Coinbase Global Inc (NASDAQ: COIN) – Market Cap as of 24/04/2021: $58.09bn

Introduction

On April 14th Coinbase, the largest cryptocurrency exchange in the US, went public via a direct listing and reached a valuation of over $80bn. The NASDAQ assigned a pre-emptive reference price of $250 per share, however, at market open the shares traded for $381. The price rallied before descending in the evening, bringing the final price to $328 per share.

The highly successful listing marked the biggest cash-out in crypto history and is also seen by many as a shift in the market’s perception and the legitimacy of the cryptocurrency industry as a whole. Coinbase’s valuation comes after an extraordinary first-quarter earnings announcement as the group posted a nine-fold jump in revenues to $1.8bn, up from $191m last year. Coinbase’s unparalleled recent growth coincides with the soar in value of cryptocurrencies Bitcoin and Ethereum which account for most of the volume on the website.

About Coinbase

Coinbase provides an easy-to-use online platform for both retail and institutional investors to buy, sell, transfer, and store digital currencies. The Silicon Valley crypto exchange was co-founded in 2012 by Brian Armstrong and Fred Ehrsam as a way to simplify the purchase of Bitcoin. It has since emerged to become the largest cryptocurrency platform in the US, serving 7000 institutions and over 56 million users, up from 32 million at the end of 2019.

Starting from allowing the trading of Bitcoin only, the platform has since added additional 90 cryptocurrencies out of more than 4000 available. Despite this, the majority of trading activity continues to surround Bitcoin and Ethereum. Coinbase’s fate is therefore inevitably linked to the demand for these two cryptocurrencies, which have climbed more than 800% and 1300%, respectively, in the past year alone. This latest bull run in cryptocurrency markets saw the company’s net income climbing from $32m in 2019 to around $730m in the first quarter of 2021. Crypto valuations are, however, extremely volatile, and this recent soar in Coinbase’s value is in strong contrast to Coinbase’s $30m annual net loss in 2019 – a year when Bitcoin averaged around $5,000-6,000. The company has admitted that its short-term financial fortunes will largely be determined by crypto prices.

Traditionally, the crypto space has been warped with many scandals, such as instances of fraud or hacking against user wallets. However, unlike some of its competitors, Coinbase has been able to avoid such hacking threats so far. It has therefore garnered a reputation for security in the storage of users’ personal data, and this reputation is extremely valuable to any crypto exchange platform.

