History

What made gold a unique asset is its shininess, its malleability and the property of endurable integrity over time. Thanks to these characteristics, it has been widely used in the history of mankind for two core aims:

- To celebrate the human power and wealth thanks to its magnificence,

- To support the exchange of goods and to preserve wealth.

Consequently, the monetary and economic use of this material is in tight relation with the celebrative one. Public and private institutions accept gold as a payment method because they are confident about the possibility of reselling it in the future. This good standing of gold was acquired over time and due to its scarcity, gold will tend to keep its value constant over time.

Demand

The aggregate demand of gold is usually divided, as mentioned above, into its conventional uses:

- Jewelry demand

- Industrial demand

- Investment demand

- Acquisition by central banks of gold reserves

Trust in gold endured for centuries, driven by the fundamental demand: jewelry and industrial use. Until the nineties, the jewelry sector represented about the 70% of the total demand of gold. It should be stressed that the countries which mostly acquire gold for jewelry purposes are the emerging ones. India and China drive the consumes, representing about half of the global jewelry demand. The industrial demand of gold is instead the least variable, and it accounts for about 10% of the total demand.

The speculative and hedging demand, considered as investment and acquisition from Central Banks demand, account for the remaining portion of total demand, which is what we previously classified as the monetary and financial purpose.

The investment demand is the most volatile one: in 2007 it accounted for 700tons, in 2008 for 1200tons and in the biennium 2016/2017 it dropped from 550 to 200 tons.

Considering that in the last years the market has not experienced a relevant mismatch between supply and demand of gold, with a low demand for investment, it is likely that in a risk-off market phase the gold price will sharply increase.

In addition, Central Banks are determinant players in the formation of gold price. Analyzing what happened from 2000 on, Central Banks continuously sold their gold until the financial crisis hit. Afterwards, considering the political, economic and monetary uncertainty, they started to accumulate the precious metal once again. In the last years the demand, albeit positive, has halved form the peak reached in the 2011/2012 (about 500 tons). Therefore, it is easy to understand that this portion of demand is quite variable, depending on the economic cycle and the various monetary stimulus of the Central Banks in the world.

Supply

The WCG (World Gold Council) estimates that the global gold reserves amount today to 174.100tons, which corresponds to the weight of a cube with a 21-meter-side. The amount of gold offered in the market is determined by the raw quantity extracted from gold mines and by the quantity retrieved by melting gold jewelry and other goods and then re-sold.

