In this article we would like to assess the current year from a macroeconomic as well as from a market perspective.

2017 – The Year Almost Behind Us

So far, 2017 has been characterized by:

- Synchronized global growth reaching 3,7%

- Equities (+17,3%) outperformed bond (+2,6%)

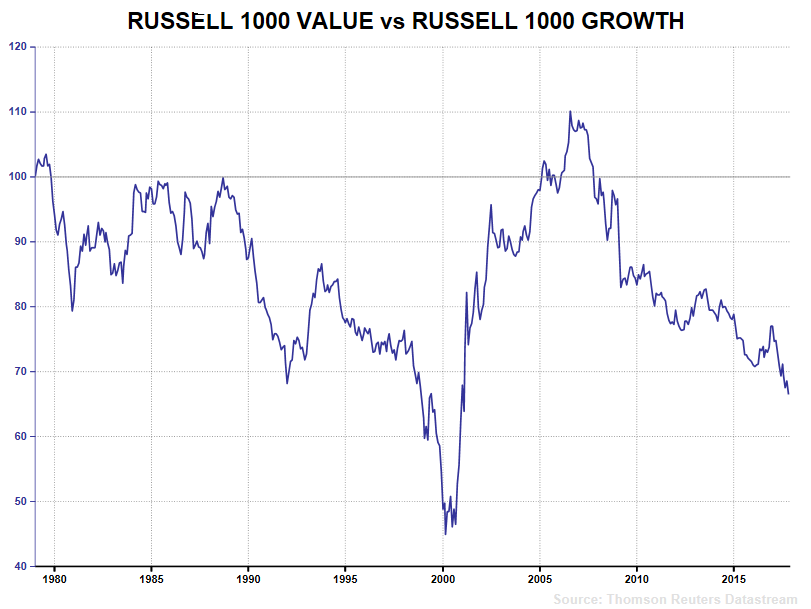

- Sector-by-sector speaking healthcare (+19,3%) and tech (+36,6%) over-performed global markets (+17,3%) but sector rotation from tech to financials (that is, a shift from “growth stories” to “value stories”) has already started

- Corporate bond (+4,8%) outperformed government debt (+1,8%) and long duration outperformed short duration

- USD lost about 10% vis-à-vis EUR (indeed, unexpectedly)

- «Conventional hedgers»: gold is up about 10%, JPY/USD (+2,4%), CHF/USD (+2%)

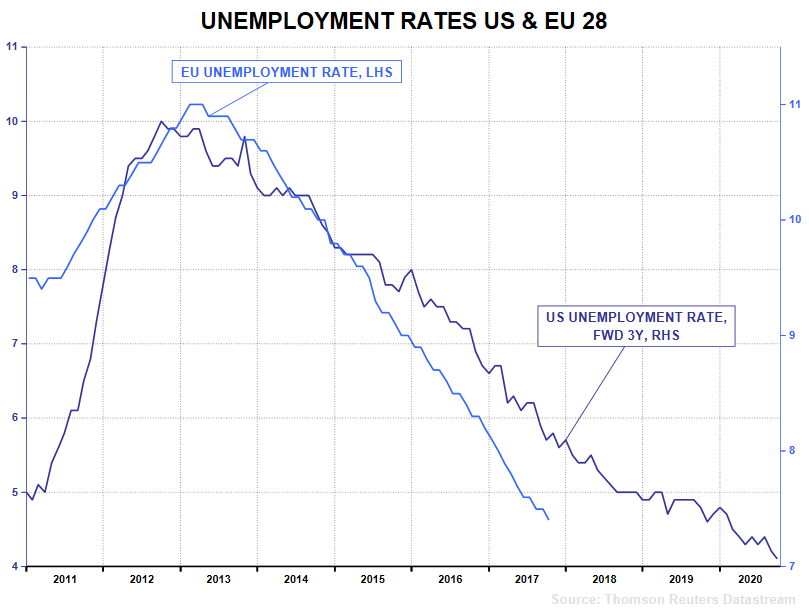

- Along with an outstanding job market performance:

Source: Thomson Reuters Datastrem

Source: Thomson Reuters Datastrem

and a very low volatility, which is now more than 1 standard deviation below historical average

Source: Thomson Reuters Datastrem

Source: Thomson Reuters Datastrem

Still it would be unfair to dismiss the 2017 to be a no surprises year, beside from USD: what about the geopolitical space?

We may not also forget one of the hottest topic in Eurozone and Italy: Non Performing Loans.