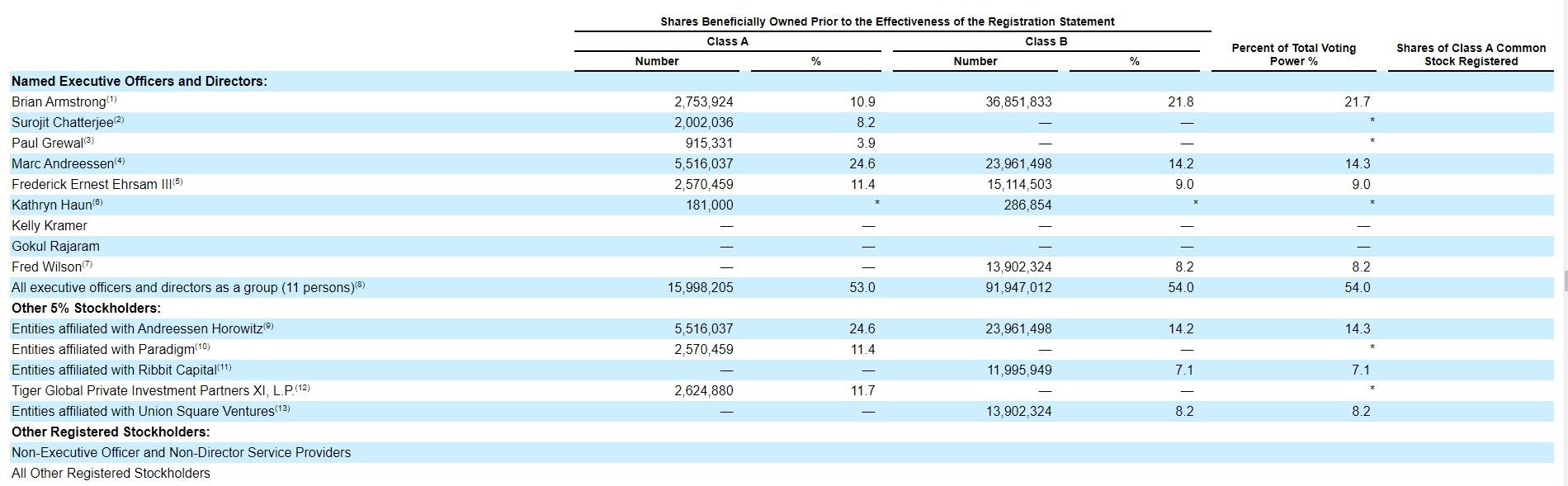

Venture capital firm Andreessen Horowitz is the largest shareholder of Coinbase, with 25% of Class A and 14% of Class B shares.

Coinbase’s Business Model

For novice crypto enthusiasts, Coinbase operates as a simple online exchange with a straightforward interface and thus provides a great environment to learn. For more experienced users, Coinbase offers a more advanced trading platform, called Coinbase Pro.

Fees on crypto trades make up approx. 90% of the firm’s revenue. The margin fee, also known as the spread, typically charges 0.5% for crypto purchases and sales below $10,000 in value. The fee is significantly reduced to 0.35% for sums between $10,000 and $50,000 and continues to decrease with each pricing tier. In addition to the margin fee, Coinbase also earns a commission on all crypto transactions, called the Coinbase fee. This fee is dependent upon the value of the purchase, the payment type, and the customer’s location.

According to Coinbase’s S1 filing, up to 11% of its revenues derived from other revenues including the sale of crypto assets where Coibase itself is the principal in the transaction. While this percentage might seem a small amount, it is likely to have a broader impact on profitability as liquidity brings liquidity. At the same time, this activity is not allowed for regulated trading venues such as CME or ICE, which instead rely on third party liquidity providers. As a result, questions remain open on the sustainability of this latter model as regulators catch up on crypto.

Coinbase also offers a free service called Coinbase Wallet to allow individuals to manage their private keys and to store their cryptocurrencies directly on their devices. Besides, the wallet allows users to move the cryptocurrencies from one wallet to another.

In addition to its exchange services Coinbase and Coinbase Pro, the company offers a wide variety of products:

- Coinbase card. In late 2020, Coinbase announced the launch of its own physical Visa debit card. Like any regular commercial bank, Coinbase uses cash deposits from its users’ accounts to lend to other institutions and collects interest.

- Coinbase Commerce. It is software that offers tools for online retailers to accept cryptocurrency payments. In a way similar to PayPal or Stripe, Coinbase created plugins to be used on ecommerce platforms such as Shopify or WooCommerce. Since its launch, Coinbase Commerce has processed over $200m in cryptocurrency transactions.

- USD Coin (USDC). Coinbase also offers its own cryptocurrency. Its value is tied to the US dollar so 1 USDC is always worth $1. The coin is built on the ethereum platform and is available to trade on 10 other trading platforms as well.