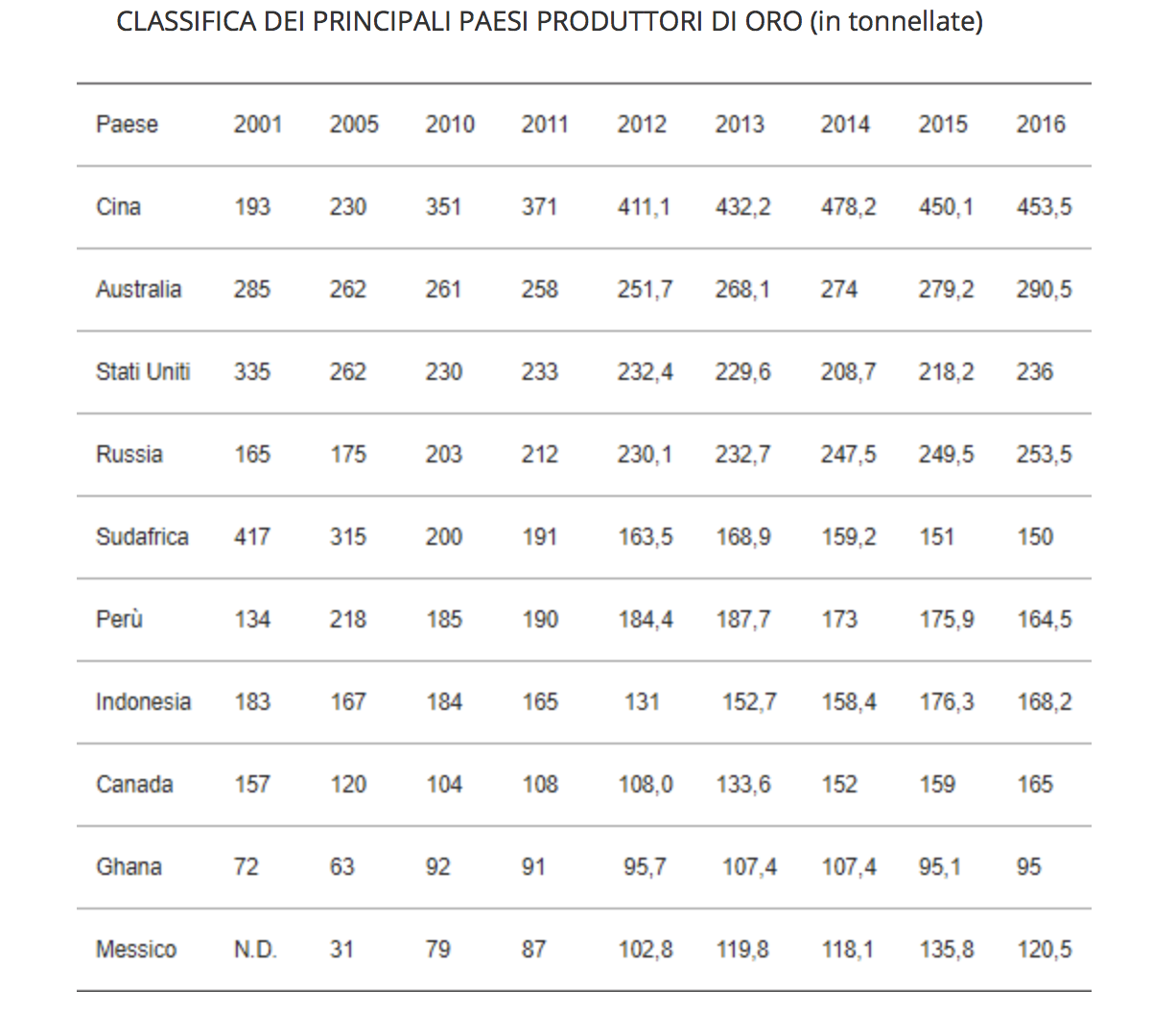

Since 2000, every year an amount between 2500 and 3000tons of gold has been extracted from mines. In the XIX and XX centuries South Africa held a leading role in the extraction, indeed during the seventies the gold coming from South Africa accounted for the 70% of the global supply.

From 2000 on things changed as South African mines’ extraction costs climbed and the country began to rapidly lose market shares.

Fig 2: Ranking of the biggest gold produces (Source: Forexsivergold)

The five biggest extracting companies hold cumulatively about 20% of market shares. They are Barrick Gold Corporation, Newmont Mining, AngloGold Ashanti, Goldcorp and Kinross Gold.

The remaining part of the supply is given from retrieving.

“Price means supply” explains Jim Rogers, referring to the commodities market in general. This means that the increase in the price of a certain commodity makes the adoption of alternative methods of extraction convenient, usually even more expensive than the previous ones. More specifically, the rising price of gold occurred in the last 15 years gave a great incentive to the sector of retrieved gold – which consists in a really expensive process – such that in the last decade the quantity of retrieved gold exceeded the 1000 tons/year.

Price

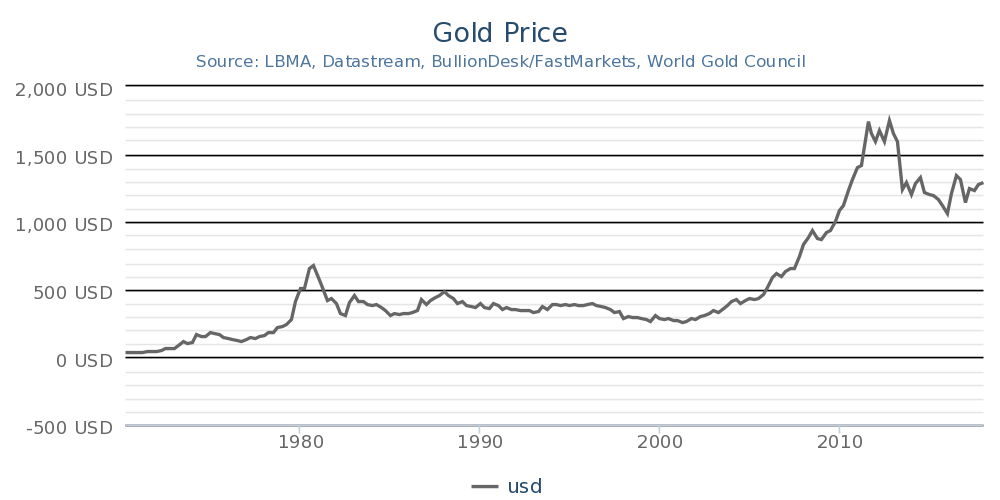

Fig 3: XAU/USD, source: Wold Gold Council

Before Bretton Woods, gold was exchanged at a fixed price of 35$/ounce. From then onwards, once the exchange was liberalized, prices started climbing up to a peak of 1920$ in August 2011. Analyzing what happened in the last decade, it can be affirmed that investors started to buy gold in Oct 2008, following the ultra-dovish monetary policy of Central Banks, moved by the fear of an outburst inflation following to the quantitative easing.

Nevertheless, after 2011, when the inflation level was low and the US economy seemed to be healthy again, a consistent amount of gold started to be sold from investors on the market, bringing to a decrease in gold price between a range of 1000-1400$.

Nowadays the US economy is experiencing full expansion, following the tax reform approved on 22 December 2017, the forecast for the real economy – intended as wages, aggregate demand and production – is excellent in the short-medium period.

Switching our horizon to the long run, we still find good reasons to hold raw gold or shares of business linked to it. Indeed, it must be considered that when the world economy will experience recession, the liquidity will move towards assets considered less risky, as in fact gold, CHF, JPY and so on; thus, gold price should increase once again.

Pushing further the analysis to how the world economy would react to the next recession, the forecast is alarming. Since 2008, private and public institutions – being in an easy leveraging environment – started to deeply run into debts. The US Federal debt grew from 74% to 105% of the GDP and the private debt composed by corporate debt, residential mortgage and other types of consumer debt accounted for the 200% of the GDP.

In 2008, thanks to a public rescue of around 1 trillion dollars, the US banking system did not collapse, but today a similar action would be more expensive and more complicated. Moreover, countries and Central Banks, in order to decrease social tensions, may be obliged to act with non-conventional monetary policies, and in the worst case scenario to print money, leading to an increased level of gold price, difficult to forecast as for today.

An imminent phase of correction of gold price should not be considered as an alarming factor by investors. The suggestions given by investors such as Ray Dalio and Jim Rogers is to hold gold in small percentages – about 5-10% percent of one’s total assets – and considering it a form of insurance. Indeed, insurance contracts are settled hoping that a certain circumstance will not take place, but even in the unlucky case it does, the insurer will cover the damage.

0 Comments