One of the main consequences of the latest financial crisis was the tremendous rise in NPLs. European banks, which failed to “clean” and lighten their balance sheets on time, suffered tremendous losses when the American Economy was instead already in an advanced state of recovery. This is why NPLs are still an actual topic in Europe, and especially in Italy, where the laws, which made the appropriation of the underlying assets more complicate for banks, substantially slowed the disposal of these extremely risky loans which absorb a tremendous amount of capital.

Year 2017 was important for the Italian NPLs market because of the increasing number of ECB regulations aimed at reducing the over 300€bn NPLs still present in Italy. Indeed, since these reforms facilitate NPLs disposal, and Italian banks are in the middle of their restructuring, there is an increasing amount of NPLs in the market which are being sold at consistent discount with respect to their face value. Therefore, this asset class may provide a substantial risk adjusted return and may be of particular interest for investors who have a positive outlook for the Italian economy for the coming years and thus believe in a higher recovery rate with respect to the one which is implied in the current discount at which NPLs are sold.

In particular, one of the recent amendments of the Italian law on securitization (June 2017) allows the SPVs to purchase the asset securing receivables (including assets subject to leasing agreements). This will result in a higher number of transactions by encouraging more players, both originators and investors, to enter this market.

So, whilst we may sum up that it has been an amazing year for many reasons such as Macron’s victory over Marine Le Pen, there are some concerns about the following year both from a «economic/market perspective» as well as from a «political perspective».

2018 – The Year Ahead

1- The Economic Perspective

Looking at 2018, the economic outlook looks good; in fact, we may expect synchronized growth across all major economic areas, an inflation picks up along with an easing fiscal stance in developed markets; regarding central banks’ intervention, it is fair to expect total balance sheet still growing even with ECB starting to taper and Fed non-reinvestment policy to begin, whilst the Bank of Japan should continue its yield targeting policy (that should still be expansionary).

We identify major source and type of risks:

- Economic risks among which we identify a recession risks, that is the possibility that the current business cycle ends along with risks associated to central banks interventions among or, better, decreasing intervention which, however, is unlikely to cause another so-called Taper Tantrum (the turmoil associated to the Bernanke’s announcement that Federal Reserve’s APP would have finished).

- Fail to deliver risks, that is, risks associated with the possibility that governments that committed to structural reforms and major policy change actually fail to deliver what they promised.

- Geopolitical risks

What it is uncomfortable to think about is that key risks are rising: major risks such as Germany, populism in EU (and therefore no more reforms) and hard Brexit are shifting from, let’s say, a stable level, to a «rising one» – ie, risk shifting to the upper of the table.

There are good news: an excessive monetary tightening (ie, policy mistakes, that is, too many hikes and/or too fast hiking) is really unlikely to happen since Fed’s chair Yellen still dismissing inflation-related events as mysterious and no hikes are coming from ECB before the end of tapering (well past Draghi’s speech: «We expect them to remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases»)

The only place where market is placing a relevant probability of an excessive monetary stance transition is UK (inflation overheating & need to sustain pound).

Let’s have a closer look to recession risk: it seems that current cycle duration and (very) low unemployment in US give reasons to think that this cycle is now approaching its end. Of course, there is no doubt that this cycle has already been very long (8,3 years), even tough not really the longest: it would take another 18 months to be the highest duration cycle.

And, as Janet Yellen pointed out, «Economic expansions do not die of old age»; there has to be something that actually “triggers” the start of the recession.

Historically, two categories of shock have been the cause for economic cycle to end: exogenous shocks (wars, commodities’ prices) and endogenous shocks (policy mistakes, financial crises).

At the current level, commodities prices do not seem to be a cause of concern, unless crude oil price falls so much that US shale-oil companies go bankrupt. Which seems even more unlikely when we factorize that breakeven point in the shale-oil industry gets lower and lower every year thanks to technology improvement.

And, as described previously, policy mistakes, specifically, a too aggressive path in main rates hiking seems very unlikely.

Therefore, we are left with the possibility that the next recession could be triggered by a war or another financial crise.