Industry Overview

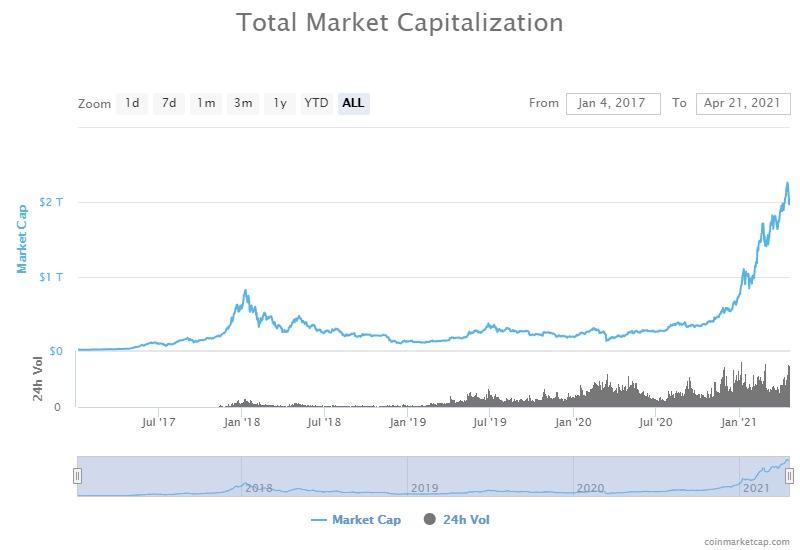

Breaking price records and reaching higher trading levels, cryptocurrencies have already made the headlines many times. They have experienced a considerable upside development in recent years. Over the last year, the combined market capitalization of all cryptocurrencies increased by more than 900%. As shown in the image below, currently the market for cryptocurrencies has a “capitalization” of more than $2tn. Although there are thousands of different currencies, the market is quite concentrated. Roughly 50% of “capitalization” belongs to Bitcoin ($1.03tn), the most popular cryptocurrency. Ethereum, Binance Coin, XRP, and Tether are following in order.

Source: coinmarketcap.com

Whereas these currencies have been mostly seen as speculative investments, a positive trend can be seen in the acceptance of cryptocurrencies. After Tesla bought $1.5bn worth of Bitcoin in February 2021, Elon Musk announced at the end of March that customers can now buy a car with Bitcoin. However, there are also contrasting examples such as Dogecoin, that damage the credibility of cryptocurrencies. Originally started as a joke, its “market capitalization” is now more than $40bn.

With the rise of the popularity of cryptocurrencies also exchanges for them emerged. When looking at cryptocurrency exchanges, there is an important distinction between centralized and decentralized exchanges. The first type is private companies that have their own servers, identify their users through “Know Your Customer” systems, and actively monitor trading, volumes, and liquidity. Key players of this type are Coinbase, Binance, eToroX, Kraken, and Bitfinex. The second type works similarly to Bitcoin: decentralized exchanges operate an unregulated network of individual computers that can be anonymously used. Notable players in this segment are AirSwap, PancakeSwapm, and MDdex. In general, centralized exchanges have higher trading volumes. The reason behind that is that it is possible to exchange conventional currencies into cryptocurrencies, whereas decentralized exchanges do not support conventional currencies. The importance of the various exchanges depends on the currency. Coinbase is strongly positioned for Bitcoin and Ethereum, which are responsible for 44% and 12% of the transactional revenues, respectively.

Although centralized exchanges face some regulation regarding customer identification, core processes such as transfer of ownership and trade validation are not easy to regulate due to the decentralized nature of cryptocurrencies. Therefore, critics call for new and better-suited regulations for crypto exchanges.

Direct Listing Structure

On April 14th Coinbase went public through a direct listing on the NASDAQ under the ticker symbol “COIN” and with a reference price of $250 per share. Direct public offerings are based on the resale of shares by registered stockholders at prevailing market prices and the new shares to be underwritten by investment banks are not issued. Therefore, Coinbase did not raise additional capital with its debut. Yet, its listing represented the largest cash-out in the history of cryptocurrency: the company achieved a valuation of $85.7bn based on the total amount of outstanding shares and raised at least $3.4bn for shareholders who sold at the opening trade on Wednesday. Before that, all executive officers and directors (11 in total) held more than 50% of shares, and the company’s biggest external investors – with more than 5% of stock each – were Andreessen Horowitz, Paradigm, Ribbit Capital, Tiger Global Management, and Union Square Ventures.

Source: Coinbase Prospectus

The cryptocurrency exchange went public with a dual-class share structure, amounting to 21,035,491 shares of Class A common stock outstanding and 164,950,620 shares of Class B common stock outstanding. With this direct listing, however, the US company was exclusively offering for sale its class A common stock.

As the major risks, Coinbase lists the inherent riskiness and uncertainty to which its business is subject, including regulatory enforcement and vulnerability to cyberattacks. Another important risk factor is the potential loss of public confidence in cryptocurrencies, which contributes hugely to the highly volatile nature of crypto assets. The latter may become less attractive due to the rising yields on safe assets such as Treasuries, bolstered by the takeoff of vaccination campaigns and the reopening of the hardest-hit sectors of the economy.

Direct Listing Rationale

The Coinbase debut on public markets comes as no surprise after Bitcoin’s price boom in 2020 and Q12021, which has more than doubled annual trading volumes of the cryptocurrency company and resulted in a ninefold increase in Q1 revenues from the previous year, with demand still rising. In fact, for Coinbase, which has progressively grown into the largest US cryptocurrency exchange, going public was the revolutionary, yet logical next step ahead on its path towards gaining success and a central role in the emerging “cryptoeconomy”.

