the Fed reduces its balance sheet. However, recent communication about the Fed’s tapering did not lead to any increase in Treasury yields, thus investors did not abruptly change their expectations, which suggests that the transparent communication about the nature of the balance sheet normalization helped the Fed avoid an infamous “taper tantrum”.

In addition, lower taxes and higher infrastructure spending, which were the responsible components for the increase in bond yields after the presidential election in 2016, have proven to be weaned down. Also, treasury yields declined on the days of negative headlines about geopolitical risks, for example the increasing tension with North Korea, which appears to be a contributor to lower treasury yields.

0 Comments