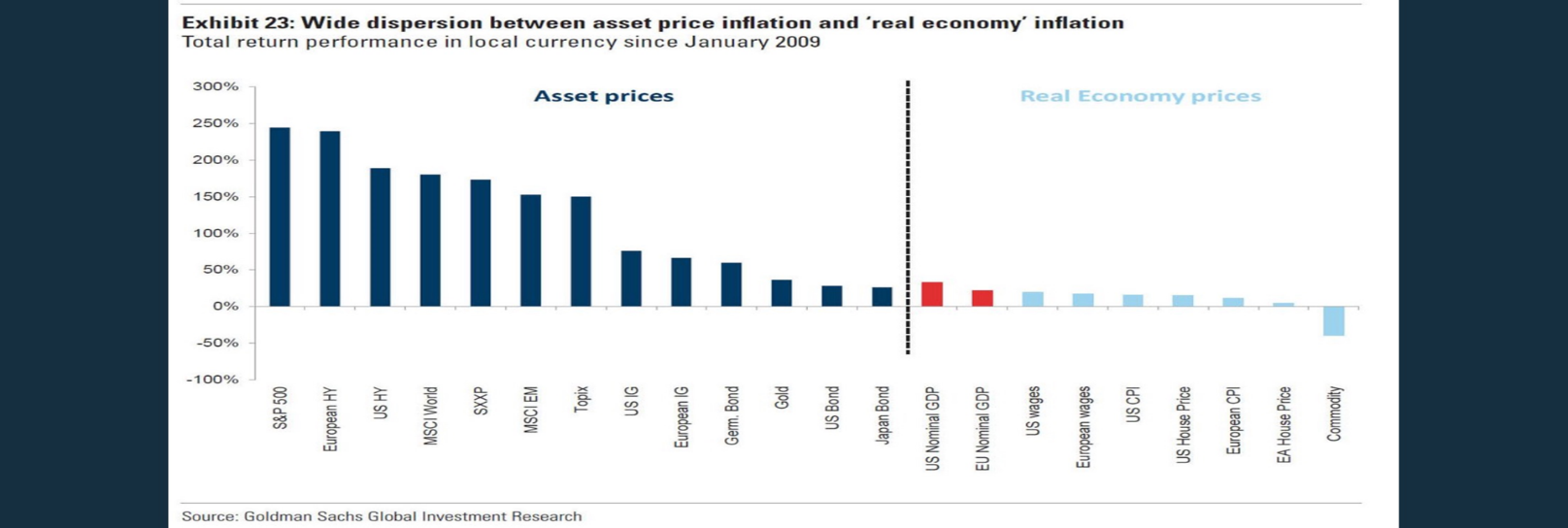

Regarding financial crises, it cannot be hidden that, thanks to massive liquidity injections, financial asset inflation since 2009 has been remarkable:

Source: Goldman Sachs Global Investment Research

which, coupled with the extremely compressed volatility environment is the most fertile soil for a financial crunch.

But, on the other hand, we can’t fail to recognize the towering regulation reforms that have been implemented since 2009 such a Basel II/III and liquidity requirements.

However, the biggest argument against the likelihood of a recession in the short future is given by leading indicators: each pre-recession/end of cycle period does share some common features that are summarized in the following table; how many of these features are happening right now? No one.

ISM Manufacturing < 50 YoY Industrial Sales Growth < 0%

Negative Industrial Production Growth Delta Initial Jobless Claim > 60’000 units

YoY Retail Sales Growth > 2,5% Tightening of Credit Conditions

Shifting to risks related to central banks’ balance sheet policy, it should be noted that whilst Fed starts reducing its balance sheet trough Principal Non-Reinvestment Policy (PNRP), and ECB is going to start tapering (gradually) and BoJ will keeps on with the yield targeting policy (likely still expansionary), total asset held by central banks are still expected to grow in 2018, taking into consideration that in 2017 liquidity added to the market is about $200bn every month).

Fail to deliver risk in another potential source of uncertainty for the year ahead.

A consistent number of governments promised lots of structural reforms, necessary in order to stimulate the long-term growth. What is going to happen if they fail?

It’s about politics and politicians so it’s not easy to forecast due to consensus problems, anyways the number of countries committed to reforms is huge, even China with respect to financial/de-leveraging reforms and more open economy. In general, necessary reforms are not appreciated by voters on a short-term scenario, e.g. France labor market reform and public spending cuts, and considering the context of rising populism in the world the likelihood of reforms failing is not low. The problem is how the markets will react? Could be sign the end of the market cycle?

Finally, the last economic risk for our forecast: Major and minor Geopolitical risk:

- Major:

- Rising populism in Italy, Germany, Spain and more in general EU.

- Trump commercial & fiscal policy

- North Korea

- Saudi Arabia – Iran conflict

- Minor:

- China South Sea conflict

- Turkey

- Cyberattacks

- Terrorism

This kind of risk can’t be really prevented but we should think about how to hedge against them.

Let’s start by overviewing the potential hedging strategies status nowadays.

- “Conventional” hedging strategies: Gold, JPY, CHF. (Very expensive at the moment).

- “Unconventional” hedging strategies: CDS, volatility (Extremely cheap).

Besides from being up almost 10% this year it should be evaluated in comparison with US real rates, in this framework, we see Gold already overvalued by about 22% with respect to US real rates, so it is actually more a risk than a hedge.