Coinbase, however, eschewed the traditional initial public offering process and opted for listing its stock directly, avoiding Wall Street investment banks’ hefty underwriting fees and choosing not to dilute its stock’s value. Furthermore, its direct listing allowed employees and other company insiders to sell shares immediately, without waiting for the lockup period to expire, as is the case with an IPO. According to Coinbase CFO Alesia Haas, the reason behind the direct listing choice is to avoid allocating shares to just a few institutions and instead include all market participants in what is going to be a robust, deep price discovery. Moreover, CEO Brian Armstrong defined the direct listing path as “more true to the ethos of crypto”. In pursuing this nontraditional path, Coinbase followed the example of world-renowned companies such as Spotify, Slack, Palantir, Asana, and Roblox, yet all of which went public on the New York Stock Exchange.

Coinbase was the first major cryptocurrency player to go public and the first major direct listing for NASDAQ, which has only hosted smaller direct listings by insurance, financial technology, and biotechnology companies so far. The choice of NASDAQ over the New York Stock Exchange is to be attributed to several selling points, including the “COIN” ticker offer, which was not part of NYSE’s pitch, as explained by Haas.

Market Reaction

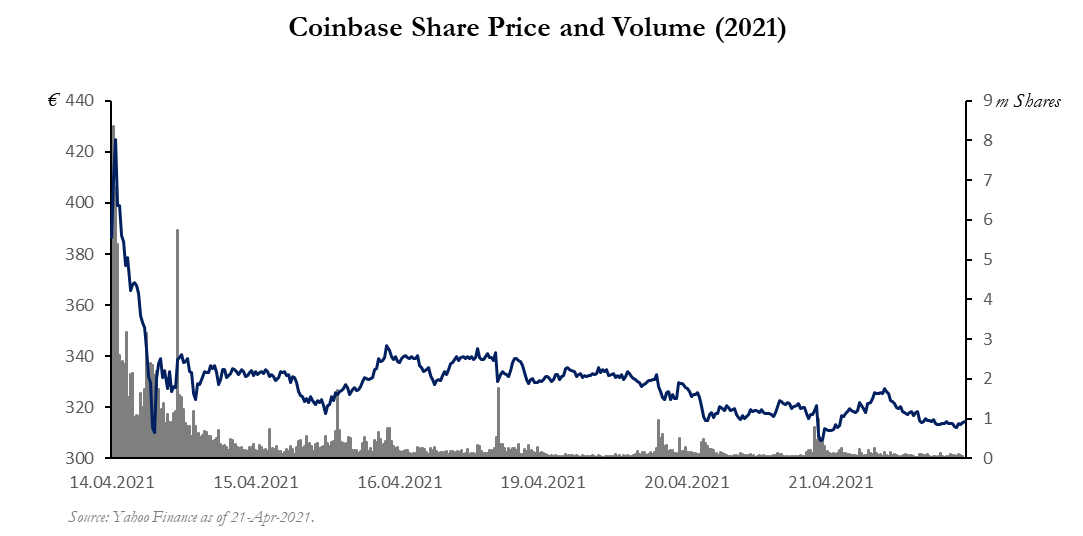

The first listing of a major cryptocurrency exchange got a lot of attention. The share price of Coinbase opened at $381 and quickly shot up to nearly $430, before dropping back below the initial price. Nonetheless, the closing price of $328 was still well above the reference price of $250, set the day before the listing. The resulting market capitalization of $65.4bn was nearly as high as the one of ICE ($67bn), the parent company of NYSE. Taking options and stock-based awards into consideration, Coinbase’s fully diluted valuation was $85.6bn. On the next trading days, the share price of Coinbase stabilized at a level of $320. After high trading volumes on the first day (81m traded shares), the volumes came to a normal level very quickly.

Overall, the listing can be seen as successful. Still, the analysts agree that the stock has further upside potential, as the consensus suggests a target price of $509 with all analysts recommending buying the share.

Source: Yahoo Finance

Financial Advisors

Goldman Sachs, JPMorgan, Allen & Co, and Citigroup were the advisors on Coinbase’s listing.

0 Comments