JPY

Japanese yen is fairly overvalued with respect to other major currencies, especially USD, the difference between theoretical (i.e., suggested by fundamentals-based models) and current USD/JPY is in the range of 4%, a consistent percentage if you think we are talking about currencies.

Volatility

With abnormally compressed volatility and a big race for returns, in 2017HI a lot of asset managers cashed volatility risk to enhance returns, up to a point where a IY call option on VIX index (strike 50) was sold for 1bp. Now, this huge amount of options on VIX can be bought for a few bps, and if something significant happens, well, high correlation between this kind of events and volatility will produce a cheap and effective hedge.

Whilst being at the center of tensions, CDS of countries more involved in these geopolitical risks are trading at discount, South Korea’s CDS is currently trading at around 60bs (not that much of a premium to be so close to KJU)

2 – The Market Perspective

Equities

From the market point of view, we suggest Equities rather than Fixed Income, it is true that we are in a mature phase of the cycle bout this does not mean that equities return will be negative. On average at this stage of the cycle, equities positive return is given by EPS growth (upward revisions) whist trailing P/E is flat or contracts by at most 1% (historical average). So, if we do not think a recession crones up it would be fair to expect an EPS growth in the range of 10-12% and a total return that is consistent with this earnings growth. Even if volatility does rise, the expected return over SPX would be in the round of 9,5% with a probability of incurring in a loss of about 25%. Considering the current interest rate environment (especially tight spread) there is not really room for capital gain in the fixed income space.

Among all the Equities world markets we think that Japan could outperform the others in 2018. Whilst being the best equity market YTD for 2017 (+18,2% for comparison: US +17%, EU +12%) because of the strongest earnings growth (+17%) with the most remarkable upward revisions, P/E ratios (i.e. valuations) are just above historical minimums (MSCI Japan – Trailing PE is around 15, i.e. 1 SD below historical average of almost 20) and consensus earnings growth for 2018 are very conservative (6%) despite of a massive revisions this year.

Being in the mature phase of the cycle usually means sector rotation so basically what we suggest is out of growth trade and get into value trade. In particular, out of tech and healthcare sectors and all the way into financials and eventually consumer staples. However, if expansion comes in stronger than what we supposed, we may be too much early in the value trade

Source: Thomson Reuters Datastrem

In EU a small vs large cap may make a lot of sense since:

- MSCI Mid-Cap EU offered higher return than MSCI Europe, with less stretched valuations this is consistent with FF 3/5 factors models.

- European small caps track very well the European economic cycle, which is about 18 months lagged to the US/global cycle.

Thus, we face large caps facing global cycle exposure, small/mid cap facing European cycle exposure with leading indicator for the Eurozone being very high (manufacturing PMI higher than 60)

Fixed Income

We all know rates are extremely low and we all expect them to raise, actually, and it would be common sense to expect rates to rise significantly since we are living in a zero-interest rate environment. Whilst compared to other cycle, this one miss of one thing: productivity growth: historical annual productivity growth is something below 3%; current one is something just above 1%, thus, this delta = 2% should be subtract by neutral (ie, non-expansionary, non-contractionary) rates, so it is obvious and fair to expect rates to rise but it is also fair to assume that the “arrival point” is closer than what we thought.

There are still sectors with the same YTM as 5 years ago, expected return on US IG are around 3,6%, between carry and roll down (moderate duration = 4yrs ), the very same as 5 years ago, even if, of course, the composition of the return has changed.

We would suggest using CDSs to gain exposure instead of physical assets, because:

- CDS-implied default rates are 6,1% whilst consensus forecasts for 2018 are below 3%

- Better liquidity (no CBs induced squeeze): actually, spreads on these products are 1/10 than cash

- They are derivative contracts, which means no market size problems

Overall CDS-based strategy (short CDS) delivered 1,1% excess of return compared to traditional (ie, cash) strategy and with a lower duration (no final payment)!

And.. NPLs

What is the outlook for 2018?

The market is likely to keep its focus on NPLs in 2018 as well given that IFRS9 is going to be effective since January 2018. This reform will lead to an «early warning» and «forward looking» approach, which would likely result in higher reclassification of performing loans to NPL and overall higher provisions. Indeed, the transition to IFRS9 (fromIAS39) will be critical as banks will be required to accrue provisions based on expected losses and not only upon the occurrence of specific events (e.g. Impairment tests): banks will be asked to adopt a “forward looking” approach and as such to anticipate losses at the first signal of deterioration.

Indeed, the same loans, which would be considered riskier, will absorb more regulatory capital. Thus, banks will have an even bigger incentive to remove those assets from the balance sheet, lowering their price even more and attracting constantly more investors.

0 Comments